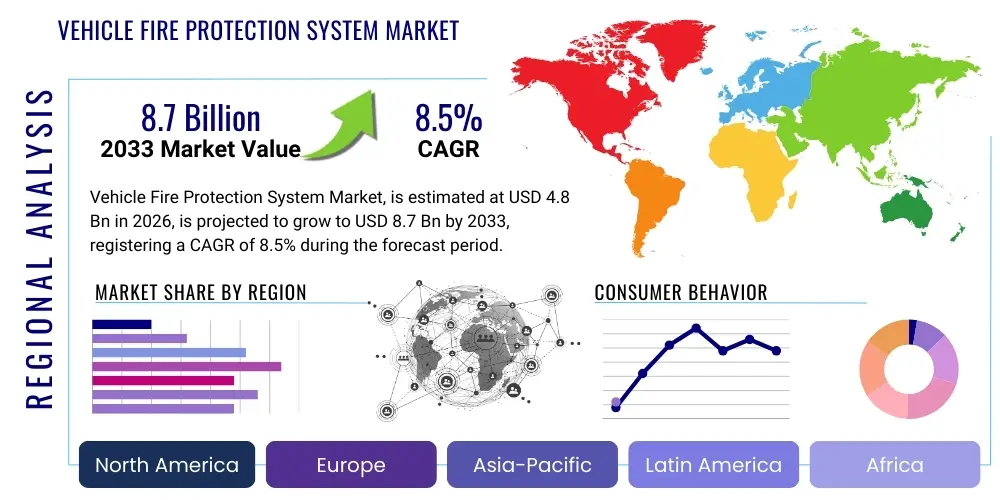

Vehicle Fire Protection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437379 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Vehicle Fire Protection System Market Size

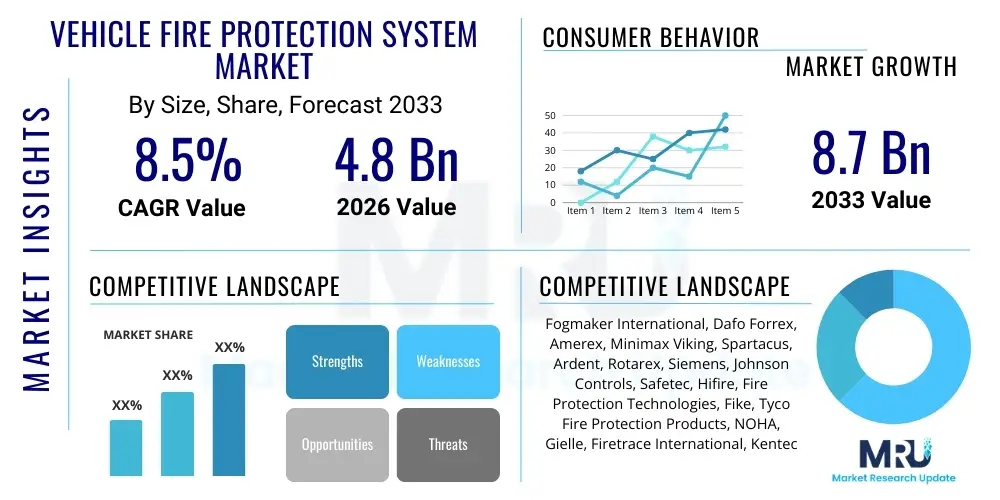

The Vehicle Fire Protection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasingly stringent global safety regulations concerning commercial and public transportation fleets, alongside technological advancements in detection and suppression agents tailored for unique vehicle environments.

Vehicle Fire Protection System Market introduction

The Vehicle Fire Protection System Market encompasses the design, manufacture, and deployment of specialized systems intended to detect and suppress fires originating within vehicles. These systems are critical for protecting passengers, drivers, and high-value assets, particularly in heavy machinery, buses, trucks, and specialized military vehicles where conventional fire extinguishers may be inadequate or impractical for immediate response. Key components include advanced heat, smoke, or flame detectors, centralized control units, and highly effective suppression systems utilizing agents such as dry chemicals, clean agents, or foam-based solutions, designed to operate automatically or manually upon detection of a thermal event.

Major applications of these protection systems span across several crucial sectors, including public transport (city buses, coaches), logistics and freight (heavy-duty trucks), construction and mining (excavators, loaders, dozers), and defense (armored personnel carriers and tanks). The increasing adoption of electric vehicles (EVs) introduces new challenges related to battery thermal runaway, subsequently boosting the demand for specialized lithium-ion battery fire suppression systems. The primary benefits derived from implementing these sophisticated fire safety solutions include significant reduction in vehicle downtime, minimized property loss, and, most importantly, enhanced human safety and compliance with international standards such as UNECE R107, which mandates fire suppression in certain types of buses.

The market's expansion is fundamentally driven by several intertwined factors. Mandatory regulatory frameworks established by regional governmental bodies, pushing for higher safety standards in public and commercial fleets, serve as the primary catalyst. Furthermore, the rising cost of vehicle replacement and insurance premiums encourages fleet operators to proactively invest in preventative safety measures. Rapid industrialization, expanding logistics networks globally, and the consistent demand for high-performance off-road equipment in emerging economies further cement the need for reliable, high-speed fire protection solutions, ensuring sustained market growth throughout the forecast period.

Vehicle Fire Protection System Market Executive Summary

The Vehicle Fire Protection System Market is experiencing a pivotal shift driven by stringent global regulatory mandates and the complex safety requirements of next-generation vehicles, particularly those powered by electricity and alternative fuels. Business trends indicate a strong focus on integration and smart system deployment, where manufacturers are increasingly incorporating predictive maintenance capabilities and real-time monitoring through IoT integration to reduce false alarms and enhance system reliability. Key industry players are pursuing strategic collaborations and mergers to consolidate technology and broaden their geographical footprint, particularly in high-growth areas like Asia Pacific, where large infrastructure projects and fleet modernization initiatives are accelerating adoption.

Regionally, North America and Europe maintain dominance due to established safety culture, early adoption of clean agent technologies, and robust regulatory oversight concerning both commercial transport and mining operations. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) driven by massive investments in public transport infrastructure in China and India, coupled with rapid urbanization that necessitates safer bus fleets. The Middle East and Africa (MEA) are also emerging markets, spurred by large-scale mining activities and oil and gas transportation, demanding heavy-duty protection systems designed for harsh operating environments.

Segment trends highlight the dominance of the Automatic System segment, favored for its rapid detection and deployment capabilities without human intervention, crucial in high-risk scenarios. Furthermore, the market for suppression agents is seeing a shift towards clean agents and specialized foams (AFFF-free alternatives) due to increasing environmental scrutiny, moving away from conventional dry chemicals in sensitive areas. The Commercial Vehicle segment, encompassing buses and heavy trucks, remains the largest application area, although the Off-Road Vehicle segment (construction and mining) is expanding rapidly, driven by the high asset value and extreme operational risks associated with this equipment type.

AI Impact Analysis on Vehicle Fire Protection System Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and Vehicle Fire Protection Systems predominantly center on predictive capabilities, reducing operational expenditures, and minimizing false alarm rates, which have historically plagued conventional systems. Users frequently ask how AI can utilize complex sensor data (temperature differentials, gas concentration, visual confirmation) to definitively distinguish between benign events (e.g., hot exhaust) and genuine fire threats (thermal runaway or engine compartment combustion). The overarching theme is the expectation that AI and Machine Learning (ML) will transition the market from reactive suppression to proactive, preventative safety management, enhancing the reliability and lowering the total cost of ownership (TCO) for large fleet operators.

AI's primary influence is expected in the realm of decision matrix optimization and predictive diagnostics. By analyzing historical fire incident data, operational parameters, maintenance logs, and real-time sensor inputs (including engine telematics and thermal imaging), ML algorithms can learn typical heat signatures and identify anomalies indicative of imminent component failure or thermal runaway long before traditional detection methods would trigger an alarm. This shift allows fleet managers to schedule preemptive maintenance, mitigating fire risk entirely rather than merely suppressing an already active event. The integration of edge AI computing within control units is crucial for providing low-latency decision-making, ensuring that suppression initiation is instantaneous and appropriate to the fire class and location.

Furthermore, AI algorithms are vital for optimizing the placement and sensitivity of detection sensors within complex vehicle architectures, such as crowded engine bays or large battery compartments, maximizing coverage while minimizing environmental interference. This capability significantly improves system trustworthiness, a key concern for fleet operators who must minimize unnecessary stops and maintenance checks. Future developments are focusing on integrating AI-powered thermal mapping and gas analysis into autonomous vehicle safety protocols, ensuring the protection system operates seamlessly within a fully digitized transport ecosystem.

- AI-Powered Predictive Maintenance: Utilizing telematics and operational data to forecast high-risk component failure (e.g., turbochargers, electrical faults) before ignition occurs.

- Enhanced Detection Accuracy: Machine Learning models differentiate genuine fire signatures (thermal runaway, fuel ignition) from non-fire related heat events, drastically reducing false alarms.

- Real-time Suppression Optimization: AI algorithms determine the precise size, location, and type of fire, optimizing the release parameters of the extinguishing agent for maximum efficiency and minimal waste.

- Sensor Fusion and Data Integration: Combining inputs from multiple disparate sensors (thermal cameras, gas detectors, conventional heat sensors) for highly reliable, consolidated threat assessment.

- Autonomous System Verification: AI continuously self-diagnoses the integrity and operational readiness of the suppression system components, ensuring high availability (AEO).

DRO & Impact Forces Of Vehicle Fire Protection System Market

The Vehicle Fire Protection System Market is powerfully shaped by the synergy between stringent regulatory pressures (Drivers) and the significant capital investment required for system implementation (Restraints). Opportunities primarily stem from technological innovation in addressing complex emerging risks, such as the thermal management of high-density lithium-ion batteries in electric vehicles. The collective impact forces indicate a market shifting rapidly towards mandatory integration, driven not just by compliance but by the operational and reputational benefits derived from superior fleet safety management. These forces compel manufacturers to continually innovate, focusing on reliability, speed, and environmental sustainability of suppression agents.

Key drivers include the global harmonization of safety standards, particularly for public transport vehicles (e.g., UNECE R107 mandate), which creates non-negotiable demand across diverse geographical markets. The high frequency and devastating impact of fires in off-road machinery (mining, construction) necessitate robust suppression systems, offering a significant return on investment by protecting multi-million dollar assets and ensuring operational continuity. Conversely, the high upfront cost of installing advanced detection and suppression systems, especially for smaller fleet operators or in older vehicles, acts as a primary restraint. Additionally, the challenge of maintaining specialized systems and ensuring certified technician availability across remote operational locations poses a logistical hurdle, impacting widespread adoption in developing regions.

Opportunities for market expansion are abundant in the field of specialized protection systems tailored for Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), where traditional fire suppression methods are ineffective against lithium-ion battery thermal runaway events. Manufacturers are focusing R&D on non-toxic, highly effective coolants and encapsulating agents that prevent the fire from propagating between cells, a critical market differentiator. The broader movement towards fleet digitalization and the integration of these fire systems with existing telematics platforms also provides growth avenues. The net impact of these forces is strong positive momentum, with regulatory compliance acting as the floor and technological necessity (especially in the EV segment) acting as the ceiling for market potential.

Segmentation Analysis

The Vehicle Fire Protection System market segmentation provides a comprehensive breakdown of the industry based on system characteristics, detection technology, fire suppression agents utilized, and the specific application or vehicle type. This granular analysis is crucial for understanding market dynamics, identifying high-growth niches, and tailoring product development to meet diverse end-user requirements across commercial logistics, heavy industry, and specialized military applications. The market is highly differentiated, reflecting the varying risk profiles and operational environments of different vehicle classes, such as the intense heat exposure in mining equipment versus the enclosed passenger environment of a public bus.

The segmentation by Vehicle Type remains the most influential factor, dictating both the required system robustness and the average selling price (ASP). Commercial Vehicles, including buses and long-haul trucks, require systems optimized for large engine bays and fuel storage areas, prioritizing fast, reliable detection. Conversely, the Off-Road/Mining segment demands extremely durable, high-capacity systems capable of withstanding extreme vibration, dust, and temperature fluctuations, often necessitating dry chemical or specialized foam solutions. Agent type segmentation highlights the ongoing transition away from halon-based products towards environmentally friendlier alternatives such as clean agents (FK-5-1-12 or HFCs) for use in passenger areas and water mist or foam for machinery spaces.

- By Type:

- Automatic Systems

- Manual Systems

- By Detection Technology:

- Heat Detectors (Linear Heat Detection Cable, Spot Heat Sensors)

- Smoke Detectors

- Flame Detectors (UV/IR)

- Gas Detectors

- By Suppression Agent:

- Dry Chemical Powder

- Foam Agents (Aqueous Film Forming Foam - AFFF, Specialized FFF)

- Water Mist

- Clean Agents (e.g., Novec 1230, FM-200)

- Specialized Coolants/Encapsulation Agents (For EV Batteries)

- By Vehicle Type:

- Commercial Vehicles (Buses, Coaches, Heavy Trucks, Delivery Vans)

- Off-Road Vehicles (Mining Equipment, Construction Machinery, Agricultural Machinery)

- Military Vehicles (APCs, Tanks, Logistics Vehicles)

- Passenger Cars (Niche applications and high-end luxury/racing vehicles)

- By End-Use Application:

- Engine Compartment Protection

- Fuel Tank Protection

- Cabin/Passenger Area Protection

- Battery Compartment Protection (EVs)

Value Chain Analysis For Vehicle Fire Protection System Market

The value chain for Vehicle Fire Protection Systems begins with upstream activities focused on raw material sourcing and component manufacturing, primarily involving specialized sensor technology, high-pressure cylinder production, and proprietary chemical agent formulation. Critical upstream components include high-grade steel and aluminum for agent storage, sophisticated electronic control units (ECUs), and advanced detection elements like thermal wires and UV/IR flame sensors. The quality and reliability of these upstream inputs directly influence the performance and certification standards of the final suppression system, requiring close collaboration and stringent quality control protocols between specialized component suppliers and system integrators.

Midstream operations involve the core manufacturing, assembly, and integration of the complete fire protection system kits, including the pressure testing of cylinders, calibration of control panels, and packaging specific to different vehicle models (e.g., bus vs. mining truck). System manufacturers often maintain extensive in-house R&D capabilities to ensure compliance with diverse international standards (e.g., FM approval, UL listing, UNECE R107). Distribution channels are highly dependent on the target vehicle market; Direct sales and installation are common for large OEM partnerships (Original Equipment Manufacturers) in the heavy vehicle sector, ensuring seamless integration during the vehicle build process, which allows for maximum customization and certified system integration.

Downstream activities center on sales, installation, commissioning, and, most critically, post-sales service and maintenance. Installation is often performed by certified, specialized third-party service providers or by the vehicle manufacturer's authorized dealerships, ensuring the system functions correctly under operational stress. Regular maintenance, including agent refilling and sensor calibration, forms a significant, recurring revenue stream. Indirect channels include independent distributors and resellers who target the aftermarket, catering to existing vehicle fleets requiring retrofitting to meet new regulatory mandates or upgrade safety features, particularly crucial in extending the lifecycle compliance of aging commercial fleets.

Vehicle Fire Protection System Market Potential Customers

Potential customers for Vehicle Fire Protection Systems are primarily large entities responsible for managing significant fleets of high-value or high-risk vehicles, where fire incidents pose a substantial threat to human life, operational continuity, and financial assets. The core customer base includes governmental and private sector entities that operate heavy commercial transport, encompassing public transportation authorities responsible for municipal bus fleets and large independent logistics companies managing national or international trucking operations. These buyers are typically driven by non-negotiable compliance requirements and the need to protect their corporate reputation and adhere to stringent insurance mandates.

Another major segment of end-users are the global mining, construction, and heavy machinery industries. Companies operating in these sectors (e.g., multinational mining corporations, infrastructure developers) purchase highly robust, heavy-duty systems for excavators, loaders, and haul trucks, often operating in remote, combustible, and high-heat environments. For these customers, the priority is minimizing the costly downtime associated with asset loss and catastrophic failure, making reliable, high-speed suppression an essential operational expense rather than a mere safety feature. Defense ministries and associated military contractors also represent a stable, specialized customer base for protecting sensitive armored vehicles and critical logistics support fleets.

The emerging customer demographic includes municipal waste management services and utility companies, which operate specialized vehicle fleets (e.g., refuse trucks, cherry pickers) that face elevated fire risks due to the nature of their cargo or frequent heavy mechanical stress. Furthermore, as the Electric Vehicle (EV) market expands rapidly, automotive OEMs and large fleet operators transitioning to electric buses and delivery vans are becoming crucial buyers, specifically seeking advanced solutions designed to manage the unique challenges posed by thermal runaway in high-voltage lithium-ion batteries, representing a future growth engine for the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fogmaker International, Dafo Forrex, Amerex, Minimax Viking, Spartacus, Ardent, Rotarex, Siemens, Johnson Controls, Safetec, Hifire, Fire Protection Technologies, Fike, Tyco Fire Protection Products, NOHA, Gielle, Firetrace International, Kentec Electronics, Seagrave Fire Apparatus, Kidde. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Fire Protection System Market Key Technology Landscape

The technology landscape of the Vehicle Fire Protection System Market is rapidly evolving, driven by the need for faster response times, greater reliability, and enhanced compliance with environmental standards regarding suppression agents. A core technology advancement involves the sophisticated use of linear heat detection (LHD) cables, which provide continuous temperature monitoring across large, complex areas like engine compartments or chassis lines. These LHD cables, often polymer or fiber-optic based, offer highly localized detection capabilities, allowing for rapid signal transmission to the control unit upon reaching a predefined activation temperature, minimizing the delay between ignition and suppression activation.

A significant technological focus is directed towards the development and deployment of specialized suppression agents tailored for specific fire classes prevalent in vehicles. For standard combustion engines, optimized foam agents (like FFF or CAF systems) and water mist systems are favored due to their ability to rapidly cool hot surfaces and suppress re-ignition risks. However, the most challenging technological area is the development of non-toxic, highly effective coolants and thermal encapsulation agents specifically designed to halt the runaway reaction in lithium-ion batteries found in EVs. These specialized agents work by absorbing the immense heat generated during cell failure and preventing the spread of fire to adjacent battery modules, a critical safety challenge that necessitates advanced chemical engineering solutions.

Furthermore, digital integration represents a foundational technology trend. Modern systems incorporate Internet of Things (IoT) sensors, GPS tracking, and telematics integration, allowing fleet managers to monitor the operational status of the fire protection system remotely in real time. This capability ensures that systems remain functional and ready for deployment, facilitating preventative maintenance alerts for low pressure or sensor failure, significantly improving overall system reliability and minimizing false positives. The move towards distributed intelligence through networked sensors enhances decision-making speed and accuracy, forming the backbone of next-generation AEO-optimized vehicle safety platforms.

Regional Highlights

- North America: This region holds a significant share of the market, primarily due to rigorous safety standards imposed by governmental bodies like the National Fire Protection Association (NFPA) and high levels of investment in the transportation sector, especially in commercial trucking and school buses. The widespread adoption of highly valuable off-road equipment in the U.S. and Canadian mining and forestry industries drives high demand for robust, certified fire suppression systems. Manufacturers here focus heavily on compliance with FM standards and integration with complex fleet telematics systems.

- Europe: Europe is a mature market heavily influenced by strict regulatory mandates, most notably UNECE Regulation No. 107 (R107), which mandates fire suppression systems in engine compartments of certain categories of buses and coaches. This regulatory environment ensures sustained baseline demand. The region is also at the forefront of adopting environmentally friendly, clean agent technologies (e.g., Fluoroketones) due to stringent EU environmental directives, pushing innovation in chemical agent formulation and promoting early adoption of EV-specific protection measures.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive infrastructure development projects, rapid urbanization, and the corresponding expansion of public transportation fleets, particularly in China, India, and Southeast Asian nations. While regulations are often less harmonized than in the West, local governments are increasingly mandating modern fire safety measures for new bus fleets. The sheer volume of new vehicle production and the vastness of the mining and construction sectors provide immense opportunity, though price sensitivity remains a key factor influencing procurement decisions.

- Latin America (LATAM): Growth in LATAM is driven by robust mining and resource extraction activities, especially in countries like Chile, Brazil, and Peru, which necessitates high-capacity suppression systems for heavy mobile equipment. Challenges include navigating diverse regulatory frameworks and overcoming supply chain complexities. The demand here is highly focused on durability and performance under harsh operational conditions, prioritizing foam and dry chemical solutions in specific industrial applications.

- Middle East and Africa (MEA): This region is characterized by significant investment in the oil & gas industry and rapid urban construction projects, creating demand for protective systems for specialized transport and heavy machinery. The operational environment, often characterized by extreme heat, demands systems with high thermal resistance and reliability. South Africa, with its mature mining sector, acts as a critical hub for high-specification vehicle fire protection system adoption, particularly for large fleet protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Fire Protection System Market.- Fogmaker International AB

- Dafo Forrex AB

- Amerex Corporation

- Minimax Viking GmbH

- Spartacus Safety & Fire Systems

- Ardent Safety Systems

- Rotarex S.A.

- Siemens AG

- Johnson Controls International plc

- Safetec of America, Inc.

- Hifire Inc.

- Fire Protection Technologies Pty Ltd

- Fike Corporation

- Tyco Fire Protection Products (part of Johnson Controls)

- NOHA Norway AS

- Gielle Group

- Firetrace International

- Kentec Electronics Ltd

- Seagrave Fire Apparatus, LLC

- Kidde (A Carrier Company)

Frequently Asked Questions

Analyze common user questions about the Vehicle Fire Protection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major regulations are driving the adoption of Vehicle Fire Protection Systems?

The primary global regulation driving adoption is UNECE Regulation No. 107 (R107), which mandates fire suppression systems for the engine compartment of certain categories of buses and coaches in Europe and many other adhering countries. Additional drivers include regional safety codes (e.g., NFPA guidelines) and mandatory requirements in high-risk sectors like mining and specialized hazardous transport.

How are fire suppression systems addressing the risks associated with Electric Vehicles (EVs)?

EV fire risks, stemming from lithium-ion battery thermal runaway, are addressed through specialized systems utilizing chemical coolants and encapsulation agents (e.g., aqueous and non-flammable fluids). These systems are designed to rapidly absorb heat, halt propagation between battery cells, and prevent re-ignition, differing significantly from conventional engine fire suppression methods.

What is the key differentiator between Automatic and Manual Vehicle Fire Protection Systems?

Automatic systems deploy extinguishing agents without human intervention immediately upon detector activation (heat, smoke, or flame sensor signal), offering faster response times critical for vehicle fires. Manual systems require the operator or driver to physically trigger the suppression mechanism, typically used as a backup or in low-risk scenarios where operator confirmation is required.

Which vehicle segment holds the largest market share for fire protection systems?

The Commercial Vehicle segment, encompassing public buses, coaches, and heavy-duty trucks, holds the largest market share. This dominance is driven by high regulatory scrutiny, the necessity to protect large volumes of passengers, and the high frequency of vehicle operation that increases the overall risk profile.

What role does IoT and AI integration play in modern Vehicle Fire Protection Systems?

IoT (telematics) and AI are crucial for transitioning from reactive suppression to proactive safety management. They enable real-time system monitoring, remote diagnostics, and predictive maintenance alerts. AI algorithms analyze operational data to distinguish genuine fire risks from false alarms and optimize suppression response based on the precise detected threat characteristics (GEO/AEO functionality).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager