Versatile Microcentrifuge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438512 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Versatile Microcentrifuge Market Size

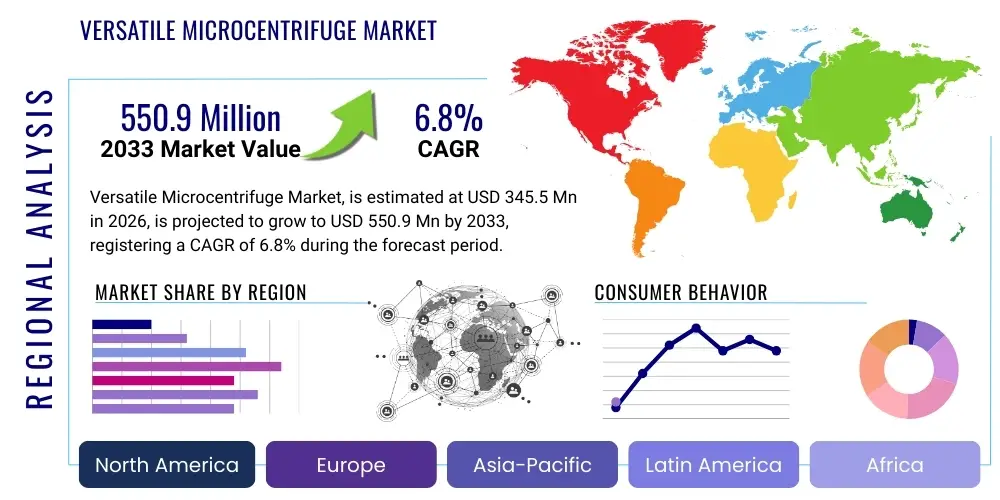

The Versatile Microcentrifuge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 345.5 Million in 2026 and is projected to reach USD 550.9 Million by the end of the forecast period in 2033.

Versatile Microcentrifuge Market introduction

Versatile Microcentrifuges are essential, high-speed laboratory instruments designed to separate components from small liquid samples, typically housed in 0.2 ml to 2.0 ml tubes, based on density. These instruments are characterized by their compact size, high rotational speeds (up to 25,000 x g), and crucial versatility, often featuring interchangeable rotors to accommodate various tube sizes, including PCR strips, standard microcentrifuge tubes, and specialized spin columns. Their core function is pivotal in sample preparation across molecular biology, biochemistry, clinical diagnostics, and pharmaceutical research, facilitating processes such as DNA/RNA precipitation, protein microfiltration, cell harvesting, and general sample pelleting. The robust demand is underpinned by the continuous expansion of life science research activities globally, particularly in precision medicine and personalized diagnostics, where high-throughput, reliable separation of minute samples is mandatory for successful experimentation and analysis.

The product description highlights key features such as refrigerated capabilities for temperature-sensitive samples, digital control interfaces for precise speed and time management, and ergonomic design elements crucial for high-volume lab work. Major applications span academic research labs, biotechnology companies, hospital pathology labs, and contract research organizations (CROs). The primary benefit these centrifuges offer is the efficient, rapid, and controlled separation of micro-volume biological components, minimizing sample degradation and maximizing yield. This capability is paramount in modern molecular diagnostics where sample scarcity is often a limiting factor, requiring instruments that guarantee optimal recovery from the smallest available volumes.

Key driving factors accelerating market growth include increasing global investment in genomics and proteomics research, the rising prevalence of infectious and chronic diseases demanding complex diagnostic tools, and technological advancements focusing on quieter operation and enhanced cooling systems. Furthermore, the push towards automated and integrated laboratory workflows necessitates reliable, network-compatible instrumentation. The versatile nature of these microcentrifuges, allowing them to perform multiple separation tasks with minimal footprint, positions them as indispensable tools in resource-constrained or multi-functional laboratory environments. Regulatory approvals for new advanced therapeutic modalities, such as cell and gene therapies, further stimulate the need for high-precision, low-volume sample handling equipment, thus solidifying the market's growth trajectory.

Versatile Microcentrifuge Market Executive Summary

The Versatile Microcentrifuge Market is exhibiting robust business trends, primarily driven by heightened R&D expenditures in both the private and public sectors aimed at accelerating drug discovery and diagnostic innovation. Key business trends include a strategic shift towards automated and smart laboratory equipment, integrating features such as IoT connectivity, remote monitoring, and pre-programmed separation protocols to enhance operational efficiency and data traceability. Manufacturers are focusing on developing models that offer superior temperature control capabilities and non-corrosive, durable materials to meet stringent quality requirements in clinical and pharmaceutical settings. Consolidation and strategic partnerships among equipment manufacturers and core life science technology providers are also defining the competitive landscape, aiming to offer integrated solutions encompassing sample preparation and downstream analysis.

Regional trends indicate North America and Europe maintaining dominance due to well-established biotechnology infrastructure, high adoption rates of advanced laboratory equipment, and significant governmental funding for biological research. However, the Asia Pacific (APAC) region, particularly China and India, is emerging as the fastest-growing market segment. This growth is fueled by increasing foreign direct investment in local pharmaceutical manufacturing, rapidly expanding academic research centers, and improvements in healthcare infrastructure. Governments in APAC are prioritizing biotech and life sciences, leading to substantial procurement of advanced laboratory instrumentation, creating significant untapped market potential for versatile microcentrifuges designed for high-volume clinical applications.

Segmentation trends reveal a strong preference for refrigerated microcentrifuges due to the increasing sensitivity of biological samples used in personalized medicine and RNA research. The end-user segment is dominated by Academic & Research Institutes, although Clinical & Diagnostic Laboratories are experiencing rapid growth driven by the rising demand for sophisticated in-vitro diagnostic (IVD) testing. In terms of speed, high-speed microcentrifuges capable of 15,000 RPM or greater are gaining prominence as research pushes the boundaries of effective component separation at the molecular level, requiring higher centrifugal force to isolate viral vectors, organelles, and minute protein complexes efficiently. The market structure is shifting towards digital models that provide comprehensive data logging and adherence to GLP/GMP standards, cementing the transition from basic benchtop tools to sophisticated analytical instruments.

AI Impact Analysis on Versatile Microcentrifuge Market

User inquiries regarding AI's influence on the Versatile Microcentrifuge Market frequently center on automation integration, predictive maintenance capabilities, and enhanced data management in high-throughput environments. Users are keen to understand how AI algorithms can optimize centrifuge protocols for novel or challenging sample matrices, ensuring maximal recovery and minimal sample shear. Concerns also revolve around the cost implications and technical complexity of integrating AI-enabled features into standard laboratory workflows. The overriding expectation is that AI will transform the microcentrifuge from a simple mechanical device into a smart component of an integrated laboratory automation system, enhancing reproducibility, automating compliance logging, and reducing operator error through intelligent protocol selection and real-time monitoring of machine health and performance metrics, moving beyond basic digital control to true predictive functionality.

- AI drives the development of intelligent sample loading and balancing systems, minimizing vibration and potential rotor damage.

- Predictive maintenance algorithms utilize operational data (speed, temperature logs, vibration patterns) to forecast potential equipment failure, maximizing uptime.

- Integration with Laboratory Information Management Systems (LIMS) is enhanced, allowing AI to automate data logging and protocol verification for regulatory compliance (GLP/GMP).

- AI optimizes separation protocols based on sample type and required purity, dynamically adjusting speed and run time to ensure optimal results.

- Automated error detection and resolution are facilitated by AI, including rapid identification of tube leaks or temperature excursions during runs.

DRO & Impact Forces Of Versatile Microcentrifuge Market

The Versatile Microcentrifuge Market is significantly influenced by a confluence of driving factors, restrictive challenges, and lucrative opportunities, forming dynamic impact forces that shape investment decisions and technological development. Primary drivers include the massive global funding directed toward biological and medical research, the expansion of pharmaceutical and biotechnology industries, and the increasing adoption of micro-volume assays which necessitate precise and specialized separation tools. Restraints, conversely, revolve around the high initial capital investment required for advanced, refrigerated, and high-speed models, particularly for smaller academic laboratories or emerging market institutions. The complexity of regulatory compliance and the need for specialized calibration and maintenance also present operational hurdles, potentially limiting widespread adoption of the most technologically advanced systems.

Opportunities for growth are abundant, notably stemming from the burgeoning field of personalized medicine, requiring highly specific and reliable separation of cellular components and biomarkers from minute patient samples. The ongoing miniaturization of diagnostic assays, moving towards point-of-care testing and microfluidics integration, creates demand for ultra-compact, portable microcentrifuges. Furthermore, technological innovation focused on achieving silent, high-efficiency operation, and the introduction of advanced safety features like bio-containment rotors, opens new avenues for market penetration in sensitive clinical and sterile environments. Addressing the current restraints through modular design, competitive pricing strategies, and comprehensive maintenance packages will be crucial for realizing these market opportunities.

The impact forces are categorized into demand-side push from increasing disease prevalence and supply-side innovation driven by engineering advancements. High competition among key players often leads to aggressive pricing and rapid feature iteration, benefiting end-users. Regulatory standards, particularly in North America and Europe concerning safety and operational data integrity, act as both a restraint (increasing manufacturing complexity) and a driver (requiring the purchase of newer, compliant equipment). The balance between affordability, functionality, and compliance dictates the pace of market expansion, placing significant pressure on manufacturers to deliver high-quality, cost-effective, and fully validated instruments that meet the rapidly evolving needs of molecular diagnostics and cutting-edge biological research globally.

Segmentation Analysis

The Versatile Microcentrifuge Market is segmented based on key functional, operational, and application characteristics, offering a granular view of market dynamics and end-user preferences. Key segmentation factors include product type (refrigerated vs. non-refrigerated), speed range (high-speed vs. low-speed), application (molecular biology, biochemistry, clinical diagnostics), and end-user (academic institutions, pharmaceutical companies, clinical labs). This structure allows market participants to tailor their offerings—such as optimizing cooling performance for protein stabilization or maximizing RCF for nucleic acid pelleting—to specific customer needs. The dominance of particular segments often reflects the intensity of research activity in corresponding fields, such as the growth in refrigerated units correlating directly with sensitive biological sample handling in drug discovery pipelines.

Understanding these segments is crucial for strategic planning. For instance, the high-speed segment, often defined as machines capable of exceeding 15,000 RPM, demonstrates resilience due to continuous demands from genomics and proteomics for highly purified pellets. Conversely, the non-refrigerated segment maintains significant market share in educational and general research laboratories where cost-effectiveness and routine sample preparation are primary requirements. Furthermore, regional regulatory environments greatly influence segmentation; strict safety standards in regulated markets often favor advanced models featuring aerosol-tight rotors and sophisticated locking mechanisms, categorized under specialized safety-focused segmentation.

- By Product Type:

- Refrigerated Microcentrifuges

- Non-Refrigerated Microcentrifuges

- By Speed Range:

- High-Speed Microcentrifuges (15,000 RPM and above)

- Low-Speed Microcentrifuges (Below 15,000 RPM)

- By Capacity:

- Standard Capacity (Up to 24 tubes)

- High Capacity (24+ tubes)

- By Application:

- Molecular Biology (DNA/RNA isolation, PCR setup)

- Biochemistry and Protein Purification

- Clinical Diagnostics and IVD Testing

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Industries

- By End-User:

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Clinical and Diagnostic Laboratories

- Contract Research Organizations (CROs)

Value Chain Analysis For Versatile Microcentrifuge Market

The Versatile Microcentrifuge Market value chain commences with upstream activities involving the sourcing and processing of raw materials, primarily high-grade polymers, specialized stainless steel alloys for rotors, and sophisticated electronic components such as brushless motors, cooling systems (for refrigerated units), and digital control boards. Key suppliers in the upstream segment focus on maintaining strict quality control and ensuring material compliance with relevant biological and chemical resistance standards. Critical upstream functions include motor manufacturing (precision bearings and quiet drive technology) and the production of highly engineered plastics necessary for robust yet lightweight rotor designs and machine casings. Innovations at this stage often focus on improving durability and minimizing noise and vibration, which are crucial performance metrics for end-users.

The midstream process involves equipment manufacturing, assembly, and rigorous testing. Leading manufacturers integrate these components, focusing heavily on R&D to introduce features like enhanced user interfaces, advanced cooling algorithms, and safety mechanisms (e.g., automatic lid locks and imbalance detection). Product differentiation at this stage is achieved through proprietary rotor designs (swing-out vs. fixed angle), superior temperature accuracy, and connectivity features (IoT integration). Strict adherence to ISO 9001 and specific medical device standards (e.g., CE marking, FDA registration) is paramount before distribution. The manufacturing excellence in this sector hinges on optimizing mass production while maintaining the precision required for high-speed centrifugation.

The downstream segment encompasses distribution, sales, and post-sale services. Distribution channels are typically bifurcated into direct sales teams, targeting large pharmaceutical companies and government research institutes, and indirect distribution through specialized scientific equipment distributors, who handle logistics, local market penetration, and inventory management for smaller labs and academic clients. Post-sale services, including installation, calibration, preventative maintenance contracts, and repair, are critical differentiators, ensuring prolonged equipment lifespan and minimizing lab downtime. The efficiency of the distribution network, coupled with responsive technical support, significantly impacts the perceived value and total cost of ownership for the end-user. Direct channels often prioritize customization and direct feedback loops, while indirect channels focus on broad accessibility and rapid delivery.

Versatile Microcentrifuge Market Potential Customers

The potential customer base for Versatile Microcentrifuges is broad and deeply embedded within the global life sciences and healthcare ecosystem, encompassing any organization involved in the manipulation and analysis of micro-volume biological fluids. The primary buyers include academic research institutions, which utilize these tools extensively for basic science discovery, student training, and grant-funded projects across departments like biochemistry, genetics, and molecular biology. These customers often prioritize durability, ease of use, and competitive pricing, typically purchasing non-refrigerated and standard-capacity models for routine applications suching as plasmid preparation and DNA cleanup.

A second major segment comprises Pharmaceutical and Biotechnology Companies, including large multinational drug developers and smaller biotech startups. These end-users demand high-precision, refrigerated, and high-speed centrifuges essential for crucial stages of drug discovery, vaccine development, quality control (QC) testing, and bioprocessing research. Their buying criteria emphasize adherence to GLP/GMP standards, robust data logging capabilities, and superior temperature stability to protect high-value, temperature-sensitive therapeutic molecules and biological reagents. Automation compatibility and integration with larger laboratory robotic systems are also key requirements for these high-throughput environments.

Finally, Clinical and Diagnostic Laboratories, including hospital labs and independent testing facilities, represent a rapidly expanding customer group. These users rely on versatile microcentrifuges for essential clinical sample processing, such as blood fractionation, urine analysis preparation, and specialized molecular diagnostics (e.g., infectious disease testing and cancer biomarker analysis). For this segment, regulatory compliance, speed of throughput, reliability, and guaranteed bio-containment are paramount, ensuring patient safety and diagnostic accuracy. Contract Research Organizations (CROs) and government public health labs also constitute significant purchasers, often requiring flexible equipment portfolios to handle diverse project requirements across multiple therapeutic areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.5 Million |

| Market Forecast in 2033 | USD 550.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eppendorf AG, Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter), Labconco Corporation, Hettich Instruments, Benchmark Scientific Inc., Becton, Dickinson and Company, Sigma Laborzentrifugen GmbH, Hitachi Koki Co., Ltd. (now Koki Holdings), Sartorius AG, NuAire Inc., Hermle Labortechnik GmbH, LW Scientific, Avantor Inc., Scilogex, Ltd., MRC Lab, Kubota Corporation, Bio-Rad Laboratories, KNF Neuberger, NIPPON Genetics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Versatile Microcentrifuge Market Key Technology Landscape

The Versatile Microcentrifuge Market is continually evolving through the incorporation of advanced engineering and digital technologies aimed at enhancing performance, safety, and operational efficiency. A core technological advancement is the widespread adoption of Brushless Direct Current (BLDC) motors, replacing traditional brushed motors. BLDC motors offer significant advantages, including extended lifespan, reduced noise and vibration, and high energy efficiency. This technology enables microcentrifuges to reach extremely high Relative Centrifugal Force (RCF) values with superior precision and temperature stability, which is essential for sensitive applications like viral vector purification and organelle separation. Furthermore, the integration of advanced sensors for real-time imbalance detection and automatic rotor identification minimizes operational risks and user error, complying with rigorous safety protocols.

Another pivotal area of innovation lies in thermal management and interface technology. Refrigerated microcentrifuges now feature optimized cooling systems utilizing non-CFC refrigerants and highly efficient heat exchangers to maintain precise temperatures (down to -10C or lower) even during high-speed runs, preventing degradation of labile biological samples such as RNA and certain proteins. Simultaneously, user interfaces have transitioned from simple mechanical dials to sophisticated, high-resolution touchscreens. These digital interfaces offer intuitive programming, multi-step protocol storage, and on-screen diagnostics, significantly improving workflow and reproducibility. These systems often include password protection and audit trail capabilities, crucial for laboratories operating under GLP/GMP regulations.

The convergence of connectivity technologies, specifically IoT and cloud-based data management, is shaping the future landscape. Modern versatile microcentrifuges are increasingly equipped with Wi-Fi or Ethernet capabilities, allowing for remote monitoring of run status, automated data transfer to LIMS, and firmware updates. This network integration facilitates centralized management of multiple instruments across a facility and streamlines documentation for compliance purposes. Future technology trends will focus heavily on further automation, including robotic loading/unloading compatibility and the use of specialized composite materials for lighter, yet stronger, bio-containment rotors, further enhancing both speed and user safety in demanding research and clinical environments.

Regional Highlights

- North America (United States, Canada): Dominant market share due to unparalleled spending on biomedical R&D, robust presence of major pharmaceutical and biotechnology companies, and the early adoption of advanced laboratory automation technologies. High demand for refrigerated, high-throughput microcentrifuges driven by cutting-edge genomics and precision medicine research. Stringent regulatory standards (FDA) necessitate the use of validated, high-quality instrumentation, favoring established market leaders.

- Europe (Germany, UK, France): Major contributor, characterized by strong governmental support for academic research and a powerful medical device manufacturing cluster. Germany, in particular, leads in manufacturing innovation and application of precision engineering in laboratory equipment. Focus on environmental sustainability drives demand for energy-efficient cooling systems and instruments designed for low noise output.

- Asia Pacific (APAC) (China, Japan, India): Fastest-growing region, fueled by expanding healthcare infrastructure, increasing government investment in local biotech sectors, and the rapid growth of Contract Manufacturing and Research Organizations (CMOs/CROs). China and India are critical growth engines, with increasing demand for both cost-effective general-purpose units and sophisticated high-end models for advanced research centers. Market growth is heavily influenced by expanding patient populations and rising demand for complex diagnostic testing.

- Latin America (Brazil, Mexico): Emerging market segment showing steady growth, primarily driven by investments in public health programs and increasing establishment of clinical diagnostic labs. Growth is often constrained by budget limitations, leading to higher demand for reliable, mid-range, and standard non-refrigerated models. International partnerships and infrastructure development are key growth drivers.

- Middle East and Africa (MEA): Smallest but developing market, characterized by concentrated demand in wealthy Gulf Cooperation Council (GCC) countries investing heavily in developing advanced medical cities and biotech hubs. Demand focuses on high-quality equipment for specialized clinical testing and infectious disease research. Market penetration relies heavily on effective local distribution and technical support networks due to logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Versatile Microcentrifuge Market.- Eppendorf AG

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Beckman Coulter)

- Hettich Instruments

- Benchmark Scientific Inc.

- Becton, Dickinson and Company (BD)

- Sigma Laborzentrifugen GmbH

- Hitachi Koki Co., Ltd. (now Koki Holdings)

- Sartorius AG

- NuAire Inc.

- Hermle Labortechnik GmbH

- LW Scientific

- Avantor Inc.

- Scilogex, Ltd.

- MRC Lab

- Kubota Corporation

- Bio-Rad Laboratories

- KNF Neuberger

- NIPPON Genetics Co., Ltd.

- Cole-Parmer Instrument Company

Frequently Asked Questions

Analyze common user questions about the Versatile Microcentrifuge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between RCF and RPM, and why is RCF more critical for Versatile Microcentrifuges?

Relative Centrifugal Force (RCF) measures the gravitational force exerted on the sample, which directly dictates separation efficiency and is measured in 'g'. Revolutions Per Minute (RPM) is merely the rotational speed of the rotor. RCF is critical because it accounts for the rotor radius, ensuring reproducible separation protocols regardless of the centrifuge model or rotor size used, making it the industry standard metric for protocol validation.

Which end-user segment drives the highest demand for refrigerated microcentrifuges?

The Pharmaceutical and Biotechnology Companies segment, along with specialized academic research focusing on proteomics and RNA biology, drives the highest demand for refrigerated microcentrifuges. Refrigeration is essential for maintaining sample integrity, particularly high-value, temperature-sensitive proteins, enzymes, and nucleic acids used in drug discovery and therapeutic development pipelines.

How is the market addressing the need for silent operation and reduced vibration?

Manufacturers are addressing this through the widespread integration of advanced Brushless Direct Current (BLDC) motors and sophisticated dynamic imbalance detection systems. BLDC technology inherently reduces mechanical friction and noise, while enhanced structural damping materials and precise rotor balancing techniques minimize vibration, crucial for maintaining sample integrity and improving the laboratory work environment.

What role does digitalization play in the modernization of versatile microcentrifuges?

Digitalization enables advanced control via touchscreen interfaces, allowing for complex protocol storage, run monitoring, and data logging for audit trails. Furthermore, modern microcentrifuges integrate IoT connectivity, facilitating remote diagnostics, automated data transfer to LIMS, and ensuring compliance with strict regulatory standards (GLP/GMP) through enhanced data traceability and documentation.

What is the primary growth opportunity for microcentrifuge vendors in the Asia Pacific region?

The primary growth opportunity in the Asia Pacific region stems from the rapid expansion of domestic pharmaceutical manufacturing, increasing government investment in public health infrastructure, and the establishment of numerous new academic research centers. This necessitates high-volume procurement of reliable laboratory equipment to support increasing research output and diagnostic testing capabilities across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager