Vehicle Pillar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437342 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Vehicle Pillar Market Size

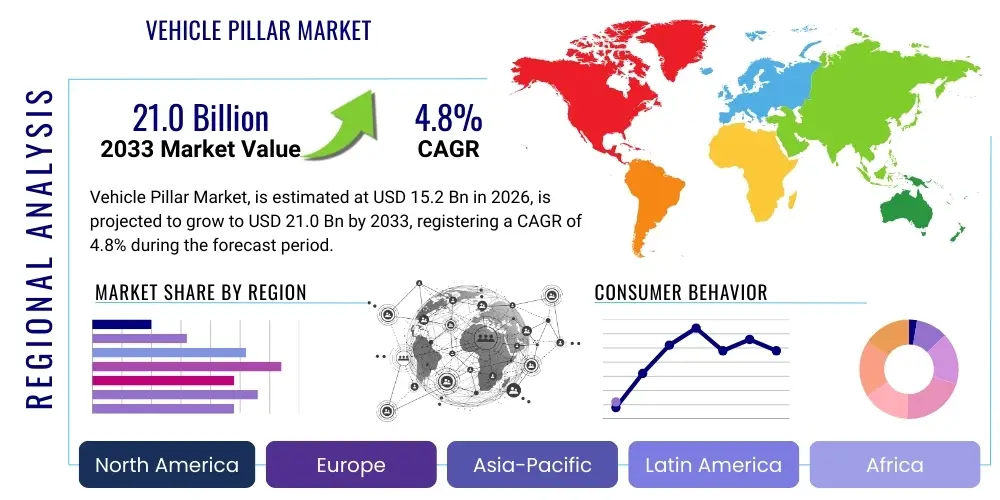

The Vehicle Pillar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033.

Vehicle Pillar Market introduction

The Vehicle Pillar Market encompasses the design, manufacturing, and supply of structural supports—specifically the A, B, C, and sometimes D pillars—integrated into the chassis of automotive vehicles. These pillars are critical safety components that provide structural integrity to the cabin, particularly in rollover and side-impact collisions, ensuring the maintenance of the survival space for occupants. Beyond safety, pillars serve as mounting points for doors, windows, and interior trim, significantly influencing the vehicle’s aesthetics, aerodynamics, and overall rigidity. Increasing global regulatory emphasis on passenger safety, such as stringent crash test standards (e.g., NCAP ratings), mandates the continuous innovation and use of advanced, lightweight materials in pillar construction, thereby driving market expansion. The shift toward electric vehicles (EVs) and autonomous driving further necessitates re-engineering pillars to accommodate new sensor placements and battery protection structures.

Product descriptions within this market focus heavily on the material composition, which often includes high-strength low-alloy (HSLA) steel, ultra-high-strength steel (UHSS), specialized aluminum alloys, and advanced composites. The A-pillar, located closest to the front windshield, often faces challenges balancing visibility requirements with structural rigidity. The B-pillar, central to the vehicle, bears the brunt of side-impact forces and requires substantial reinforcement. Major applications span the entire automotive sector, including passenger cars (sedans, SUVs, hatchbacks), light commercial vehicles (LCVs), and heavy trucks. The primary benefits derived from these components are enhanced occupant safety, improved vehicle handling due to torsional rigidity, and compliance with increasingly strict international safety mandates. Key driving factors include escalating global vehicle production, mandatory adoption of advanced safety features like curtain airbags integrated into pillars, and ongoing technological advancements in material science aimed at reducing vehicle weight without compromising strength.

The market landscape is characterized by established automotive component suppliers working closely with Original Equipment Manufacturers (OEMs) during the early stages of vehicle platform development. Customization based on vehicle segment—ranging from entry-level passenger vehicles to high-end luxury and armored cars—plays a crucial role. For instance, luxury vehicles often integrate sophisticated damping materials and noise reduction technologies within the pillar structure. The aftermarket segment, though smaller, contributes through replacement parts following accidents. The continuous evolution of manufacturing techniques, such as hydroforming and advanced welding processes, allows for complex geometric shapes that optimize energy absorption and streamline assembly processes, cementing the pillar's role as a core element of modern vehicle architecture.

Vehicle Pillar Market Executive Summary

The Vehicle Pillar Market is experiencing robust growth fueled primarily by global regulatory pressure emphasizing passive safety and the ongoing trend of vehicle lightweighting. Business trends indicate a strong focus among tier-one suppliers on vertical integration and strategic partnerships with material science companies to develop next-generation pillar structures using multi-phase steel and carbon fiber reinforced polymers (CFRP). This innovation is critical for meeting safety requirements while enhancing fuel efficiency or EV range. Furthermore, the increasing complexity of pillar design, driven by the need to integrate sophisticated safety systems (such as side-curtain airbags and crash sensors) and the aesthetic requirement for slimmer profiles to improve visibility, is prompting significant R&D investment across the industry. Supply chain resilience, particularly concerning the sourcing of specialized high-strength steel, remains a key challenge and a central theme in competitive business strategies.

Regional trends reveal the Asia Pacific (APAC) region, led by China and India, as the fastest-growing market due to rapid industrialization, burgeoning middle-class vehicle ownership, and rising adoption of global safety standards. Europe and North America remain mature markets characterized by high technology penetration and established stringent safety regulations, making them lucrative areas for advanced material implementation and premium component sales. The transition toward electric vehicles is profoundly affecting regional manufacturing, particularly in Europe, where OEMs are redesigning platforms that often eliminate the traditional engine compartment, influencing A-pillar geometry and material selection to manage frontal impact forces differently. Regulatory harmonization efforts across regions are streamlining product development but increasing the required baseline performance levels globally.

Segmentation trends highlight the dominance of the High-Strength Steel segment due to its excellent balance of cost-effectiveness, strength, and recyclability, though Aluminum and Composites are rapidly gaining share, particularly in high-performance and premium vehicle applications seeking maximum weight reduction. By pillar type, the B-Pillar segment commands the largest market share owing to its critical role in side-impact protection and roof support, demanding the highest degree of structural integrity. Passenger Vehicles represent the overwhelmingly largest vehicle type segment. The OEM channel dominates sales, reflecting the intrinsic nature of pillars being integral structural components supplied directly to assembly lines, leaving the aftermarket as a supplementary source primarily for collision repair.

AI Impact Analysis on Vehicle Pillar Market

User inquiries regarding AI's influence on the Vehicle Pillar Market commonly center on how AI-driven simulation can accelerate crashworthiness design, optimize material usage, and potentially automate quality inspection during manufacturing. Key concerns relate to whether AI can effectively predict failure modes in highly complex, multi-material pillar assemblies under various crash scenarios (e.g., oblique impacts) that current finite element analysis (FEA) struggles with. Users are also interested in the integration of AI-powered design tools that allow engineers to rapidly iterate pillar geometries to improve occupant visibility while maintaining structural integrity, addressing the persistent safety vs. visibility trade-off. Expectations are high for AI-driven manufacturing process control, using machine learning to optimize welding, stamping, and bonding parameters, ensuring zero-defect production of these critical safety components.

The impact of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is primarily transformative in the design and manufacturing phases of vehicle pillars. In design, AI facilitates topology optimization, enabling engineers to generate complex, load-path-optimized pillar geometries that minimize weight while maximizing energy absorption efficiency. This shifts the design paradigm from relying purely on iterative human experience and traditional FEA toward data-driven, predictive material allocation. AI algorithms can process vast datasets from thousands of simulated or real-world crash tests, identifying non-obvious correlations between material properties, geometry, and failure outcomes, thus dramatically reducing the design cycle time required for achieving top safety ratings (e.g., IIHS Top Safety Pick+).

Furthermore, within the production environment, AI enhances quality control and process efficiency. Computer vision systems combined with ML models can perform real-time, high-precision inspections of welded joints, material thickness consistency, and hydroforming accuracy, far exceeding human inspection capabilities. Predictive maintenance systems, trained on operational data from stamping and assembly equipment, can forecast potential equipment failure or drift in process parameters that might affect the integrity of the pillars, thereby ensuring consistent quality crucial for safety-critical parts. This integration of AI supports the goal of creating structurally perfect safety components that are crucial for both conventional and new energy vehicles.

- AI-Driven Topology Optimization: Accelerates design of lightweight, high-strength pillar structures.

- Predictive Crash Simulation: Utilizes ML to forecast failure modes in complex assemblies, improving crashworthiness.

- Real-Time Quality Inspection: Implements computer vision and ML for automated, high-precision detection of defects in welds and material surfaces during manufacturing.

- Material Performance Prediction: AI algorithms optimize material selection and blending for multi-material pillars (e.g., steel and composites).

- Supply Chain Optimization: ML models enhance forecasting and inventory management for specialized high-strength steel alloys.

- Autonomous Manufacturing Control: Uses AI to adjust stamping and bonding parameters dynamically for maximum process efficiency and component integrity.

DRO & Impact Forces Of Vehicle Pillar Market

The Vehicle Pillar Market dynamics are shaped by a complex interplay of forces. Key drivers include stringent global safety regulations, particularly those established by Euro NCAP and NHTSA, which necessitate stronger cabin structures capable of withstanding higher-velocity impacts and rollovers, demanding advanced pillar designs. Opportunities lie heavily in the burgeoning demand for lightweight materials in electric vehicles (EVs) to extend battery range, creating a niche for advanced composites and specialized aluminum structures that offer superior strength-to-weight ratios. Restraints primarily involve the high cost associated with advanced materials like carbon fiber reinforced plastics (CFRP) and ultra-high-strength steel (UHSS), coupled with the complexities and high energy requirements of specialized manufacturing processes like hot stamping and hydroforming. These combined forces dictate investment priorities and technological pathways for key market participants.

The primary impact forces driving investment and innovation are legislative mandates and consumer safety perceptions. Regulatory bodies consistently raise the bar for roof crush resistance and side impact protection, forcing OEMs to continually upgrade pillar design and materials. This mandatory compliance acts as a consistent growth engine. Conversely, the industry faces the challenge of managing manufacturing tolerances; even minor deviations in the assembly of pillars can severely compromise crash performance, requiring intensive quality control measures which increase operational costs. The opportunity to monetize intellectual property related to proprietary multi-material joining techniques (like specialized adhesive bonding or friction stir welding for dissimilar materials) is also a powerful impact force, driving competition among tier-one suppliers seeking differentiation.

Furthermore, environmental sustainability goals act as both a driver and a restraint. The demand for lightweighting (a driver) must be balanced against the environmental impact and recyclability challenges associated with certain multi-material structures (a restraint). The shift towards EVs offers a significant opportunity; as EVs often have higher curb weights due to batteries, the necessity to minimize non-battery structural weight becomes paramount, creating immense demand for innovative, weight-optimized A-B-C pillar assemblies. Failure to innovate in material science and manufacturing processes could restrain growth, as traditional steel pillars may not meet the future criteria for both safety and lightweight targets in electrified platforms.

Segmentation Analysis

The Vehicle Pillar Market is comprehensively segmented based on Pillar Type, Material, Vehicle Type, and Sales Channel. This structure allows for granular analysis of demand patterns and technological preferences across different applications and geographical regions. Understanding these segments is crucial for manufacturers to tailor their production capabilities and material sourcing strategies. For instance, the choice between high-strength steel and aluminum depends heavily on the target vehicle segment (premium vs. mass-market) and specific regulatory requirements related to vehicle mass and crash energy management. The highest volume remains concentrated in the mass-market passenger vehicle segment, predominantly utilizing optimized steel structures, whereas niche segments drive innovation in advanced materials.

Segmentation by Pillar Type (A, B, C, D) reveals distinct manufacturing and structural demands. The B-Pillar typically commands the highest material strength specifications due to its primary role in side impact and roof crush protection, often requiring multi-stage hot stamping. The A-Pillar, however, must balance structural stiffness with stringent visibility standards, leading to thinner, but equally strong, designs. Material segmentation reflects the industry's lightweighting efforts, ranging from conventional high-strength steels to cutting-edge composite solutions, each presenting unique challenges in joining and manufacturing integration. The rapid growth of the SUV and truck categories influences the D-Pillar segment, as these vehicle types frequently incorporate additional rear pillars for structural support, cargo capacity, and aesthetic purposes.

The Vehicle Type segmentation separates the market into Passenger Vehicles (PVs) and Commercial Vehicles (CVs), with PVs being the dominant consumer due to higher global production volumes. However, CVs, particularly heavy trucks, require extremely robust and durable pillar structures to ensure cabin integrity under high-stress operating conditions and stringent roof crush tests specific to heavy-duty platforms. Finally, the Sales Channel bifurcation between OEM and Aftermarket clearly shows the dominance of OEM sales, emphasizing the highly integrated, safety-critical nature of pillars, where they are supplied directly to assembly lines as structural sub-assemblies rather than individual components for retail distribution.

- Pillar Type

- A-Pillar

- B-Pillar

- C-Pillar

- D-Pillar (Primarily SUVs and large vehicles)

- Material

- High-Strength Steel (HSS & UHSS)

- Aluminum Alloys

- Composites (Carbon Fiber Reinforced Plastics - CFRP)

- Others (Magnesium Alloys, Multi-Material Hybrids)

- Vehicle Type

- Passenger Vehicles (Hatchbacks, Sedans, SUVs, Vans)

- Commercial Vehicles (LCVs, HCVs)

- Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Vehicle Pillar Market

The value chain for the Vehicle Pillar Market begins with upstream activities centered on raw material extraction and processing, dominated by specialized steel producers, aluminum smelters, and chemical companies supplying resins and fibers for composites. Steel mills provide various grades of high-strength and ultra-high-strength steel sheets, critical for hot stamping processes. This stage is highly influential as raw material quality directly determines the structural integrity and potential weight of the final pillar assembly. Key suppliers must maintain rigorous quality control and supply chain stability, especially for proprietary steel alloys that offer specific strength characteristics demanded by advanced crash management systems. Price volatility and geopolitical stability in sourcing these materials represent significant risk factors within the upstream segment.

Midstream activities involve Tier 1 suppliers (like Magna, Gestamp, Benteler) who undertake complex manufacturing processes such as hot stamping, cold forming, hydroforming, and sophisticated multi-material joining techniques (e.g., laser welding, structural adhesive bonding). These suppliers transform raw materials into finished pillar sub-assemblies, often integrating brackets, reinforcement patches, and mounting points for airbags and interior trim. The complexity here lies in achieving precise dimensional tolerances and ensuring the material properties are maintained throughout the forming process, particularly for highly stressed parts like the B-Pillar. Distribution channels primarily follow a direct model; Tier 1 suppliers deliver just-in-time (JIT) to OEM assembly plants globally, reflecting the high volume and continuous supply nature of vehicle production. Indirect channels are negligible for new vehicle production but exist in the aftermarket for collision repair components supplied through distributor networks.

Downstream analysis focuses on the integration of the pillars into the vehicle structure at the OEM assembly line and the final sale to the end-user. OEMs are the immediate customers, demanding components that fit perfectly and contribute optimally to the vehicle's passive safety performance. The ultimate potential customers are vehicle buyers whose purchasing decisions are increasingly influenced by safety ratings (e.g., 5-star NCAP). The high interdependence between OEMs and suppliers necessitates early involvement of Tier 1 suppliers in vehicle design (co-design), further strengthening the direct distribution model and long-term contractual agreements, thereby limiting the influence of indirect sales channels in the primary market segment.

Vehicle Pillar Market Potential Customers

The primary and immediate potential customers for vehicle pillars are Original Equipment Manufacturers (OEMs) across the globe, including established automotive giants such as Toyota, Volkswagen Group, General Motors, Ford, and emerging players in the Electric Vehicle (EV) space like Tesla, Rivian, and numerous Chinese EV startups. These manufacturers require massive volumes of structurally sound, dimensionally precise, and safety-certified pillar assemblies tailored to specific vehicle platforms. The purchasing criteria for these OEMs are rigorous, prioritizing crash performance data, mass reduction potential, cost efficiency, and the supplier's capability for global scale and just-in-time delivery. As structural components, pillars are sourced based on long-term contracts established early in the vehicle development cycle.

The secondary but growing segment of potential customers includes specialized vehicle manufacturers focusing on niche applications, such as armored vehicles, specialty recreational vehicles (RVs), and high-performance racing platforms. These customers often demand customization, requiring pillars made from specialized materials (like composite or ballistic-resistant steel) that exceed standard regulatory requirements. For example, defense contractors require specialized B-pillars designed to withstand explosive impacts while maintaining cabin integrity. Although lower in volume, these customers typically represent high-margin opportunities due to the custom engineering and advanced material costs involved.

A third group of customers is the global network of collision repair facilities and authorized service centers, representing the aftermarket segment. These end-users, typically body shops, purchase replacement pillar parts following structural damage in accidents. Their purchasing decisions are driven by availability, certification, and compatibility with specific vehicle models. While the OEM segment focuses on new vehicle construction, the aftermarket ensures that structural integrity is restored post-collision, sustaining a continuous, albeit smaller, revenue stream for specialized distributors and certified spare parts suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autoliv, ZF Friedrichshafen AG, Continental AG, Magna International Inc., Hyundai Mobis Co. Ltd., Faurecia (Forvia), Adient PLC, Toyota Boshoku Corporation, Gestamp Automocion S.A., Benteler International AG, Martinrea International Inc., Kirchhoff Automotive GmbH, Samvardhana Motherson Group, Sumitomo Electric Industries, Yanfeng Automotive Interiors, Lear Corporation, TATA AutoComp Systems, CIE Automotive, Multimatic Inc., Aisin Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Pillar Market Key Technology Landscape

The Vehicle Pillar Market is technologically driven, focusing primarily on material science and advanced manufacturing processes to achieve the seemingly contradictory goals of enhanced safety (higher strength) and reduced vehicle mass (lightweighting). Hot stamping (or press hardening) technology remains foundational, particularly for high-volume production of Ultra-High-Strength Steel (UHSS) pillars, allowing components to achieve tensile strengths exceeding 1500 MPa. Advancements in this area involve tailored blank welding before stamping, enabling different material thicknesses or grades within a single component, optimizing stress distribution. Furthermore, the integration of specialized coatings in the hot stamping process is crucial to prevent oxidation and ensure consistent material flow during forming.

A rapidly evolving area is the implementation of multi-material joining technologies. As manufacturers increasingly use hybrid pillars combining steel, aluminum, and carbon fiber composites to achieve optimal performance and weight characteristics, traditional welding techniques are often inadequate. Key innovations include friction stir welding (FSW) for aluminum-to-aluminum joints, laser welding for complex steel-steel configurations, and advanced structural adhesives and riveting systems for joining dissimilar materials without compromising structural integrity or introducing galvanic corrosion. The quality control associated with these joining techniques often relies on non-destructive testing (NDT) methods like ultrasound and advanced computer vision systems to ensure the integrity of every critical joint, a necessity given the safety-critical function of the pillars.

The role of computer-aided engineering (CAE) and simulation tools is becoming increasingly sophisticated. Generative design and topology optimization software, often leveraging AI, are used to create complex internal pillar structures (often with varying wall thicknesses or internal lattice structures) that maximize energy absorption during a crash while using the minimum amount of material. This move towards highly optimized, asymmetrical geometries requires parallel investment in high-precision manufacturing equipment and robotics capable of handling complex parts consistently. The ultimate goal is the development of intelligent, adaptable pillars that integrate internal features for future requirements, such as wiring harnesses for sensors or specialized mountings for panoramic glass roofs, all while meeting the strictest roof crush standards globally.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth: APAC is the largest and fastest-growing region, driven by robust automotive manufacturing bases in China, India, Japan, and South Korea. China's shift toward New Energy Vehicles (NEVs) and the implementation of stricter local safety standards (aligning with or exceeding Euro NCAP) mandates the rapid adoption of advanced pillar technology, particularly in SUVs and mid-size sedans. High volume production and increasing consumer safety awareness are the core growth accelerators.

- North America (NA) Focus on Large Vehicles and Technology: North America, dominated by the US, shows high demand for strong pillar structures, specifically for large pickup trucks and SUVs, which have unique roof crush and rollover requirements. The region is characterized by early adoption of advanced materials (aluminum and composites) and significant investment in Tier 1 supplier facilities focused on hot stamping and advanced material bonding to service domestic OEM needs.

- Europe's Emphasis on Lightweighting and Standardization: Europe is a mature market known for stringent safety regulations (Euro NCAP) and a strong push toward vehicle lightweighting mandated by EU emissions targets. This region leads in the utilization of multi-material hybrid pillars and sophisticated joining techniques. Standardization efforts and high technology readiness among German and French automotive component suppliers define the market landscape.

- Latin America (LATAM) Catch-up Potential: LATAM, particularly Brazil and Mexico, is experiencing growing demand for standardized and cost-effective pillar solutions. While safety regulations are often less stringent than in NA or Europe, local NCAP initiatives are accelerating the need for improved structural integrity. Market growth is closely tied to local vehicle production volumes and economic stability.

- Middle East and Africa (MEA) Specific Requirements: The MEA region represents a smaller, specialized market segment. Demand is often concentrated in key hubs (UAE, Saudi Arabia, South Africa). Specific regional requirements include pillars designed for high-temperature resistance and, in certain specialized defense and diplomatic sectors, advanced armor-integrated pillar solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Pillar Market.- Autoliv

- ZF Friedrichshafen AG

- Continental AG

- Magna International Inc.

- Hyundai Mobis Co. Ltd.

- Faurecia (Forvia)

- Adient PLC

- Toyota Boshoku Corporation

- Gestamp Automocion S.A.

- Benteler International AG

- Martinrea International Inc.

- Kirchhoff Automotive GmbH

- Samvardhana Motherson Group

- Sumitomo Electric Industries

- Yanfeng Automotive Interiors

- Lear Corporation

- TATA AutoComp Systems

- CIE Automotive

- Multimatic Inc.

- Aisin Corporation

Frequently Asked Questions

Analyze common user questions about the Vehicle Pillar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Vehicle Pillar Market?

The primary drivers are global legislative mandates that require increasingly rigorous passive safety performance (e.g., roof crush resistance, side impact protection) and the accelerating industry transition to Electric Vehicles (EVs), which necessitates advanced, lightweight structural pillars to offset battery weight and extend range.

How does the B-Pillar differ functionally and structurally from the A-Pillar?

The B-Pillar is structurally critical for side-impact resistance and roof support, demanding the highest strength materials (often UHSS) and the most complex hot-stamping processes. The A-Pillar must balance structural rigidity with occupant visibility requirements and is generally designed to manage frontal crash energy and prevent cabin intrusion upon rollover.

Which materials are dominating the Vehicle Pillar Market for lightweighting purposes?

While Ultra-High-Strength Steel (UHSS) dominates due to its cost-to-strength ratio, the market is rapidly adopting advanced Aluminum alloys and specialized composites, particularly Carbon Fiber Reinforced Plastics (CFRP), especially in premium and electric vehicle platforms where maximizing weight reduction is essential for performance and range.

What role does Artificial Intelligence play in modern vehicle pillar design and manufacturing?

AI is crucial in two main areas: optimizing design through topology analysis to create complex, lightweight geometries that maximize crash energy absorption, and enhancing manufacturing quality control via machine learning-driven computer vision systems to inspect critical welds and bonding processes in real time.

Which geographic region exhibits the highest growth potential for vehicle pillar manufacturers?

The Asia Pacific (APAC) region, particularly China and India, holds the highest growth potential. This growth is underpinned by rising vehicle production volumes, rapid adoption of international safety standards, and increasing localization of advanced manufacturing technologies, especially for the burgeoning Electric Vehicle segment in the region.

The Vehicle Pillar Market, foundational to automotive safety, continues to evolve rapidly, necessitating substantial R&D investment in material science and joining technologies. The market's future trajectory is inextricably linked to regulatory changes, particularly those governing crash safety and sustainable manufacturing. Suppliers focusing on flexible, multi-material manufacturing lines and leveraging AI for design optimization will be best positioned to capitalize on the shift towards electrified and autonomous vehicle architectures. Continued globalization of vehicle platforms will further drive demand for standardized, yet highly technical, structural safety components.

The technical challenges inherent in vehicle pillar production—specifically managing the interface between visibility requirements, structural integrity, and weight reduction goals—ensure that innovation remains a competitive differentiator. Hot stamping remains crucial, but the industry is moving toward hybrid material applications, requiring proficiency in advanced joining techniques that maintain material strength without introducing weak points. Furthermore, the increasing complexity of interior integration, including advanced safety restraint systems housed within the pillars, demands tighter collaboration between Tier 1 suppliers and interior system providers to achieve seamless functionality and aesthetics.

In summary, the market outlook is overwhelmingly positive, characterized by resilient demand driven by non-negotiable safety mandates globally. While cost pressures remain a constraint, the opportunity presented by the widespread adoption of EV platforms—which are inherently more weight-sensitive—provides a powerful impetus for adopting premium, advanced composite, and aluminum-based pillar solutions. Manufacturers must prioritize supply chain security for specialized alloys and invest heavily in automation and precision manufacturing to meet the stringent quality and dimensional standards required for these life-critical components.

The structural transformation of the automotive industry toward autonomous capability also impacts pillar design, albeit indirectly. While the pillars themselves remain focused on passive safety, their geometries may need modification to accommodate new exterior sensor arrays and interior monitoring equipment, especially around the A-pillar and roofline structure. This evolving design environment requires suppliers to move beyond traditional metal forming expertise and develop system-level integration capabilities, treating the pillar as a highly functional, multi-purpose structural hub rather than a simple support beam. This forward-looking perspective will ensure long-term relevance and sustained market growth in the coming decade.

Advanced simulation capabilities, coupled with machine learning, are now non-negotiable tools for market players. The iterative cycle of physical prototyping and destructive testing is being replaced by predictive virtual testing, dramatically cutting development costs and time. The integration of advanced computational fluid dynamics (CFD) and thermal management analysis is also becoming relevant, particularly for pillars in electric vehicles, where heat management and aerodynamic efficiency play a direct role in battery performance and vehicle range. These technological convergences underscore the high-tech nature of the seemingly mundane vehicle pillar component.

Looking at the competitive landscape, consolidation among Tier 1 suppliers continues as companies strive for economies of scale and global reach necessary to serve major OEMs worldwide. Strategic acquisitions and joint ventures focused on acquiring specific material expertise (e.g., carbon fiber processing) or advanced manufacturing capabilities (e.g., tailored hot stamping) are common maneuvers aimed at securing market advantage. Furthermore, intellectual property protection surrounding novel joining methods and proprietary high-strength alloy formulations is a key battleground, defining who controls the most advanced segments of the vehicle pillar supply chain.

The aftermarket segment, while smaller, presents a distinct challenge related to ensuring structural integrity post-repair. The correct identification and use of certified replacement parts, often requiring specialized installation and welding procedures unique to UHSS and multi-material structures, are vital. Training and certification programs for body shop technicians regarding advanced pillar replacement techniques are necessary to maintain the vehicle's original safety rating, emphasizing the need for suppliers to offer comprehensive technical support alongside the components themselves. Non-compliance in this segment poses a direct threat to passenger safety and the reputation of both the OEM and the component supplier.

Future growth will be disproportionately influenced by the mass adoption of SUVs and Crossover vehicles, which typically incorporate C-Pillars and often D-Pillars for enhanced structural support and design aesthetics. The market for these larger vehicle types demands highly rigid structures capable of supporting greater roof loads and handling complex door arrangements. This trend necessitates that suppliers maintain flexible production lines capable of rapidly switching between manufacturing components for compact cars and large utility vehicles, requiring high capital expenditure in versatile stamping and forming equipment.

Finally, sustainability considerations are increasingly impacting material sourcing and processing. Automotive manufacturers are pushing for lower embodied carbon in their components, driving interest in processes that reduce energy consumption, such as specialized cold-forming of advanced high-strength steel (AHSS) where feasible, or greater use of recycled aluminum alloys. Recyclability at the end of the vehicle's life cycle is also a growing design concern, particularly for complex multi-material pillars, forcing engineers to consider component disassembly and separation during the initial design phase to enhance material recovery, aligning the industry with circular economy principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager