Vascular Interventional Surgery Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436025 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Vascular Interventional Surgery Robot Market Size

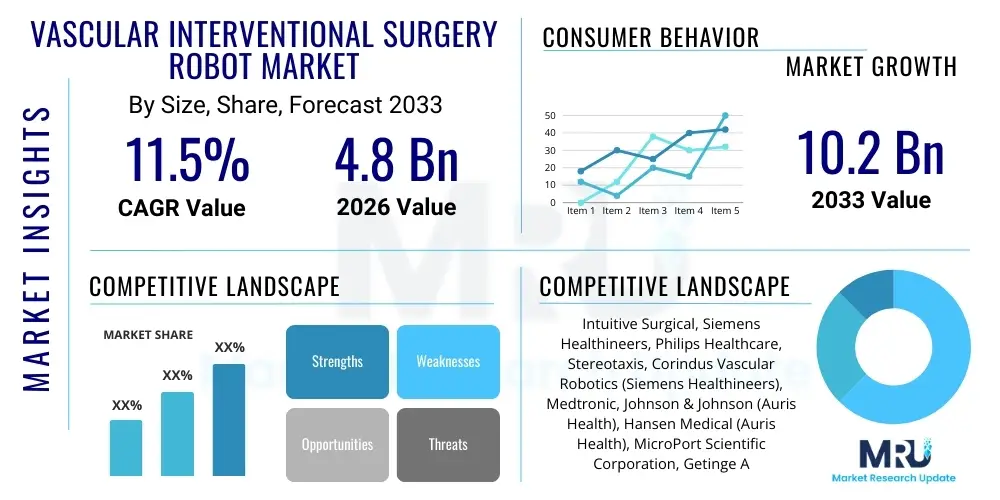

The Vascular Interventional Surgery Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.2 Billion by the end of the forecast period in 2033.

Vascular Interventional Surgery Robot Market introduction

The Vascular Interventional Surgery Robot Market encompasses highly sophisticated robotic systems designed to assist or autonomously perform minimally invasive procedures within the vascular network, including coronary, peripheral, and neurovascular interventions. These advanced medical devices integrate high-resolution imaging, precision catheter manipulation, and remote navigation capabilities, significantly enhancing procedural accuracy and reducing radiation exposure for both patients and clinicians. Key products include robotic platforms that enable precise steering of guidewires and catheters in tortuous anatomies, fundamentally transforming the standard of care for complex cardiovascular and endovascular diseases. The primary applications span coronary artery disease treatment, complex aneurysm repair, and peripheral artery disease management. The profound benefits derived from these systems—such as reduced recovery times, lower complication rates, and enhanced surgical ergonomics—are driving their rapid adoption across major healthcare institutions globally. Furthermore, the increasing prevalence of lifestyle diseases leading to cardiovascular and cerebrovascular conditions, coupled with technological advancements in haptics and telepresence, serves as the principal driving factor for sustained market expansion, positioning robotic intervention as the future benchmark in vascular surgery.

Vascular Interventional Surgery Robot Market Executive Summary

The Vascular Interventional Surgery Robot Market is characterized by robust business trends focusing on strategic collaborations between technology developers and major medical device manufacturers, aiming to accelerate regulatory approvals and global market penetration. A significant trend involves the transition from purely assistive systems to those offering greater autonomy and integration with real-time diagnostic tools, enhancing decision-making during complex interventions. Regionally, North America maintains market dominance due to high healthcare expenditure, established robotic surgery infrastructure, and strong reimbursement policies, while the Asia Pacific region is poised for the fastest growth, fueled by rising disposable incomes and aggressive investment in medical tourism and digital healthcare infrastructure, particularly in China and India. Segmentation trends highlight the critical role of Instruments and Accessories, which represent a high-turnover segment due to the disposable nature of specialized catheters, guidewires, and mapping tools required for each procedure. Furthermore, the application segment is increasingly skewed toward Peripheral Vascular Procedures, driven by the aging global population and the escalating incidence of diabetes-related vascular complications, demanding minimally invasive solutions for complex revascularization, thus collectively shaping a dynamic and high-growth investment landscape.

AI Impact Analysis on Vascular Interventional Surgery Robot Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vascular Interventional Surgery Robot Market frequently center on the potential for autonomous navigation, enhanced procedural planning, and the optimization of clinical workflow efficiency. Users are keenly interested in how AI algorithms will process real-time imaging data—such as fluoroscopy, intravascular ultrasound (IVUS), and Optical Coherence Tomography (OCT)—to provide predictive guidance and mitigate human error during complex interventions like stenting or coiling. Key expectations revolve around AI enabling highly personalized procedures, improving patient outcomes, and significantly decreasing the variability associated with operator skill. Concerns often address regulatory hurdles related to autonomous systems, data security in teleoperated procedures, and the necessary retraining of specialized interventional cardiologists and radiologists to effectively integrate AI-driven decision support into their practice. The general consensus among stakeholders is that AI will initially function primarily as a sophisticated decision-support and image-enhancement tool, gradually progressing toward shared control and limited autonomy, profoundly redefining safety and efficacy standards in vascular interventions.

- AI enables real-time image segmentation and fusion, enhancing visualization of subtle vascular structures and lesions.

- Predictive modeling powered by machine learning assists in selecting optimal catheter sizes, deployment forces, and procedural pathways, minimizing tissue trauma.

- AI integration supports autonomous or semi-autonomous tasks, such as initial guidewire navigation or stabilizing the catheter tip during critical maneuvers.

- Enhanced procedural planning through deep learning algorithms analyzes pre-operative scans (CT, MRI) to generate precise 3D roadmaps for the robotic system.

- Workflow optimization utilizing AI reduces procedure time, controls radiation dosage exposure, and manages robotic system diagnostics and maintenance scheduling.

- Haptic feedback systems are refined by AI to simulate real tissue resistance, improving the surgeon's sense of touch during teleoperation.

- Development of personalized treatment protocols based on analyzing vast datasets of successful interventions, improving prognosis for complex cases.

DRO & Impact Forces Of Vascular Interventional Surgery Robot Market

The trajectory of the Vascular Interventional Surgery Robot Market is fundamentally shaped by a delicate interplay of powerful drivers, stringent restraints, emerging opportunities, and competitive impact forces. The core drivers stem from the global surge in cardiovascular diseases and the undeniable advantages of minimally invasive surgery, which necessitate highly precise robotic assistance to ensure patient safety and rapid recovery. However, market adoption is restrained by the substantial initial capital investment required for these sophisticated systems and the complex, prolonged regulatory approval processes mandated by global health authorities. Opportunities are predominantly found in the synergistic convergence of robotics with advanced AI, 5G connectivity for teleneuro-intervention, and the expansion into underpenetrated emerging economies seeking to upgrade their medical infrastructure. These forces create a dynamic environment where technological superiority, strategic partnerships, and focused clinician training programs determine competitive success and dictate the pace of market evolution. The need for specialized training infrastructure acts as a critical bottleneck, while the long-term cost-effectiveness compared to traditional open surgery serves as a profound compelling factor for widespread adoption.

Market Drivers

The primary driver fueling the growth of the vascular interventional surgery robot market is the escalating global prevalence of chronic cardiovascular conditions, including coronary artery disease, peripheral artery disease, and cerebrovascular disorders. These diseases, often linked to aging populations and sedentary lifestyles, necessitate frequent and complex interventions. Traditional open surgical procedures carry high risks and extended recovery periods, making minimally invasive, robot-assisted interventions a significantly more appealing alternative for both patients and healthcare providers. The demand for solutions that minimize patient trauma, reduce hospital stays, and lower the risk of hospital-acquired infections (HAIs) is paramount across mature healthcare systems. Furthermore, robotic systems offer unmatched precision in navigating tortuous and delicate vascular structures, a critical capability that enhances procedural success rates and minimizes the risk of complications associated with manual catheter manipulation.

A secondary, yet equally powerful, driver is the emphasis on minimizing occupational hazards for clinical staff, specifically radiation exposure. Interventional procedures traditionally expose cardiologists and supporting personnel to significant scatter radiation over time, posing long-term health risks. Robotic platforms often allow the physician to operate from a protected control console, significantly reducing radiation dose exposure. This ergonomic benefit, combined with the ability of robotic systems to enhance procedural consistency regardless of the operating physician's fatigue or physical strain, positions them as crucial instruments for maintaining high standards of clinical care. Governments and hospital administrators are increasingly recognizing the long-term operational savings and improved safety profiles associated with these advanced robotic solutions, thereby accelerating procurement cycles.

- Increasing incidence and prevalence of complex cardiovascular and peripheral vascular diseases globally.

- Growing preference for minimally invasive surgical procedures due to reduced patient trauma and shorter recovery times.

- Need for reduced radiation exposure for interventional cardiologists and clinical staff.

- Technological advancements leading to improved haptic feedback, visualization, and precision in catheter navigation.

- Rising investment in healthcare infrastructure and adoption of advanced surgical technologies in developed nations.

Market Restraints

The most significant restraint impeding broad market penetration is the extraordinarily high initial capital cost associated with acquiring vascular interventional robotic systems. These systems require substantial investment, often exceeding several million dollars per unit, which poses a considerable financial barrier, especially for smaller hospitals, specialized clinics, and institutions in emerging markets with constrained budgets. Beyond the upfront purchase price, ongoing maintenance, necessary software updates, specialized consumable instruments, and mandatory service contracts contribute to a high total cost of ownership (TCO), making it challenging for institutions to justify the return on investment (ROI) within competitive healthcare environments.

Furthermore, the steep learning curve and the necessity for specialized, rigorous training represent another substantial barrier. Operating vascular interventional robots requires highly skilled specialists, and standardized training infrastructure is still developing. A shortage of trained personnel, coupled with the need for interventionalists to dedicate significant time and resources to mastering the robotic interface, can limit the utilization rate of these expensive machines. Additionally, complex and fragmented regulatory pathways, particularly in diverse regional markets, introduce considerable delays and high costs for manufacturers seeking product approval and market expansion, slowing the pace of technological deployment.

- High initial capital expenditure and subsequent maintenance costs for robotic systems.

- Lack of standardized training programs and the steep learning curve for operators.

- Strict and lengthy regulatory approval processes governing high-risk medical devices.

- Unfavorable or inconsistent reimbursement policies for specific robot-assisted vascular procedures in some geographic regions.

- Potential for technical failures or system downtime leading to procedural delays and interruptions.

Market Opportunities

A significant opportunity lies in the ongoing integration of robotics with advanced artificial intelligence (AI) and machine learning (ML), leading to the development of autonomous or semi-autonomous functions. AI can revolutionize real-time decision support, optimizing trajectory planning and enabling superior catheter control in exceptionally complex anatomical scenarios, such as chronic total occlusions (CTOs) or highly calcified lesions. The evolution toward telerobotic surgery, facilitated by 5G networks, presents immense potential for extending specialized care to geographically remote or underserved patient populations, particularly in neuro-intervention and acute stroke management, creating new service delivery models.

Moreover, market expansion into the rapidly developing Asia Pacific and Latin American regions offers substantial untapped growth potential. These regions are experiencing rapid infrastructure modernization, increasing private healthcare investment, and a growing middle class demanding access to cutting-edge medical technologies. Manufacturers can capitalize on these opportunities by developing more affordable, scalable robotic platforms tailored to the infrastructure and budgetary constraints prevalent in these emerging markets. Focused development efforts aimed at simplifying the user interface and reducing the footprint of the systems can further accelerate their adoption beyond major academic medical centers.

- Integration of advanced AI and machine learning for superior surgical guidance and enhanced procedural automation.

- Development and adoption of telerobotic capabilities to expand surgical reach to remote and rural areas, leveraging 5G infrastructure.

- Untapped potential in emerging economies (APAC, LATAM) due to improving healthcare infrastructure and increasing medical tourism.

- Expansion of applications beyond coronary interventions into complex peripheral, neurovascular, and structural heart procedures.

- Strategic collaborations with imaging companies (e.g., CT, MRI, IVUS) to provide highly integrated, multimodal intraoperative guidance.

Impact Forces Analysis

The impact forces influencing the Vascular Interventional Surgery Robot Market are primarily driven by continuous technological innovation and intense competitive pressure. The rapid pace of hardware and software development, particularly in precision engineering and advanced sensors, constantly raises the performance benchmark, pressuring existing market leaders to reinvest heavily in R&D to maintain relevance. This technological force dictates that systems must be smaller, more modular, and capable of integrating diverse imaging modalities seamlessly, forcing a high rate of product iteration.

Furthermore, regulatory changes and shifts in healthcare policy regarding medical device clearance and reimbursement profoundly affect market dynamics. Favorable reimbursement policies, particularly in key markets like the United States and Western Europe, act as a massive pull factor, directly influencing hospital purchasing decisions and patient accessibility. Conversely, stringent clinical trial requirements or changes in safety standards can significantly delay product launches and elevate development costs. The increasing demand for evidence-based medicine also compels manufacturers to conduct robust long-term clinical studies demonstrating superior patient outcomes and cost-effectiveness compared to non-robotic alternatives, which ultimately determines market adoption and successful differentiation in a highly competitive landscape.

- Technological Advancement Pressure: Continuous innovation in haptics, remote control systems, and modular design demands constant product upgrades.

- Reimbursement Landscape: Coverage policies by public and private payers dictate the financial feasibility and accessibility of robotic procedures.

- Clinical Validation and Evidence: Requirement for robust clinical data proving long-term superior outcomes and cost-effectiveness drives market acceptance.

- Competitive Rivalry: Intense competition among established surgical robot manufacturers and specialized vascular device companies pushes pricing and feature parity.

- Cybersecurity Concerns: Increasing reliance on networked systems and telerobotics necessitates robust security protocols, impacting trust and adoption.

Segmentation Analysis

The Vascular Interventional Surgery Robot Market is meticulously segmented based on components, application areas, and end-user types, providing a detailed understanding of revenue streams and growth vectors. The Component segment, comprising Robotic Systems, Instruments & Accessories, and Services, demonstrates that while the initial system purchase provides substantial revenue, the recurring revenue generated by consumables (Instruments & Accessories) and maintenance Services ensures long-term profitability and customer retention for manufacturers. The Application segmentation clearly reflects the current procedural volume, with Coronary Procedures maintaining a leading share, though Peripheral Vascular Procedures are rapidly gaining momentum due to the demographic surge in associated diseases. End-user analysis reveals that Hospitals remain the dominant purchasing entities due to their capability to handle high-volume, complex cases, while the burgeoning role of Ambulatory Surgical Centers (ASCs) is expected to introduce cost-effective, specialized robotic procedure options in the future.

- By Component:

- Robotic Systems

- Instruments & Accessories (Guidewires, Catheters, Stents, Balloons)

- Services (Maintenance, Training, Software Upgrades)

- By Application:

- Coronary Procedures (Angioplasty, Stenting)

- Peripheral Vascular Procedures (Atherectomy, Thrombectomy)

- Neurovascular Procedures (Coiling, Thrombectomy for Stroke)

- Structural Heart Procedures (Valve Repair, PFO/ASD Closure)

- By End-User:

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Specialty Clinics

- By Technology:

- Telerobotic Systems

- Shared Control Systems

- Master-Slave Systems

Value Chain Analysis For Vascular Interventional Surgery Robot Market

The value chain for the Vascular Interventional Surgery Robot Market is characterized by highly specialized stages, beginning with intensive upstream research and development, followed by complex manufacturing and stringent quality assurance, culminating in critical downstream activities such as direct sales, distribution, installation, and ongoing support services. Upstream activities are dominated by highly specialized engineering firms and technology providers focused on creating proprietary software, specialized sensor technologies, haptic feedback mechanisms, and high-precision mechanical components. Success at this stage relies heavily on securing intellectual property and maintaining deep partnerships with academic and clinical research institutions to validate design principles. The manufacturing process itself involves meticulous assembly under strict medical device regulations (e.g., ISO 13485, FDA GMP), focusing on miniaturization, biocompatibility of instruments, and reliability of the robotic arm mechanics.

Downstream activities are crucial for profitability and market presence. Given the high-cost, high-complexity nature of the product, sales are predominantly direct, involving extensive consultation, clinical demonstrations, and negotiation with hospital procurement committees and key opinion leaders (KOLs). Direct sales teams are typically highly educated, possessing both technical and clinical expertise. Distribution involves specialized logistics for handling high-value, sensitive medical capital equipment, often requiring direct manufacturer involvement for installation and commissioning. Post-sale, the services segment—including mandatory software updates, preventative maintenance, and specialized technical support—becomes the primary source of recurring revenue and a key differentiator in customer loyalty.

The distribution channel is structured to manage the high touchpoints required for capital equipment sales. Direct channels are preferred for the main robotic systems, ensuring optimal control over installation, calibration, and subsequent training programs, which are vital for successful clinical integration. Indirect distribution, involving regional distributors or value-added resellers (VARs), may be used for distributing high-volume consumable instruments and accessories, especially in geographically dispersed markets where a local presence is necessary for efficient supply chain management. Effective management of this complex channel ensures timely delivery of critical consumables and rapid response to technical support needs, which are prerequisites for consistent system uptime and maximizing procedural throughput for the end-user hospitals.

- Upstream Analysis: R&D, component manufacturing (sensors, motors, software), clinical research, and securing IP.

- Core Manufacturing: System assembly, quality control, sterilization, and regulatory compliance (FDA/CE Mark).

- Downstream Analysis: Direct sales force engagement, specialized logistics, installation, and comprehensive user training.

- Distribution Channel: Predominantly Direct Sales for Capital Equipment; Indirect/Dealer network for Consumables (Instruments & Accessories).

- Post-Sale Services: Mandatory maintenance contracts, technical support, clinical application support, and software upgrades (high-margin recurring revenue).

Vascular Interventional Surgery Robot Market Potential Customers

The primary and most significant potential customers for Vascular Interventional Surgery Robot systems are large, tertiary-care Hospitals and specialized Cardiac and Neurovascular Centers. These institutions possess the requisite high patient volume of complex vascular diseases, the financial capacity for substantial capital investment, and the necessary infrastructure, including dedicated hybrid operating rooms and advanced imaging facilities, to effectively utilize robotic platforms. Furthermore, these academic and teaching hospitals are typically early adopters of cutting-edge medical technology, driven by research interests, a mandate for specialized patient care, and a desire to attract top-tier surgical talent. Their purchasing decisions are influenced not only by clinical efficacy and safety profiles but also by the system's potential to enhance institutional reputation and market share in high-value procedures.

A rapidly growing segment of potential customers includes Ambulatory Surgery Centers (ASCs) and specialized, high-volume outpatient clinics. As vascular procedures become less invasive and recovery times shorten, certain interventional treatments are migrating out of inpatient hospital settings and into ASCs, driven by cost-efficiency and patient preference. While ASCs may initially focus on lower-acuity peripheral vascular interventions, the development of smaller, more cost-effective robotic systems specifically designed for outpatient settings is accelerating their market entry. These centers are highly sensitive to operational costs and seek robotic systems that minimize footprint and maximize procedural turnover, positioning them as a critical mid-term growth opportunity for manufacturers.

Finally, governmental health ministries and military hospitals in high-growth emerging economies also represent key potential buyers. Governments in nations investing heavily in medical infrastructure modernization (e.g., Middle East, China, Southeast Asia) prioritize acquiring state-of-the-art technology to address rising non-communicable disease burdens and enhance their national healthcare prestige. These bulk institutional buyers often require systems capable of managing a wide range of vascular pathologies, frequently negotiating favorable package deals that include extensive long-term service agreements and comprehensive local training programs, reflecting a strategic, nation-wide adoption strategy rather than localized hospital procurement.

- Large Tertiary and Quaternary Hospitals (Academic Medical Centers).

- Specialized Cardiac and Neurovascular Intervention Centers.

- High-Volume Ambulatory Surgery Centers (ASCs) focusing on peripheral vascular care.

- Private Specialty Clinics and Diagnostic Centers with high patient flow and advanced imaging capabilities.

- Governmental Health Systems and Ministry of Defense Hospitals undertaking national medical modernization programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intuitive Surgical, Siemens Healthineers, Philips Healthcare, Stereotaxis, Corindus Vascular Robotics (Siemens Healthineers), Medtronic, Johnson & Johnson (Auris Health), Hansen Medical (Auris Health), MicroPort Scientific Corporation, Getinge AB, Asensus Surgical, CMR Surgical, Olympus Corporation, Accuray Incorporated, Stryker Corporation, Becton Dickinson (BD), Abbott Laboratories, Zimmer Biomet, ConMed Corporation, TransEnterix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vascular Interventional Surgery Robot Market Key Technology Landscape

The technological landscape of the Vascular Interventional Surgery Robot Market is rapidly evolving, moving beyond basic remote navigation systems towards sophisticated platforms incorporating advanced haptics, augmented reality (AR), and enhanced imaging integration. Modern systems rely heavily on miniaturized, high-torque robotic actuators that provide sub-millimeter precision in catheter and guidewire manipulation, crucial for safely navigating complex, distal vascular anatomies, especially in neurovascular interventions. A key technological focus is the development of advanced haptic feedback mechanisms that allow the physician, stationed miles away or behind a console, to sense the real-time forces exerted by the catheter tip against the vessel wall, thereby preventing perforations and improving tactile sensation that is otherwise lost in conventional teleoperated systems. This simulation of touch significantly bridges the gap between manual and robotic intervention.

Furthermore, the integration of multi-modality imaging is central to technological superiority. Contemporary robotic systems seamlessly overlay pre-operative data (CT/MRI) and real-time intraoperative imaging (fluoroscopy, IVUS, OCT) onto the surgical field, often employing augmented reality interfaces projected directly into the surgeon's view. This fusion allows for enhanced situational awareness and precise guidance without relying solely on two-dimensional X-ray imagery. Another critical area is the emergence of magnetic guidance systems, which utilize controlled magnetic fields to steer specialized catheters or micro-devices through the vasculature, offering an alternative to purely mechanical manipulation, particularly promising for highly delicate neuro-interventions where flexibility and minimal force application are paramount for safety.

Looking ahead, the technological frontier is centered on leveraging 5G connectivity for ultra-low latency telerobotics, enabling expert surgeons to perform critical procedures across vast distances with minimal temporal lag, thereby democratizing access to specialized vascular care. Furthermore, ongoing research focuses on developing smaller, more modular, and mobile robotic units that can be deployed in diverse clinical settings, including emergency rooms and mobile stroke units, rather than being confined solely to specialized hybrid operating rooms. These next-generation systems will prioritize cost-efficiency, faster setup times, and greater compatibility with existing hospital IT infrastructure, marking a significant step toward widespread clinical adoption and standardization of robot-assisted vascular care worldwide.

- Haptic Feedback Systems: Advanced mechanisms providing tactile sensation to the operating physician, simulating real-time interaction with vascular tissue.

- Integrated Imaging Modalities: Seamless fusion of fluoroscopy, Intravascular Ultrasound (IVUS), Optical Coherence Tomography (OCT), CT, and MRI data for superior navigation.

- Telerobotics and Low-Latency Control: Utilization of 5G infrastructure to enable remote surgery capabilities for neurovascular and cardiac emergencies.

- Miniaturization and Modular Design: Development of smaller robotic arms and control consoles to increase versatility and fit into existing Cath Labs.

- Magnetic Guidance Technology: Systems employing precise magnetic fields to guide specialized, highly flexible micro-catheters in complex anatomies.

- Augmented Reality (AR) Guidance: Projection of 3D anatomical models and procedural roadmaps onto the live fluoroscopic image for improved accuracy.

Regional Highlights

- North America: Market Leader and Innovation Hub

North America, particularly the United States, commands the largest share of the Vascular Interventional Surgery Robot Market. This dominance is attributed to several factors: highly advanced healthcare infrastructure, high healthcare spending driven by both public and private insurance systems, favorable and structured reimbursement policies for robotic procedures, and the strong presence of key market players and innovation centers. The US market is characterized by rapid adoption of new technologies, high procedural volumes, and intensive clinical research validating robot-assisted interventions. Canada also contributes significantly, though its adoption is often governed by public provincial healthcare budgeting. The region sets the global standards for clinical trials and regulatory benchmarks, influencing global market trends.

- Europe: Steady Growth and Regulatory Harmony

Europe represents the second-largest market, exhibiting steady growth propelled by increasing awareness of minimally invasive surgery benefits and the high prevalence of cardiovascular diseases across major economies like Germany, the UK, and France. The market benefits from well-established healthcare systems and initiatives focused on improving procedural outcomes. Adoption rates vary, often driven by centralized procurement policies and national health technology assessments (HTA). The gradual harmonization of medical device regulations under the EU MDR is streamlining market entry for advanced robotic systems, though pricing pressures remain a consistent restraint in public healthcare systems.

- Asia Pacific (APAC): Fastest Growing and High Potential

The Asia Pacific region is projected to register the highest CAGR during the forecast period. This rapid expansion is fueled by massive infrastructure investments, increasing penetration of private healthcare, and a burgeoning patient population suffering from vascular diseases. Countries such as China, Japan, and India are key growth engines. Japan is noted for early adoption and technological sophistication, while China is rapidly building domestic manufacturing capabilities and investing heavily in healthcare digitalization. India offers immense potential, driven by medical tourism and the need for scalable solutions in densely populated areas, though affordability remains a crucial factor for widespread market penetration.

- Latin America (LATAM): Emerging Opportunities

The LATAM market, while currently smaller, is emerging as an opportunity area, particularly in Brazil and Mexico. Market growth is driven by the expansion of private clinics and hospitals catering to affluent populations seeking advanced Western medical treatments. Economic instability and fluctuating currency exchange rates, coupled with less developed reimbursement frameworks, pose significant challenges. However, the increasing focus on complex cardiology and oncology treatments in major metropolitan areas is pushing demand for high-precision robotic systems.

- Middle East and Africa (MEA): Strategic Niche Markets

The MEA region, led by Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), demonstrates robust demand driven by government strategic initiatives to establish world-class medical cities and healthcare hubs. High per capita income in these oil-rich nations allows for significant capital investment in expensive robotic technology, primarily aimed at specialized centers of excellence. The African market remains largely nascent, with adoption concentrated in private facilities in South Africa, constrained by limited infrastructure and budgetary limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vascular Interventional Surgery Robot Market.- Stereotaxis

- Siemens Healthineers (Corindus Vascular Robotics)

- Intuitive Surgical

- Medtronic

- Philips Healthcare

- Johnson & Johnson (Auris Health)

- MicroPort Scientific Corporation

- Hansen Medical (acquired by Auris Health/J&J)

- Getinge AB

- Asensus Surgical

- CMR Surgical

- Olympus Corporation

- Abbott Laboratories

- Becton Dickinson (BD)

- Stryker Corporation

- Accuray Incorporated

- Zimmer Biomet

- ConMed Corporation

- TransEnterix

- Boston Scientific Corporation

Frequently Asked Questions

Analyze common user questions about the Vascular Interventional Surgery Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market size and growth rate of the Vascular Interventional Surgery Robot Market?

The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.2 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 11.5% due to the rising incidence of cardiovascular diseases and advancements in minimally invasive technology.

How does robot-assisted vascular surgery improve patient outcomes compared to manual procedures?

Robotic systems enhance precision by offering sub-millimeter control, significantly reducing the risk of procedural complications, shortening operative times, minimizing radiation exposure for both patient and staff, and ultimately leading to faster patient recovery and reduced length of hospital stay.

What are the main financial barriers to the adoption of vascular interventional robots?

The primary barrier is the high initial capital investment required for the robotic system, typically followed by substantial recurring costs for disposable instruments, accessories, maintenance services, and specialized staff training, necessitating a robust financial model for justifying the investment.

Which geographical region is expected to show the fastest market growth, and why?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, driven by rapid modernization of healthcare infrastructure, escalating government and private investment in medical technology, and the large, aging population facing a growing burden of vascular diseases, particularly in China and India.

How is Artificial Intelligence (AI) influencing the future of vascular interventional robotics?

AI is crucial for enhancing procedural safety and efficacy by providing real-time decision support, integrating multimodal imaging data for superior visualization, refining haptic feedback, and developing predictive algorithms for optimal catheter trajectory planning, moving systems toward greater autonomy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager