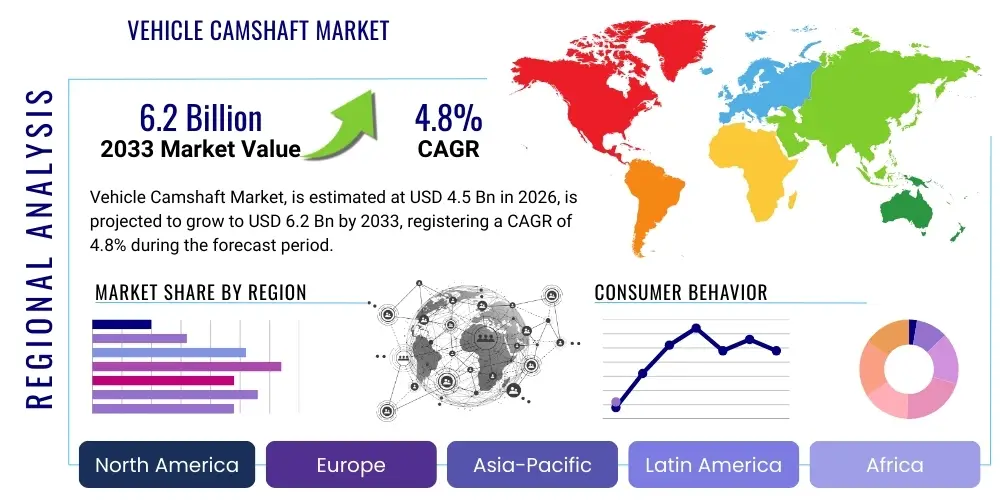

Vehicle Camshaft Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437584 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Vehicle Camshaft Market Size

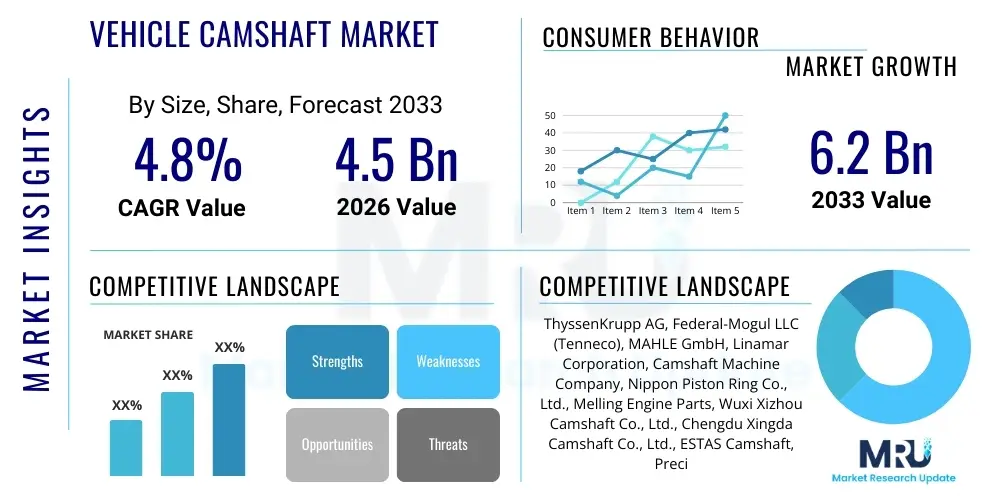

The Vehicle Camshaft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Vehicle Camshaft Market introduction

The Vehicle Camshaft Market encompasses the design, manufacture, and distribution of components critical to the internal combustion engine (ICE) valve train system. Camshafts are responsible for controlling the opening and closing cycles of the engine's intake and exhaust valves, thereby regulating the gas exchange process essential for engine operation. These components must withstand extreme thermal and mechanical stresses, requiring high precision in material selection and manufacturing, primarily involving casting, forging, and specialized machining processes. The market landscape is highly dependent on global automotive production volumes, advancements in engine technology (such as variable valve timing, VVT), and evolving regulatory requirements aimed at improving fuel efficiency and reducing vehicular emissions.

Key products within this market include cast iron camshafts, forged steel camshafts, and composite or assembled camshafts, each chosen based on engine performance requirements, cost sensitivity, and vehicle segment. Major applications span passenger vehicles, heavy commercial vehicles, and light commercial vehicles, serving both Original Equipment Manufacturers (OEMs) and the automotive aftermarket for repair and replacement. The inherent benefits of high-performance camshafts include optimized engine breathing, improved torque delivery, and enhanced fuel economy, making them indispensable components in modern ICE architectures.

Driving factors for market growth involve the increasing global demand for high-efficiency engines, particularly in emerging economies, and the continuous development of sophisticated valve train systems, such as dual overhead camshaft (DOHC) configurations and friction reduction technologies. Although the long-term industry trajectory is influenced by the transition to electric vehicles (EVs), the sustained reliance on hybrid vehicles and conventional ICEs in the near to medium term ensures a stable demand for technologically advanced camshaft solutions, alongside significant demand from the robust global aftermarket segment.

Vehicle Camshaft Market Executive Summary

The Vehicle Camshaft Market exhibits resilient growth driven by mandated emission reductions and continued strong sales of high-performance ICE and hybrid vehicles globally. Business trends show a strong focus on lightweight materials, such as hollow and assembled camshafts, to reduce mass and parasitic losses within the engine. Strategic partnerships between specialized component manufacturers and major OEMs are intensifying to co-develop camshafts optimized for complex variable valve actuation (VVA) systems. Furthermore, manufacturers are heavily investing in advanced surface treatments and coatings, like plasma nitriding and hard chrome plating, to enhance wear resistance and longevity, directly impacting the component's performance characteristics over its lifetime.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive vehicle production bases in China, India, and Japan, coupled with the rapid adoption of Euro 6/BS VI equivalent emission standards requiring sophisticated engine components. North America and Europe demonstrate mature market characteristics, focusing primarily on high-value, precision-engineered camshafts suitable for premium, high-performance, and heavy-duty commercial segments. Regulatory timelines, especially those phasing in stricter efficiency mandates, significantly influence procurement and design cycles across all major geographic markets, necessitating localized manufacturing and supply chain agility.

Segment trends highlight the dominance of passenger vehicle applications due to volume, although the commercial vehicle segment provides higher average selling prices (ASPs) due to robust material requirements. By material, forged steel and billet camshafts are gaining traction over traditional cast iron, especially in applications demanding higher strength and durability. The aftermarket segment is characterized by pricing volatility but offers significant volume opportunities, particularly in established markets where the vehicle fleet age is increasing, driving demand for replacement parts and engine overhaul kits utilizing high-quality, standardized camshaft units.

AI Impact Analysis on Vehicle Camshaft Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can maintain the relevance of camshaft manufacturing amidst the EV transition. Key themes emerging from these questions center on leveraging AI for predictive maintenance in fleet operations, optimizing complex valve profile designs to maximize combustion efficiency, and ensuring zero-defect manufacturing through real-time quality control. Users seek definitive information on how AI models can predict material fatigue, optimize casting and forging parameters for customized performance, and streamline the vast simulation requirements necessary for developing advanced variable valve timing (VVT) systems, thereby accelerating time-to-market for new engine designs and supporting the longevity of the existing ICE fleet.

AI’s primary impact is observable in enhancing the efficiency and precision of the entire camshaft lifecycle, from initial concept design to final deployment. Generative design algorithms are now being utilized to explore thousands of potential lobe profiles and material distributions that traditional CAD methods cannot easily achieve, leading to lighter, stronger components tailored precisely to specific engine performance maps. This optimization reduces the rotational mass, contributing directly to better fuel economy and lower emissions—a critical factor for market sustainability. Furthermore, ML models integrated into Computer Numerical Control (CNC) machining and grinding equipment predict tool wear and automatically adjust cutting parameters, significantly reducing scrap rates and improving overall production yield.

In the maintenance phase, AI-powered diagnostic tools analyze vibration and temperature data from operational engines to predict potential camshaft or valve train failures far in advance. This capability is especially crucial for high-utilization commercial fleets, minimizing downtime and shifting maintenance strategies from reactive to proactive, which adds significant value for fleet operators. While AI does not fundamentally change the need for a camshaft in an ICE, it profoundly transforms the development speed, manufacturing quality, and operational reliability of this essential component, ensuring that the necessary precision is met for next-generation, ultra-low emission combustion engines.

- AI-Driven Design Optimization: Utilizing generative algorithms to create novel, lightweight camshaft profiles for maximum lift and duration efficiency.

- Predictive Maintenance: Deployment of ML models to monitor engine health and forecast camshaft wear or failure in fleet vehicles, reducing catastrophic engine damage.

- Manufacturing Quality Control: Real-time analysis of sensor data in forging and machining processes to identify and correct anomalies, achieving zero-defect production standards.

- Supply Chain Forecasting: AI aids in optimizing raw material procurement and inventory management based on fluctuating global vehicle production schedules and OEM demand shifts.

- Simulation and Testing Acceleration: Using AI to reduce the number of physical prototypes required by accurately simulating the durability and performance of new designs under various operating conditions.

DRO & Impact Forces Of Vehicle Camshaft Market

The Vehicle Camshaft Market is shaped by a confluence of technological advancements, strict regulatory pressures, and shifting consumer preferences towards powertrain electrification. Drivers center predominantly on the global imperative to comply with stringent environmental regulations (like Euro 7 or equivalent standards), which necessitate highly accurate valve train control to minimize harmful emissions and maximize thermal efficiency. Opportunities arise from technological breakthroughs in materials science, particularly the utilization of advanced coatings and the commercialization of modular and assembled camshafts that offer superior lightweighting benefits and design flexibility. However, the market faces a significant restraint due to the accelerating global transition towards Battery Electric Vehicles (BEVs), which entirely eliminate the need for a camshaft, posing a long-term existential threat to market volume.

The primary impact force driving current innovation is the pursuit of fuel efficiency. Since camshaft performance directly dictates how efficiently an engine breathes, manufacturers are compelled to invest heavily in Variable Valve Timing (VVT) and Variable Valve Lift (VVL) systems, which require highly precise camshaft machining and assembly. These systems often utilize electronic actuators that depend on the camshaft design to execute complex valve events dynamically. Furthermore, the commercial vehicle sector acts as a powerful driver, as regulations concerning greenhouse gas emissions (GHG Phase 2 in North America) demand robust, durable, and optimized camshafts capable of extended, high-load operation while maintaining precise timing.

Conversely, a critical restraint is the high capital investment required for dedicated tooling (such as molds and complex grinding machines) associated with manufacturing new camshaft designs. This high initial cost creates barriers to entry and favors established, large-scale manufacturers. Opportunities are also being capitalized on through friction reduction technologies, where camshafts are designed with specialized bearing surfaces and advanced coatings to minimize parasitic friction losses, offering a critical competitive edge in an industry where marginal efficiency gains are highly valued. Ultimately, the market is caught in a dual dynamic: striving for perfection in ICE technology while simultaneously planning for a future dominated by electric mobility, leading to cautious but targeted investment strategies focused on hybrid powertrains.

Segmentation Analysis

The Vehicle Camshaft Market is strategically segmented based on critical technical and application parameters, providing a clear view of where growth and value creation are concentrated. The segmentation helps in understanding specific product demand profiles, ranging from high-volume, cost-sensitive passenger vehicle applications to low-volume, high-performance, and heavy-duty commercial applications requiring specialized metallurgy. Key segmentation criteria include the type of material utilized (Cast Iron, Forged Steel), the manufacturing process (Casting, Forging, Assembly), the engine configuration (SOHC, DOHC), the vehicle category (Passenger, Commercial), and the sales channel (OEM vs. Aftermarket). Each segment responds differently to macroeconomic shifts and regulatory changes, necessitating customized market strategies for participants. For instance, the demand in the OEM segment is governed by new vehicle production rates and engine design changes, whereas the aftermarket is primarily driven by vehicle aging and replacement cycles.

- By Material Type:

- Cast Iron Camshafts (Traditional, cost-effective, high volume)

- Forged Steel Camshafts (Superior strength, high-performance engines)

- Billet Steel Camshafts (Specialized racing/aftermarket, custom applications)

- Composite/Assembled Camshafts (Lightweighting focus, growing trend)

- By Manufacturing Process:

- Casting (Economical production method)

- Forging (High strength and durability)

- Machining/Billet (Precision, custom)

- Assembly (Modular, lightweight)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (LCVs, HCVs, Buses)

- By Engine Design:

- Single Overhead Camshaft (SOHC)

- Double Overhead Camshaft (DOHC)

- Cam-in-Block/Pushrod Designs

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Performance)

Value Chain Analysis For Vehicle Camshaft Market

The value chain for the Vehicle Camshaft Market is characterized by highly specialized manufacturing processes requiring significant capital expenditure and material expertise. Upstream activities involve the sourcing of high-grade raw materials, primarily specialized iron alloys and steel billets, from major metal producers. Key material preparation steps include smelting, casting, or forging, which must meet strict metallurgical specifications regarding hardness, ductility, and microstructure uniformity. This phase is capital intensive, placing high reliance on reliable, certified suppliers capable of delivering materials that withstand the intense thermal cycling and high-stress environments characteristic of modern engine operation. Relationships with key material providers are crucial for ensuring cost stability and material traceability.

The core manufacturing stage involves highly precise processes such as rough machining, specialized heat treatment (e.g., induction hardening or nitriding), precise grinding, and final polishing to achieve micro-level tolerances. For assembled camshafts, the process includes press-fitting individual lobes onto a central tube. Quality control measures, utilizing advanced metrology equipment, are integral at every stage to ensure the lobes conform to the specified lift, duration, and ramp profiles required by engine designers. Downstream activities involve distribution, which is bifurcated into direct channels serving OEMs and indirect channels supplying the vast global aftermarket. OEMs often demand just-in-time (JIT) delivery directly to engine assembly plants, requiring complex logistics and high inventory accuracy.

The aftermarket distribution relies heavily on a network of authorized distributors, wholesalers, and specialized parts retailers who manage inventory for both general repair shops and performance tuners. The distinction between direct OEM sales (driven by long-term contracts and design specificity) and indirect aftermarket sales (driven by pricing, brand recognition, and availability) dictates market pricing power and profitability structures. The overall efficiency of the value chain is determined by minimizing manufacturing defects, optimizing logistical pathways, and maintaining technological superiority through continuous investment in advanced grinding and finishing equipment to meet evolving engine performance demands.

Vehicle Camshaft Market Potential Customers

Potential customers for the Vehicle Camshaft Market fall primarily into two major categories: Original Equipment Manufacturers (OEMs) and the expansive automotive Aftermarket segment, each with distinct purchasing criteria and volume demands. OEMs, including global automotive giants and specialized engine manufacturers (e.g., Ford, General Motors, Toyota, Volkswagen, Cummins, and Caterpillar), represent the largest volume purchasers. Their decisions are based on long-term supply agreements, adherence to precise technical specifications (often related to VVT systems), competitive pricing, and certified quality management systems (such as ISO/TS 16949). The OEM segment focuses heavily on collaborating with suppliers for next-generation engine designs, demanding strict compliance with mass reduction targets and durability requirements.

The second substantial customer base comprises the Aftermarket, which includes independent automotive parts wholesalers, franchised distributors, specialized engine rebuilders, and high-performance tuning shops. These buyers require a broad inventory covering older, legacy engine platforms as well as current models. Aftermarket demand is driven by vehicle repair cycles, engine overhauls, and performance modifications. Purchasing criteria here revolve around part availability, brand reputation (trustworthiness regarding fit and function), competitive warranty periods, and cost-effectiveness compared to dealership prices. The Aftermarket often represents a critical profit margin opportunity for manufacturers, especially for standardized, high-wearing components like cast iron camshafts.

A smaller, specialized customer segment includes manufacturers of heavy industrial equipment, marine engines, and power generation units that utilize large, high-displacement internal combustion engines. For these customers, the primary purchasing drivers are extreme durability, resilience under continuous load, and certified compliance with non-road emission standards. Serving these diverse customer groups requires a flexible manufacturing strategy, capable of handling high-volume, standardized production for the OEM passenger segment, alongside lower-volume, specialized, heavy-duty production for industrial clients, and efficient logistical support for global aftermarket networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ThyssenKrupp AG, Federal-Mogul LLC (Tenneco), MAHLE GmbH, Linamar Corporation, Camshaft Machine Company, Nippon Piston Ring Co., Ltd., Melling Engine Parts, Wuxi Xizhou Camshaft Co., Ltd., Chengdu Xingda Camshaft Co., Ltd., ESTAS Camshaft, Precision Camshafts Ltd. (PCL), Musashi Seimitsu Industry Co., Ltd., Metaldyne Performance Group (MPG), Shenyang Camshaft Co., Ltd., Surin Manufacturing, TAIHO KOGYO Co., Ltd., Wuxi Kebo Camshaft Co., Ltd., AMS Automotive, Schrick Camshafts, Elgin Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Camshaft Market Key Technology Landscape

The Vehicle Camshaft Market is undergoing continuous technological evolution driven primarily by the need for friction reduction, lightweighting, and enhanced compatibility with increasingly sophisticated valve train control systems. A crucial technology is the widespread adoption of Variable Valve Timing (VVT) and Variable Valve Lift (VVL) systems, which require camshafts manufactured to exceptionally tight tolerances to ensure instantaneous and precise actuation. Manufacturers are utilizing advanced CNC grinding and polishing techniques, often incorporating specialized cubic boron nitride (CBN) wheels, to achieve the necessary surface finish and lobe profile accuracy, minimizing friction and maximizing valve timing precision, which directly impacts engine combustion efficiency.

Another dominant technological trend is the shift toward assembled or composite camshafts, moving away from traditional solid castings or forgings, particularly in high-volume passenger vehicles. Assembled camshafts utilize a lightweight hollow steel tube onto which pre-fabricated, often powdered metal or forged steel, cam lobes are hydraulically pressed and fixed. This modular approach significantly reduces the weight of the valve train compared to solid construction, contributing to lower engine mass and improved rotational dynamics. Furthermore, the use of different materials for the lobes and the base shaft allows for optimized mechanical properties in critical wear areas, enhancing overall durability and component life.

Surface technology plays a vital role in extending component lifespan and reducing frictional losses. Advanced surface treatments such as plasma nitriding, induction hardening, and specialized coatings (including Diamond-Like Carbon, DLC, or advanced phosphating) are commonly applied to the lobes and bearing journals. These treatments increase surface hardness, improve wear resistance, and reduce the coefficient of friction, critical for engines operating under higher loads and temperatures while attempting to meet stringent friction efficiency targets. The combination of lightweight assembly techniques and advanced surface engineering defines the cutting edge of camshaft manufacturing technology, securing the component's relevance in high-efficiency hybrid powertrains.

Regional Highlights

The global Vehicle Camshaft Market demonstrates varied growth dynamics across key geographic regions, heavily correlated with local manufacturing output, regulatory timelines, and the speed of EV adoption.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, primarily due to the massive scale of automotive manufacturing in China, India, Japan, and South Korea. China, in particular, drives volume demand for camshafts across both passenger and commercial vehicle segments. Strict implementation of emission standards (e.g., China VI and BS VI in India) necessitates the deployment of modern engine technologies, demanding high-precision DOHC and VVT-compatible camshafts, boosting the value segment.

- Europe: Europe is characterized by technological maturity and a high demand for premium, high-performance, and lightweight camshafts. Regulatory pressure from the European Union to reduce CO2 emissions forces manufacturers to adopt advanced VVA systems and composite camshafts to maximize efficiency in turbocharged gasoline and diesel engines. The region is also a key hub for research and development in friction reduction technologies, despite the aggressive long-term transition policies toward electric mobility.

- North America: This region exhibits robust demand driven by the large fleet of heavy-duty trucks and high-performance light vehicles. The implementation of GHG Phase 2 standards maintains significant demand for optimized, durable camshafts in commercial vehicle engines. The aftermarket is particularly strong in North America, sustained by high average vehicle age and a preference for engine modification and rebuilding, ensuring a steady stream of replacement and performance-grade camshaft sales.

- Latin America (LATAM): LATAM markets, including Brazil and Mexico, are driven by stable, though slower, growth in vehicle production and the continued reliance on conventional ICE technology. The demand here focuses on cost-effective, durable cast iron and forged steel camshafts suitable for regional fuel qualities and maintenance practices, with increasing, though localized, adoption of modern emission standards.

- Middle East and Africa (MEA): Growth in MEA is primarily influenced by infrastructure development, leading to increased commercial vehicle sales, and a reliance on imported vehicle technologies. The market is sensitive to oil price fluctuations and political stability, with procurement often focused on standard, reliable componentry for both new and replacement parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Camshaft Market.- ThyssenKrupp AG

- Federal-Mogul LLC (Tenneco)

- MAHLE GmbH

- Linamar Corporation

- Camshaft Machine Company

- Nippon Piston Ring Co., Ltd.

- Melling Engine Parts

- Wuxi Xizhou Camshaft Co., Ltd.

- Chengdu Xingda Camshaft Co., Ltd.

- ESTAS Camshaft

- Precision Camshafts Ltd. (PCL)

- Musashi Seimitsu Industry Co., Ltd.

- Metaldyne Performance Group (MPG)

- Shenyang Camshaft Co., Ltd.

- Surin Manufacturing

- TAIHO KOGYO Co., Ltd.

- Wuxi Kebo Camshaft Co., Ltd.

- AMS Automotive

- Schrick Camshafts

- Elgin Industries

Frequently Asked Questions

Analyze common user questions about the Vehicle Camshaft market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving current innovation in the Vehicle Camshaft Market?

The primary factor driving innovation is the implementation of global, stringent emission standards (e.g., Euro 7, China VI). These regulations necessitate the integration of highly precise Variable Valve Timing (VVT) and Variable Valve Lift (VVL) systems, which demand specialized, lightweight, and high-tolerance camshaft designs to maximize combustion efficiency and minimize exhaust pollutants.

How does the shift to electric vehicles (EVs) impact the long-term viability of camshaft manufacturers?

The shift to Battery Electric Vehicles (BEVs) is the major long-term restraint, as EVs do not utilize camshafts. However, manufacturers are mitigating this risk by focusing on hybrid electric vehicles (HEVs), which still require sophisticated ICE components, and by diversifying into assembled/composite camshafts offering superior efficiency for the residual ICE and hybrid market segments.

Which manufacturing process is most commonly used for lightweight, high-performance camshafts?

The assembly manufacturing process is increasingly favored for lightweight, high-performance applications. Assembled camshafts utilize lightweight hollow tubes and press-fitted, high-strength cam lobes (often made of forged or powdered metal), resulting in significant weight reduction compared to traditional solid cast or forged shafts, thereby improving engine performance dynamics.

What role does the Aftermarket segment play in the overall Vehicle Camshaft Market?

The Aftermarket segment is critical for stability and volume, focusing on replacement parts for general repairs and performance upgrades. It is driven by the age of the global vehicle fleet and provides manufacturers with revenue streams insulated from new vehicle production fluctuations, especially through the supply of durable, standardized cast iron and forged steel components.

What are the key technological advancements utilized to reduce friction in modern camshafts?

Key technological advancements include advanced surface treatments like plasma nitriding and the application of specialized low-friction coatings, such as Diamond-Like Carbon (DLC), to the cam lobes and bearing journals. These processes significantly increase surface hardness and reduce the coefficient of friction, minimizing parasitic losses in the valve train.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager