Vehicle Cleaning Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434265 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vehicle Cleaning Systems Market Size

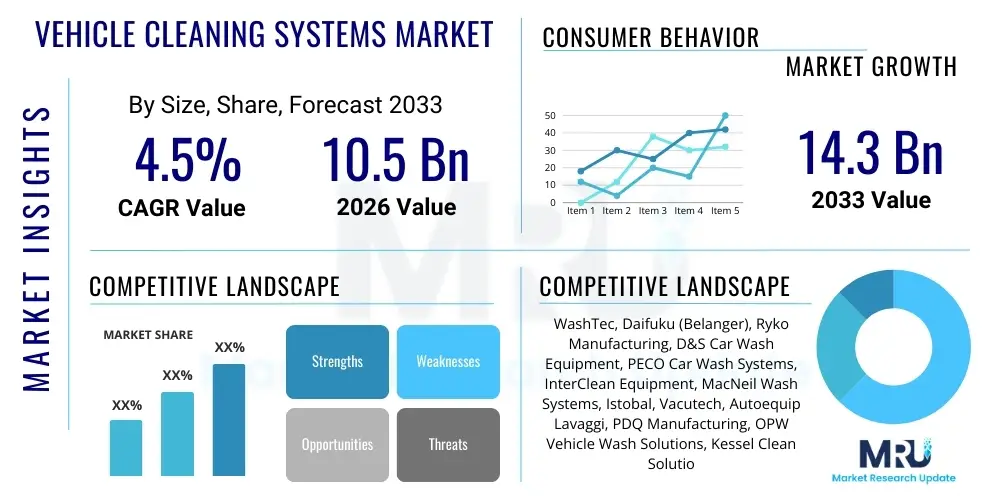

The Vehicle Cleaning Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 14.3 Billion by the end of the forecast period in 2033.

Vehicle Cleaning Systems Market introduction

The Vehicle Cleaning Systems Market encompasses automated and manual solutions designed for washing, cleaning, and drying various types of vehicles, ranging from standard passenger cars to heavy commercial transport. These systems utilize advanced technologies, including high-pressure water jets, specialized chemical detergents, brushes, and conveyor mechanisms, aimed at improving cleaning efficiency, reducing water consumption, and optimizing operational throughput. Major applications span professional car wash establishments, automotive dealerships, government and municipal fleets, and large logistics companies prioritizing vehicle maintenance and aesthetic upkeep. The primary benefits include time efficiency, superior cleaning quality compared to traditional methods, and environmental advantages derived from water recycling and precise detergent dosage. Key driving factors accelerating market expansion include rapid urbanization leading to increased vehicle ownership, stringent governmental regulations concerning water usage and effluent disposal, and the growing consumer demand for convenience and automated services that maintain vehicle resale value and appearance. The shift toward touchless and tunnel wash systems, incorporating smart sensors and variable speed drives, further solidifies the market's trajectory towards automation and sustainability.

Vehicle Cleaning Systems Market Executive Summary

The Vehicle Cleaning Systems Market is experiencing robust growth driven by significant business trends such as the integration of digital payment systems, subscription models for frequent washing, and the widespread adoption of environmentally friendly cleaning chemicals and water reclamation technologies. Technologically, the market is moving towards highly modular and scalable systems that can accommodate the growing diversity in vehicle sizes and shapes, particularly electric vehicles (EVs), which require specialized care around battery components and charging ports. Regionally, the market is highly dynamic, with North America and Europe demonstrating maturity characterized by high penetration of automated tunnel washes and sophisticated equipment, while the Asia Pacific region is poised for rapid expansion fueled by increasing middle-class disposable income, accelerating fleet modernization efforts, and a developing infrastructure of professional cleaning centers. Segment trends indicate a substantial preference for automatic, conveyor-based systems in high-throughput commercial settings due to superior speed and consistency, although self-service and in-bay automatic systems remain critical in localized markets offering flexibility. Furthermore, the commercial vehicle segment, driven by strict regulatory requirements for fleet cleanliness for safety and branding purposes, is expected to exhibit a higher growth rate for heavy-duty wash systems.

AI Impact Analysis on Vehicle Cleaning Systems Market

Common user questions regarding AI's impact on Vehicle Cleaning Systems often center on how automation can move beyond simple mechanical processes to include intelligent recognition, process optimization, and predictive maintenance. Users frequently inquire about the reliability of AI algorithms in detecting specific dirt types or vehicle damage prior to washing, the potential for personalized wash cycles based on vehicle model or weather conditions, and the role of machine learning in optimizing water and chemical consumption to comply with ecological standards while minimizing operational costs. Key concerns also revolve around the capital investment required for adopting AI-enabled equipment and the necessity of upskilling labor to manage and maintain these complex systems effectively. There is high expectation that AI will redefine the customer experience, making the cleaning process faster, more accurate, and entirely autonomous, thereby increasing overall customer satisfaction and loyalty in the competitive car wash industry.

AI's integration is fundamentally transforming system efficiency by enabling equipment to analyze vast amounts of operational data, such as cycle times, chemical usage per vehicle type, and energy consumption patterns. This data-driven approach allows operators to pinpoint bottlenecks and proactively adjust settings in real-time, achieving unprecedented levels of resource optimization. For example, AI-powered vision systems can precisely map the contours of a vehicle, ensuring brushes and jets apply optimal pressure and coverage without causing damage or wasting resources on unnecessary areas. This intelligence enhances system resilience and longevity, shifting the business model towards high-precision service delivery.

Moreover, Artificial Intelligence facilitates advanced predictive maintenance protocols, significantly reducing unexpected downtime which is a major cost driver in the car wash industry. By analyzing vibration data, motor temperatures, and flow rates, AI algorithms can predict component failure with high accuracy, scheduling maintenance before a breakdown occurs. From a customer interface perspective, AI contributes to a seamless experience through intelligent booking systems, personalized upsell recommendations (e.g., suggesting specific protective coatings based on a vehicle's wash history), and responsive chatbots handling service inquiries, thereby creating a smart, interconnected vehicle care ecosystem.

- AI-powered vision systems enable precise vehicle profiling and damage detection before the wash cycle commences.

- Machine learning algorithms optimize resource consumption (water, chemicals, energy) based on real-time environmental and vehicle data.

- Predictive maintenance analytics minimize system downtime by forecasting component failure and scheduling proactive servicing.

- Integration of AI facilitates personalized customer experiences, including tailored wash cycles and dynamic pricing strategies.

- Autonomous decision-making enhances throughput efficiency in high-volume conveyor systems by managing vehicle spacing and speed.

DRO & Impact Forces Of Vehicle Cleaning Systems Market

The Vehicle Cleaning Systems Market is primarily driven by the expanding global vehicle parc, coupled with increasing consumer awareness regarding vehicle maintenance and aesthetic appeal, and the need for high-speed automated services in urban centers. Restraints include the high initial capital investment required for sophisticated automated systems, significant operational costs associated with water treatment and utility consumption, and regulatory challenges related to environmental discharge and chemical usage, particularly concerning PFAS-containing detergents. Opportunities are abundant in developing markets where infrastructure is expanding, and through technological advancements such as IoT integration, which allows for remote diagnostics and enhanced operational monitoring, and the development of specialized systems catering specifically to the rapidly growing fleet of electric vehicles and large commercial buses. The major impact forces shaping the industry trajectory are the tightening environmental regulations forcing investment in advanced water recycling and filtration systems, the persistent pressure from consumers for faster, higher-quality, and more ecologically sustainable washing options, and the consolidation of independent wash operations under large, tech-focused corporate entities seeking economies of scale and operational standardization.

Segmentation Analysis

Segmentation of the Vehicle Cleaning Systems Market provides a detailed perspective on key revenue streams and operational preferences across various end-user groups and technology types. The market is fundamentally segmented by the degree of automation, the primary application (passenger vs. commercial vehicles), and the specific components utilized in the washing process (e.g., gantry systems, conveyor tunnels). Analyzing these segments reveals that while automated systems dominate in terms of market value due to higher investment costs and throughput capabilities, self-service and manual washing remain crucial in specific geographies, especially where labor costs are lower or land availability restricts large installations. The growing diversification of the vehicle fleet, including oversized SUVs, trucks, and specialized municipal vehicles, necessitates flexible segmentation strategies for manufacturers to ensure equipment compatibility and optimal cleaning performance across the spectrum.

- By Type:

- Automatic Car Wash Systems (In-Bay Automatic, Tunnel Wash Systems)

- Self-Service Systems

- Manual Washing Equipment

- By Component:

- Washing Systems (Brushes, High-Pressure Jets)

- Drying Systems (Air Blowers, Dryers)

- Water Treatment & Recycling Systems

- Chemical Dosing Systems

- By Application/Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Light Trucks)

- Commercial Vehicles (Trucks, Buses, Trains, Specialty Fleets)

- By End-User:

- Professional Car Wash Operators

- Automotive Dealerships and Garages

- Fleet Owners (Logistics, Government)

Value Chain Analysis For Vehicle Cleaning Systems Market

The value chain for Vehicle Cleaning Systems begins with upstream activities dominated by raw material suppliers and specialized component manufacturers. These upstream players provide essential inputs such as heavy-duty stainless steel, advanced polymer composites for brushes and structural elements, sophisticated electronic controls (PLCs, sensors, VFDs), and chemical formulations (detergents, waxes, protective coatings). Innovation at this stage is crucial, focusing on materials that offer increased durability, resistance to harsh chemicals, and better ecological profiles, notably in the development of biodegradable cleaning agents and low-friction brush materials that minimize paint damage. Strong relationships between system integrators and these component suppliers ensure quality control and the timely incorporation of modular, energy-efficient parts, such as high-efficiency motors and optimized pump systems, driving down the overall cost of ownership for end-users.

Midstream activities involve the core market players: system design, manufacturing, assembly, and rigorous testing of the complex vehicle cleaning machinery. Manufacturers typically specialize in distinct system types, such as large-scale conveyor tunnels or compact in-bay automatics, requiring specific engineering expertise in hydraulics, pneumatics, electrical control, and software integration. Distribution channels form a critical link in the value delivery process. Direct distribution is common for large, custom installations involving fleet operators or major car wash chains, where manufacturers provide installation, training, and ongoing technical support directly. Indirect distribution often utilizes specialized regional distributors and value-added resellers (VARs) who manage sales, financing, and localized service support for smaller, independent operators or dealerships, leveraging established local relationships and service capabilities crucial for ensuring rapid response to maintenance issues.

Downstream activities center on installation, operation, and maintenance. Installation is highly specialized and site-specific, involving complex civil engineering and utility hookups (water, power, drainage). The operational phase includes the critical provision of recurring supplies (chemicals, water treatment consumables) and maintenance services. Post-sales support is a significant value differentiator, encompassing warranty provision, scheduled preventative maintenance contracts, and remote diagnostics facilitated by IoT connectivity. End-users, including professional car wash owners and fleet managers, place high value on system reliability and rapid repair turnaround, making the efficiency of the service network a crucial element in determining supplier preference and ensuring long-term profitability within this capital-intensive service sector.

Vehicle Cleaning Systems Market Potential Customers

The primary end-users, or buyers, of Vehicle Cleaning Systems are segmented based on their volume requirements, operational scale, and the specific vehicles they manage. Professional car wash operators constitute the largest and most dynamic customer segment, characterized by high investment in state-of-the-art automated equipment to maximize throughput and offer diverse service packages. These customers demand systems that are highly reliable, scalable, and capable of integrating advanced payment processing and loyalty programs. Their purchasing decisions are heavily influenced by the equipment's lifespan, energy and water efficiency ratings, and the overall capacity to minimize labor reliance while maintaining premium cleaning quality, driving the adoption of high-speed tunnel systems and sophisticated drying arches to handle large daily volumes efficiently.

Another significant customer base includes automotive dealerships and independent garages. For dealerships, the cleaning system is not merely an operational tool but a critical element of the vehicle presentation process, essential for maintaining the pristine condition of new and certified pre-owned vehicles before customer delivery. These facilities often require compact, highly efficient in-bay automatic systems that offer consistent quality without demanding extensive physical space. Fleet owners, encompassing logistics companies, rental agencies, municipal transit authorities, and construction firms, represent a rapidly expanding segment. Their focus is less on aesthetic enhancement and more on mandatory cleanliness for safety compliance (e.g., maintaining visibility) and regulatory adherence, necessitating heavy-duty, customized wash systems capable of handling large dimensions, mud, grease, and specialized debris, often located within their private depots for operational convenience.

The emerging potential customer base includes large residential complexes and corporate parks that are beginning to integrate automated washing services as a premium amenity for residents and employees, reflecting the increasing demand for convenience services closer to home or work. Furthermore, the specialized transport sector, including railway operators and airport ground handling services, requires tailored wash solutions for rolling stock and specialized equipment. These buyers seek durable, often gantry-based systems designed for extreme environments and unique vehicle geometries, where high initial cost is justified by the requirement for industrial-grade longevity and compliance with strict organizational maintenance standards. Manufacturers targeting this segment must focus on customization and robust engineering capable of continuous, heavy-duty operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 14.3 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WashTec, Daifuku (Belanger), Ryko Manufacturing, D&S Car Wash Equipment, PECO Car Wash Systems, InterClean Equipment, MacNeil Wash Systems, Istobal, Vacutech, Autoequip Lavaggi, PDQ Manufacturing, OPW Vehicle Wash Solutions, Kessel Clean Solutions, Coleman Hanna, Tammermatic, New Haden Pumps. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Cleaning Systems Market Key Technology Landscape

The technology landscape of the Vehicle Cleaning Systems Market is rapidly advancing, moving beyond simple mechanical agitation and high-pressure water delivery toward sophisticated, digitally controlled platforms. A fundamental shift involves the widespread adoption of Internet of Things (IoT) sensors and connectivity across all major components. This integration allows for real-time monitoring of operational parameters such as brush wear, water pressure consistency, chemical concentrations, and motor health. IoT connectivity is essential for enabling centralized fleet management, allowing operators of multiple car wash sites to monitor performance remotely, standardize quality, and optimize schedules for preventative maintenance, thereby maximizing uptime and operational efficiency across their entire network portfolio.

Another dominant technological trend is the evolution of water management and recycling systems. Given the increasing scarcity of fresh water and stricter environmental regulations, market success hinges on developing highly efficient closed-loop systems. Current systems employ advanced multi-stage filtration technologies, including ozone treatment, biological reactors, and ultrafiltration membranes, which dramatically reduce fresh water consumption—in some cases by up to 80-90% per wash cycle. Simultaneously, chemical technology is progressing towards greener formulations; manufacturers are investing heavily in producing pH-neutral, biodegradable, and non-toxic detergents, waxes, and clear coats. This is crucial for meeting ecological certifications and catering to the growing consumer preference for sustainable service providers, ensuring that effluent discharge meets stringent municipal standards without compromising cleaning effectiveness or vehicle finish integrity.

Furthermore, the market is seeing major advancements in cleaning mechanism design, particularly in touchless and friction systems. Touchless systems now utilize advanced high-pressure contouring technology, often guided by 3D scanners, to ensure complete coverage without physical contact, appealing to premium car owners concerned about paint swirl marks. Conversely, friction systems are improving brush materials, transitioning to lighter, less abrasive microfiber materials that deliver superior shine while being gentle on specialized coatings and matte finishes. The integration of Variable Frequency Drives (VFDs) and specialized robotic delivery systems ensures that the speed and intensity of the wash process are dynamically adjusted based on vehicle size and dirt level, minimizing energy expenditure and providing a highly consistent and customized cleaning output regardless of the vehicle passing through the system.

Regional Highlights

- North America (U.S. and Canada): This region is characterized by high market maturity, dominated by large, sophisticated tunnel wash systems and professional operators utilizing subscription-based models. Technological adoption is high, focusing heavily on automation, IoT integration for predictive maintenance, and premium service offerings like ceramic coating applications. The U.S. remains the largest individual market globally, driven by consumer willingness to pay for convenience and speed.

- Europe (Germany, UK, France): European markets exhibit robust growth, particularly in environmentally conscious washing technologies. Strict regulations regarding water use and chemical discharge mandate high investment in recycling and water treatment systems. Germany and the UK lead in adopting gantry (roll-over) wash systems, often integrated into petrol stations, prioritizing high quality and eco-friendliness.

- Asia Pacific (China, India, Japan): APAC is the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and massive increases in vehicle ownership. While Japan utilizes highly advanced systems, China and India represent explosive growth opportunities for new installations, moving rapidly from manual washing towards semi-automatic and automatic systems tailored for high volume and varied vehicle types.

- Latin America (Brazil, Mexico): The market here is growing, driven by commercial fleet expansion and improved economic conditions. Focus is often placed on economical and durable equipment, with a balanced mix of self-service and in-bay automatic units. Water scarcity issues in certain areas necessitate demand for efficient water management solutions.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC states (UAE, Saudi Arabia) due to high vehicle luxury ownership and substantial construction activity, demanding robust systems to handle desert dust and extreme temperatures. Water conservation is a critical technology requirement in this arid region, driving interest in highly effective recycling and low-water-usage systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Cleaning Systems Market.- WashTec AG

- Daifuku Co., Ltd. (Belanger, Inc.)

- Ryko Manufacturing, LLC

- Istobal, S.A.

- D&S Car Wash Equipment Co.

- PECO Car Wash Systems

- InterClean Equipment, Inc.

- MacNeil Wash Systems

- Coleman Hanna Carwash Systems LLC

- Tammermatic Oy

- PDQ Manufacturing, Inc.

- OPW Vehicle Wash Solutions

- Vacutech LLC

- Autoequip Lavaggi Srl

- Kessel Clean Solutions

- Norshine Limited

- Broadway Equipment Company

- New Haden Pumps Ltd

- Hydro-Chem Systems, Inc.

Frequently Asked Questions

Analyze common user questions about the Vehicle Cleaning Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Vehicle Cleaning Systems Market?

The Vehicle Cleaning Systems Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period from 2026 to 2033, driven primarily by increasing automation adoption and rising commercial fleet requirements.

How is AI influencing the operational efficiency of modern car wash systems?

AI integrates through smart vision systems for precise vehicle contour mapping and damage detection, and uses machine learning to optimize resource consumption (water and chemicals) and implement predictive maintenance, significantly boosting throughput and reducing operational downtime.

Which segmentation type currently holds the largest market share in terms of value?

The Automatic Car Wash Systems segment, specifically the high-volume Tunnel Wash Systems, typically holds the largest market value share due to the higher capital investment required, superior speed, and ability to handle extensive throughput demanded by professional operators.

What are the primary drivers related to sustainability in this market?

Key sustainability drivers include stringent governmental mandates on water conservation, leading to high demand for advanced water recycling and filtration systems, and increasing consumer preference for biodegradable and ecologically friendly cleaning chemical formulations.

Which region is expected to demonstrate the fastest growth in the Vehicle Cleaning Systems Market?

The Asia Pacific (APAC) region, spearheaded by rapid urbanization and increasing middle-class vehicle ownership in countries like China and India, is anticipated to record the fastest market growth rate for new installations and infrastructure development during the forecast period.

The information provided in this comprehensive report summarizes the critical dynamics shaping the Vehicle Cleaning Systems Market globally. Key elements analyzed include market sizing projections, technological advancements centered around AI and IoT integration, detailed segmentation based on application and end-user, and regional performance trends highlighting growth hotspots such as the Asia Pacific region. Strategic focus areas for market participants must center on developing highly water-efficient systems, offering flexible automated solutions, and leveraging data analytics for predictive maintenance to ensure competitive advantage. The shift toward subscription-based service models and specialized cleaning solutions for electric vehicles represents further strategic opportunities for sustained growth throughout the forecast period. This analysis confirms that the market trajectory is firmly focused on efficiency, environmental compliance, and enhanced customer convenience.

Further examination of the competitive landscape reveals that market leaders are consistently investing in merger and acquisition activities to consolidate technological expertise, particularly in software and smart sensor integration capabilities. Small and medium-sized enterprises often thrive by specializing in niche areas, such as modular water treatment components or customized cleaning agents, forming essential partnerships with larger system manufacturers. The strategic alliances formed between technology providers and car wash operators are proving instrumental in testing and deploying next-generation systems, such as fully autonomous robotic cleaning arms and integrated vehicle health scanning features. Regulatory compliance, particularly concerning environmental protection and labor safety standards, continues to pose a persistent challenge that necessitates continuous research and development investment to maintain operational legality and corporate responsibility.

The commercial vehicle sector, encompassing heavy-duty trucks, buses, and specialized utility vehicles, presents a unique set of demands often overlooked in analyses focusing solely on passenger cars. Cleaning these large vehicles requires exceptionally robust, often custom-built gantry systems capable of delivering high-impact cleaning to remove road grime, grease, and industrial residues that could compromise safety mechanisms or fleet branding visibility. Market growth in this sub-segment is intrinsically linked to global logistics expansion and government infrastructure investment. Fleet operators prioritize durability, minimal maintenance requirements, and reliable performance in harsh working environments, making the total cost of ownership (TCO) a more critical purchasing factor than aesthetics alone. Manufacturers developing highly modular and easily serviceable components gain a distinct advantage when targeting this specialized and high-value customer base.

The increasing consumer awareness regarding vehicle paint protection has spurred innovation in chemical delivery systems and drying processes. Modern systems are incorporating advanced coating technologies, such as nano-ceramic sealants and high-gloss polymer polishes, which require precise application through sophisticated chemical dosing pumps and sensor-controlled spray mechanisms. Furthermore, the final drying stage has evolved significantly; high-velocity air drying systems utilizing optimized blower arrangements and contoured nozzles are designed to rapidly remove residual water without physical contact, preventing water spots and minimizing energy usage by leveraging variable speed drives. The ability of a vehicle cleaning system to consistently deliver a spot-free, protected finish is increasingly becoming the defining differentiator in premium service offerings, justifying higher price points and fostering stronger brand loyalty among end-users.

The integration of digital platforms extends far beyond simple payment processing. Modern car wash systems are now often part of a wider ecosystem of connected services, allowing users to schedule washes, manage subscription packages, and receive service alerts directly via mobile applications. This digital transformation improves customer engagement, enhances operational forecasting for operators, and provides valuable data on peak usage times and service preferences. For instance, dynamic pricing models, informed by real-time demand and weather conditions, are being adopted to smooth out daily traffic fluctuations and optimize revenue streams. This blend of physical engineering excellence and digital service delivery defines the competitive edge in the contemporary Vehicle Cleaning Systems Market, requiring manufacturers to possess expertise not only in machinery but also in cloud computing and customer relationship management (CRM) technologies.

Looking ahead, emerging technologies such as robotic scrubbing systems utilizing advanced machine vision and articulation are poised to further revolutionize manual detailing tasks, offering automated pre-wash or spot cleaning services with high precision. While still in nascent stages, the deployment of fully autonomous wash bays, where the entire process from vehicle entry to exit is managed by integrated AI systems, represents the ultimate goal for maximizing efficiency and minimizing labor intervention. Addressing the challenge of water contamination, particularly managing microplastics and tire wear particles washed off vehicles, will require future innovations in filtration technology to move beyond standard recycling and meet stricter sustainability benchmarks, ensuring the industry's long-term viability in water-stressed regions globally.

The financial viability of new car wash installations is significantly influenced by site selection, local zoning laws, and the availability of utilities, adding layers of complexity to market expansion. Market participants must offer comprehensive consultation services encompassing site feasibility studies, regulatory navigation, and customized equipment sizing to minimize risk for potential investors. Financing solutions, often provided or facilitated by major equipment manufacturers, play a crucial role in enabling small and mid-sized operators to adopt high-cost automated technologies, thereby broadening market penetration. As the cost of labor continues to rise across developed economies, the return on investment (ROI) calculation increasingly favors high-automation solutions that can operate reliably with minimal human oversight, further cementing the dominance of tunnel and high-tech in-bay automatic systems in mature markets.

The emphasis on user interface and experience (UI/UX) is also gaining traction, particularly in self-service and in-bay automatic systems. Modern user interfaces feature intuitive, touch-screen displays that offer multilingual instructions, customizable wash options, and clear, transparent pricing structures. This focus on ease of use is critical for reducing customer confusion and improving the perceived value of the service. Furthermore, safety features, including advanced sensors and emergency stop mechanisms compliant with global industrial machinery standards, are non-negotiable requirements that drive engineering excellence. The successful convergence of rugged industrial hardware, intelligent software control, and user-centric design principles will dictate which manufacturers lead the market evolution in the coming decade, catering effectively to the demanding operational needs of professional car wash businesses and high-stakes commercial fleet maintenance operations.

Technological advancement is also being driven by the need to cater to the specific demands of Electric Vehicles (EVs). While EVs generally require standard exterior cleaning, specialized considerations involve protecting delicate battery enclosures, ensuring sensors and cameras crucial for autonomous driving capabilities are perfectly clean, and implementing non-contact drying methods near exposed charging ports. Manufacturers are developing tailored wash programs that minimize hydraulic shock and utilize specialized cleaning agents that do not react adversely with composite body panels or sensitive electronic components found increasingly in modern electrified vehicles, thereby future-proofing current system designs and expanding compatibility with the rapidly evolving global automotive fleet.

In summary, the Vehicle Cleaning Systems Market remains dynamic, poised for sustained growth through a strong interplay between ecological demands, technological innovation (AI, IoT), and shifting consumer expectations for speed and quality. The competitive landscape is intensely focused on vertical integration, offering end-to-end solutions from equipment manufacturing to chemical supply and financing. Companies that successfully navigate regulatory complexities while delivering energy and water-efficient, high-throughput automated systems are best positioned to capture market share and capitalize on the urbanization and fleet modernization trends across major global geographies.

The future market will be characterized by greater service personalization and fully integrated digital management, turning car wash facilities into smart maintenance hubs. Investment in research focused on material science for long-lasting, low-abrasion cleaning tools and the development of sustainable, closed-loop operational systems will remain paramount. The strategic importance of the after-sales service network—providing quick, expert maintenance and reliable consumables supply—cannot be overstated, as operational uptime is directly correlated with customer profitability and satisfaction within this high-volume, service-intensive industry.

Expansion strategies increasingly target secondary markets and emerging economies where the adoption of automated systems is accelerating rapidly. However, success in these regions requires tailoring equipment specifications to handle local conditions, such as challenging water quality, variable power supply, and different vehicle size standards. Manufacturers must develop flexible, modular solutions that allow operators to start with a base system and scale up features like advanced drying and undercarriage cleaning as their business grows, enabling broader market accessibility and reducing the entry barriers for new operators across diverse economic landscapes.

Final analysis underscores that competitive differentiation will increasingly rely on proprietary software and data analytics capabilities. Offering operators granular insights into machine performance, customer behavior, and revenue generation through a single, intuitive platform provides immense value beyond the physical machinery itself. This integration of hardware and software intelligence transforms the car wash from a static utility into a dynamic, revenue-optimizing business system, securing the long-term relevance and sustained growth of major technology providers in the Vehicle Cleaning Systems Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager