Vehicles Fog Lights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439427 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Vehicles Fog Lights Market Size

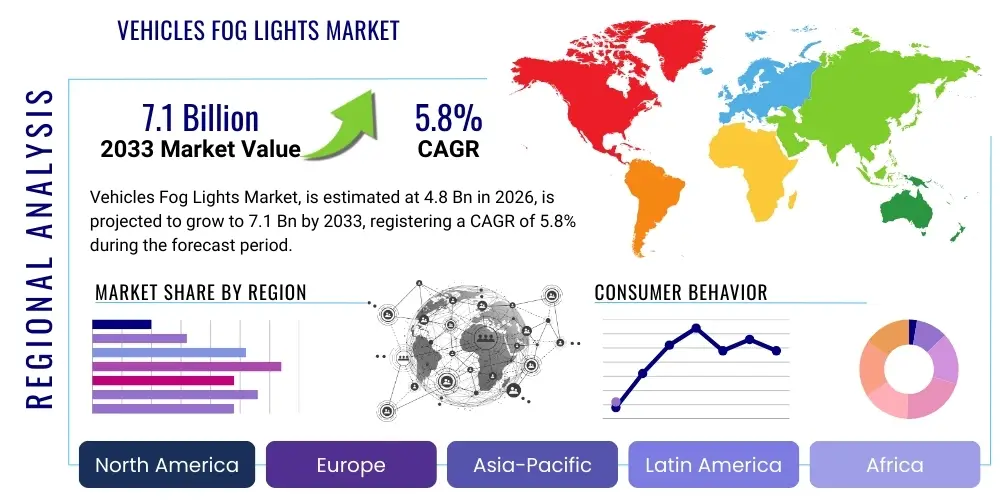

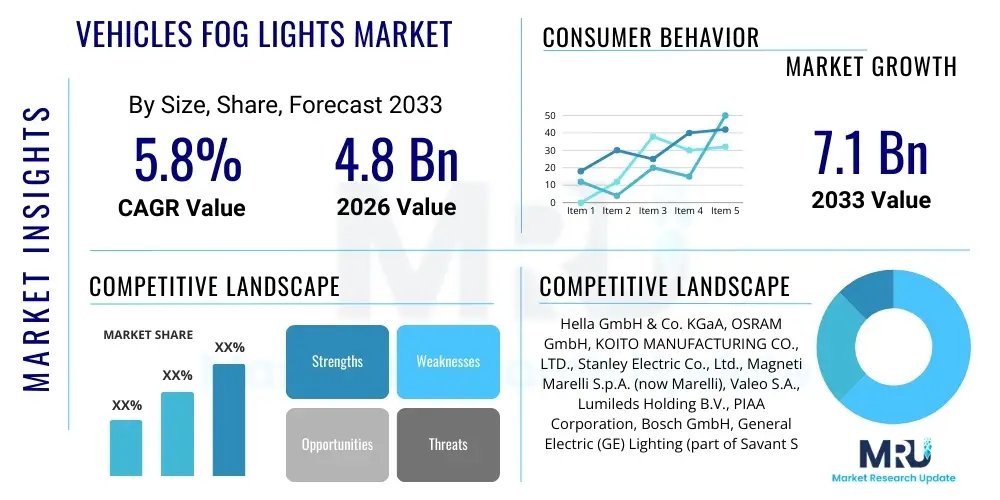

The Vehicles Fog Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Vehicles Fog Lights Market introduction

The Vehicles Fog Lights Market encompasses the global industry involved in the design, manufacturing, distribution, and sale of specialized lighting units designed to improve visibility in adverse weather conditions such as fog, heavy rain, snow, or dust. These lights are typically mounted low on the front of a vehicle, below the headlights, to illuminate the road surface directly in front of the vehicle without reflecting light back into the driver's eyes from airborne water droplets or particles. The primary purpose of fog lights is to enhance safety by providing a clearer view of the road and making the vehicle more visible to oncoming traffic under conditions where regular headlights might be less effective or even counterproductive due to glare.

Product descriptions within this market vary, ranging from traditional halogen fog lights to advanced LED (Light Emitting Diode) and even laser-based systems. LED fog lights have rapidly gained traction due to their superior brightness, energy efficiency, longer lifespan, and compact design, allowing for greater design flexibility in vehicle aesthetics. Major applications for fog lights span across all vehicle segments, including passenger cars (sedans, SUVs, hatchbacks), commercial vehicles (trucks, buses, vans), and off-road vehicles. Their importance is particularly pronounced in regions experiencing frequent inclement weather, mountainous terrains, or areas with dense fog, making them a crucial safety feature rather than merely an accessory.

The benefits derived from vehicle fog lights are primarily centered on enhanced road safety and driver confidence. By cutting through adverse conditions more effectively than standard headlights, fog lights reduce the risk of accidents, especially during nighttime fog or heavy downpours. Driving factors propelling this market include increasingly stringent automotive safety regulations worldwide, a growing consumer awareness regarding vehicle safety features, and the continuous technological advancements in automotive lighting, particularly the shift towards energy-efficient and high-performance LED solutions. Furthermore, the rising production and sales of vehicles globally, coupled with the increasing demand for advanced driver-assistance systems (ADAS) that often integrate with sophisticated lighting solutions, contribute significantly to market expansion.

Vehicles Fog Lights Market Executive Summary

The Vehicles Fog Lights Market is experiencing robust growth, driven by a confluence of factors including heightened global emphasis on automotive safety, continuous technological innovation in lighting systems, and increasing consumer demand for advanced vehicle features. Business trends indicate a significant shift from traditional halogen fog lights towards LED-based solutions, which offer superior performance, energy efficiency, and aesthetic integration with modern vehicle designs. Manufacturers are investing heavily in R&D to develop adaptive fog light systems that can automatically adjust intensity and beam patterns based on real-time weather and road conditions, further enhancing safety and convenience. Moreover, the aftermarket segment continues to be a crucial revenue stream, catering to vehicle owners looking to upgrade or replace existing fog lights with more advanced or customized options.

Regional trends reveal that mature automotive markets in North America and Europe are witnessing steady demand, largely driven by regulatory compliance and replacement cycles, alongside a growing preference for premium and technologically advanced vehicles. However, the Asia Pacific region, particularly countries like China and India, is emerging as the fastest-growing market due to escalating vehicle production, rapid urbanization, improving road infrastructure, and a rising disposable income leading to higher adoption rates of safety features. Latin America and the Middle East & Africa regions are also showing promising growth potential, albeit at a slower pace, as economic development and vehicle parc expansion drive initial adoption and upgrades. The varying climatic conditions across these regions further underscore the necessity and adoption of fog lights, tailoring market demand to specific environmental challenges.

Segmentation trends highlight the dominance of LED technology within the product type category, projected to expand its market share significantly over the forecast period due to its inherent advantages. By vehicle type, passenger cars remain the largest segment, but commercial vehicles and off-road applications are demonstrating strong growth as their respective industries emphasize operational safety and driver well-being. The OEM (Original Equipment Manufacturer) channel commands a substantial share, indicating the increasing integration of fog lights as standard or optional features in new vehicles, while the aftermarket sales channel thrives on personalization, replacement parts, and upgrades. The evolution of smart lighting systems, integrating with vehicle's electronic architecture and ADAS, is a defining trend shaping future segment dynamics, creating opportunities for specialized product offerings and integrated solutions.

AI Impact Analysis on Vehicles Fog Lights Market

Common user questions regarding AI's impact on the Vehicles Fog Lights Market often revolve around how artificial intelligence can enhance their functionality, integration with other vehicle systems, and overall safety contributions. Users are keen to understand if AI can make fog lights "smarter" by adapting to specific environmental conditions, whether they will integrate seamlessly with Advanced Driver-Assistance Systems (ADAS) for predictive visibility, and if AI will lead to more efficient energy usage or customized lighting patterns. There is also interest in the role of AI in manufacturing processes for improved quality and cost-effectiveness. The overarching themes suggest an expectation for fog lights to evolve from static safety features into dynamic, intelligent components that proactively contribute to driving safety and comfort, leveraging AI for real-time decision-making and optimal performance under diverse challenging conditions.

- AI-powered adaptive lighting systems can automatically adjust beam intensity, width, and direction based on real-time sensor data from cameras, lidar, and radar, detecting fog density, rain severity, and approaching vehicles.

- Predictive visibility enhancement: AI algorithms can analyze weather forecasts, GPS data, and historical road conditions to anticipate adverse visibility and proactively activate or pre-adjust fog lights before the driver even perceives the hazard.

- Integration with ADAS: AI enables seamless communication and coordination between fog lights and ADAS features like adaptive cruise control, lane-keeping assist, and autonomous emergency braking, optimizing overall vehicle perception and safety responses.

- Optimized energy management: AI can fine-tune power consumption of LED fog lights, ensuring maximum illumination efficacy with minimal energy draw, contributing to better fuel efficiency or extended EV range.

- Manufacturing and quality control: AI-driven inspection systems can enhance the precision and consistency of fog light production, detecting defects early and optimizing assembly processes for improved product reliability and cost efficiency.

DRO & Impact Forces Of Vehicles Fog Lights Market

The Vehicles Fog Lights Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its growth trajectory and competitive landscape. A primary driver is the escalating global focus on automotive safety, with governments and regulatory bodies implementing stricter mandates for vehicle lighting standards and driver visibility features, particularly in regions prone to adverse weather conditions. This regulatory push, coupled with a heightened consumer awareness regarding the importance of active safety systems, compels vehicle manufacturers to integrate advanced fog lights as standard or highly desirable optional features. Furthermore, continuous technological advancements, especially in LED lighting, offer superior performance, energy efficiency, and design flexibility, attracting both OEMs and aftermarket consumers seeking upgrades and aesthetically pleasing solutions. The increasing production and sales of passenger and commercial vehicles worldwide naturally expand the addressable market for fog lights.

However, several restraints temper the market's growth. One significant challenge is the rising cost associated with advanced lighting technologies, such as intelligent LED or laser fog lights, which can increase the overall vehicle price or aftermarket upgrade expense, potentially deterring budget-conscious consumers. The complexity of integrating sophisticated lighting systems with a vehicle's intricate electronic architecture and ADAS can also pose manufacturing and design challenges. Moreover, the ambiguity in some regional regulations regarding the exact specifications or mandatory nature of fog lights can lead to inconsistent adoption rates. The presence of low-quality, uncertified aftermarket products also poses a risk, as they may not meet performance or safety standards, undermining consumer trust and potentially leading to safety hazards.

Despite these restraints, abundant opportunities exist for market expansion and innovation. The burgeoning trend towards autonomous and semi-autonomous vehicles presents a significant opportunity, as these vehicles will require highly sophisticated and reliable lighting systems to ensure optimal sensor performance and environmental perception in all conditions, including fog. The development of smart fog lights that can communicate with other vehicles (V2V) and infrastructure (V2I) for enhanced collective visibility offers a futuristic growth avenue. Furthermore, the expansion of the aftermarket for performance upgrades, customization, and replacement of older, less efficient fog light technologies provides a consistent revenue stream. Emerging markets, with their rapidly growing middle class and increasing vehicle penetration, represent untapped potential for both OEM and aftermarket sales, particularly as safety standards evolve in these regions. Innovations in material science leading to more durable, weather-resistant, and aesthetically integrated designs also open new product development avenues.

Segmentation Analysis

The Vehicles Fog Lights Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics, offering insights into various product types, vehicle applications, sales channels, and technological advancements. This segmentation allows stakeholders to identify specific growth areas, understand market preferences, and tailor their strategies to address distinct consumer needs and regulatory environments. The market is primarily analyzed based on the type of technology employed in the fog lights, the categories of vehicles they are designed for, and the distribution channels through which they reach the end-user. Additionally, geographical segmentation helps delineate regional market sizes, growth rates, and prevailing trends, accounting for local regulations, climatic conditions, and consumer purchasing power.

- By Technology

- Halogen Fog Lights

- LED Fog Lights

- Xenon/HID Fog Lights

- Laser Fog Lights (Emerging)

- Adaptive Fog Lights (Integrated with ADAS)

- By Vehicle Type

- Passenger Cars

- Sedans

- Hatchbacks

- SUVs

- MPVs

- Luxury Cars

- Sports Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

- Vans

- Off-Road Vehicles

- ATVs (All-Terrain Vehicles)

- UTVs (Utility Terrain Vehicles)

- Jeeps

- Specialty Off-Road Trucks

- Passenger Cars

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement & Upgrades)

- Online Retail

- Offline Retail (Auto Parts Stores, Garages)

- By Application

- Front Fog Lights

- Rear Fog Lights

Value Chain Analysis For Vehicles Fog Lights Market

The value chain for the Vehicles Fog Lights Market is an intricate network of interconnected activities, beginning from raw material sourcing and extending to the final consumer. It encompasses various stages including upstream suppliers, manufacturing and assembly, distribution channels, and after-sales services, each adding value to the end product. Upstream analysis involves the procurement of essential components and raw materials such as plastics for housings, glass or polycarbonate for lenses, metals for heat sinks, and electronic components like LEDs, drivers, and wiring. Key raw material suppliers provide specialized materials that meet stringent automotive quality and durability standards. Manufacturers often rely on a global network of component suppliers to achieve cost efficiencies and access advanced technologies. The quality and availability of these upstream components directly impact the final product's performance, cost, and time-to-market.

The core of the value chain lies in the manufacturing and assembly process, where raw materials and components are transformed into finished fog light units. This stage includes sophisticated processes such as injection molding for housings, lens shaping, circuit board assembly, LED module integration, sealing for waterproofing, and rigorous testing for performance and durability. Many automotive lighting companies specialize in this manufacturing aspect, often leveraging automation and precision engineering. Downstream analysis then focuses on how these finished products reach the market. This primarily involves two main distribution channels: the Original Equipment Manufacturer (OEM) channel, where fog lights are supplied directly to vehicle assembly plants for installation in new vehicles, and the aftermarket channel, which caters to replacement, upgrade, and customization needs for existing vehicles.

The distribution channel plays a critical role in market penetration and customer reach. Direct distribution often occurs in the OEM segment, where lighting manufacturers work closely with vehicle makers, often co-developing specific lighting solutions for new vehicle models. Indirect distribution is more prevalent in the aftermarket, involving a network of distributors, wholesalers, retailers (both online and brick-and-mortar automotive parts stores), and independent repair shops. Online retail has gained significant traction, offering consumers convenience and a wider selection, while traditional auto parts stores provide immediate availability and expert advice. After-sales services, including warranties, technical support, and installation guidance, further enhance customer satisfaction and brand loyalty. Understanding these direct and indirect channels is crucial for market players to optimize their supply chain, enhance market access, and effectively serve their diverse customer base across global regions.

Vehicles Fog Lights Market Potential Customers

The Vehicles Fog Lights Market caters to a diverse range of potential customers, spanning both the industrial and consumer sectors, each with distinct needs and purchasing motivations. The primary customer segment comprises Original Equipment Manufacturers (OEMs), which are major automotive companies purchasing fog lights directly from specialized lighting manufacturers for integration into their new vehicle models. These OEMs include leading global passenger car manufacturers like Toyota, Volkswagen, General Motors, Ford, and BMW, as well as commercial vehicle giants such such as Daimler Trucks, Volvo, and PACCAR. Their demand is driven by design specifications, regulatory compliance, safety standards, and the desire to offer advanced features that enhance vehicle aesthetics and functionality. OEMs seek reliable, high-quality, and cost-effective lighting solutions that can be seamlessly integrated into their vehicle platforms, often requiring extensive collaborative development and testing.

Another significant customer base exists within the aftermarket segment, which encompasses both individual vehicle owners and fleet operators. Individual consumers, whether they own sedans, SUVs, or off-road vehicles, purchase fog lights for replacement due to damage or wear, or for upgrading their vehicles with better performing or more stylish lighting solutions. This segment is highly influenced by factors such as product aesthetics, performance specifications (e.g., brightness, beam pattern), brand reputation, ease of installation, and price. They often purchase through online retail platforms, specialized automotive parts stores, or general merchandise retailers. Fleet operators, on the other hand, manage large numbers of commercial vehicles and are primarily concerned with durability, reliability, long-term cost of ownership, and compliance with safety regulations to ensure continuous operation and minimize downtime. Their procurement decisions are often made in bulk and prioritize robust, low-maintenance options that can withstand demanding operational environments.

Beyond these major segments, the market also serves niche customers, including customization shops, performance tuning centers, and specialty vehicle manufacturers (e.g., for emergency vehicles, agricultural machinery, or construction equipment). These customers often require bespoke or highly specialized fog light solutions that cater to unique operational requirements, extreme environmental conditions, or specific aesthetic preferences. The growing trend of vehicle personalization further drives demand from the customization segment. Moreover, governmental agencies and municipalities that maintain large fleets of service vehicles (police cars, fire trucks, public utility vehicles) also represent an important segment, procuring fog lights that meet specific performance and regulatory standards for their critical applications. These varied customer profiles underscore the broad utility and essential nature of fog lights across the automotive ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella GmbH & Co. KGaA, OSRAM GmbH, KOITO MANUFACTURING CO., LTD., Stanley Electric Co., Ltd., Magneti Marelli S.p.A. (now Marelli), Valeo S.A., Lumileds Holding B.V., PIAA Corporation, Bosch GmbH, General Electric (GE) Lighting (part of Savant Systems), Ichikoh Industries, Ltd., ZKW Group GmbH, Automotive Lighting (a division of Marelli), TYC Brother Industrial Co. Ltd., Depo Auto Parts Ind. Co., Ltd., Philips (Signify Holding), KC HiLiTES, AnzoUSA, HELLA Australia Pty Ltd., Grote Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicles Fog Lights Market Key Technology Landscape

The Vehicles Fog Lights Market is characterized by a dynamic and evolving technology landscape, with continuous innovation driving performance, efficiency, and integration capabilities. Historically, halogen fog lights dominated the market, offering a cost-effective solution with a yellowish beam known for its ability to cut through fog without excessive glare. While still present in older vehicle models and budget-friendly aftermarket options, their relatively lower energy efficiency, shorter lifespan, and limited design flexibility have led to a gradual decline in their market share. The technology relies on a tungsten filament sealed in a glass envelope filled with halogen gas, which allows the filament to operate at a higher temperature, producing a brighter light than conventional incandescent bulbs.

The advent and rapid proliferation of Light Emitting Diode (LED) technology have fundamentally transformed the fog lights market. LED fog lights offer numerous advantages, including significantly higher brightness, superior energy efficiency, an exceptionally longer lifespan, and a compact size that allows for greater styling freedom and integration into modern vehicle aesthetics. Their instant-on capability and ability to produce a crisp, white light that closely mimics natural daylight further enhance visibility and driver comfort. Advanced LED systems often incorporate sophisticated optics to precisely control the beam pattern, ensuring maximum road illumination without blinding oncoming drivers. The ongoing miniaturization and cost reduction of LED components continue to accelerate their adoption in both OEM and aftermarket segments, making them the current standard for high-performance fog lights.

Beyond LEDs, the market is witnessing the emergence of even more advanced technologies such as Xenon High-Intensity Discharge (HID) lights and, more recently, laser fog lights. HID lights offer intense brightness and a longer lifespan than halogen, but they require a ballast and can have a slower warm-up time, making them less agile than LEDs for some applications. Laser fog lights, while still nascent and primarily confined to high-end luxury vehicles, represent the cutting edge, offering extremely precise and long-range illumination with minimal energy consumption. Furthermore, the integration of fog lights with Advanced Driver-Assistance Systems (ADAS) is a significant technological trend. Adaptive fog lights can dynamically adjust their beam pattern, intensity, and even color temperature based on real-time data from vehicle sensors (e.g., rain sensors, lidar, cameras) and AI algorithms, providing optimal visibility conditions automatically. This convergence with smart vehicle systems is shaping the future of automotive lighting, promising a safer and more intelligent driving experience.

Regional Highlights

- North America: A mature market with high adoption rates of advanced lighting technologies, driven by stringent safety regulations, a strong aftermarket for vehicle upgrades, and a preference for SUVs and trucks which often include fog lights as standard features. The presence of major automotive OEMs and a strong focus on premium vehicle segments contribute to consistent demand.

- Europe: Characterized by diverse regulations across countries (some mandating rear fog lights, others making front fog lights optional). The market is driven by robust vehicle sales, a strong emphasis on road safety, and a quick adoption of innovative lighting solutions, with a particular focus on energy efficiency and aesthetic integration in premium European brands.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapidly increasing vehicle production and sales in countries like China, India, Japan, and South Korea. Rising disposable incomes, improving road infrastructure, and a growing awareness of vehicle safety features are propelling both OEM and aftermarket demand. Technological advancements and competitive pricing are key drivers.

- Latin America: An emerging market experiencing steady growth, driven by increasing urbanization, expanding vehicle parc, and rising consumer demand for basic and enhanced safety features. Economic development and infrastructure improvements contribute to the adoption of fog lights, particularly in countries with varied climatic conditions.

- Middle East and Africa (MEA): Demonstrating promising growth potential, influenced by increasing vehicle sales, particularly in the GCC countries, and a rising focus on vehicle safety. Harsh environmental conditions (e.g., dust storms, desert fog) in certain areas make fog lights a practical and desirable safety feature, driving demand across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicles Fog Lights Market.- Hella GmbH & Co. KGaA

- OSRAM GmbH

- KOITO MANUFACTURING CO., LTD.

- Stanley Electric Co., Ltd.

- Magneti Marelli S.p.A. (now Marelli)

- Valeo S.A.

- Lumileds Holding B.V.

- PIAA Corporation

- Bosch GmbH

- General Electric (GE) Lighting (part of Savant Systems)

- Ichikoh Industries, Ltd.

- ZKW Group GmbH

- Automotive Lighting (a division of Marelli)

- TYC Brother Industrial Co. Ltd.

- Depo Auto Parts Ind. Co., Ltd.

- Philips (Signify Holding)

- KC HiLiTES

- AnzoUSA

- HELLA Australia Pty Ltd.

- Grote Industries

Frequently Asked Questions

Analyze common user questions about the Vehicles Fog Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary purpose of vehicle fog lights?

The primary purpose of vehicle fog lights is to enhance visibility for the driver and make the vehicle more conspicuous to others in adverse weather conditions, such as fog, heavy rain, snow, or dust, where standard headlights might cause excessive glare.

Are LED fog lights better than halogen fog lights?

Generally, LED fog lights are considered superior to halogen fog lights. They offer significantly brighter illumination, consume less energy, have a much longer lifespan, and provide greater design flexibility and a more modern aesthetic.

Are fog lights mandatory on all vehicles?

The mandatory nature of fog lights varies by region and country. While rear fog lights are often mandatory in some European countries, front fog lights are typically optional in many regions, though increasingly integrated as standard features in newer vehicles for enhanced safety.

How do smart fog lights differ from traditional ones?

Smart fog lights integrate with a vehicle's ADAS and utilize sensors and AI to dynamically adjust their beam pattern, intensity, and sometimes color based on real-time environmental conditions, vehicle speed, and steering angle, offering optimized visibility automatically unlike traditional static lights.

Can I install aftermarket fog lights on my vehicle?

Yes, you can install aftermarket fog lights on most vehicles, provided there is space and proper electrical connections can be made. It's crucial to choose certified products and consider professional installation to ensure proper alignment and functionality, adhering to local regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager