Vehicle Lidar Optical Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433337 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Vehicle Lidar Optical Components Market Size

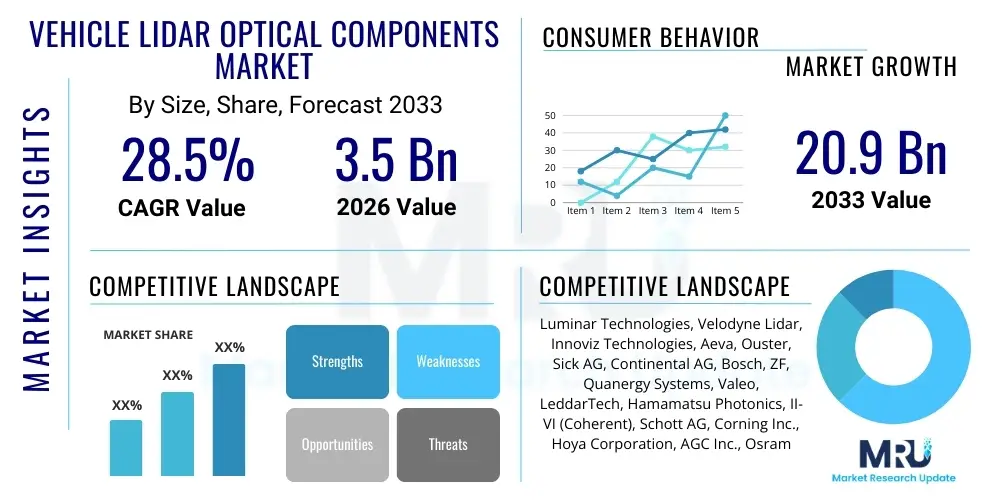

The Vehicle Lidar Optical Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $20.9 Billion by the end of the forecast period in 2033.

Vehicle Lidar Optical Components Market introduction

The Vehicle Lidar Optical Components Market encompasses specialized hardware elements critical for the functionality of Light Detection and Ranging (Lidar) systems integrated into modern automobiles. These components, including laser emitters (such as VCSELs and EELs), highly sensitive detectors (like SPADs and APDs), complex beam steering mechanisms (MEMS mirrors or optical phase arrays), and high-precision optics (lenses, prisms, filters), are essential for generating, transmitting, and receiving the light signals that allow Lidar sensors to create accurate, high-resolution 3D maps of the surrounding environment. The primary function of these components is to ensure the reliability, resolution, and range necessary for advanced safety features and autonomous driving capabilities (ADAS Levels 3, 4, and 5).

The escalating demand for enhanced vehicular safety and the rapid progression toward fully autonomous driving technology are the dominant factors propelling this market. Lidar systems offer superior performance compared to traditional radar and camera systems, especially in poor lighting conditions or complex driving scenarios, by providing robust depth perception and object classification. Major applications span from basic driver assistance systems (ADAS) focused on collision avoidance and adaptive cruise control, up to complete autonomy in both passenger vehicles and commercial fleet operations. The inherent reliability and decreasing cost curve associated with solid-state Lidar technology are democratizing its adoption across various vehicle segments, further accelerating the need for advanced, miniaturized, and cost-effective optical components.

Key benefits derived from utilizing high-quality Lidar optical components include enhanced measurement accuracy, increased sensing range, resilience to external environmental interference, and reduced system size and power consumption. The driving factors involve stringent global governmental regulations mandating higher levels of vehicular safety, significant investments by automotive OEMs and technology giants into autonomous vehicle development, and continuous technological breakthroughs in semiconductor manufacturing and photonics engineering, specifically concerning the integration of components onto single chips (photonic integrated circuits - PICs). These advancements are lowering the overall bill of materials (BOM) for Lidar systems, making them viable for mass-market deployment.

Vehicle Lidar Optical Components Market Executive Summary

The Vehicle Lidar Optical Components market is experiencing a pivotal transition driven by technological maturity and mass market adoption. Key business trends indicate a strong focus on vertical integration among Lidar system manufacturers who are acquiring or partnering with component specialists to secure supply chains and optimize proprietary designs. The shift from bulky, expensive mechanical Lidar towards compact, durable, and production-scalable solid-state and semi-solid-state solutions (utilizing technologies like MEMS and OPA) is reshaping the competitive landscape, emphasizing the need for highly precise, wafer-level manufactured optical components.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive electric vehicle (EV) penetration and aggressive governmental support for autonomous technology development in China and South Korea. North America and Europe remain foundational markets, leading in research and development and premium vehicle segment adoption, driven by technology hubs like Silicon Valley and stringent Euro NCAP safety standards that favor advanced sensor suites. Segment-wise, the Optics segment (lenses, diffusers, beam steerers) dominates in terms of value, while the Laser Emitters segment (especially VCSEL arrays) is demonstrating the highest growth velocity due to its critical role in enabling low-cost, high-performance flash Lidar designs suitable for mass production.

Overall, the market dynamic is characterized by intense cost reduction pressures coupled with escalating performance demands (higher resolution, longer range, superior angular coverage). The trend is moving towards components compatible with 1550 nm wavelengths, favored for their enhanced eye safety and long-range capabilities, though 905 nm systems currently hold the volume advantage. Successful market participants are those who can successfully navigate the semiconductor fabrication scaling challenges and deliver highly reliable, automotive-grade components capable of withstanding harsh operational environments while maintaining competitive pricing suitable for high-volume automotive production runs.

AI Impact Analysis on Vehicle Lidar Optical Components Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vehicle Lidar Optical Components Market frequently center on whether AI-powered perception software will reduce the complexity or required resolution of Lidar hardware, or conversely, whether AI necessitates even higher data quality from the optical components. Users are keen to understand how sophisticated machine learning algorithms affect the demand for specific component types, such as high-density detector arrays or specialized optics designed to mitigate noise and improve signal-to-noise ratios. The key themes revolve around system optimization, the trade-off between hardware cost and software capability, and the future relevance of optical component specifications in an increasingly software-defined vehicle architecture. Concerns often focus on standardization and interoperability, anticipating that AI models trained on specific Lidar data formats might constrain component innovation.

AI's primary influence is accelerating the demand for components that provide superior raw data fidelity and reliability, enabling more robust perception systems. While AI software handles the interpretation and classification of Lidar point clouds, the accuracy of that interpretation relies directly on the precision and resolution delivered by the optical components. Therefore, AI drives the requirement for smaller pixel sizes in SPAD arrays, higher output power stability in VCSEL emitters, and better aberration correction in lenses, ensuring that the input data for the AI pipeline is flawless. Furthermore, AI facilitates real-time calibration and noise suppression, which allows component manufacturers to push the boundaries of miniaturization and cost reduction without compromising overall system performance, thus driving innovation in compact optical modules.

The synergy between Lidar optical components and AI algorithms is crucial for operational safety. Advanced AI models, especially deep learning networks, require consistent and highly repeatable data across diverse environmental conditions. This puts tremendous pressure on component manufacturers to ensure thermal stability, longevity, and environmental robustness (vibration, temperature swings) for every optical element. Components that contribute to dense point cloud generation, such as fast-scanning MEMS mirrors or wide-field-of-view diffractive optics, are highly valued as they feed rich, diverse datasets essential for training and running complex AI perception stacks, ultimately validating the investment in high-performance optical hardware.

- AI necessitates higher fidelity optics for generating reliable, high-resolution point clouds.

- AI algorithms drive demand for stable and consistent laser emitters (VCSELs/EELs) across varying temperatures.

- Increased computational capability allows for optimization of smaller, lower-power detector arrays (SPADs), reducing overall component size.

- AI-powered calibration tools reduce manufacturing tolerances, enabling cheaper, mass-produced optical elements.

- Demand for components supporting advanced spectral analysis and multi-modal sensing is amplified by AI data fusion requirements.

DRO & Impact Forces Of Vehicle Lidar Optical Components Market

The dynamics of the Vehicle Lidar Optical Components market are complex, governed by a powerful combination of technological necessity and economic feasibility. The primary market driver is the global regulatory push for L3 autonomy adoption, particularly in premium vehicle segments, alongside massive investment in ADAS safety features requiring Lidar redundancy. However, the market faces significant restraints, chiefly the elevated manufacturing costs associated with high-precision optical alignment and the severe qualification timelines (ASIL standards) required for automotive integration. Opportunities abound in the development of low-cost, solid-state manufacturing techniques, particularly leveraging silicon photonics for component integration. The key impact forces include technological complexity, which maintains high barriers to entry, and price sensitivity from OEMs, who continuously seek robust, yet inexpensive, component solutions to meet consumer price expectations for Lidar-equipped vehicles.

Segmentation Analysis

The Vehicle Lidar Optical Components Market is meticulously segmented based on Component Type, Technology, Application, and Vehicle Type, allowing for targeted analysis of growth pockets and technological shifts. The Component Type segmentation is vital, distinguishing between the active elements (Emitters and Detectors) responsible for signal generation and capture, and the passive elements (Optics) critical for beam shaping and steering. Technology segmentation highlights the fundamental architectural shift occurring in the industry, moving from traditional mechanical systems to more robust, scalable solid-state approaches. Application analysis delineates the varying requirements for Level 2/3 ADAS versus Level 4/5 full autonomy systems, while Vehicle Type clarifies adoption rates between passenger and commercial fleet vehicles.

Understanding these segments provides clarity on where investment and technological convergence are highest. For instance, the transition to solid-state Lidar architecture heavily favors VCSEL emitters and Silicon Photonics Optics, demanding significant R&D spending in these areas. Furthermore, the application distinction is critical: ADAS components prioritize robustness and low cost for broad adoption, while components for L4/L5 applications prioritize ultra-high resolution and long-range detection accuracy, often justifying a higher component BOM. The dominance of passenger vehicles in initial market volume underscores the necessity for component miniaturization and mass production readiness.

The fastest growth rates are anticipated in the segments supporting next-generation architecture, specifically solid-state Lidar components and those targeting Level 4 and Level 5 autonomous applications, which require redundant, high-performance sensing stacks. As production volumes scale, cost optimization within the Optics segment (specifically injection-molded, high-quality plastic lenses replacing glass) will be crucial for maintaining profitability across the value chain, demonstrating the necessity of segment-specific strategic planning.

- By Component:

- Laser Emitters (VCSEL, Edge-Emitting Lasers (EEL))

- Photodetectors (Single-Photon Avalanche Diodes (SPAD), Avalanche Photodiodes (APD), PIN Diodes)

- Optics (Lenses, Mirrors, Prisms, Filters, Diffusers, Beam Splitters)

- Scanning Systems (MEMS Mirrors, Optical Phase Arrays (OPA))

- By Technology:

- Solid-State Lidar

- Semi-Solid State Lidar (Hybrid)

- Mechanical Lidar

- By Application:

- ADAS (L2/L3)

- Autonomous Vehicles (L4/L5)

- Parking Assistance

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles (Trucks, Buses, Robotaxis)

Value Chain Analysis For Vehicle Lidar Optical Components Market

The value chain for the Vehicle Lidar Optical Components market is highly specialized, beginning with fundamental materials science and progressing through highly integrated system manufacturing. Upstream analysis focuses on raw material providers, including specialty glass, semiconductor substrates (Silicon, III-V materials like Gallium Arsenide for lasers), and advanced polymer resins for plastic optics. This stage is dominated by specialized suppliers like Schott, Corning, and key semiconductor foundries. The complexity lies in securing high-purity, defect-free materials necessary for high-performance photonics devices, creating significant dependence on a select group of material manufacturers who dictate initial component costs and scalability.

Midstream activities involve core component manufacturing, including wafer fabrication for emitters (VCSEL arrays), detectors (SPAD/APD arrays), and the precision manufacturing of custom optics (molding, coating, polishing). Companies like Hamamatsu, II-VI (Coherent), and dedicated MEMS foundries play critical roles here. Direct distribution often occurs at this stage, with component specialists supplying Lidar system integrators (e.g., Luminar, Innoviz). Indirect distribution involves smaller, specialized module assemblers who integrate individual components into sub-assemblies before delivery to the final Lidar system producer. Quality control and high-volume testing are paramount in this phase, given the stringent automotive grade requirements (AEC-Q100/AEC-Q101).

Downstream analysis involves the integration of the complete Lidar unit into the vehicle architecture, led primarily by Tier 1 automotive suppliers (e.g., Bosch, Continental, ZF) and increasingly, by the OEMs themselves (e.g., Tesla, General Motors). The final end-users are the automotive consumers purchasing vehicles equipped with ADAS or autonomous capabilities. The value chain is characterized by strong backward integration attempts by Lidar system providers to control component quality and supply, and strong forward linkages with OEMs demanding customized, highly integrated sensor packages optimized for specific vehicle platforms. Efficiency in the logistics and testing phases ultimately determines the profitability margins across the entire chain.

Vehicle Lidar Optical Components Market Potential Customers

Potential customers and primary buyers in the Vehicle Lidar Optical Components Market consist primarily of three distinct groups, each with specific purchasing criteria driven by scale and application needs. The largest immediate customers are dedicated Lidar System Manufacturers (e.g., Luminar, Velodyne, Innoviz), who purchase optical components in high volumes for integration into their proprietary sensors. These customers demand high performance, competitive unit pricing, and robust supply agreements for components like custom lenses, laser diodes, and detector arrays, focusing heavily on achieving the necessary automotive qualification standards (e.g., ISO 26262 ASIL ratings).

The second major group includes Automotive Tier 1 Suppliers (e.g., Continental, Bosch, ZF, Valeo), who often develop or integrate Lidar systems as part of broader sensor suites (including radar and camera systems) delivered directly to global automotive OEMs. These buyers prioritize components that offer high reliability, seamless integration into established manufacturing processes, and adherence to strict automotive operational lifetimes. Their purchasing is volume-driven, requiring manufacturers to demonstrate significant production capacity and supply chain resilience to meet the predictable but large demands of global vehicle platforms.

Finally, global Automotive Original Equipment Manufacturers (OEMs), particularly those heavily investing in Level 4/Level 5 autonomy (e.g., General Motors, Ford, BMW, Chinese EV startups), represent the ultimate end-users/buyers. While they often source through Tier 1s or dedicated Lidar providers, advanced OEMs sometimes engage directly with specialized component suppliers (especially those dealing in advanced VCSELs or silicon photonics) to co-develop custom components tailored precisely to their vehicle architecture, aiming for unique performance characteristics and cost optimization through vertical integration. These groups require components that enable high-volume scalability and significant cost reductions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $20.9 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Luminar Technologies, Velodyne Lidar, Innoviz Technologies, Aeva, Ouster, Sick AG, Continental AG, Bosch, ZF, Quanergy Systems, Valeo, LeddarTech, Hamamatsu Photonics, II-VI (Coherent), Schott AG, Corning Inc., Hoya Corporation, AGC Inc., Osram Opto Semiconductors, Lumentum Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Lidar Optical Components Market Key Technology Landscape

The technological landscape of the Vehicle Lidar Optical Components market is undergoing rapid evolution, primarily driven by the transition from macro-scale moving parts to micro-scale integrated circuits. The leading technologies defining this shift include Vertical-Cavity Surface-Emitting Lasers (VCSELs) for illumination and Silicon Photonics for integration. VCSELs, favored for their low cost, array scalability, and ability to be modulated at high speeds, are the cornerstone of Flash Lidar systems, offering a robust, non-mechanical solution suitable for short to medium-range ADAS applications. Parallelly, Edge-Emitting Lasers (EELs) operating at 1550 nm are critical for long-range detection, benefiting from enhanced eye safety standards at this wavelength, though their cost remains a challenge compared to 905 nm VCSELs.

On the receiving end, the market is defined by advanced detector technologies: Single-Photon Avalanche Diodes (SPADs) and Avalanche Photodiodes (APDs). SPADs, known for their extreme sensitivity, enable long-range detection by registering single photons, making them ideal for high-performance Lidar sensors. The challenge lies in managing crosstalk and uniformity across large arrays, an issue being mitigated through advanced wafer fabrication techniques. APDs, while less sensitive than SPADs, offer better linearity and are crucial in systems requiring precise measurement of light intensity variations. The integration of these detectors into dense focal plane arrays (FPAs) is a major technological focus, driving down system size and improving overall thermal performance.

Crucially, the development of scanning mechanisms is bifurcating the market. Micro-Electro-Mechanical Systems (MEMS) mirrors represent the most mature non-mechanical solution, offering a favorable balance between scanning speed, size, and cost, dominating current semi-solid-state designs. However, Optical Phase Arrays (OPAs), leveraging Silicon Photonics to steer the laser beam electronically with no moving parts, represent the future ideal of truly solid-state Lidar. While OPAs currently face limitations regarding scanning angle and complexity of manufacturing, significant R&D efforts are underway to resolve these challenges, promising a fully chip-based Lidar system that would drastically reduce the cost and size of optical component assemblies, thereby transforming the entire market landscape through superior integration and reliability.

Regional Highlights

The global Vehicle Lidar Optical Components Market exhibits varied growth trajectories influenced by regulatory environments, technological adoption rates, and OEM market concentration across key geographical regions. Each region presents unique opportunities and demands that shape investment priorities for component manufacturers.

- Asia Pacific (APAC): APAC is projected to lead market growth, driven intensely by China's aggressive adoption of electric vehicles (EVs) and smart infrastructure. China, along with South Korea and Japan, is investing heavily in L4 and L5 autonomy for robotaxis and logistics vehicles. Component manufacturers focus on high-volume, low-cost optical solutions (especially 905 nm systems) to meet the rapidly expanding Chinese EV market demand.

- North America: This region is a leader in technological innovation and high-performance Lidar adoption. Driven by technology giants and automotive giants in the US, demand centers on premium, long-range 1550 nm Lidar components favored by L4 autonomous driving developers (like Waymo and Cruise). Emphasis is placed on ruggedized, high-fidelity components that meet rigorous safety standards and performance benchmarks.

- Europe: European market growth is steady, fueled by stringent safety regulations (Euro NCAP) pushing for advanced ADAS integration (L2+ and L3). The focus here is on reliability and aesthetic integration. European OEMs often demand highly integrated, compact Lidar sensor packages, favoring sophisticated optics and solid-state scanning solutions compatible with diverse vehicle designs and high-speed driving conditions typical of the continent.

- Latin America, Middle East, and Africa (LAMEA): While smaller currently, these regions offer future growth potential, particularly in high-growth economies in the Middle East investing in smart city projects (e.g., NEOM in Saudi Arabia). Initial component adoption is constrained but is expected to accelerate in logistics and public transit sectors requiring basic Lidar mapping and navigation capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Lidar Optical Components Market.- Luminar Technologies

- Velodyne Lidar

- Innoviz Technologies

- Aeva

- Ouster

- Sick AG

- Continental AG

- Bosch

- ZF Friedrichshafen AG

- Quanergy Systems

- Valeo

- LeddarTech

- Hamamatsu Photonics

- II-VI (Coherent)

- Schott AG

- Corning Inc.

- Hoya Corporation

- AGC Inc.

- Osram Opto Semiconductors

- Lumentum Holdings

Frequently Asked Questions

Analyze common user questions about the Vehicle Lidar Optical Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between 905 nm and 1550 nm Lidar optical components?

905 nm components (typically VCSEL emitters and Silicon detectors) are lower cost, widely adopted for short to medium-range ADAS, and utilize abundant silicon technology. 1550 nm components (typically EEL emitters and InGaAs detectors) offer superior eye safety at higher power, allowing for longer detection ranges crucial for L4/L5 autonomy, but involve higher component costs due to specialized material requirements.

How is the transition to solid-state Lidar affecting the demand for traditional optics?

Solid-state Lidar architecture, particularly those using MEMS or OPAs, is shifting the demand from large, rotating mirrors and complex multi-lens assemblies towards miniaturized, precision-molded optics, diffractive optical elements (DOEs), and integrated waveguided components built on silicon photonics platforms, prioritizing compact form factors and wafer-level scalability.

Which component segment is expected to show the highest CAGR during the forecast period?

The Laser Emitters segment, particularly high-power, reliable VCSEL arrays and specialized 1550 nm EELs, is anticipated to exhibit the highest Compound Annual Growth Rate. This growth is driven by the mass production requirements of flash Lidar systems and the intense demand for enhanced long-range perception in autonomous vehicles.

What are the main automotive safety and reliability standards relevant to Lidar optical components?

Lidar optical components must adhere rigorously to AEC-Q100 (for semiconductor devices like detectors and emitters) and ISO 26262 functional safety standards, specifically aiming for Automotive Safety Integrity Levels (ASIL) B or C for critical components, ensuring functional robustness under extreme temperature and vibration conditions, and maintaining consistent operational performance.

Who are the major end-user buyers of Vehicle Lidar Optical Components?

The major end-user buyers are Lidar System Manufacturers (e.g., Luminar, Ouster) and large Automotive Tier 1 Suppliers (e.g., Bosch, Continental) who integrate these components into complete Lidar sensor modules before supplying them to global Automotive OEMs for final vehicle integration into ADAS and fully autonomous driving systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager