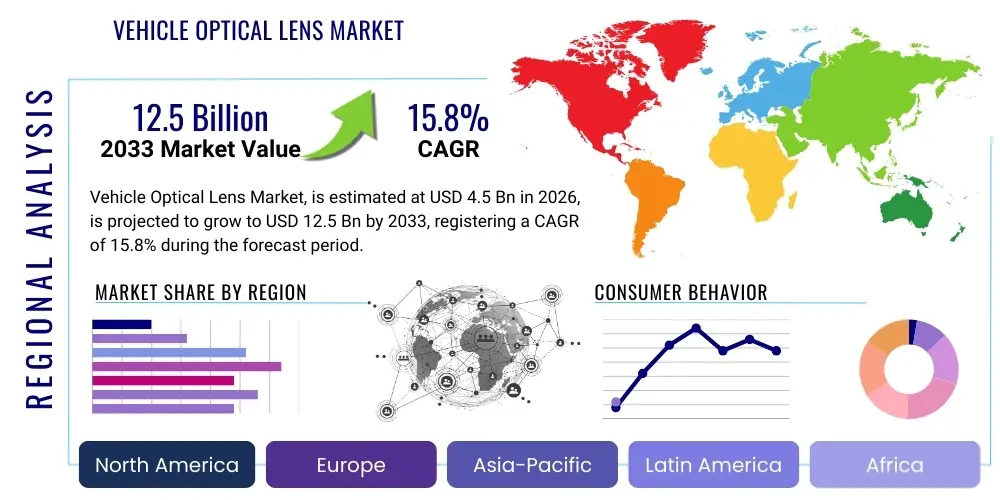

Vehicle Optical Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438498 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Vehicle Optical Lens Market Size

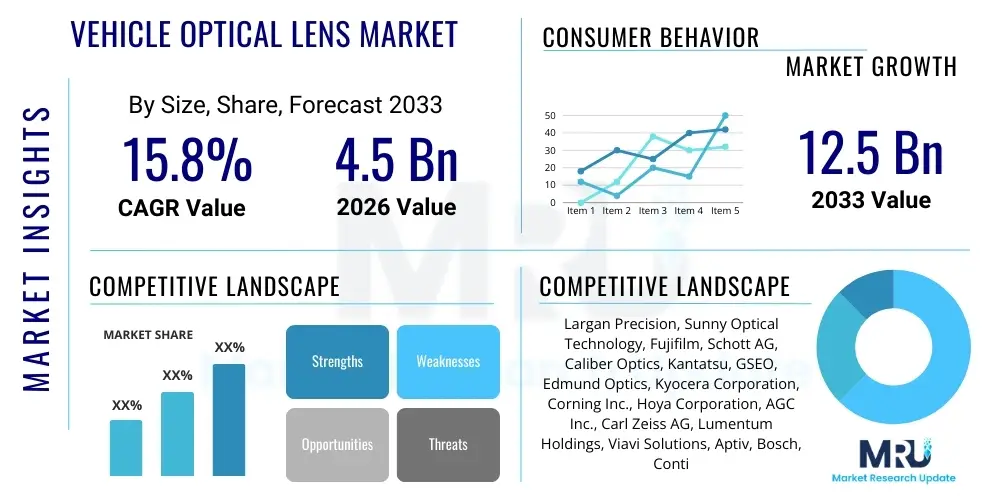

The Vehicle Optical Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

Vehicle Optical Lens Market introduction

The Vehicle Optical Lens Market encompasses the design, manufacture, and distribution of high-precision lenses used in various automotive applications, ranging from basic lighting systems to sophisticated Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle technologies. These optical components are critical for capturing high-resolution images, detecting objects, and ensuring accurate illumination, serving as the "eyes" of modern vehicles. The rapid evolution of automotive technology, particularly the shift toward increased vehicle intelligence and safety features, is the primary accelerator for this market, demanding robust, miniaturized, and highly reliable optical solutions. The scope of products includes not only lenses for visible light spectrum cameras but also specialized infrared (IR) optics necessary for night vision, driver monitoring systems (DMS), and the coherent light systems integral to LiDAR technology. These products must demonstrate exceptional durability to withstand the extreme temperature fluctuations, high vibration levels, and exposure to corrosive agents inherent in the automotive operational environment.

Product descriptions within this market span several categories, including complex multi-element lenses for camera modules (used in surround view systems, rearview cameras, and driver monitoring), precision optics for LiDAR systems (both emitter and receiver lenses), and high-performance optics utilized in advanced headlamps (such as adaptive driving beam systems, or ADB). Major applications extend across parking assistance, critical collision avoidance systems, lane keeping assists, and forming the crucial foundational infrastructure for fully autonomous driving stacks, requiring precise data input for real-time decision making. The benefits derived from advanced optical lenses include substantially enhanced vehicular safety through reliable object detection, improved situational awareness for the driver under diverse weather and lighting conditions, and providing the high-fidelity data input necessary for complex vehicular decision-making algorithms that define autonomous capabilities.

Key driving factors fueling market expansion include increasingly stringent global safety regulations mandated by governmental bodies—such as mandating pedestrian detection and automatic emergency braking (AEB)—significant and sustained investments by automotive OEMs and Tier 1 suppliers into ADAS technologies, and the decreasing overall cost of high-resolution sensor technology, which makes advanced optical integration more economically feasible across mid-range and entry-level vehicle segments. The continuous need for superior optical performance in challenging environmental conditions (vibration, rapid temperature cycling, humidity, dust) drives intense innovation in optical materials science, lens manufacturing processes like precision glass molding (PGM), and advanced coating technologies, ensuring market vitality and sustained, double-digit growth throughout the forecast period. The proliferation of electric vehicles (EVs) further contributes to this growth, as new-generation EV platforms are almost universally designed to be sensor-heavy from inception.

Vehicle Optical Lens Market Executive Summary

The global Vehicle Optical Lens Market is currently undergoing a transformative period, largely dictated by the widespread technological transition toward full autonomous driving capabilities (L3 to L5) and the increasing proliferation of sensor fusion architecture across all new vehicle designs. Business trends highlight a strong industry emphasis on strategic collaborations, mergers, and acquisitions between traditional high-volume optical manufacturers (Tier 2) and technology conglomerates specializing in embedded software, deep learning, and image processing (Tier 1). This integration aims to create streamlined, integrated sensing solutions rather than relying on disparate components. There is a noticeable operational shift towards utilizing hybrid lens structures—combining highly durable glass elements with cost-efficient, lightweight plastic elements—to achieve optimal performance parameters while simultaneously managing mass production costs and overall module weight, reflecting a core strategy among market leaders to optimize supply chains and increase production scalability rapidly to meet the anticipated exponential surge in OEM demands.

Regional trends robustly indicate that Asia Pacific (APAC), primarily driven by the colossal automotive markets of China, Japan, and South Korea, dominates both market consumption and production capacity. This leadership stems from having highly sophisticated and mature automotive manufacturing bases and the world’s highest adoption rates of Electric Vehicles (EVs) which typically integrate multiple advanced sensor arrays as standard features. In contrast, North America and Europe, galvanized by demanding regulatory environments like the European New Car Assessment Programme (Euro NCAP) and robust consumer safety expectations, lead in technological complexity and the fast deployment of premium, high-resolution ADAS and high-definition LiDAR systems. This technological leadership fosters robust demand for specialized, high-purity glass optics and advanced precision molded components. Emerging regions, including the Middle East and Africa (MEA) and Latin America (LATAM), are positioned for accelerated future growth as local governments increasingly prioritize road safety initiatives and invest heavily in intelligent urban transportation systems, driving the initial volume adoption of basic camera modules.

Segment trends conclusively demonstrate that the ADAS camera lens segment currently retains the largest market share by volume, specifically wide-angle and ultra-wide-angle lenses essential for critical functionalities like surround view systems and blind spot detection. However, the specialized LiDAR lens segment is unequivocally projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is directly attributed to the pending mass commercial deployment of Level 3 and Level 4 autonomous vehicles that critically rely on robust, laser-based optical systems for accurate long-range environmental sensing and high-fidelity 3D point cloud mapping. Furthermore, analysis of material segmentation reveals intense innovation in high-refractive-index, durable polymer lenses, offering appealing lighter weight and lower total cost solutions for non-critical viewing applications. Nonetheless, ultra-high-purity, precision-molded glass components remain dominant and irreplaceable in applications requiring extreme thermal stability, long-term environmental durability, and high radiation resistance, such as the forward-facing sensing modules mounted directly behind the vehicle windshield.

AI Impact Analysis on Vehicle Optical Lens Market

User inquiries regarding the profound influence of Artificial Intelligence (AI) on the Vehicle Optical Lens Market frequently center on several critical themes: how sophisticated machine learning algorithms are beginning to dictate precise lens design specifications, the critical, interdependent relationship between the high sensor resolution (which is fundamentally enabled by the optics) and the overall quality and efficiency of AI training data, and the impending shift from highly manual, traditional optics verification methodologies toward fully AI-driven quality assurance and automated defect control. Users are fundamentally seeking to determine if advanced AI optimization techniques will ultimately permit the use of simpler, potentially lower-cost lenses by computationally compensating for intrinsic optical imperfections through highly sophisticated software correction (computational photography), or if the unyielding requirement for high raw data fidelity for robust sensor fusion will necessitate even more advanced, high-precision, and optically perfect systems. Key concerns frequently revolve around the complex technical standardization of optical requirements across varied AI perception platforms and the risk of increasing market fragmentation driven by vendor-specific computational imaging solutions.

The integration of Artificial Intelligence into the automotive perception stack fundamentally and irrevocably alters the core requirements for vehicle optical lenses by pivoting the design focus from purely deterministic, human-view-centric optical performance to providing the absolute best possible input data quality specifically tailored for machine learning models. AI-driven perception systems are voracious consumers of consistent data, necessitating lenses that deliver extremely high contrast, near-zero geometric distortion, and reliable, invariant performance across drastically varying light and ambient temperature conditions to ensure the integrity and robustness of the training data and real-time inference. This paradigm shift compels optical component manufacturers to design lenses optimized not merely for human visual acuity but specifically for machine vision interpretation, leading to the rapid development of highly sophisticated designs that aggressively minimize common optical defects such as chromatic aberrations, spherical distortions, and stray light contamination, thereby drastically reducing the initial noise floor and maximizing the subsequent effectiveness of subsequent AI processing layers.

Consequently, sophisticated AI optimization algorithms are being increasingly deployed in the initial design and simulation phase itself (a practice known as AI-driven optical design optimization). These tools enable engineers to explore vast parameter spaces traditionally considered computationally prohibitive, drastically accelerating the development of highly customized and bespoke lenses precisely tailored for specific, proprietary sensor types (CMOS, CCD, SPAD arrays). Furthermore, AI plays an absolutely crucial role in dramatically enhancing manufacturing quality control protocols. Machine vision and deep learning models are now automating micron-level defect detection in high-volume lens production lines, ensuring that every single component consistently meets the extremely stringent reliability and performance standards demanded for safety-critical ADAS and autonomous driving applications. The prevailing market consensus among leading suppliers suggests that while AI provides correctional capabilities, its primary long-term impact is driving the baseline need for higher reliability and impeccable optical input, fundamentally elevating the required complexity and precision of the optical components themselves, as the safety foundation of autonomous systems rests squarely on unimpeachable data acquisition.

- AI mandates lenses with extremely high resolution, minimal distortion, and high contrast to maximize the integrity and utility of training data sets.

- The rise of computational imaging techniques, enabled by AI software, directly influences lens design trade-offs, often prioritizing high raw data integrity over absolute optical perfection.

- AI algorithms are extensively employed for advanced, automated quality control and metrology, significantly improving manufacturing yield rates and the precision consistency of complex multi-element lens arrays.

- The demand for highly optimized, application-specific lenses for varied sensor fusion architectures (especially integrating Camera and LiDAR data) is directly driven by the unique requirements of vendor-specific AI perception platforms.

- AI simulation and predictive modeling drastically accelerate the optical system development cycle, allowing for rapid iteration and virtual testing under diverse simulated environmental conditions before physical prototyping.

DRO & Impact Forces Of Vehicle Optical Lens Market

The market dynamics of the Vehicle Optical Lens sector are powerfully shaped by a synergistic combination of stringent regulatory drivers and immense technological opportunity, which is, in turn, moderated by significant constraints relating to cost sensitivity, manufacturing complexity, and supply chain volatility. The primary drivers are anchored in global governmental safety mandates (such as the mandatory implementation of rear-view cameras in many territories and the accelerating adoption of pedestrian and cyclist detection systems) and the unprecedented technological expenditure toward achieving full vehicular autonomy (L3-L5). The latter necessitates the integration of a vast array of optical sensors—often exceeding twenty high-resolution lenses per fully autonomous vehicle—drastically increasing market volume demand. Significant opportunities emerge from the necessity of developing and scaling advanced optical materials (e.g., highly durable anti-fog/anti-scratch coatings, specialized optical polymers) and specializing in high-power, precision LiDAR optics, which remains a nascent but rapidly scaling segment critical for reliable, high-level automation. These overwhelmingly positive forces generate substantial, predictable forward momentum, guaranteeing high sustained levels of capital investment and innovation.

Despite the strong growth trajectory, the market must navigate several critical restraints. The foremost restraint is the exceptionally high capital expenditure and associated operational cost involved in producing ultra-precision molded glass and complex hybrid lens systems that are mandated to survive the extremely harsh and prolonged operational lifespan required by automotive standards (AEC-Q100 equivalent). This includes survival through rapid, extreme temperature cycling, high mechanical vibration, and continuous exposure to common automotive chemicals and cleaning agents. Furthermore, the inherent manufacturing complexity involved in accurately assembling and aligning intricate multi-lens stacks (often comprising seven or more individual elements per ADAS camera module) to micron-level tolerances presents significant manufacturing hurdles, substantial production yield risks, and inflated calibration costs. Market growth is also temporarily constrained by the lack of universal industry standardization for autonomous sensor inputs and persistent supply chain bottlenecks for specific, rare high-purity optical materials essential for cutting-edge thermal and IR sensing applications, which are often sensitive to geopolitical instability and trade restrictions.

The single most powerful impact force dictating the current direction and investment strategy in this market is the synergistic pressure created by the regulatory environment coupled with heightened consumer and OEM expectations regarding vehicle safety performance. As global safety standards continuously escalate and insurance premiums become increasingly tied to safety features, OEMs are compelled to rapidly adopt more advanced, optically complex, and robust sensing systems, ensuring robust market stability for high-quality providers. Additionally, the sweeping transition toward electric vehicles (EVs) and the growth of emerging mobility paradigms like shared robotaxis and autonomous logistics services creates entirely new specialized opportunities, specifically for lenses catering to interior cabin monitoring (Driver Monitoring Systems - DMS) and specialized sensing optimized for operation within highly dense, urban environments. The confluence of these macro-factors ensures that technological innovation remains acutely focused on three core attributes: system resilience, drastic miniaturization, and seamless electronic and physical integration into next-generation vehicle architectures.

Segmentation Analysis

The Vehicle Optical Lens Market exhibits high complexity and is intricately segmented based on core factors including application function, fundamental lens type/structure, constituent material, and the required vehicle autonomy level, thereby providing a highly granular view of varied end-user performance requirements and technological maturity across different sectors of the global automotive industry. This comprehensive segmentation is vital for both market participants and investors to understand precisely where technological investment is most intensely concentrated, revealing a significant divergence between high-volume, highly cost-sensitive camera applications (e.g., parking assist) and the high-performance, precision-dependent, and thermally demanding optics required for LiDAR sensing systems. Analyzing and understanding these specific segments is absolutely crucial for manufacturers aiming to strategically tailor their production capabilities, optimize their material sourcing strategies, and accurately target their research and development efforts to meet evolving regulatory and OEM demands.

The primary technological axes of segmentation definitively highlight the inherent bifurcation of the market: firstly, by the specific functional role the lens performs (distinguishing between simple visual viewing, complex metric distance sensing, and high-power illumination control); and secondly, by the complexity, required durability, and cost metrics associated with the required optical material utilized (differentiating between ultra-precision glass, simple plastics/polymers, and advanced hybrid combinations). The segments demonstrating the most vigorous and sustained growth are those directly correlated with the global acceleration of vehicle automation levels, particularly lenses specifically designed for ultra-high-resolution vision systems that are essential for robust, all-weather, and all-condition environmental perception. Geographic segmentation further meticulously details the widely varying adoption rates and technological preferences of these sophisticated technologies, which is a direct reflection of regional differences in safety legislation, local manufacturing capabilities, and pervasive consumer purchasing power and acceptance of autonomous features.

Within the application segment, ADAS Camera Systems are further subdivided into multiple categories based on their field of view (FoV) and location, such as ultra-wide FoV lenses for surround view systems, telephoto lenses for advanced object identification at speed, and narrow FoV lenses for side-view mirrors replacement (Camera Monitoring Systems, or CMS). The material segment is also becoming increasingly nuanced, with specialized materials like chalcogenide glass gaining traction for advanced long-wave infrared (LWIR) applications used in high-end night vision systems, where standard silicon or germanium optics might not offer optimal performance or cost structure. This constant evolution in material science directly informs performance improvements across all application segments, underscoring the R&D intensity required to maintain market competitiveness and address future challenges in extreme weather operation and sensor reliability.

- By Application:

- ADAS Camera Systems

- Rearview & Parking Assistance Cameras (Wide FoV)

- Surround View System Cameras (Ultra-Wide FoV)

- Front Facing Sensing Cameras (Narrow to Mid FoV)

- Camera Monitoring Systems (CMS)

- LiDAR Systems

- Scanning/Mechanical LiDAR Emitter Lenses

- Solid State LiDAR Optics (Micro-lenses, Diffractive Optics)

- Lighting Systems

- High-Definition Matrix LED Lenses

- Adaptive Driving Beam (ADB) Projection Optics

- Infrared (IR) Sensing/Night Vision Systems (LWIR, SWIR)

- Driver Monitoring Systems (DMS) & Cabin Sensing Lenses

- ADAS Camera Systems

- By Lens Type/Structure:

- Molded Glass Lenses (High Purity)

- Plastic/Polymer Lenses (Injection Molded)

- Hybrid Lenses (Glass-Plastic Combination)

- Wafer-Level Optics (WLO)

- Freeform Optics

- By Sensor Technology:

- CMOS/CCD Camera Lenses

- LiDAR Emitter and Receiver Lenses (IR Wavelength Specific)

- By Vehicle Autonomy Level:

- L1 & L2 Vehicles (Driver Assistance)

- L3 & L4 Vehicles (Conditional & High Automation)

- L5 Vehicles (Full Automation)

- By Vehicle Type:

- Passenger Vehicles (BEV, PHEV, ICE)

- Commercial Vehicles (Heavy-Duty Trucks, Buses, Autonomous Shuttles)

Value Chain Analysis For Vehicle Optical Lens Market

The highly complex and specialized value chain for vehicle optical lenses commences intensely upstream with the critical sourcing of raw optical materials, primarily involving high-purity, specialized glass blanks (e.g., low-dispersion optical glass) and highly tailored optical resins and polymers engineered for automotive use. This foundational stage is characterized by highly capital-intensive operations focused on precise material synthesis, bulk molding, and comprehensive quality assurance testing, which collectively ensure that the raw materials consistently meet the incredibly stringent automotive-grade specifications regarding refractive index uniformity, exceptional thermal stability across wide ranges, and extremely low impurity and defect levels. Key upstream market players are specialized chemical corporations and highly integrated optical glass manufacturers (e.g., Schott AG, Corning). The inherent effectiveness and consistency of this initial sourcing stage fundamentally dictates the overall cost structure, manufacturing yield, and ultimate optical performance ceiling of the entire final lens product.

The midstream manufacturing process encompasses a variety of highly precision-driven activities, including state-of-the-art diamond turning (for freeform surfaces), ultra-precision glass and plastic injection molding, highly accurate grinding and polishing (for spherical and aspherical surfaces), and the highly specialized application of multi-layer anti-reflective (AR) and sophisticated protective coatings. This manufacturing phase represents the core and most proprietary competency of the entire market, demanding massive and continuous investment in advanced robotic assembly, highly accurate metrology equipment, and strictly controlled ISO-classified cleanroom environments to prevent micro-contamination. Following the meticulous fabrication of individual lens elements, specialized assembly houses undertake the complex process of integrating and precisely bonding these components into finished multi-element lens barrels. This step frequently involves bonding the completed lens assembly directly with the sensor array (known as module integration) to form ready-to-install camera modules. Strict quality control, precise calibration, and thermal cycling testing are paramount at this stage, particularly for safety-critical ADAS applications where micron-level tolerance deviations can lead to catastrophic system failure.

Downstream activities predominantly involve the highly controlled distribution channel, which is overwhelmingly characterized by deep integration, long-term contracts, and direct sales relationships between Tier 2 optical component specialists and the powerful Tier 1 automotive system integrators (e.g., Continental, Bosch, Aptiv, Magna). These Tier 1 suppliers perform the final, complex system integration—combining the lens modules with electronic control units, software, and housing—to create the complete sensing systems (e.g., integrated radar, camera, and LiDAR modules) before directly supplying them to the global Automotive Original Equipment Manufacturers (OEMs) for final integration into the vehicle platforms and electronic architectures. Indirect channels, such as conventional wholesale or retail distribution, are almost negligible, limited primarily to the highly regulated and much smaller aftermarket segment for replacement parts. This structure emphasizes the strong, centralized reliance on the established B2B automotive supply chain for all critical original equipment fitments, necessitating high commitment to quality control and rapid fulfillment capabilities from lens manufacturers.

Vehicle Optical Lens Market Potential Customers

The primary end-users and substantial direct buyers of vehicle optical lenses are tightly concentrated within the global automotive manufacturing ecosystem, specifically targeting those large, specialized corporate entities responsible for the engineering, production, and integration of vehicle safety, advanced connectivity, and autonomous driving features. The most immediate and high-volume customers are the dominant Tier 1 automotive suppliers (e.g., Harman, Valeo, ZF) who function as system integrators, purchasing the precision optical lenses in bulk for immediate integration into their complex camera, LiDAR, and high-definition lighting modules. These Tier 1 suppliers demand incredibly high-volume batches of components that are verified as defect-free and adhere rigorously to highly specific OEM and system-level specifications for robust integration into high-performance ADAS control units and central domain computing platforms.

Automotive OEMs themselves (e.g., Volkswagen Group, Tesla, General Motors) represent the ultimate specifiers and major indirect purchasers, profoundly influencing the entire procurement chain by dictating specific performance requirements, technological roadmaps, and lifecycle durability standards. While OEMs predominantly acquire fully integrated sensing modules from their contracted Tier 1 partners, their engineering teams exercise significant authority over the choice of lens specifications, often mandating requirements for specific field-of-view, required minimum resolution, and long-term durability metrics for their proprietary vehicle platforms. The increasing strategic trend of internal vertical integration, where certain major OEMs (e.g., Tesla, potentially others) are developing proprietary, in-house ADAS hardware and highly specialized software, strongly suggests that they may transition to becoming increasingly direct purchasers of highly specialized, often bespoke lenses, particularly those required for their next-generation, high-performance LiDAR and advanced lighting systems.

A crucial secondary market for vehicle optical lenses includes specialized entities such as military and defense contractors, who require exceptionally ruggedized and environmentally sealed optical systems for tactical, surveillance, and armored vehicles operating under combat-grade stress. Additionally, companies operating in the rapidly expanding field of autonomous logistics (e.g., last-mile delivery robots, autonomous industrial shuttles, port automation vehicles) and heavy off-road machinery (used in highly demanding mining, construction, and agricultural sectors) represent significant niche markets. These highly specialized end-users prioritize extreme environmental durability, reliability under shock, and sustained optical performance over strict cost minimization, demanding robust high-purity glass or high-performance hybrid optics capable of maintaining integrity under prolonged, severe operational stress, substantially expanding the market scope beyond conventional consumer passenger vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Largan Precision, Sunny Optical Technology, Fujifilm, Schott AG, Caliber Optics, Kantatsu, GSEO, Edmund Optics, Kyocera Corporation, Corning Inc., Hoya Corporation, AGC Inc., Carl Zeiss AG, Lumentum Holdings, Viavi Solutions, Aptiv, Bosch, Continental AG, Panasonic Corporation, Sekonix, Ofilm Group Co., Ltd., Oplink Communications LLC (Molex), Kuangyee Optics, Asia Optical Co., Inc., Ricoh Imaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Optical Lens Market Key Technology Landscape

The contemporary technology landscape within the Vehicle Optical Lens Market is fundamentally defined and dominated by relentless advancements in ultra-precision molding techniques, which are applied rigorously to both high-purity glass elements and specialized optical polymer elements. Precision Glass Molding (PGM) technology remains absolutely critical for manufacturing the highest performance front-facing cameras, the complex optical arrays for LiDAR, and advanced lighting systems, offering unparalleled thermal stability, superior optical homogeneity, and essential environmental resilience compared to plastic, although PGM entails significantly higher manufacturing costs. Current technological breakthroughs in PGM are hyper-focused on drastically improving the repeatability, throughput, and consistency of the molding processes, thereby enabling the reliable mass production of highly complex, high-numerical-aperture aspheric and freeform lens designs. These complex geometries allow for substantial reductions in the total number of lens elements required in a typical lens stack while simultaneously preserving or even enhancing image quality, resulting in critical miniaturization and weight reduction of the entire sensing module, a primary goal for seamless vehicle integration.

Concurrently, the utilization of sophisticated, specialized optical polymers and advanced plastic injection molding techniques has experienced a phenomenal surge in adoption. This trend is driven by the imperative need for extremely low-cost, high-volume production lenses, primarily targeting interior monitoring systems (DMS) and lower-resolution surround view cameras. A key innovation rapidly gaining commercial traction involves sophisticated hybrid lens designs, which strategically and optimally combine one or two high-performance glass elements (for critical light bending) with multiple plastic elements (for cost and weight savings) to expertly balance high optical performance, required robustness, and cost efficiency. Furthermore, advanced functional coatings—including multi-layer anti-scratch treatments, specialized anti-fog technologies utilizing nanostructured surfaces, and cutting-edge hydrophobic/hydrophilic de-icing coatings—are fast becoming standardized requirements. These coatings are indispensable for maintaining continuous sensor clarity and ensuring reliable functional capability under the most adverse weather conditions, which is a non-negotiable prerequisite for the operational safety of Level 3 and above autonomous functions.

Looking ahead, the development and industrial scaling of Diffractive Optical Elements (DOEs) and highly efficient Wafer-Level Optics (WLO) represent a significant, near-future technological disruptive force. WLO technology allows for the simultaneous fabrication, stacking, and highly accurate alignment of multiple lens elements at the silicon or glass wafer level prior to dicing and module assembly, drastically reducing complexity, minimizing alignment errors, and achieving unprecedented degrees of miniaturization. This is critically important for integrating sensing technology discreetly into the vehicle body aesthetic. For the rapidly evolving LiDAR market, the technological focus is rapidly shifting away from bulky mechanical scanning toward fully solid-state beam steering mechanisms and highly specialized micro-lenses or lens arrays designed specifically to efficiently couple and manage high-power Vertical-Cavity Surface-Emitting Lasers (VCSEL) or Edge-Emitting Lasers (EEL) arrays. This transition ensures highly efficient light transmission and reception necessary for accurate, long-range, and rapid 3D point cloud mapping, while simultaneously eliminating the reliability and maintenance issues associated with traditional mechanical moving parts, thus cementing the future of LiDAR optics.

Regional Highlights

The global market landscape for vehicle optical lenses is significantly heterogeneous, clearly differentiated by factors such as entrenched manufacturing capacity, the varying urgency of regulatory implementation, and the differing pace of advanced autonomous vehicle technology adoption across continents. Asia Pacific (APAC) currently holds the dominant position as the largest and most rapidly expanding regional market, primarily propelled by the immense economic powerhouses of China, Japan, and South Korea. This explosive growth is fundamentally fueled by robust domestic automotive production, notably within the skyrocketing electric vehicle (EV) segment, where new platforms inherently demand comprehensive, integrated sensing packages. Critically, APAC functions as the preeminent global manufacturing hub for electronic and optical components, resulting in highly optimized, localized supply chains and strong cost advantages for the mass production of both polymer and hybrid lens systems, allowing the region to sustain a cost-competitive edge.

In contrast, North America and Europe collectively constitute highly mature market environments characterized by a high Average Selling Price (ASP) for optical components. This premium pricing reflects the pervasive demand for technologically advanced, high-performance, and extremely reliable sensing systems necessary to rigorously satisfy the stringent safety standards promulgated by bodies such as the National Highway Traffic Safety Administration (NHTSA) and Euro NCAP. These regions are primary early adopters of sophisticated premium vehicular features, including complex adaptive high-definition (HD) lighting systems and emerging Level 3 conditional automation platforms, thereby driving robust demand for the highest quality precision-molded glass and high-fidelity LiDAR optics. Furthermore, significant technological innovation, foundational research, and core R&D activities related to advanced optical testing, calibration, and sophisticated sensor integration methodologies are heavily concentrated in these advanced geographical areas.

Latin America (LATAM) and the Middle East and Africa (MEA) are recognized as rapidly emerging markets that are currently experiencing robust accelerated growth, albeit starting from a comparatively smaller market base. The primary market expansion in these regions is largely attributable to rapidly increasing governmental and regulatory pressure to standardize fundamental vehicle safety features, such as the mandate for compulsory rearview cameras, coupled with increasing strategic investment in developing intelligent urban transportation and smart city infrastructure. While the current market demand profile is dominated by the procurement of lower-cost polymer lenses suitable for entry-level ADAS applications, the mid-to-long term forecast strongly suggests a swift technological assimilation, particularly as local automotive manufacturing and assembly capabilities mature and autonomous public transport pilot programs begin to gain widespread regional governmental support and traction.

- Asia Pacific (APAC): Maintains the largest global market share and highest growth rate; driven by immense domestic EV manufacturing in key nations like China and South Korea; characterized by strong capabilities in high-volume polymer, hybrid lens, and WLO production, ensuring cost leadership.

- North America: Exhibits exceptionally high demand for premium, high-resolution ADAS and high-performance LiDAR optics; positioned as a technology leader in the stringent testing and widespread deployment of Level 3/4 autonomous vehicle platforms; market growth heavily regulated and driven by consumer safety advocacy and federal mandates.

- Europe: The highly demanding regulatory environment (especially Euro NCAP and UNECE regulations) mandates extremely high safety standards, consistently driving the adoption of highly precise lenses for advanced matrix LED headlamps and sophisticated, multi-layer sensor fusion architectures; core focus remains on high-quality precision glass molding and stringent automated quality control protocols.

- Latin America & MEA: Emerging, high-potential markets demonstrating accelerating growth fueled by foundational governmental safety regulations and initial strategic investments in connected vehicle infrastructure; current demand is concentrated on the cost-effective integration of standardized camera lenses for foundational safety and viewing features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Optical Lens Market.- Largan Precision Co., Ltd.

- Sunny Optical Technology (Group) Company Limited

- Fujifilm Corporation

- Schott AG (Specialized Glass)

- Caliber Optics Inc.

- Kantatsu Co., Ltd.

- GSEO (Genius Electronic Optical)

- Edmund Optics Inc.

- Kyocera Corporation (Automotive Components)

- Corning Incorporated (High-Performance Glass)

- Hoya Corporation

- AGC Inc. (Asahi Glass Co.)

- Carl Zeiss AG (Specialized Optics Division)

- Lumentum Holdings Inc. (LiDAR Optics Focus)

- Viavi Solutions Inc. (Optical Coatings and Filters)

- Sekonix Co., Ltd.

- Oplink Communications LLC (Molex)

- Ofilm Group Co., Ltd.

- Kuangyee Optics

- Asia Optical Co., Inc.

- Ricoh Imaging Company, Ltd.

- Tamron Co., Ltd.

- Aptiv PLC (Integrated System Supplier)

- Robert Bosch GmbH (Tier 1 Integrator with in-house optics)

Frequently Asked Questions

Analyze common user questions about the Vehicle Optical Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between glass and plastic lenses in automotive applications, regarding performance?

Glass lenses offer superior environmental robustness, including exceptional thermal stability, chemical inertness, and higher resistance to scratching, making them mandatory for high-precision, exposed front-facing ADAS and high-power LiDAR systems. Conversely, plastic (polymer) lenses allow for significant cost reduction, lighter weight, and easier incorporation of complex aspherical geometries via injection molding, commonly utilized for interior monitoring and surround-view cameras where operating conditions are less severe.

How is LiDAR technology fundamentally influencing the design and accelerating the demand for vehicle optical lenses?

LiDAR systems necessitate highly specialized, infrared-transmitting, and ultra-high-efficiency optical components, specifically micro-lenses, collimators, and focusing optics, often requiring durable materials like fused silica or high-index glass to precisely manage IR wavelengths. The inevitable mass commercialization of Level 3 and Level 4 autonomous vehicles is driving unprecedented, exponential demand for these complex, high-precision, and dedicated LiDAR optical elements, establishing it as the fastest-growing market segment by value.

Which critical regulatory factors are most significantly driving the mandatory adoption of advanced vehicle optical systems globally?

The most critical drivers are global governmental safety mandates, such as the universal requirement for rearview cameras (like the US FMVSS 111 mandate) and the continuous escalation of rating systems like Euro NCAP, which strongly incentivize and reward vehicle models equipped with superior collision avoidance, robust pedestrian detection, and autonomous emergency braking (AEB) capabilities, all of which require high-resolution, reliable wide-field-of-view lenses.

What are the key benefits of hybrid lens assemblies, and why are they strategically popular in the automotive industry supply chain?

Hybrid lenses strategically combine high-durability glass elements with cost-efficient plastic elements within a single optical stack. Their primary benefit is achieving an optimal balance, leveraging the superior thermal and refractive stability of glass for critical elements while utilizing lightweight, economical plastic for non-critical components. This methodology helps deliver the high optical performance and requisite robustness needed for ADAS, while simultaneously ensuring the overall mass production cost remains economically feasible for OEMs.

In what specific ways does the global shift to Electric Vehicles (EVs) impact the demand structure in the Vehicle Optical Lens Market?

Electric Vehicle (EV) platforms are fundamentally engineered as highly integrated, 'smart' systems, resulting in a significantly higher inherent density and complexity of integrated sensors (cameras, radar, LiDAR) compared to traditional ICE vehicles. This heightened sensor integration, combined with the necessity for extensive internal monitoring (e.g., thermal management, cabin surveillance), directly and strongly accelerates both the required volume and the technological complexity of optical lens requirements per vehicle unit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager