Vertical Precision Contour Projector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438362 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Vertical Precision Contour Projector Market Size

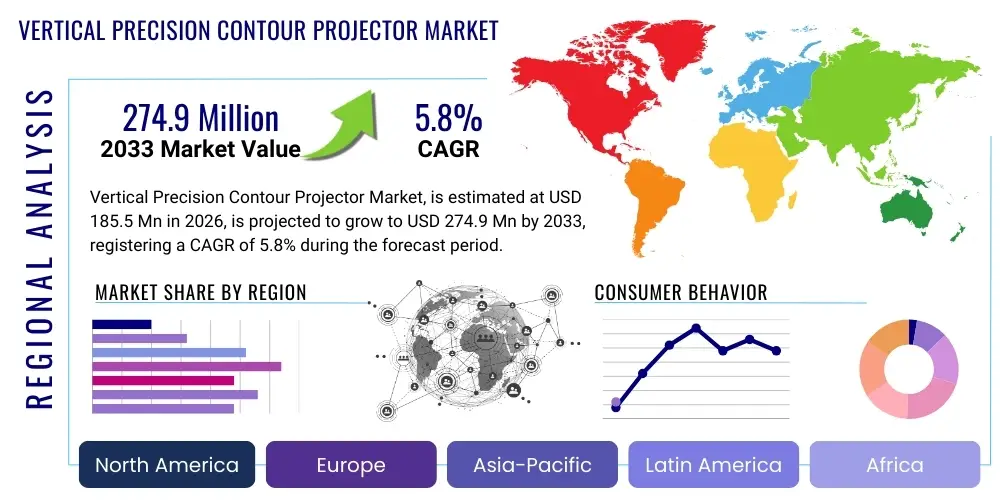

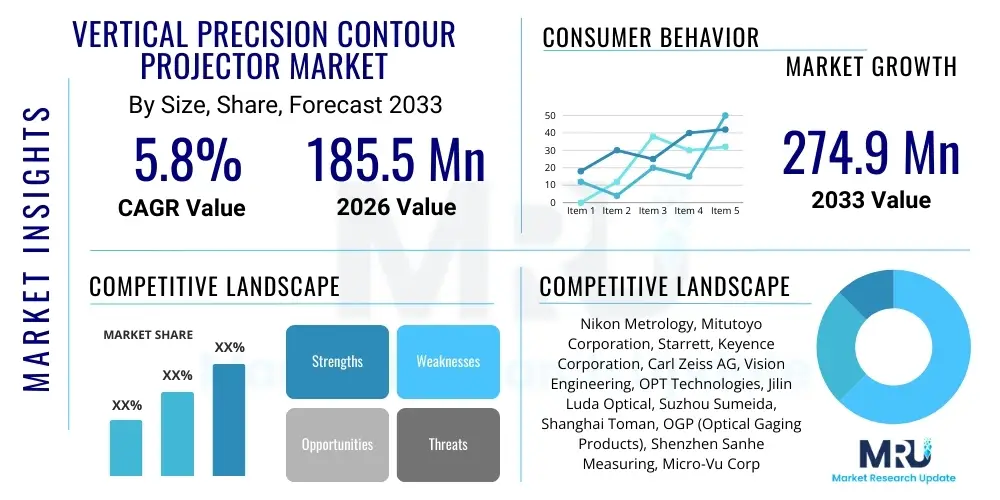

The Vertical Precision Contour Projector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $185.5 Million USD in 2026 and is projected to reach $274.9 Million USD by the end of the forecast period in 2033.

Vertical Precision Contour Projector Market introduction

The Vertical Precision Contour Projector Market encompasses specialized optical instruments, often referred to as profile projectors or optical comparators, used primarily for non-contact measurement and inspection in quality control environments. These systems magnify and project the profile of a manufactured part onto a screen, enabling operators to measure precise dimensions, angles, and shapes against tolerance specifications or overlay templates. The vertical configuration is specifically designed for inspecting flat, thin, or small components, where the part is placed horizontally on the stage, and the projection light path travels vertically, offering stability and ease of fixturing for specific applications.

Major applications for vertical contour projectors span highly demanding sectors, including aerospace, automotive component manufacturing, medical device production, and precision tool and die making. Their essential benefit lies in providing rapid, high-accuracy, two-dimensional dimensional confirmation, which is crucial for maintaining tight manufacturing tolerances required by modern engineering standards. They are often utilized for batch inspection and for analyzing complex contours that might be difficult to measure using traditional contact methods or handheld gauges. The increasing complexity and miniaturization of manufactured parts necessitate the use of these highly precise optical instruments, further driving market demand.

The primary driving factors for this market expansion include the global shift toward Industry 4.0, which emphasizes stringent quality assurance (QA) protocols and data traceability in production lines. Furthermore, rising regulatory requirements across industries such as healthcare and defense mandate rigorous documentation of quality parameters, making contour projectors, especially those equipped with digital readouts (DROs) and advanced software, indispensable tools. The continuous development of LED illumination technology and high-resolution digital imaging integrated into these projectors enhances their accuracy and utility, securing their relevance despite competition from more advanced coordinate measuring machines (CMMs) and pure vision systems.

Vertical Precision Contour Projector Market Executive Summary

The Vertical Precision Contour Projector Market is experiencing stable growth, underpinned by consistent investment in manufacturing infrastructure across Asia Pacific and the increasing demand for high-precision components globally. Business trends indicate a strong move toward automating the inspection process, replacing manual operation with advanced digital features, automated stage movements, and sophisticated software for edge detection and data processing. Key manufacturers are focusing on integrating smart features, connectivity (IoT), and user-friendly interfaces to reduce operator dependency and increase throughput efficiency, making these projectors suitable for inline quality checks rather than just laboratory use.

Regional trends highlight the Asia Pacific region, particularly China, Japan, and South Korea, as the dominant force in both consumption and manufacturing of contour projectors. This dominance is attributed to the presence of large electronics, automotive, and general manufacturing ecosystems that require constant dimensional verification. North America and Europe remain mature markets, characterized by replacement cycles and high demand for premium, highly automated models necessary for aerospace and specialized medical applications, emphasizing performance and software integration over raw volume. Growth in these established regions is driven primarily by technological upgrades rather than greenfield installations.

Segment trends reveal a pronounced shift from manual contour projectors to highly automated digital contour projectors (DCPs) equipped with powerful measurement software and Computer Numerical Control (CNC) controlled stages. The digital segment, which includes integrated video and optical capabilities, is forecast to capture the largest share due to its enhanced accuracy, reduced measurement time, and ability to easily interface with Statistical Process Control (SPC) systems. End-user segments, such as automotive and precision machining, show consistent demand, while the aerospace and defense sectors represent high-value opportunities due to extremely tight tolerance requirements and stringent compliance standards.

AI Impact Analysis on Vertical Precision Contour Projector Market

User queries regarding the impact of Artificial Intelligence on contour projectors frequently revolve around how AI can enhance measurement speed, automate complex decision-making processes, and improve the reliability of edge detection in challenging material surfaces. Key themes include the feasibility of integrating Machine Learning (ML) for predictive calibration needs, reducing false rejects caused by subjective operator interpretation, and transforming projectors from simple measuring tools into smart, self-diagnosing inspection stations. Users are primarily concerned with whether AI integration will significantly lower the total cost of ownership by minimizing downtime and accelerating the learning curve for new operators, while also enabling the analysis of large datasets generated during high-volume inspection runs.

AI's influence is transforming the market by improving the core function of image analysis. Traditional contour projectors rely on fixed algorithms for edge detection; however, ML algorithms can be trained on vast libraries of images, allowing the system to accurately identify edges and features on difficult components (e.g., highly reflective, translucent, or parts with poorly defined radii) with significantly higher repeatability than conventional methods. This capability reduces the dependency on ideal illumination and fixturing conditions, thereby broadening the practical application range of these instruments in real-world factory settings. Furthermore, AI can interpret deviations and immediately suggest corrective actions or classify defects based on predefined severity levels, moving beyond simple pass/fail metrics.

The integration of AI also significantly impacts maintenance and operational efficiency. Predictive maintenance algorithms, powered by ML, monitor system performance metrics such as illumination decay, stage movement precision, and sensor drift, alerting maintenance personnel to potential failures before they occur. This proactive approach minimizes unexpected downtime, which is critical in high-throughput manufacturing environments. Moreover, AI can be utilized in operator training simulations and quality control feedback loops, analyzing operator interaction patterns to optimize workflow and reduce human errors associated with manual measurement setup and data entry, thereby enhancing the overall productivity of the quality assurance department.

- Enhanced automatic feature recognition (AFR) and robust edge detection through machine learning, especially on complex or low-contrast surfaces.

- Implementation of predictive maintenance protocols for critical optical and mechanical components, maximizing uptime and reducing unscheduled servicing.

- Automated defect classification and real-time anomaly detection, improving inspection speed and reducing reliance on subjective operator judgment.

- Integration with factory IoT networks for centralized data processing, utilizing AI for advanced statistical process control (SPC) and trend analysis across production batches.

- Development of self-calibrating systems that use AI algorithms to compensate for minor environmental variations (temperature, vibration) impacting measurement accuracy.

DRO & Impact Forces Of Vertical Precision Contour Projector Market

The Vertical Precision Contour Projector Market is propelled by robust drivers centered on global manufacturing shifts toward high-precision output, while simultaneously facing significant restraints due to technological substitution and high capital investment costs. Opportunities exist primarily in the realm of automation and software integration, allowing these devices to compete effectively with newer measurement technologies. These factors collectively exert powerful impact forces on market dynamics, compelling manufacturers to innovate constantly in terms of speed, resolution, and connectivity to justify the instruments' continued deployment in modern manufacturing facilities. The need for quality assurance in safety-critical industries remains the fundamental, non-negotiable driver.

Key drivers include the rigorous quality standards enforced across the automotive, aerospace, and medical device sectors, which necessitate frequent and traceable dimensional inspection of complex components. The rising adoption of micro-manufacturing and precision engineering, particularly in Asia, pushes demand for non-contact measurement solutions that can handle increasingly small and intricate part geometries. However, market growth is significantly restrained by the high initial capital cost of advanced digital contour projectors (DCPs) and the increasing competitive threat posed by highly versatile Coordinate Measuring Machines (CMMs) and dedicated industrial vision systems, which often offer 3D measurement capabilities, an area where traditional contour projectors lack inherent strengths.

Opportunities for growth are concentrated in the development of highly automated systems that minimize operator interaction and maximize data throughput. Integrating contour projectors with advanced measurement software, CAD systems, and factory management platforms provides a crucial opportunity to enhance efficiency and data utility. The primary impact force on this market is technological substitution, where end-users are constantly evaluating whether to invest in a contour projector or a competitive, often more flexible, 3D measurement solution. Manufacturers who can leverage AI and enhanced connectivity to maintain measurement integrity while dramatically increasing speed and ease of use will dictate the future trajectory of the vertical contour projector segment, especially within retrofit and upgrade markets.

Segmentation Analysis

The Vertical Precision Contour Projector Market is segmented primarily based on technology, measurement type, magnification capability, and end-use industry. Understanding these segments is crucial for manufacturers tailoring their product offerings and for end-users determining the most suitable instrument for their specific quality control needs. Technology segmentation differentiates between older, manual systems utilizing conventional optical components and modern systems incorporating advanced Digital Readouts (DROs), high-resolution CMOS/CCD cameras, and sophisticated measurement software, which account for the majority of new market investments.

Measurement type segmentation focuses on the degree of automation, ranging from purely manual projectors requiring operators to physically position the stage and align measuring scales, to fully automated CNC-controlled systems. The automated segment is experiencing the fastest growth globally due to its reduced reliance on specialized labor, high repeatability, and seamless integration capabilities with automated production lines. Furthermore, industry segmentation remains critical, with specialized models often required for the unique material characteristics and tolerance requirements of sectors like watchmaking, microelectronics, and orthopedic implants, where absolute precision is paramount.

- Technology Type

- Digital Contour Projectors (DCP)

- Non-Digital (Manual) Contour Projectors

- Screen Size

- Small Screen (Up to 14 inches)

- Medium Screen (14 to 20 inches)

- Large Screen (Above 20 inches)

- End-Use Industry

- Automotive

- Aerospace and Defense

- Electronics and Semiconductors

- Medical Devices (Orthopedics, Implants)

- Precision Manufacturing and Job Shops

- Measurement Axis

- 2-Axis Systems (XY Measurement)

- 3-Axis Systems (Incorporating Z-axis focusing or measurement capabilities)

Value Chain Analysis For Vertical Precision Contour Projector Market

The value chain for Vertical Precision Contour Projectors starts with upstream suppliers providing highly specialized components essential for projection accuracy and digital capture. This upstream segment is characterized by reliance on high-quality optical glass and lenses, precision linear scales and encoders, high-resolution digital sensors (CCD/CMOS), and advanced LED illumination modules. The precision required for these components means that a few specialized global suppliers often dominate this crucial stage. Effective management of this supply chain is critical, as the quality of the final measurement output directly depends on the integrity of these foundational materials and components.

Core manufacturing involves the complex assembly and calibration of the optical system, mechanical stage, and electronic controls. Leading OEMs invest heavily in research and development to improve lens quality, light efficiency, and the accuracy of the stage movement mechanisms, focusing on minimizing geometric errors inherent in optical projection. Distribution channels are varied but highly specialized. Due to the technical nature of the product, both direct sales by the manufacturer's specialized sales engineering teams and indirect sales through highly trained local distributors and value-added resellers (VARs) are common. Distributors play a crucial role in providing local support, installation, calibration, and essential after-sales service, given the frequent requirement for precision adjustment.

Downstream analysis focuses on the end-users—the manufacturers, quality control laboratories, and research institutions that utilize these instruments. The choice of distribution strategy often depends on the market maturity; mature markets in North America and Europe rely heavily on long-standing specialized distributors, while emerging markets in Asia may see more direct investment by manufacturers to establish market share quickly. Crucially, the post-sale value chain includes mandatory software updates, annual calibration and maintenance contracts, and training services, which often represent a significant and recurring revenue stream for the OEMs and their partners, solidifying customer relationships over the long lifespan of the equipment.

Vertical Precision Contour Projector Market Potential Customers

Potential customers for Vertical Precision Contour Projectors are concentrated within industries where dimensional accuracy, repeatability, and non-contact inspection are mandatory elements of the production process. The primary buyers are quality control managers, metrology lab technicians, and manufacturing engineers who require robust systems for verifying thousands of parts daily against tight tolerance specifications. These instruments are purchased as essential capital equipment for final inspection, incoming material verification, and in-process monitoring, particularly for components that are fragile, prone to distortion under contact measurement, or have intricate 2D profiles.

The largest end-user segments include Tier 1 and Tier 2 automotive suppliers specializing in small engine parts, gears, connectors, and stamped metal components, where high-volume, rapid inspection is necessary. Similarly, the aerospace and defense sectors, which manufacture complex turbine blades, fasteners, and highly specialized structural components, are high-value customers due to their uncompromising requirement for verifiable precision and stringent regulatory compliance standards. In these high-stakes environments, the ability of the vertical projector to reliably measure internal and external profiles against CAD overlays is invaluable.

Furthermore, the medical device industry represents a rapidly expanding customer base, particularly manufacturers of orthopedic implants, surgical tools, and micro-electronic components used in diagnostic equipment. Given the critical nature of these products, regulatory bodies demand absolute adherence to specifications, making non-contact optical inspection a preferred method. Tool and die shops, precision machine shops (job shops), and plastics injection molders also form a significant customer segment, using contour projectors for first-article inspection (FAI) and to check the accuracy of tooling before high-volume production begins, ensuring molds and dies are within specified parameters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million USD |

| Market Forecast in 2033 | $274.9 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nikon Metrology, Mitutoyo Corporation, Starrett, Keyence Corporation, Carl Zeiss AG, Vision Engineering, OPT Technologies, Jilin Luda Optical, Suzhou Sumeida, Shanghai Toman, OGP (Optical Gaging Products), Shenzhen Sanhe Measuring, Micro-Vu Corporation, Tokyo Seimitsu Co. Ltd. (ACCRETECH), Tesa SA (Hexagon Metrology), Gagemaker Inc., Deltronic Corporation, Trimos S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vertical Precision Contour Projector Market Key Technology Landscape

The technological landscape of the Vertical Precision Contour Projector Market is defined by the migration from purely optical, analog systems toward advanced digital integration, significantly enhancing both accuracy and operational throughput. Modern projectors leverage high-intensity, long-life LED illumination systems, replacing older, heat-generating halogen lamps. LED lighting offers superior color temperature stability, crucial for consistent edge detection, and drastically reduces maintenance requirements. Furthermore, sophisticated telecentric optics are increasingly utilized to ensure that the magnification remains constant regardless of the object's distance from the lens, thereby eliminating parallax error, a major limitation of older optical systems and enhancing measurement integrity across the entire projected image.

Digital Readouts (DROs) are now standard, replacing manual micrometer heads and reducing operator fatigue and transcription errors. The true technological leap, however, comes from integrating high-resolution digital cameras (CCD or CMOS sensors) that capture the projected image instantaneously. This digital image is processed by powerful measurement software, which employs complex algorithms for automated edge detection, eliminating subjective human interpretation of the profile boundary. These software platforms facilitate geometric dimensioning and tolerancing (GD&T) analysis, allowing operators to compare the measured profile directly against imported CAD files, streamlining the entire inspection workflow and generating verifiable data logs.

Another crucial technological development is the implementation of fully automated, CNC-controlled stages. These stages allow for pre-programmed measurement routines, making the inspection process highly repeatable and suitable for high-volume automated quality control. Advanced vertical projectors often include integrated Z-axis focusing or measurement capabilities, transforming the instrument into a quasi-3D measurement system for specific tasks, such as measuring step height or focusing on different planes. Connectivity is also key, with new models featuring Ethernet and Wi-Fi capabilities, enabling seamless integration into factory management systems (MES) and centralized data storage for quality traceability and SPC analysis, aligning with the principles of the Industrial Internet of Things (IIoT).

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Vertical Precision Contour Projector Market, driven by its expansive and rapidly growing manufacturing base across electronics, automotive parts, and consumer goods. Countries like China, Japan, South Korea, and India are major hubs for precision engineering, necessitating continuous investment in high-accuracy quality control equipment. The region is characterized by high volume manufacturing, leading to strong demand for automated, high-throughput digital projectors that can handle rapid inspection cycles.

- North America: North America represents a mature, high-value market, focusing heavily on technology upgrades and advanced functionality, particularly within the aerospace, defense, and specialized medical device manufacturing sectors. Demand here is characterized by the need for projectors capable of handling extremely tight tolerances and providing detailed regulatory documentation, favoring suppliers who offer advanced software integration, AI capabilities, and superior metrological traceability.

- Europe: Europe, particularly Germany, Switzerland, and Italy, maintains a strong focus on high-precision engineering, tools, and luxury goods manufacturing. The market is stable, driven by replacement cycles and the need for high-quality instruments compliant with strict European manufacturing standards. There is a notable preference for versatile systems that support both R&D applications and production line quality checks, emphasizing German and Japanese manufacturers known for optical excellence and long lifespan.

- Latin America (LATAM): The LATAM market is emerging, with growth driven by foreign direct investment in automotive assembly and regional industrial expansion, particularly in Brazil and Mexico. The market often seeks cost-effective solutions and reliable mid-range digital projectors. Growth is somewhat constrained by economic instability, but increasing localization of manufacturing processes presents long-term opportunities for market penetration.

- Middle East and Africa (MEA): MEA is the smallest regional market, primarily focused on oil and gas equipment manufacturing, defense, and localized assembly operations. Demand is concentrated in technologically advanced Gulf Cooperation Council (GCC) countries. The market requires robust, reliable equipment, often sourced through international distributors, prioritizing durability and comprehensive service contracts due to geographical distances from main manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vertical Precision Contour Projector Market.- Nikon Metrology

- Mitutoyo Corporation

- Starrett

- Keyence Corporation

- Carl Zeiss AG

- Vision Engineering

- OGP (Optical Gaging Products)

- Micro-Vu Corporation

- Hexagon Manufacturing Intelligence (Tesa SA)

- Tokyo Seimitsu Co. Ltd. (ACCRETECH)

- Deltronic Corporation

- OPT Technologies

- Jilin Luda Optical

- Suzhou Sumeida

- Shanghai Toman

- Shenzhen Sanhe Measuring

- Gagemaker Inc.

- Trimos S.A.

Frequently Asked Questions

Analyze common user questions about the Vertical Precision Contour Projector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Vertical Precision Contour Projector over a Horizontal system?

Vertical contour projectors are generally preferred for inspecting small, thin, or delicate parts that require horizontal placement on the measuring stage. The vertical light path simplifies fixturing, improves stability, and is often better suited for objects like stamped components, gaskets, or micro-electronic parts, preventing slippage or distortion during measurement.

How is AI improving the measurement accuracy of contour projectors?

AI significantly improves accuracy by utilizing machine learning algorithms for automated edge detection (AFR). This minimizes measurement variability caused by surface imperfections, differing material reflectivity, or operator subjectivity, leading to faster, more repeatable measurements, especially when dealing with complex or low-contrast profiles.

What is the difference between a Digital Contour Projector (DCP) and an Optical Comparator?

While both are optical comparators, a DCP is a modern version incorporating high-resolution digital cameras, advanced measurement software, and integrated DROs. A traditional optical comparator relies solely on visual inspection against a graticule or template, whereas the DCP offers computerized data logging, automated feature recognition, and CAD integration for enhanced efficiency and traceability.

Which industries are the major buyers driving the demand for high-end contour projectors?

The major demand drivers are high-precision sectors such as aerospace and defense, medical devices (implants and surgical tools), and high-reliability automotive components. These industries require stringent quality control, verifiable data, and non-contact inspection of extremely complex and tight-tolerance parts, justifying investment in premium, automated systems.

What are the main competitive technologies challenging the Vertical Precision Contour Projector Market?

The primary competitive threats are Coordinate Measuring Machines (CMMs), which offer superior 3D measurement capabilities, and dedicated 3D industrial vision systems (non-contact), which are becoming faster and more affordable. Contour projectors maintain relevance by offering superior 2D profile measurement speed, ease of use, and visual inspection capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager