Vegetarian Sausage Casings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431765 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vegetarian Sausage Casings Market Size

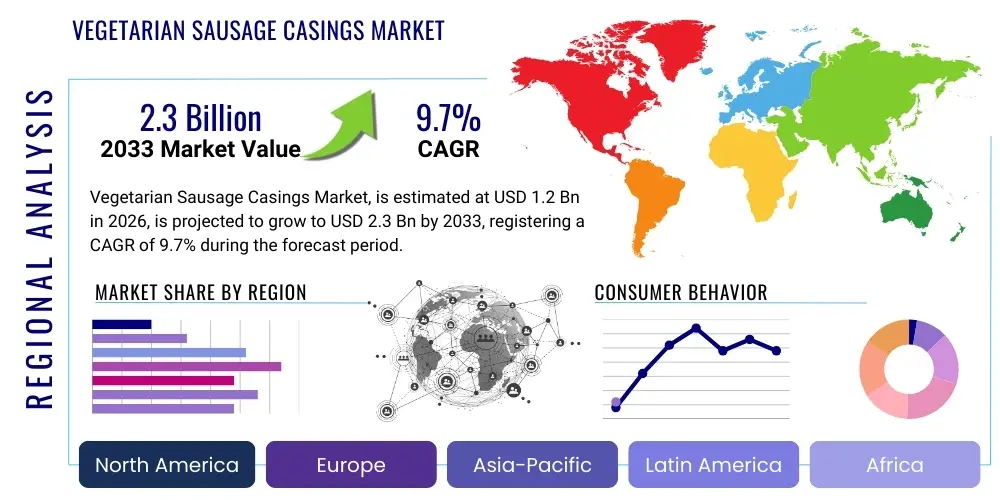

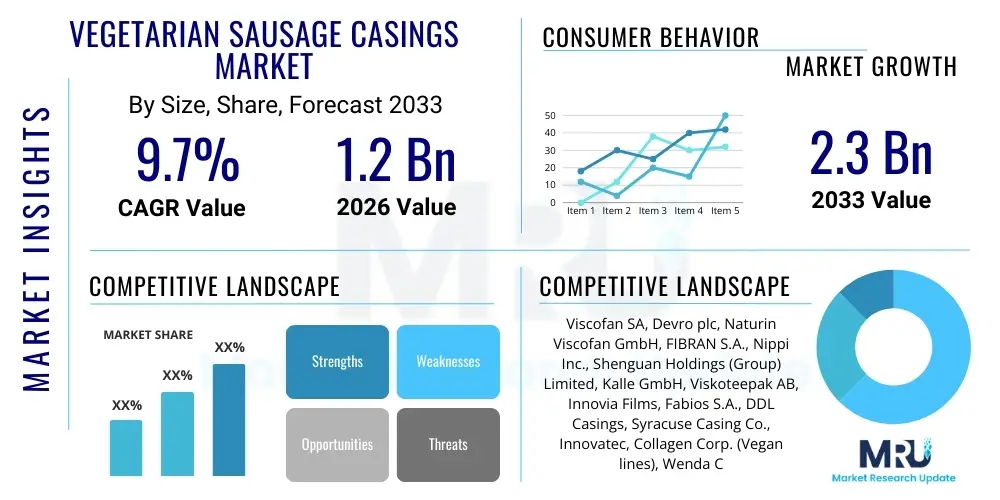

The Vegetarian Sausage Casings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.7% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Vegetarian Sausage Casings Market introduction

The Vegetarian Sausage Casings Market encompasses materials derived from non-animal sources, primarily plant-based polymers such as alginate, cellulose, and various polysaccharides, used to encase sausages, meat alternatives, and other processed food products. These casings serve the critical functions of providing shape, ensuring structural integrity during cooking and processing, and protecting the contents from external contamination. Historically dominated by natural animal gut and collagen, the shift towards plant-based alternatives is driven fundamentally by surging consumer demand for vegan, vegetarian, and flexitarian diets, alongside growing ethical concerns regarding animal welfare and environmental sustainability. These modern casings are often designed to be edible, possessing neutral flavor profiles that do not interfere with the final product's taste, thereby appealing directly to food manufacturers aiming for clean-label status and broader consumer acceptance in the rapidly evolving plant-based foods sector. Furthermore, technological advancements in material science allow manufacturers to tailor casing properties, such as tensile strength, barrier functionality, and texture, ensuring optimal performance across high-speed industrial stuffing processes, addressing a crucial requirement for scalability in the alternative meat industry.

A central product description defining the scope of this market includes casings made from ingredients like vegetable fiber, seaweed extracts (alginate), pea protein isolates, and modified starch. Major applications span across various meat substitute categories, including vegan hot dogs, plant-based bratwurst, specialized artisan sausages, and meatless luncheon meats, ensuring these products possess the familiar bite and visual appeal associated with traditional encased products. Key benefits driving market penetration include the assurance of 100% vegetarian and vegan compliance, enhanced shelf life due to superior barrier properties in certain engineered casings, and standardized quality that surpasses the variability inherent in natural casings. The regulatory environment, particularly in North America and Europe, which increasingly favors transparent labeling and sustainable sourcing, further bolsters the adoption of these innovative vegetarian casings. This adoption is critical for manufacturers aiming for international market harmonization and compliance with diverse dietary laws, including Kosher and Halal certifications, which can be complex with animal-derived products.

The principal driving factors propelling this market forward are multifaceted. Firstly, the exponential rise in the global population identifying as flexitarian or reducing meat intake, driven by health consciousness (e.g., reducing fat and cholesterol intake) and environmental advocacy (reducing the carbon footprint associated with livestock farming), creates a substantial demand floor. Secondly, continuous innovation by key market players in developing next-generation edible films and high-throughput casing solutions is reducing production costs and improving manufacturing efficiencies for end-users, making vegetarian casings economically competitive with traditional counterparts. Thirdly, robust marketing and distribution efforts by leading food manufacturers, emphasizing the ethical and sustainable advantages of plant-based packaging components, are educating consumers and accelerating purchase decisions. Furthermore, the development of customized casings tailored to specific protein bases (like soy, wheat, or fungi) ensures product integrity and improves the sensory experience of the final vegetarian sausage, cementing the long-term viability and growth trajectory of the Vegetarian Sausage Casings Market.

Vegetarian Sausage Casings Market Executive Summary

The Vegetarian Sausage Casings Market is characterized by vigorous growth, largely fueled by pervasive shifts in global consumer dietary preferences and significant technological breakthroughs in food science. Current business trends indicate a strong move towards vertical integration, where major casing producers are collaborating closely with plant-based protein manufacturers to co-develop optimized casing solutions that address specific texture and processing challenges inherent in alternative meat formulations. The market is seeing an influx of venture capital and private equity investment directed towards start-ups specializing in novel bio-polymer research, particularly focusing on sustainable and locally sourced materials like algae and specific agricultural byproducts, promising cost-effective and environmentally superior alternatives to traditional cellulose or collagen. Furthermore, competition is intensifying, leading to aggressive pricing strategies in mature segments like basic alginate casings, while premium, functional casings offering enhanced smoke permeability or superior snap continue to command higher margins. The overarching business goal for market participants remains scalability and the development of solutions that can effectively handle the high-volume, continuous manufacturing processes of global food giants entering the meat alternatives space.

Regional trends reveal that North America and Europe are currently the dominant markets, attributed to high disposable incomes, deeply ingrained consumer awareness regarding plant-based diets, and robust retail infrastructure that supports the proliferation of alternative meat products. Europe, specifically countries like Germany and the UK, leads in per capita consumption and innovative product launches, driven by stringent sustainability mandates and strong regulatory support for vegan food certification. The Asia Pacific (APAC) region, however, is projected to be the fastest-growing market segment. This accelerated growth is primarily propelled by the vast populations of emerging economies, particularly China and India, where traditional dietary cultures are evolving rapidly, incorporating more Western-style processed foods, coupled with rising middle-class awareness of health and ethical food choices. Key investment in APAC is centered on establishing local manufacturing hubs to reduce logistical costs and tailor casing properties to suit region-specific processed food traditions, such as specialty vegetable-based sausages popular in Japanese and Korean cuisines. The Middle East and Africa (MEA) market remains nascent but shows increasing promise, driven by urbanization and the growing desire for shelf-stable, certified-safe food products.

Segmentation trends illustrate a distinct polarization within the market. By material, alginate casings are experiencing explosive growth due to their low cost, flexibility, and suitability for co-extrusion technologies, which streamline manufacturing. However, cellulose casings maintain a stronghold in specific industrial applications requiring non-edible peel-off properties for larger-diameter products. The most notable trend is the rapid expansion of functionalized vegetable protein casings (e.g., derived from pea or soy), which are designed to mimic the texture and mouthfeel of collagen more closely, catering to premium sausage manufacturers seeking sensory replication of traditional products. In terms of application, the fresh sausage and hot dog segments remain the largest revenue generators, yet the specialized meat alternatives segment—including deli slices and unique plant-based charcuterie—is exhibiting the highest Compound Annual Growth Rate (CAGR), reflecting manufacturers' efforts to diversify beyond basic patties and links. The shift towards B2B sales remains critical, as the majority of volume is procured directly by large-scale food processors, emphasizing the importance of consistent supply chain performance and technical support provided by casing manufacturers.

AI Impact Analysis on Vegetarian Sausage Casings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vegetarian Sausage Casings Market frequently revolve around three core themes: accelerated material discovery, optimization of manufacturing processes, and predictive demand forecasting. Users are keen to understand how machine learning (ML) models can drastically reduce the time and cost associated with identifying novel, food-grade biopolymers that exhibit superior strength, elasticity, and barrier properties compared to existing materials like conventional alginate or cellulose. Furthermore, substantial interest exists concerning the role of AI in quality control and process optimization, specifically how computer vision systems can monitor co-extrusion lines in real-time, ensuring uniform thickness, minimizing defects, and optimizing ingredient ratios, leading to significant waste reduction and operational efficiency improvements. Finally, food supply chain stakeholders inquire about AI's capacity for demand prediction, linking evolving consumer preferences (tracked via social media and retail data) directly to production scheduling for specialized casings, thereby minimizing inventory risks and ensuring timely fulfillment of increasingly personalized product specifications within the plant-based sector.

- AI-driven material informatics accelerates the discovery and testing of novel sustainable polymers (e.g., microbial cellulose, fermentation-derived polysaccharides) suitable for high-speed casing production.

- Predictive maintenance analytics, powered by ML, optimize casing manufacturing equipment uptime, reducing unexpected failures on sensitive extrusion and drying machinery, thereby enhancing operational efficiency.

- Computer vision and deep learning algorithms enable real-time, high-precision quality control, detecting microscopic flaws, thickness variations, and texture inconsistencies in casings faster than human inspection.

- AI models integrate complex market data (social media trends, seasonal consumption patterns, regional dietary shifts) to provide highly accurate demand forecasts for specific casing types, improving inventory management for manufacturers and suppliers.

- Robotics and AI-guided automation in the stuffing and linking processes improve hygiene standards and handling precision, critical for delicate vegetarian casings, leading to higher throughput rates for end-product manufacturers.

- Natural Language Processing (NLP) tools assist in analyzing global regulatory documents swiftly, ensuring that new casing formulations instantly comply with diverse international food safety and labeling standards (e.g., vegan certification requirements).

- Optimized resource allocation, including water and energy consumption during casing production, is achieved through reinforcement learning algorithms, contributing to the overall sustainability goals of the vegetarian food industry.

DRO & Impact Forces Of Vegetarian Sausage Casings Market

The dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces significantly shapes the trajectory of the Vegetarian Sausage Casings Market. The primary driver is the irreversible global shift towards sustainable and ethical food choices, exemplified by the mainstream acceptance of vegan and flexitarian diets, which necessitates reliable, high-performance, non-animal casing alternatives. Complementing this is technological innovation, particularly the refinement of co-extrusion methods and the increasing sophistication of hydrocolloid chemistry, which allows for the creation of vegetarian casings that match the "snap" and textural attributes traditionally provided only by natural animal gut, appealing directly to quality-conscious consumers and high-end processed food manufacturers. Furthermore, supportive regulatory environments in developed economies, emphasizing consumer transparency and encouraging the use of cleaner labels, are acting as a strong impetus for the adoption of plant-based materials. These combined drivers exert a powerful accelerating force on market expansion, compelling food processors globally to reformulate their product lines using these advanced casings to remain competitive and relevant.

Conversely, significant restraints hinder optimal market growth. The principal constraint is the relatively higher cost of production for advanced vegetarian casings, especially those incorporating novel biopolymers, compared to mass-produced traditional collagen or synthetic plastic casings, which can strain the profit margins of large-volume producers. Furthermore, achieving consistent mechanical strength and heat stability across diverse processing environments remains a technical challenge; some plant-based materials are susceptible to tearing or loss of integrity during high-temperature smoking or boiling processes common in industrial sausage making, leading to operational inefficiencies and product loss for the end-user. Regulatory complexity also acts as a minor restraint; while generally supportive, the classification and approval process for completely novel food-grade biopolymers can be lengthy and capital-intensive, slowing the pace of commercialization for cutting-edge materials. These restraints necessitate substantial R&D investment to reduce material costs and enhance product resilience, representing a frictional force against rapid, widespread adoption.

Crucial opportunities exist in leveraging emerging markets and developing hyper-specialized casings tailored for specific meat substitute textures. The expansive untapped potential in Asian markets, where traditional plant-based protein consumption is high but processed sausage consumption is growing, presents a significant revenue avenue. Additionally, opportunities lie in developing functionalized casings that incorporate beneficial ingredients, such as vitamins, minerals, or flavor enhancers, thereby transforming the casing from merely a structural component into a value-added ingredient that improves the nutritional profile of the final product, directly addressing consumer demand for functional foods. The overarching impact forces derived from these dynamics are transformative. The market is witnessing a rapid structural realignment, characterized by intensified M&A activity as traditional casing providers seek to acquire plant-based expertise, leading to market consolidation and a heightened focus on sustainability reporting. The primary enduring force is the pressure for innovation, pushing material science boundaries to achieve cost parity and performance superiority over animal-derived products, ultimately accelerating the vegetarian casing solution towards becoming the industry standard, rather than a niche alternative.

Segmentation Analysis

The Vegetarian Sausage Casings Market is highly segmented based on the core material used, the specific application of the final product, and the distribution channel employed to reach end-users. This granularity in segmentation is essential for understanding the varying performance requirements and consumer acceptance levels across different product categories within the expansive plant-based food industry. Material science dictates performance characteristics, such as edibility, diameter range, and smoke permeability, making the Material Type segmentation the most critical determinant of market dynamics and competitive strategy. Application segmentation reveals the largest end-user categories, primarily hot dogs and fresh sausages, while the Distribution Channel segmentation highlights the dominance of Business-to-Business transactions due to the industrial nature of casing procurement. Analyzing these segments provides strategic insights necessary for manufacturers seeking to optimize product development and market penetration efforts across diverse geographies and processing requirements.

- By Material Type:

- Alginate (Seaweed-derived polysaccharides)

- Cellulose (Regenerated cellulose from wood pulp or cotton)

- Polysaccharides (e.g., Carrageenan, Pectin, Xanthan Gum)

- Vegetable Proteins (e.g., Pea Protein, Soy Protein Isolates)

- Novel Bio-polymers (e.g., Fermentation-derived materials)

- By Application:

- Fresh Sausages (e.g., Breakfast links, raw plant-based sausages)

- Processed Sausages (e.g., Cooked and cured vegan salamis)

- Hot Dogs and Frankfurters (High-volume industrial applications)

- Specialty Meat Alternatives (e.g., Vegetarian deli slices, ring sausages)

- Pet Food (Non-edible packaging for specialized vegetarian pet snacks)

- By Distribution Channel:

- Business-to-Business (Direct supply to food processors and manufacturers)

- Business-to-Consumer (Limited retail sales, primarily specialty bulk food suppliers)

- E-commerce (Online procurement of specialty casings by small artisans)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Vegetarian Sausage Casings Market

The Value Chain for the Vegetarian Sausage Casings Market commences with the Upstream Analysis, which focuses heavily on the procurement and processing of raw, renewable materials. This stage involves sourcing high-purity inputs such as sustainable wood pulp for cellulose, specific seaweed species for alginate extraction, or high-grade pea and soy proteins. Success at this upstream stage relies on securing stable, cost-effective supply chains for these biological materials, often involving long-term contracts with agricultural cooperatives or specialized bio-resource suppliers. Significant value is added during the raw material processing phase, where sophisticated chemical and mechanical techniques are employed to purify, modify, and solubilize these components into polymer solutions or gels ready for casing manufacture. Ensuring traceability and sustainability certifications (e.g., FSC for cellulose, responsible aquaculture practices for alginate) is paramount at this foundational level, directly impacting the final product's clean-label appeal and regulatory compliance, particularly in environmentally conscious markets like Europe. Efficiency in conversion, minimizing waste, and maximizing yield from raw inputs are the primary competitive factors upstream.

The Midstream phase involves the core manufacturing process, where the processed biopolymers are converted into finished casings through sophisticated extrusion, co-extrusion, or casting techniques. This stage is highly capital-intensive, requiring specialized, high-speed machinery capable of continuous production while maintaining ultra-precise thickness uniformity and structural integrity, especially for smaller diameter edible casings. Technological differentiation, such as proprietary drying methods or cross-linking chemistries that enhance thermal stability and tensile strength, creates significant competitive advantages. Manufacturers here must also consider customization, producing casings that are tinted, flavored, or coated with functional ingredients (e.g., antimicrobials) to meet diverse client specifications. Quality control is non-negotiable; rigorous testing for porosity, burst pressure, and uniform diameter alignment with industrial stuffing equipment standards defines success. The direct channel for distribution—selling directly from the manufacturer to the large-scale food processor—dominates this midstream-to-downstream transaction, minimizing intermediaries and ensuring technical support is integrated with product supply.

The Downstream Analysis involves the distribution channel and the final integration into the end product. The distribution network is predominantly B2B, utilizing highly specialized logistics chains designed for industrial packaging materials, where timely delivery and controlled storage conditions (especially for moisture-sensitive cellulose or protein casings) are vital. Indirect distribution, through regional food ingredient distributors, serves smaller, artisan sausage makers or specific geographical areas where the casing manufacturer lacks a direct presence. The final stage is the application by the end-user (the food manufacturer), where the casings are used in high-speed stuffing and processing operations. The performance of the casing in the client's production line—its peelability, ability to withstand smoking/cooking cycles, and consistent performance across millions of units—determines long-term supplier retention. Customer service in the downstream phase focuses heavily on technical field support and application consulting, helping clients adapt their machinery and recipes to optimize the unique handling characteristics of vegetarian casings, thereby ensuring smooth commercialization of the final packaged meat alternative product.

Vegetarian Sausage Casings Market Potential Customers

The primary potential customers and end-users of Vegetarian Sausage Casings are large-scale industrial food processing companies and multinational corporations specializing in meat substitutes and plant-based protein products. These entities operate high-throughput manufacturing facilities requiring immense volumes of consistent, reliable casings that can withstand continuous stuffing, linking, and thermal processing cycles. Companies like Beyond Meat, Impossible Foods, and major traditional meat processors diversifying into plant-based lines (e.g., Tyson Foods' Raised & Rooted) represent the most significant segment of the buyer population. Their demand is driven by the necessity for scalability, cost-effectiveness, and securing casings that guarantee the vegan status of their final products. The purchasing decisions for these large customers are heavily influenced by technical specifications, including diameter uniformity, tensile strength, and the ability of the casing to handle specific flavor treatments like smoke application, making long-term technical partnership crucial for suppliers.

A secondary, yet rapidly growing, customer segment includes mid-sized, regional specialty food manufacturers and artisan producers who focus on niche, high-quality, or gourmet vegetarian sausage varieties. These smaller players prioritize unique textural qualities, customization options (such as colored or flavored casings), and lower minimum order quantities compared to industrial giants. Their buyer motivation is often linked to product differentiation and meeting the specific demands of local health-focused retailers or specialty grocery stores. For this segment, ease of use on semi-automated equipment and the overall natural sourcing narrative associated with the casing material (e.g., non-GMO verification for protein casings or sustainably sourced alginate) often outweigh minor cost differences. Catering to this group requires flexible production scheduling and a strong emphasis on providing excellent customer training and application support, often through indirect distribution channels.

Finally, emerging customer segments include private label manufacturers and catering/food service suppliers. Private label brands, often associated with major supermarkets (like Tesco or Walmart), demand large volumes of cost-competitive casings for their store-brand vegan sausage lines, making pricing and consistent supply the paramount purchasing criteria. Food service providers, supplying institutional kitchens, schools, and hospitals, seek standardized casings that perform reliably under various bulk preparation methods (e.g., steaming or baking). Furthermore, the burgeoning vegetarian pet food industry represents a niche, yet promising, end-user group, requiring non-toxic, durable casings for chewable pet snacks and specialized extruded products. These varied customer groups collectively underscore the market's diversity, requiring casing manufacturers to offer a portfolio ranging from high-volume, cost-optimized solutions to specialized, premium-performance products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 9.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viscofan SA, Devro plc, Naturin Viscofan GmbH, FIBRAN S.A., Nippi Inc., Shenguan Holdings (Group) Limited, Kalle GmbH, Viskoteepak AB, Innovia Films, Fabios S.A., DDL Casings, Syracuse Casing Co., Innovatec, Collagen Corp. (Vegan lines), Wenda Co., Ltd., Shenzhou Casings, Atlantic Marine, Plant Based Casing Technologies, SWM International, DSM Food Specialties. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vegetarian Sausage Casings Market Key Technology Landscape

The technological landscape of the Vegetarian Sausage Casings Market is highly dynamic, centered around advanced polymer processing and material customization techniques aimed at replicating the superior performance attributes of natural collagen while maintaining strict plant-based purity. One of the most critical technologies is the Co-Extrusion Process, specifically designed for alginate and protein-based casings. This technique involves simultaneously extruding the sausage emulsion and the casing material, followed immediately by a hardening bath (typically containing calcium chloride for alginate) that instantaneously forms a resilient, edible film around the sausage core. This method eliminates the need for pre-formed casings, significantly increasing manufacturing speed, reducing product handling, and enabling seamless integration into high-volume industrial production lines. Innovations in co-extrusion are focused on developing multi-layered casings that combine the tensile strength of one material (e.g., cellulose) with the edibility of another (e.g., protein hydrolysates) to achieve superior textural properties like the desired 'snap' or crisp bite upon consumption, which is a major sensory driver for consumer acceptance.

Another crucial area of innovation involves Hydrocolloid Modification and Functionalization. Casing manufacturers are heavily investing in R&D to chemically and physically modify plant-derived hydrocolloids—suchatespectine cellulose and carrageenan—to enhance their thermal stability, barrier properties against oxygen and moisture, and their capacity to accept smoke flavors. Advanced techniques include controlled molecular cross-linking and surface treatments that improve the interaction between the casing and the plant-based meat matrix, reducing potential slippage or wrinkling during cooking and ensuring a smooth, aesthetically pleasing final product. Furthermore, the use of nanotechnology and microencapsulation is emerging, allowing manufacturers to embed active ingredients, such as natural preservatives or colorants, directly within the casing structure. This not only extends the product's shelf life but also reduces the need for external chemical additives, aligning perfectly with the clean-label trend highly valued by end consumers, offering a significant differentiator in a crowded market.

Finally, automation and process control technologies are essential enablers of growth. High-speed Casing Manufacturing Lines require sophisticated sensors and control systems to maintain precise control over extrusion pressure, temperature, and drying parameters, which are highly sensitive parameters for plant-based polymers. Automated quality inspection using machine vision systems ensures that thickness deviations and physical flaws are detected and corrected instantaneously, minimizing waste associated with high-volume production. Furthermore, the integration of 3D printing or additive manufacturing techniques is being explored for the rapid prototyping of specialized casing structures tailored to unique plant protein recipes or exotic sausage shapes. This commitment to digitalization and automation not only ensures the high quality and consistency demanded by major food manufacturers but also drives down operational costs over the long term, positioning these advanced vegetarian casings as highly competitive alternatives to their traditional counterparts in terms of both performance and price point.

Regional Highlights

- North America (United States & Canada): Dominates the market value due to the high per capita consumption of processed meat alternatives and a strong presence of leading plant-based food innovators. The U.S. drives demand, characterized by early adoption of clean-label ingredients and a well-established retail environment supporting refrigerated and frozen vegan products. Investment is focused on high-performance alginate and protein casings capable of handling large-diameter applications (e.g., deli slices) and replicating the 'snap' texture crucial for American-style hot dogs.

- Europe (Germany, UK, France, Scandinavia): Leads in innovation and market penetration, particularly in Germany and the UK, which have the highest percentage of flexitarian and vegetarian consumers. European demand is intensely focused on sustainability, demanding casings made from locally sourced, certified bio-materials, and often requiring strict non-GMO and organic compliance. Regulatory frameworks strongly support plant-based labeling, fostering a conducive environment for manufacturers to launch functionalized cellulose and novel bio-polymer casings.

- Asia Pacific (China, Japan, India, Australia): Fastest-growing region driven by rapid urbanization, Westernization of diets, and increased awareness of meat-related health issues. China and India, with immense consumer bases, are rapidly scaling up domestic meat alternative production. While price sensitivity remains a factor, particularly in emerging economies, Australia and Japan show high demand for premium, imported vegetarian sausages, driving growth in functional, edible protein-based casings suited for specialty products. Localized sourcing of raw materials like seaweeds for alginate production is a growing strategic trend in coastal APAC nations.

- Latin America (Brazil, Argentina, Mexico): Emerging market where the shift from traditional meat-heavy diets is accelerating, primarily driven by economic factors and growing health consciousness in urban centers. Demand is currently concentrated on basic, cost-effective cellulose and standard alginate casings used in mid-range meat substitute products. Investment potential lies in Brazil, which has a substantial agribusiness sector and is positioning itself as a key supplier of protein isolates suitable for casing production.

- Middle East and Africa (MEA): A nascent but high-potential market characterized by significant poultry and processed meat consumption, where ethical and Halal certification requirements often make non-animal-derived casings highly advantageous. Growth is currently centered in the UAE and Saudi Arabia, driven by expatriate populations and government initiatives promoting food diversification. Demand is primarily for consistent, high-barrier casings ensuring product integrity in challenging supply chain environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vegetarian Sausage Casings Market.- Viscofan SA

- Devro plc (Focus on Collagen & Plant-Based Solutions)

- Naturin Viscofan GmbH

- Kalle GmbH

- FIBRAN S.A.

- Nippi Inc. (Specializing in materials applicable to food coatings)

- Shenguan Holdings (Group) Limited

- Viskoteepak AB

- Innovia Films

- Fabios S.A.

- DDL Casings

- Syracuse Casing Co.

- Innovatec

- Wenda Co., Ltd.

- Shenzhou Casings

- Atlantic Marine (Raw material supplier for alginates)

- Plant Based Casing Technologies

- SWM International (Specializing in engineered papers/films)

- DSM Food Specialties (Ingredient and technology supplier)

- Nutracap Labs

Frequently Asked Questions

Analyze common user questions about the Vegetarian Sausage Casings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are used to make vegetarian sausage casings?

Vegetarian sausage casings are primarily produced from renewable, plant-derived biopolymers. The main materials include alginate (derived from seaweed), regenerated cellulose (often from wood pulp), and various polysaccharides such as carrageenan or pectin. Advanced casings also utilize vegetable protein isolates, typically sourced from pea or soy, specifically engineered to replicate the texture and tensile strength of traditional animal collagen.

Are vegetarian sausage casings edible, and how do they affect the taste?

Yes, the majority of vegetarian casings, particularly those made from alginate and vegetable proteins, are fully edible and designed to be consumed with the sausage. Cellulose casings are typically non-edible and intended to be peeled off after cooking or processing. Edible vegetarian casings are formulated to have a neutral flavor profile, ensuring they do not impart any undesirable taste and preserve the integrity of the sausage's seasoning and flavor.

How does the performance of plant-based casings compare to traditional collagen casings?

Modern plant-based casings, especially high-grade alginate and functionalized protein versions, are engineered to match or exceed the performance of traditional collagen in industrial settings, offering comparable tensile strength, diameter consistency, and suitability for high-speed stuffing. While collagen traditionally offered superior 'snap,' technological advancements in co-extrusion and material modification are rapidly closing this gap, often providing better heat stability and vegan compliance.

What are the primary drivers of growth for the Vegetarian Sausage Casings Market?

The market is predominantly driven by the massive global increase in consumer adoption of vegan, vegetarian, and flexitarian diets, spurred by growing health consciousness and ethical concerns regarding animal welfare. Key commercial drivers include the need for sustainable, clean-label ingredients by major food manufacturers and continuous technological innovation that lowers production costs and improves the textural quality of plant-based casings.

Which geographical region is leading the innovation in vegetarian casings technology?

Europe, specifically the Western European nations like Germany and the UK, is recognized as the leader in innovation and regulatory support for vegetarian casing technology. This leadership is rooted in strict clean-label requirements, high consumer demand for sustainably sourced materials, and significant investment in R&D focusing on advanced hydrocolloids and novel bio-polymer development suited for high-performance, edible applications in the meat alternative sector.

How does AI contribute to improving the quality of vegetarian sausage casings?

AI significantly enhances quality by deploying machine learning algorithms and computer vision systems for real-time monitoring during the manufacturing process. These systems detect microscopic flaws, ensure uniform thickness across long runs of casing material, and optimize ingredient ratios in complex polymer blends, drastically reducing defects and ensuring superior product consistency required by industrial food processors.

What is the main challenge faced by manufacturers in adopting plant-based casings?

The main challenge is achieving cost parity and optimizing the thermal processing resilience of plant-based casings. While performance is improving, advanced vegetarian materials can still be more expensive to produce than conventional collagen. Furthermore, ensuring that these casings withstand intense industrial thermal processes (smoking, boiling) without compromising structural integrity or texture remains a technical hurdle requiring specialized chemical modifications and precise manufacturing controls.

What is Co-Extrusion and why is it important for the vegetarian casing market?

Co-extrusion is a vital manufacturing technology where the sausage filling and the liquid casing material (like alginate gel) are simultaneously extruded through a die. Immediately following extrusion, the casing is set or hardened chemically. This process is crucial because it eliminates the time and cost associated with filling pre-formed casings, dramatically increases production speed, and is particularly well-suited for the delicate handling requirements of plant-based meat substitutes.

Are vegetarian casings suitable for use in Kosher and Halal certified products?

Yes, one of the significant advantages of vegetarian casings is their inherent suitability for Kosher and Halal certification, provided the raw materials and processing aids are also certified. Using a casing that is inherently free from animal products simplifies the complex certification process required for traditional collagen or natural gut casings, making plant-based casings highly attractive to manufacturers targeting diverse international markets, particularly in the Middle East and Asia.

Which type of vegetarian casing material is currently experiencing the highest demand growth?

Alginate casings, derived from brown seaweed, are currently experiencing the highest growth in demand due to their relatively lower cost, excellent processability through co-extrusion technology, and versatility in forming various diameter sizes. However, specialized vegetable protein casings are also rapidly increasing their market share in the premium segment, driven by manufacturers seeking textural attributes that closely mimic traditional meat products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager