Vehicle Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433742 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vehicle Instrument Cluster Market Size

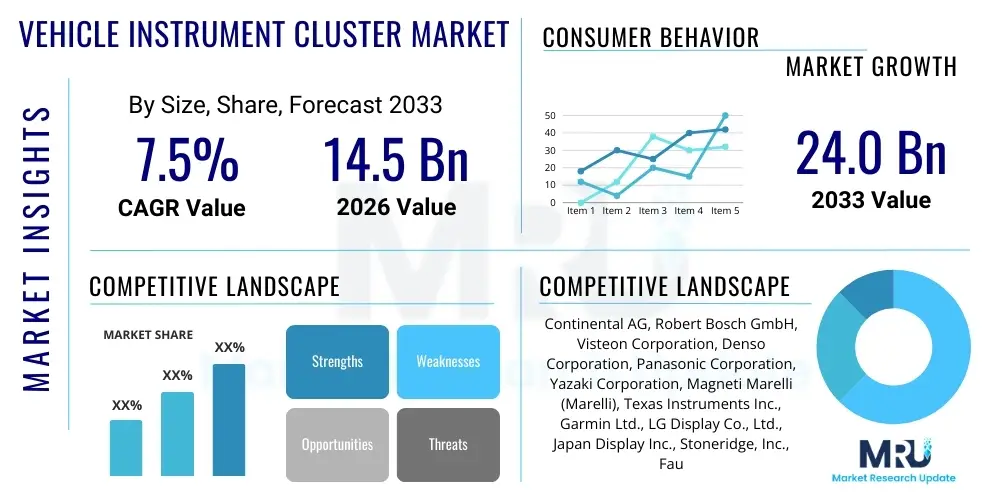

The Vehicle Instrument Cluster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $24.0 Billion by the end of the forecast period in 2033.

Vehicle Instrument Cluster Market introduction

The Vehicle Instrument Cluster Market encompasses the technologies and components used to provide essential driving and vehicle status information to the operator. Traditionally, these clusters relied on mechanical analog gauges. However, the market has undergone a radical transformation driven by the automotive industry's pivot toward digitalization, connectivity, and advanced driver-assistance systems (ADAS). Modern instrument clusters, often fully digital (known as digital cockpits), serve as sophisticated human-machine interface (HMI) systems, integrating complex navigation, infotainment data, vehicle diagnostics, and safety alerts into a customizable, visually rich display. The core product is evolving from a mere informational panel into a critical component of the integrated vehicle environment.

Major applications of these advanced clusters are pervasive across the automotive sector, spanning passenger vehicles (sedans, SUVs, luxury cars), commercial vehicles (trucks, buses), and specialized vehicles. The primary benefit derived from these digital clusters is enhanced driver safety and convenience. By consolidating disparate information streams—such as speed, fuel level, engine status, navigation prompts, and ADAS warnings—into a cohesive, ergonomically designed display, driver distraction is minimized, and critical information accessibility is maximized. Furthermore, the flexibility of digital displays allows OEMs to differentiate their product offerings significantly, providing personalized user experiences that cater to modern consumer expectations for technological integration.

Key driving factors propelling market expansion include stringent global safety regulations mandating clearer presentation of warning indicators, the increasing production and adoption of electric vehicles (EVs) which necessitate specific battery and range information displays, and the consumer demand for premium, technologically advanced vehicle interiors. The integration of advanced computational capabilities, often powered by high-performance GPUs and sophisticated operating systems, allows these clusters to handle vast amounts of data generated by connected car technologies and sensors, further solidifying their role as the central informational hub within the vehicle architecture. This foundational shift towards intelligent, software-defined cockpits is fundamentally reshaping the supplier landscape and driving significant investment in R&D.

Vehicle Instrument Cluster Market Executive Summary

The global Vehicle Instrument Cluster Market is characterized by a rapid technological transition from traditional analog and hybrid clusters towards high-resolution, fully digital displays. Key business trends indicate a strong push for integration, with Tier 1 suppliers developing consolidated domain controllers capable of managing both the instrument cluster and the central infotainment system, leading to cost efficiencies and improved seamlessness of the user experience. The increasing penetration of semiconductor technology and sophisticated graphical processors is driving average selling prices upwards in the premium segment, while standardization efforts are making basic digital clusters more accessible in mass-market vehicles. Strategic partnerships between automotive OEMs, traditional Tier 1 suppliers, and software technology providers (like chip manufacturers and OS developers) are critical to maintaining competitive edge and accelerating the pace of innovation within the digital cockpit space.

Regionally, the Asia Pacific (APAC) region dominates the market, primarily fueled by the massive production volumes in China, the aggressive adoption of electric vehicles, and the emergence of domestic automotive giants prioritizing digital integration. North America and Europe demonstrate mature market characteristics, focusing intensely on advanced features such as augmented reality Head-Up Displays (HUDs), seamless connectivity protocols (5G integration), and highly customized, luxurious digital interfaces. Regulatory pressures related to vehicle safety standards, particularly in Europe, are also driving the mandatory incorporation of specific warning indicators, which are most effectively delivered via fully digital systems, thereby boosting regional demand.

Segment trends highlight the significant growth of the fully Digital Instrument Cluster segment, expected to eclipse the Analog/Hybrid cluster segment over the forecast period. Within the technology sub-segment, TFT-LCD remains the dominant display type due to cost-effectiveness, but OLED and P-OLED are gaining traction, especially in the luxury and premium vehicle categories, offering superior contrast ratios and design flexibility. Furthermore, the rapid growth in Electric Vehicle production is creating a specialized demand segment for clusters optimized for real-time energy management, charge status, and regenerative braking indicators, fundamentally altering the functional requirements and display priorities compared to internal combustion engine (ICE) vehicles.

AI Impact Analysis on Vehicle Instrument Cluster Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vehicle Instrument Cluster Market primarily revolve around three core themes: personalized HMI experiences, the role of AI in processing complex sensor data for ADAS visualization, and how AI can prevent driver distraction while simultaneously delivering more data. Users are keen to understand if AI will enable the cluster to become truly context-aware, adjusting the display layout and priority of information dynamically based on driving conditions, driver state (fatigue detection), and navigational complexity. Concerns often relate to data privacy associated with continuous driver monitoring and ensuring the reliability of AI-driven alerts, especially concerning critical safety functions.

The key consensus emerging from user expectations is that AI integration will shift the instrument cluster from a passive display device to an active, intelligent interface. AI algorithms are crucial for filtering and prioritizing the deluge of data generated by modern vehicles—including inputs from radar, lidar, camera systems, and vehicle networks—to present only the most relevant safety information instantaneously. This shift necessitates powerful edge computing capabilities within the cluster hardware. Furthermore, machine learning is increasingly applied to understand driver preferences and habits, allowing the cluster to proactively suggest shortcuts, manage power consumption in EVs, or personalize ambient lighting and graphical themes, dramatically enhancing the perceived quality and adaptability of the vehicle cabin.

- AI enables dynamic HMI adaptation based on real-time driving context and environment.

- Predictive maintenance alerts and system diagnostics are improved through machine learning models analyzing vehicle data.

- AI supports personalized cockpit experiences, adjusting layouts, themes, and information priority for different drivers.

- Integration with driver monitoring systems (DMS) allows AI to detect fatigue or distraction and issue timely, non-intrusive warnings displayed on the cluster.

- AI facilitates the intelligent visualization of complex ADAS data, rendering surrounding objects and autonomous system status clearly and quickly.

DRO & Impact Forces Of Vehicle Instrument Cluster Market

The market for vehicle instrument clusters is strongly influenced by a combination of foundational drivers, technological limitations acting as restraints, and emerging opportunities stemming from the shift towards autonomous and electrified mobility. The primary driving force is the global demand for advanced safety features, where digital clusters provide the necessary flexibility to integrate complex ADAS visuals, traffic sign recognition, and mandatory warning indicators clearly and effectively. Concurrently, increasing consumer demand for technologically sophisticated and aesthetically appealing vehicle interiors, particularly the shift towards large-format, seamlessly integrated digital screens that mimic consumer electronic devices, exerts significant upward pressure on market growth. The rapid electrification of the automotive fleet also necessitates specialized digital clusters capable of optimizing and displaying range, charging schedules, and energy flow management, which analog systems cannot achieve.

Restraints primarily revolve around the high initial cost associated with fully digital clusters, particularly those utilizing premium OLED technology or complex augmented reality features, making penetration challenging in the highly cost-sensitive entry-level and commercial vehicle segments. Furthermore, the reliance on complex software and connectivity introduces significant cybersecurity vulnerabilities, requiring stringent design protocols and continuous updates, which increases the total cost of ownership and development risk for OEMs. The ongoing global shortage and fluctuating prices of critical semiconductor components required for high-performance clusters also pose an immediate operational constraint, affecting production stability and supply chain efficiency across the industry.

Opportunities are abundant, particularly in the realm of future mobility. The convergence of instrument clusters with Head-Up Displays (HUDs) and centralized domain controllers presents avenues for optimizing hardware costs and software integration. The development of advanced Human-Machine Interfaces (HMI) that leverage gesture control, voice commands, and sophisticated visual feedback offers a path to superior user interaction. Furthermore, the rise of software-defined vehicles (SDVs) means that instrument clusters can be updated over-the-air (OTA), creating new revenue streams for OEMs through feature upgrades and customization packages. The potential integration of holographic or 3D display technologies represents a long-term growth opportunity focused on providing unparalleled depth and clarity to driving information.

Segmentation Analysis

The Vehicle Instrument Cluster Market is comprehensively segmented based on three primary categories: Display Type, Technology, and Vehicle Type. This segmentation allows for precise market analysis, reflecting the diversity in product offerings and consumer adoption patterns across different vehicle classes and price points. The ongoing migration towards fully digital cockpits is the most critical trend defining these segments, impacting supplier investments and OEM product strategies globally. The dominance of digital displays reflects the increasing requirements for integrating complex navigation, media, and advanced safety features, which are poorly supported by legacy analog systems.

Based on Display Type, the market is categorized into Analog, Hybrid, and Digital Clusters. Analog clusters, while declining, still hold a share in cost-sensitive markets. Hybrid clusters, combining mechanical gauges with a small digital screen, represent a transitional technology. However, Digital Clusters, offering full screen flexibility, personalization, and high-resolution graphical capabilities (often leveraging TFT-LCD or OLED panels), are the fastest-growing segment. Segmentation by Technology primarily focuses on the type of display panel utilized—TFT-LCD being the market volume leader due to cost efficiency and maturity, while superior-quality OLED/P-OLED panels capture the high-end luxury vehicle segment. Finally, segmentation by Vehicle Type separates Passenger Vehicles (PVs), which prioritize aesthetic integration and personalization, from Commercial Vehicles (CVs), which emphasize durability, reliability, and clear presentation of operational metrics.

- By Display Type:

- Analog Clusters

- Hybrid Clusters

- Digital Clusters (Fully Reconfigurable)

- By Technology:

- Thin-Film Transistor Liquid Crystal Display (TFT-LCD)

- Organic Light-Emitting Diode (OLED)

- Passive Matrix OLED (P-OLED)

- Head-Up Display (HUD) Integration

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Vehicle Propulsion:

- Internal Combustion Engine (ICE)

- Electric Vehicle (EV)

- Hybrid Electric Vehicle (HEV)

Value Chain Analysis For Vehicle Instrument Cluster Market

The value chain for the Vehicle Instrument Cluster Market is complex and involves multiple highly specialized layers, starting from upstream component manufacturing and extending through midstream system integration to downstream distribution and end-user deployment. Upstream analysis focuses on suppliers of core electronic components, including semiconductor manufacturers (providing microprocessors, GPUs, and memory chips), display panel fabricators (TFT-LCD and OLED panels), and specialized sensor suppliers. These foundational components dictate the performance capabilities, resolution, and overall cost structure of the final instrument cluster. The competitive advantage at this stage often lies in miniaturization, power efficiency, and the ability to meet stringent automotive quality standards (AEC-Q100).

The midstream phase is dominated by Tier 1 suppliers, who are responsible for the system design, software integration, housing manufacturing, and final assembly of the instrument cluster module. Companies like Continental, Bosch, and Visteon act as system integrators, leveraging proprietary software stacks (HMI development, operating systems) to customize the cluster according to specific OEM requirements. This stage is crucial as it involves validating compliance with functional safety standards (ISO 26262) and ensuring seamless communication with the vehicle's broader electronic control units (ECUs) via communication protocols like CAN or Automotive Ethernet. The shift towards consolidated domain controllers is forcing these Tier 1 suppliers to enhance their software capabilities significantly.

Downstream analysis involves the direct and indirect distribution channels leading to the end-users. The vast majority of sales flow through Direct Channels, where Tier 1 suppliers deliver the finished clusters directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle production lines. The relationship here is deeply embedded and long-term, characterized by joint development contracts and strict quality assurance. Indirect Channels encompass the Aftermarket, which serves replacement parts, upgrades (e.g., analog to digital conversion kits), and modifications. While smaller in volume than the OEM channel, the aftermarket provides flexibility and caters to consumer demands for personalization and technological refresh cycles in older vehicles, often involving specialized installers and distributors.

Vehicle Instrument Cluster Market Potential Customers

The primary customers in the Vehicle Instrument Cluster Market are global automotive Original Equipment Manufacturers (OEMs), who constitute the largest segment of buyers due to the necessity of installing an instrument cluster in every new vehicle produced. OEMs demand high levels of customization, integration security, and reliability, selecting suppliers based on technological capability, scale of production, and ability to adhere to rigorous safety standards. The increasing differentiation between vehicle models, especially across luxury, mainstream, and electric vehicle portfolios, means OEMs often require multiple cluster variants from their suppliers, driving specialized purchasing requirements focused on display size, graphical processing power, and connectivity integration.

Secondary but significant buyers include Commercial Fleet Operators and Aftermarket Retailers. Commercial fleet operators (trucking companies, bus services, logistics providers) prioritize clusters that offer robust durability, clear telematics integration, and specialized operational data, such as driver behavior metrics and fuel efficiency indicators. Their purchasing decisions are highly sensitive to lifecycle cost and operational longevity. Aftermarket retailers and independent service operators purchase clusters either for replacement due to failure or for consumer-driven upgrades. As digital clusters become more standardized, the aftermarket for cluster upgrades is expected to grow, driven by consumers seeking to refresh the technology in their existing vehicles without purchasing a new one.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $24.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Visteon Corporation, Denso Corporation, Panasonic Corporation, Yazaki Corporation, Magneti Marelli (Marelli), Texas Instruments Inc., Garmin Ltd., LG Display Co., Ltd., Japan Display Inc., Stoneridge, Inc., Faurecia (FORVIA), Desay SV Automotive, Pioneer Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Instrument Cluster Market Key Technology Landscape

The technological landscape of the Vehicle Instrument Cluster Market is centered on advanced display technologies and robust, high-speed networking capabilities essential for handling integrated cockpit functions. Thin-Film Transistor Liquid Crystal Displays (TFT-LCDs) dominate the volume market due to their cost efficiency, reliability, and ability to provide high-resolution, full-color graphical output necessary for modern digital clusters. However, in the high-end segment, Organic Light-Emitting Diode (OLED) and Plastic OLED (P-OLED) technologies are increasingly preferred. OLED offers superior contrast ratios (true blacks), faster response times, and greater design flexibility due to its thin, pliable structure, enabling curved display surfaces that integrate seamlessly into complex dashboard designs, meeting the aesthetic demands of luxury vehicle manufacturers.

Beyond traditional screen technology, Head-Up Displays (HUDs), particularly those utilizing Augmented Reality (AR) technology, represent a significant area of innovation. AR-HUDs project critical information—such as navigation arrows, speed, and ADAS warnings—directly onto the driver’s line of sight, overlaid onto the real-world environment. This minimizes the time the driver's eyes are off the road, offering superior safety benefits compared to traditional cluster interaction. The technological hurdle here lies in integrating complex projection systems and ensuring accurate calibration relative to the vehicle's position and environment. Furthermore, the underlying electronic architecture is shifting away from decentralized ECUs to Consolidated Domain Controllers (CDCs) that manage multiple HMI functions (cluster, infotainment, telematics) through a single high-performance processor, streamlining communication and reducing latency via high-bandwidth communication protocols like Automotive Ethernet.

The shift to digital clusters is also inextricably linked to software innovation and data processing. Modern clusters rely on powerful Systems-on-Chips (SoCs) and Graphical Processing Units (GPUs), often supplied by technology giants, to render complex 3D graphics and manage sophisticated operating systems (like Linux, Android Automotive, or proprietary systems). Connectivity technologies, specifically CAN-FD (Flexible Data-Rate) and Automotive Ethernet, are critical for transmitting large volumes of data (especially from cameras and sensors) rapidly and reliably to the cluster processor. These technological advancements ensure that the instrument cluster remains the most authoritative source of real-time, mission-critical information for the driver, capable of handling the increasing data load generated by L2/L3 autonomous driving systems while maintaining required functional safety levels.

Regional Highlights

Geographical market dynamics demonstrate significant divergence based on production capacity, technological maturity, and regulatory environments. Asia Pacific (APAC) holds the largest market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is primarily driven by massive automotive production volumes in China, India, Japan, and South Korea, coupled with aggressive governmental initiatives promoting the rapid adoption and localized manufacturing of Electric Vehicles (EVs). Since EVs inherently require sophisticated digital clusters to manage battery status and range information, this segment is a major catalyst for growth in the region. Furthermore, APAC manufacturers are quickly integrating advanced digital cockpits into even mid-range vehicles to compete globally, driving high unit demand.

Europe represents a mature market characterized by stringent safety regulations and a strong inclination towards premium, high-specification vehicle interiors. European OEMs are leading the integration of sophisticated technologies such as large format, curved OLED clusters and cutting-edge Augmented Reality Head-Up Displays (AR-HUDs). The regulatory framework, particularly concerning safety indicators and standardized data presentation, mandates sophisticated display capabilities, ensuring high per-unit expenditure on advanced cluster technologies. The strong presence of established luxury vehicle manufacturers continually pushes the boundaries of HMI design and hardware performance.

North America is another key growth region, driven by high consumer spending power and a rapid shift towards large SUVs and trucks, which often feature oversized and feature-rich digital cockpits. The demand is concentrated on integration capability—consumers prioritize seamless connectivity with smartphone ecosystems and sophisticated infotainment integration managed through consolidated domain controllers. While regulatory safety requirements are strong, the market is also heavily influenced by consumer desire for advanced convenience features, leading to high adoption rates of advanced graphics and personalization options within the digital cluster interface.

- Asia Pacific (APAC): Market leader by volume; driven by China's immense automotive manufacturing base and accelerated EV adoption rates. Focus on cost-effective digitalization and high-volume production.

- Europe: High-value market segment; driven by strict safety regulations, luxury vehicle manufacturing, and early adoption of advanced technologies like OLED displays and AR-HUD systems.

- North America: Strong market for high-end digital cockpits and integrated systems; high consumer demand for connectivity, personalization, and features in large trucks and SUVs.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets showing gradual transition from analog to hybrid clusters; growth tied to vehicle fleet modernization and localized manufacturing expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Instrument Cluster Market.- Continental AG

- Robert Bosch GmbH

- Visteon Corporation

- Denso Corporation

- Panasonic Corporation

- Yazaki Corporation

- Magneti Marelli (Marelli)

- Nvidia Corporation

- LG Display Co., Ltd.

- Japan Display Inc.

- Texas Instruments Inc.

- Garmin Ltd.

- Faurecia (FORVIA)

- Desay SV Automotive

- Pioneer Corporation

- Stoneridge, Inc.

- Sharp Corporation

- Harman International (Samsung)

- Aptiv PLC

- Mitsubishi Electric Corporation

Frequently Asked Questions

Analyze common user questions about the Vehicle Instrument Cluster market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the market transition from analog to digital instrument clusters?

The primary driver is the necessity of integrating complex information from Advanced Driver-Assistance Systems (ADAS) and connectivity features into the driver’s interface. Digital clusters provide the flexibility, high resolution, and customization required to present critical safety and navigational data clearly, enhancing both safety and user experience, especially in modern electric and autonomous vehicles.

Which display technology dominates the Vehicle Instrument Cluster Market in terms of volume?

Thin-Film Transistor Liquid Crystal Display (TFT-LCD) technology currently dominates the volume segment of the market. TFT-LCD offers an optimal balance between high resolution, reliable performance, and cost-effectiveness, making it suitable for deployment across mass-market and mainstream vehicle segments globally.

How does the rise of Electric Vehicles (EVs) impact the design and functionality of instrument clusters?

EV adoption requires clusters to prioritize real-time battery status, remaining range calculation, energy flow visualization, and charge management interface functions. EV clusters are typically fully digital to accommodate complex graphical representations of energy recuperation and consumption, which necessitates more powerful processing hardware than those used in traditional internal combustion engine vehicles.

What role do Consolidated Domain Controllers (CDCs) play in the future of instrument clusters?

CDCs are merging the functions of the instrument cluster, infotainment system, and sometimes ADAS visualization onto a single, powerful processor. This reduces hardware complexity, improves data communication speeds (low latency), and allows for seamless interaction between different cockpit screens, thereby optimizing system integration and enabling over-the-air (OTA) software updates across the entire cockpit domain.

What are the major cybersecurity risks associated with advanced digital instrument clusters?

Digital clusters, due to their connectivity and increasing reliance on advanced operating systems, face risks such as unauthorized data access, manipulation of displayed safety information (e.g., speed or warning lights), and vulnerability to malware injection via external interfaces. Robust hardware security modules and secure boot processes are essential countermeasures employed by manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager