Vena Cava Filter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435522 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Vena Cava Filter Market Size

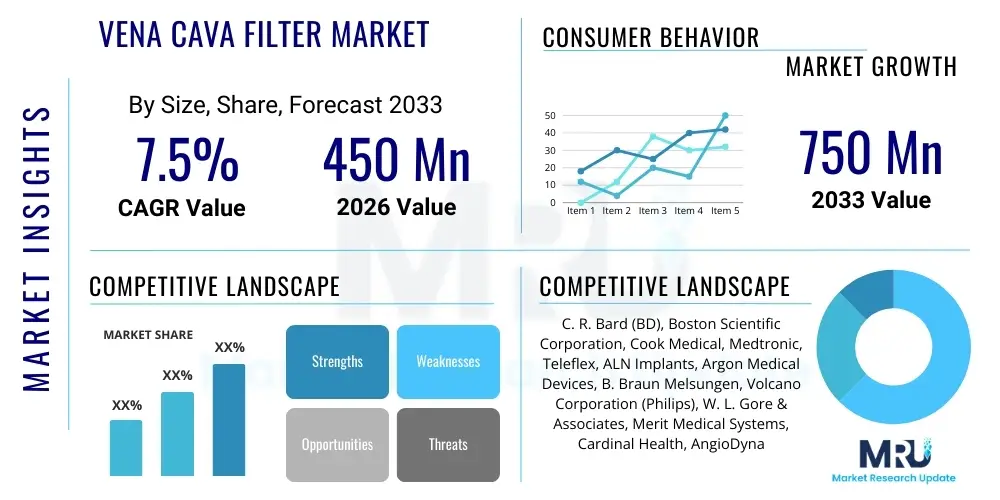

The Vena Cava Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $750 Million by the end of the forecast period in 2033.

Vena Cava Filter Market introduction

The Vena Cava Filter (VCF) Market encompasses devices strategically implanted into the inferior vena cava (IVC) to capture blood clots, thereby preventing their migration to the lungs, a condition known as pulmonary embolism (PE). These devices are critical interventions utilized primarily in patients who have contraindications to anticoagulant therapy, or in those for whom anticoagulation has failed to prevent recurrent PE. The primary product types include permanent filters and retrievable filters, with the latter gaining significant traction due to the reduced risk profile associated with temporary use and subsequent removal, aligning with clinical guidelines promoting removal once the risk of PE subsides.

Major applications for Vena Cava Filters revolve around the management of Deep Vein Thrombosis (DVT) and the prevention of subsequent, potentially fatal, pulmonary emboli. Patients typically requiring VCF implantation include trauma victims, post-surgical patients, individuals with active bleeding risk, and patients with specific cancer diagnoses that elevate thrombotic risk. The essential benefit offered by VCFs is the immediate mechanical protection against acute PE, especially in high-risk settings where time-sensitive intervention is paramount to patient survival. While historically associated with certain long-term complications, continuous advancements in filter design, material science, and implantation techniques are driving increased confidence and adoption across various clinical settings.

The market expansion is fundamentally driven by the escalating global incidence of venous thromboembolism (VTE), which includes both DVT and PE, particularly among aging populations and those with sedentary lifestyles. Furthermore, technological innovations focusing on enhanced biocompatibility, improved navigation systems for precise placement, and the development of truly bioabsorbable filters are contributing factors. Increased awareness among healthcare providers regarding the appropriate selection criteria and timing for VCF retrieval, coupled with growing interventional procedural volumes globally, establishes a robust foundation for sustained market growth throughout the forecast period.

Vena Cava Filter Market Executive Summary

The Vena Cava Filter Market is currently characterized by a critical shift from permanent to retrievable filter systems, reflecting heightened regulatory scrutiny and the long-term risk associated with permanent implants, such as IVC penetration and filter fracture. Key business trends indicate strong investment in developing advanced retrieval kits and procedural guidance technologies, aimed at minimizing complications and improving procedural success rates for device removal. Consolidation remains a factor, with major medical device manufacturers continually acquiring smaller, specialized companies to enhance their vascular access and interventional cardiology portfolios. Pricing pressures, particularly in established markets like North America, necessitate manufacturers to focus on value-based outcomes and optimized supply chain efficiency.

Regionally, North America maintains market dominance due to high procedural volumes, established healthcare infrastructure, and favorable reimbursement policies for interventional procedures, although future growth rates are projected to be highest in the Asia Pacific (APAC) region. APAC is experiencing rapid expansion fueled by increasing healthcare expenditure, improving access to advanced diagnostic imaging, and a rising prevalence of VTE risk factors associated with lifestyle changes and urbanization. Europe demonstrates steady, but more constrained, growth, governed by stringent regulatory frameworks, particularly concerning long-term device efficacy and safety profiles, pushing innovation toward temporary and readily removable solutions.

Segment trends underscore the sustained market leadership of the retrievable filter segment, driven by updated clinical guidelines emphasizing device removal within a specified timeframe. In terms of end-users, hospitals, particularly those offering comprehensive cardiovascular and trauma services, remain the largest consumers of VCFs, although the trend toward specialized Ambulatory Surgical Centers (ASCs) for minimally invasive vascular procedures is offering new avenues for market penetration. Innovations within the product material category, such as filters offering enhanced MRI compatibility and smaller profile delivery systems, are critical in maintaining competitive edge and driving differentiation in this technologically mature yet clinically evolving market space.

AI Impact Analysis on Vena Cava Filter Market

User queries regarding the integration of Artificial Intelligence (AI) in the Vena Cava Filter market predominantly focus on three critical areas: improving procedural precision, enhancing patient selection for VCF placement, and analyzing long-term outcomes to minimize complication rates. Users are keenly interested in how machine learning algorithms can analyze complex diagnostic images (CT, venography) pre-procedure to automatically calculate optimal filter placement depth and angle, reducing the incidence of migration or tilting. A primary concern is utilizing AI for predictive risk stratification, helping clinicians accurately identify patients at the highest risk of PE who also have contraindications for standard anticoagulation, thereby ensuring VCF placement is justified and avoiding unnecessary procedures in low-risk individuals.

Furthermore, there is significant user interest in leveraging AI to interpret large datasets from registries and post-market surveillance. These systems could identify subtle patterns linking specific filter designs, patient comorbidities, and long-term complications (such as IVC thrombosis or filter fracture) far faster than traditional statistical methods. This predictive capability would fundamentally influence filter design improvements and guide clinical best practices regarding retrieval timing. The underlying expectation is that AI will transform VCF placement from a reactive intervention to a highly personalized and risk-optimized procedure, directly addressing the past safety concerns that have plagued the market.

In the short term, the integration of AI is expected to focus heavily on workflow automation in the cath lab, streamlining imaging analysis, and providing real-time decision support during implantation, potentially lowering procedural time and radiation exposure. As algorithms mature and incorporate more diverse real-world data, the strategic application of AI promises to enhance the safety profile of VCFs, potentially leading to revised clinical guidelines that endorse broader, yet more precise, utilization of these devices under data-driven clinical protocols, ultimately restoring confidence in VCF technology.

- AI-powered image analysis for precise, optimal filter deployment location determination.

- Machine learning algorithms to predict patient-specific risk of recurrent PE versus risk of filter-related complications (e.g., IVC thrombosis).

- Real-time procedural guidance systems integrating historical anatomical data for enhanced safety during complex retrieval procedures.

- Automated analysis of post-market surveillance data to rapidly identify device-specific failure modes and inform design iteration.

- Optimization of inventory and procedural planning in hospital settings based on predictive modeling of VTE incidence rates.

DRO & Impact Forces Of Vena Cava Filter Market

The dynamics of the Vena Cava Filter Market are shaped by powerful opposing forces: escalating disease incidence driving demand (Drivers) countered by long-term safety concerns and regulatory pressures (Restraints), opening avenues for next-generation products (Opportunities). The increasing global burden of Venous Thromboembolism (VTE), particularly among an aging demographic prone to mobility limitations and associated co-morbidities like cancer and obesity, forms the primary demand driver. Moreover, advancements in diagnostic imaging techniques, such as computed tomography pulmonary angiography (CTPA) and ultrasound, lead to earlier and more frequent identification of deep vein thrombosis, increasing the patient pool eligible for prophylactic or therapeutic VCF placement when anticoagulation is contraindicated. This clinical necessity, particularly in trauma and high-risk surgical settings, maintains a baseline level of essential demand.

Conversely, the market growth is significantly restrained by high rates of reported long-term complications associated with VCFs, including filter tilt, fracture, migration, and the subsequent development of IVC thrombosis, which necessitates complex and costly retrieval attempts or corrective surgeries. Regulatory oversight, particularly from bodies like the FDA in North America, has become increasingly rigorous, issuing safety alerts and recommendations emphasizing the timely removal of retrievable filters, leading to market uncertainty and cautious adoption among clinicians. Furthermore, the availability of highly effective and safer novel oral anticoagulants (NOACs) diminishes the immediate necessity for mechanical filtration in many patient segments, thus posing a competitive challenge to VCF utilization.

Opportunities for market players are concentrated in technological innovation aimed at resolving these restraints. The development of bioabsorbable or biodegradable VCFs represents a transformative opportunity, eliminating the need for complex retrieval procedures and mitigating the risk of long-term foreign body reactions within the IVC. Furthermore, improving retrieval technologies, focusing on creating universal retrieval systems capable of managing older, complexly embedded filters, provides a substantial service opportunity. Strategic market entry into emerging economies, where VTE awareness and hospital infrastructure are rapidly improving, also presents lucrative growth prospects, provided manufacturers can navigate diverse regulatory and pricing environments efficiently.

Segmentation Analysis

The Vena Cava Filter market segmentation provides a comprehensive view of product preferences, clinical necessity, and end-user behavior. The market is primarily divided based on Product Type (Retrievable and Permanent), Application (Pulmonary Embolism Prevention and Deep Vein Thrombosis Treatment), and End-User (Hospitals and Ambulatory Surgical Centers). The most significant current trend within the product segment is the dominance of retrievable filters, a direct result of clinical guidelines recommending filter removal to prevent long-term complications, thereby shifting the procedural focus from device permanence to successful temporary deployment and subsequent extraction.

Application segmentation highlights that the prevention of fatal pulmonary embolism, especially in high-risk patients unsuitable for anticoagulation, remains the core driver. While VCFs are utilized in DVT management, their role is specifically defined by the risk of clot propagation to the lungs, making PE prevention the paramount clinical application. The end-user segment distribution reflects the critical nature of the procedures, which primarily occur within structured hospital settings that possess the necessary interventional radiology suites, surgical support, and post-procedural intensive care capabilities for managing complications.

Future segmentation trends are likely to focus on materials, with new classifications emerging around novel filter designs such as suture-retaining filters or filters designed for specific IVC anatomical variations. This increasing specialization reflects the industry's response to enhancing safety and efficacy in diverse patient populations. Understanding these nuanced segments is crucial for manufacturers to align their product development pipelines with evolving clinical needs and address niche markets seeking specialized, lower-profile, and safer VCF solutions.

- By Product Type

- Retrievable Filters (Temporary Filters)

- Permanent Filters (Non-Retrievable Filters)

- By Application

- Pulmonary Embolism (PE) Prevention

- Deep Vein Thrombosis (DVT) Treatment

- By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Specialty Cardiac Centers

- By Material

- Nitinol

- Stainless Steel/Cobalt Chromium

- Bioabsorbable Polymers (Emerging)

Value Chain Analysis For Vena Cava Filter Market

The Vena Cava Filter value chain begins with the Upstream segment, dominated by highly specialized raw material suppliers providing biocompatible alloys such as Nitinol and medical-grade stainless steel. These materials are critical, as they dictate the filter's structural integrity, radiopacity, and shape-memory characteristics essential for minimally invasive deployment. Manufacturing involves complex processes including wire forming, laser cutting, and electropolishing, requiring stringent quality control and advanced sterilization techniques. Suppliers must meet rigorous specifications, and the dependence on a limited number of specialized alloy providers introduces certain supply chain vulnerabilities that leading VCF manufacturers actively manage through dual-sourcing strategies.

The Midstream component focuses on the distribution channels, which are segmented into direct sales and indirect distribution through specialized medical device distributors. Direct sales models are typically favored by major market players for high-volume hospital systems and key opinion leaders (KOLs) to maintain margin control and immediate feedback loops regarding device performance. Indirect channels are crucial for penetrating smaller regional markets, particularly in Asia Pacific and Latin America, where local distributors possess established relationships with regional healthcare providers and navigate complex import regulations. The effectiveness of the distribution channel is highly dependent on logistics capabilities, ensuring the sterile, high-value devices reach catheterization labs and surgical units promptly.

Downstream analysis focuses on the final users—hospitals, ASCs, and independent interventional clinics. The procurement process is highly complex, involving multiple stakeholders including interventional radiologists, vascular surgeons, hospital administration, and purchasing groups. The selection criteria are heavily influenced by clinical data, long-term safety registries, ease of use of the delivery system, and procedural cost-effectiveness. The rising focus on outcomes-based healthcare delivery means that downstream success relies heavily on comprehensive clinical support, robust training programs, and successful retrieval rates to validate the product's overall value proposition. Direct communication between manufacturers and interventional specialists is therefore vital for driving adoption and securing formulary inclusion.

Vena Cava Filter Market Potential Customers

The primary end-users and buyers of Vena Cava Filters are large hospital systems, particularly those designated as Level I or Level II trauma centers, and tertiary care facilities that manage high volumes of cardiovascular, orthopedic, and oncology patients. Within these institutions, the purchase decision is primarily driven by interventional specialists, including interventional radiologists and vascular surgeons, who are the primary implanters of the devices. These clinicians require devices that offer superior navigability, precise deployment mechanisms, and documented high retrieval success rates, especially for temporary filters, making clinical data and procedural ease key purchasing determinants.

Secondary potential customers include specialized Ambulatory Surgical Centers (ASCs) that focus on elective, minimally invasive vascular procedures. While VCF placement in ASCs is less common than in full-service hospitals due to the immediate risk profile of VTE patients, selected stable patients requiring VCF placement, or those returning for scheduled filter retrieval procedures, represent a growing market for specialized ASCs aiming to offer cost-effective alternatives to hospital stays. These centers often prioritize products that minimize logistical complexity and procedural duration, emphasizing user-friendly delivery systems and reliable inventory management.

Furthermore, Integrated Delivery Networks (IDNs) and Group Purchasing Organizations (GPOs) act as crucial institutional buyers, aggregating the purchasing power across multiple hospitals and clinics. These organizations are highly sensitive to overall procurement costs, demanding favorable long-term contracts and bundled pricing for VCFs, associated sheaths, and retrieval kits. Manufacturers must demonstrate clear economic value and high clinical efficacy to secure large-scale contracts with GPOs, linking product quality directly to favorable reimbursement and positive patient outcomes, thus cementing their position within these essential customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | C. R. Bard (BD), Boston Scientific Corporation, Cook Medical, Medtronic, Teleflex, ALN Implants, Argon Medical Devices, B. Braun Melsungen, Volcano Corporation (Philips), W. L. Gore & Associates, Merit Medical Systems, Cardinal Health, AngioDynamics, Spectranetics (Philips), Lombard Medical, Penumbra, Inc., MicroVention, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vena Cava Filter Market Key Technology Landscape

The current technology landscape in the Vena Cava Filter market is defined by continuous iterative improvements focused on addressing historical safety concerns and enhancing procedural efficiency. Material science plays a pivotal role, with Nitinol (Nickel Titanium) alloys being the material of choice due to their superb superelasticity and shape memory, enabling the filter to compress into a small delivery sheath and then fully expand upon deployment in the inferior vena cava. Recent technological focus includes developing filters with lower-profile delivery systems (reducing vessel trauma), enhanced fluoroscopic visibility, and features designed to resist tilt and migration, such as anchoring hooks or struts specifically engineered to engage the IVC wall without causing perforation.

A significant technological push involves the development of bioabsorbable VCFs. These filters are designed using specialized polymers or magnesium alloys that maintain structural integrity to trap clots for the necessary duration (typically 6-12 weeks) before safely degrading and being absorbed by the body, thus completely circumventing the long-term complication risks associated with permanent devices or the inherent risks of retrieval procedures. While still largely in the clinical trial and early commercialization phase, this technology holds the potential to be a major disruptive force, significantly altering the traditional market for permanent and standard retrievable filters by redefining safety and device management protocols.

Beyond the filter itself, technology advancements are integrated into the procedural process. This includes sophisticated imaging guidance tools, such as intravascular ultrasound (IVUS), which provides superior visualization of the IVC wall, clots, and precise filter positioning compared to traditional fluoroscopy alone. Furthermore, complex retrieval devices are being engineered using specialized snares and sophisticated deflection systems to address filters that have become significantly incorporated into the IVC wall or have fractured. These innovations in materials, biodegradability, and procedural visualization are crucial for sustaining clinical relevance and navigating the strict regulatory landscape that demands evidence of improved long-term patient safety.

Regional Highlights

- North America (NA): Represents the largest and most mature market segment, driven by high prevalence of VTE, advanced healthcare infrastructure, and favorable reimbursement policies for interventional procedures. The U.S. accounts for the majority of the regional share, characterized by high adoption rates of advanced retrievable filters and a strong focus on regulatory compliance following past safety issues. The regional market is highly competitive, dominated by major multinational players, with growth now centered on product innovation addressing complex retrieval cases.

- Europe: Exhibits steady growth, heavily influenced by strict regulations from bodies like the European Medicines Agency (EMA), leading to cautious adoption and a strong preference for devices with extensive clinical evidence of safety and high retrieval rates. Germany, France, and the UK are key contributors, benefiting from universal healthcare systems that prioritize cost-effective, high-quality patient care. Emphasis is placed on protocols that ensure timely removal of temporary filters, driving demand for optimized retrieval kits.

- Asia Pacific (APAC): Projected to be the fastest-growing region during the forecast period. This growth is spurred by rapidly improving healthcare access, increasing disposable incomes, and the modernization of hospital facilities across countries like China, India, and Japan. The rising awareness of VTE, coupled with Westernization of lifestyles contributing to thrombotic risk, is expanding the addressable patient pool. Local manufacturing capabilities are also emerging, challenging established international players on price and regional supply logistics.

- Latin America (LATAM): A developing market characterized by varying levels of healthcare spending and infrastructure. Brazil and Mexico are the largest regional contributors, driven by a combination of private sector healthcare growth and increasing government investment in specialized medical care. Market access is often dependent on navigating complex import tariffs and establishing strong local distribution partnerships, but represents a significant long-term growth opportunity.

- Middle East and Africa (MEA): A nascent market with significant pockets of high growth in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) due to high per capita healthcare spending and investment in world-class medical facilities. The utilization of VCFs is growing, particularly in trauma and high-risk surgical settings. Challenges remain regarding fragmented distribution networks and low penetration rates in sub-Saharan Africa, limiting overall regional market size.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vena Cava Filter Market.- C. R. Bard (BD)

- Boston Scientific Corporation

- Cook Medical

- Medtronic

- Teleflex Incorporated

- ALN Implants

- Argon Medical Devices

- B. Braun Melsungen AG

- W. L. Gore & Associates

- Merit Medical Systems

- Cardinal Health

- AngioDynamics

- Spectranetics (A Philips Company)

- Volcano Corporation (A Philips Company)

- Lombard Medical

- Penumbra, Inc.

- MicroVention, Inc.

- Guerbet

- Terumo Corporation

- Abbott Laboratories

Frequently Asked Questions

Analyze common user questions about the Vena Cava Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for retrievable vena cava filters?

The primary driver is the growing clinical consensus and regulatory mandates (such as FDA recommendations) emphasizing the timely removal of filters to mitigate serious, long-term complications like filter fracture, IVC penetration, and filter-related thrombosis, positioning retrievable options as the standard of care.

How significant is the role of bioabsorbable VCF technology in market expansion?

Bioabsorbable VCFs are expected to significantly transform the market by eliminating the need for retrieval procedures and associated long-term risks. Although currently an emerging segment, successful commercialization will likely accelerate adoption, offering a safer profile compared to both permanent and current retrievable designs.

Which region currently holds the largest share in the Vena Cava Filter market?

North America maintains the largest market share, predominantly due to high procedural volumes driven by the prevalence of VTE risk factors, established infrastructure for interventional radiology, and sophisticated reimbursement frameworks supporting advanced device utilization.

What are the main alternatives to Vena Cava Filter placement for VTE management?

The primary alternative is pharmacological treatment, specifically the use of anticoagulants, including traditional agents like heparin and warfarin, as well as Direct Oral Anticoagulants (DOACs). VCFs are typically reserved for patients with absolute contraindications to effective anticoagulation therapy.

What impact do technological advancements in imaging have on VCF procedures?

Advanced imaging technologies like Intravascular Ultrasound (IVUS) and sophisticated C-arm fluoroscopy significantly enhance procedural success by providing clearer visualization of the IVC anatomy, pre-existing thrombus, and optimal filter deployment zone, thereby improving placement accuracy and reducing potential complications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager