Veneer Sheet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433947 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Veneer Sheet Market Size

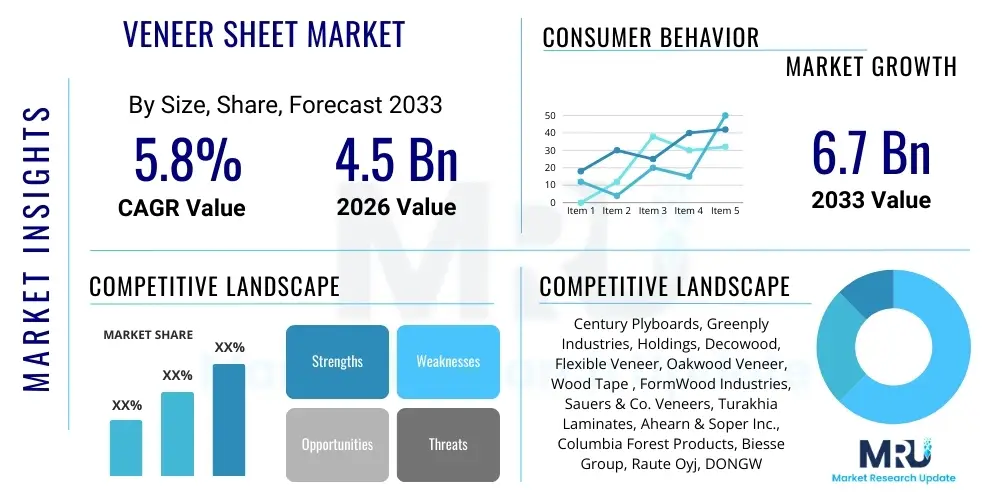

The Veneer Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Veneer Sheet Market introduction

The Veneer Sheet Market encompasses the production, distribution, and application of thin slices of natural wood or engineered materials, typically glued onto core panels like plywood, particleboard, or Medium Density Fiberboard (MDF). Veneer sheets offer the aesthetic appeal of solid wood while providing structural stability, cost efficiency, and reduced environmental impact due to optimized material usage. These sheets are crucial components in modern interior design and architectural finishing, ranging from decorative surfaces in high-end residential projects to utilitarian applications in mass-produced furniture. The manufacturing process, involving slicing, rotary cutting, or sawing, dictates the final grain pattern and thickness, allowing for a wide range of aesthetic outcomes that cater to diverse consumer preferences for species like oak, maple, walnut, and exotic timbers, subject to stringent environmental sourcing regulations.

Major applications of veneer sheets span across the furniture industry, architectural millwork, flooring, doors, cabinetry, and increasingly, the automotive interior sector where lightweight and premium finishes are valued. The inherent benefits of veneer, such as dimensional stability, resistance to warping, and the ability to cover large surface areas with rare wood species, drive their sustained demand. Furthermore, advancements in adhesive technology and backing materials, including paper-backed, phenolic-backed, and flexible veneer sheets, have expanded their versatility and eased installation processes, making them accessible for complex and curved surfaces that would be challenging or prohibitively expensive to cover with solid wood.

Key driving factors accelerating market growth include the rising global demand for sustainable and natural aesthetic materials in building and construction, particularly in rapidly urbanizing regions across Asia Pacific. The shift towards renovation and remodeling activities, coupled with the necessity for cost-effective yet high-quality alternatives to expensive solid wood, further bolsters market expansion. Environmental concerns are promoting certified sustainable veneer sourcing, appealing to environmentally conscious consumers and supporting market segmentation towards eco-friendly and recycled material options. The continuous innovation in engineered veneers, which offer consistent grain patterns and color uniformity, also plays a significant role in penetrating large-scale commercial project markets.

Veneer Sheet Market Executive Summary

The Veneer Sheet Market is characterized by robust growth, propelled primarily by booming residential construction and extensive commercial refurbishment projects globally. Current business trends indicate a strong consumer preference shift toward natural, light-colored wood species and technologically enhanced finishes that mimic aged or reclaimed wood aesthetics, driving product innovation. Manufacturers are increasingly focusing on automation in the slicing and bonding processes to improve yield rates and reduce waste, aligning with cost efficiency mandates. Furthermore, strategic mergers and acquisitions among key market players are consolidating market share, particularly for specialized decorative veneer segments, allowing larger entities to control supply chains from timber sourcing to final product distribution. The market also witnesses a growing adoption of eco-certified materials, influencing procurement decisions in major architectural firms.

Regionally, Asia Pacific maintains its dominance as the fastest-growing market, driven by massive infrastructure development in countries like China and India, alongside the rapidly expanding middle-class demand for high-quality, aspirational home furnishings. North America and Europe, while mature, exhibit strong demand for high-value specialty veneers, focusing on bespoke furniture and architectural applications requiring specific fire-retardant and low-Volatile Organic Compound (VOC) characteristics. Regulatory landscapes concerning formaldehyde emissions and sustainable forest management critically influence product offerings in these regions, compelling European manufacturers, in particular, to invest heavily in bio-based adhesives and sustainably managed forests (FSC and PEFC certifications).

Segmentation trends highlight the increasing importance of the application segment, with the furniture and cabinet manufacturing sectors remaining the largest consumers due to high volume requirements for veneer sheets. However, the flooring and automotive interior segments are projecting higher-than-average growth rates, fueled by demand for lightweight, durable, and scratch-resistant finishes. Technology segmentation emphasizes the growth of engineered or reconstituted veneers, which offer superior customization regarding color, pattern, and consistency compared to natural wood veneer, thereby catering effectively to mass production lines that require uniformity across large batches. The shift towards thinner veneer sheets also minimizes raw material usage, meeting both economic and ecological objectives.

AI Impact Analysis on Veneer Sheet Market

User inquiries regarding AI's impact on the veneer sheet market frequently center on three main themes: optimizing raw material utilization, enhancing quality control consistency, and revolutionizing design and customization capabilities. Users are concerned about how AI can predict log yield rates before slicing, minimizing waste of high-value timber, and how machine vision systems can instantly identify and grade veneer defects (knots, splits, mineral streaks) far more accurately than human inspectors. Expectations are high concerning AI-driven optimization of the supply chain, particularly predicting demand fluctuations to manage inventory of diverse wood species, which historically has been a complex logistical challenge due to seasonality and sourcing constraints. Furthermore, users anticipate AI tools will assist designers in generating novel veneer layups and complex matching patterns (e.g., book matching, slip matching) based on specific aesthetic inputs and material constraints, significantly reducing pre-production design time and material sampling costs.

- AI-powered machine vision systems are rapidly deployed for automated defect detection and grading of veneer sheets, ensuring high quality control consistency at production speed.

- Predictive analytics driven by AI optimizes the rotary cutting and slicing processes, maximizing veneer yield from expensive logs based on internal log geometry scanning.

- AI algorithms facilitate inventory management and demand forecasting for rare or specialized wood species, minimizing storage costs and mitigating supply chain risks.

- Generative Design tools utilizing AI assist in creating complex, optimized veneer layups and custom decorative patterns based on material parameters and client aesthetic preferences.

- Automation and robotics integrated with AI minimize handling damage and improve throughput rates in the drying and pressing stages of veneer sheet production.

DRO & Impact Forces Of Veneer Sheet Market

The dynamics of the Veneer Sheet Market are defined by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape strategic decisions and growth trajectory. Key drivers include the escalating global demand for premium, natural aesthetics in residential and commercial interiors, coupled with the economic necessity to substitute costly solid timber with highly aesthetic and structurally stable veneers. The sustainability movement acts as a significant catalyst, with veneer sheets being inherently more resource-efficient than solid wood applications, appealing strongly to green building standards and environmentally conscious consumers. Technological advancements in adhesive chemistry, resulting in low-VOC and enhanced moisture-resistant bonding, further expand the applicability of veneers into previously challenging environments like kitchens and bathrooms.

However, market growth faces considerable restraints, primarily the volatility and increasingly stringent regulatory landscape surrounding raw material sourcing, particularly tropical hardwoods. The inherent variability in natural wood veneer (color, grain, and knot frequency) poses challenges for manufacturers aiming for consistency in large-scale projects, sometimes pushing consumers towards engineered or laminate alternatives. Furthermore, the specialized skill set required for high-quality veneer installation, especially for complex architectural applications, often limits its adoption in regions lacking specialized craftsmanship, contributing to installation costs that can sometimes outweigh the material savings compared to simpler alternatives.

Opportunities for expansion are abundant, particularly through the development of highly customized, digitally printed, and three-dimensional textured veneers that blur the lines between natural material and engineered innovation, opening new applications in high-end design. Penetration into emerging markets, especially the modular furniture and prefabricated housing sectors, offers substantial growth potential due to the ease of large-scale standardized application of veneer sheets. The increasing trend of retrofitting and interior renovation in mature markets provides a continuous demand stream for aesthetically upgrading existing structures. The primary impact forces influencing the market trajectory include global housing starts, the price volatility of timber commodities, stringent environmental certifications (such as FSC/PEFC), and shifting consumer aesthetics favoring minimalist and Scandinavian design trends.

Segmentation Analysis

The Veneer Sheet Market is comprehensively segmented based on material, thickness, application, and end-use, reflecting the diverse requirements of the construction, furniture, and design industries. The material segmentation differentiates between natural wood veneer, derived directly from slicing high-quality logs, and engineered or reconstituted veneer, which utilizes fast-growing species, dyes, and pressing techniques to create consistent patterns. Thickness segmentation is critical, ranging from ultra-thin decorative foils (0.1 mm) to structural veneers (over 1 mm) used in high-traffic applications. Analyzing these segments provides strategic insights into consumer preferences, technological maturity, and regional demand dynamics, enabling manufacturers to tailor their product lines efficiently.

The application segments clearly delineate the high-volume usage areas. Furniture and cabinets consistently dominate due to the essential need for decorative surfaces in residential and commercial settings. However, the fastest growth is observed in architectural millwork and specialized applications such as acoustic paneling and automotive interiors, where aesthetic quality, lightweight properties, and specific performance characteristics (like fire resistance) are paramount. End-user segmentation distinguishes between residential, commercial, and institutional projects, with the commercial sector exhibiting higher demand for high-performance and standardized products, while the residential sector drives demand for customized, high-aesthetics wood species.

- Material Type: Natural Wood Veneer, Engineered Veneer (Reconstituted), Paper-Backed Veneer, Phenolic-Backed Veneer.

- Veneer Species: Oak, Maple, Walnut, Cherry, Birch, Ash, Exotic Species.

- Thickness: 0.1 mm to 0.5 mm (Decorative Foils), 0.5 mm to 1.0 mm (Standard Veneer), Above 1.0 mm (Thick Veneer/Structural).

- Application: Furniture and Cabinets, Architectural Millwork, Doors and Windows, Flooring, Automotive Interiors, Musical Instruments.

- End-Use: Residential (New Construction, Renovation), Commercial (Office Space, Hospitality, Retail), Institutional (Healthcare, Education).

Value Chain Analysis For Veneer Sheet Market

The value chain for the Veneer Sheet Market is intricate, starting from sustainable forest management and log acquisition (upstream) and extending through sophisticated manufacturing processes to final product application (downstream). The upstream analysis involves timber harvesting, selecting specific species and quality logs suitable for slicing, and initial processing steps like debarking and conditioning (steaming or heating) to ensure optimal plasticity for cutting. Effective upstream management requires stringent adherence to sustainable logging practices and certifications (FSC, PEFC) to ensure long-term supply security and compliance with international trade regulations, which significantly influences the cost structure and environmental footprint of the final product.

The core manufacturing phase includes precision slicing (using slicers or rotary lathes), drying, grading, defect repairing, and splicing of individual veneer sheets to create standard panel sizes or specific matching patterns (like book matching). This phase is capital-intensive, requiring high-precision machinery and specialized knowledge to minimize waste, especially when processing expensive or rare species. Adhesion and backing (applying paper, fleece, or phenolic resin backing) are crucial sub-processes that determine the stability and application flexibility of the final veneer sheet. Efficiency gains in this midstream segment through automation directly impact market competitiveness.

The downstream analysis focuses on distribution channels and end-user application. Distribution is generally managed through a mix of direct sales to large furniture manufacturers or architectural firms (B2B model) and indirect sales through specialized distributors, woodworking retailers, and large hardware stores. Direct sales ensure tight quality control and customized orders, while indirect channels provide wider market penetration for standard products. Potential customers, including architects, interior designers, and professional cabinet makers, influence demand significantly, often specifying products based on sustainability certifications and aesthetic uniqueness. The complexity of the value chain necessitates strong vertical integration or collaborative partnerships to ensure traceability and consistent supply, particularly for specialized, high-demand veneer types.

Veneer Sheet Market Potential Customers

The primary end-users and potential buyers in the Veneer Sheet Market are multifaceted, driven predominantly by the construction, interior design, and manufacturing sectors. Large-scale furniture manufacturers represent a substantial customer base, utilizing vast quantities of standardized and engineered veneers for mass-produced cabinets, case goods, and office furniture where consistency, cost, and high aesthetic quality are required. Architectural firms and interior designers constitute another critical segment, demanding high-end, customized, and often rare natural wood veneers for bespoke projects in hospitality, high-end residential, and corporate interiors, placing a premium on sustainability certifications and unique grain patterns.

Beyond traditional construction and furniture sectors, specialized manufacturing industries are increasing their consumption of veneer sheets. The automotive industry, specifically manufacturers of luxury and premium vehicles, utilizes high-grade, lightweight, and thin veneer sheets for interior trims, dashboards, and door panels, valuing both the aesthetics and the low weight contribution. Similarly, manufacturers of high-end consumer electronics and musical instruments require specific, vibration-dampening, and aesthetically pleasing veneer sheets, often sourced for precise acoustic properties and visual appeal, indicating a growing niche market for technical veneers.

Residential consumers engaged in home renovation and do-it-yourself (DIY) projects, often purchasing through retail channels, also represent a growing segment, particularly for flexible, pre-finished, and paper-backed veneers that simplify installation. The trend towards built-in cabinetry and customized interior elements in modern housing drives this demand. Furthermore, the contract market, including large developers managing hotel chains, hospitals, and educational institutions, acts as a major bulk purchaser, focusing on durable, fire-rated, and aesthetically consistent veneer products that comply with stringent commercial building codes and offer long-term performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Century Plyboards, Greenply Industries, Holdings, Decowood, Flexible Veneer, Oakwood Veneer, Wood Tape , FormWood Industries, Sauers & Co. Veneers, Turakhia Laminates, Ahearn & Soper Inc., Columbia Forest Products, Biesse Group, Raute Oyj, DONGWA Veneer, Veneer Technologies, M. Bohlke Veneer, Veneer Factory, Ply Gem Industries, Garnica Plywood |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veneer Sheet Market Key Technology Landscape

The technological landscape of the Veneer Sheet Market is heavily influenced by advancements aimed at increasing resource efficiency, improving aesthetic consistency, and enhancing product durability. A fundamental technology is the deployment of high-precision slicing and rotary cutting machines, particularly the use of linear slicers and half-round slicers capable of achieving ultra-thin veneer cuts with minimal waste and maximum preservation of the log's original grain pattern. Modern machinery incorporates sophisticated laser alignment and automated calibration systems to maintain consistent thickness across large production runs, critical for high-quality book matching and splicing operations. Furthermore, the integration of advanced drying kilns and moisture control systems ensures the stability of the veneer sheets, preventing defects like cracking and warping post-production.

A significant area of innovation lies in the engineering and reconstitution process, which involves high-pressure pressing, dyeing, and lamination of fast-growing, low-cost wood fibers to create Engineered Veneers. This technology provides unparalleled consistency in color and grain structure, eliminating the natural variation inherent in traditional wood veneers, making them ideal for large commercial projects requiring uniformity. The development of specialized backing materials, such as non-woven fleece, also improves the flexibility and stability of the veneer, allowing it to be applied easily to curved surfaces without cracking. Furthermore, surface treatment technologies, including UV-cured finishes and nano-coatings, are applied to enhance scratch resistance, moisture protection, and color fastness, broadening the application scope of veneer sheets.

Digitalization and automation are also transforming the market. Computer Numerical Control (CNC) technology is widely used in splicing and panel assembly to automate the creation of complex patterned surfaces (e.g., parquet veneers or highly decorative designs), reducing labor intensity and increasing precision. Non-destructive testing using ultrasonic and visual inspection equipment is becoming standard practice to identify internal defects in logs before slicing, maximizing the valuable output. The adoption of advanced, low-formaldehyde, and bio-based adhesive technologies addresses critical health and environmental regulations, particularly in mature markets like Europe and North America, positioning these technical developments as central drivers for market acceptance and compliance.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, led by China, India, and Southeast Asian nations, represents the largest and fastest-growing market segment. This growth is directly attributable to rapid urbanization, massive government investment in housing and infrastructure, and the expansion of the regional furniture manufacturing hub. Demand focuses on cost-efficient and high-volume standard veneers, with an increasing trend towards sustainably sourced or engineered options to meet growing internal environmental standards.

- North America Market Maturity and High Value: The North American market is characterized by maturity, stable growth, and a strong preference for high-value natural wood veneers, particularly oak, maple, and walnut. Demand is primarily driven by residential remodeling activities and the upscale architectural millwork sector, demanding specific certifications (e.g., CARB compliance) and premium, custom finishes. Adoption of flexible and thin veneers for quick, high-quality renovations is a notable trend.

- European Market Focus on Sustainability and Regulation: Europe is highly influenced by stringent environmental regulations (EUTR, REACH) and strong consumer awareness of sustainability. The market emphasizes FSC/PEFC certified materials, low-VOC adhesives, and technological innovation in producing fire-retardant and acoustic veneers. Germany, Italy, and France are key consumers, often driving innovation in decorative design and high-specification architectural applications.

- Latin America Emerging Market Growth: Latin America shows significant potential, propelled by nascent construction booms and improving economic conditions, particularly in Brazil and Mexico. The market is transitioning from purely basic materials toward incorporating more decorative and imported veneer types in mid-range construction and furniture production, though local sourcing and cost remain primary factors influencing purchase decisions.

- Middle East and Africa (MEA) Luxury and Hospitality Demand: MEA displays concentrated demand in key urban centers, driven by major hospitality, retail, and luxury residential projects (especially in the UAE, Saudi Arabia, and Qatar). This region places a high premium on visual aesthetics, consistency, and exotic, high-gloss finishes, often importing specialized veneer types that meet high aesthetic and performance standards for extreme climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veneer Sheet Market.- Century Plyboards (India) Ltd.

- Greenply Industries Limited

- Holdings (U.K.)

- Decowood Veneers Pvt. Ltd.

- Flexible Veneer Co.

- Oakwood Veneer Co.

- Wood Tape Inc.

- FormWood Industries Inc.

- Sauers & Co. Veneers

- Turakhia Laminates Pvt. Ltd.

- Ahearn & Soper Inc.

- Columbia Forest Products

- Biesse Group

- Raute Oyj

- DONGWA Veneer

- Veneer Technologies Inc.

- M. Bohlke Veneer Corp.

- Veneer Factory Outlet

- Ply Gem Industries

- Garnica Plywood S.A.

Frequently Asked Questions

Analyze common user questions about the Veneer Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Veneer Sheet Market?

The Veneer Sheet Market is projected to grow at a robust CAGR of 5.8% during the forecast period from 2026 to 2033, driven primarily by increasing residential construction and the rising global demand for sustainable, high-aesthetic interior finishes.

What is the primary difference between Natural Wood Veneer and Engineered Veneer?

Natural Wood Veneer is a thin slice cut directly from a log, retaining the unique natural grain and color variation of the original species. Engineered Veneer, conversely, is manufactured by laminating, dyeing, and pressing reconstituted wood fibers, offering superior consistency, uniformity, and customization of color and pattern for large-scale projects.

Which application segment drives the highest demand in the Veneer Sheet Market?

The Furniture and Cabinet manufacturing segment consistently drives the highest volume demand for veneer sheets globally. This is due to the necessity of high-quality, stable, and cost-effective surface material for mass-produced goods in both residential and commercial sectors.

How do sustainability certifications impact the purchase of veneer sheets?

Sustainability certifications, such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification), are critical impact forces. They ensure responsible sourcing and are increasingly mandated by architectural firms and commercial developers, particularly in Europe and North America, favoring certified suppliers and products.

What is the role of AI and machine vision in modern veneer production?

AI-driven machine vision systems are fundamentally changing production by enabling high-speed, automated defect detection and precise grading of veneer sheets. This enhances quality consistency, minimizes human error, and optimizes raw material utilization by maximizing the yield of usable premium veneer from each log.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager