Vegetable Transplanter Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431791 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Vegetable Transplanter Machine Market Size

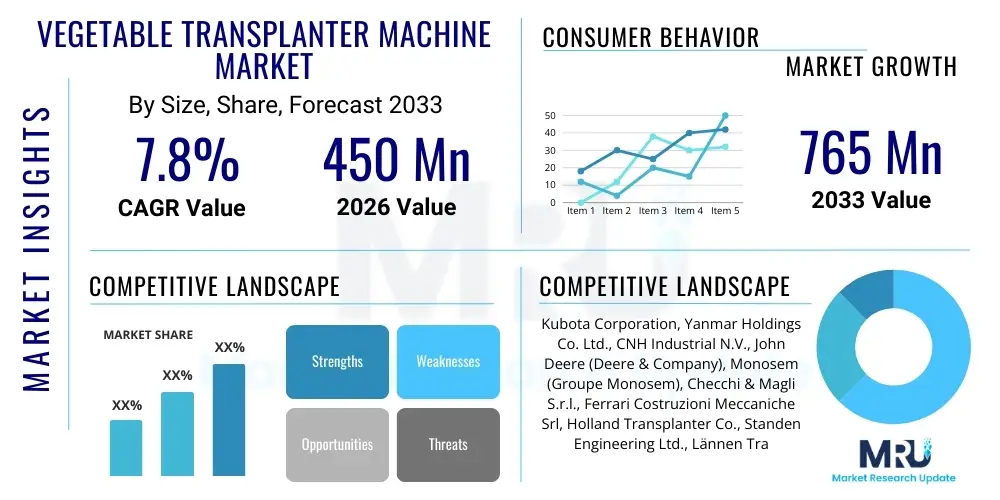

The Vegetable Transplanter Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033.

Vegetable Transplanter Machine Market introduction

The Vegetable Transplanter Machine Market encompasses the manufacturing, sales, and deployment of specialized agricultural equipment designed to automate the process of transplanting seedlings (such as tomatoes, cabbage, peppers, and rice) from nursery trays into prepared field beds. These machines are critical tools for enhancing agricultural productivity and addressing the increasing global shortage of manual farm labor, which is particularly acute in developing economies and established agricultural regions alike. The product category includes various configurations, ranging from manual walk-behind models to highly sophisticated, multi-row, self-propelled automated systems integrated with GPS and sensor technology. The primary function is to ensure optimal plant spacing, depth, and orientation, which directly contributes to uniform crop growth and maximized yield per hectare.

Major applications of vegetable transplanters span across large commercial farms specializing in row crops, small-to-medium enterprises focused on high-value vegetables, and contract farming operations that require high throughput and precision. The benefits derived from adopting these machines are substantial, including significant reductions in planting time, minimized seedling damage during transfer, and improved planting accuracy leading to better resource utilization (water and fertilizer). Furthermore, mechanized transplanting allows farmers to execute planting operations during optimal weather windows, reducing the risk associated with manual labor delays.

The market is predominantly driven by powerful socio-economic and technological factors. Rapid urbanization globally has led to an exodus of labor from rural areas, making mechanization a necessity rather than an optional enhancement. Concurrently, government policies, particularly in Asia Pacific and Europe, are actively promoting farm mechanization through subsidies and financial incentives aimed at boosting domestic food security and enhancing the competitiveness of agricultural exports. This systemic shift toward precision agriculture methodologies, which demand accurate placement and timing, further accelerates the adoption of advanced transplanter machines.

Vegetable Transplanter Machine Market Executive Summary

The Vegetable Transplanter Machine Market is experiencing robust expansion driven by the critical need for operational efficiency and labor cost reduction across the global agricultural sector. Current business trends indicate a strong pivot towards fully automated and self-propelled transplanters, moving away from semi-automatic, tractor-mounted units, particularly in North America and Europe where labor costs are highest. Manufacturers are increasingly integrating IoT capabilities, real-time diagnostics, and hydraulic systems that allow for variable rate planting based on soil conditions and pre-existing field maps, positioning the technology as a core component of digital farming strategies. This technological escalation ensures higher precision and operational longevity, thus justifying the substantial initial investment required for sophisticated machinery.

Regionally, Asia Pacific maintains its dominance in terms of volume consumption, fueled by extensive rice and vegetable cultivation in countries like China, India, and Japan. However, the fastest growth in terms of value is observed in North America and Europe, attributed to the high penetration rate of expensive, high-capacity, automated machinery equipped with GPS guidance and AI-driven systems. Latin America is also emerging as a significant growth hub, characterized by increasing industrial farming operations focused on export crops, requiring medium to high levels of mechanization. The European market, while mature, is focused on machines compliant with strict environmental standards, prioritizing fuel efficiency and reduced soil compaction.

Segmentation analysis reveals that the semi-automatic segment currently holds a larger market share in terms of unit volume due to affordability and suitability for small and fragmented land holdings prevalent in developing regions. However, the fully automatic segment is projected to exhibit the highest CAGR through 2033, driven by increasing farm consolidation and the demand for maximum labor substitution. In terms of power source, tractor-mounted transplanters remain versatile and popular, yet the operational advantages of self-propelled machines, including improved maneuverability and reduced reliance on specialized tractor units, are rapidly accelerating their market uptake among large commercial growers.

AI Impact Analysis on Vegetable Transplanter Machine Market

Common user questions regarding AI’s impact on vegetable transplanter machines often revolve around operational autonomy, planting precision under diverse field conditions, and predictive maintenance schedules. Users are keen to understand how AI-powered vision systems can identify and select the healthiest seedlings in real-time before transplanting, and how machine learning algorithms can dynamically adjust planting depth and density based on soil moisture and texture data captured instantaneously, thereby maximizing initial survival rates and field uniformity. A primary concern is the potential for AI integration to dramatically increase the cost and complexity of the machinery, potentially sidelining smaller farmers. Ultimately, user expectations center on achieving truly autonomous, highly efficient, and resource-optimized planting operations that transcend the capabilities of traditional hydraulic and mechanically controlled systems.

- AI-driven Vision Systems: Enables real-time assessment of seedling quality and orientation, ensuring only viable plants are transplanted, reducing waste.

- Autonomous Operation: Facilitates self-navigation (in combination with GPS/LIDAR), allowing machines to operate 24/7 without direct human intervention, maximizing field time.

- Predictive Maintenance: Machine learning algorithms analyze operational data (vibrations, temperature, hydraulic pressure) to forecast potential component failures, minimizing unplanned downtime.

- Variable Rate Planting (VRP): AI algorithms process sensor data to dynamically adjust row spacing, depth, and fertilizer application based on specific micro-field conditions, optimizing yield uniformity.

- Robotics and Gripper Control: Advanced AI fine-tunes the force and trajectory of robotic arms or grippers, drastically reducing physical damage to delicate seedlings during handling.

- Optimized Route Planning: Uses historical data and real-time field constraints to determine the most efficient path for planting, reducing fuel consumption and operational hours.

DRO & Impact Forces Of Vegetable Transplanter Machine Market

The trajectory of the Vegetable Transplanter Machine Market is fundamentally shaped by a complex interplay of systemic drivers (D), persistent restraints (R), evolving opportunities (O), and external impact forces. The dominant driver is the critical scarcity of farm labor globally, forcing agricultural operations to invest heavily in mechanization to maintain production levels. This is synergized by the rising global demand for food, particularly high-quality vegetables, requiring farmers to adopt precision agriculture techniques where transplanting accuracy is paramount. Conversely, the market faces significant hurdles due to the high initial capital expenditure required for sophisticated, automated transplanters, which can be prohibitive for small and medium-sized farmers, especially in regions with limited access to agricultural credit.

Opportunities in the market are abundant, primarily focused on technological integration. The widespread adoption of the Internet of Things (IoT), coupled with 5G connectivity in rural areas, presents manufacturers with opportunities to offer sophisticated telemetry, remote diagnostics, and data-as-a-service models. Furthermore, the development of specialized machines for challenging crops (e.g., highly delicate leaf vegetables) or adverse terrains opens up niche high-margin segments. This push for innovation is also fueled by global mandates for sustainable farming, prompting the development of electric or hybrid transplanters that reduce the carbon footprint associated with planting operations.

The primary impact forces include government regulations and subsidies, which can dramatically influence purchasing decisions—a high subsidy rate in a region immediately catalyzes market growth. Fluctuations in commodity prices, particularly for staple crops, also indirectly affect the willingness of farmers to invest in capital equipment. Moreover, the accelerating pace of technological convergence, where planting machines increasingly incorporate vision, AI, and autonomous driving capabilities, is restructuring the competitive landscape, shifting dominance towards companies capable of executing complex software-hardware integration rather than purely mechanical engineering. This synthesis of operational, economic, and technological factors dictates the speed and direction of market penetration across different geographies.

Segmentation Analysis

The Vegetable Transplanter Machine Market is strategically segmented across several critical dimensions, allowing for a detailed understanding of market dynamics specific to various farming practices, economic capacities, and geographical needs. The most prominent segmentation is by level of automation, differentiating between rudimentary manual or semi-automatic models and highly complex, fully automatic robotic systems. This delineation is essential because it directly correlates with machine cost, operational capacity (rows per hour), and the degree of labor reduction achievable. Additionally, the market is segmented by power source, distinguishing between flexible tractor-mounted units, which leverage existing farm assets, and dedicated self-propelled machines, offering superior maneuverability and integrated design optimization for transplanting specific crops.

Further segmentation includes capacity (number of rows), which dictates the target user base—from 1-row/2-row machines for small holdings to 6-row or 8-row large-scale commercial planters. The application scope, detailing the primary crops handled (e.g., rice, tobacco, cabbage, sweet potatoes), also guides product development, as different crops require unique gripping and placement mechanisms. Analyzing these segments provides manufacturers and stakeholders with the necessary granularity to tailor marketing efforts and R&D investment towards the most lucrative and rapidly evolving sub-markets, particularly those moving toward higher automation and greater operational precision.

- By Automation Level:

- Semi-Automatic Transplanters

- Automatic/Robotic Transplanters

- By Power Source:

- Tractor-Mounted Transplanters

- Self-Propelled Transplanters

- By Capacity (Rows):

- 1-Row to 2-Row Transplanters (Small Farms)

- 4-Row to 6-Row Transplanters (Medium Farms)

- 8-Row and Above Transplanters (Large Commercial Farms)

- By Application:

- Vegetables (e.g., Tomato, Pepper, Cabbage, Broccoli)

- Cash Crops (e.g., Tobacco, Sugarcane)

- Rice (Paddy Transplanters)

Value Chain Analysis For Vegetable Transplanter Machine Market

The value chain for the Vegetable Transplanter Machine Market begins with upstream activities involving the sourcing of highly specialized raw materials, including high-grade steel alloys for structural frames, precision hydraulic components, and advanced electronic sensors and control units. Key upstream suppliers include manufacturers of specialized farming robotics components and GPS/GNSS technology providers. Efficient procurement and quality control at this stage are crucial, as machine reliability and longevity directly depend on material integrity, especially given the harsh operating environments encountered in agricultural settings.

The midstream focuses on manufacturing and assembly, where sophisticated processes are employed to integrate mechanical, hydraulic, and electronic systems. Original Equipment Manufacturers (OEMs) often maintain large, automated assembly lines, emphasizing lean manufacturing practices to manage costs. The distribution channel plays a vital role in connecting these specialized machines to end-users. Direct channels, involving OEM service centers and direct farm consultation, are preferred for highly automated, high-value machinery, enabling bespoke customization and immediate post-sales support. Indirect channels, encompassing authorized dealers, regional distributors, and agricultural cooperative buying groups, handle the bulk sales of standardized or semi-automatic models, leveraging established local relationships and providing critical local spare parts inventory and basic maintenance services.

Downstream analysis focuses on post-sale services, including maintenance contracts, spare parts distribution, and the provision of software updates (especially for AI-enabled machines). Given the seasonality of transplanting, prompt and efficient service is a critical competitive differentiator. Potential customers, including large commercial farms and specialized contract farming organizations, drive demand not only for the product itself but also for integrated solutions that include financing, training on precision farming techniques, and data analytics support, ensuring optimal utilization and maximizing the return on investment (ROI) from the advanced machinery.

Vegetable Transplanter Machine Market Potential Customers

The primary customer base for Vegetable Transplanter Machines is highly diversified, ranging from expansive commercial agricultural enterprises to cooperative farming associations and government-supported demonstration farms. Large-scale commercial growers represent the most lucrative segment for high-end, fully automatic, multi-row, and GPS-guided transplanters. These customers prioritize machine throughput, speed, precision, and the ability to integrate seamlessly with other farming systems (e.g., automated irrigation and fertilization setups), viewing the transplanter as a core capital asset essential for mass production and global supply chain efficiency.

The second major group comprises mid-sized and cooperative farms, particularly prevalent in densely populated agricultural regions across Asia and Europe. These buyers typically opt for robust, versatile semi-automatic or tractor-mounted transplanters that offer a high degree of mechanization at a more accessible price point. Their purchasing decisions are often driven by immediate labor cost savings and efficiency gains achieved during peak planting seasons. These groups frequently utilize shared ownership models or government-backed purchasing schemes to mitigate the individual financial burden of mechanization.

Emerging buyers include specialized horticulturalists and organic farmers who require specific, low-impact transplanting solutions. While their volume demand may be lower, they often require customized machines capable of handling delicate organic seedlings or planting in non-conventional bed layouts. Furthermore, agricultural service providers and contract farming organizations, which rent out mechanized services to multiple small landholders, constitute a growing customer segment, purchasing high-utilization machines built for durability and continuous operation across varied field conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kubota Corporation, Yanmar Holdings Co. Ltd., CNH Industrial N.V., John Deere (Deere & Company), Monosem (Groupe Monosem), Checchi & Magli S.r.l., Ferrari Costruzioni Meccaniche Srl, Holland Transplanter Co., Standen Engineering Ltd., Lännen Tractors Oy, AgroMaster, Fedele S.r.l., Kverneland Group, Nardi S.p.A., Foton Lovol International Heavy Industry Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vegetable Transplanter Machine Market Key Technology Landscape

The technological evolution of the Vegetable Transplanter Machine Market is centered on enhancing precision, operational autonomy, and data integration to meet the demands of modern precision agriculture. A foundational technology driving this market is Global Navigation Satellite System (GNSS) guidance, including both GPS and GLONASS, which ensures centimeter-level accuracy in row spacing and straight-line planting across vast fields. This accuracy is paramount for subsequent mechanized operations like weeding and harvesting. Modern transplanters leverage RTK (Real-Time Kinematic) correction services to achieve high repeatability and reduce operator fatigue, fundamentally shifting the planting process from manual steering to automated path execution.

Another critical area involves advanced sensor and control systems, specifically electro-hydraulic mechanisms. Unlike older purely mechanical linkages, contemporary machines utilize sophisticated hydraulic actuators controlled by electronic monitoring units. These systems can instantaneously adjust planting depth, soil compaction pressure, and water application based on input from integrated sensors that measure soil moisture, temperature, and texture in real-time. This dynamic adjustment capability ensures optimal micro-environment conditions for each transplanted seedling, which significantly boosts survival rates and growth uniformity across the field.

Furthermore, the integration of IoT and telematics platforms is defining the competitive edge for leading manufacturers. These technologies enable real-time data logging, collecting information on operational efficiency, fuel consumption, and component health. Farmers can access this data remotely, facilitating better farm management decisions and enabling predictive maintenance scheduling. Future technological advancements are heavily leaning towards fully autonomous robotic transplanters that use computer vision and machine learning (AI) for tasks such as automated tray feeding, precise seedling gripping (minimizing trauma), and obstacle avoidance, promising a completely hands-off planting solution.

Regional Highlights

The global Vegetable Transplanter Machine Market exhibits significant regional variation in technology adoption, market maturity, and product demand profile. North America and Europe are defined by their pursuit of high automation levels, characterized by strong demand for large-capacity, self-propelled, and GPS-guided transplanters. High labor costs and large average farm sizes in regions like the US Midwest and Western Europe justify the substantial investment in these advanced systems. Market growth in these regions is stable and driven primarily by replacement cycles and the increasing incorporation of AI-enabled planting diagnostics.

Asia Pacific (APAC) represents the largest market globally in terms of volume and installed base, fueled by immense agricultural activities, particularly rice, vegetable, and tobacco cultivation in countries such as China, India, Japan, and Vietnam. The APAC market is highly diverse, with Japan and South Korea adopting high-technology transplanters due to rapid aging of the farm population, while India and Southeast Asian nations show robust demand for affordable, semi-automatic, and tractor-mounted units suitable for fragmented land ownership and small farms. Government subsidies aimed at promoting mechanization are the single biggest catalyst for market penetration across this region.

Latin America (LATAM) is emerging as a high-growth region, driven by the expansion of large-scale industrialized agriculture focused on export markets in countries like Brazil and Argentina. Demand here is shifting rapidly from basic mechanization towards high-capacity, durable machines capable of handling continuous, intensive operations. The Middle East and Africa (MEA) market remains niche, primarily focused on climate-controlled agriculture (greenhouses) and specific cash crop plantations, with growth contingent upon improvements in agricultural infrastructure and access to affordable financing.

- North America: Focus on high-capacity (8+ rows), autonomous, and RTK-GPS guided systems to address acute labor scarcity and optimize vast field operations.

- Asia Pacific (APAC): Dominant market volume driven by rice and vegetable cultivation; dual demand for both high-tech automation (Japan) and affordable semi-automatic models (India, China).

- Europe: High adoption of sophisticated machines emphasizing environmental compliance, fuel efficiency, and specialized solutions for high-value organic produce and varied terrain.

- Latin America (LATAM): Rapid growth in industrialized farming; increasing investment in 4-to-6 row capacity machines suitable for large-scale export-oriented cultivation.

- Middle East & Africa (MEA): Growth driven by controlled environment agriculture projects and government initiatives aimed at boosting regional food security and mechanization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vegetable Transplanter Machine Market.- Kubota Corporation

- Yanmar Holdings Co. Ltd.

- CNH Industrial N.V.

- John Deere (Deere & Company)

- Monosem (Groupe Monosem)

- Checchi & Magli S.r.l.

- Ferrari Costruzioni Meccaniche Srl

- Holland Transplanter Co.

- Standen Engineering Ltd.

- Lännen Tractors Oy

- AgroMaster

- Fedele S.r.l.

- Kverneland Group

- Nardi S.p.A.

- Foton Lovol International Heavy Industry Co. Ltd.

- Rinieri S.r.l.

- Shandong Wuzheng Group Co. Ltd.

- Zhejiang Agsun Machinery Co. Ltd.

- Pöttinger Landtechnik GmbH

- Maschio Gaspardo S.p.A.

Frequently Asked Questions

Analyze common user questions about the Vegetable Transplanter Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully automatic vegetable transplanters?

The primary driver is the critical, persistent scarcity of manual labor in agricultural regions coupled with rising labor costs globally. Fully automatic systems offer maximum labor substitution, guaranteeing high-precision planting operations regardless of worker availability or skill level.

How does the integration of GPS/RTK technology enhance transplanter efficiency?

GPS/RTK technology provides centimeter-level accuracy for navigation and row spacing uniformity. This precision minimizes overlap, optimizes resource application, and ensures that subsequent mechanized operations (e.g., harvesting) can be executed efficiently, maximizing field profitability.

Which geographical region holds the largest market share for transplanter machines?

The Asia Pacific (APAC) region currently holds the largest volume market share due to extensive vegetable and rice cultivation, supported by numerous government initiatives promoting farm mechanization across countries like China and India.

What is the biggest barrier to entry for small farmers adopting automated transplanter technology?

The primary barrier is the high initial capital expenditure (CapEx) associated with purchasing fully automatic, high-capacity machinery. This often requires significant government subsidies or accessible agricultural financing to overcome for small and medium-sized enterprises.

Are electric or hybrid transplanters becoming prevalent in the market?

Yes, driven by sustainability mandates and the push for lower operational noise and emissions, electric and hybrid models are emerging, particularly in Europe, offering reduced carbon footprints and lower long-term maintenance costs compared to traditional diesel-powered systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager