Vanadio Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438136 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vanadio Market Size

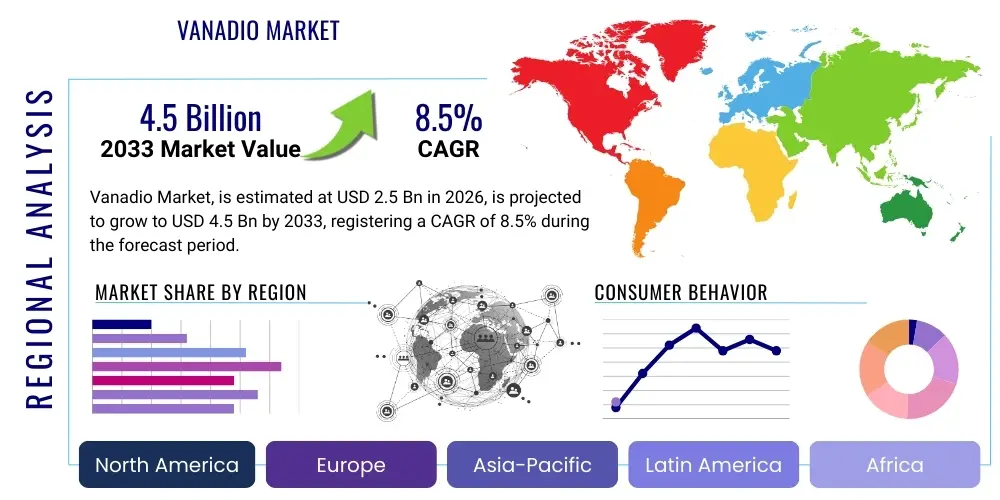

The Vanadio Market, fundamentally driven by its indispensable role in strengthening steel alloys and its growing prominence in long-duration energy storage, is projected for substantial expansion. This growth is intrinsically linked to global infrastructure development and the accelerating transition toward renewable energy systems requiring robust battery storage solutions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

The valuation reflects the critical dependency of key industrial sectors, particularly automotive manufacturing, construction, and aerospace, on vanadium's superior metallurgical properties. High-strength low-alloy (HSLA) steel, which utilizes ferrovanadium to achieve significant weight reduction and increased tensile strength, represents the cornerstone of current demand. Furthermore, the strategic importance of Vanadium Redox Flow Batteries (VRFBs) in stabilizing large-scale electrical grids is now gaining significant commercial traction, providing a powerful secondary growth vector that will influence pricing and supply dynamics throughout the forecast period.

Market expansion is also supported by increasing global regulatory mandates encouraging material efficiency and recyclability. Vanadium’s ability to enhance material performance allows for less material usage overall in structural applications, aligning with sustainability objectives. Geographic shifts, especially the rapid industrialization and infrastructure investment within the Asia Pacific region, particularly China and India, continue to exert the most profound influence on market size, solidifying the region's position as both the largest consumer and a major producer of processed vanadium products.

Vanadio Market introduction

The Vanadio Market encompasses the global extraction, processing, distribution, and utilization of vanadium, a silvery-gray, ductile transition metal identified by the symbol V and atomic number 23. Vanadium rarely occurs as a native element; instead, it is primarily obtained as a co-product from iron ore processing, uranium mining waste, or through the recycling of spent catalysts and fly ash. Its primary commercial forms include Vanadium Pentoxide (V2O5), Ferrovanadium (FeV), and specialized chemical compounds used in catalysis. The market is critical due to vanadium's unparalleled ability to impart toughness, strength, and resistance to corrosion and thermal shock when alloyed with steel, even in small concentrations.

Major applications of Vanadio span multiple high-value industrial sectors. Approximately 90% of current vanadium production is dedicated to the metallurgy industry, specifically for producing high-strength, low-alloy steel used in pipelines, bridges, and high-rise structures, and for specialty alloys used in jet engines and advanced tools. In the chemical sector, vanadium compounds act as crucial catalysts for producing sulfuric acid and maleic anhydride. Crucially, the newest frontier driving market dynamics is the application of vanadium electrolytes in Vanadium Redox Flow Batteries (VRFBs), which offer scalable, non-degradable, and long-duration storage solutions essential for integrating intermittent renewable energy sources into the existing power grid infrastructure.

The benefits derived from Vanadio include increased structural longevity, enhanced fuel efficiency in transportation (due to lighter HSLA steel), and greater stability and reliability in electrical distribution systems. Key driving factors include rigorous global infrastructure modernization programs, the mandatory adoption of stricter material standards in emerging economies, and decisive governmental investments worldwide aimed at scaling up stationary energy storage capacity to meet climate change mitigation goals. These drivers position the Vanadio market as a vital contributor to both traditional heavy industry and the burgeoning green technology sector.

Vanadio Market Executive Summary

The Vanadio Market is poised for substantial growth, characterized by significant shifts in consumption patterns favoring non-metallurgical applications, specifically energy storage. Business trends indicate a movement away from concentrated supply risk, with increased investment in diversified extraction techniques, including secondary recovery from refining waste and steel slag, aiming to stabilize global pricing and ensure long-term supply resilience. Market participants are increasingly focusing on vertical integration, particularly those involved in the VRFB supply chain, spanning electrolyte production to battery assembly, establishing new competition dynamics against traditional ferrovanadium producers. The overarching theme remains the balancing act between consistent, high-volume demand from the steel sector and the volatile, high-potential growth trajectory dictated by global battery storage requirements.

Regional trends clearly delineate the Asia Pacific (APAC) region, dominated by China, as the undisputed hub for both demand (driven by construction and manufacturing) and supply (owing to vast reserves and processing capacity). However, North America and Europe are rapidly increasing their strategic importance, driven primarily by robust governmental funding and policy frameworks aimed at localizing VRFB technology development and deployment. These Western regions are focusing less on raw extraction and more on high-value processing, specialized alloy production for aerospace and defense, and establishing domestic electrolyte manufacturing capacity to mitigate geopolitical supply vulnerabilities. This polarization highlights a bifurcated market strategy: bulk supply management in the East versus technological leadership and specialized application development in the West.

Segmentation trends confirm that while Ferrovanadium remains the volume leader, the fastest growth is observed in the Vanadium Redox Flow Battery segment. This growth mandates stricter quality controls for Vanadium Pentoxide (V2O5) feedstock, pushing demand toward higher purity grades. Steel and alloy applications continue to evolve, with increasing adoption of microalloyed steel in complex automotive structures, demanding reliable and traceable supply chains. Furthermore, the market structure is moving toward greater consolidation among primary producers who possess cost efficiencies in extraction, while downstream processing and energy storage sectors remain highly competitive, attracting significant startup capital and innovation focused on extending VRFB performance metrics.

AI Impact Analysis on Vanadio Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Vanadio Market primarily center on optimizing operational efficiencies, ensuring supply chain transparency, and accelerating material innovation. Common themes include how AI can enhance the notoriously complex and energy-intensive extraction processes, mitigate supply chain risks associated with concentrated production, and, critically, speed up the R&D cycle for next-generation vanadium alloys and high-performance VRFB electrolytes. Users are keenly interested in predictive maintenance models for mining equipment, AI-driven demand forecasting that accurately reflects VRFB uptake, and machine learning applications that analyze vast material science datasets to discover optimal vanadium compound formulations for specific industrial requirements, thereby potentially disrupting current material specification standards.

AI's initial major impact is anticipated in resource management and processing optimization. Machine learning algorithms can analyze geological surveys and operational data to pinpoint optimal mining strategies, significantly improving ore recovery rates and reducing waste. In the complex refining process—where vanadium is often co-extracted—AI can fine-tune smelting temperatures, chemical ratios, and energy consumption in real-time, leading to substantial cost reductions and higher yields of high-purity Vanadium Pentoxide (V2O5), which is essential for specialized applications like battery electrolytes. These operational improvements directly address the market's historical challenges concerning high energy usage and processing variability.

In the downstream VRFB segment, AI is instrumental in simulating battery performance under various grid load conditions, optimizing charging/discharging protocols, and predicting the long-term degradation of electrolyte chemistries. Furthermore, AI platforms are being utilized to manage complex, multi-source supply chains, providing real-time risk assessment concerning geopolitical instability or transportation bottlenecks, thereby ensuring a reliable supply of processed vanadium compounds to battery manufacturers. The integration of digital twins and predictive analytics across the value chain enhances decision-making, moving the market toward more resilient and efficient operational frameworks.

- AI-driven optimization of mining and refining processes results in higher vanadium recovery rates and reduced energy expenditure.

- Predictive analytics enhances supply chain transparency and mitigates risks associated with geographical supply concentration.

- Machine learning accelerates the discovery and testing of novel high-performance vanadium alloys and advanced VRFB electrolyte chemistries.

- AI systems optimize operational parameters for large-scale VRFB installations, maximizing grid integration efficiency and longevity.

- Advanced algorithms enable real-time quality control checks during V2O5 production, ensuring the required purity for battery applications.

DRO & Impact Forces Of Vanadio Market

The dynamics of the Vanadio Market are shaped by a potent combination of driving forces related to global infrastructure demands and emerging technological opportunities, counterbalanced by significant restraints concerning supply concentration and inherent price volatility. Primary drivers include the persistent, massive global demand for high-strength steel, mandated by stricter building codes and advancements in automotive lightweighting technologies. Concurrently, the accelerating pace of the global energy transition is creating an unprecedented opportunity in the energy storage sector, particularly favoring VRFBs due to their inherent safety, scalability, and long cycle life, positioning them as a critical alternative to lithium-ion solutions for grid stabilization.

However, the market faces structural restraints that impede smoother growth. A primary concern is the heavily concentrated supply chain, with a few countries dominating both the mining of primary ore and the subsequent processing of vanadium products, leading to significant geopolitical risk and susceptibility to sudden price spikes or supply disruptions. Furthermore, the complex and capital-intensive nature of vanadium extraction, often as a co-product, means production volumes are frequently tied to the economics of the primary metal (like iron or steel slag), making independent volume adjustments challenging. Regulatory hurdles pertaining to waste disposal from extraction processes also add to operational costs and complexity.

Opportunities for market expansion are abundant, particularly in developing circular economy initiatives focused on recycling spent catalysts, oil refinery residues, and steel slag, which offer more sustainable and geographically diverse sources of vanadium. The development of advanced flow battery technology, alongside new applications in niche sectors such as specialized aerospace coatings and medical isotopes, provides avenues for market diversification away from solely relying on the steel industry. These impact forces—the persistent pull of traditional industry, the strong push of green energy mandates, and the inherent supply vulnerabilities—create a complex and high-stakes environment for market stakeholders navigating future investment decisions.

Segmentation Analysis

Segmentation of the Vanadio Market is essential for understanding the varied demand drivers and technological requirements across different end-use industries. The market is primarily segmented based on product type (differentiating raw material forms), application (defining end-use sectors), and geographical region. This detailed breakdown allows market participants to tailor supply chain strategies, product purity levels, and marketing efforts according to the specific technical demands and economic sensitivities of each segment. The distinct requirements for high-purity V2O5 in electrolytes contrast sharply with the volume and price sensitivity typical of ferrovanadium used in commodity steel production, necessitating separate market analyses for accurate forecasting and strategic planning.

The product type segmentation differentiates between high-value refined chemicals and bulk alloying materials. Ferrovanadium (FeV) typically commands the largest share by volume, serving the metallurgical sector, while Vanadium Pentoxide (V2O5) is the critical intermediate product, serving both the chemical catalyst market and the high-growth VRFB electrolyte market, which requires V2O5 of exceptional purity. Analyzing these product segments reveals differential growth rates; while FeV growth is steady, V2O5, driven by battery demand, is expected to show superior CAGR over the forecast period.

Application segmentation illustrates the diversification efforts within the industry. While the Steel & Alloys segment remains foundational, the Energy Storage segment, though currently smaller, represents the largest potential for disruptive growth. Catalyst applications, particularly in environmental mitigation (denox systems), provide a stable, technologically advanced market niche. Understanding the interplay between these segments is crucial, as massive swings in VRFB adoption could potentially strain the supply chain, impacting the availability and pricing for traditional steel producers.

- By Type:

- Vanadium Pentoxide (V2O5)

- Ferrovanadium (FeV)

- Vanadium Chemicals and Alloys (e.g., Vanadium Nitride, Vanadium Electrolyte)

- By Application:

- Steel and Alloys Manufacturing (High-Strength Low-Alloy Steel, Tool Steels, Specialty Alloys)

- Chemical Catalysts (Sulfuric Acid Production, Maleic Anhydride)

- Energy Storage (Vanadium Redox Flow Batteries - VRFBs)

- Aerospace and Defense (Titanium-Vanadium Alloys)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Vanadio Market

The Vanadio Market value chain is segmented into three primary stages: upstream (extraction and concentration), midstream (processing and refining), and downstream (product manufacturing and distribution). The upstream stage is characterized by high capital intensity and geographical concentration, largely dominated by primary mining operations where vanadium is extracted either from dedicated deposits (like titaniferous magnetites) or, more commonly, as a co-product of iron ore, uranium, or phosphate mining. An increasingly vital part of the upstream segment involves secondary recovery, focusing on reclaiming vanadium from industrial wastes such as power plant fly ash and spent oil refining catalysts. Effective upstream management is critical, as it dictates the quality and consistency of the initial feedstock entering the processing stage.

The midstream processing stage converts concentrated ore or waste into commercially viable products, mainly Vanadium Pentoxide (V2O5). This stage is chemically complex and energy-intensive, involving roasting, leaching, and precipitation processes. The purity level achieved here is paramount; standard V2O5 is used for ferrovanadium production, while ultra-high purity V2O5 is required for electrolyte manufacturing, demanding specialized refining techniques. Midstream operators must maintain strict quality controls and leverage advanced technology to manage costs and environmental footprints, as purity determines the final product's market value and suitability for high-tech applications.

The downstream stage involves transforming V2O5 into end-products like Ferrovanadium (FeV), which is sold directly to steel mills, or Vanadium Electrolyte, which is supplied to VRFB manufacturers. Distribution channels are typically bifurcated: direct contracts for large-volume customers like major steel producers and specialized chemical distributors for smaller buyers and niche applications. The proliferation of VRFB technology is creating entirely new downstream channels, including leasing models for the vanadium electrolyte itself, designed to reduce the high upfront cost of VRFB systems for end-users like utility companies. The distinction between direct sales (for bulk FeV) and indirect distribution (through specialized chemical logistics) highlights the diverse demands of the end market.

Vanadio Market Potential Customers

Potential customers for the Vanadio Market span a broad spectrum of heavy industries and advanced technology sectors, primarily characterized by a need for materials possessing superior strength, durability, and operational longevity. The largest and most established customer segment is the steel industry, encompassing major global steel manufacturers, specialized alloy producers, and foundries. These entities utilize ferrovanadium extensively to produce high-strength low-alloy (HSLA) steel, tool steels, and specialized alloys integral to construction (rebar, structural beams), heavy machinery, and pipelines, seeking enhanced material performance while minimizing structural weight.

A rapidly expanding and strategically crucial customer base lies within the global energy sector, specifically utility companies, independent power producers (IPPs), and microgrid developers. These customers are the primary buyers of Vanadium Redox Flow Battery (VRFB) systems, requiring vanadium electrolytes for long-duration, stationary energy storage applications necessary for integrating wind and solar power and ensuring grid stability. The appeal of VRFBs to these customers stems from their non-flammability, virtually unlimited cycle life, and capacity for independent scaling of power and energy, making them indispensable for large-scale energy infrastructure projects.

Furthermore, niche but high-value customer segments include the aerospace and defense industries, which require high-performance titanium-vanadium alloys (e.g., Ti-6Al-4V) for critical components such as airframe structures, jet engines, and weaponry, valuing the material's exceptional strength-to-weight ratio and fatigue resistance. Chemical manufacturers also represent a consistent customer base, purchasing vanadium catalysts for essential industrial processes, notably the production of sulfuric acid, a foundational chemical used worldwide. These diverse end-users require varying grades of vanadium purity, driving complexity and specialization within the supply chain to meet strict technical specifications across all segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glencore, EVRAZ, AMG Advanced Metallurgical Group, Largo Inc., Bushveld Minerals, China National Rare Earth Group, Refratechnik, Tivan, US Vanadium, Bear Creek Mining, Tremond Metals, HBIS Group, Hickman, Atlantic, Australian Vanadium, Dalian Rongke Power. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vanadio Market Key Technology Landscape

The technology landscape of the Vanadio Market is currently undergoing a transformative phase, driven equally by efficiency demands in extraction and the rigorous performance requirements of the energy storage sector. Upstream technological advancements are centered on optimizing the hydrometallurgical and pyrometallurgical routes for extraction. Specifically, improved leaching techniques and solvent extraction methods are being deployed to enhance the recovery yield from low-grade ores and, crucially, from secondary sources like spent catalysts and steel slag. These innovations address both sustainability concerns and the challenge of geographically diversified, reliable supply, reducing reliance on primary ore mining. Furthermore, continuous process monitoring systems, often utilizing sensor technology and predictive maintenance, are becoming standard to maximize uptime and reduce the high operational costs associated with vanadium processing.

A critical area of focus in midstream technology development involves achieving ultra-high purity Vanadium Pentoxide (V2O5), essential for use in high-performance Vanadium Redox Flow Batteries (VRFBs). Impurities, even in trace amounts, can significantly degrade VRFB performance. New refining technologies, including advanced purification steps and crystallization methods, are being patented to consistently produce battery-grade V2O5. This technological push is vital for establishing the long-term viability and competitiveness of VRFBs against competing battery chemistries, ensuring maximum energy efficiency and cycle stability in grid applications.

Downstream technological evolution is predominantly defined by advancements in VRFB system design and electrolyte chemistry. Key innovations include developing high-energy density vanadium electrolytes, often achieved through chemical modifications or stabilization additives, which allow the batteries to store more energy within a smaller footprint, thereby reducing system size and capital expenditure. Additionally, significant R&D is invested in flow battery stack architecture, focusing on materials science improvements in membranes, bipolar plates, and cell design to minimize resistance, enhance efficiency, and reduce overall manufacturing complexity. These technology developments are paramount to achieving the necessary cost parity for widespread commercial adoption in the utility storage market.

Regional Highlights

The Vanadio market exhibits significant regional variation in both production capacity and consumption patterns, reflecting global industrial and energy policy disparities. The Asia Pacific (APAC) region currently dominates the global Vanadio market, primarily driven by China, which acts as the largest consumer due to its massive steel production and infrastructure development, and also serves as the largest global producer. Demand is further fueled by rapid urbanization in India and Southeast Asian nations, sustaining the massive requirement for ferrovanadium in HSLA steel. This region is also leading the charge in VRFB deployment, particularly in China and South Korea, which are aggressively investing in domestic long-duration storage projects to stabilize their expanding renewable energy capacity, making APAC the key determinant of global vanadium pricing and demand trends.

North America and Europe represent mature, high-value markets focused on specialized applications and technological leadership. While possessing smaller extraction operations compared to APAC, these regions drive demand for specialized, high-purity vanadium products used in the aerospace and defense sectors, where strict material specifications dictate premium pricing. Crucially, both regions have prioritized the domestic production and deployment of VRFBs as a strategic energy security measure. Government initiatives, such as the EU's Critical Raw Materials Act and various US Department of Energy programs, are stimulating localized electrolyte production and VRFB manufacturing, aiming to reduce reliance on foreign supply chains and establish robust domestic energy storage ecosystems.

Latin America (LATAM) and the Middle East & Africa (MEA) play significant roles primarily as resource providers. Brazil and South Africa are major global vanadium mining centers, supplying raw materials and concentrates to global refiners. Although domestic consumption is relatively smaller, focusing mainly on regional construction and local steel production, the importance of these regions lies in their large, often underexploited vanadium reserves. Future market growth in these regions will be influenced by global investment in extraction infrastructure and the development of localized beneficiation facilities to increase the value capture within the region before export.

- Asia Pacific (APAC) is the dominant market, driven by high steel production in China and massive governmental investments in VRFB technology for grid storage integration.

- North America and Europe focus on specialized, high-purity vanadium applications for aerospace and defense, alongside strategic localization of VRFB manufacturing and electrolyte production.

- South Africa and Brazil are key players in primary vanadium extraction, essential for global supply, though their processed product export capability is often limited.

- Increased infrastructure spending in India and Southeast Asia supports sustained, high-volume demand for ferrovanadium in construction materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vanadio Market. These companies are actively involved across the value chain, ranging from primary mining and co-product extraction to the refining, alloy manufacturing, and development of energy storage solutions. Strategic profiles examine their core competencies, recent developments, financial performance, and technological investment in high-purity vanadium production and VRFB electrolyte services.- Glencore

- EVRAZ

- AMG Advanced Metallurgical Group N.V.

- Largo Inc.

- Bushveld Minerals Limited

- China National Rare Earth Group Co., Ltd. (Including associated vanadium operations)

- Refratechnik Holding GmbH

- Tivan Limited

- US Vanadium LLC

- Bear Creek Mining Corporation

- Tremond Metals Corp.

- HBIS Group Co., Ltd. (Hebei Iron & Steel)

- Hickman, Williams & Company

- Atlantic Vanadium Ltd.

- Australian Vanadium Limited

- Dalian Rongke Power Co., Ltd. (VRFB focused)

- Sumitomo Electric Industries, Ltd. (VRFB focused)

- JFE Holdings, Inc.

- CITIC Resources Holdings Limited

- Huayuan Mining Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Vanadio market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for vanadium?

The primary factor driving demand is the global requirement for high-strength, lightweight steel alloys (HSLA) used extensively in construction, automotive, and infrastructure projects, where vanadium significantly enhances material durability and performance.

How is the adoption of Vanadium Redox Flow Batteries (VRFBs) impacting the market?

VRFB adoption is critically impacting the market by creating a significant, high-growth demand vector for high-purity Vanadium Pentoxide (V2O5) electrolytes, shifting market focus towards energy storage and diversification away from traditional steel applications.

Which geographical region dominates the global vanadium supply chain?

The Asia Pacific region, particularly China, dominates the global vanadium supply chain, acting as the largest producer, processor, and consumer of refined vanadium products, although geopolitical factors are driving Western nations to seek localized supply alternatives.

What are the key technical challenges facing vanadium producers?

Key technical challenges include managing the high energy intensity and complexity of the extraction process, ensuring consistent quality and high purity (especially for battery grade V2O5), and overcoming the volatility of co-product extraction economics.

Is vanadium primarily mined as a standalone mineral?

No, vanadium is rarely mined as a standalone mineral. It is predominantly obtained as a co-product, primarily recovered during the processing of titaniferous magnetite iron ore, or through the recycling of secondary materials like steel slag and spent oil refining catalysts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager