Vehicle Mount Terminal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432733 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Vehicle Mount Terminal Market Size

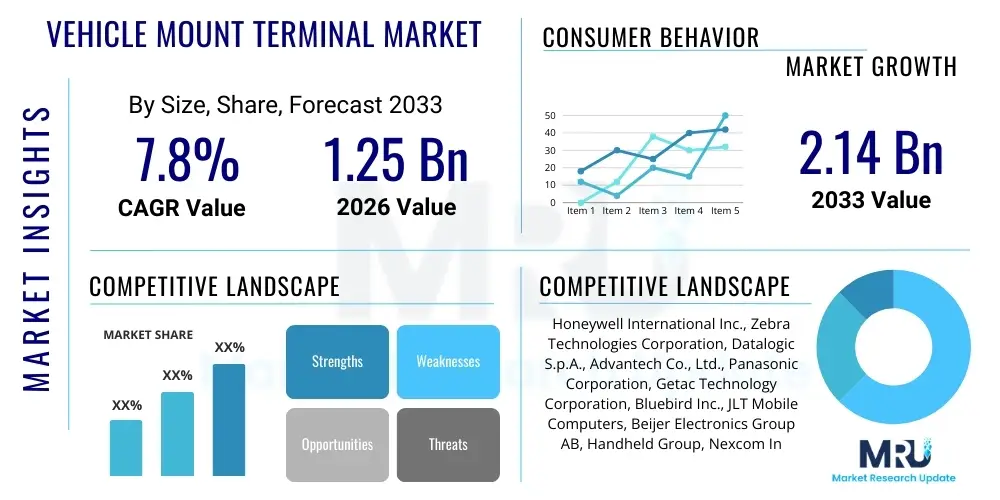

The Vehicle Mount Terminal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.14 Billion by the end of the forecast period in 2033.

Vehicle Mount Terminal Market introduction

The Vehicle Mount Terminal (VMT) market encompasses ruggedized computing devices specifically designed for installation on industrial vehicles, such as forklifts, reach trucks, yard spotters, and other specialized equipment used in logistics, warehousing, ports, and cold storage environments. These terminals function as essential components of enterprise resource planning (ERP) and warehouse management systems (WMS), providing mobile data access, real-time inventory updates, and task management capabilities directly to vehicle operators. The primary function of VMTs is to enhance operational efficiency, minimize manual data entry errors, and ensure seamless communication between the mobile workforce and central systems, thereby optimizing supply chain throughput and accuracy. Modern VMTs are characterized by features such as high-brightness displays for outdoor use, resistive or capacitive touchscreens operable with gloves, robust protection against shock and vibration (meeting MIL-STD standards), and broad temperature tolerances.

The product portfolio within the VMT sector spans various form factors, including full-screen displays, compact units, and dedicated keyboard devices, often utilizing operating systems like Android and Windows CE/10 IoT. Key applications driving adoption include receiving and putaway processes in distribution centers, cycle counting, cross-docking operations, and managing complex inventory movements in high-volume settings. The core benefit derived from deploying VMTs is the substantial reduction in operational bottlenecks, achieved through instant access to actionable data regarding stock location, order priority, and routing optimization. Furthermore, VMTs contribute significantly to worker safety by minimizing distractions and providing integrated tools for vehicle checklist completion and maintenance reporting.

Driving factors propelling market expansion include the exponential growth of e-commerce, which necessitates faster and more accurate warehousing operations; increasing automation levels in material handling industries; and the pervasive need across global supply chains for real-time visibility and data integrity. The movement toward digitalization in sectors traditionally reliant on paper-based processes, combined with stringent regulatory requirements for tracking goods, further solidify the demand for high-performance VMT solutions. The continual evolution of wireless connectivity standards, particularly the adoption of Wi-Fi 6 and 5G in industrial settings, is enabling more reliable and higher-speed data transmission, enhancing the utility of these vehicle-mounted devices.

Vehicle Mount Terminal Market Executive Summary

The Vehicle Mount Terminal (VMT) market is experiencing robust growth fueled by irreversible trends toward automation, particularly within the logistics, cold chain, and manufacturing sectors globally. Key business trends indicate a strong market preference for Android-based VMTs due to their flexibility, ease of integration, and lower development costs compared to proprietary or legacy Windows Embedded systems. Vendors are intensely focused on integrating advanced features such as heated screens for freezer applications, multi-touch capabilities, and advanced security protocols to protect sensitive WMS data. Furthermore, the market is observing consolidation, with major players acquiring specialized technology firms to bolster their software and services offerings, shifting the value proposition from hardware sales alone to comprehensive industrial mobility solutions. Sustainability mandates and the focus on optimizing fleet utilization are also steering purchasing decisions toward VMTs that provide detailed telemetry and integration with vehicle diagnostics.

Regionally, North America and Europe remain the dominant markets, characterized by high investment in advanced logistics infrastructure and early adoption of industrial IoT technologies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily driven by massive infrastructure investments in emerging economies like China, India, and Southeast Asia, coupled with the rapid development of large-scale e-commerce fulfillment centers and expanding port capacities. These APAC markets are quickly skipping intermediate technology phases and directly implementing modern, ruggedized VMT solutions to handle surging domestic and international trade volumes. Segment-wise, the ruggedness level remains paramount, with ultra-rugged terminals maintaining high demand in harsh environments such as ports and outdoor staging areas, while standard rugged terminals see broad adoption in general warehousing and distribution centers.

Segmentation trends reveal increasing sophistication in display technology, where larger, higher-resolution screens are becoming standard to accommodate complex graphical interfaces required by modern WMS software. By application, the warehousing and distribution segment dominates the market share, reflecting the sheer volume of inventory movement facilitated by VMTs. However, specialized applications, particularly in cold storage and container handling operations, are growing rapidly, demanding specialized VMTs built to withstand extreme temperatures and environmental conditions. The ongoing supply chain diversification and resilience efforts post-pandemic further underscore the importance of robust, real-time data capture tools like VMTs, ensuring continuity and operational visibility across complex, multi-modal transportation networks.

AI Impact Analysis on Vehicle Mount Terminal Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vehicle Mount Terminal (VMT) market frequently center on three critical themes: how AI enhances predictive maintenance, how it optimizes real-time operational flows (e.g., routing and task allocation), and the necessity of upgrading existing VMT hardware to support complex edge computing capabilities required for AI inferencing. Users are keenly interested in VMTs evolving beyond simple data input/output devices into intelligent hubs capable of local processing and immediate decision-making, reducing latency associated with cloud-based AI. Concerns often revolve around the security implications of deploying AI models on distributed edge devices and the necessary bandwidth requirements for continually updating these models. Expectations are high for AI to transform forklift operations from reactive task fulfillment to proactive, optimized movement patterns, minimizing idle time and energy consumption, and ultimately driving higher utilization rates for warehouse assets.

The integration of AI directly into the VMT ecosystem is transitioning VMTs from static information displays to active decision support tools. Machine learning algorithms, often running locally on high-powered VMT processors (Edge AI), are enabling real-time adjustments to material handling tasks based on immediate environmental factors, congestion levels, and predictive analysis of inventory requirements. For instance, AI can dynamically re-route a forklift operator mid-shift based on a sudden change in priority or a real-time bottleneck detected by facility cameras linked to the VMT network. This sophisticated orchestration drastically improves efficiency metrics such as case picks per hour and reduces unnecessary travel time, directly impacting the profitability of logistics operations. Moreover, AI-driven computer vision integrated with VMTs can instantly verify the accuracy of loaded pallets or detect potential safety hazards, offering immediate alerts to the operator.

This shift necessitates that VMT manufacturers continually enhance processing power (e.g., incorporating specialized neural processing units or leveraging more powerful CPUs) while maintaining the device's rugged integrity and energy efficiency. The market is witnessing increased demand for VMTs that are ‘AI-ready’—meaning they possess the computational headroom and seamless integration capabilities with AI platforms and sensors (such as LiDAR or proximity sensors) necessary to run complex, proprietary logistical optimization models. The data captured by VMTs—relating to cycle times, vehicle speed, tilt, and operator interaction—becomes the foundational fuel for training these advanced AI models, establishing a continuous feedback loop that drives systematic operational improvement throughout the lifecycle of the terminal and the vehicle it monitors.

- AI enables real-time dynamic task allocation and routing optimization for vehicle operators.

- Edge AI processing within VMTs reduces latency for instant operational decision-making.

- Predictive maintenance algorithms use VMT data to schedule vehicle servicing, minimizing unplanned downtime.

- Computer vision integration via VMT cameras allows for automated verification of inventory and hazard detection.

- AI-driven natural language processing (NLP) can simplify complex WMS instructions displayed on the VMT screen.

- Enhanced security features utilizing AI monitor user behavior and device integrity in real-time.

- AI optimizes power consumption and battery management within the VMT itself.

DRO & Impact Forces Of Vehicle Mount Terminal Market

The Vehicle Mount Terminal (VMT) market dynamics are significantly influenced by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), collectively shaping its growth trajectory and competitive landscape. The primary drivers include the relentless expansion of global e-commerce, which mandates faster, more accurate fulfillment processes across distribution centers, necessitating highly mobile and robust computing solutions. Secondly, the increasing regulatory focus on workplace safety and accountability pushes companies to adopt technologies like VMTs that provide real-time reporting on vehicle utilization, speed, and potential impact events. Finally, the modernization of aging supply chain infrastructure, particularly in developing economies, coupled with the widespread adoption of advanced Warehouse Management Systems (WMS) and ERP platforms, creates a fertile ground for VMT integration as the essential interface between the physical and digital worlds of inventory management.

Despite strong underlying demand, the market faces several inherent restraints. The significant initial capital investment required for deploying ruggedized VMTs across an entire fleet can be prohibitive, especially for Small and Medium Enterprises (SMEs) operating on tight margins. Furthermore, the complexity of integrating new VMT hardware with legacy WMS and existing enterprise IT infrastructure often poses substantial technical challenges and demands specialized integration expertise, leading to extended deployment timelines. Another crucial restraint is the environmental stress factors inherent in many operational settings—extreme cold (freezer environments), high dust levels, and constant vibration—which require highly specialized, expensive hardware solutions, limiting the standardization and driving up the total cost of ownership (TCO). Issues related to maintaining reliable wireless connectivity (Wi-Fi dead zones) within massive, multi-level warehouse structures also periodically hamper the effectiveness of these real-time devices.

Opportunities for market expansion are abundant, centered primarily on technological advancement and untapped industry verticals. The shift toward subscription-based models (Hardware-as-a-Service or Device-as-a-Service) offers a key opportunity to lower the barrier to entry for smaller companies, mitigating the initial capital expenditure restraint. Furthermore, the explosive growth in cold chain logistics, driven by pharmaceutical and specialty food distribution, presents a highly lucrative niche for specialized VMTs equipped with thermal management features. The rapid evolution of VMT operating systems, particularly the migration to industrial Android, opens up new avenues for developing highly customizable, user-friendly applications that significantly enhance operator efficiency and reduce training time. Finally, the growing need for enhanced security and compliance, especially concerning data privacy (e.g., GDPR, HIPAA compliance in specific supply chains), creates opportunities for VMT vendors to integrate advanced biometric authentication and data encryption features, positioning their products as critical security assets within the supply chain framework.

These drivers, restraints, and opportunities interact through powerful impact forces. The competitive force of standardization is pushing vendors towards common platforms (like Android) to leverage the vast developer ecosystem, making devices more interoperable but potentially eroding high margins previously associated with proprietary systems. The technological impact force dictates continuous investment in ruggedization and connectivity (5G readiness, better roaming capabilities) to meet the escalating demands of high-throughput environments. Economically, the imperative for operational efficiency acts as a constant upward pressure, forcing businesses to justify VMT investment through clear ROI metrics derived from reduced labor costs and improved inventory accuracy. Regulatory and social forces emphasize worker safety, driving feature development focused on minimizing operator distraction and integrating telemetry for incident analysis, ensuring that VMTs serve not only as efficiency tools but also as safety enhancement mechanisms within dynamic industrial settings.

Segmentation Analysis

The Vehicle Mount Terminal (VMT) market is comprehensively segmented based on three primary axes: the operating system used, the type of ruggedness rating, and the specific application or end-user industry. Analyzing these segments provides critical insights into purchasing trends and technological priorities across different market verticals. The segmentation by operating system (OS) is currently undergoing a significant shift, moving away from legacy proprietary and older Windows platforms towards more open, modern systems like Android and Windows 10 IoT Enterprise. This transition is motivated by the need for greater security, simplified device management, and access to a larger pool of mobile application developers. The ruggedness segmentation, typically categorized as standard rugged and ultra-rugged, reflects the severity of the operational environment, dictating hardware specifications such as ingress protection (IP) ratings, shock absorption capabilities, and temperature range tolerances necessary for reliable long-term performance.

Segmentation by application highlights the core demand sectors, with warehousing and distribution centers constituting the largest segment due to the sheer scale of material handling activities required for global trade and e-commerce fulfillment. However, specialized sectors like cold storage, ports and yard management, and dedicated manufacturing environments demand tailored VMT solutions that address unique environmental and operational constraints. For instance, cold storage VMTs require specific heating elements to prevent screen condensation and maintain operational temperatures, while port terminals need high visibility displays suitable for bright outdoor conditions and robust resistance to corrosive saltwater spray. Understanding these subtle differences allows manufacturers to develop highly targeted product portfolios and deployment strategies, maximizing market penetration by aligning product features directly with specific industry requirements.

Furthermore, segmentation by technology type—primarily display size (e.g., 8-inch, 10-inch, 12-inch) and input method (touchscreen only vs. integrated keyboard)—influences user experience and operator preference. Larger screens are increasingly favored for viewing complex WMS graphical interfaces or running multiple applications simultaneously, a common requirement in supervisory roles. Conversely, integrated keyboards remain critical in environments where gloves are mandatory, or where rapid data entry involving long alphanumeric codes is essential, such as in logistics tracking and cross-docking operations. The confluence of these segmentation variables underscores the market’s maturity and the necessity for vendors to offer a diversified and adaptable range of products capable of serving the varied needs of modern industrial operations.

- By Operating System:

- Android OS

- Windows 10 IoT/CE

- Others (Proprietary, Linux)

- By Ruggedness Level:

- Standard Rugged VMTs (IP54 to IP65)

- Ultra-Rugged VMTs (IP66 and above, MIL-STD certified)

- By Display Size:

- Small (7 to 8 inches)

- Medium (9 to 10 inches)

- Large (12 inches and above)

- By Application/End-user Industry:

- Warehousing and Distribution Centers

- Cold Storage and Freezer Environments

- Ports and Intermodal Terminals

- Manufacturing and Production Floors

- Transportation and Fleet Management

- Mining and Heavy Industry

- By Type of Input:

- Touchscreen Only

- Integrated Keyboard/Function Keys

Value Chain Analysis For Vehicle Mount Terminal Market

The value chain for the Vehicle Mount Terminal (VMT) market is complex, spanning raw material sourcing, sophisticated manufacturing, software integration, specialized distribution, and post-sale support. The upstream analysis begins with the procurement of critical components, including high-performance processors (often supplied by Intel or Qualcomm), ruggedized display panels (requiring specialized bonding and protection), high-grade memory, and various sensor technologies. Suppliers of these components must meet stringent quality and durability standards, as the failure of any single part can compromise the reliability of the VMT in harsh industrial environments. Key activities at this stage involve design and engineering, where VMT manufacturers collaborate closely with component providers to ensure optimal performance, thermal management, and adherence to industry ruggedization standards (e.g., IP ratings and vibration testing protocols). Efficiency and cost management at the component level directly influence the final pricing and competitive positioning of the finished VMT.

The midstream process involves assembly and advanced software integration. VMT assembly is typically highly specialized, requiring clean-room conditions for display integration and meticulous chassis construction to ensure waterproofing and shock absorption. Critical value is added through the proprietary software layer, including operating system hardening, device management utilities, and pre-loaded client software necessary for WMS connectivity. Distribution channels play a vital role in reaching the end-user. Direct channels are often used for very large enterprise clients requiring highly customized solutions or complex integration services, allowing manufacturers to maintain tight control over the sales and installation process. Indirect channels, primarily specialized industrial mobility distributors and value-added resellers (VARs), handle the majority of transactions, offering local support, systems integration expertise, and regional supply chain logistics. VARs often act as the critical link, bundling VMT hardware with mounting solutions, scanners, and comprehensive software packages.

Downstream analysis focuses on deployment, integration, and aftermarket services, which are critical differentiators in this market. The successful deployment of VMTs requires extensive integration with the client's existing wireless network, WMS, and ERP systems, often necessitating on-site technical expertise provided by the manufacturer or VAR. Post-sale support, including warranty services, repair programs, and ongoing software updates (especially security patches for Android/Windows), represents a significant and recurring revenue stream. The trend towards Device-as-a-Service (DaaS) further strengthens the relationship between the VMT vendor and the end-user, ensuring continuous device maintenance and lifecycle management. The efficiency of the distribution channel—both direct and indirect—determines the speed of delivery and the quality of localized support, directly impacting customer satisfaction and retention in this competitive technology sector.

Vehicle Mount Terminal Market Potential Customers

The primary potential customers for Vehicle Mount Terminals (VMTs) are large enterprises and logistics providers that operate extensive fleets of material handling equipment within high-throughput environments. These customers are predominantly found in the warehousing, distribution, and manufacturing sectors where the optimization of inventory movement is directly correlated with profitability. Specifically, major e-commerce fulfillment centers, large third-party logistics (3PL) providers, and global retail chains with complex supply chain operations represent the largest buying segments. These organizations require reliable, real-time data input and access to maintain inventory accuracy, accelerate order processing, and comply with strict service level agreements (SLAs) regarding delivery speed and precision. For these enterprise buyers, VMTs are seen not just as hardware, but as strategic tools essential for minimizing human error and maximizing operational uptime, justifying substantial investment in high-quality, ruggedized devices.

A rapidly growing segment of potential customers includes specialized industries with particularly demanding environmental conditions. This includes cold storage and refrigerated logistics companies that require VMTs designed to operate reliably in temperatures as low as -30°C, port and intermodal terminal operators who need terminals resistant to heavy shock, vibration, and outdoor weather, and large-scale food and beverage processors prioritizing hygiene and wash-down resistance. These niche buyers often seek highly customized VMT configurations, including features like heated displays, specialized mounting kits, and specific IP ratings (e.g., IP67). Their procurement decisions are heavily influenced by device longevity, reliability in extreme conditions, and compliance with industry-specific safety standards, making them highly valuable, albeit technically demanding, customers.

Furthermore, mid-market manufacturers and regional distribution companies are increasingly becoming high-potential customers as they transition away from paper-based or older, less reliable mobile computing solutions. Driven by competitive pressure to adopt WMS technology and improve productivity, these customers often seek VMT solutions that offer strong value propositions, often facilitated through financing options like DaaS or simplified integration packages provided by VARs. While their order volumes may be smaller than global 3PLs, their cumulative need for modernization constitutes a significant and largely accessible market segment. Ultimately, any organization leveraging industrial vehicles for material tracking or asset management and aiming for a digital transformation of its internal logistics processes represents a core potential buyer for VMT solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.14 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Zebra Technologies Corporation, Datalogic S.p.A., Advantech Co., Ltd., Panasonic Corporation, Getac Technology Corporation, Bluebird Inc., JLT Mobile Computers, Beijer Electronics Group AB, Handheld Group, Nexcom International Co., Ltd., Trimble Inc., Kontron S&T AG, Winmate Inc., TouchPoint, Sierra Wireless, Capacitive Systems, Logic Supply (OnLogic), Arbor Technology Corp., Glacier Computer. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Mount Terminal Market Key Technology Landscape

The technological landscape of the Vehicle Mount Terminal (VMT) market is defined by a convergence of rugged hardware engineering, advanced wireless connectivity, and sophisticated operating system architecture. Modern VMTs utilize high-performance, energy-efficient processors, crucial for running complex Warehouse Management System (WMS) client applications and emerging edge computing algorithms without rapid battery depletion or excessive heat generation. Display technology is paramount, focusing on sunlight readability for outdoor applications (e.g., yard management) and specialized heating elements essential for non-condensing operation in freezer environments (down to -30°C). Furthermore, manufacturers heavily leverage advanced mechanical design, utilizing high-grade aluminum alloys and proprietary dampening systems to ensure compliance with MIL-STD-810G standards against shock and vibration, guaranteeing operational continuity even when mounted on vehicles exposed to rough terrains or constant jarring motions typical of industrial machinery.

Connectivity is another core technological pillar, moving beyond basic Wi-Fi capabilities to embrace faster and more reliable industrial networking standards. The integration of dual-band Wi-Fi 6 (802.11ax) is becoming standard, offering increased throughput and reduced network congestion in densely packed warehouses containing hundreds of devices. Cellular connectivity, particularly 5G readiness, is crucial for VMTs used in extensive outdoor applications like container ports or large transportation hubs, ensuring seamless data handover and low latency communication over wide areas. Additionally, sophisticated power management systems are employed, featuring intelligent vehicle ignition control, uninterrupted power supplies (UPS), and rapid-swap battery options to maximize device uptime and protect against data loss during power fluctuations or vehicle engine startup/shutdown cycles.

Software and platform technologies are rapidly evolving, with industrial Android dominating the OS segment due to its modern architecture, robust security updates, and simplified application deployment via managed enterprise app stores. VMT vendors are increasingly focusing on developing proprietary Device Management Software (DMS) and Enterprise Mobility Management (EMM) suites that allow IT departments to remotely configure, monitor device health (e.g., battery status, thermal load), and securely update large fleets of VMTs simultaneously. The deployment of advanced human-machine interface (HMI) technologies, including highly accurate capacitive touchscreens operable with thick gloves and integrated haptic feedback mechanisms, ensures intuitive and error-free data input, even under high-pressure industrial conditions. The continuous drive for greater security features, including multifactor authentication and hardware-level encryption, is essential to protect the sensitive logistical and financial data handled by these terminals.

Regional Highlights

Geographically, the Vehicle Mount Terminal (VMT) market exhibits significant disparity in maturity, investment, and growth rates across different global regions. North America holds a dominant market share, primarily driven by the presence of vast logistics infrastructure, the early adoption of automation technologies, and the high concentration of global e-commerce giants and 3PL providers that continually invest in optimizing their fulfillment networks. The stringent focus on efficiency and safety standards in the U.S. and Canada necessitates the deployment of high-end, ruggedized VMTs that integrate seamlessly with advanced WMS and vehicle telematics systems. The replacement cycle in this region is also relatively shorter, as companies aggressively upgrade to newer technologies like Android and Wi-Fi 6 enabled VMTs to maintain a competitive edge in delivery speed and accuracy.

Europe represents another key established market, characterized by strong demand from manufacturing (especially automotive and aerospace), efficient port operations, and complex intra-European distribution networks. The market dynamics here are influenced by high labor costs, which strongly incentivize automation and technology deployment, making VMTs a critical tool for boosting labor productivity. Furthermore, Northern European countries have substantial cold chain logistics sectors, driving specific demand for specialized freezer-grade VMT hardware. However, market fragmentation across different national regulatory environments can sometimes complicate unified regional deployment strategies for global enterprises operating across the European Union.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is attributed to rapid industrialization, massive investments in infrastructure development (ports, warehouses), and the explosive rise of domestic e-commerce in countries like China, India, and Southeast Asian nations. APAC markets are often skipping older generations of VMT technology and moving directly to modern, Android-based rugged devices to handle the unprecedented volume of goods flowing through their logistics chains. While initial ASP (Average Selling Price) might be lower in certain APAC sub-regions compared to North America, the sheer scale of fleet expansion and new warehouse construction provides an enormous opportunity for VMT vendors. Conversely, Latin America, the Middle East, and Africa (MEA) are emerging markets, where VMT adoption is still nascent but accelerating, particularly in oil and gas, mining, and large port operations, driven by global logistics investment seeking to modernize local supply chain capabilities.

- North America: Dominant market share; driven by large-scale e-commerce fulfillment and advanced WMS integration; high demand for latest Android/Windows IoT VMTs.

- Europe: Strong uptake in manufacturing and cold chain logistics; emphasis on labor productivity enhancement; adherence to high environmental and safety standards.

- Asia Pacific (APAC): Fastest growing region; fueled by infrastructure spending, urbanization, and domestic e-commerce expansion in China, India, and Southeast Asia; opportunities in greenfield deployments.

- Latin America (LATAM): Growing adoption in commodity logistics (mining, agriculture) and expanding retail distribution networks; sensitive to economic volatility.

- Middle East and Africa (MEA): Key demand originating from port modernization projects, oil & gas logistics, and developing free trade zones; increasing need for outdoor-rated VMTs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Mount Terminal Market.- Honeywell International Inc.

- Zebra Technologies Corporation

- Datalogic S.p.A.

- Advantech Co., Ltd.

- Panasonic Corporation

- Getac Technology Corporation

- Bluebird Inc.

- JLT Mobile Computers

- Beijer Electronics Group AB

- Handheld Group

- Nexcom International Co., Ltd.

- Trimble Inc.

- Kontron S&T AG

- Winmate Inc.

- TouchPoint

- Sierra Wireless

- Capacitive Systems

- Logic Supply (OnLogic)

- Arbor Technology Corp.

- Glacier Computer

Frequently Asked Questions

Analyze common user questions about the Vehicle Mount Terminal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Vehicle Mount Terminal market?

The primary factor driving market growth is the global surge in e-commerce, which necessitates extreme efficiency, real-time inventory visibility, and accelerated throughput in warehousing and logistics operations. VMTs are essential tools for enabling this high-speed, data-driven fulfillment model.

Which operating system is becoming the standard for new Vehicle Mount Terminal deployments?

Industrial Android is rapidly becoming the standard operating system for new VMT deployments, favored over legacy Windows CE/Embedded platforms due to its modern user interface, enhanced security features, and extensive support from enterprise application developers, simplifying integration with modern WMS.

How do Vehicle Mount Terminals withstand extreme cold environments like freezers?

VMTs designed for cold storage utilize specialized features such as insulated chassis, thermostatically controlled heaters built into the display and internal components, and specialized seals to prevent condensation, ensuring operational capability down to temperatures of -30°C or lower without failure.

What is the role of AI and Edge Computing in modern Vehicle Mount Terminals?

AI and Edge Computing allow modern VMTs to process data locally and execute real-time operational decisions, such as dynamic route optimization and predictive maintenance alerts. This shift enhances efficiency by reducing latency and improving the responsiveness of vehicle operators without reliance solely on cloud processing.

What are the main financial constraints preventing widespread adoption of VMTs by small and medium enterprises (SMEs)?

The main constraint is the high initial capital expenditure (CapEx) associated with purchasing ruggedized VMT hardware and the complexity of integrating it with existing IT infrastructure. This restraint is increasingly being addressed by flexible financing options like Device-as-a-Service (DaaS) models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager