Vascular Closure Devices and Hemostatic Dressings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435373 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Vascular Closure Devices and Hemostatic Dressings Market Size

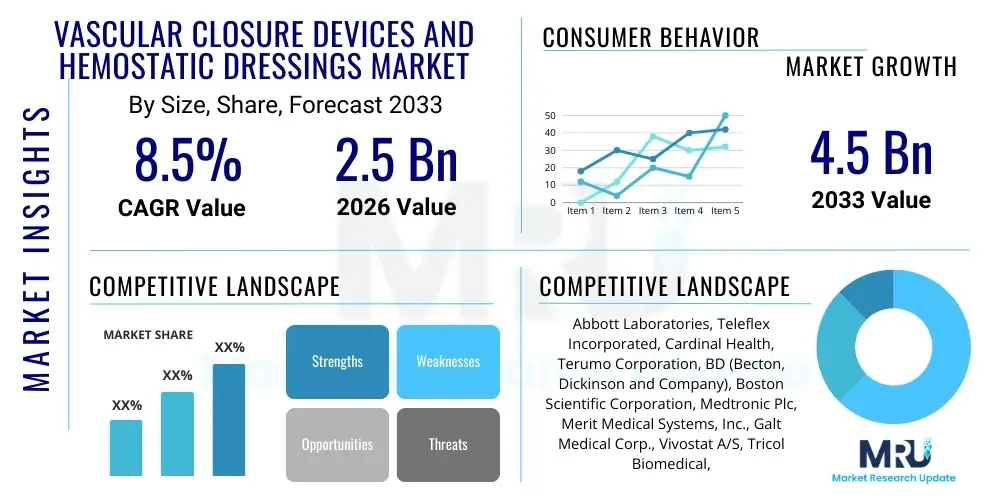

The Vascular Closure Devices and Hemostatic Dressings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033.

Vascular Closure Devices and Hemostatic Dressings Market introduction

The Vascular Closure Devices (VCDs) and Hemostatic Dressings Market encompasses specialized medical products designed to achieve immediate and reliable hemostasis following endovascular procedures. VCDs, such as passive and active closure systems, are critical in minimizing complications, reducing time to ambulation, and enhancing patient throughput after catheterization procedures like angiography, angioplasty, and stent placement. These devices are essential components in the rapidly expanding field of interventional cardiology and radiology, driven by the increasing global prevalence of cardiovascular diseases (CVDs) and the growing preference for minimally invasive surgical techniques over traditional open procedures.

The product portfolio within this market spans mechanical closure devices, sealants and patches, and various forms of external compression adjuncts. Hemostatic dressings, often utilizing advanced materials like oxidized regenerated cellulose (ORC), chitosan, or thrombin-based agents, play a crucial role in controlling severe bleeding in emergency settings, surgical suites, and trauma care. The major applications for these technologies include femoral and radial arterial access site closure, trauma management, general surgery, and complex wound care. The shift towards radial access for cardiac interventions, while generally reducing complication rates, still requires specialized closure solutions to manage potential hematoma formation and ensure patient comfort.

Key benefits driving market adoption include significantly reduced time to hemostasis compared to manual compression, lower incidence of access site complications (e.g., pseudoaneurysm, AV fistula), improved patient comfort, and decreased hospital length of stay, which translates directly to cost savings for healthcare systems. The primary driving factors are the aging global population, which correlates with higher rates of CVDs necessitating interventional procedures, technological advancements leading to safer and more effective closure mechanisms, and supportive clinical evidence demonstrating superior outcomes compared to older methods. Furthermore, the robust investment in healthcare infrastructure, particularly in emerging economies, is fueling the demand for premium VCDs and advanced hemostatic agents.

Vascular Closure Devices and Hemostatic Dressings Market Executive Summary

The Vascular Closure Devices and Hemostatic Dressings Market is characterized by robust innovation focusing on automation, biocompatibility, and procedural efficiency. Current business trends indicate a strong move toward developing fully automated VCDs that minimize operator variability and enhance ease of use, particularly in high-volume catheterization labs. Strategic partnerships and mergers & acquisitions are common, as major medical device manufacturers seek to integrate comprehensive portfolios covering both femoral and radial access closures, alongside complementary advanced hemostatic products for surgical applications. Furthermore, the increasing pressure from payers globally to demonstrate cost-effectiveness is accelerating the adoption of devices proven to reduce readmission rates and overall procedure costs, favoring sophisticated closure systems over prolonged manual care.

Regionally, North America maintains market dominance due to high procedure volumes, well-established reimbursement policies, and the rapid adoption of cutting-edge medical technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding healthcare access, rising incidence of cardiovascular and peripheral artery diseases, and significant investments by governments in modernizing hospital facilities. Europe demonstrates steady growth, highly influenced by regulatory pathways such as the MDR (Medical Device Regulation), which drives manufacturers to ensure rigorous clinical validation and product quality. The growing trend of ambulatory surgical centers (ASCs) performing interventional procedures is also shifting demand towards VCDs that facilitate rapid patient discharge.

Segment trends reveal that the VCD segment holds a larger market share, driven primarily by the high average selling prices and necessity in high-stakes cardiac procedures. Within VCDs, active closure devices utilizing sutures or clips are gaining traction due to high reliability, although passive closure devices remain popular for less complex cases. In the hemostatic dressings segment, the demand for advanced materials, specifically those based on biologically active agents like thrombin or synthetic polymers that accelerate the clotting cascade, is rapidly outpacing traditional dressings. Procedure-wise, interventional cardiology, especially Percutaneous Coronary Intervention (PCI), remains the dominant application, followed closely by interventional radiology and diagnostics. The continuous development of smaller-profile devices suitable for smaller vessels and pediatric applications represents a significant opportunity.

AI Impact Analysis on Vascular Closure Devices and Hemostatic Dressings Market

Common user questions regarding AI's influence on the VCD and Hemostatic Dressings market frequently center on how machine learning algorithms can improve procedural safety, personalize closure techniques, and optimize inventory management. Users are concerned about whether AI can accurately predict access site complications based on patient specific clinical data (e.g., vessel calcification, sheath size, anticoagulant use), thereby guiding the selection of the most appropriate VCD or hemostatic agent. Key themes emerging include the potential for AI-driven image analysis to standardize puncture site assessment, the development of smart devices that automatically adjust closure force, and the integration of predictive analytics into operating room workflows to minimize manual errors and improve material forecasting, ultimately seeking to enhance patient outcomes and cost-efficiency in high-volume catheterization laboratories.

The primary impact of Artificial Intelligence (AI) and Machine Learning (ML) on this sector lies in optimizing pre-procedural planning and post-procedural monitoring. AI systems can analyze vast datasets of patient demographics, procedural details, and outcomes to develop highly accurate predictive models for complication risk, especially hematoma and pseudoaneurysm formation. This enables clinicians to select the optimal VCD type and size, or pre-emptively intensify hemostatic strategies, moving beyond generalized protocols toward precision medicine in vascular access management. Furthermore, AI-driven tools can assist during the intervention itself by analyzing real-time ultrasound or fluoroscopic images to confirm the proper deployment and position of the closure device, ensuring maximal efficacy and reducing the need for repeat interventions.

Looking ahead, AI integration is expected to revolutionize training and simulation for VCD deployment, offering highly realistic virtual environments customized to specific anatomical variations. For hemostatic dressings, AI could be utilized in smart wound care monitoring, analyzing changes in blood loss rate, temperature, and wound characteristics captured by integrated sensors within the dressing, triggering alerts for critical intervention. This convergence of smart materials, data analytics, and decision support systems will not only enhance clinical performance but also accelerate the development cycle of new devices by providing richer, faster feedback on device performance across diverse patient populations.

- AI enhances pre-procedural risk assessment for access site complications (e.g., predicting hematoma risk).

- Machine learning optimizes VCD selection based on patient-specific vessel anatomy and procedural parameters.

- AI-powered image guidance systems improve the precision of vascular puncture and device deployment confirmation.

- Predictive analytics streamline hospital inventory and supply chain management for VCDs and hemostatic products.

- Integration of ML algorithms into smart hemostatic dressings for real-time monitoring of bleeding control effectiveness.

- Development of AI-driven simulation platforms for training interventionalists in complex closure techniques.

DRO & Impact Forces Of Vascular Closure Devices and Hemostatic Dressings Market

The Vascular Closure Devices and Hemostatic Dressings Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). A major driver is the accelerating shift towards minimally invasive interventional procedures globally, particularly in cardiology and peripheral interventions, which inherently necessitate effective and rapid access site management provided by VCDs. Coupled with this is the substantial increase in the aging population and the corresponding rise in chronic diseases, requiring frequent diagnostic and therapeutic catheterizations. However, these positive drivers are moderated by significant restraints, primarily the high cost associated with advanced VCDs compared to traditional manual compression methods, alongside stringent regulatory hurdles, particularly in obtaining approvals for novel bioabsorbable components, which can slow market entry and adoption.

Opportunities for growth are abundant, focusing primarily on technological innovation. The development of VCDs specifically optimized for radial artery access—a procedure gaining immense popularity due to its lower complication rates—presents a major avenue for expansion. Furthermore, there is an unmet clinical need for closure devices suitable for large-bore access (e.g., Transcatheter Aortic Valve Replacement (TAVR) and Endovascular Aneurysm Repair (EVAR) procedures), driving research into novel, highly robust closure systems. In the hemostatic segment, opportunities lie in developing next-generation materials with superior bioactivity, faster clotting times, and enhanced safety profiles for use in trauma and battlefield medicine, extending application beyond traditional surgical settings.

The primary impact forces shaping the market include technological advancements leading to shorter time-to-hemostasis, thereby impacting hospital operational efficiency and costs. Regulatory policies, such as specific guidelines for device testing and approval based on patient outcomes data, exert a strong influence on market accessibility and product lifecycle. Additionally, the economic pressure from payers and healthcare administrators demanding evidence of superior clinical and economic value from VCDs and advanced dressings dictates purchasing decisions, favoring products that minimize post-procedural complications and reduce overall procedure costs, thus pushing manufacturers towards rigorous clinical validation and value-based pricing models.

Segmentation Analysis

The Vascular Closure Devices and Hemostatic Dressings Market is comprehensively segmented based on product type, access site, application, end-user, and mechanism of action, providing granular insights into market dynamics. The product segmentation is foundational, dividing the market into Vascular Closure Devices (VCDs) and Hemostatic Agents/Dressings, with each segment exhibiting distinct growth trajectories influenced by clinical need and technological maturity. Further refinement within VCDs distinguishes between active closure systems (sutures, clips) and passive closure systems (sealants, patches), reflecting varying degrees of invasiveness and complexity of procedures. This multifaceted segmentation is crucial for stakeholders to tailor marketing strategies and product development to specific high-growth niches within the complex vascular access management landscape.

Segmentation by application highlights the dominance of interventional cardiology, which encompasses high-volume procedures like Percutaneous Coronary Intervention (PCI) and cardiac catheterization. However, interventional radiology applications, peripheral vascular procedures, and neuro-interventions represent rapidly growing areas where specialized closure solutions are increasingly required, particularly devices suitable for smaller vessel diameters or complex anatomical locations. The distinction based on access site, primarily femoral versus radial, is becoming critically important as the industry witnesses a substantial global shift toward radial access, necessitating the development of specific, smaller-profile closure systems tailored for this anatomical location.

The segmentation by end-user reflects the primary consuming entities, mainly comprising hospitals, ambulatory surgical centers (ASCs), and specialized cardiac and trauma centers. Hospitals currently hold the largest share due to the capacity for high-volume, complex procedures. However, ASCs are projected to be the fastest-growing end-user segment due to the cost-effectiveness and increased prevalence of outpatient interventional procedures, driving demand for VCDs that guarantee rapid, predictable hemostasis and swift patient discharge. Understanding these segments is key to optimizing distribution channels and ensuring product availability where procedural volumes are highest or growing most rapidly.

- Product Type:

- Vascular Closure Devices (VCDs)

- Active Closure Devices (Sutures, Clips, Staples)

- Passive Closure Devices (Sealants, Patches, External Compression)

- Suture-Mediated Devices

- Clip-Mediated Devices

- Collagen-Plug Based Devices

- Hemostatic Agents and Dressings

- Thrombin-Based Agents

- Chitosan-Based Agents

- Oxidized Regenerated Cellulose (ORC)

- Gelatin-Based Agents

- Combination Hemostatic Patches

- Vascular Closure Devices (VCDs)

- Access Site:

- Femoral Access

- Radial Access

- Brachial Access

- Pedal Access

- Application:

- Interventional Cardiology (PCI, Cardiac Catheterization)

- Interventional Radiology and Diagnostics

- Peripheral Vascular Procedures

- Neurosurgery/Neurointerventions

- Trauma and Emergency Medicine

- End-User:

- Hospitals (Catheterization Laboratories)

- Ambulatory Surgical Centers (ASCs)

- Specialized Cardiac Centers

Value Chain Analysis For Vascular Closure Devices and Hemostatic Dressings Market

The value chain for the Vascular Closure Devices and Hemostatic Dressings Market begins with upstream activities involving the sourcing and refinement of specialized raw materials, primarily polymers, biocompatible metals (e.g., nickel-titanium alloys), collagen, and advanced biological agents (e.g., purified thrombin or chitosan). Upstream suppliers are focused on quality control, ensuring materials meet stringent biocompatibility and regulatory standards required for implantable or direct contact medical devices. Manufacturers invest heavily in R&D to design complex mechanical systems (VCDs) or synthesize advanced hemostatic formulations. Key activities at this stage include clinical trials, intellectual property protection, and scaling manufacturing processes while adhering to ISO 13485 standards and specific regional medical device regulations.

The core of the value chain involves the manufacturing and assembly of the final product, followed by rigorous sterilization and packaging. Distribution channels are critical in this market, often employing a dual strategy encompassing direct sales teams for major hospital systems and indirect channels utilizing specialized medical device distributors, particularly in geographically diverse or smaller markets. Direct channels are preferred for high-value VCDs that require intensive clinical training and ongoing technical support, allowing manufacturers to maintain better control over pricing and customer relationships. Indirect channels leverage local distributor networks to ensure broad market penetration and efficient inventory management across a wide array of end-users, including ASCs and smaller clinics.

Downstream activities center on the end-users—hospitals and ASCs—where the devices are utilized in clinical procedures. The post-sales phase involves significant educational support and training for interventionalists and cath lab staff to ensure correct and effective deployment, which directly impacts patient outcomes and device efficacy perception. Furthermore, the downstream collection of post-market surveillance data is vital for continuous product improvement and maintaining regulatory compliance. The integration of digital health solutions for tracking device performance and usage patterns is increasingly becoming a critical part of the downstream value delivery, ensuring a closed-loop system of quality improvement and evidence generation.

Vascular Closure Devices and Hemostatic Dressings Market Potential Customers

The primary potential customers and end-users for Vascular Closure Devices and Hemostatic Dressings are entities that perform high volumes of percutaneous access procedures, necessitating reliable and rapid hemostasis. Foremost among these are specialized cardiac catheterization laboratories within large tertiary and quaternary care hospitals. These facilities frequently perform complex coronary interventions, structural heart procedures (like TAVR), and diagnostic angiographies, generating the highest demand for advanced VCDs that can manage large-bore access sites and minimize complications in high-risk patients. The decision-makers here typically include Chief Procurement Officers (CPOs), Cath Lab Directors, and Interventional Cardiologists, who prioritize efficacy, ease of use, and long-term cost savings associated with reduced complication rates.

Ambulatory Surgical Centers (ASCs) represent a rapidly growing customer base. As many diagnostic and certain therapeutic peripheral interventions shift to outpatient settings, ASCs require VCDs that facilitate extremely fast time-to-ambulation and safe same-day discharge. Their purchasing criteria heavily emphasize efficiency, reliability, and cost-effectiveness on a per-procedure basis. Similarly, specialized trauma centers, emergency departments, and military field hospitals are crucial customers for high-performance hemostatic dressings, where immediate and reliable blood control is paramount in life-threatening situations, often favoring agents that can function effectively despite severe blood loss or hypothermia.

Beyond traditional healthcare settings, potential customers include large multispecialty clinics focusing on peripheral vascular disease management and specialized interventional radiology practices. These groups increasingly utilize VCDs for non-cardiac access closure, such as procedures involving chemoembolization, dialysis fistula management, or peripheral stenting. Additionally, academic research institutions and medical universities serve as important customers, not only utilizing these products in patient care but also engaging in clinical trials and training the next generation of physicians, thereby influencing future adoption patterns and preferences for specific closure technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Teleflex Incorporated, Cardinal Health, Terumo Corporation, BD (Becton, Dickinson and Company), Boston Scientific Corporation, Medtronic Plc, Merit Medical Systems, Inc., Galt Medical Corp., Vivostat A/S, Tricol Biomedical, Baxter International Inc., Integra Lifesciences Holdings Corporation, TZ Medical, Advanced Medical Solutions Group plc, CryoLife, Inc., C. R. Bard (now part of BD), Essity AB, Ethicon (Johnson & Johnson), 3M Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vascular Closure Devices and Hemostatic Dressings Market Key Technology Landscape

The technological landscape of the Vascular Closure Devices (VCDs) market is dominated by advancements in bioabsorbable materials and mechanical engineering aimed at minimizing foreign body reaction and optimizing closure efficacy. Current VCD technologies largely fall into two categories: mechanical closure systems utilizing sutures or metallic clips (active closure), and sealant-based systems relying on collagen plugs or synthetic polymers (passive closure). A significant innovation focus is the transition towards fully bioabsorbable VCDs that dissolve completely over time, leaving no permanent implant behind, thereby reducing the long-term risk of inflammation or chronic complications. This involves the use of materials like polyglycolic acid (PGA) and polylactic acid (PLA) in suture and clip mechanisms, offering temporary structural support followed by complete resolution.

In the realm of hemostatic dressings, technological evolution centers on enhancing the speed and mechanism of clot formation through biologically active agents. Key technologies include the use of purified human or bovine thrombin, which directly catalyzes the conversion of fibrinogen to fibrin, providing rapid hemostasis, especially in patients on anticoagulants. Chitosan-based dressings are also prominent, leveraging the inherent positive charge of chitosan to rapidly attract negatively charged red blood cells and platelets, forming a strong, rapid seal, particularly effective in field trauma settings. Furthermore, combination dressings, which integrate a hemostatic agent with a mechanical barrier or patch, represent a growing trend, offering a multi-modal approach to control challenging bleeds.

The introduction of sophisticated devices specifically tailored for large-bore access (exceeding 8 French sheath size), required for structural heart procedures like TAVR and Mitraclip, has significantly impacted the landscape. These devices often employ robust suture-based mechanisms or double-layered closure techniques to handle the increased stress on the access site. Additionally, the development of smaller, more ergonomic VCDs designed for the radial artery is a critical area of innovation, responding to the global preference shift in interventional cardiology. Peripheral to the physical devices, the integration of imaging modalities, such as fluoroscopy and intravascular ultrasound (IVUS) guidance, into the closure procedure ensures precise delivery and confirmation of device deployment, significantly enhancing safety and effectiveness across all technology platforms.

Regional Highlights

- North America: This region, comprising the United States and Canada, holds the dominant share of the global market. The high market value is attributed to the presence of technologically advanced healthcare infrastructure, high incidence of cardiovascular diseases, favorable reimbursement policies for complex interventional procedures, and the early and rapid adoption of novel closure technologies and premium hemostatic agents. The United States specifically drives innovation and accounts for the largest procedural volume globally, with a strong focus on maximizing cath lab efficiency and reducing length of stay through advanced VCD usage.

- Europe: The European market shows steady, mature growth, influenced heavily by the implementation of the new Medical Device Regulation (MDR), which has spurred manufacturers to refine product documentation and clinical evidence. Countries like Germany, France, and the UK are key contributors, characterized by high adoption rates of both femoral and radial VCDs. Increasing investment in healthcare digitalization and standardization of care across the EU drives demand for high-quality, clinically proven hemostatic solutions, though pricing pressure remains a significant factor influencing procurement decisions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, driven by massive untapped patient populations, improving healthcare infrastructure, and rising medical tourism. Countries such as China, India, and Japan are investing heavily in establishing advanced cardiac centers. While Japan is a mature market similar to Western nations, the rapid expansion of healthcare coverage and increasing prevalence of lifestyle diseases in China and India are creating explosive demand for affordable and effective vascular closure and hemostatic products. Local manufacturing and market penetration strategies are crucial for success in this heterogeneous region.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, demonstrates moderate growth. Market expansion is often hampered by fluctuating economic conditions and variability in public versus private healthcare investment. However, increasing awareness of minimally invasive procedures and improvements in regulatory harmonization across major economies are gradually increasing the adoption of VCDs, particularly in private hospital networks seeking to upgrade their procedural capabilities and patient care standards.

- Middle East and Africa (MEA): This region is characterized by diverse market maturity. The Middle Eastern countries, particularly the UAE and Saudi Arabia, exhibit high growth rates due to massive governmental spending on world-class healthcare facilities, leading to the rapid adoption of premium VCD technologies, especially in specialized cardiac centers. Conversely, the African market remains nascent, with demand largely confined to major urban centers, though there is steady growth in demand for basic, cost-effective hemostatic dressings for trauma management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vascular Closure Devices and Hemostatic Dressings Market.- Abbott Laboratories

- Teleflex Incorporated

- Cardinal Health

- Terumo Corporation

- BD (Becton, Dickinson and Company)

- Boston Scientific Corporation

- Medtronic Plc

- Merit Medical Systems, Inc.

- Galt Medical Corp.

- Vivostat A/S

- Tricol Biomedical

- Baxter International Inc.

- Integra Lifesciences Holdings Corporation

- TZ Medical

- Advanced Medical Solutions Group plc

- CryoLife, Inc.

- C. R. Bard (now part of BD)

- Essity AB

- Ethicon (Johnson & Johnson)

- 3M Company

Frequently Asked Questions

Analyze common user questions about the Vascular Closure Devices and Hemostatic Dressings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Vascular Closure Devices (VCDs) market?

The primary drivers are the rising global prevalence of cardiovascular diseases (CVDs), leading to increased volumes of interventional procedures (PCI, angiography), the documented clinical benefits of VCDs in reducing time to hemostasis and post-procedural complications, and the growing preference for minimally invasive treatment options globally.

How does the shift towards radial access affect the demand for specific VCD types?

The global shift from femoral to radial access significantly increases demand for smaller-profile VCDs and specialized hemostatic compression bands designed specifically for the radial artery. Radial access procedures generally require less complex closure than large femoral sheaths, favoring products optimized for patient comfort and rapid discharge from ambulatory settings.

What is the difference between active and passive vascular closure devices?

Active VCDs mechanically close the access site using internal components such as sutures, clips, or staples, offering a definitive closure method. Passive VCDs rely on applying a sealant, often a collagen plug or synthetic patch, to accelerate the natural clotting cascade, requiring external compression to achieve full hemostasis.

Which advanced materials are primarily used in next-generation hemostatic dressings?

Next-generation hemostatic dressings commonly utilize biologically active agents such as purified thrombin (which directly accelerates clotting), chitosan (a naturally derived polymer that attracts platelets rapidly), and oxidized regenerated cellulose (ORC), often combined with proprietary polymers to enhance adherence and absorption in active bleeding scenarios.

What role does the Ambulatory Surgical Center (ASC) segment play in market revenue?

The ASC segment is the fastest-growing end-user sector. ASCs are increasingly performing lower-risk interventional procedures and require VCDs that guarantee predictable, rapid hemostasis and ambulation. This focus on efficiency drives significant demand for VCD technologies that support same-day discharge and reduce overall healthcare costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager