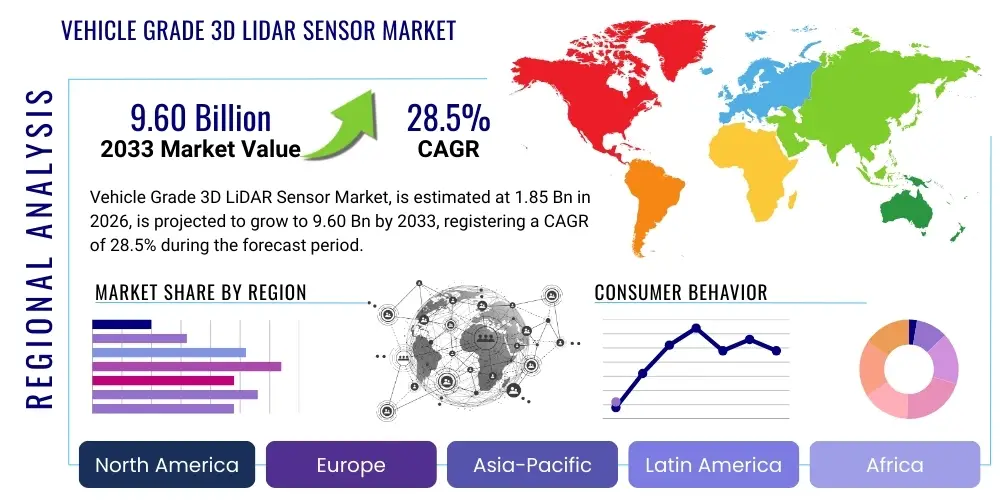

Vehicle Grade 3D LiDAR Sensor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440605 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Vehicle Grade 3D LiDAR Sensor Market Size

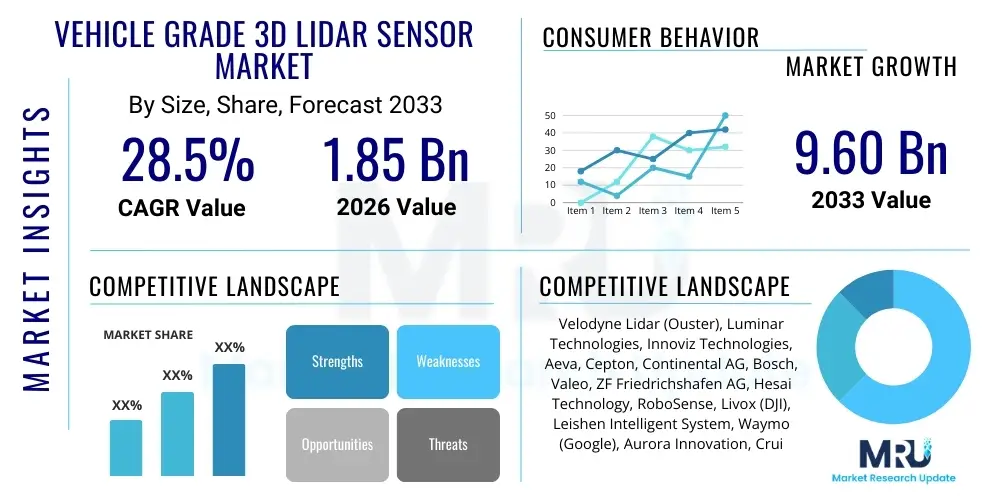

The Vehicle Grade 3D LiDAR Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 9.60 Billion by the end of the forecast period in 2033.

Vehicle Grade 3D LiDAR Sensor Market introduction

The Vehicle Grade 3D LiDAR Sensor Market is at the forefront of the autonomous vehicle revolution, providing critical environmental perception capabilities essential for Advanced Driver-Assistance Systems (ADAS) and full autonomous driving (Level 3-5). These sophisticated sensors emit pulsed laser light to measure distances to objects, generating highly accurate, real-time 3D point clouds of the vehicle's surroundings. This detailed spatial data allows for precise object detection, classification, tracking, and mapping, significantly enhancing situational awareness and safety on the road.

Major applications for vehicle-grade 3D LiDAR sensors span a wide range of automotive functionalities, including collision avoidance, adaptive cruise control, lane keeping assist, automated parking, and complex urban navigation for autonomous vehicles. The inherent benefits of LiDAR, such as its independence from ambient light conditions and superior depth perception compared to camera-only systems, make it indispensable for robust and reliable autonomous operation. Key driving factors propelling market growth include the escalating global demand for enhanced vehicle safety features, the rapid development and deployment of autonomous driving technologies by automotive OEMs and technology companies, and the continuous innovation leading to more compact, cost-effective, and high-performance LiDAR solutions.

Furthermore, stringent regulatory frameworks pushing for higher levels of vehicle safety and the competitive landscape among automotive manufacturers to integrate cutting-edge ADAS functionalities are significant accelerators for market expansion. The technological evolution from bulky mechanical LiDAR to sleek solid-state solutions, including MEMS, Flash, and FMCW LiDAR, is also broadening its adoption by addressing previous challenges related to cost, size, and durability. As sensor fusion platforms become more sophisticated, integrating LiDAR with radar and cameras, the capabilities of perception systems are reaching unprecedented levels, paving the way for safer and more efficient future mobility solutions.

Vehicle Grade 3D LiDAR Sensor Market Executive Summary

The Vehicle Grade 3D LiDAR Sensor Market is experiencing transformative business trends characterized by intense innovation, strategic partnerships, and aggressive investment in research and development. Key players are focusing on reducing the cost and improving the performance and reliability of LiDAR sensors, particularly through the development of solid-state technologies. There is a clear trend towards vertical integration, with automotive OEMs directly investing in LiDAR startups or forging exclusive supply agreements, aiming to secure advanced technology and streamline integration into future vehicle platforms. Furthermore, the market is seeing a consolidation trend through mergers and acquisitions as companies seek to expand their technological portfolios and market reach, fostering a highly competitive yet collaborative environment for autonomous driving advancement.

Regionally, the market exhibits diverse growth dynamics with Asia Pacific, particularly China and Japan, emerging as a dominant force driven by rapid adoption of autonomous driving initiatives, substantial government support for smart mobility solutions, and a burgeoning electric vehicle market. North America continues to be a hub for innovation and early deployment of autonomous vehicle fleets, with significant R&D investments from tech giants and automotive pioneers. Europe, spearheaded by Germany's robust automotive industry, is prioritizing ADAS integration and setting high standards for vehicle safety, contributing to steady market expansion. These regional trends are shaped by varying regulatory landscapes, consumer acceptance of autonomous technologies, and the pace of infrastructure development to support advanced mobility solutions.

Segment trends highlight a significant shift from mechanical LiDAR to solid-state LiDAR due to its advantages in durability, cost-effectiveness, and compact form factor, making it more suitable for mass production and automotive integration. Within solid-state, Frequency Modulated Continuous Wave (FMCW) LiDAR is gaining traction for its enhanced capabilities in immediate velocity detection and interference immunity. The long-range segment is witnessing heightened demand for autonomous driving applications requiring detection capabilities beyond 200 meters, crucial for highway driving and high-speed scenarios. Application-wise, autonomous driving (L3-L5) remains the primary growth driver, but advanced ADAS features are increasingly integrating LiDAR for enhanced safety and convenience, demonstrating the technology's versatile utility across the automotive spectrum.

AI Impact Analysis on Vehicle Grade 3D LiDAR Sensor Market

Common user questions regarding AI's impact on the Vehicle Grade 3D LiDAR Sensor Market often revolve around how artificial intelligence enhances LiDAR data processing, whether AI will eventually replace LiDAR, and its role in sensor fusion for autonomous vehicles. Users are keen to understand the extent to which AI contributes to the accuracy of object detection and classification using LiDAR, and how it addresses the challenges of processing vast amounts of point cloud data in real-time. There is also interest in AI's potential to mitigate LiDAR's limitations in adverse weather and improve overall system reliability. Essentially, the core themes center on AI as an enabler and enhancer for LiDAR, rather than a competitor, and its integral role in unlocking the full potential of 3D perception for autonomous driving systems.

- AI significantly enhances the interpretation and processing of complex 3D point cloud data generated by LiDAR sensors, enabling more accurate object detection, classification, and tracking in real-time.

- Machine learning algorithms allow LiDAR systems to differentiate between various objects (pedestrians, vehicles, cyclists) with higher precision, reducing false positives and improving situational awareness for autonomous vehicles.

- AI-driven sensor fusion algorithms integrate LiDAR data with inputs from cameras, radar, and ultrasonic sensors, creating a more robust and comprehensive perception of the environment, thereby compensating for individual sensor limitations.

- Deep learning models can predict the movement of dynamic objects based on LiDAR data, providing critical foresight for autonomous driving systems to make safer and more informed decisions.

- AI contributes to the development of self-calibrating LiDAR systems, improving their long-term stability and reducing the need for manual adjustments or complex calibration procedures.

- The use of AI in simulation and validation tools accelerates the development and testing cycles for LiDAR-based autonomous driving systems, reducing time to market and enhancing system reliability.

- AI facilitates the development of intelligent LiDAR systems capable of adaptive scanning patterns, optimizing data collection based on specific driving scenarios and environmental conditions for improved efficiency.

DRO & Impact Forces Of Vehicle Grade 3D LiDAR Sensor Market

The Vehicle Grade 3D LiDAR Sensor Market is shaped by a dynamic interplay of driving forces, significant restraints, and emerging opportunities, all contributing to its overall impact. Rapid advancements in autonomous driving technology and the increasing demand for sophisticated Advanced Driver-Assistance Systems (ADAS) are primary drivers, fueled by a global push for enhanced vehicle safety and efficiency. Stricter regulatory frameworks mandating certain safety features, coupled with continuous innovations leading to more affordable and compact LiDAR solutions, further propel market expansion. However, the market faces notable restraints, including the relatively high initial cost of integrating LiDAR into mass-market vehicles, performance limitations in challenging weather conditions such as heavy fog or snow, and the substantial computational power required for real-time processing of large LiDAR datasets. Additionally, ongoing regulatory uncertainties and the lack of universal standardization across different regions pose complexities for manufacturers.

Opportunities in the market are abundant, particularly with the advent of solid-state LiDAR technologies, which promise lower costs, smaller form factors, and increased durability, making them more viable for widespread automotive integration. The expansion into novel applications beyond passenger vehicles, such as robotaxis, autonomous shuttles, commercial trucking, and smart city infrastructure, presents lucrative avenues for growth. Furthermore, the development of advanced sensor fusion techniques, which seamlessly combine LiDAR data with inputs from cameras and radar, is enhancing system robustness and reliability, creating new market potential. Strategic partnerships and collaborations between LiDAR manufacturers, automotive OEMs, and Tier 1 suppliers are also crucial in accelerating technological advancements and market penetration. These collaborations aim to optimize sensor integration, improve data interpretation, and ultimately bring safer autonomous solutions to market more efficiently.

The collective impact of these forces is driving the market towards innovation and diversification. The competitive landscape is intensifying, pushing companies to invest heavily in R&D to differentiate their offerings. Technological innovation remains a high impact force, constantly redefining product capabilities and cost structures. While economic factors and consumer acceptance play a role, the regulatory environment is a significant impact force, dictating the pace and scope of autonomous technology deployment. Overall, the market is characterized by a high degree of technological dynamism and strategic maneuvering, all aimed at realizing the promise of fully autonomous and safer transportation systems.

Segmentation Analysis

The Vehicle Grade 3D LiDAR Sensor Market is extensively segmented to reflect the diverse technological approaches, application requirements, and vehicle integration strategies shaping its evolution. This segmentation provides a granular view of market dynamics, revealing specific growth pockets and competitive landscapes within various categories. Key segmentation criteria include the underlying LiDAR technology, the operational range of the sensors, their intended application in vehicles, the type of vehicle they are integrated into, the constituent components, and the operational wavelength, each playing a crucial role in defining market preferences and technological advancements.

- By Technology:

- Mechanical LiDAR

- Solid-State LiDAR

- MEMS (Micro-electromechanical Systems)

- Flash LiDAR

- OPA (Optical Phased Array)

- FMCW (Frequency Modulated Continuous Wave)

- By Range:

- Short Range

- Medium Range

- Long Range

- By Application:

- ADAS (Advanced Driver-Assistance Systems)

- Autonomous Driving (L3, L4, L5)

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- By Component:

- Transceiver (Emitter & Detector)

- Receiver

- Data Processing Unit

- Optics

- ASICs

- By Wavelength:

- 905nm

- 1550nm

Value Chain Analysis For Vehicle Grade 3D LiDAR Sensor Market

The value chain for the Vehicle Grade 3D LiDAR Sensor Market is a multi-tiered ecosystem beginning with upstream component manufacturing and extending through integration, software development, and various distribution channels to reach end-users. The upstream segment involves the supply of critical raw materials and highly specialized components, including laser emitters (e.g., VCSELs, EELs), photodetectors (e.g., APDs, SPADs), custom optics, and application-specific integrated circuits (ASICs) that manage signal processing and control. Manufacturers of these core components are crucial, as their innovation directly impacts the performance, size, and cost of the final LiDAR unit. Research and development in material science and semiconductor technology form the foundational layer of this upstream activity, driving efficiency and miniaturization.

Midstream activities involve the actual assembly and calibration of LiDAR sensors by specialized manufacturers. These companies integrate the various components, develop proprietary scanning mechanisms (for mechanical LiDAR) or solid-state architectures (for MEMS, Flash, FMCW), and implement sophisticated signal processing algorithms. This stage often includes extensive testing and quality assurance to meet automotive grade specifications for durability, reliability, and performance under varying environmental conditions. Tier 1 automotive suppliers play a pivotal role here, often collaborating with LiDAR sensor manufacturers to tailor solutions for specific vehicle platforms and integrate them into broader ADAS or autonomous driving modules.

Downstream activities focus on the integration of LiDAR systems into vehicles by automotive OEMs and autonomous driving technology developers. This includes mechanical mounting, electrical interfacing, and, critically, software integration for data fusion with other sensors (cameras, radar) and the overarching autonomous driving stack. The distribution channels can be direct, where LiDAR manufacturers sell directly to large OEMs or technology companies for integration into their production lines or test fleets. Indirect channels involve sales through Tier 1 suppliers who package LiDAR with other components into comprehensive ADAS solutions, or through specialized system integrators who provide turnkey solutions for smaller autonomous vehicle developers or niche applications like robotaxis. The after-sales service and software updates are also integral parts of the downstream value chain, ensuring long-term performance and adaptability of the LiDAR systems.

Vehicle Grade 3D LiDAR Sensor Market Potential Customers

The primary potential customers and end-users for Vehicle Grade 3D LiDAR Sensors are diverse, reflecting the broad application spectrum of this critical technology in the evolving mobility landscape. Automotive Original Equipment Manufacturers (OEMs) stand as the most significant customer segment, including established passenger vehicle manufacturers (e.g., Daimler, BMW, General Motors, Toyota, Hyundai) and emerging electric vehicle (EV) startups (e.g., Tesla, Nio, Rivian). These OEMs are integrating LiDAR into their production vehicles for both advanced ADAS functionalities and as a cornerstone for future autonomous driving capabilities, ranging from Level 3 highway autonomy to Level 4/5 full self-driving systems.

Beyond traditional carmakers, Tier 1 automotive suppliers (e.g., Bosch, Continental, Valeo, ZF Friedrichshafen) represent a crucial customer group. These companies develop and supply comprehensive perception modules and ADAS platforms to OEMs, often integrating LiDAR sensors from specialized manufacturers into their broader offerings. Their role is pivotal in standardizing and industrializing LiDAR integration for mass production. Furthermore, dedicated autonomous driving technology developers and companies operating robotaxi fleets (e.g., Waymo, Cruise, Aurora) are key customers, requiring high-performance, robust LiDAR systems for their advanced self-driving stacks and commercial operations. These entities often push the boundaries of LiDAR technology, demanding sensors capable of operating reliably in complex urban environments.

Other emerging potential customers include logistics and commercial vehicle operators (e.g., autonomous trucking companies, last-mile delivery services) who are leveraging LiDAR for enhanced safety and efficiency in their autonomous fleets. While smaller in volume compared to passenger vehicles, the commercial segment offers significant growth potential as autonomous logistics solutions become more prevalent. Additionally, developers of smart city infrastructure and intelligent transportation systems may also indirectly influence demand, as LiDAR data can be utilized for traffic monitoring and urban planning, though direct vehicle-grade sensor sales to these entities are less common compared to their automotive counterparts. The overarching trend points towards an expanding customer base driven by the relentless pursuit of safer, more efficient, and fully autonomous transportation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 9.60 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Velodyne Lidar (Ouster), Luminar Technologies, Innoviz Technologies, Aeva, Cepton, Continental AG, Bosch, Valeo, ZF Friedrichshafen AG, Hesai Technology, RoboSense, Livox (DJI), Leishen Intelligent System, Waymo (Google), Aurora Innovation, Cruise (GM), Argo AI (Ford/VW), Blackmore (Aurora), Quanergy Systems, Sick AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Grade 3D LiDAR Sensor Market Key Technology Landscape

The Vehicle Grade 3D LiDAR Sensor market is characterized by a rapidly evolving technology landscape, with continuous innovation aimed at improving performance, reducing cost, and enhancing reliability for automotive integration. A significant trend is the shift from bulky, expensive mechanical LiDAR systems, which use rotating mirrors to scan the environment, towards more compact, robust, and mass-producible solid-state LiDAR technologies. These solid-state approaches eliminate moving parts, leading to increased durability, lower manufacturing costs, and smaller form factors that are more aesthetically pleasing and easier to integrate into vehicle designs. Key solid-state technologies include Micro-electromechanical Systems (MEMS) LiDAR, which uses tiny, movable mirrors to steer laser beams; Flash LiDAR, which illuminates an entire scene simultaneously with a single laser pulse; and Optical Phased Array (OPA) LiDAR, which uses optical interference to steer beams electronically without moving parts.

Another pivotal technological advancement is Frequency Modulated Continuous Wave (FMCW) LiDAR. Unlike traditional pulsed LiDAR, FMCW LiDAR measures both distance and instantaneous velocity of objects, providing a fourth dimension of data that is crucial for robust autonomous driving systems. This technology also offers superior immunity to interference from other LiDAR sensors or ambient light, enhancing its reliability in congested environments. Furthermore, advancements in laser technology, particularly the shift towards 1550nm wavelength lasers, are gaining traction. While 905nm lasers are common due to their lower cost, 1550nm lasers are eye-safe at higher power levels, allowing for longer detection ranges and improved performance in challenging conditions, albeit at a higher cost due to the need for more expensive detectors and optical components. The choice of wavelength often involves a trade-off between cost, range, and eye safety considerations, influencing adoption patterns.

Beyond the sensor hardware itself, the technology landscape encompasses critical software and processing capabilities. Sophisticated algorithms for point cloud processing, object detection, classification, and tracking are essential to extract meaningful information from the vast amounts of data generated by LiDAR sensors. The integration of Artificial Intelligence and Machine Learning (AI/ML) is paramount for interpreting complex scenarios, predicting object behavior, and improving the overall robustness of perception systems, especially in dynamic urban environments. Sensor fusion platforms, which seamlessly combine LiDAR data with inputs from cameras, radar, and ultrasonic sensors, represent another vital technological area. These platforms leverage the strengths of each sensor type to create a more comprehensive and resilient environmental model, enhancing the reliability and safety of autonomous driving systems and further solidifying LiDAR's indispensable role.

Regional Highlights

- North America: This region is a leading hub for autonomous vehicle research, development, and early deployment. The United States, in particular, boasts a robust ecosystem of technology companies, automotive OEMs, and startups heavily investing in LiDAR innovation and autonomous driving trials. Strong venture capital funding and a favorable regulatory environment for testing advanced driver assistance systems contribute to its market dominance. Canada also plays a role in LiDAR development and application.

- Europe: Driven by stringent vehicle safety regulations and a strong automotive industry base, Europe is witnessing significant adoption of vehicle-grade 3D LiDAR sensors, especially in premium and luxury vehicle segments. Countries like Germany, with its leading automotive manufacturers, and France, with its strong tech sector, are key contributors. The focus here is often on high-precision ADAS features and advanced autonomous functionalities designed for diverse road conditions.

- Asia Pacific (APAC): APAC is projected to be the largest and fastest-growing market for vehicle-grade 3D LiDAR sensors. China is a powerhouse, fueled by massive government investments in smart city infrastructure, autonomous transportation initiatives, and a rapidly expanding electric vehicle market. Japan and South Korea also demonstrate strong growth, driven by technological prowess, high consumer acceptance of advanced vehicle technologies, and active participation from major automotive and electronics companies in LiDAR development and integration.

- Latin America: This region is an emerging market for vehicle-grade 3D LiDAR sensors, with slower but steady growth. Adoption is primarily concentrated in premium vehicle segments and early pilot projects for autonomous public transport or logistics. Economic factors and varying regulatory landscapes mean that widespread integration is still in nascent stages, though interest in enhanced vehicle safety and future mobility solutions is growing.

- Middle East and Africa (MEA): The MEA region represents another nascent but promising market. Countries in the Middle East, particularly the UAE and Saudi Arabia, are investing heavily in smart city projects and futuristic transportation systems, creating potential opportunities for LiDAR integration in autonomous fleets. Africa's market is in its very early stages, with adoption largely limited to high-end vehicles or specific industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Grade 3D LiDAR Sensor Market.- Velodyne Lidar (Ouster)

- Luminar Technologies

- Innoviz Technologies

- Aeva

- Cepton

- Continental AG

- Bosch

- Valeo

- ZF Friedrichshafen AG

- Hesai Technology

- RoboSense

- Livox (DJI)

- Leishen Intelligent System

- Waymo (Google)

- Aurora Innovation

- Cruise (GM)

- Argo AI (Ford/VW)

- Blackmore (Aurora)

- Quanergy Systems

- Sick AG

Frequently Asked Questions

Analyze common user questions about the Vehicle Grade 3D LiDAR market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Vehicle Grade 3D LiDAR Sensor?

A Vehicle Grade 3D LiDAR Sensor is an advanced perception system used in automobiles that emits pulsed laser light to measure distances to objects, creating precise, real-time 3D maps of the vehicle's surroundings for ADAS and autonomous driving applications.

How does LiDAR contribute to autonomous driving?

LiDAR provides highly accurate 3D spatial data, enabling autonomous vehicles to detect and classify objects, measure distances, and map the environment with exceptional precision, crucial for safe navigation, obstacle avoidance, and decision-making, especially in varying light conditions.

What are the key challenges facing the LiDAR market?

Key challenges include the high cost of some LiDAR technologies, performance limitations in extreme weather (fog, heavy rain), the complexity of data processing, and the need for standardized regulatory frameworks to enable widespread adoption and deployment.

What are the different types of LiDAR technology used in vehicles?

Vehicle LiDAR technologies primarily include mechanical (rotating) LiDAR, and solid-state LiDAR which comprises MEMS, Flash, OPA (Optical Phased Array), and FMCW (Frequency Modulated Continuous Wave) types, each offering distinct advantages in terms of cost, size, and performance.

What is the future outlook for the Vehicle Grade 3D LiDAR market?

The future outlook is highly positive, driven by the rapid growth of autonomous vehicle development, declining sensor costs, continuous technological advancements (especially in solid-state and FMCW LiDAR), and increasing demand for advanced vehicle safety features, leading to significant market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager