Variable Optical Attenuators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440547 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Variable Optical Attenuators Market Size

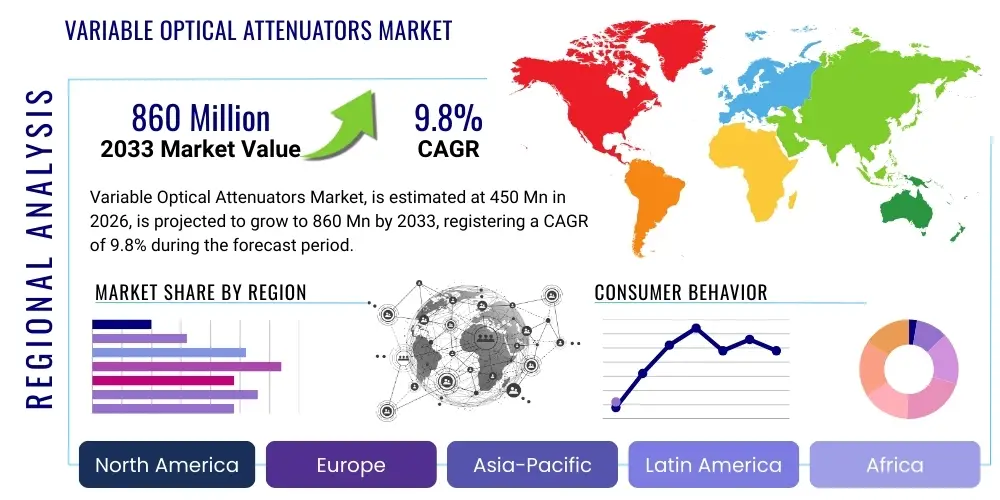

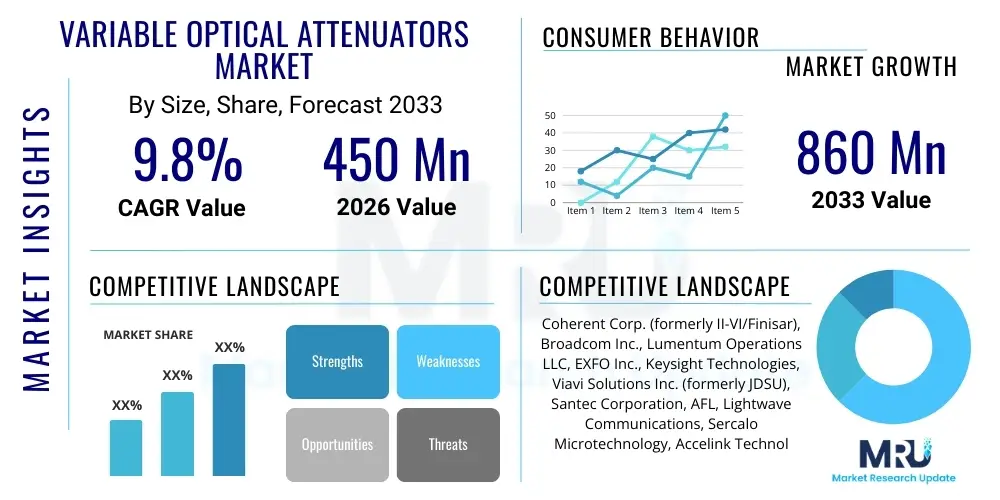

The Variable Optical Attenuators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 860 Million by the end of the forecast period in 2033. This significant growth is propelled by the escalating demand for high-bandwidth communication infrastructure, particularly within the telecommunications and data center sectors. As optical networks continue to expand and evolve with technologies like 5G, Fiber-to-the-Home (FTTH), and cloud computing, the need for precise light signal control becomes paramount, directly influencing market expansion.

The market's trajectory is further influenced by ongoing technological advancements that enhance the performance, reliability, and cost-efficiency of Variable Optical Attenuators (VOAs). Innovations in MEMS-based VOAs and integrated photonic solutions are opening new application avenues and improving existing ones, making these devices indispensable for optimizing network performance and managing optical power levels. The rising complexity of optical networks demands sophisticated components that can adapt to varying signal conditions, thus solidifying the VOA market's growth prospects over the next decade.

Variable Optical Attenuators Market introduction

Variable Optical Attenuators (VOAs) are crucial components in optical communication systems, designed to precisely control and adjust the power level of an optical signal. These devices play a vital role in balancing power within optical links, preventing saturation of optical receivers, and ensuring optimal performance across diverse network architectures. From managing signal power in dense wavelength division multiplexing (DWDM) systems to calibrating test and measurement equipment, VOAs provide the flexibility required for robust and efficient optical network operation. Their ability to dynamically adjust attenuation makes them indispensable for both system design and ongoing network maintenance.

The primary function of a VOA is to intentionally reduce the intensity of a light signal, without significantly distorting the signal's waveform. This attenuation can be either manual, where an operator sets the level, or automatic/motorized, where the attenuation is controlled electronically, often in response to system feedback. Major applications span across telecommunications, including FTTx deployments, submarine cables, and long-haul networks, as well as in data centers for intra-data center connectivity. Beyond communication, VOAs are integral to optical sensor systems, medical diagnostics, and R&D laboratories, where precise light control is fundamental to experimental accuracy and device functionality.

Benefits of employing VOAs include enhanced network stability, improved signal-to-noise ratio, reduced bit error rates, and increased system longevity by protecting sensitive optical components from excessive power. Key driving factors for market growth encompass the global surge in internet traffic, the widespread deployment of 5G technology, the continuous expansion of hyperscale data centers, and the growing demand for higher bandwidth in enterprise and consumer applications. Furthermore, the increasing complexity of optical networks necessitates advanced power management solutions, making VOAs a critical enabler for next-generation optical infrastructures.

Variable Optical Attenuators Market Executive Summary

The Variable Optical Attenuators (VOA) market is experiencing robust growth, driven by fundamental shifts in global communication infrastructure and an accelerating demand for high-speed data. Key business trends include the increasing integration of VOAs into larger optical modules and subsystems, moving beyond discrete components. This integration reflects a broader industry push towards miniaturization, cost reduction, and enhanced performance through integrated photonics. Furthermore, strategic partnerships and collaborations between VOA manufacturers and telecom equipment providers are becoming more prevalent, aimed at developing tailored solutions that address specific network challenges. The adoption of automated and remotely configurable VOAs is also a significant trend, aligning with the operational efficiency goals of modern data centers and telecommunication networks.

Regionally, the Asia Pacific (APAC) market is anticipated to maintain its dominance and exhibit the highest growth rate, primarily due to extensive investments in 5G network rollouts, Fiber-to-the-Home (FTTH) deployments, and the proliferation of data centers, especially in countries like China, India, and Southeast Asian nations. North America and Europe also present strong markets, characterized by ongoing upgrades to existing fiber optic infrastructure and significant R&D activities in advanced optical technologies. Latin America, the Middle East, and Africa are emerging markets, showing considerable potential driven by increasing internet penetration and government initiatives to enhance digital connectivity. Each region's growth trajectory is intricately linked to its pace of digital transformation and infrastructure development.

In terms of segmentation, motorized and MEMS-based VOAs are projected to witness the fastest growth, reflecting the industry's preference for automation, precision, and compact form factors. The telecommunications sector remains the largest end-user segment, consistently demanding high volumes of VOAs for diverse applications ranging from core networks to access networks. Within applications, test and measurement equipment constitutes a rapidly expanding segment, as the complexity of optical systems necessitates sophisticated tools for characterization, calibration, and maintenance. The market is also seeing increased demand for VOAs capable of operating across wider wavelength ranges and with greater dynamic attenuation, catering to the evolving requirements of diverse optical systems.

AI Impact Analysis on Variable Optical Attenuators Market

User inquiries concerning AI's impact on the Variable Optical Attenuators market frequently revolve around how artificial intelligence can enhance network optimization, predictive maintenance, and autonomous operation within complex optical infrastructures. Common questions explore the potential for AI-driven algorithms to dynamically adjust attenuation levels in real-time, thereby optimizing signal quality and power efficiency across vast networks. Users also inquire about AI's role in identifying and mitigating network anomalies or failures through intelligent VOA control, and the potential for AI to integrate VOA functionalities within broader software-defined networking (SDN) and network function virtualization (NFV) frameworks. There is significant interest in how AI can transform VOAs from static or manually-controlled components into intelligent, adaptive elements of a self-optimizing network, leading to reduced operational costs and improved service delivery.

- AI can enable predictive power management within optical networks by analyzing real-time traffic patterns and network performance data. This allows for proactive adjustment of VOA settings to maintain optimal signal integrity and prevent potential outages, significantly improving network reliability and uptime.

- Dynamic attenuation control facilitated by AI algorithms can fine-tune optical signal levels more precisely than traditional methods. This ensures that optical receivers are neither saturated nor starved of power, leading to enhanced bit error rates (BER) and overall system performance, especially in highly dynamic DWDM environments.

- AI integration supports the development of self-healing optical networks where VOAs, combined with other intelligent optical components, can automatically reroute traffic or adjust power to compensate for fiber cuts or component degradation. This reduces manual intervention and speeds up recovery from network faults.

- For test and measurement applications, AI can automate complex VOA calibration and characterization processes, reducing human error and improving the speed and accuracy of equipment testing. This is crucial for mass production and deployment of optical components.

- AI can contribute to energy efficiency by optimizing VOA settings to minimize power consumption across the optical network without compromising performance. This aligns with broader industry goals for sustainable and greener data centers and telecom networks.

- The convergence of AI with Software-Defined Networking (SDN) and Network Function Virtualization (NFV) allows VOAs to be managed as virtualized resources. This enables network operators to provision and control attenuation dynamically through software, creating more agile and programmable optical infrastructures tailored to specific service requirements.

DRO & Impact Forces Of Variable Optical Attenuators Market

The Variable Optical Attenuators (VOA) market is propelled by a confluence of robust drivers stemming from the ever-increasing demand for high-bandwidth communication and sophisticated optical network management. Foremost among these is the pervasive global expansion of data centers, which necessitate precise optical power control for efficient intra-data center connectivity and inter-data center communication. Additionally, the widespread deployment of 5G networks, Fiber-to-the-Home (FTTH) initiatives, and other next-generation access technologies across both developed and emerging economies significantly fuel the demand for VOAs to manage signal power in complex fiber optic infrastructure. The increasing utilization of DWDM systems for maximizing fiber capacity further underscores the critical role of VOAs in channel equalization and power balancing. Moreover, the growth of optical test and measurement equipment markets, where VOAs are essential for calibration and precise power regulation, also acts as a substantial driver for market expansion.

Despite the strong tailwinds, the VOA market faces certain restraints that could temper its growth trajectory. The relatively high cost associated with advanced VOA technologies, particularly MEMS-based and integrated solutions, can pose a barrier to adoption for smaller operators or in cost-sensitive applications. Furthermore, the complexity involved in integrating these precise optical components into existing heterogeneous network infrastructures can lead to implementation challenges and increased deployment times. While VOAs offer unique advantages, competition from alternative and often simpler attenuation methods, such as fixed attenuators or software-based power management at the transponder level, might limit market penetration in certain segments where dynamic control is not critically required. Supply chain vulnerabilities and the availability of specialized manufacturing processes for optical components also represent potential bottlenecks.

Significant opportunities abound for market participants in the VOA space, driven by emerging technological landscapes and evolving application requirements. The ongoing research and development in integrated photonics and silicon photonics platforms present a substantial opportunity for miniaturized, high-performance, and cost-effective VOAs that can be seamlessly integrated into photonic integrated circuits (PICs). The rise of quantum computing and quantum communication networks, which demand exceptionally precise control over optical signals, opens new niche markets for advanced VOAs. Furthermore, the growing adoption of Internet of Things (IoT) devices and the development of smart cities will lead to an increased proliferation of interconnected sensors and edge computing infrastructure, indirectly boosting the demand for underlying optical network components. The continuous need for network upgrades and capacity enhancements in an increasingly digital world ensures a sustained opportunity for VOA manufacturers. Impact forces on the market are predominantly shaped by rapid technological advancements, evolving industry standards, global economic conditions influencing infrastructure investments, and geopolitical factors affecting supply chains and market access.

Segmentation Analysis

The Variable Optical Attenuators market is meticulously segmented to provide a granular understanding of its diverse landscape, reflecting variations in technology, functionality, application, and end-user requirements. This segmentation allows for a detailed analysis of market dynamics, growth drivers, and competitive landscapes within specific product categories and demand sectors. Understanding these segments is crucial for strategic planning, product development, and identifying lucrative market niches. The market's complexity necessitates a multi-dimensional approach to segmentation, capturing both the technological innovation within the devices themselves and the specific needs of various industries that utilize them. Each segment exhibits unique characteristics and growth potentials, driven by different factors such as technological maturity, deployment scale, and specific performance prerequisites.

- By Type

- Manual VOAs: Devices requiring physical adjustment to change attenuation levels. These are cost-effective and reliable for static or infrequently adjusted applications.

- Motorized VOAs: Electrically controlled attenuators that allow for remote or automated adjustment of power levels, crucial for dynamic network management and test setups.

- Digital VOAs: Offer precise, step-wise attenuation control through digital interfaces, often integrated into larger systems for automated network optimization.

- MEMS VOAs: Micro-Electro-Mechanical Systems based attenuators known for their compact size, low power consumption, high reliability, and fast response times, ideal for high-density applications.

- Variable Optical Isolators (VOIs) with Attenuation: Devices that combine optical isolation with variable attenuation capabilities, offering dual functionality for protecting sensitive optical components while controlling signal power.

- By Application

- Fiber Optic Communication Systems: The largest segment, including FTTx, DWDM, SDH/SONET, and long-haul networks, where VOAs are vital for power balancing, channel equalization, and receiver protection.

- Test and Measurement: VOAs are extensively used in laboratories and production environments for calibrating optical instruments, characterization of optical components, and system testing.

- Optical Sensors: Used in sensor systems to adjust light intensity for optimal measurement accuracy and dynamic range.

- Medical Devices: Applications in medical imaging, diagnostics, and laser therapy where precise control of light intensity is critical.

- Data Centers: Essential for managing optical power in high-speed interconnects and optimizing transceiver performance within hyperscale and enterprise data centers.

- By End-User

- Telecommunication: Includes service providers, network operators, and equipment manufacturers for all aspects of telecom infrastructure.

- Cable TV (CATV): Used in head-ends and distribution networks for managing optical signal levels in hybrid fiber-coaxial systems.

- Enterprise Networks: For large corporate networks, campus networks, and storage area networks (SANs) utilizing fiber optics.

- R&D Institutions: Universities, government labs, and private research entities conducting studies in photonics and optical communications.

- Healthcare: Hospitals, clinics, and medical device manufacturers using optical technologies for various applications.

- By Technology

- Absorptive VOAs: Attenuate light by absorbing optical power, often using materials that become opaque or reflective when activated.

- Reflective VOAs: Redirect or reflect a portion of the optical signal to achieve attenuation, commonly found in certain MEMS designs.

- MEMS-based VOAs: Utilize microscopic mirrors or shutters to manipulate light paths, offering high precision, low insertion loss, and fast response.

- Liquid Crystal-based VOAs: Employ the electro-optic properties of liquid crystals to vary light transmission, often used for polarization-dependent attenuation.

- Electro-optic VOAs: Utilize electro-optic materials whose refractive index changes with an applied electric field, providing rapid and precise attenuation.

Value Chain Analysis For Variable Optical Attenuators Market

The value chain for the Variable Optical Attenuators (VOA) market begins with upstream activities, primarily involving the sourcing and manufacturing of raw materials and foundational components. This critical initial stage encompasses suppliers of specialized optical fibers, semiconductor materials (for MEMS devices), precision mechanical parts, optical glasses, and electronic components necessary for VOA construction. Key upstream participants are typically specialized material providers and component manufacturers that produce high-purity silica, silicon wafers, and various polymers used in optical and mechanical assemblies. The quality and availability of these raw materials directly impact the performance, reliability, and cost-effectiveness of the final VOA product, making robust supplier relationships and quality control paramount at this stage. Innovation in material science, such as developing new low-loss materials or more efficient electro-optic crystals, can significantly influence the market's upstream segment.

Midstream activities in the VOA value chain involve the design, fabrication, assembly, and testing of the attenuator devices themselves. This is where the core manufacturing process takes place, transforming raw materials and components into functional VOAs. Companies at this stage invest heavily in R&D to develop proprietary designs, advanced manufacturing techniques, and automated assembly lines. This includes precision machining for mechanical parts, microfabrication for MEMS structures, and sophisticated packaging to ensure optical alignment and environmental resilience. Extensive quality assurance and testing are conducted to ensure devices meet stringent performance specifications, including insertion loss, return loss, dynamic range, and reliability under various operating conditions. This phase is characterized by specialized engineering expertise and high capital investment in manufacturing facilities.

Downstream activities focus on the distribution, sales, and post-sales support of Variable Optical Attenuators to end-users. The distribution channel typically involves a mix of direct sales and indirect channels. Direct sales are common for large volume orders from major telecom equipment manufacturers or hyperscale data centers, where direct engagement allows for customization and technical support. Indirect channels include a network of distributors, value-added resellers (VARs), and system integrators who incorporate VOAs into larger systems or provide them as part of a broader solution to smaller enterprises, test labs, or regional service providers. These intermediaries often offer regional warehousing, logistics, and localized support. Post-sales services, such as technical support, warranty services, and maintenance contracts, are crucial for customer satisfaction and long-term relationships. The effectiveness of this downstream segment directly influences market penetration and customer reach, requiring efficient supply chain management and strong customer relationships.

Variable Optical Attenuators Market Potential Customers

The Variable Optical Attenuators market serves a broad spectrum of potential customers, primarily concentrated within industries reliant on sophisticated optical communication and precise light control. The telecommunications sector stands as the largest and most critical end-user, encompassing mobile network operators, fixed-line broadband providers, and internet service providers (ISPs). These entities require VOAs for various applications, including balancing power in Dense Wavelength Division Multiplexing (DWDM) systems, equalizing optical power in Fiber-to-the-Home (FTTH) and Fiber-to-the-Curb (FTTC) networks, and optimizing signal levels in core, metro, and access networks. Their demand is driven by the continuous need for network upgrades, capacity expansion, and the deployment of next-generation technologies like 5G, which necessitate dynamic and precise optical power management to maintain signal integrity across long distances and complex topologies.

Another significant customer segment is the data center industry, particularly hyperscale and enterprise data centers. As data traffic continues its exponential growth, data centers rely on high-speed optical interconnects for intra-data center communication and connectivity to external networks. VOAs are essential here for optimizing the performance of optical transceivers, ensuring consistent signal power levels across vast fiber optic infrastructures, and protecting sensitive optical components from excessive power. The continuous build-out of new data centers and the expansion of existing ones to support cloud computing, AI, and big data analytics fuels a steady demand for VOAs. Companies specializing in network infrastructure for cloud service providers are also key buyers, seeking reliable and scalable optical components to ensure robust and efficient data flow.

Beyond communication infrastructure, a diverse range of other industries represent important potential customers. This includes manufacturers of optical test and measurement equipment, who integrate VOAs into their devices for calibration, characterization, and quality control of optical components and systems. Research and development institutions, including universities and government laboratories, also frequently procure VOAs for experimental setups and advanced photonics research. Furthermore, the healthcare sector utilizes VOAs in certain medical devices for precise light control in applications such as diagnostic imaging, endoscopy, and laser-based therapies. The aerospace and defense sectors also find niche applications for VOAs in specialized optical sensing and secure communication systems, where robust and reliable performance in challenging environments is paramount. This wide array of end-users underscores the versatile utility and indispensable nature of Variable Optical Attenuators across multiple technology-driven industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 860 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coherent Corp. (formerly II-VI/Finisar), Broadcom Inc., Lumentum Operations LLC, EXFO Inc., Keysight Technologies, Viavi Solutions Inc. (formerly JDSU), Santec Corporation, AFL, Lightwave Communications, Sercalo Microtechnology, Accelink Technologies, Go!Foton, DiCon Fiberoptics, Ascent Optics, Sumitomo Electric Industries, Fujikura Ltd., OZ Optics Ltd., Optokon, Thorlabs Inc., Corning Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Variable Optical Attenuators Market Key Technology Landscape

The Variable Optical Attenuators (VOA) market is characterized by a dynamic and evolving technology landscape, with advancements continuously improving performance, reducing size, and expanding application possibilities. A significant technological trend involves the increasing prevalence of Micro-Electro-Mechanical Systems (MEMS) technology. MEMS-based VOAs utilize microscopic mirrors or shutters fabricated on silicon wafers to precisely manipulate the optical path and introduce variable attenuation. These devices offer numerous advantages, including compact form factors, low power consumption, high reliability due to the absence of bulk moving parts, and rapid response times, making them highly suitable for high-density optical modules and automated network systems. Their ability to deliver high precision and repeatable attenuation over a wide dynamic range positions them at the forefront of VOA innovation, particularly for applications requiring dynamic power control in DWDM and data center environments.

Another crucial aspect of the technology landscape is the development and adoption of integrated photonics. This paradigm shift involves integrating multiple optical components, including VOAs, onto a single chip or platform, often using silicon photonics or indium phosphide. Integrated VOAs promise further miniaturization, reduced manufacturing costs in high volumes, and enhanced performance through improved component alignment and reduced insertion losses. This technology is particularly critical for the development of next-generation optical transceivers and photonic integrated circuits (PICs) that demand a high level of functionality within a small footprint. Furthermore, advancements in electro-optic and thermo-optic materials are contributing to the creation of VOAs with faster switching speeds and lower power consumption, leveraging properties where refractive indices can be altered by electrical signals or temperature changes, allowing for dynamic control of light intensity.

Beyond MEMS and integrated photonics, continuous improvements are being made in traditional VOA designs, such as motorized and manual types, focusing on enhanced reliability, broader wavelength compatibility, and improved power handling capabilities. Research into liquid crystal-based VOAs continues, aiming to improve their response time and reduce polarization dependence for specific applications. The ongoing development of software-defined networking (SDN) and network function virtualization (NFV) frameworks also indirectly influences VOA technology, pushing towards devices that are more programmable, remotely configurable, and interoperable within intelligent network architectures. This shift towards smart, interconnected optical components encourages the adoption of digital interfaces and control protocols, enabling VOAs to become more integral to self-optimizing and adaptive optical networks.

Regional Highlights

- North America: This region represents a mature yet highly dynamic market for Variable Optical Attenuators, driven by ongoing upgrades to existing fiber optic infrastructure, significant investments in 5G network expansion, and the continuous growth of hyperscale data centers. The presence of major technology players, extensive R&D activities, and early adoption of advanced optical technologies contribute to its sustained demand. Demand is particularly strong from telecom service providers and cloud giants.

- Europe: The European market is characterized by significant investments in FTTH deployments, the rollout of 5G infrastructure, and initiatives to enhance digital connectivity across the continent. Countries like Germany, the UK, and France are leading in adopting advanced optical components to modernize their communication networks. The focus on energy efficiency and sustainable networking also influences VOA selection.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for VOAs, fueled by massive investments in telecom infrastructure, including aggressive 5G deployments and extensive FTTH rollouts, particularly in China, India, Japan, and South Korea. The region's rapid economic growth, increasing internet penetration, and the proliferation of data centers are key drivers for the exponential demand for optical components, including VOAs.

- Latin America: This region is an emerging market with substantial growth potential, driven by improving economic conditions, increasing internet penetration, and government initiatives aimed at expanding broadband access. Countries such as Brazil and Mexico are witnessing significant investments in fiber optic networks, creating a growing demand for VOAs for new installations and network expansions.

- Middle East and Africa (MEA): The MEA region is experiencing growth in the VOA market, primarily due to ambitious smart city projects, increasing investment in digital infrastructure, and rising demand for high-speed internet services. Countries in the GCC (Gulf Cooperation Council) are leading in adopting advanced communication technologies, including fiber optic networks and 5G, which contribute to the demand for precise optical power management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Variable Optical Attenuators Market.- Coherent Corp. (formerly II-VI/Finisar)

- Broadcom Inc.

- Lumentum Operations LLC

- EXFO Inc.

- Keysight Technologies

- Viavi Solutions Inc. (formerly JDSU)

- Santec Corporation

- AFL

- Lightwave Communications

- Sercalo Microtechnology

- Accelink Technologies

- Go!Foton

- DiCon Fiberoptics

- Ascent Optics

- Sumitomo Electric Industries

- Fujikura Ltd.

- OZ Optics Ltd.

- Optokon

- Thorlabs Inc.

- Corning Inc.

Frequently Asked Questions

What is a Variable Optical Attenuator (VOA) and why is it important?

A Variable Optical Attenuator is an optical device used to precisely adjust or control the power level of a light signal in a fiber optic system. It is crucial for preventing receiver saturation, balancing power in complex networks like DWDM, equalizing signal levels, and optimizing network performance by ensuring all optical components operate within their optimal power range. Its importance stems from the need for dynamic power management in high-speed, high-capacity optical communication systems, improving reliability and efficiency.

What are the main types of Variable Optical Attenuators?

The main types of Variable Optical Attenuators include Manual VOAs, which require physical adjustment; Motorized VOAs, offering remote or automated control; Digital VOAs, providing precise step-wise attenuation via digital interfaces; and MEMS (Micro-Electro-Mechanical Systems) VOAs, known for their compact size, low power, and fast response. Each type is suited for different applications based on the required level of control, precision, and integration within optical systems.

Which industries are the primary end-users of Variable Optical Attenuators?

The primary end-users of Variable Optical Attenuators are the telecommunications industry, including mobile network operators and internet service providers for 5G and FTTH deployments, and the data center sector, particularly hyperscale data centers, for optimizing optical interconnects. Other significant end-users include manufacturers of optical test and measurement equipment, R&D institutions, and specialized applications within medical devices and aerospace for precise light control.

How does AI impact the Variable Optical Attenuators market?

AI significantly impacts the Variable Optical Attenuators market by enabling more intelligent and autonomous network operations. AI algorithms can dynamically adjust VOA settings in real-time based on network conditions, optimizing signal quality, preventing overloads, and enhancing energy efficiency. This integration facilitates predictive maintenance, self-healing networks, and more precise power management within complex optical infrastructures, leading to reduced operational costs and improved network reliability.

What are the key growth drivers for the VOA market?

Key growth drivers for the VOA market include the escalating global demand for high-bandwidth communication, driven by increased internet usage and data traffic. The widespread deployment of 5G wireless networks, the expansion of Fiber-to-the-Home (FTTH) initiatives, and the rapid growth of hyperscale data centers are major factors. Additionally, the increasing need for precise power control in optical test and measurement applications and advancements in integrated photonics contribute substantially to market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Reconfigurable Optical Add/ Drop Multiplexing (ROADM) Market Statistics 2025 Analysis By Application (Commercial, Industrial), By Type (Wavelength Selective Switch (WSS), Optical Channel Monitoring (OCM), Variable Optical Attenuators (VOAs)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- ROADM Module Market Statistics 2025 Analysis By Application (Commercial, Industrial), By Type (Wavelength Selective Switch (WSS), Optical Channel Monitoring (OCM), Variable Optical Attenuators (VOAs)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Variable Optical Attenuators Market Statistics 2025 Analysis By Application (Fiber Optical Communiction System, Test Equipment), By Type (Component, Handheld, Benchtop), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Electrical Variable Optical Attenuators (Evoa) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Channel, 4 Channel), By Application (Optical Power Control and Equalization, Receiver Protection, Channel on/off Switching), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager