Ventilator Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431576 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ventilator Consumables Market Size

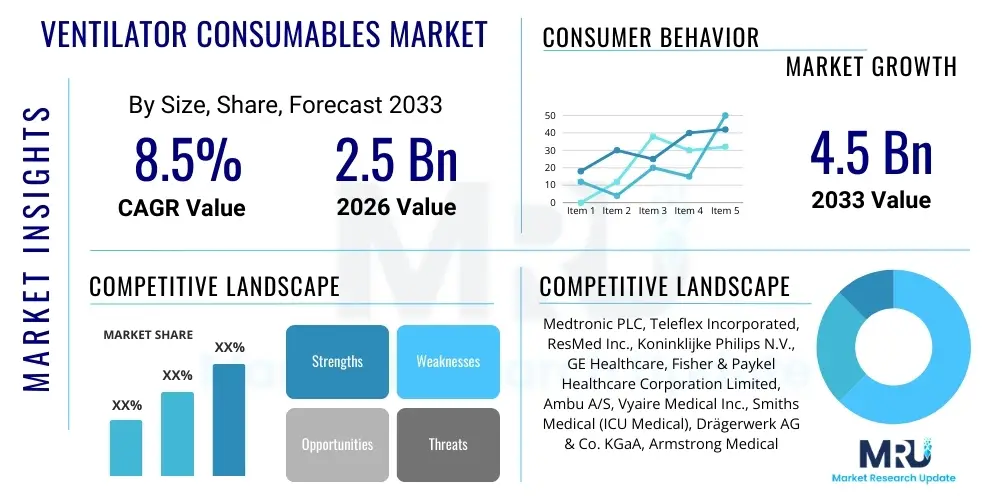

The Ventilator Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Ventilator Consumables Market introduction

The Ventilator Consumables Market encompasses a crucial range of disposable and reusable medical accessories essential for the safe and effective operation of mechanical ventilation systems across various clinical settings. These products are mandatory components in critical care units, operating rooms, emergency departments, and increasingly, home healthcare environments, forming the interface between the ventilation machine and the patient's respiratory system. Key consumables include specialized breathing circuits, robust humidification components such as high-efficiency heat and moisture exchangers (HMEs) and advanced heated humidifiers, various forms of endotracheal and tracheostomy tubes designed for secure airway management, highly efficient resuscitators, viral and bacterial filters, specialized connectors, and disposable sensors necessary for accurate monitoring of respiratory parameters. The primary function of these consumables is multifaceted: to ensure sterile, temperature-controlled, and humidity-optimized air delivery, to protect the patient and the ventilation system from cross-contamination through highly effective filtration, and to facilitate secure, long-term airway management while maximizing patient comfort and safety. The demand for these indispensable products is inherently linked to the escalating global prevalence of chronic and acute respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD), severe asthma, pandemic-related pneumonia, and Acute Respiratory Distress Syndrome (ARDS). Furthermore, the continuous demographic shift toward an aging global population, which requires increasing levels of intensive care support, both post-surgery and during episodes of severe illness, acts as a perpetual demand driver for high-quality, certified consumables. These products offer significant clinical benefits by enhancing critical care efficacy, minimizing the risk of serious complications like Ventilator-Associated Pneumonia (VAP), optimizing gas exchange parameters, and enabling efficient monitoring and precise delivery of therapeutic gases. The increasing global focus on infection control protocols and the rising number of both invasive and non-invasive ventilation procedures performed worldwide are accelerating market growth substantially. Technological advancements, particularly in advanced filtration efficiency, materials science used in manufacturing breathing circuits to reduce problematic condensation, and ergonomic design improvements, are contributing significantly to market value, leading to superior clinical outcomes and greater long-term cost-effectiveness in diverse healthcare settings.

Ventilator Consumables Market Executive Summary

The global Ventilator Consumables Market is currently characterized by exceptionally robust growth and transformative dynamics, primarily driven by sustained governmental and private sector investment in expanding global critical care infrastructure and the lasting organizational changes brought about by heightened public health crises concerning respiratory illness management. Business trends strongly indicate a strategic move toward enhancing supply chain resiliency, increasing localized manufacturing capacity, and fostering greater collaboration between suppliers and healthcare providers, particularly for essential, high-volume components like closed-suction systems and specialized breathing circuits tailored for vulnerable populations such as pediatrics and neonates. Major industry players are focusing on integrating advanced features into consumables, such as embedded tracing mechanisms (e.g., RFID) for superior inventory management and automated usage tracking, thereby significantly improving operational efficiencies in high-throughput hospital environments and ensuring compliance with replacement schedules. The market exhibits a highly competitive landscape, characterized by high fragmentation in the production of basic, commodity-like consumables but with strategic consolidation among key providers of technologically advanced, specialized, and higher-margin items like advanced HMEs and complex multi-stage filtering systems, where intellectual property and clinical validation provide competitive insulation. Regionally, North America and Europe continue to hold a significant revenue share due to their mature healthcare systems, high per capita healthcare expenditure, and established, rigorous regulatory frameworks that readily support the rapid adoption of advanced medical devices and disposable products; however, the Asia Pacific region is demonstrating the highest Compound Annual Growth Rate trajectory. This accelerated growth in APAC is spurred by rapidly expanding patient access to modern healthcare, substantial investments in building new critical care facilities in highly populous nations like China and India, and a rapidly increasing clinical awareness regarding stringent infection prevention protocols. Segment trends clearly highlight breathing circuits and airway management components as the largest segments by overall revenue, primarily due to their intrinsic necessity in every ventilation procedure and mandated frequent replacement schedules. Furthermore, the single-use disposable segment continues its rapid expansion, strategically eclipsing the reusable segment across virtually all product categories. This shift is strongly necessitated by increasingly stringent infection control guidelines and the compelling operational simplicity and reduced sterilization costs provided by disposable components, establishing infection prevention and streamlined logistics as critical competitive differentiators for all manufacturers operating in this essential medical sector. This market resilience is further supported by the global shift towards Non-Invasive Ventilation (NIV), which has significantly propelled the market segment for specialized NIV masks and interfaces, products that require routine, high-frequency replacement to maintain optimal pneumatic seal and patient comfort, underscoring the market’s responsiveness to evolving clinical standards and technological progression in respiratory support modalities.

AI Impact Analysis on Ventilator Consumables Market

Analysis of common user questions regarding the intersection of Artificial Intelligence and the Ventilator Consumables Market reveals several critical thematic areas centered around optimizing inventory flows, implementing predictive maintenance strategies for associated hardware, and substantially enhancing supply chain resilience against geopolitical and logistical disruptions. Users frequently express concerns about past supply shortages and inquire specifically about how AI-driven analytics can mitigate these risks in the future, particularly by creating proactive supply buffer strategies. Expectations are exceptionally high that sophisticated AI and machine learning algorithms can provide significantly more accurate and dynamic forecasting of complex demand fluctuations, encompassing both regional variations and seasonal spikes in respiratory illness, thereby optimizing manufacturing production schedules and refining distribution strategies for high-volume, critical items such as specialized filters and breathing circuits. Furthermore, significant user interest and investment focus lie in AI’s powerful potential to transform quality control processes during the manufacturing lifecycle. This involves employing advanced computer vision systems and deep learning models to automatically detect microscopic or structural defects in sensitive components—such as the integrity of the filtration media or the sealing capability of endotracheal tubes—ensuring dramatically higher product reliability and uncompromising patient safety standards. A secondary, yet crucial, theme involves the optimization of operational efficiency within hospital procurement departments, where users anticipate AI will manage completely automated reordering processes. These systems would utilize real-time consumption data derived directly from point-of-use sensors and centralized hospital management systems, effectively minimizing both expensive product waste and the critical risk of stockouts in intensive care environments. Primary concerns remain focused on the complexity and security of data integration when connecting proprietary AI platforms across disparate hospital and manufacturing systems, as well as the substantial initial capital investment required for implementing these sophisticated, data-intensive AI-driven logistics and quality assurance platforms, emphasizing the necessity for clear and verifiable Return on Investment (ROI) justification in crucial procurement decisions.

- AI-driven Predictive Demand Forecasting: Utilizing machine learning algorithms to significantly enhance the accuracy of supply chain management for highly fluctuating consumable needs, especially critical during seasonal peaks or unforeseen epidemic cycles, ensuring optimal stock levels.

- Automated Inventory Management Systems: Implementation of advanced machine learning for real-time tracking of individual consumable units within hospital environments, automatically triggering precise reorder points and substantially reducing the risk of critical stock shortages in ICU settings.

- Quality Control and Manufacturing Defect Detection: Deploying specialized computer vision and image processing algorithms during the production phase to identify minute, often invisible, structural defects in highly sensitive components such as breathing circuits, high-efficiency HMEs, and specialized medical filters, ensuring product integrity.

- Optimized Logistics and Distribution Network Planning: AI models calculating the most efficient, risk-mitigated routes and warehousing strategies for time-sensitive, sterile disposable medical products, minimizing delivery lead times and transportation costs across complex global networks.

- Enhanced Patient Safety and Risk Reduction: AI systems assisting clinicians and procurement staff in precisely tracking the operational usage life and mandated replacement schedules of both disposable and certain reusable components, playing a preventative role in reducing the incidence of life-threatening Ventilator-Associated Pneumonia (VAP) linked to overdue changes.

- Personalized Consumable Sizing and Fit Recommendations: Utilizing vast patient anthropometric data and AI analysis to recommend optimal sizing and interface types for NIV masks and endotracheal tubes, significantly minimizing air leakage, enhancing overall patient comfort, and substantially improving ventilation efficacy and therapy compliance.

- Automated Compliance Monitoring: AI systems ensuring that the correct, specific type of consumable (e.g., correct filter rating, specific circuit length) is matched to the ventilator model and patient type, thereby enforcing protocol adherence and reducing clinical errors during setup.

DRO & Impact Forces Of Ventilator Consumables Market

The operational and strategic trajectory of the Ventilator Consumables Market is critically shaped by a dynamic and often conflicting blend of core Drivers, operational Restraints, and latent Opportunities, which are themselves profoundly influenced by powerful macro impact forces arising from global health policy shifts and ongoing technological evolution in respiratory care. Key drivers consistently propelling market expansion include the inexorable rise in the global prevalence of chronic respiratory disorders, such as COPD and pulmonary fibrosis, which necessitate prolonged and repetitive mechanical ventilation support across diverse healthcare settings. This is synergistically combined with the continuous, large-scale expansion and necessary modernization of critical care facilities and surgical capacity worldwide. Furthermore, increasingly strict global regulatory mandates specifically promoting and enforcing stringent infection control measures act as a powerful catalyst, strongly favoring the necessary adoption of high-performance, single-use disposable consumables over reusable options, thereby rapidly accelerating their market penetration across all pertinent clinical segments. Conversely, the market must navigate significant structural restraints, primarily stemming from the inherent logistical challenges associated with manufacturing and globally distributing high-volume, relatively low-margin disposable goods, which are exceptionally susceptible to sharp volatility in critical raw material costs, particularly specialized medical-grade polymers and filtering media. Economic restraints present persistent barriers in emerging and developing nations, where budgetary constraints often severely restrict the adoption of premium, specialized consumables, frequently compelling healthcare providers to opt for lower-cost alternatives, sometimes compromising adherence to optimal replacement schedules. However, opportunities for robust, sustained growth are substantial, particularly concentrated in the research and development of highly advanced filtration technologies that offer demonstrably enhanced protection against increasingly prevalent and emerging pathogens. Furthermore, the strategic opportunity to develop specialized, user-friendly consumables optimized for the fast-growing homecare and non-hospital settings reflects the overarching global trend toward decentralized healthcare delivery. Moreover, targeted geographical expansion into strategically underserved emerging markets represents a major avenue for future revenue growth and market share acquisition. The most powerful impact force influencing the market’s trajectory remains the increasing global geriatric population, which intrinsically requires greater levels of critical respiratory support and surgical recovery care, alongside mandatory governmental stockpiling policies and comprehensive preparedness plans against future widespread pandemics or large-scale health emergencies, ensuring a resilient baseline demand for all critical respiratory care supplies. Finally, the growing power and global consolidation of large Group Purchasing Organizations (GPOs) act as a substantial commercial impact force, significantly influencing pricing dynamics and negotiation leverage across the entire supply chain, thereby demanding continuous improvements in operational efficiency, cost-effectiveness, and verifiable clinical value from consumables manufacturers.

Segmentation Analysis

The Ventilator Consumables Market is intricately segmented across several critical dimensions, including product type, specific patient demographics, mode of usage (invasive vs. non-invasive), and the various end-user environments, providing industry stakeholders with a highly nuanced, data-driven perspective on prevailing demand patterns and optimal strategic focus areas. Segmentation by product type remains foundational, clearly delineating between high-volume, essential disposables, which include diverse breathing circuits and humidification systems (HMEs), and specialized, higher-margin airway management tools, such as advanced endotracheal and tracheostomy tubes designed for long-term securement. The breathing circuits segment consistently commands the largest share of the overall market revenue, a dominance sustained by the mandatory necessity of their frequent replacement in every clinical setting to stringently prevent cross-contamination and maintain elevated standards of patient safety and hygiene. Segmentation based on usage—specifically analyzing invasive versus non-invasive ventilation—reveals an exceptionally rapid acceleration of growth in the non-invasive ventilation (NIV) interfaces category, encompassing complex masks and nasal pillows. This expansion is robustly fueled by continuous technological improvements that maximize patient comfort, minimize skin breakdown, and often reduce the clinical necessity for invasive intubation, thereby shortening hospital stays and improving recovery profiles. The structural market analysis universally confirms that the pronounced trend toward adopting single-use, disposable products is dominating across nearly all sub-segments, systematically replacing reusable alternatives in high-risk critical care environments. This strategic shift is largely mandated by enhanced, globally applied infection prevention protocols that have definitively demonstrated lower rates of serious hospital-acquired infections. Furthermore, the segmentation by patient group is strategically important, spotlighting specialized vertical markets such as neonatal and pediatric care, which necessitate the development and supply of specific, highly sensitive, miniaturized, and low-compliance consumables to protect vulnerable patients. End-user segmentation shows that acute care hospitals, particularly their Intensive Care Units (ICUs) and busy Operating Theatres (OTs), are and will remain the largest volume consumers. However, the concurrent, significant emergence of specialized long-term acute care facilities (LTACs) and the sustained, growing adoption of complex respiratory care in home healthcare settings are collectively and substantially expanding the total addressable market, requiring manufacturers to diversify their product portfolio and adapt their packaging and logistics to support non-clinical environments efficiently. Understanding and leveraging these detailed segmentation dynamics is absolutely vital for stakeholders to effectively tailor their product development pipelines, optimize their pricing strategies, and efficiently structure their distribution channels to maximize market penetration and ensure full compliance with the highly diverse and rigorous clinical requirements across the entire continuum of respiratory care.

- By Product Type:

- Breathing Circuits (Reusable and Disposable, Adult and Pediatric/Neonatal)

- Airway Management Devices (Endotracheal Tubes, Tracheostomy Tubes, Laryngeal Mask Airways, Tube Holders)

- Humidification Components (Heat and Moisture Exchangers (HMEs), Heated Humidifiers, Specialized Water Traps)

- Filters (Bacterial/Viral Filters, Combined HME Filters, HEPA Filters)

- Resuscitator Bags and Components (Manual Resuscitators, Reservoir Bags)

- Connectors, Adaptors, and Extension Lines

- By Patient Type:

- Adult Consumables (Largest Volume Segment)

- Pediatric and Neonatal Consumables (Requires specialized sizing and lower compliance components)

- By Usage:

- Invasive Ventilation Consumables (Requires Airway Management Devices)

- Non-Invasive Ventilation Consumables (NIV Masks, Nasal Pillows, Headgear, and Specialized Interfaces)

- By End User:

- Hospitals (ICUs, Operating Rooms, Emergency Departments)

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings (Long-Term Ventilator Dependent Patients)

- Long-Term Acute Care Facilities (LTACs)

- Emergency Medical Services (EMS)

Value Chain Analysis For Ventilator Consumables Market

The value chain for the Ventilator Consumables Market is fundamentally characterized by highly specialized, interconnected stages, commencing with the critical upstream sourcing of high-grade raw materials. These materials primarily include medical-grade polymers, high-performance plastics (such as PVC, polyethylene, and silicone), specialized metals for connectors, and advanced, multi-layer filtration media. Upstream analysis focuses intensely on maintaining absolute quality assurance, verifying biocompatibility, and ensuring material sourcing stability, as the ultimate performance, regulatory compliance, and inherent safety of the final product critically depend on the precise purity and physical properties of these feedstock materials. Significant volatility in global petrochemical feedstock markets and potential supply chain interruptions, particularly for highly specialized polymers and proprietary components, pose persistent challenges at this stage, necessitating the adoption of robust, proactive risk mitigation strategies by core manufacturers, including geographical diversification of suppliers. The core manufacturing stage involves complex processes such as precision injection molding, automated assembly in certified clean rooms, rigorous gamma or ethylene oxide sterilization, and multi-point quality control checks utilizing vision systems. Major global market players often strategically integrate vertically to gain tighter control over the quality, cost, and lead time for key proprietary aspects of production, especially for high-value items like specialized HMEs and geometrically complex breathing circuits. Distribution channels are necessarily multifaceted and often hybrid; direct sales models are typically reserved for engaging large, strategic hospital systems, governmental bodies for large tenders, and major Group Purchasing Organizations (GPOs), allowing manufacturers superior control over sensitive pricing negotiations, customized product solutions, and the provision of intensive technical support. Crucially, however, the indirect distribution channel, involving large national and regional medical supply distributors and specialized value-added resellers, plays a paramount role in achieving high-volume market saturation. These indirect partners provide essential, scalable logistics capabilities, secure warehousing for sterile stock, specialized inventory management services, and the crucial local market reach required to serve smaller clinics, ambulatory centers, and the exponentially growing home care market, demanding highly efficient partnership management and complete inventory visibility across the entire chain. Downstream, the final activities involve actual clinical adoption, effective usage, and mandated replacement schedules, activities heavily influenced by continuous healthcare professional training, rigorous adherence to dynamic infection control protocols, and the overall efficiency of procurement and inventory management systems within the hospital environment. The prevailing market structure dictates that indirect distribution remains the primary volume path, ensuring widespread accessibility and rapid, efficient deployment, especially vital during periods of acute demand, while direct engagement focuses on securing large strategic accounts and facilitating the market entry of technologically advanced, often proprietary, consumable systems that necessitate intensive technical support and robust clinical application training to maximize market penetration and secure profitable, long-term supply contracts based on verifiable clinical efficacy and lower overall cost-in-use benefits.

Ventilator Consumables Market Potential Customers

The core customer base for the Ventilator Consumables Market consists predominantly of institutional healthcare providers, with a rapidly growing segment represented by organizations managing patients in decentralized, non-traditional care settings. The single dominant customer segment remains acute care hospitals, specifically their high-traffic Intensive Care Units (ICUs), highly specialized Neonatal ICUs (NICUs), Pediatric ICUs (PICUs), fast-paced Emergency Departments (EDs), and surgical Operating Theatres (OTs). These departments necessitate continuous, high-volume, guaranteed replenishment of standard and specialized disposable breathing circuits, highly effective filters, and various secure airway management devices due to the critical nature of patient populations and the strict adherence to uncompromising single-use protocols designed to prevent healthcare-associated infections. Procurement decisions within substantial hospital systems are typically centralized and overseen by high-level purchasing departments or influential Group Purchasing Organizations (GPOs). These entities prioritize several key factors: unwavering supplier reliability, verifiable cost-effectiveness achieved through large-scale bulk purchasing, proven product performance metrics (especially concerning infection reduction), ease of integration, and guaranteed patient comfort features. Specialized clinics, such as numerous ambulatory surgical centers (ASCs) and dedicated pulmonary rehabilitation centers, represent a substantial and rapidly expanding customer segment, frequently requiring smaller, highly specialized volumes, predominantly focused on non-invasive ventilation consumables tailored for post-operative recovery, short-stay procedures, or the management of chronic conditions. A third, dramatically expanding customer base is the rapidly growing long-term care and home healthcare sector. As advanced medical technologies and comprehensive reimbursement structures increasingly enable patients requiring chronic, long-term ventilator support to be safely managed outside the traditional hospital environment, durable medical equipment (DME) providers and specialized home care agencies become crucial, high-volume buyers. These customers exhibit a strong preference for products specifically optimized for straightforward operation, high durability, and superior patient comfort in non-clinical, residential settings, often securing products through complex, long-term supply contracts managed via private insurance carriers or specific governmental reimbursement programs. Furthermore, national governmental bodies and large-scale national health organizations, entrusted with pandemic preparedness, civil defense, and the maintenance of essential national medical stockpiles, operate as major, large-scale, and often periodic customers. They procure exceptionally large quantities of essential high-volume consumables like filters, basic breathing circuits, and humidification components in response to immediate public health crises or for strategic maintenance of inventory mandates, ensuring a robust, resilient baseline demand that stabilizes the market even outside routine, day-to-day clinical consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic PLC, Teleflex Incorporated, ResMed Inc., Koninklijke Philips N.V., GE Healthcare, Fisher & Paykel Healthcare Corporation Limited, Ambu A/S, Vyaire Medical Inc., Smiths Medical (ICU Medical), Drägerwerk AG & Co. KGaA, Armstrong Medical Ltd., Westmed Inc., Intersurgical Ltd., Salter Labs, Sunset Healthcare Solutions, Well Lead Medical Co. Ltd., Vadi Medical Technology Co., Ltd., Flexicare Medical Limited, Halyard Health (now part of Owens & Minor), Ventlab Corporation, Drive DeVilbiss Healthcare, Allied Healthcare Products, Inc., ConMed Corporation, Becton, Dickinson and Company (BD) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ventilator Consumables Market Key Technology Landscape

The key technology landscape within the Ventilator Consumables Market is intensely focused on leveraging advances in materials science, fluid dynamics, and digital integration to significantly enhance patient safety, optimize ventilation efficacy, and improve overall clinical usability. A cornerstone technological trend involves the rigorous development and deployment of advanced filtration media, particularly utilizing specialized HEPA-grade materials and sophisticated electrostatic filters. These filters are engineered to provide superior, documented protection against both aerosolized viral and bacterial pathogens, which is fundamentally critical for minimizing dangerous cross-contamination risks throughout the entire ventilator circuit and protecting both the patient and the machine. Manufacturers are heavily investing in ensuring these new-generation filters maintain their exceptionally high efficiency ratings even when exposed to high moisture levels or extreme airflow rates, thereby guaranteeing continuous barrier protection without detrimentally compromising vital gas delivery dynamics or increasing resistance excessively. Another highly significant area of ongoing innovation centers on modern breathing circuit design, which is steadily migrating towards lighter, substantially more flexible materials, often incorporating specialized co-axial circuits that efficiently integrate both inspiratory and expiratory lines within a single conduit. This advanced design minimizes circuit dead space, substantially reduces problematic moisture condensation (rainout), and significantly improves patient handling and mobility, especially critical in long-term care settings. Furthermore, materials used in critical components are increasingly incorporating prophylactic anti-microbial coatings, typically leveraging silver-ion embedded polymers or similar compounds, which actively inhibit microbial colonization within the circuit tubing walls, thereby furnishing an essential, proactive layer of defense specifically against the development of Ventilator-Associated Pneumonia (VAP). Moreover, the strategic integration of sophisticated smart technologies is rapidly moving from niche application to mainstream adoption; this includes the practical utilization of miniature embedded sensors and robust Radio Frequency Identification (RFID) tags directly within the consumable products. These integral digital features enable automated and precise tracking of product usage duration, systematically triggering necessary alerts for mandatory replacement, and facilitating seamless, instant integration with hospital Electronic Health Records (EHR) and centralized inventory management systems. This extensive digital integration drastically improves compliance with patient safety protocols, ensures verifiable usage tracking, and significantly streamlines high-volume logistical operations. Finally, the development of high-performance Heat and Moisture Exchangers (HMEs) remains a core technological focus. Contemporary HMEs are designed for maximal efficiency, effectively managing the critical aspects of humidity retention and heat transfer with minimized airflow resistance, thereby ensuring optimal physiological conditioning for the patient's delicate airway over potentially extended periods of required mechanical ventilation, serving as a primary differentiator for premium consumable products based on clinically verifiable, superior performance metrics.

Regional Highlights

Geographically, the global Ventilator Consumables Market exhibits distinct maturity levels, varying regulatory adoption speeds, and significantly divergent growth trajectories across its major operational regions, reflecting varied healthcare expenditures and infrastructure capabilities. North America, unequivocally anchored by the massive market strength of the United States, continues to command the largest overall revenue share. This dominance is robustly attributed to exceptionally high per capita healthcare spending, the concentrated presence of influential key market players specializing in high-end disposables, and a universally sophisticated critical care infrastructure that quickly implements advanced, specialized consumables and monitoring systems. The highly stringent regulatory environment in North America actively enforces the utilization of high-quality, single-use, specialized components to meet uncompromising VAP prevention guidelines, which invariably drives premium pricing and technological leadership in this region. Europe closely follows North America in market size, with its demand principally fueled by near-universal healthcare coverage and a rapidly expanding geriatric population that is inherently highly susceptible to acute and chronic respiratory illnesses. Western European nations demonstrate persistently high demand for state-of-the-art filtration and active humidification technologies, strongly supported by established, predictable national reimbursement policies. However, it must be noted that cost containment pressures are generally more pronounced in numerous European markets, often strategically favoring robust, cost-effective disposable solutions while rigorously maintaining stipulated quality standards. Crucially, the Asia Pacific (APAC) region is dynamically projected to register the fastest growth rate throughout the entire forecast period. This anticipated, rapid expansion is fundamentally attributed to massive, unprecedented governmental and private sector investments in building modern healthcare infrastructure, the aggressive expansion of certified critical care beds in highly populous nations like China and India, and a rapidly increasing clinical and patient awareness regarding rigorous infection control standards and the benefits of modern respiratory support. While APAC currently remains more sensitive to product costs, favoring essential, high-volume options, the escalating medical tourism industry and rising middle-class disposable incomes are collectively fueling a rapid, discernible shift towards higher-quality, sophisticated, and internationally compliant consumables. Latin America and the Middle East & Africa (MEA) constitute strategically emerging markets, where growth rates are highly contingent upon the success of governmental national health initiatives and continuous improvements in regional economic stability, focusing initially on establishing baseline essential critical care supply inventories and modernizing basic consumable management logistics to address fundamental healthcare access.

- North America: Remains the dominant market leader, driven by exceptionally high critical care expenditure, stringent regulatory standards favoring high-cost specialized disposables, and early, rapid adoption of advanced respiratory technologies.

- Europe: Second-largest market, with sustained demand fueled by a significant and aging demographic and highly standardized critical care protocols, showing particularly strong demand for advanced high-efficiency filters and precise humidification systems (HMEs).

- Asia Pacific (APAC): The fastest-growing region globally, propelled by immense governmental and private investment in expanding hospital infrastructure, rapidly increasing patient volumes, and rising clinical adoption of strict infection control standards across major developing economies.

- Latin America (LATAM): Growth concentrated around continuous expansion of healthcare access, modernization of existing hospital facilities, and rising awareness of respiratory care needs, focusing strategically on ensuring reliable access to cost-effective, high-volume consumables.

- Middle East and Africa (MEA): Represents an emerging growth opportunity, significantly driven by substantial government investments in establishing specialized, high-standard medical facilities and aggressively building healthcare capacity, particularly evident in the Gulf Cooperation Council (GCC) member countries and strategically developing regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ventilator Consumables Market.- Medtronic PLC

- Teleflex Incorporated

- ResMed Inc.

- Koninklijke Philips N.V.

- GE Healthcare

- Fisher & Paykel Healthcare Corporation Limited

- Ambu A/S

- Vyaire Medical Inc.

- Smiths Medical (ICU Medical)

- Drägerwerk AG & Co. KGaA

- Armstrong Medical Ltd.

- Westmed Inc.

- Intersurgical Ltd.

- Salter Labs

- Sunset Healthcare Solutions

- Well Lead Medical Co. Ltd.

- Vadi Medical Technology Co., Ltd.

- Flexicare Medical Limited

- Halyard Health (now part of Owens & Minor)

- Ventlab Corporation

Frequently Asked Questions

Analyze common user questions about the Ventilator Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the accelerated growth of the Ventilator Consumables Market?

Market growth is primarily driven by the increasing global prevalence of debilitating Chronic Obstructive Pulmonary Disease (COPD) and Acute Respiratory Distress Syndrome (ARDS), coupled with the mandatory, strict implementation of global infection control guidelines, which necessitates the frequent replacement and use of high-quality, single-use disposable components like highly efficient filters and sterile breathing circuits across all critical care settings worldwide, ensuring optimal patient outcomes and safety compliance.

How is the current shift towards Non-Invasive Ventilation (NIV) impacting the structure of consumable demand?

The growing clinical preference for Non-Invasive Ventilation is significantly increasing the segment demand for non-invasive consumables, specifically specialized, comfortable masks, ergonomic nasal pillows, and adaptable interface components. These NIV products require very frequent replacement to maintain an effective pneumatic seal and rigorous hygiene standards, thereby significantly expanding the high-volume segment focused on comfort, compliance, and verified performance outside traditional invasive intubation procedures.

What is identified as the most critical operational restraint currently facing manufacturers in this market?

The most critical operational restraint is the significant volatility and rapid, continuous increase in the cost of crucial raw materials, particularly medical-grade polymers and specialized plastics used in circuit manufacturing, intensified by severe margin compression and aggressive pricing pressure exerted by large, consolidated Group Purchasing Organizations (GPOs) and national health systems seeking effective cost containment strategies for essential, high-volume disposables.

Which geographical region is robustly expected to demonstrate the highest future growth rate in the market?

The Asia Pacific (APAC) region is comprehensively projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is fueled by massive governmental and private investments in aggressively expanding regional healthcare infrastructure, sustained modernization of existing hospital facilities, and sharply increasing clinical awareness and adoption of stringent infection control standards across highly populous, rapidly developing economies such as China and India.

How does ongoing technological innovation actively address the significant risks associated with Ventilator-Associated Pneumonia (VAP)?

Technological innovation strategically targets VAP reduction through multiple preventative avenues, including the intense development of advanced hydrophobic and specialized viral/bacterial filters, the proactive application of anti-microbial coatings onto circuit materials and tubing, and the design and integration of advanced closed-suction systems, all precisely engineered to minimize the introduction, migration, and widespread dissemination of pathogens within the patient airway and the entire interconnected ventilator circuit system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager