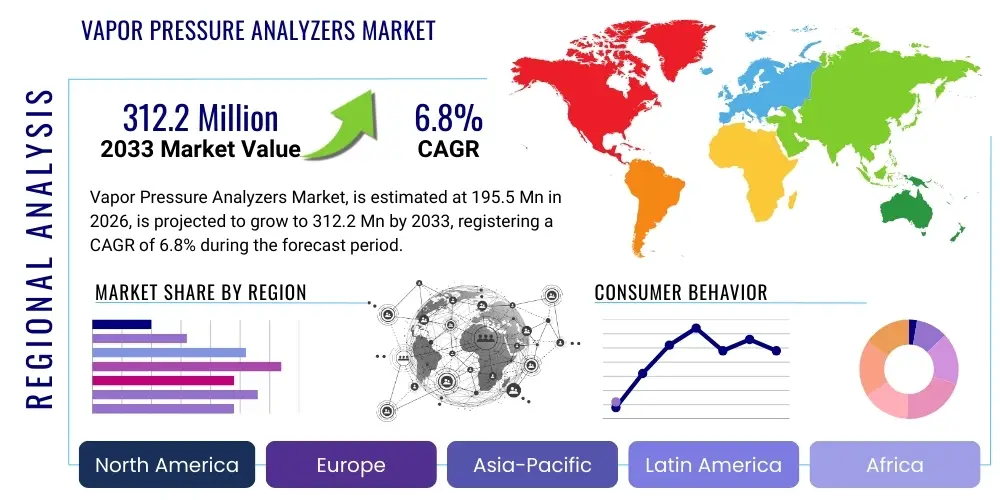

Vapor Pressure Analyzers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439892 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Vapor Pressure Analyzers Market Size

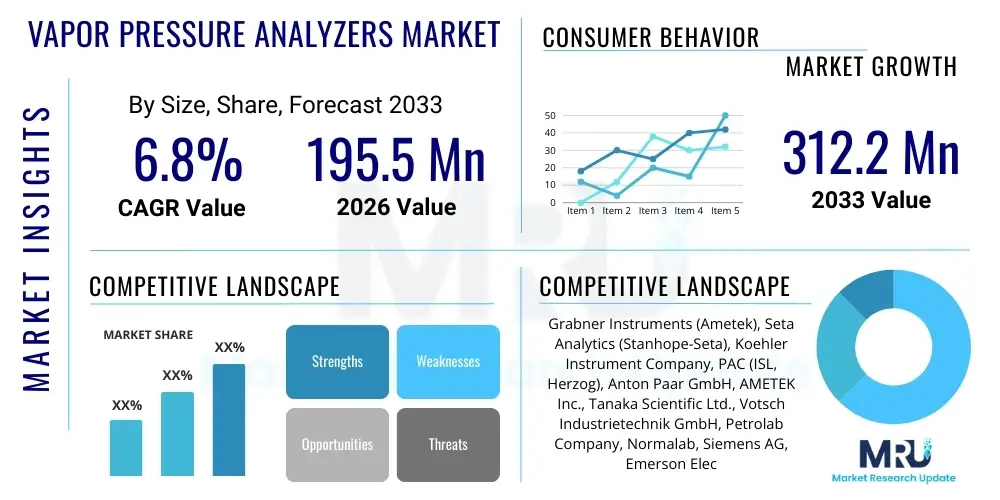

The Vapor Pressure Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 195.5 million in 2026 and is projected to reach USD 312.2 million by the end of the forecast period in 2033.

Vapor Pressure Analyzers Market introduction

Vapor pressure analyzers are sophisticated instruments designed to accurately measure the vapor pressure of various volatile liquids and petroleum products. This measurement is crucial for quality control, safety, and regulatory compliance across numerous industries. These analyzers typically employ a range of technologies, including static, dynamic, and differential pressure methods, to determine the pressure exerted by a vapor in thermodynamic equilibrium with its condensed phases at a given temperature. The primary product description encompasses both benchtop and portable units, often equipped with advanced sensors, integrated temperature control, and automated testing procedures.

Major applications for vapor pressure analyzers span the petroleum industry, where they are vital for characterizing gasoline, crude oil, LPG, and jet fuel, ensuring compliance with standards such as ASTM D6378, D5191, and D323. Beyond petroleum, these instruments are indispensable in chemical manufacturing for solvent analysis, in the pharmaceutical sector for active pharmaceutical ingredient (API) and excipient characterization, and in environmental monitoring for VOC emissions assessment. The benefits derived from accurate vapor pressure analysis include enhanced product quality, improved operational safety by preventing excessive pressure buildup, optimization of manufacturing processes, and adherence to stringent national and international regulatory frameworks concerning volatility and environmental impact.

The market for vapor pressure analyzers is fundamentally driven by several critical factors. Increasingly strict environmental regulations, particularly those aimed at reducing volatile organic compound (VOC) emissions from fuels and chemicals, necessitate precise vapor pressure measurements. Furthermore, the expanding global energy landscape and the continuous demand for refined petroleum products, along with the growth of the chemical and pharmaceutical industries, underpin the sustained need for these analytical tools. Technological advancements, leading to more accurate, faster, and user-friendly instruments, also contribute significantly to market expansion, enabling better process control and broader application possibilities.

Vapor Pressure Analyzers Market Executive Summary

The Vapor Pressure Analyzers Market is experiencing robust growth, propelled by the convergence of stringent regulatory mandates, significant industrial expansion, and continuous technological innovation. Key business trends indicate a strong move towards automation, integration with laboratory information management systems (LIMS), and the development of more compact, portable, and online monitoring solutions to meet diverse operational needs. Manufacturers are focusing on enhancing measurement precision, reducing sample consumption, and improving user interfaces to streamline analysis processes and reduce operational complexities, thereby offering higher value propositions to end-users across various sectors.

Regionally, the market exhibits varied growth dynamics. North America and Europe, characterized by established industrial infrastructures and stringent environmental protection regulations, represent mature markets with a consistent demand for advanced analytical instruments. These regions often drive innovation in compliance and high-performance analysis. Conversely, the Asia Pacific (APAC) region is emerging as a significant growth engine, fueled by rapid industrialization, increasing investments in refining and petrochemical capacities, and a rising focus on product quality and environmental standards. Countries like China and India are particularly pivotal in this regional expansion, driven by both domestic demand and export-oriented manufacturing.

Segmentation trends within the market highlight distinct preferences and evolving technological landscapes. The static method segment continues to be a foundational technology, while dynamic and differential pressure methods gain traction for specific applications requiring greater speed or different measurement conditions. From an end-user perspective, the oil and gas industry remains the largest consumer, but demand from the chemical, pharmaceutical, and environmental testing sectors is steadily increasing, diversifying the market's revenue streams. There is a noticeable shift towards online/process analyzers for real-time monitoring and process optimization, reflecting a broader trend towards Industry 4.0 and predictive analytics in industrial operations.

AI Impact Analysis on Vapor Pressure Analyzers Market

User inquiries concerning AI's influence on the Vapor Pressure Analyzers Market frequently revolve around how artificial intelligence can enhance accuracy, automate analysis, provide predictive insights, and improve overall operational efficiency. There is significant interest in AI's potential to interpret complex data patterns, optimize calibration processes, and facilitate proactive maintenance of analytical instruments. Users are keen to understand if AI can lead to more robust quality control measures, reduce human error, and offer real-time actionable intelligence, thereby transforming traditional laboratory and process analysis into more intelligent and autonomous operations. Expectations are high for AI to contribute to smarter, more resilient analytical workflows that support increasingly sophisticated industrial demands and regulatory requirements.

- Enhanced Predictive Analytics: AI algorithms can analyze historical and real-time data from vapor pressure analyzers to predict potential equipment failures or maintenance needs, thereby minimizing downtime and optimizing operational longevity.

- Automated Data Interpretation: AI-powered software can process large datasets from multiple tests, identify trends, detect anomalies, and generate comprehensive reports, significantly reducing manual effort and potential for human error.

- Optimized Calibration and Self-Correction: AI can learn from calibration patterns and environmental variables to suggest optimal calibration schedules or even enable self-correcting mechanisms, ensuring sustained accuracy and reducing the need for frequent manual intervention.

- Real-time Monitoring and Anomaly Detection: Integration of AI allows for continuous, real-time monitoring of vapor pressure measurements, instantly flagging any deviations from expected ranges that might indicate process issues or non-compliance.

- Improved Process Control: By providing immediate and intelligent insights into vapor pressure dynamics, AI can enable more precise and adaptive control over industrial processes, leading to better product consistency and efficiency.

- Advanced Quality Assurance: AI systems can correlate vapor pressure data with other product characteristics to provide a holistic view of quality, potentially identifying root causes of variations faster and more accurately than traditional methods.

DRO & Impact Forces Of Vapor Pressure Analyzers Market

The Vapor Pressure Analyzers Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, all contributing to dynamic impact forces. Drivers such as the escalating stringency of environmental regulations, particularly those targeting volatile organic compound emissions from fuels and chemicals, compel industries to adopt advanced analytical solutions for precise measurements and compliance. The continuous expansion and modernization of the global oil and gas, petrochemical, and chemical industries also fuels demand, as these sectors heavily rely on accurate vapor pressure data for process optimization, product quality, and safety protocols. Furthermore, a growing emphasis on product safety and quality assurance across various end-user segments necessitates reliable and highly accurate instrumentation, further bolstering market growth. Technological advancements in sensor design, automation, and data processing capabilities within the analyzers also act as significant drivers, making the instruments more efficient and versatile.

However, the market faces notable restraints that temper its growth trajectory. The high initial capital investment required for purchasing advanced vapor pressure analyzers can be a barrier for smaller enterprises or those with limited budgets, particularly for highly specialized or automated systems. The inherent complexity in the calibration, maintenance, and operation of these sophisticated instruments often requires skilled technical personnel, and a shortage of such expertise can hinder adoption and efficient utilization. Additionally, the global economic volatility, including fluctuations in crude oil prices and industrial output, can impact investment decisions in new analytical equipment, leading to periods of dampened demand. Regulatory changes, while often drivers, can also present challenges if they introduce complex or inconsistent standards across different regions, requiring manufacturers to adapt their products and users to manage diverse compliance requirements.

Despite these restraints, significant opportunities exist for market expansion and innovation. The increasing integration of vapor pressure analyzers with IoT (Internet of Things) platforms and Industry 4.0 initiatives presents a substantial opportunity for real-time remote monitoring, predictive maintenance, and seamless data exchange across industrial ecosystems. The development of new applications in emerging sectors such as biofuels, specialty chemicals, and advanced materials opens untapped market segments, requiring tailored analytical solutions. Moreover, the growing demand for portable and online analyzers offers immense potential for field testing, rapid diagnostics, and continuous process monitoring, moving beyond traditional laboratory-centric analysis. Manufacturers who invest in research and development to create more cost-effective, user-friendly, and versatile instruments, especially for emerging markets, are well-positioned to capitalize on these opportunities, ensuring sustained market growth and addressing evolving industry needs with innovative solutions.

Segmentation Analysis

The Vapor Pressure Analyzers Market is extensively segmented to reflect the diverse technological approaches, product types, applications, and end-user industries that characterize its landscape. This segmentation provides a granular view of market dynamics, revealing specific growth trends and competitive landscapes within each category. Understanding these segments is crucial for stakeholders to identify niche opportunities, tailor product development, and formulate effective market entry and expansion strategies. The analysis spans technologies such as static and dynamic methods, different instrument types from benchtop to online, varied applications including petroleum products and chemicals, and a broad range of end-user industries from oil & gas to pharmaceuticals, each presenting unique demands and market characteristics.

- By Technology

- Static Method

- Dynamic Method

- Differential Pressure Method

- Expansion Method

- By Type

- Benchtop Analyzers

- Portable Analyzers

- Online/Process Analyzers

- By Application

- Gasoline

- Crude Oil

- LPG (Liquefied Petroleum Gas)

- Jet Fuel

- Solvents

- Chemicals

- Pharmaceuticals

- Fragrances

- Biofuels

- By End-User Industry

- Oil & Gas Industry

- Chemical & Petrochemical Industry

- Pharmaceutical Industry

- Environmental Testing Laboratories

- Research & Academia

- Food & Beverage Industry

Value Chain Analysis For Vapor Pressure Analyzers Market

The value chain for the Vapor Pressure Analyzers Market begins with upstream activities involving the sourcing of raw materials and the manufacturing of critical components. This phase includes suppliers of high-precision sensors, microcontrollers, pumps, valves, and specialized materials (e.g., stainless steel for chambers, advanced polymers for seals) that are essential for the accurate and reliable operation of the analyzers. Key players in this segment include specialized sensor manufacturers, electronic component providers, and precision engineering firms. The quality and availability of these upstream components directly impact the final product's performance, cost-effectiveness, and production timelines. Strong relationships with reliable suppliers are paramount for maintaining consistent quality and managing production costs within the competitive landscape.

Further along the value chain, the manufacturing and assembly of the vapor pressure analyzers constitute the core activities, where various components are integrated into the final instrument. This stage involves complex R&D, design, software development, assembly, calibration, and rigorous quality control testing to ensure compliance with industry standards and customer specifications. Market leaders often invest heavily in advanced manufacturing processes and skilled labor to achieve high levels of precision and reliability. Following manufacturing, the products move into distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to end-users, often for large industrial clients or through specialized sales teams that provide technical support and customization. This approach allows for direct customer feedback and stronger relationships, but requires significant internal resources.

Indirect distribution involves leveraging a network of distributors, wholesalers, and specialized laboratory equipment resellers. These partners typically have established sales networks, local market knowledge, and the capacity to provide after-sales support, service, and training. This approach helps manufacturers reach a broader customer base, particularly in geographically diverse or fragmented markets, without the overhead of extensive direct sales operations. The downstream activities then culminate with the end-users, which include various industries such as oil and gas, chemical, pharmaceutical, and environmental testing laboratories. These end-users utilize the analyzers for critical applications like quality control, research, and regulatory compliance. The effectiveness of the distribution channels and the level of technical support and service provided significantly influence customer satisfaction and repeat business, thereby impacting the overall market success of vapor pressure analyzer manufacturers.

Vapor Pressure Analyzers Market Potential Customers

Potential customers for vapor pressure analyzers are primarily concentrated in industries where the precise measurement of volatility is critical for product quality, operational safety, environmental compliance, and research. The largest segment of end-users are participants in the oil and gas industry, including crude oil refineries, petrochemical plants, and fuel distributors. These entities rely on vapor pressure analyzers to characterize gasoline, jet fuel, LPG, and crude oil, ensuring that products meet specifications, prevent unwanted evaporation, and comply with stringent regulatory standards related to storage, transportation, and emissions. Accurate vapor pressure data is essential for blending operations, ensuring stability and safety across the entire hydrocarbon value chain.

Another significant customer base exists within the chemical and specialty chemical manufacturing sectors. Here, vapor pressure analysis is crucial for evaluating the properties of solvents, various chemical compounds, and intermediates. This is particularly important for process control, ensuring product purity, and managing safety aspects related to volatile chemicals during production, handling, and storage. The pharmaceutical industry also represents a growing segment, utilizing these analyzers for characterizing active pharmaceutical ingredients (APIs), excipients, and solvents to ensure product stability, quality, and compliance with pharmacopoeial standards, especially for liquid formulations where volatility can impact drug delivery and shelf-life.

Furthermore, environmental testing laboratories and research institutions are key potential customers. Environmental labs use vapor pressure analyzers to assess the volatility of various substances, aiding in the monitoring and regulation of volatile organic compound (VOC) emissions from industrial sources and waste materials, thus contributing to air quality control. Academic and industrial research facilities employ these instruments for developing new materials, optimizing chemical processes, and conducting fundamental studies on thermodynamic properties of liquids. Emerging applications in sectors like biofuels, food & beverage (for flavor analysis), and fragrances also contribute to a diversifying customer landscape, as more industries recognize the critical importance of volatility measurements for their specific applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Million |

| Market Forecast in 2033 | USD 312.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grabner Instruments (Ametek), Seta Analytics (Stanhope-Seta), Koehler Instrument Company, PAC (ISL, Herzog), Anton Paar GmbH, AMETEK Inc., Tanaka Scientific Ltd., Votsch Industrietechnik GmbH, Petrolab Company, Normalab, Siemens AG, Emerson Electric Co., Thermo Fisher Scientific Inc., Xylem Inc., Yokogawa Electric Corporation, Agilent Technologies Inc., Spectro Scientific, Sciex, KNF Neuberger, Buchi Labortechnik AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vapor Pressure Analyzers Market Key Technology Landscape

The technology landscape of the Vapor Pressure Analyzers Market is characterized by a continuous evolution towards greater precision, automation, and versatility to meet the demanding requirements of various industries. The foundational technologies include static, dynamic, and differential pressure methods, each offering distinct advantages depending on the sample type and regulatory standards. Static methods, often governed by ASTM D5191 and D6378, involve allowing the sample to reach equilibrium in a sealed chamber, providing highly accurate measurements for volatile liquids like gasoline. Dynamic methods, such as those used for measuring Reid Vapor Pressure (RVP) under ASTM D323, typically involve displacing a portion of a liquid sample with air and measuring the pressure, offering robust solutions for crude oil and other petroleum products.

Beyond these established methodologies, the market is increasingly adopting advanced sensor technologies, including micro-electro-mechanical systems (MEMS) based sensors, which offer enhanced sensitivity, faster response times, and reduced sample volumes. These newer sensors contribute to the development of more compact, portable, and energy-efficient analyzers. Integrated software solutions play a critical role, providing comprehensive data acquisition, analysis, and reporting capabilities. Modern analyzers often feature intuitive touchscreen interfaces, onboard data storage, connectivity options (USB, Ethernet, Wi-Fi), and compatibility with laboratory information management systems (LIMS) for seamless data integration and workflow optimization, reducing manual intervention and improving data integrity.

Furthermore, automation and self-calibration features are becoming standard, significantly reducing the need for manual setup and improving measurement reproducibility. Automated sample handling systems, intelligent cleaning cycles, and diagnostic functions minimize operator involvement and extend the lifespan of the instruments. There is also a notable trend towards online/process analyzers, which are designed for continuous, real-time monitoring of vapor pressure directly within industrial processes. These systems leverage robust industrial-grade components, remote connectivity, and predictive maintenance algorithms to ensure uninterrupted operation and immediate feedback for process control, embodying the principles of Industry 4.0 and driving efficiency in manufacturing and refining operations.

Regional Highlights

- North America: This region represents a mature market driven by stringent environmental regulations, a well-established oil and gas industry, and significant investments in R&D for advanced analytical instruments. The demand for highly accurate and automated vapor pressure analyzers is consistently high, especially in the US and Canada, for compliance with fuel quality standards and environmental protection agencies.

- Europe: Similar to North America, Europe is characterized by strict regulatory frameworks (e.g., REACH regulations) and a strong focus on quality control in petrochemicals, chemicals, and pharmaceuticals. Countries like Germany, the UK, and France are key contributors, emphasizing innovation in portable and online analyzers to enhance operational efficiency and environmental compliance across diverse industrial sectors.

- Asia Pacific (APAC): The APAC region is a rapidly expanding market, primarily fueled by fast-paced industrialization, increasing energy demand, and growing investments in refining and petrochemical capacities, particularly in China, India, and Southeast Asian nations. The region is witnessing a surge in demand for vapor pressure analyzers as local industries strive to meet international quality standards and address emerging environmental concerns.

- Latin America: This region presents considerable growth potential due to expanding oil and gas exploration and production activities, alongside a developing chemical industry. Countries like Brazil and Mexico are key markets, driven by the need for modern analytical solutions to optimize local refining processes, ensure product quality, and comply with evolving national and regional regulations.

- Middle East and Africa (MEA): The MEA region's market for vapor pressure analyzers is predominantly driven by its massive oil and gas reserves and extensive refining operations. Countries such as Saudi Arabia, UAE, and Qatar are major consumers, seeking robust and reliable instruments for crude oil characterization, fuel blending, and ensuring the quality and safety of petroleum products for both domestic consumption and international export.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vapor Pressure Analyzers Market.- Grabner Instruments (Ametek)

- Seta Analytics (Stanhope-Seta)

- Koehler Instrument Company

- PAC (ISL, Herzog)

- Anton Paar GmbH

- AMETEK Inc.

- Tanaka Scientific Ltd.

- Votsch Industrietechnik GmbH

- Petrolab Company

- Normalab

- Siemens AG

- Emerson Electric Co.

- Thermo Fisher Scientific Inc.

- Xylem Inc.

- Yokogawa Electric Corporation

- Agilent Technologies Inc.

- Spectro Scientific

- Sciex

- KNF Neuberger

- Buchi Labortechnik AG

Frequently Asked Questions

What is a vapor pressure analyzer and why is it important?

A vapor pressure analyzer is an instrument used to measure the pressure exerted by a vapor in equilibrium with its liquid phase. This measurement is crucial for determining the volatility of liquids, particularly petroleum products, chemicals, and pharmaceuticals, ensuring product quality, safety during handling and storage, and compliance with environmental and industrial regulations.

What industries primarily use vapor pressure analyzers?

The primary industries utilizing vapor pressure analyzers include oil and gas (for gasoline, crude oil, LPG, jet fuel), chemical and petrochemical manufacturing (for solvents, various chemicals), pharmaceutical (for APIs and excipients), and environmental testing laboratories (for VOC emissions).

What are the main types of vapor pressure measurement technologies?

The main technologies are static methods (measuring equilibrium pressure in a sealed chamber), dynamic methods (involving air displacement), and differential pressure methods. Each is suited for different sample types and regulatory standards, offering varying levels of precision and speed.

How do AI and advanced technologies impact the vapor pressure analyzers market?

AI and advanced technologies are transforming the market by enabling enhanced predictive analytics for maintenance, automated data interpretation, optimized calibration, real-time monitoring for anomaly detection, and improved process control, leading to greater efficiency, accuracy, and reduced operational costs.

What are the key factors driving the growth of the Vapor Pressure Analyzers Market?

Key drivers include increasingly stringent environmental regulations, sustained growth in the global oil and gas and chemical industries, a rising focus on product quality and safety, and continuous technological advancements leading to more accurate and automated analytical solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager