Vehicle License Plate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431873 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vehicle License Plate Market Size

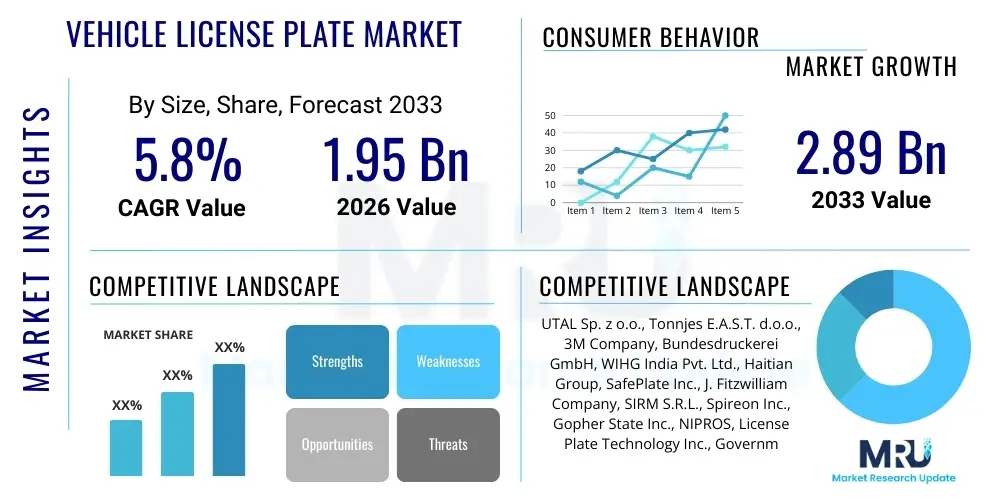

The Vehicle License Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.89 Billion by the end of the forecast period in 2033.

Vehicle License Plate Market introduction

The Vehicle License Plate Market encompasses the manufacturing, distribution, and implementation of official identification plates affixed to motorized vehicles. These plates serve as a mandatory regulatory instrument, providing unique alphanumeric identifiers essential for law enforcement, vehicle registration, taxation, and traffic management across global jurisdictions. The product range extends beyond traditional embossed metal plates to include sophisticated digital, RFID-embedded, and security-enhanced license plates designed to counter counterfeiting and facilitate advanced surveillance systems. The primary applications span governmental vehicle registries, private fleet management, intelligent transportation systems (ITS), and toll collection mechanisms. The fundamental benefit provided by this market is the establishment of a standardized, verifiable method for vehicle identification, crucial for maintaining public safety and regulatory compliance.

The driving factors propelling the growth of this market are deeply intertwined with increasing global vehicle parc volumes, stringent governmental mandates concerning vehicle security, and the pervasive adoption of smart city infrastructure. Governments worldwide are consistently upgrading their vehicle identification standards to incorporate features such as holographic overlays, laser etching, and sophisticated reflective materials to enhance visibility and security. Furthermore, the rising integration of advanced technologies like Automatic Number Plate Recognition (ANPR) cameras and electronic toll collection (ETC) systems necessitates high-quality, standardized, and machine-readable license plates. The continuous replacement cycles mandated by regulatory changes and the shift towards standardized international formats further stimulate demand for new plate production and distribution services.

Product innovation within the license plate sector is increasingly focused on smart technologies, notably the introduction of digital license plates (DLPs) in several key markets. These DLPs offer dynamic display capabilities, instant registration renewal updates, and enhanced anti-theft measures, fundamentally transforming the utility of a traditional license plate. While initial adoption is cautious due to high costs and regulatory hurdles, the long-term trend points toward integrating connectivity and electronic features into vehicle identification hardware. This transformation, driven by the quest for enhanced security, operational efficiency in enforcement, and seamless integration with broader ITS frameworks, underscores the transition of license plates from simple identifiers to integral components of the digital mobility ecosystem.

Vehicle License Plate Market Executive Summary

The Vehicle License Plate Market is currently undergoing significant evolution, driven by governmental mandates for security enhancements and the technological integration of digital solutions. Key business trends include the consolidation among major plate manufacturers who can offer end-to-end solutions, encompassing design, production, distribution, and secure database management. Market participants are increasingly focusing on securing long-term contracts with national governments or large regional authorities, which provides stable revenue streams but intensifies competitive pressures during bidding processes. Furthermore, there is a pronounced shift towards incorporating sustainable manufacturing practices, such as using recycled materials and reducing the environmental footprint of plate production, responding to global corporate sustainability goals and public procurement requirements.

Regionally, the market dynamics show diverse growth profiles. Developed regions like North America and Europe are witnessing steady demand driven by the regulatory push for digitalization, replacement of aging plates, and the widespread deployment of ANPR systems. These regions represent mature markets focused on premium, high-security, and digital plate adoption. Conversely, the Asia Pacific (APAC) region, particularly emerging economies such as India and China, demonstrates explosive growth fueled by rapid urbanization, substantial increases in vehicle sales, and governmental initiatives to centralize and standardize vehicle registration processes, often migrating from decentralized or less secure systems to unified, high-security formats. Latin America and the Middle East and Africa (MEA) are also experiencing substantial market expansion, often adopting turnkey solutions provided by international vendors to modernize their identification infrastructure.

In terms of segmentation, the security technology segment is poised for the fastest growth. High-security plates featuring integrated anti-counterfeiting elements like laser marking, retro-reflective sheeting, and holograms are becoming the industry standard due to escalating concerns over vehicle theft and regulatory circumvention. The material segment remains dominated by aluminum, valued for its durability and light weight, but polycarbonate and specialized plastics are gaining traction, especially in the production of digital license plate casings. Moreover, the shift toward electronic features, encompassing RFID tags for automated identification and embedded chips for dynamic information display, represents the most critical segment trend dictating future investment and technological direction within the vehicle license plate manufacturing sector.

AI Impact Analysis on Vehicle License Plate Market

Users commonly express interest in how AI enhances the existing functionalities of license plate technology, specifically querying improvements in enforcement accuracy, speed of identification, and the integration of predictive analytics into traffic management. Key themes revolve around the operational efficiency gains, such as reducing false positives in ANPR systems, enabling complex pattern recognition for identifying stolen or unregistered vehicles across large networks, and managing the vast datasets generated by high-volume camera installations. Consumers and enforcement agencies seek assurance regarding data privacy and security, questioning how AI-driven surveillance systems balance public safety needs with civil liberties, leading to expectations for robust governance models and transparent operational parameters for AI algorithms utilized in identifying vehicle identification tags.

The application of Artificial Intelligence primarily revolutionizes the downstream consumption and utility of license plates rather than the manufacturing process itself. AI algorithms are crucial for refining Automatic Number Plate Recognition (ANPR) and optical character recognition (OCR) systems, significantly improving accuracy rates under challenging conditions such as poor lighting, high speeds, or damaged plates. This enhancement in reliability reduces manual intervention and increases the efficiency of automated tolling, parking enforcement, and real-time criminal detection systems. Furthermore, AI facilitates the rapid cross-referencing of plate data with centralized police and government databases, enabling instant identification of vehicles associated with outstanding warrants, unpaid fees, or safety violations, thereby bolstering the effectiveness of law enforcement and governmental oversight.

Beyond simple recognition, AI enables sophisticated behavioral analysis using license plate data as a primary input. By analyzing movement patterns captured by multiple fixed and mobile ANPR readers, AI models can detect anomalies indicative of illegal activity, optimize traffic flow planning, and predict congestion points. This transition transforms license plates from passive identifiers into active data points within an Intelligent Transportation System (ITS) framework. However, this advancement mandates the development of highly standardized and durable plates optimized for machine readability, driving manufacturers to adopt superior reflective coatings, consistent fonts, and robust security features to ensure high data capture quality for AI systems, indirectly influencing production standards.

- AI optimizes ANPR systems for higher accuracy rates (99%+), even in suboptimal environmental conditions.

- Predictive policing models use plate data to analyze movement patterns and identify suspicious vehicles or routes.

- AI integration enhances electronic toll collection by accelerating transaction processing and reducing identification errors.

- Facilitates real-time, large-scale data cross-referencing with national vehicle registration and criminal databases.

- Drives demand for machine-readable, high-contrast, standardized plates optimized for algorithmic processing.

- Improves traffic management systems by analyzing vehicle flow derived from sequential plate readings across urban networks.

DRO & Impact Forces Of Vehicle License Plate Market

The Vehicle License Plate Market is strongly influenced by a complex interplay of governmental regulations (Drivers), high initial investment costs for security integration (Restraints), technological advancements offering new identification solutions (Opportunities), and the stringent mandates for enhancing national security and combating vehicular fraud (Impact Forces). The market's stability is largely predicated on mandatory legal requirements for vehicle registration and identification, meaning demand is inherently inelastic. However, the pace of technological change and the varying adoption rates across different economies introduce significant variability, necessitating manufacturers to remain agile in product development and compliance assurance. The ongoing battle against counterfeiting remains a dominant force, compelling continuous innovation in high-security features.

Drivers for market growth are predominantly regulatory and demographic. Global increases in vehicle ownership, particularly in rapidly developing nations, necessitate massive production scaling of identification plates. Simultaneously, strict government legislation demanding high-security features—such as integrated RFID tags, unique holographic security markers, and tamper-proof mounting mechanisms—drive the premium segment. Technological convergence, notably the widespread implementation of smart city programs and ITS, mandates plates compatible with automated reading systems. Furthermore, the mandatory replacement cycles imposed by many governments to update outdated or damaged plates ensure consistent recurring demand across the forecast period, underpinning the market's foundational stability.

Restraints, however, pose significant challenges to maximizing market potential. The high initial capital investment required for governments to implement sophisticated centralized plate production systems and the associated secure database infrastructure can be prohibitive for budget-constrained regions. Additionally, public resistance and high costs associated with adopting highly advanced plates, such as Digital License Plates (DLPs), slow the adoption rate in consumer markets. Furthermore, the persistent threat of counterfeiting, despite enhanced security features, necessitates ongoing investment in anti-fraud measures, increasing production costs and potentially leading to market skepticism regarding the efficacy of new security protocols. Opportunities lie primarily in expanding digital and electronic identification solutions. The shift toward Digital License Plates (DLPs) presents substantial high-margin opportunities for specialized technology providers. Developing countries represent huge untapped potential for modernization projects, offering large-scale, long-term contractual opportunities for integrated secure plate systems. Furthermore, market participants can capitalize on the growing demand for sustainable and eco-friendly plate materials, aligning with global environmental governance trends.

Impact forces largely center on regulatory stringency and the need for global interoperability. Governments are increasingly prioritizing national security through enhanced vehicle tracking capabilities, making tamper resistance and immediate electronic traceability non-negotiable requirements. The global migration toward standardized plate formats, although slow, is an underlying force simplifying production for international vendors. The political stability and enforcement capabilities of a nation directly impact the success and revenue generation potential of high-security plate contracts, making regulatory environments a critical variable in market assessment and strategic planning for manufacturers.

Segmentation Analysis

The Vehicle License Plate Market is systematically segmented based on Type, Material, Technology, and Application, providing a structured view of market dynamics and growth potential across various dimensions. Understanding these segments is crucial for manufacturers to tailor their product offerings to specific governmental and commercial needs. The differentiation based on Type, such as standard embossed plates versus specialized digital plates, reflects the technological maturity and regulatory requirements of different end-markets, with advanced types commanding higher price points and stricter compliance standards. This comprehensive segmentation allows stakeholders to analyze key drivers and restraints unique to each product category, facilitating targeted investment and strategic market entry decisions.

The segmentation by Material—primarily aluminum, plastic/polycarbonate, and specialized composite materials—highlights the trade-offs between cost, durability, weight, and the ability to integrate sophisticated security features. Aluminum remains the dominant material due to its proven resilience and low cost, but specialized materials are gaining ground, particularly for plates requiring highly specific technical specifications, such as heat resistance or enhanced radio frequency transparency for embedded RFID tags. Technological segmentation, covering aspects like reflectivity, security elements (holograms, laser etching), and electronic integration (RFID, Digital Display), represents the future growth trajectory, emphasizing the ongoing shift from passive identification toward active, smart identification systems integrated into the broader IoT ecosystem.

Finally, Application-based segmentation distinguishes between the massive volumes driven by New Vehicle Registration and the recurring, necessary demand from Replacement Plates (due to damage, theft, or regulatory change). Government Fleet and Commercial Fleet applications often demand bulk orders with specific management features, such as fleet-specific numbering or integrated tracking features, while individual private vehicle registration forms the backbone of the steady annual market demand. Analyzing these distinct segments provides clarity on where the most robust revenue opportunities lie, typically pointing toward government contracting for secure, mass-produced plates, while high-tech DLPs represent the premium, future-oriented niche.

- By Type:

- Standard Embossed Plates

- High-Security Plates (HSP)

- Digital License Plates (DLP)

- Temporary Plates

- By Material:

- Aluminum

- Plastic/Polycarbonate

- Composite Materials

- By Technology/Security Feature:

- Retro-reflective Sheeting

- Holograms and Watermarks

- RFID Tags (Passive/Active)

- Laser Etching and Micro-printing

- By Application/End-User:

- New Vehicle Registration

- Replacement Plates

- Government and Public Fleets

- Commercial Fleets (Logistics, Taxi, Rental)

Value Chain Analysis For Vehicle License Plate Market

The Value Chain for the Vehicle License Plate Market begins with the upstream sourcing and processing of raw materials, primarily specialized aluminum sheets, reflective sheeting (often proprietary technology), and high-security inks and holograms. This phase is characterized by procurement relationships with specialized chemical and metal suppliers who must adhere to stringent quality and safety standards, particularly concerning reflectivity and durability specifications mandated by regulatory bodies like ISO and various national highway safety administrations. The specialized nature of security materials, which are often patented or supplied under strict governmental oversight, creates bottlenecks and dependency on a select group of high-tech material producers, significantly influencing the total production cost and security integrity of the final product.

The mid-stream segment involves the core manufacturing process: cutting, shaping, embossing, applying reflective films, hot stamping of alphanumeric characters, and, crucially, embedding security features like laser marks or RFID chips. This phase requires significant capital expenditure in specialized machinery (e.g., embossing presses, hot stamping equipment, and digital display assembly lines) and adherence to strict chain-of-custody protocols to prevent materials from entering unauthorized channels. Major manufacturers often perform these steps in secure, audited facilities, reflecting the sensitive nature of producing official identification documents. Quality control and regulatory compliance checks, ensuring font style, size, color, and reflectivity meet exact governmental specifications, are paramount at this stage.

The downstream segment, encompassing distribution and implementation, is highly regulated. Distribution often occurs directly from the secure manufacturer to centralized government agencies (e.g., Department of Motor Vehicles or equivalent transport authorities) or designated secure retail/installation centers. Direct distribution channels ensure maximum security and accountability, minimizing opportunities for tampering or diversion. Indirect distribution, though less common for high-security plates, may involve authorized third-party logistics providers under strict contractual agreements for plate delivery to regional registration offices. The final link involves the secure attachment of the plate to the vehicle, often utilizing tamper-proof seals or fasteners, completing the regulatory loop and ensuring the plates are correctly associated with the vehicle database entry, which is critical for law enforcement and automated systems.

Vehicle License Plate Market Potential Customers

The primary customers in the Vehicle License Plate Market are governmental organizations and agencies responsible for national or regional vehicle registration and transportation regulation. This includes Ministries of Transport, Department of Motor Vehicles (DMVs), federal and state police authorities, and specialized bodies managing toll roads and electronic enforcement systems. These entities represent the largest procurement sector, requiring high volumes of plates that meet specific, often unique, security and durability standards. Their purchasing decisions are driven by mandatory compliance, long-term contract reliability, security features, and the vendor's ability to manage complex, large-scale, secure supply chains and database integrations.

A secondary, yet rapidly growing, segment of potential customers includes large commercial fleet operators and logistics companies. Although standard plates are procured through government channels, commercial entities often require ancillary services and specialized plate features compatible with their internal fleet management systems, such as specific barcoding or enhanced passive RFID for yard management and logistical tracking. Additionally, vehicle manufacturers (OEMs) constitute a customer base for temporary or transit plates used during the vehicle delivery process. The demand from commercial sectors is often focused on efficiency, durability under heavy use, and integration capability with existing telematics and tracking infrastructure.

Finally, the growing market for specialized and premium license plates, such as digital license plates (DLPs) or personalized novelty plates (where permitted by law), targets individual vehicle owners, though this market operates within the regulatory framework established by the government. While individual consumers do not purchase standard registration plates directly from the manufacturer, they are the end-users who ultimately drive replacement demand due to damage, loss, or changes in regulatory requirements. The adoption of advanced technologies like DLPs will shift a portion of the expenditure directly onto the consumer, requiring manufacturers to address consumer concerns regarding aesthetics, functionality, and cost-effectiveness while maintaining governmental security standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.89 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UTAL Sp. z o.o., Tonnjes E.A.S.T. d.o.o., 3M Company, Bundesdruckerei GmbH, WIHG India Pvt. Ltd., Haitian Group, SafePlate Inc., J. Fitzwilliam Company, SIRM S.R.L., Spireon Inc., Gopher State Inc., NIPROS, License Plate Technology Inc., Government Security Group, Digital Plate Technologies, Compliance Services International, Waldale Manufacturing, Fine Art Security Systems, Plates of Distinction, Jali Company Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle License Plate Market Key Technology Landscape

The technological evolution of the Vehicle License Plate Market is characterized by a strong emphasis on security features, machine readability, and electronic integration, moving beyond simple metallic identification. A foundational technology remains retro-reflective sheeting, which is essential for ensuring the plate is highly visible and legible under low-light conditions and to ANPR camera systems. Advanced retro-reflective materials incorporate micro-prismatic elements that significantly enhance reflectivity and angularity performance, exceeding traditional glass-bead sheeting standards. Crucially, sophisticated security technologies like embedded holograms, micro-printing, and laser etching are now standard requirements in high-security plate contracts globally. These features provide multi-layered defense against tampering and counterfeiting, requiring specialized equipment both for production and verification, thereby raising the barrier to entry for unauthorized manufacturers.

The most transformative technology influencing this landscape is Radio-Frequency Identification (RFID) and, increasingly, Near Field Communication (NFC) integration. RFID tags, either embedded directly within the plate structure or attached as secure decals, allow for non-contact, high-speed identification, making them invaluable for electronic toll collection (ETC), parking management, and real-time vehicle tracking. The passive RFID tags are widely used due to their cost-effectiveness, while active RFID tags offer greater range and data transmission capabilities, often utilized in high-value asset tracking or specific commercial fleet applications. The shift towards secure, encrypted data storage within these chips ensures that the electronic identity remains tamper-proof and linked securely to the vehicle registration database, significantly enhancing enforcement capabilities.

Furthermore, the development and initial deployment of Digital License Plates (DLPs) represent the cutting edge of technological advancement. DLPs utilize high-definition electronic screens (often E-Ink or specialized LCD) to display registration information dynamically. These plates offer features such as remote updating of registration status, integration with digital payment systems for tolls, emergency messaging capabilities, and enhanced anti-theft measures like dynamic GPS tracking and remote disabling. While currently facing regulatory hurdles and high manufacturing costs, DLPs are seen as the future standard, fundamentally changing the plate from a static physical object to a connected electronic device, requiring expertise in ruggedized electronics, power management, and secure wireless communication protocols compliant with automotive standards.

Regional Highlights

Market activity and growth rates for the Vehicle License Plate Market vary significantly across geographical regions, reflecting differences in vehicle parc size, regulatory modernization efforts, and technological adoption capabilities. North America, driven by the United States and Canada, is a mature market characterized by stringent state-level security requirements and high penetration of ANPR systems. Growth here is primarily fueled by the mandatory replacement of older plates, the adoption of premium security features, and the piloting and scaling of Digital License Plate technology in states such as California, providing a model for future national adoption. The emphasis remains on seamless integration with existing law enforcement infrastructure and tackling jurisdictional complexities in data sharing.

Europe demonstrates a stable market, propelled by harmonization efforts across the European Union regarding plate standards (though national formats remain predominant) and a strong regulatory focus on vehicle security and environmental control. Countries like Germany and the UK exhibit high demand for robust, anti-counterfeiting features and high-quality reflective sheeting. Eastern European countries, undergoing modernization of their public security and vehicle registration systems, present substantial opportunities for large-scale contract procurement of centralized high-security plate production facilities. The European market is also increasingly sensitive to sustainability in manufacturing, favoring producers with certified eco-friendly processes.

Asia Pacific (APAC) stands out as the highest growth region globally, led by massive vehicle population expansion in China, India, and Southeast Asian nations. Regulatory shifts in countries like India, mandating High-Security Registration Plates (HSRPs) with RFID tags, have created colossal, sustained demand for advanced plate production capabilities. This region is characterized by large government contracts aimed at combating widespread vehicle theft and improving tax collection efficiency. Latin America and the Middle East and Africa (MEA) are emerging markets characterized by significant governmental investment in secure vehicle identification as part of broader efforts to enhance national security and modernize outdated registration systems. These regions often favor turnkey solutions encompassing secure manufacturing, distribution, and IT integration provided by experienced international vendors.

- North America (US and Canada): Focus on Digital License Plate pilot programs, advanced ANPR integration, and high-security replacement cycles.

- Europe: Stable demand driven by harmonization efforts, mandatory security upgrades, and strong focus on eco-friendly manufacturing materials.

- Asia Pacific (APAC): Explosive growth fueled by massive vehicle parc increase, government mandates for HSRP and RFID technology (e.g., India's HSRP implementation).

- Latin America: Modernization efforts driving demand for secure, centralized production systems and anti-fraud features across multiple nations.

- Middle East and Africa (MEA): High growth potential driven by smart city initiatives, enhanced security requirements, and adoption of electronic identification for vehicle tracking and traffic enforcement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle License Plate Market.- UTAL Sp. z o.o.

- Tonnjes E.A.S.T. d.o.o.

- 3M Company

- Bundesdruckerei GmbH

- WIHG India Pvt. Ltd.

- Haitian Group

- SafePlate Inc.

- J. Fitzwilliam Company

- SIRM S.R.L.

- Spireon Inc.

- Gopher State Inc.

- NIPROS

- License Plate Technology Inc.

- Government Security Group

- Digital Plate Technologies

- Compliance Services International

- Waldale Manufacturing

- Fine Art Security Systems

- Plates of Distinction

- Jali Company Ltd.

Frequently Asked Questions

Analyze common user questions about the Vehicle License Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards High-Security Registration Plates (HSRPs)?

The shift is primarily driven by stringent governmental mandates aimed at combating vehicle theft, reducing counterfeiting, and streamlining electronic enforcement. HSRPs incorporate advanced features like tamper-proof seals, holograms, and unique identification codes, significantly improving public security and tax compliance integrity across national registries.

How do Digital License Plates (DLPs) differ from traditional plates, and what are their benefits?

DLPs replace static physical plates with electronic screens capable of dynamic display. They offer real-time updating of registration and validation information, remote messaging capabilities, integrated GPS tracking for anti-theft measures, and seamless electronic payment integration for tolls and parking, marking a transition to connected vehicle identification.

Which geographical region exhibits the highest growth potential for license plate manufacturing?

The Asia Pacific (APAC) region, led by populous nations like India and China, presents the highest growth potential. This growth is spurred by rapid vehicle population expansion, extensive government infrastructure projects requiring standardized identification, and large-scale implementation of new mandatory security plates (e.g., RFID-enabled HSRPs).

What role does Artificial Intelligence (AI) play in the Vehicle License Plate Market?

AI significantly enhances the efficiency of downstream applications, primarily through improving the accuracy and speed of Automatic Number Plate Recognition (ANPR) systems. AI algorithms enable sophisticated data analysis for traffic management, behavioral tracking, and real-time cross-referencing against national law enforcement databases, making enforcement more reliable.

What are the main restraints hindering the global adoption of advanced license plate technologies?

The primary restraints include the high initial capital investment required by governments to implement new secure manufacturing infrastructure and integrated IT systems, coupled with the high per-unit cost of advanced products like Digital License Plates (DLPs), which face consumer price sensitivity and regulatory caution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Vehicle License Plate Market Size Report By Type (Aluminum License Plate, Plastic License Plate, Other), By Application (Passenger Vehicles, Commercial Vehicles), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Vehicle License Plate Recognition Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (ANPR Cameras, Software, Frame Grabbers, Triggers), By Application (Traffic Management, Law Enforcement, Electronic Toll Collection, Parking Management), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager