Venture Capital & Private Equity Firms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431652 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Venture Capital & Private Equity Firms Market Size

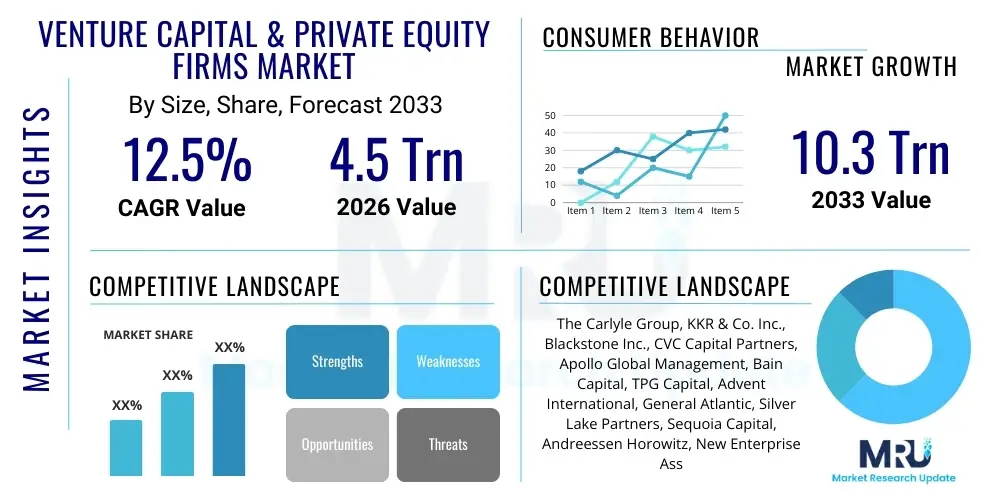

The Venture Capital & Private Equity Firms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 Trillion in 2026 and is projected to reach USD 10.3 Trillion by the end of the forecast period in 2033.

Venture Capital & Private Equity Firms Market introduction

The Venture Capital (VC) and Private Equity (PE) Firms Market encompasses sophisticated financial institutions dedicated to managing pooled capital for investment into private companies or acquiring public companies to take them private. These firms specialize in providing growth capital, executing complex leveraged buyouts (LBOs), and offering strategic operational expertise to enhance the value of their portfolio companies before eventual exit via IPO, merger, or sale. The market operates at the nexus of innovation and corporate restructuring, serving as a vital engine for economic transformation by channeling institutional and high-net-worth individual (HNWI) capital towards high-potential, non-listed assets.

Major applications of this capital include funding disruptive technology startups (VC), orchestrating large-scale corporate acquisitions (PE Buyout), and financing established businesses seeking accelerated growth or operational turnarounds (Growth Equity). The primary benefits derived from the VC/PE ecosystem are substantial value creation through operational improvements, efficient capital allocation, and the professionalization of management teams within portfolio companies. Furthermore, these activities provide significant diversification opportunities for institutional investors, such as pension funds and endowments, seeking superior, often uncorrelated returns compared to traditional public market investments.

The driving factors propelling the expansion of this market are deeply rooted in global macroeconomic trends and technological shifts. The proliferation of digital transformation across all industries has created fertile ground for venture capital investment, particularly in areas like FinTech, BioTech, and Enterprise Software. Concurrently, the increasing regulatory burden and public market volatility have led established firms to seek private ownership for restructuring and long-term strategic execution, fueling the PE segment. Low interest rates globally, though fluctuating, have historically supported the leverage requirements necessary for LBOs, further accelerating fundraising cycles and deployment activities across both the VC and PE asset classes.

Venture Capital & Private Equity Firms Market Executive Summary

The Venture Capital and Private Equity Firms Market is experiencing dynamic shifts characterized by robust fundraising cycles, heightened regulatory scrutiny, and a pronounced focus on sustainable and impact investing (ESG). Business trends indicate a bifurcation in investment strategies: VC firms are prioritizing deep tech and frontier technology investments, requiring specialized sector expertise, while PE firms are leveraging operational excellence, platform build-ups, and artificial intelligence (AI) tools for enhanced due diligence and portfolio monitoring. Furthermore, secondary market transactions are gaining prominence, offering liquidity solutions and sophisticated portfolio management strategies for Limited Partners (LPs). Key operational challenges revolve around valuation compression in certain VC stages and the increasing competition for proprietary deal flow in the saturated mid-market PE segment.

Regional trends highlight North America and Europe retaining dominance due to mature institutional investor bases and robust regulatory frameworks, though the Asia Pacific (APAC) region, particularly China and India, exhibits the fastest growth trajectory driven by rapid technological adoption and massive domestic market sizes. APAC PE funds are increasingly focused on consumer-tech and cross-border transactions, whereas European firms are navigating complex geopolitical risks alongside stringent ESG mandates set by the EU taxonomy. In contrast, the Middle East and Africa (MEA) are emerging as high-potential regions, buoyed by sovereign wealth fund participation and sector-specific investments in renewable energy and digital infrastructure, signifying diversified global deployment strategies.

Segmentation trends reveal significant movement towards specialized funds over generalist approaches. In the PE segment, Growth Equity funds are experiencing high demand as they bridge the gap between late-stage VC and traditional LBOs, focusing on capital injection without requiring immediate control acquisition. By industry, the Healthcare and Life Sciences segment remains exceptionally resilient, driven by demographic shifts and sustained innovation requirements. Within the VC landscape, seed-stage funding is seeing increased sophistication, often involving corporate venture capital (CVC) arms, while late-stage VC rounds face pressure from institutional LPs demanding clear pathways to profitability, reflecting a broader market shift towards disciplined financial metrics and away from growth-at-any-cost models prevalent in earlier cycles.

AI Impact Analysis on Venture Capital & Private Equity Firms Market

User queries regarding AI’s influence on the VC/PE market predominantly center on automation capabilities, enhanced predictive analytics for deal sourcing, and the potential for AI-driven portfolio value creation. Common concerns include the displacement of traditional due diligence roles, data privacy issues inherent in large-scale dataset analysis, and the 'black box' nature of complex algorithmic investment decisions. Users expect AI to revolutionize the front-office functions, specifically in identifying nascent market trends and conducting rapid, comprehensive competitive analyses that were previously impractical due to time constraints. There is also significant interest in how AI can de-risk early-stage investing by modeling failure probabilities more accurately, and how PE firms can use machine learning to optimize supply chains and operating models within existing portfolio assets.

The core expectation is that AI will move the industry beyond reliance on human intuition and network effects toward data-driven certainty. For VC firms, AI-powered tools are already being deployed to scan millions of data points—including patent filings, social media chatter, hiring trends, and corporate registry information—to identify potential investment targets that traditional networks might miss. This democratization of deal flow allows smaller funds to compete effectively with tier-one institutions by leveraging superior analytical leverage. However, the success of these systems hinges entirely on the quality and proprietary nature of the training data used, pushing firms to invest heavily in robust data aggregation and cleaning infrastructure.

For PE firms, the impact of AI extends deep into operational transformation. Post-acquisition, AI algorithms are utilized to forecast demand, optimize inventory management, and personalize customer engagement, thereby accelerating the 100-day plan and achieving targeted internal rates of return (IRRs) faster. Furthermore, AI assists in evaluating bolt-on acquisitions by rapidly assessing synergy potential and integration risks. Despite the vast opportunities, regulatory frameworks governing data usage and algorithmic transparency, particularly in heavily regulated sectors like finance and healthcare, remain a key challenge that firms must proactively address to ensure compliance and maintain investor trust in AI-enhanced processes.

- AI optimizes deal flow identification by screening millions of disparate data sources.

- Machine learning enhances due diligence by predicting company performance and modeling failure risks.

- Predictive analytics supports portfolio management through real-time operational benchmarking and intervention strategies.

- AI automates back-office functions, reducing operational costs related to reporting and compliance.

- Natural Language Processing (NLP) is used to rapidly analyze legal documents and investment memorandums.

- Generative AI assists in scenario planning and financial modeling for complex leveraged buyout structures.

- Increased focus on investing in AI-native startups and adopting AI tools within portfolio companies (value creation).

DRO & Impact Forces Of Venture Capital & Private Equity Firms Market

The Venture Capital and Private Equity market is influenced by powerful forces that simultaneously encourage aggressive growth and enforce cautious capital deployment. Key drivers include the massive pools of dry powder accumulated by general partners (GPs) demanding deployment, sustained low opportunity costs relative to public markets, and continuous technological disruption necessitating specialized capital. Restraints, however, are significant, notably high asset valuations driven by intense competition, rising interest rates increasing the cost of debt crucial for LBOs, and heightened anti-trust scrutiny on large-scale roll-ups. Opportunities are concentrated in emerging geographies, the expansion of private credit complementing traditional equity, and the growing demand for secondary market liquidity solutions, creating a robust, yet complex, investment landscape that requires sophisticated risk management.

The primary impact forces manifest through macroeconomic cycles and regulatory adjustments. On the positive side, the demonstrated ability of VC and PE firms to generate superior returns over the long term continues to attract massive capital allocations from institutional LPs, strengthening the market foundation. This structural demand contrasts with the restraining force of geopolitical instability, which introduces uncertainty and volatility, potentially freezing M&A activity and complicating cross-border investments. The regulatory environment acts as both a driver (e.g., clear guidelines facilitating compliance technology investments) and a restraint (e.g., stricter reporting requirements under Dodd-Frank or EU directives increasing operational complexity and legal costs).

Crucially, the inherent dynamic of the asset class dictates that innovation itself acts as a perpetual driver, necessitating venture investment to commercialize new technologies, while market saturation and the 'winner-take-all' nature of many startup ecosystems introduce significant risk and volatility as a restraint. The overarching opportunity lies in ESG integration; firms demonstrating excellence in environmental, social, and governance practices are increasingly favored by LPs, creating a competitive advantage for those who treat sustainability not as a compliance burden but as a value creation lever, thereby transforming traditional investment models and attracting capital focused on long-term societal impact alongside financial return.

Segmentation Analysis

The Venture Capital and Private Equity Firms Market is highly heterogeneous, segmented meticulously based on fund type, investment stage, industry focus, and geographical region. This segmentation allows Limited Partners (LPs) to tailor their exposure to specific risk-return profiles and allows General Partners (GPs) to develop specialized sector expertise, thereby maximizing value creation potential. The overarching shift is towards specialization, where deep domain knowledge in areas like climate tech or personalized medicine is prioritized over broad generalist approaches, reflecting the complexity of modern markets and the necessity for hands-on, expert guidance in portfolio companies. Analyzing these segments is critical for understanding capital flows and future market trends, especially concerning which areas are currently experiencing valuation expansion versus those undergoing consolidation.

By Investment Type, the market clearly divides between Private Equity (focused on controlling stakes in mature companies via LBOs or Growth Equity) and Venture Capital (focused on minority stakes in nascent or rapidly scaling companies). The distinction is blurring slightly with the rise of "Crossover Funds" that participate in both late-stage venture rounds and public market investments, requiring regulatory agility. Further granularity is achieved by considering the structure of the investment vehicle, including buyout funds, distressed debt funds, funds of funds, and co-investment vehicles, each addressing a unique need within the capital structure of private companies and offering varied liquidity timelines to investors.

Industry Focus remains a decisive segmentation criterion, reflecting the underlying technological and demographic shifts shaping the global economy. Technology and Healthcare historically dominate capital deployment due to high growth potential and resilience to macroeconomic shocks. However, increasingly popular segments include Infrastructure (e.g., digital towers, renewable energy), Financial Services (FinTech and InsurTech), and Consumer Goods (e-commerce enablement and direct-to-consumer brands), all requiring specialized capital and operational expertise. Understanding the interplay between these different segments is essential for anticipating shifts in investment strategy and regional dominance across the global private markets landscape.

- By Type:

- Venture Capital (VC)

- Private Equity (PE)

- Buyout Funds

- Growth Equity Funds

- Mezzanine Funds

- Distressed Debt/Special Situations Funds

- Fund of Funds

- Secondary Funds

- Infrastructure Funds

- Real Estate Funds

- By Investment Stage (VC):

- Seed Stage

- Early Stage (Series A & B)

- Growth Stage (Series C+)

- Late Stage/Pre-IPO

- By End-Use Industry:

- Technology & Software (SaaS, AI, Cybersecurity)

- Healthcare & Life Sciences (BioTech, MedTech, Pharma)

- Financial Services (FinTech, InsurTech)

- Consumer Goods & Retail

- Industrial & Manufacturing

- Energy & Power (Traditional and Renewable)

- Media & Telecommunications

- By Region:

- North America (U.S., Canada)

- Europe (UK, Germany, France, Nordics)

- Asia Pacific (China, India, Japan, Southeast Asia)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Venture Capital & Private Equity Firms Market

The value chain for the Venture Capital and Private Equity market begins with Upstream activities focused on fundraising and origination, extending through the critical investment phase (due diligence and deployment), and concluding with Downstream activities involving portfolio management, value creation, and eventual exit. Upstream analysis reveals that Limited Partners (LPs), such as pension funds, endowments, and sovereign wealth funds, are the primary sources of capital. GPs must engage in extensive relationship management, meticulous reporting, and consistent performance tracking to secure commitments, a process increasingly mediated by placement agents and fund advisors who specialize in matching LPs with suitable fund strategies based on risk tolerance and liquidity needs. The successful origination of proprietary deals relies heavily on professional networks and thematic research, distinguishing top-tier firms.

The core of the value chain involves the investment decision and execution. This phase encompasses rigorous financial, operational, and commercial due diligence, often involving third-party consultants and specialized technology platforms (Direct). For PE, this includes structuring complex leveraged financing (often involving private credit providers, forming an indirect but crucial channel) and executing the transaction. For VC, the focus is rapid evaluation of technological feasibility and market fit. Downstream activities are where value is primarily generated: GPs actively manage their portfolio companies, implementing operational efficiencies, recruiting executive talent, and pursuing bolt-on acquisitions. This management often utilizes a range of third-party advisors—from supply chain experts to digital transformation consultants—representing indirect distribution channels for expertise.

The final stage, the Exit Strategy, dictates the liquidity events for LPs. Distribution channels for exits are manifold, including Initial Public Offerings (IPOs, supported by investment banks as direct intermediaries), strategic sales to corporate buyers (M&A advisors), or secondary buyouts (sale to another PE firm). The efficiency and profitability of these exit channels are highly dependent on macroeconomic conditions and public market appetite. The distribution of financial returns back to LPs completes the cycle, influencing future fundraising efforts. The entire value chain is underpinned by legal and regulatory compliance, necessitating strong indirect support from specialized legal counsel and compliance technology providers, reinforcing the formality and high barrier to entry in this specialized financial ecosystem.

Venture Capital & Private Equity Firms Market Potential Customers

The primary potential customers, or end-users/buyers, of the capital and strategic expertise provided by Venture Capital and Private Equity firms are the portfolio companies themselves, ranging from early-stage startups requiring initial seed funding to large, mature corporations targeted for complete leveraged buyouts. Startups and high-growth, mid-market companies represent the core customer base for VC and Growth Equity funds, seeking not only capital but also critical operational guidance in scaling, market entry, and technological development. These customers value the VC/PE relationship because it accelerates their growth trajectory far beyond what traditional bank financing can offer, often injecting crucial sector expertise and governance structures necessary for institutional maturation.

For large-cap Private Equity funds, the target customers are established, often underperforming, corporate divisions or public companies seeking to go private. These companies require vast amounts of capital to execute strategic restructuring, divest non-core assets, or undertake major R&D initiatives away from the quarterly pressures of the public markets. The value proposition here is strategic turnaround and financial engineering; the PE firm acts as a temporary owner and specialized management consultant, tasked with maximizing enterprise value over a defined holding period, typically 3 to 7 years. These buyers are sophisticated entities requiring bespoke financial solutions.

Beyond the portfolio companies, the institutional investors—Limited Partners (LPs)—are also critical "customers" in the ecosystem, although they are capital providers rather than capital receivers in the traditional sense. These LPs, including pension funds, sovereign wealth funds, university endowments, and family offices, "buy" the expertise and access to illiquid, high-return private assets offered by VC/PE GPs. Their decision-making is based on fund performance metrics (IRR, TVPI), thematic alignment (ESG, sector focus), and the perceived operational integrity of the GP, making them essential stakeholders whose preferences directly shape market strategy and fundraising success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Trillion |

| Market Forecast in 2033 | USD 10.3 Trillion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Carlyle Group, KKR & Co. Inc., Blackstone Inc., CVC Capital Partners, Apollo Global Management, Bain Capital, TPG Capital, Advent International, General Atlantic, Silver Lake Partners, Sequoia Capital, Andreessen Horowitz, New Enterprise Associates (NEA), Accel, Kleiner Perkins, Warburg Pincus, Vista Equity Partners, Hellman & Friedman, Permira, Goldman Sachs Asset Management. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Venture Capital & Private Equity Firms Market Key Technology Landscape

The technological landscape supporting the Venture Capital and Private Equity market is rapidly evolving, moving beyond basic data room platforms to sophisticated analytical and automation tools crucial for maintaining competitive advantage and managing increasingly complex regulatory demands. A key technology is the development and implementation of proprietary data aggregation and analysis platforms (often using cloud-native architectures) designed to ingest vast quantities of unstructured data—such as news articles, social media trends, competitor patent filings, and corporate financial statements—to generate predictive insights for deal sourcing and due diligence. These systems utilize advanced machine learning algorithms to identify pattern anomalies and forecast sector trajectories, allowing firms to pivot strategy faster than traditional, manual research methods permit.

Furthermore, technology plays a pivotal role in the operational phase of the investment lifecycle. Portfolio monitoring has been revolutionized by Software-as-a-Service (SaaS) platforms that offer real-time visualization of key performance indicators (KPIs) across a diverse portfolio, enabling GPs to benchmark performance and identify intervention points proactively. The integration of Robotic Process Automation (RPA) and AI-driven workflow tools in the back office streamlines compliance, regulatory filings, and quarterly reporting to LPs, significantly lowering administrative costs and reducing human error. This technological infrastructure is essential for fund managers navigating a globalized and highly regulated environment, ensuring transparency and efficiency in capital stewardship.

Blockchain technology, while still nascent in widespread adoption within the private markets, holds significant potential, particularly in fund administration and secondary market liquidity. Smart contracts can automate capital calls and distributions, reducing friction and counterparty risk. Additionally, tokenization of fund interests could fundamentally transform how LPs manage liquidity and transfer ownership stakes, moving towards a more liquid, yet still highly secure, trading environment. Cybersecurity tools remain paramount, as VC/PE firms manage extremely sensitive intellectual property and financial data, necessitating continuous investment in advanced threat detection and secure data storage solutions to protect both the firm and its portfolio assets from increasing digital threats.

Regional Highlights

The market dynamics of Venture Capital and Private Equity are strongly regionalized, reflecting varying legal frameworks, economic maturity levels, and sectorial strengths. North America, particularly the United States, remains the undisputed global leader, characterized by the deepest pool of institutional capital, the most mature exit environment (via NASDAQ and NYSE), and a robust ecosystem of technological innovation anchored around Silicon Valley, Boston, and New York. This region consistently sets global trends in fund structuring, technological adoption within firms (FinTech and PropTech), and the development of specialized investment strategies such as growth equity and complex structured debt solutions. The sheer volume of deals and the size of the average fund deployment differentiate North America from other regions.

Europe represents a highly fragmented yet rapidly consolidating market. The region’s strength lies in specific sectors such as industrial technology (Germany), life sciences (Switzerland/UK), and consumer brands (France). Regulatory standardization efforts, such as the Alternative Investment Fund Managers Directive (AIFMD) and increasingly stringent ESG requirements under the EU Taxonomy, are driving convergence and attracting cross-border capital, particularly from U.S. and Asian LPs seeking diversification. The UK remains a key hub despite Brexit, maintaining dominance in financial services and FinTech venture capital, while the Nordic countries lead in impact investing and sustainability-focused PE funds, demonstrating sectoral specialization.

The Asia Pacific (APAC) region is the engine of future growth, driven by China, India, and Southeast Asia. China dominates APAC VC activity, focusing heavily on consumer internet, artificial intelligence, and electric vehicles, though geopolitical tensions and domestic regulatory shifts (particularly concerning data security and overseas listings) introduce significant volatility. India is rapidly emerging, fueled by digital public infrastructure (like UPI and Aadhaar) and a burgeoning middle class, attracting significant global growth equity capital. Southeast Asia, leveraging younger demographics and rapid digital adoption, presents opportunities in fragmented markets like Indonesia and Vietnam. The region is characterized by a high volume of local partnerships and a strong focus on localization and scalability across diverse regulatory environments.

- North America (U.S., Canada): Dominates in deal volume and average fund size, specializing in large-scale tech buyouts, cutting-edge biotech, and software venture capital. Benefits from deep capital markets and favorable regulatory environments for innovation.

- Europe (UK, DACH, Nordics): High specialization in industrial tech, software, and robust ESG mandates. Growth is driven by consolidation and strong institutional interest in mid-market opportunities and green transition infrastructure.

- Asia Pacific (China, India, SEA): Fastest growing region; characterized by rapid digital transformation, large domestic consumer markets, and intensive government involvement in key strategic industries like AI and semiconductors.

- Latin America (Brazil, Mexico): Emerging markets with high volatility but significant upside potential in FinTech, logistics, and digital commerce, driven by underbanked populations and regional integration efforts.

- Middle East and Africa (MEA): Growth centered around sovereign wealth fund deployment into strategic national assets (energy, logistics) and high-potential VC hubs like the UAE and Israel, focusing on deep tech and cross-border innovation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Venture Capital & Private Equity Firms Market.- The Carlyle Group

- KKR & Co. Inc.

- Blackstone Inc.

- CVC Capital Partners

- Apollo Global Management

- Bain Capital

- TPG Capital

- Advent International

- General Atlantic

- Silver Lake Partners

- Sequoia Capital

- Andreessen Horowitz (a16z)

- New Enterprise Associates (NEA)

- Accel

- Kleiner Perkins

- Warburg Pincus

- Vista Equity Partners

- Hellman & Friedman

- Permira

- Goldman Sachs Asset Management

Frequently Asked Questions

Analyze common user questions about the Venture Capital & Private Equity Firms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Venture Capital (VC) and Private Equity (PE)?

The primary difference lies in the stage of company investment and control strategy. VC invests capital, typically in exchange for a minority stake, into early-stage, high-growth startups with high risk profiles but high return potential. PE invests in mature companies, often taking a controlling or majority stake, to implement operational and financial restructuring, aiming for value creation through operational leverage and efficiency improvements.

How is the market size of VC and PE firms measured, and what drives its growth?

Market size is typically measured by the total amount of Assets Under Management (AUM) or the total committed capital (dry powder) across active funds globally. Growth is driven by sustained inflows from institutional Limited Partners (LPs) seeking diversification and superior returns, the continuous emergence of disruptive technologies requiring specialized growth capital, and favorable macroeconomic conditions supporting leverage-based transactions.

What are the major exit strategies for private equity firms?

The three major exit strategies are strategic sales, Initial Public Offerings (IPOs), and secondary buyouts. Strategic sales involve selling the portfolio company to a larger corporate buyer, often yielding the highest premiums. IPOs involve listing the company on a public stock exchange. Secondary buyouts involve selling the company to another private equity firm, which is often utilized when market conditions are unfavorable for public listings or corporate M&A.

What impact does ESG (Environmental, Social, and Governance) have on modern VC/PE investment decisions?

ESG criteria have shifted from a compliance checklist to a core value creation lever. LPs are increasingly mandating ESG integration, and GPs recognize that strong ESG performance mitigates operational risk, enhances brand reputation, and improves long-term portfolio company valuations, leading to preferential capital allocation towards funds demonstrating superior sustainability credentials.

How is technology, specifically AI, disrupting traditional due diligence processes in private markets?

AI disrupts due diligence by automating data analysis and enhancing predictive modeling. Algorithms can rapidly analyze complex financial and market datasets, identify hidden risks or opportunities in deal flow, and provide real-time performance benchmarks for portfolio companies, drastically reducing the time required for comprehensive commercial and operational assessments compared to manual processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager