Variable Optic Attenuators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434671 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Variable Optic Attenuators Market Size

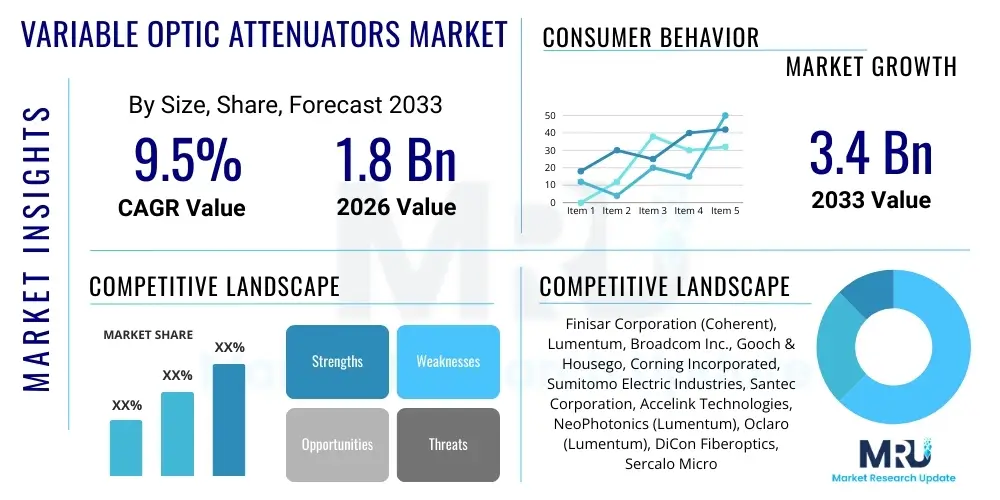

The Variable Optic Attenuators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Variable Optic Attenuators Market introduction

Variable Optic Attenuators (VOAs) are essential passive components utilized in fiber optic communication systems and networking infrastructure to precisely control or adjust the power level of an optical signal. These devices are crucial for system optimization, allowing network designers to balance the optical power budget across complex fiber paths, prevent receiver saturation, and manage inter-channel crosstalk in dense wavelength division multiplexing (DWDM) systems. The fundamental product description involves components that introduce a known, adjustable loss in the light path, typically realized using technologies such as Micro-Electro-Mechanical Systems (MEMS), Liquid Crystal (LC), or thermal/mechanical mechanisms. VOAs ensure signal integrity and reliable data transmission over long distances or in high-capacity data centers.

Major applications of VOAs span the entire optical ecosystem, including long-haul telecommunications, metropolitan area networks (MANs), Fiber-to-the-Home (FTTH) deployment, and increasingly, hyper-scale data center interconnects. In DWDM systems, VOAs are indispensable for dynamic channel equalization, ensuring that all channels arrive at the demultiplexer with uniform power levels, thereby maximizing the system's performance and spectral efficiency. Furthermore, they are widely used in laboratories for testing optical components and systems, facilitating precise calibration and performance verification across various operating conditions. The ability of VOAs to provide dynamic power control makes them superior to fixed attenuators in adaptive networking environments.

The primary driving factors for the Variable Optic Attenuators Market stem from the relentless global demand for higher bandwidth and faster data rates, necessitating continuous upgrades in optical infrastructure. The massive proliferation of 5G networks, coupled with the exponential growth in cloud computing and streaming services, drives the deployment of advanced optical components capable of dynamic power management. Benefits associated with VOAs include enhanced network flexibility, improved signal-to-noise ratio (SNR) maintenance, and the ability to automate power adjustments remotely, leading to lower operational expenditures (OpEx) and improved service reliability. The transition towards 400G and 800G Ethernet standards in data centers further cements the necessity for high-speed, dynamically managed attenuation solutions.

Variable Optic Attenuators Market Executive Summary

The Variable Optic Attenuators Market exhibits robust growth propelled by significant advancements in optical networking technologies and accelerating infrastructure expansion globally. Key business trends indicate a strong shift towards high-performance VOA technologies, particularly those based on MEMS, due to their superior speed, low insertion loss, small form factor, and excellent reliability required for integration into sophisticated transceivers and network equipment. Manufacturers are focusing on developing compact, integrated VOA arrays suitable for use in silicon photonics platforms and tunable optical modules, aligning with the industry's push for miniaturization and cost-efficiency. Strategic collaborations between VOA component suppliers and optical system integrators are becoming prevalent, aiming to optimize component performance specifically for high-density DWDM and passive optical network (PON) applications.

Regionally, the Asia Pacific (APAC) market maintains dominance, driven by extensive investment in fiber optic deployment, particularly in China, India, and Southeast Asian nations, supporting large-scale FTTH rollout and the build-out of 5G infrastructure. North America and Europe, while mature, demonstrate strong demand for advanced, high-speed VOAs, primarily fueled by the rapid expansion of hyperscale data centers requiring 400G/800G connectivity and the continuous modernization of core transport networks. Latin America and the Middle East & Africa (MEA) represent emerging high-growth opportunities, as governments and private entities intensify efforts to bridge the digital divide through substantial investments in optical backbone networks, thereby increasing the procurement of essential components like VOAs for power management.

Segmentation trends highlight the increasing prominence of VOAs categorized by technology, with MEMS-based VOAs gaining significant market share due to their dynamic performance characteristics crucial for DWDM applications. By application, the telecommunications segment remains the largest consumer, though the data center segment is demonstrating the fastest CAGR, reflecting the substantial ongoing investment in cloud infrastructure worldwide. The demand for VOA arrays (integrated devices containing multiple attenuators) is outpacing that of single-channel devices, driven by the need for higher channel density and parallel processing capabilities in next-generation optical line systems (OLS). Furthermore, fixed-line broadband deployment continues to support the demand for packaged VOAs used in OLTs (Optical Line Terminals) and ONTs (Optical Network Terminals) to ensure optimal signal reception across varying network distances.

AI Impact Analysis on Variable Optic Attenuators Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Variable Optic Attenuators Market centers predominantly on how AI-driven network management systems influence the need for dynamic, high-precision attenuation. Users frequently inquire whether AI optimization algorithms can predict power fluctuations more effectively, necessitating VOAs with ultra-fast response times and finer resolution. Key themes include the integration of machine learning (ML) for predictive maintenance of optical power levels, the requirement for VOAs to communicate real-time performance data back to AI controllers, and the potential for AI to optimize VOA settings in dynamic environments like reconfigurable optical add/drop multiplexers (ROADMs). Users expect AI to move the market beyond simple reactive attenuation to proactive, sophisticated power conditioning, demanding VOAs that are highly reliable, digitally controllable, and seamlessly integrable into software-defined networking (SDN) architectures.

The core expectation is that AI will significantly enhance the utilization efficiency and longevity of optical networks, thereby influencing VOA design requirements. AI algorithms trained on massive datasets of network traffic, temperature variations, and component degradation profiles can predict necessary power adjustments before performance degradation occurs. This shift from manual or static adjustment to AI-driven dynamic power leveling necessitates VOAs capable of performing millions of rapid, highly accurate adjustments over their lifespan. Specifically, AI-managed DWDM systems require VOAs that can respond to channel power imbalances caused by fluctuating network loads or temperature shifts in milliseconds, ensuring minimal downtime and maximizing throughput. This focus on rapid, data-driven optimization is compelling manufacturers to invest heavily in smart VOA technology.

Furthermore, AI-driven automation in network testing and certification processes directly benefits VOA manufacturers. In R&D environments, AI can optimize test routines that utilize VOAs for simulating various network conditions, accelerating the development cycle for new optical components. The market concern often relates to standardization: ensuring that VOA control interfaces (such as I2C or SPI) are robust enough to handle complex, high-frequency commands generated by ML controllers without latency or failure. The overall impact is a movement away from commodity VOA components toward premium, AI-ready attenuators that offer enhanced digital control, diagnostic feedback capabilities, and proven long-term stability under dynamic operation, fundamentally changing the product value proposition.

- AI algorithms facilitate predictive optical power management, requiring ultra-fast VOA response times.

- Integration of VOAs into SDN and AI-driven control loops demands highly reliable digital interfaces.

- AI optimizes VOA settings in DWDM ROADMs for dynamic channel power equalization and minimization of crosstalk.

- Machine learning models use VOA diagnostic data (insertion loss, temperature) for predictive network maintenance.

- AI accelerates optical component testing by automating VOA-based signal conditioning and impairment simulation.

- Increased reliance on AI-managed networks drives demand for high-precision, low-latency MEMS VOAs.

DRO & Impact Forces Of Variable Optic Attenuators Market

The Variable Optic Attenuators Market is shaped by a powerful confluence of driving, restraining, and opportunity factors, which collectively constitute the core impact forces influencing its trajectory. The dominant driver is the unprecedented growth in global data traffic, necessitating continuous infrastructure expansion in telecommunications and data centers. The rapid deployment of 5G networks requires sophisticated optical components, and the transition to high-speed 400G and 800G data center interconnects mandates highly precise, dynamic power control achievable only through advanced VOAs. Restraints, conversely, include the high initial cost associated with manufacturing high-performance VOA arrays, particularly those utilizing complex MEMS technology, coupled with the increasing commoditization of standard, low-end VOA products, leading to margin erosion for some manufacturers. Additionally, stringent requirements for device reliability and performance stability under harsh environmental conditions pose continuous engineering challenges, especially for components integrated into submarine cables or remote infrastructure.

Opportunities in the market are abundant, primarily focused on emerging applications beyond traditional telecom. The development of integrated photonics platforms, where VOAs are monolithically integrated onto silicon chips, represents a major avenue for future growth, offering smaller form factors and reduced power consumption critical for space-constrained devices. Furthermore, the burgeoning demand for high-power fiber lasers used in industrial manufacturing, military applications, and medical devices creates a niche market for specialized high-power VOAs capable of handling extreme optical loads without thermal degradation. The ongoing investment in Quantum Computing and Quantum Key Distribution (QKD) also presents an opportunity, as these sensitive technologies require ultra-precise, low-loss optical power control components to maintain qubit integrity and secure transmission paths. These emerging fields demand specifications that push the boundaries of current VOA technology.

The primary impact force remains technological evolution coupled with market consolidation. The continuous innovation in VOA fabrication techniques, particularly in MEMS actuation and silicon integration, constantly lowers the cost-per-function while improving performance metrics like switching speed and insertion loss uniformity. However, the market is subject to consolidation pressure, where large optical system vendors often internalize VOA component manufacturing or heavily rely on a few specialized suppliers, impacting smaller players. The shift towards dynamic networking (SDN/NFV) acts as a compounding force, strongly favoring suppliers whose products can seamlessly interface with advanced network management software, thus linking technical performance directly to system-level commercial success. Ultimately, the sustained exponential demand for bandwidth outweighs the current cost and reliability hurdles, sustaining robust market momentum.

- Drivers:

- Massive global proliferation of 5G and 6G infrastructure build-out.

- Accelerated deployment of hyperscale and edge data centers requiring 400G/800G connectivity.

- Increasing implementation of DWDM and ROADM systems demanding dynamic channel equalization.

- Growing adoption of Fiber-to-the-Home (FTTH) and Passive Optical Network (PON) technologies.

- Restraints:

- High manufacturing complexity and associated costs for high-precision VOA arrays.

- Commoditization pressure on standard, single-channel VOA modules.

- Requirement for high reliability and long-term stability in diverse operating environments.

- Trade-offs between switching speed, insertion loss, and polarization dependent loss (PDL).

- Opportunities:

- Integration of VOAs into silicon photonics and integrated optical modules.

- Expansion into niche applications like high-power industrial fiber lasers and medical optics.

- Development of next-generation components for Quantum Key Distribution (QKD) systems.

- Advancements in automated manufacturing processes to reduce unit cost.

- Impact Forces:

- Technological superiority (MEMS vs. LC) dictating market share dominance.

- Supplier consolidation and vertical integration within the optical component ecosystem.

- Standardization efforts (e.g., MSA groups) influencing design and compatibility.

- Global macroeconomic conditions affecting large-scale infrastructure capital expenditure.

Segmentation Analysis

The Variable Optic Attenuators Market is primarily segmented based on the core technology employed, the product type (single channel vs. array), the mechanism of operation, and the end-use application. Understanding these segments is crucial as they reflect the diverse performance requirements across various optical networking domains. Technological segmentation is particularly vital, differentiating between advanced, high-speed MEMS-based devices necessary for dynamic systems like ROADMs, and simpler, cost-effective technologies such as Liquid Crystal (LC) or Mechanical/Thermal approaches typically found in lower-speed or less dynamic environments. The performance parameters demanded by these technologies directly correlate with their suitability for specific high-bandwidth transmission standards and system architectures.

Segmentation by product type highlights the shift in market demand toward multi-channel arrays. While single-channel VOAs remain essential for laboratory testing and simple point-to-point links, the exponential increase in channel count in DWDM systems mandates the use of integrated VOA arrays. These arrays offer footprint reduction, improved channel-to-channel uniformity, and simplified integration into complex line cards. Further differentiation exists based on the packaging and physical format, distinguishing between packaged components (used in OLTs/ONTs) and bare-die or chip-scale devices integrated directly into optical transceivers, a trend driven by the miniaturization demands of modern pluggable optics (e.g., QSFP-DD, OSFP).

The application segmentation reveals the strongest revenue stream originating from the Telecommunications sector (long-haul, metro, access networks), followed closely by the rapidly expanding Data Center and Cloud Services segment. Emerging segments, including Military & Aerospace, Industrial Sensing, and Research & Development, exhibit niche but high-value growth due to their stringent requirements for environmental robustness, high power handling, and extreme precision. This diverse application base ensures that manufacturers must maintain a broad portfolio, catering to high-volume, cost-sensitive demands in telecom while simultaneously addressing the bespoke, high-specification requirements of industrial and defense customers, demanding continuous product differentiation and targeted marketing strategies.

- By Technology:

- Micro-Electro-Mechanical Systems (MEMS) VOA

- Liquid Crystal (LC) VOA

- Thermal Optic VOA

- Mechanical VOA (Motorized/Rotating Filter)

- By Type/Mechanism:

- Single-Channel Variable Optic Attenuator

- VOA Array (Multi-Channel)

- Integrated Chip VOA

- By Application:

- Telecommunications (Long-Haul, Metro, Access)

- Data Centers and Cloud Services

- Cable TV (CATV) Networks

- Test and Measurement Equipment

- Aerospace and Defense

- Industrial and Medical Sensing

- By Control Type:

- Manual Control VOA

- Remote/Digital Control VOA

Value Chain Analysis For Variable Optic Attenuators Market

The value chain for the Variable Optic Attenuators Market begins with the upstream segment, dominated by the sourcing of critical raw materials and the complex fabrication processes. Key inputs include specialized semiconductor materials (e.g., silicon, silicon-on-insulator for MEMS), optical fibers, precision glasses, and specific polymers used in packaging and assembly. Upstream analysis involves highly specialized foundry operations, particularly in the case of MEMS VOAs, where lithography, etching, and thin-film deposition are performed. The competitive edge at this stage relies heavily on intellectual property regarding material composition, yield rates, and the ability to scale high-precision manufacturing processes necessary to meet the stringent optical performance specifications (e.g., low polarization dependent loss and high extinction ratios).

The mid-stream segment encompasses component manufacturing and assembly, where the bare VOA chip is integrated with optical fibers, packaged into a rugged module, and calibrated. This stage involves sophisticated alignment and testing procedures to ensure the device meets specified insertion loss, return loss, and dynamic range requirements. Distribution channels in this market are highly specialized. Direct sales are common for high-volume, custom-designed VOA arrays sold to Tier 1 telecommunications equipment manufacturers (TEMs) and hyperscale cloud providers who require direct technical support and customized integration. Indirect distribution, leveraging specialized optical component distributors and value-added resellers (VARs), serves smaller system integrators, academic institutions, and the vast test and measurement market, providing logistical support and inventory management across diverse geographical regions.

The downstream segment involves the integration of VOAs into larger optical systems, such as ROADMs, optical line terminals (OLTs), amplifiers, and high-speed transceivers, culminating in deployment by end-users like telecommunication service providers (Carriers), Internet Service Providers (ISPs), and large enterprise data centers. The influence of downstream players, particularly TEMs (e.g., Ciena, Nokia, Huawei), is significant, as their design choices dictate the specifications and volumes required from VOA manufacturers. Successful navigation of the value chain requires VOA vendors to maintain close relationships with upstream material suppliers to ensure supply chain resilience, while simultaneously collaborating tightly with downstream system integrators to align product roadmaps with evolving network architectures like Coherent Optics and Flex Grid DWDM systems.

Variable Optic Attenuators Market Potential Customers

The potential customers for Variable Optic Attenuators are diverse, spanning multiple verticals centered around high-capacity data transmission and precision optical experimentation. The primary end-users are telecommunication service providers and carriers globally, encompassing major fixed and mobile network operators who utilize VOAs extensively in their core, metro, and access networks. These customers rely on VOAs for dynamic channel equalization in DWDM systems, signal power management in long-haul transmission, and optimization of power budgets in large-scale FTTH and PON deployments to ensure equitable service delivery across varying fiber lengths. Their procurement decisions are driven by factors such as device reliability, footprint, power consumption, and the ability of the VOA to support advanced modulation formats.

A second major category of buyers includes hyperscale data center operators (such as Amazon, Google, Microsoft, and Meta) and large enterprise IT departments. As these entities continuously upgrade their data center interconnects (DCIs) to 400G and 800G, VOAs are critical for managing the high optical power levels within modern transceivers and ensuring proper signal conditioning between network racks and buildings. For these customers, factors like ultra-low latency, high integration density (VOA arrays), and compatibility with silicon photonics platforms are paramount. Their purchasing cycles are often large volume and project-specific, requiring customized solutions that minimize operational complexity and maximize energy efficiency within the cooling-constrained data center environment.

Furthermore, critical secondary markets include Test and Measurement equipment manufacturers (e.g., Keysight, EXFO), who incorporate VOAs into their optical power meters, optical spectrum analyzers (OSAs), and bit error rate testers (BERTs) to simulate network loss profiles for component qualification. Research institutions, universities, and defense contractors also constitute potential customers, utilizing high-precision, low-back reflection VOAs for advanced optical experimentation, laser control, fiber sensing, and classified military communication systems. The key differentiation for these buyers often revolves around precision calibration, environmental stability (temperature and vibration resistance), and compliance with military or specialized industrial standards, rather than solely unit cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Finisar Corporation (Coherent), Lumentum, Broadcom Inc., Gooch & Housego, Corning Incorporated, Sumitomo Electric Industries, Santec Corporation, Accelink Technologies, NeoPhotonics (Lumentum), Oclaro (Lumentum), DiCon Fiberoptics, Sercalo Microtechnology, OZ Optics, Lightel, Fiberer, AFOP, NTT Advanced Technology Corporation, Piezosystem Jena, General Photonics Corporation, Photon Control |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Variable Optic Attenuators Market Key Technology Landscape

The technological landscape of the Variable Optic Attenuators Market is highly dynamic, driven by the continuous demand for faster switching speeds, lower insertion loss, and higher integration density. Micro-Electro-Mechanical Systems (MEMS) technology currently dominates the high-performance segment. MEMS VOAs utilize miniature movable mirrors or shutters fabricated on silicon wafers to precisely deflect or block the optical signal path, offering highly reproducible attenuation and exceptionally fast response times—often in the microsecond range. This speed and accuracy are critical for dynamic channel equalization in modern ROADM architectures and for managing burst-mode traffic in high-speed optical access networks. The key technical challenge for MEMS remains miniaturization and ensuring long-term mechanical reliability under continuous high-frequency actuation cycles.

Liquid Crystal (LC) technology represents a viable alternative, particularly in cost-sensitive applications where extremely high speed is not the primary requirement. LC VOAs modulate the polarization state of the light, which, when coupled with a polarizer, results in variable attenuation. These devices are attractive due to their simple structure, low power consumption, and suitability for integration into planar lightwave circuits (PLCs). However, LC technology typically suffers from slower response times (milliseconds) compared to MEMS and higher sensitivity to temperature fluctuations, which must be carefully managed through active thermal compensation circuits. Despite these drawbacks, LC technology remains prevalent in certain access network deployment scenarios and integrated transceiver modules where cost-effectiveness outweighs speed demands.

Emerging technologies focus heavily on integration via Silicon Photonics (SiPh). Integrating VOA functionality directly onto a silicon chip alongside other optical components (such as modulators, detectors, and splitters) significantly reduces footprint, complexity, and power consumption, aligning perfectly with the needs of 400G and 800G pluggable transceivers. These integrated VOAs often leverage thermo-optic effects, using electrical heating elements to change the refractive index of waveguide materials (like silicon or polymer), thereby altering the signal path loss. While thermo-optic VOAs offer simple fabrication and high integration density, they are generally characterized by slower speed than MEMS and require continuous power to maintain an attenuation state, contrasting with the latching or non-volatile nature of some MEMS designs. The ongoing competition between MEMS and SiPh-based thermo-optic VOAs for integration into high-density interconnects defines the current technological frontier.

Regional Highlights

The Variable Optic Attenuators Market exhibits distinct regional dynamics, primarily dictated by the pace of digital infrastructure investment, 5G rollout speed, and the maturity of existing fiber optic networks. Asia Pacific (APAC) holds the largest market share and is projected to maintain the fastest growth rate throughout the forecast period. This dominance is attributed largely to massive government and private sector investments in countries like China, Japan, South Korea, and India for nationwide FTTH deployment, comprehensive 5G network expansion, and the establishment of vast metropolitan and regional data centers. China, in particular, drives substantial volume demand due to its aggressive build-out of optical transport infrastructure, favoring high-volume procurement of VOA arrays for next-generation DWDM systems and access networks. The need for robust, cost-effective components for large-scale rural and urban deployments defines the requirements in this region, necessitating localized supply chains and customized packaging solutions.

North America represents the second-largest market, characterized by high technological maturity and a strong demand for premium, high-performance VOA products. The market here is primarily driven by the continuous upgrade cycles in hyperscale data centers, which are rapidly transitioning to 400G and preparing for 800G standards. Carriers in the U.S. and Canada are focused on densification and virtualization of their networks, utilizing sophisticated ROADMs and coherent optical systems that mandate the use of high-speed, MEMS-based VOAs for dynamic network configuration and power optimization. Innovation in the North American region is often centered around integrating VOAs into emerging silicon photonics platforms and meeting the rigorous specifications required for telecom-grade reliability, including extended temperature range operation and long Mean Time Between Failures (MTBF).

Europe constitutes a stable and mature market, focusing heavily on network modernization, digital single market initiatives, and the transition from legacy copper infrastructure to fiber networks across the European Union. Demand for VOAs in Europe is primarily fueled by the rollout of 5G, the expansion of regional data centers, and the implementation of advanced optical transport layers supporting cross-border data traffic. European market requirements often emphasize high environmental standards and energy efficiency, pushing manufacturers to develop low-power consuming LC and thermo-optic VOA solutions, particularly for fiber access points. Latin America and the Middle East & Africa (MEA) are emerging markets showing accelerated growth. In MEA, government-led digital transformation initiatives, particularly in the UAE, Saudi Arabia, and South Africa, are spurring significant investment in new fiber backbone infrastructure, creating substantial demand for basic and mid-range VOAs for initial network deployment and optimization. These regions often prioritize reliable, robust components suitable for challenging installation environments and high-volume deployment projects.

- Asia Pacific (APAC): Dominates the market due to large-scale FTTH and 5G deployment, primarily driven by China, India, and South Korea's aggressive infrastructure investment.

- North America: Focuses on high-end, dynamic VOA arrays (MEMS) driven by hyperscale data center upgrades (400G/800G) and core network modernization.

- Europe: Characterized by stable demand fueled by 5G rollout, network virtualization, and adherence to stringent environmental and energy efficiency standards.

- Latin America (LATAM): Growing market driven by government initiatives to expand broadband access and new regional data center construction, increasing demand for fiber components.

- Middle East & Africa (MEA): High growth potential stemming from greenfield fiber infrastructure projects and digital economic diversification strategies in the GCC countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Variable Optic Attenuators Market.- Finisar Corporation (Coherent)

- Lumentum

- Broadcom Inc.

- Gooch & Housego

- Corning Incorporated

- Sumitomo Electric Industries

- Santec Corporation

- Accelink Technologies

- NeoPhotonics (Lumentum)

- Oclaro (Lumentum)

- DiCon Fiberoptics

- Sercalo Microtechnology

- OZ Optics

- Lightel

- Fiberer

- NTT Advanced Technology Corporation

- Piezosystem Jena

- General Photonics Corporation

- AFL Telecommunications

- EXFO Inc.

Frequently Asked Questions

Analyze common user questions about the Variable Optic Attenuators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Variable Optic Attenuator (VOA) in a fiber network?

The primary function of a VOA is to precisely and dynamically control or adjust the power level of an optical signal. This is essential for preventing receiver saturation, managing the optical power budget across long fiber links, and performing channel equalization in Dense Wavelength Division Multiplexing (DWDM) systems to ensure optimal system performance and signal integrity.

Which technology segment of VOAs is driving growth in high-speed data centers?

Micro-Electro-Mechanical Systems (MEMS) VOA technology is driving growth in high-speed data centers. MEMS VOAs offer extremely fast switching speeds, low insertion loss, and high reliability, making them ideal for dynamic power management in 400G and 800G transceiver modules and Reconfigurable Optical Add/Drop Multiplexers (ROADMs).

How does the adoption of 5G networks influence the Variable Optic Attenuators Market?

5G network adoption significantly increases VOA demand by requiring massive fiber densification and advanced backhaul infrastructure. VOAs are critical for managing the complex, dynamic optical power requirements in 5G front-haul and metro networks, ensuring reliable signal distribution across new fiber access points and central offices.

What is the difference between a VOA array and a single-channel VOA?

A single-channel VOA manages the power of one optical path, typically used in testing or simple links. A VOA array integrates multiple independent attenuators (e.g., 4, 8, or 16 channels) into a single, compact package. Arrays are crucial for high-density applications like DWDM and ROADM line cards where multiple fiber channels require simultaneous, coordinated power adjustment, optimizing space and integration complexity.

What key challenge do manufacturers face when developing VOAs for silicon photonics integration?

The key challenge is achieving high performance and low power consumption while maintaining manufacturability on the silicon chip. Integrated VOAs, often relying on the thermo-optic effect, must overcome limitations related to speed and the continuous power required to maintain an attenuation state, compared to the potentially non-volatile operation of traditional MEMS components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- MEMS Variable Optic Attenuators (mVOA) Market Statistics 2025 Analysis By Application (Fiber Optical Communiction System, Test Equipment), By Type (Small Type, Handheld Type, Desktop), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Variable Optic Attenuators Consumption Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Manual, Electrical), By Application (Fiber Optical Communiction System, Test Equipment), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager