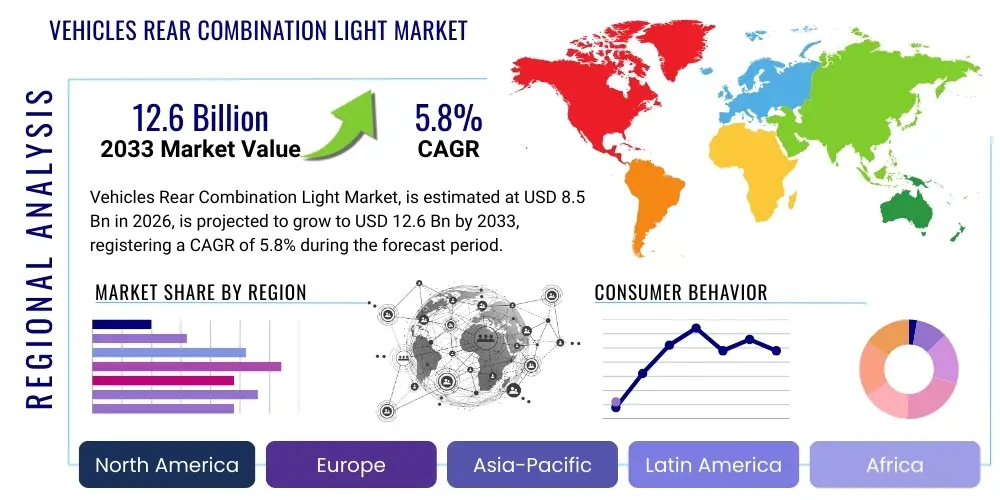

Vehicles Rear Combination Light Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438521 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vehicles Rear Combination Light Market Size

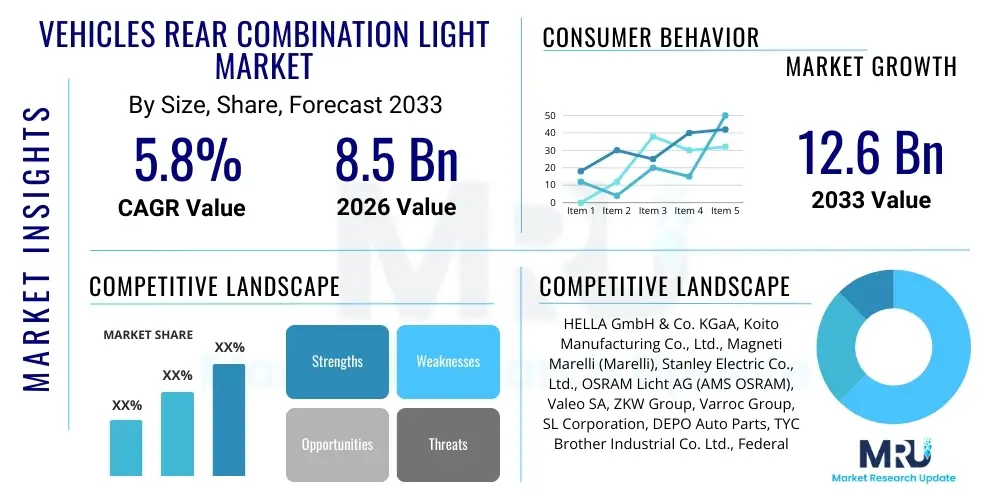

The Vehicles Rear Combination Light Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $12.6 Billion by the end of the forecast period in 2033.

Vehicles Rear Combination Light Market introduction

The Vehicles Rear Combination Light Market encompasses the design, manufacturing, and distribution of integrated lighting systems positioned at the rear of automobiles. These combination lights are critical safety components, typically incorporating multiple functions such as stop lights, tail lights, turn signals, and reverse lights into a single unit. The primary product evolution is driven by the shift from conventional incandescent and halogen bulbs toward highly efficient, durable, and aesthetically versatile LED (Light Emitting Diode) technology. The robust introduction of advanced driver assistance systems (ADAS) and the mandatory implementation of stringent vehicle safety standards across major global economies are pivotal factors underpinning the market's sustained growth. Furthermore, the increasing consumer preference for personalized vehicle aesthetics and premium lighting designs is pushing manufacturers to innovate in optical performance and styling.

Rear combination lights serve fundamental purposes in ensuring road safety by communicating a vehicle's intent to surrounding drivers and pedestrians. Major applications span the entire spectrum of the automotive industry, including passenger vehicles (sedans, SUVs, hatchbacks), commercial vehicles (trucks, buses), and increasingly, electric vehicles (EVs). The benefits associated with modern rear combination lights, especially those utilizing LED technology, include superior energy efficiency, significantly longer operational lifespan compared to traditional lighting, faster illumination response times crucial for braking safety, and greater design flexibility that contributes to distinct vehicle branding and aerodynamic profiles. This technological migration addresses both regulatory safety mandates and consumer demands for low maintenance and high performance.

The market is actively driven by several concurrent factors. First, the expanding global vehicle parc and the surging production of passenger vehicles, particularly in emerging economies like China and India, directly translate into higher demand for OEM installations. Second, the rising global adoption of electric vehicles, which require lightweight and energy-efficient components, strongly favors LED rear lighting solutions. Third, governmental regulations, such as those emphasizing visibility and collision prevention (e.g., mandating high-mounted stop lamps and dynamic signaling), continuously elevate the required standards for rear lighting performance. These drivers collectively ensure a fertile environment for market expansion, supported by ongoing material science and electronic integration advancements.

Vehicles Rear Combination Light Market Executive Summary

The Vehicles Rear Combination Light Market is experiencing robust expansion characterized by profound shifts toward sustainable and intelligent lighting solutions. Key business trends indicate a strong prioritization of LED technology adoption across all vehicle segments, significantly displacing halogen and xenon options due to superior efficiency and reduced maintenance costs. Strategic alliances and vertical integration between automotive lighting suppliers and vehicle OEMs are intensifying, focusing on co-developing lighting systems that integrate seamlessly with advanced vehicle designs and electrical architectures, particularly in the premium and luxury segments. Furthermore, the aftermarket segment is seeing growth driven by the replacement of aging conventional lights with modern LED retrofit kits, capitalizing on consumer desires for improved aesthetics and safety features, establishing a dual pathway for revenue generation across both new installations and service/replacement channels.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, primarily fueled by massive automotive manufacturing hubs in China, Japan, and South Korea, coupled with rapidly rising domestic consumer demand for advanced vehicles. North America and Europe, while mature, remain critical markets characterized by stringent safety regulations and high penetration of premium vehicles, driving demand for technologically complex and highly reliable combination lighting systems, including those incorporating organic light-emitting diodes (OLED) and matrix LED functionalities. Investment in manufacturing capacity expansion is concentrated in APAC, while research and development efforts focusing on smart lighting integration are centered in established European and North American automotive innovation clusters.

Segmentation trends highlight the dominance of the Passenger Vehicle segment in terms of volume, although the Commercial Vehicle segment is projected to show notable growth due to increasing regulatory focus on truck and trailer visibility. The LED segment holds the largest market share and is expected to maintain the highest CAGR throughout the forecast period, reflecting its technological superiority and pervasive integration into new vehicle platforms. The OEM channel remains the principal sales route, directly tied to vehicle production cycles, yet the Aftermarket channel is increasingly important, driven by crash repairs, vehicle refurbishment, and technology upgrades, providing resilience and stable demand independent of new car sales fluctuations. This segmentation dynamic emphasizes resilience and diversification across product type, application, and distribution method.

AI Impact Analysis on Vehicles Rear Combination Light Market

Common user inquiries concerning AI's influence on the Vehicles Rear Combination Light Market frequently revolve around how artificial intelligence and machine learning (ML) can enhance the functional safety and dynamic capabilities of external lighting systems. Users are keen to understand the potential for predictive failure analysis, adaptive lighting control based on external conditions (weather, traffic density), and the role of AI in quality control during the manufacturing process. Key themes center on optimizing beam patterns, achieving instantaneous regulatory compliance adjustments, and enabling smarter communication between vehicles (V2X) where rear lights act as sophisticated visual communicators, going beyond simple on/off functions. Expectations focus heavily on AI facilitating the transition from static lighting to dynamic, context-aware visual signaling, minimizing driver cognitive load and maximizing reaction time for following traffic.

- AI enables predictive maintenance by monitoring LED performance, temperature, and current draw, signaling potential failures before they occur.

- Machine learning algorithms optimize manufacturing quality control through rapid, non-destructive visual inspection of lens uniformity and component assembly.

- AI facilitates adaptive rear signaling, adjusting brightness and visual patterns dynamically based on ambient light, speed, and braking intensity (e.g., dynamic deceleration warnings).

- Integration of AI with ADAS and autonomous driving systems allows rear lights to display complex vehicle intent, such as impending lane changes or emergency maneuvers, through advanced graphical projections or communication interfaces.

- Deep learning models assist in simulating various driving scenarios to rapidly test and certify new rear combination light designs for regulatory compliance and optimal human visibility.

DRO & Impact Forces Of Vehicles Rear Combination Light Market

The Vehicles Rear Combination Light Market is significantly propelled by regulatory drivers mandating enhanced vehicle safety and visibility, particularly the global adoption of LED technology due to its efficiency and safety advantages. However, the market faces restraints primarily related to the high initial investment required for advanced lighting systems and the complex integration challenges associated with vehicle electrical architecture, especially when transitioning to dynamic or matrix lighting systems. Opportunities abound in the burgeoning electric vehicle sector, demanding lightweight and low-power consuming components, and in the development of smart, communicative lighting that integrates with V2X environments. The primary impact forces include accelerating technological innovation toward intelligent lighting and intense pricing competition, particularly in the high-volume replacement market, which pressures profit margins and necessitates continuous process optimization by manufacturers.

Drivers include the accelerating pace of global vehicle production, especially in emerging Asian markets, creating consistent demand for OEM installations. Furthermore, continuous legislative updates worldwide mandate higher standards for rear visibility and require features like brake force display (BFD) and dynamic turn indicators, compelling automakers to integrate more sophisticated combination light units. The increasing lifespan of vehicles globally means a continuously expanding aftermarket for replacement and upgrade components, providing a stable long-term revenue stream for manufacturers and distributors. Consumer demand for enhanced vehicle aesthetics and differentiation also plays a crucial role, as rear light designs are highly impactful styling elements, encouraging technological adoption such as sequential signaling and 3D light pipes.

Restraints center on the volatile raw material costs, particularly for semiconductors and specialized polymers used in lens construction, which impact overall production expenses. Another critical constraint is the complexity of integrating advanced electronic control units (ECUs) needed for matrix and dynamic LED functionalities, leading to increased design verification time and higher system complexity. Moreover, the replacement market faces challenges from counterfeit products and lower-quality substitutes, which undermine the value proposition of genuine OEM components and pose safety risks. These factors require manufacturers to prioritize intellectual property protection and maintain stringent quality standards to differentiate their offerings.

Opportunities are strongly concentrated in the rapid proliferation of autonomous and semi-autonomous vehicles, where rear lights evolve from simple signaling devices into sophisticated human-machine interfaces (HMIs) communicating the vehicle's autonomous status and intentions. The development of ultra-thin, flexible lighting solutions, utilizing technologies like OLEDs, opens new avenues for aesthetic design and packaging efficiencies, especially important for aerodynamic electric vehicle platforms. Strategic regional expansion into previously underserved or rapidly growing automotive markets, coupled with continuous optimization of manufacturing processes through Industry 4.0 principles, represents significant growth potential. The shift towards circular economy models also presents opportunities for sustainable materials use and component recyclability within the combination light manufacturing lifecycle.

Segmentation Analysis

The Vehicles Rear Combination Light Market is comprehensively segmented based on technology type, vehicle application, and sales channel, providing a granular view of market dynamics and growth potential across various product lines and end-user categories. The Technology segment delineates the market based on the illumination source, with LED technology dominating due to its efficiency and design flexibility, while traditional Halogen technology maintains a presence primarily in cost-sensitive and older vehicle platforms. The Application segment differentiates between the high-volume Passenger Vehicle sector and the specialized Commercial Vehicle sector, each driven by distinct regulatory and durability requirements. Finally, the Sales Channel segment separates the large, stable OEM market from the highly fragmented and price-competitive Aftermarket, highlighting diverse strategies for market penetration and revenue optimization across the component lifecycle.

Analysis of these segments reveals shifting investment priorities. Manufacturers are heavily investing in modular LED systems to reduce production costs and complexity, thereby enabling wider adoption across mid-range vehicle models. Furthermore, the convergence of safety regulations means that features once exclusive to premium vehicle rear lights, such as high uniformity and rapid response times, are now becoming standard across mass-market segments, driving up the technological baseline for all market participants. This segmentation framework allows stakeholders to accurately gauge demand heterogeneity and tailor product portfolios to specific regulatory environments and consumer expectations within key global regions.

The future trajectory suggests continuous innovation within the LED segment, specifically focusing on dynamic and matrix functionalities that offer higher levels of safety and customization. The Aftermarket segment is poised for significant growth, driven by an aging global car fleet and increasing consumer willingness to upgrade safety-critical components. The specialization within the Commercial Vehicle segment will intensify, focusing on extreme durability, resistance to vibration, and integration into fleet management telematics systems, distinguishing its needs sharply from the aesthetic-driven passenger vehicle market. This detailed segmentation analysis is crucial for strategic planning regarding manufacturing allocation and R&D focus.

- By Technology Type:

- LED (Light Emitting Diode)

- Halogen

- Xenon/High Intensity Discharge (HID)

- OLED (Organic Light Emitting Diode)

- By Vehicle Application:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Functionality:

- Stop Lights

- Tail Lights

- Turn Signals (Static and Dynamic)

- Reverse Lights

Value Chain Analysis For Vehicles Rear Combination Light Market

The Value Chain for the Vehicles Rear Combination Light Market begins with Upstream Analysis, encompassing the procurement of critical raw materials such as specialized polymers (polycarbonate for lenses), electronic components (LED chips, PCBs, driver ICs), and semiconductor materials. Key upstream suppliers include major global chemical companies and high-tech electronics manufacturers, where cost control and quality assurance of these foundational inputs directly determine the final product's performance and margin. Strategic sourcing and long-term contracts with these suppliers are crucial due to the complexity and proprietary nature of LED and lens materials, impacting manufacturing stability and responsiveness to technological change.

Midstream activities involve the design, engineering, assembly, and rigorous testing of the combination light unit. Manufacturers engage in complex optical design using simulation software to ensure regulatory compliance regarding light distribution and intensity. Automated assembly lines integrate the various components—housings, reflectors, wiring harnesses, and lenses—into a single unit. Downstream analysis focuses on the distribution channels, which are bifurcated into the OEM channel (direct supply to assembly plants, highly reliant on ‘just-in-time’ logistics) and the Aftermarket channel (supplied through authorized distributors, wholesalers, and independent repair shops). The OEM channel demands precision and volume, while the Aftermarket requires broad inventory management and rapid fulfillment.

The distribution channel network is defined by a distinct separation between direct and indirect sales. Direct sales are predominantly to the OEMs, characterized by close collaboration during the vehicle development cycle (Tier 1 suppliers). Indirect sales dominate the Aftermarket, involving layers of distribution. Key distribution channel efficiency relies on minimizing logistics costs and optimizing inventory management to balance the high volume of standard parts needed for older vehicles with the specific, low-volume requirements of newer, technologically advanced replacement parts. Effective channel management, including addressing piracy and counterfeit goods, is essential for maintaining brand integrity and market share across both the OEM and replacement spheres.

Vehicles Rear Combination Light Market Potential Customers

The primary customers and end-users of Vehicles Rear Combination Lights are segmented into three distinct groups: Original Equipment Manufacturers (OEMs), Independent Aftermarket Service Providers (IAM), and direct consumers. OEMs represent the largest customer base, comprising global automotive manufacturers of passenger cars, heavy-duty trucks, buses, and trailers (e.g., Toyota, Volkswagen, Ford, Daimler). Their purchasing decisions are driven by stringent performance specifications, long-term supply agreements, integration capabilities with vehicle architecture (CAN bus), and cost efficiency over the vehicle program life cycle. Their demand is directly correlated with global vehicle production volumes and regulatory mandates requiring new lighting features.

The second major group includes the Independent Aftermarket (IAM) and crash repair centers. These buyers require a continuous supply of replacement parts that meet or exceed OEM specifications. Their purchasing dynamics are highly sensitive to pricing, product availability, and logistics speed, as they often deal with immediate repair needs. This segment sources products through specialized automotive parts distributors and wholesalers. The growth in the average age of vehicles on the road significantly fuels the replacement demand from this customer base, which is increasingly seeking high-quality, non-OEM alternatives that still offer certified safety performance.

The third group includes individual vehicle owners seeking upgrades or customization. While purchasing volume from individual consumers is low, their demand drives the market for premium and aesthetically enhanced products, such as sequential LED kits or specialized lens tints. For manufacturers, understanding the divergent needs of these customer groups—high volume, long-term stability from OEMs; rapid delivery, competitive pricing from IAM; and aesthetic differentiation from consumers—is crucial for developing a balanced commercial strategy and optimizing distribution networks to maximize market reach and profitability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HELLA GmbH & Co. KGaA, Koito Manufacturing Co., Ltd., Magneti Marelli (Marelli), Stanley Electric Co., Ltd., OSRAM Licht AG (AMS OSRAM), Valeo SA, ZKW Group, Varroc Group, SL Corporation, DEPO Auto Parts, TYC Brother Industrial Co. Ltd., Federal-Mogul LLC, Ichikoh Industries, Fiem Industries Ltd., Grupo Antolin, LUKAS, Lumileds, Hyundai Mobis, Ming Yang, Xingyu Automotive Light System |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicles Rear Combination Light Market Key Technology Landscape

The technology landscape of the Vehicles Rear Combination Light Market is defined by a rapid transition toward solid-state lighting and sophisticated electronic controls. Light Emitting Diode (LED) technology currently dominates, characterized by high luminous efficacy, compact size, and exceptional longevity. Recent technological advancements focus on miniaturization and thermal management of high-power LEDs, allowing for sleeker, integrated light designs that consume less energy, a critical factor for electric and hybrid vehicles. Furthermore, the use of light guides and 3D light pipes, leveraging precision optics and injection molding techniques, is transforming the aesthetics of rear lighting, enabling highly customized and brand-specific visual signatures that enhance vehicle differentiation and perceived quality.

A key technological frontier is the development and commercialization of Dynamic Lighting Systems, specifically sequential turn indicators and dynamic brake lights. These systems utilize advanced microcontrollers and complex wiring harnesses to illuminate LED segments in a moving pattern, significantly improving communication clarity to following drivers. Beyond standard LEDs, Organic Light Emitting Diode (OLED) technology is gaining traction, particularly in the premium segment. OLEDs offer ultra-thin, planar illumination sources that facilitate completely new design possibilities, such as curved or flexible rear lights, while also providing high uniformity and low power consumption, though manufacturing costs remain a barrier to mass-market adoption.

The integration of lighting systems with the vehicle's central electronic architecture (such as CAN or Ethernet protocols) is essential, supporting features like predictive diagnostics and dynamic adjustments based on speed and weather conditions. Future technological advancements will prioritize communication functions, moving beyond simple illumination to create light-based Human-Machine Interfaces (HMIs). This includes projecting warnings onto the road surface or displaying graphical symbols through the rear lights to communicate the status of autonomous driving systems, requiring robust software and sophisticated sensor integration to ensure reliability and regulatory compliance across diverse operating environments.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the largest and fastest-growing region in the Vehicles Rear Combination Light Market, driven by high-volume automotive manufacturing bases in China, India, and ASEAN countries, supported by expanding domestic vehicle ownership. Regulatory modernization in safety standards, paralleled by a rapid shift towards EV production, accelerates the adoption of advanced LED and smart lighting systems. Regional manufacturers are intensely focused on cost-effective, high-quality production, positioning APAC as a global supply hub for rear combination lights.

- North America: This region is characterized by high demand for premium and technologically integrated lighting solutions, driven by rigorous safety regulations enforced by entities like NHTSA and strong consumer preference for ADAS-compatible vehicles. The market sees steady replacement demand and a strong emphasis on technology integration, especially for heavy-duty commercial vehicles and SUVs, where lighting durability and visibility are paramount. Investments are focused on enhancing light reliability and energy efficiency to meet evolving fuel economy standards.

- Europe: Europe is a mature market known for leading technological innovation and stringent standards, particularly those governed by UNECE regulations, which often serve as global benchmarks. The high penetration of luxury automotive brands pushes the adoption of advanced lighting technologies like OLED and Matrix LED for rear combination functions, focusing heavily on aesthetic customization and superior performance. The strong push towards electromobility further drives demand for energy-efficient, low-profile lighting solutions that contribute minimally to vehicle weight.

- Latin America (LATAM): LATAM represents a market with growing potential, primarily driven by increasing urbanization and the modernization of aging vehicle fleets. While price sensitivity remains high, there is a gradual movement toward adopting modern safety features, often following North American or European regulatory precedents. Demand centers around robust, reliable, and cost-efficient rear combination light units for mass-market vehicles, with the Aftermarket playing a crucial role due to longer vehicle lifecycles.

- Middle East and Africa (MEA): This region is diverse, with demand concentrated in key automotive importing and assembly nations (GCC states and South Africa). The market is heavily influenced by imported vehicle specifications and is gradually adopting higher-standard lighting systems, often driven by government initiatives to improve road safety. High ambient temperatures pose unique challenges, demanding robust thermal management solutions and durable materials for lighting components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicles Rear Combination Light Market.- HELLA GmbH & Co. KGaA

- Koito Manufacturing Co., Ltd.

- Magneti Marelli (Marelli)

- Stanley Electric Co., Ltd.

- OSRAM Licht AG (AMS OSRAM)

- Valeo SA

- ZKW Group

- Varroc Group

- SL Corporation

- DEPO Auto Parts

- TYC Brother Industrial Co. Ltd.

- Federal-Mogul LLC

- Ichikoh Industries

- Fiem Industries Ltd.

- Grupo Antolin

- LUKAS

- Lumileds

- Hyundai Mobis

- Ming Yang

- Xingyu Automotive Light System

Frequently Asked Questions

Analyze common user questions about the Vehicles Rear Combination Light market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the Vehicles Rear Combination Light Market?

The primary growth driver is LED (Light Emitting Diode) technology, favored for its superior energy efficiency, longer life span, faster activation response time (enhancing safety), and the design flexibility it offers for modern vehicle aesthetics and dynamic signaling features.

How is the adoption of electric vehicles (EVs) impacting the demand for rear combination lights?

EV adoption increases demand for lightweight, energy-efficient lighting solutions. Since EVs prioritize battery range, low-power components like LEDs are essential. EVs also drive design innovation, integrating rear lights as part of unique brand styling and aerodynamic optimization.

What are the main distinctions between the OEM and Aftermarket segments?

The OEM (Original Equipment Manufacturer) segment demands high volume, stringent specifications, and integration during vehicle production. The Aftermarket focuses on replacement parts, where demand is driven by vehicle repair and upgrades, prioritizing competitive pricing and quick distribution through independent channels.

Which geographical region holds the largest market share for Vehicle Rear Combination Lights?

Asia Pacific (APAC) currently holds the largest market share due to its massive scale of automotive production, particularly in countries like China and India, coupled with rapid urbanization and subsequent increases in new vehicle sales and fleet renewal.

What role does smart lighting play in the future of rear combination lights?

Smart lighting, enabled by AI and sensor integration, allows rear lights to become active communication tools. Future applications include dynamic braking intensity based on distance, communicating autonomous driving status, and projecting warnings, significantly enhancing vehicle-to-vehicle (V2X) safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager