Vertical Roller Mill Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433673 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vertical Roller Mill Market Size

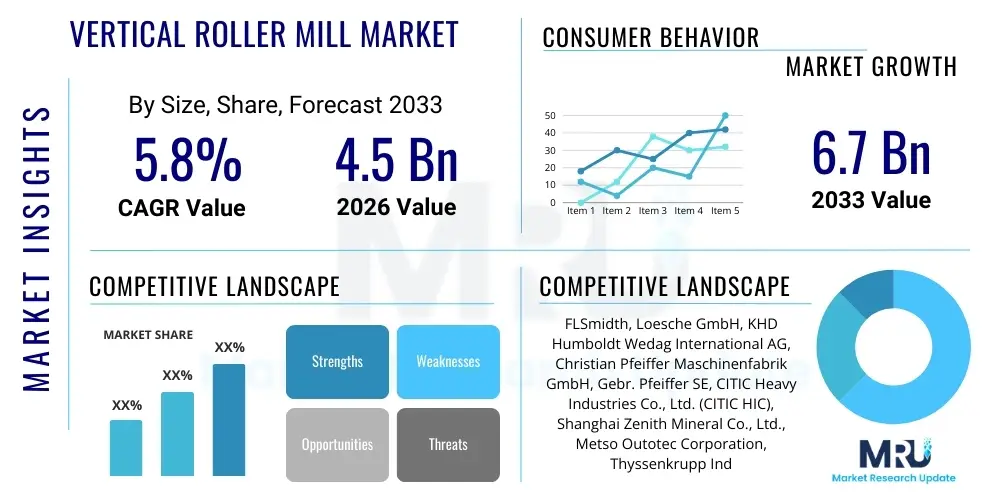

The Vertical Roller Mill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by sustained global investment in infrastructure development, particularly across emerging economies in Asia Pacific and Africa, where demand for cement and processed minerals remains exceptionally high. The inherent efficiency and lower energy consumption of vertical roller mills (VRMs) compared to traditional ball mills positions them as the preferred grinding solution for large-scale production facilities seeking to comply with stringent environmental regulations and reduce operational expenditure. Furthermore, the expanding use of VRMs beyond traditional cement grinding into sectors such as slag, coal, and industrial minerals contributes significantly to the market expansion, ensuring steady revenue acceleration over the forecast horizon.

Vertical Roller Mill Market introduction

The Vertical Roller Mill (VRM) is a sophisticated grinding machine utilized extensively across heavy industries for pulverizing raw materials into fine powders. VRMs operate on the principle of attrition and compression, using large rollers that grind material spread on a rotating table. This technology is critical in sectors like cement manufacturing, where it is used for grinding clinker, raw meal, and blast furnace slag; in the power generation industry for coal pulverization; and in the mining sector for processing various ores and industrial minerals. The structural design of VRMs allows for simultaneous grinding, drying, and classification of materials within a single unit, leading to high operational efficiency and superior product fineness control, making them indispensable components in modern high-capacity material processing plants.

The primary benefits associated with adopting VRMs include significantly lower energy consumption—often 30% to 50% less than ball mills for similar outputs—and substantially reduced maintenance requirements due to fewer moving parts and easier access for repairs. They also possess the capability to handle materials with high moisture content efficiently, a crucial feature for processing raw materials like limestone and coal. Key driving factors underpinning market growth include rapid urbanization and subsequent infrastructure projects worldwide, the focus on utilizing industrial byproducts like slag for sustainable construction, and the global push toward enhanced energy efficiency in industrial manufacturing processes. These technological and economic advantages solidify the VRM's position as the leading grinding solution.

Vertical Roller Mill Market Executive Summary

The Vertical Roller Mill market demonstrates robust business trends characterized by a shift towards ultra-fine grinding capabilities and the integration of advanced automation systems to maximize throughput and minimize specific power consumption. Manufacturers are increasingly focusing on developing hybrid VRM designs capable of processing multiple material types and offering modular solutions that facilitate easier installation and faster commissioning. Regionally, the Asia Pacific continues to dominate the market, propelled by massive governmental investments in housing, transportation, and industrial infrastructure, particularly in China, India, and Southeast Asian nations. These countries serve as the primary global manufacturing hubs for cement and steel, driving substantial demand for high-capacity grinding machinery. Simultaneously, North America and Europe show steady growth, primarily driven by the modernization of existing plant infrastructure and strict environmental mandates promoting the use of energy-efficient grinding solutions.

Segment trends reveal that the cement industry application remains the largest segment by revenue, although the usage in coal grinding and slag processing is expanding rapidly due to rising environmental pressures favoring pulverized coal injection (PCI) and the utilization of ground granulated blast furnace slag (GGBS) as a supplementary cementitious material. By product type, the market is favoring high-capacity mills (above 300 TPH), reflecting the economies of scale pursued by major industrial producers. Key players are employing strategic acquisitions, long-term maintenance contracts, and technological licensing agreements to consolidate their market presence and ensure a consistent revenue stream from aftermarket parts and services, which constitute a significant portion of the total market valuation.

AI Impact Analysis on Vertical Roller Mill Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vertical Roller Mill market predominantly center on the potential for autonomous operation, optimization of grinding parameters in real-time, and the efficacy of AI-driven predictive maintenance (PdM) systems. Users are keen to understand how AI algorithms can reduce the specific energy consumption (kWh/ton) by dynamically adjusting roller pressure, throughput, and classifier speed based on input material quality and desired output fineness, thereby moving beyond traditional PID control loops. A major concern revolves around the complexity of integrating sophisticated AI models with legacy industrial control systems (ICS) and ensuring data security across the operational technology (OT) network. Expectations are high that AI will significantly minimize unplanned downtime, which is exceedingly costly in continuous operations like cement production, and extend the lifespan of high-wear components such as grinding tables and rollers by optimizing usage patterns.

AI's primary influence is observed in enhancing operational reliability and maximizing energy efficiency, transforming VRMs from purely mechanical assets into smart, self-optimizing systems. By leveraging deep learning models trained on historical operational data, current sensor inputs (vibration, temperature, acoustic emissions), and material chemistry, AI can accurately predict equipment failure weeks in advance, enabling highly optimized scheduling of preventative maintenance. Furthermore, AI systems are instrumental in quality control, using machine vision and analytical models to continuously monitor the particle size distribution (PSD) of the finished product, immediately signaling adjustments to the classifier if the product deviates from specification, ensuring a consistently high-quality output while reducing product giveaway or reprocessing requirements. This level of precision minimizes human error and enhances the overall profitability of grinding operations.

The adoption of AI facilitates the creation of digital twins for complex VRM installations. These simulations allow operators to test control strategies, simulate various material feed conditions, and optimize start-up and shutdown sequences without risking damage to physical equipment. This predictive and prescriptive approach, enabled by machine learning, is vital for managing the complex, non-linear relationships between variables (such as moisture content, hardness, and throughput) inherent in the grinding process. AI also plays a crucial role in optimizing the supply chain for wear parts by predicting consumption rates based on real-time operational severity, ensuring parts are ordered precisely when needed, minimizing inventory holding costs, and further reducing overall maintenance expenditures.

- AI-driven predictive maintenance forecasts component failure, drastically reducing unplanned downtime and optimizing inventory management for wear parts.

- Real-time optimization algorithms adjust roller pressure and classifier speed to minimize specific energy consumption (kWh/ton) while maintaining target fineness.

- Integration of AI-enhanced quality control systems ensures continuous monitoring and adjustment of particle size distribution (PSD).

- Machine learning models are utilized to create accurate digital twins, simulating grinding processes for optimized control strategy development and operator training.

- Autonomous operation capabilities are being piloted, allowing the VRM to self-regulate input feed rates and mill parameters based on material property fluctuations.

- Enhanced safety protocols are established through AI analysis of anomalous operational patterns indicative of high-stress conditions or component failure risks.

DRO & Impact Forces Of Vertical Roller Mill Market

The dynamics of the Vertical Roller Mill market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. A major driver is the accelerating global pace of urbanization and the subsequent surge in infrastructure and construction projects, which directly translates into heightened demand for cement, the largest application sector for VRMs. Simultaneously, manufacturers are capitalizing on the opportunity presented by the global pivot towards sustainable and energy-efficient processing technologies. VRMs inherently offer better energy efficiency compared to older grinding technologies, satisfying industry mandates and regulatory pressures aimed at reducing industrial carbon footprints. However, high initial capital expenditure (CapEx) required for acquiring and installing large-scale VRMs, coupled with the long decision cycles within heavy industries, acts as a significant restraint, particularly impacting smaller producers or facilities in financially constrained emerging markets. Furthermore, the reliance on specialized, proprietary parts from Original Equipment Manufacturers (OEMs) for maintenance creates dependency and potential cost volatility.

Opportunities are prominently visible in the retrofitting segment, where existing cement and power plants globally are replacing outdated, inefficient ball mills with modern VRM units to boost capacity and reduce operational costs without constructing entirely new facilities. Another substantial opportunity lies in the burgeoning market for specialized VRMs designed for non-traditional materials such as petcoke, fly ash, and rare earth minerals, broadening the market scope beyond the conventional cement raw meal and clinker processing. The key impact forces driving strategic decisions include stringent environmental regulations related to particulate matter emissions and energy usage, which compel end-users to invest in high-efficiency grinding solutions. Technological advancements, particularly in roller materials and gearbox design, are lowering maintenance complexity and extending operational intervals, mitigating some of the previous restraints associated with component wear and tear. The competitive intensity is moderate, characterized by a few major global players dominating technology innovation and high-capacity system installations, leading to fierce competition for large-scale, greenfield projects.

The overall market trajectory is highly positive, largely insulated by the inelastic demand for processed materials like cement and power generation fuels. The ongoing technological refinement in VRM design—focusing on minimizing vibration, enhancing accessibility, and integrating smart sensors—further strengthens the VRM's value proposition against competing technologies. While economic volatility in key consuming regions poses a short-term constraint, the long-term, structural need for sustainable and efficient industrial processing underpins continued investment in advanced VRM systems. This scenario suggests that the opportunities derived from energy efficiency and capacity expansion significantly outweigh the restraints imposed by high CapEx and maintenance complexities, fostering sustained market growth throughout the forecast period.

Segmentation Analysis

The Vertical Roller Mill market is systematically segmented based on multiple critical parameters including the product type, primary application area, operating capacity, and geographic region. This segmentation provides a granular view of market dynamics, revealing varying growth rates and adoption patterns across industrial sub-sectors and capacities. The Type segmentation distinguishes between vertical raw mills (VRM for raw meal grinding), vertical cement mills (VCM for clinker grinding), and vertical coal mills (VCoM for pulverizing coal). Application segmentation highlights the heavy reliance on the cement industry, followed by power generation (thermal power plants), and the mineral processing sector. Capacity segmentation is crucial, classifying mills into low, medium, and high-capacity units, reflecting the scale of the facility and the associated investment required. Understanding these segments is vital for manufacturers to tailor their product offerings, marketing strategies, and R&D investments toward the most lucrative and rapidly evolving sectors, especially those prioritizing high-capacity and energy-efficient grinding solutions.

- By Type:

- Vertical Raw Mill (VRM)

- Vertical Cement Mill (VCM)

- Vertical Coal Mill (VCoM)

- Vertical Slag Mill (VSM)

- By Application:

- Cement Industry (Clinker, Raw Meal, Slag)

- Power Generation (Coal Pulverization)

- Mining and Metallurgy (Iron Ore, Limestone, Gypsum)

- Chemical and Industrial Minerals

- By Capacity (Tonnes Per Hour - TPH):

- Low Capacity (Below 100 TPH)

- Medium Capacity (100 TPH – 300 TPH)

- High Capacity (Above 300 TPH)

- By Component:

- Grinding Rollers

- Grinding Table/Liner

- Gearbox and Drive System

- Hydraulic System

- Classifier and Separator

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Vertical Roller Mill Market

The Value Chain for the Vertical Roller Mill market begins with the Upstream analysis, focusing on the procurement of specialized raw materials and complex components crucial for mill fabrication. This involves securing high-grade steel alloys for the main mill body, high-wear-resistant materials (e.g., specialized cast iron or ceramics) for grinding rollers and table liners, and advanced hydraulic and gear systems from specialized component manufacturers. The quality and cost of these input materials significantly influence the final product’s performance, durability, and pricing. Following material procurement, the Manufacturing and Assembly phase constitutes the core value addition, involving precision machining, welding, and rigorous quality control. Leading OEMs differentiate themselves through proprietary designs for grinding elements and sophisticated assembly processes that minimize tolerance issues and ensure operational longevity. Supply chain efficiency in this stage is critical, given the massive size and customization required for high-capacity mills.

The Distribution Channel analysis highlights that VRMs are almost exclusively sold through Direct Sales models, as these are highly complex, customized, and high-value capital assets requiring extensive pre-sales consultation, engineering design integration, and post-sales installation and commissioning support. Direct engagement ensures that the OEM can manage project timelines, handle logistics for oversized components, and provide specialized training to the end-user's operating staff. Indirect channels, such as local agents or distributors, are sometimes utilized for smaller mills or solely for spare parts and aftermarket service provision in remote geographies. Downstream analysis emphasizes the role of Installation, Commissioning, and Aftermarket Services. This phase involves civil works, integration into the client's plant control system, and rigorous testing. The recurring revenue stream derived from maintenance contracts, supply of proprietary wear parts, and system upgrades (e.g., digitalization packages) is immensely valuable, often surpassing the profit margins from the initial equipment sale over the operational life cycle of the mill.

Therefore, strategic value capture occurs not just in the manufacturing excellence of the mill itself, but also in the robustness of the service network and the effectiveness of the digital offerings that enhance the mill's productivity over time. Manufacturers are investing heavily in establishing global service hubs and digital monitoring capabilities to solidify their aftermarket dominance. Optimizing logistics for large components and maintaining strong relationships with specialized foundries for wear parts are crucial competitive advantages. The complexity of the product means the value chain is highly integrated and demands close collaboration between the OEM, specialized component suppliers, and the end-user throughout the entire lifecycle of the grinding plant, ensuring peak performance and maximizing customer lifetime value.

Vertical Roller Mill Market Potential Customers

The primary and most significant segment of potential customers for Vertical Roller Mills consists of major global and regional Cement Manufacturers. Cement production is fundamentally dependent on efficient grinding processes for raw meal preparation (limestone, clay, sand) and final product finishing (cement clinker and supplementary materials like slag or fly ash). These companies continuously seek high-capacity, energy-efficient VRMs to reduce operating costs and meet stringent environmental standards while coping with ever-increasing production demands driven by construction activity. Investment decisions in this sector are typically large-scale, strategic, and tied to multi-year infrastructure projections. The shift towards producing blended cement, utilizing materials like ground granulated blast furnace slag (GGBS), further necessitates specialized VRMs capable of handling these distinct raw material characteristics efficiently and reliably.

Another vital customer segment encompasses Thermal Power Plants, particularly those reliant on coal as a primary fuel source. VRMs are essential here for pulverizing coal to the required fineness before injection into boilers for combustion. The efficiency of the mill directly impacts combustion efficiency and emissions compliance, making investment in state-of-the-art VRMs a priority, especially in regions like Asia Pacific where coal remains a major energy source. Furthermore, the global mining and mineral processing industry represents a growing customer base. This includes companies processing non-metallic minerals such as lime, gypsum, bentonite, and various industrial fillers. As these industries seek to improve product quality (e.g., ultra-fine particle sizes) and reduce processing energy costs, the benefits offered by VRM technology—superior fineness control and high throughput—make them increasingly attractive alternatives to older crushing and grinding circuits.

The strategic nature of these purchases means that customers are highly informed, focusing not only on the initial purchase price but heavily prioritizing lifetime ownership cost, including spare parts availability, maintenance schedules, specific energy consumption per ton, and the OEM’s reputation for technical support. The buying cycle is long, involving technical evaluations, feasibility studies, and detailed negotiation over performance guarantees and service level agreements. Emerging markets, particularly in Africa and Southeast Asia, offer significant potential for greenfield projects, while established markets in Europe and North America offer consistent demand for replacement and upgrade projects targeting enhanced sustainability and automation integration.

- Cement Production Facilities: Largest consumer base, purchasing mills for raw meal grinding, clinker grinding, and cement additions (slag, gypsum).

- Thermal Coal Power Plants: Acquire Vertical Coal Mills (VCoM) to achieve optimal coal pulverization fineness for high-efficiency combustion.

- Integrated Steel Mills: Use VRMs for grinding granulated blast furnace slag (GGBS) used as a supplementary cementitious material.

- Industrial Mineral Processors: Companies handling materials such as dolomite, phosphate, barite, and various fillers requiring fine particle sizing.

- Independent Grinding Units: Facilities specializing in outsourcing grinding services, often processing specialty materials or cement additives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Loesche GmbH, KHD Humboldt Wedag International AG, Christian Pfeiffer Maschinenfabrik GmbH, Gebr. Pfeiffer SE, CITIC Heavy Industries Co., Ltd. (CITIC HIC), Shanghai Zenith Mineral Co., Ltd., Metso Outotec Corporation, Thyssenkrupp Industrial Solutions AG, Estanda Foundry, Kawasaki Heavy Industries, Ltd., Pengfei Group Co., Ltd., Williams Patent Crusher & Pulverizer Co., Inc., Nanjing Kisen International Engineering Co., Ltd., Shenyang Liming Heavy Industry Machinery Co., Ltd., Chengdu Jinsong Machinery Equipment Co., Ltd., China National Building Materials Group Co., Ltd. (CNBM), Claudius Peters Projects GmbH, NEI Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vertical Roller Mill Market Key Technology Landscape

The Vertical Roller Mill market is characterized by continuous technological innovation focused primarily on enhancing wear resistance, improving energy efficiency, and enabling higher throughput capacities. A significant development is the advancement in Grinding Element Metallurgy, where manufacturers are increasingly utilizing highly wear-resistant materials, such as specific grades of high-chromium cast iron and composite ceramics, for rollers and table liners. These specialized materials significantly extend the operational lifespan of the grinding elements, drastically reducing maintenance downtime and associated costs, which is a major contributor to the Total Cost of Ownership (TCO). Furthermore, sophisticated Hydraulic Systems are employed to optimize roller pressure dynamically, ensuring that grinding force is precisely matched to the raw material's hardness and moisture content, maximizing grinding efficiency and minimizing unnecessary power consumption. This precision control is central to modern VRM performance.

Another critical area of technological advancement is the design of High-Efficiency Classifiers (Separators). Modern VRMs integrate dynamic classifiers, often employing variable speed drives and advanced blade designs, which allow for exceptionally sharp cut-points and precise control over the final product fineness (particle size distribution). This is crucial for meeting stringent quality specifications, particularly in cement and mineral processing where uniformity is paramount. Improvements in gearbox and drive technology, including the adoption of planetary gear systems, allow for the transmission of enormous torque in a compact design, accommodating the ever-increasing demand for mills capable of capacities exceeding 600 TPH. These robust drive systems are designed for minimal vibration and extended operational intervals, aligning with the industry's focus on operational reliability.

Digitalization and the Industrial Internet of Things (IIoT) represent the frontier of VRM technology. Modern mills are now equipped with extensive sensor arrays—monitoring vibration, bearing temperature, acoustic emissions, and motor load—feeding data into centralized Process Control Systems (PCS) and often cloud-based AI platforms. This enables real-time performance monitoring, automated fault detection, and prescriptive optimization. Technologies such as automatic grinding gap adjustment and autonomous start-up/shutdown sequences are becoming standard features in high-end VRMs. The ability to remotely diagnose performance issues and apply software updates further enhances operational flexibility and efficiency, cementing the role of integrated digital solutions in the competitive landscape of the VRM market.

- Advanced Metallurgy: Utilization of high-chrome cast iron and composite materials for grinding components to maximize wear resistance and component lifespan.

- Dynamic Classifiers: Implementation of high-efficiency dynamic separators with adjustable speed and blade design for superior control over product fineness and reduced recirculating loads.

- Precision Hydraulic Systems: Automated adjustment of grinding pressure based on material feed quality to optimize energy use and throughput.

- Digitalization and IIoT Integration: Embedding smart sensors for real-time condition monitoring, vibration analysis, and remote diagnostics to facilitate predictive maintenance.

- Gearbox and Drive Innovation: Deployment of advanced planetary and helical gear systems designed for high torque capacity, low noise, and maximum operational reliability.

Regional Highlights

The global Vertical Roller Mill market exhibits significant regional variations in growth patterns, maturity levels, and underlying demand drivers. Asia Pacific (APAC) stands out as the undisputed leader in market size and growth potential. This dominance is attributed to the unprecedented scale of infrastructure development across economies such as China, India, and Indonesia. These nations are massive consumers and producers of cement, coal, and processed minerals, necessitating continuous investment in new, high-capacity VRM installations for both greenfield projects and capacity expansion. Government initiatives promoting domestic manufacturing and urbanization, coupled with favorable regulatory environments regarding cement blending, further stimulate demand for efficient slag and raw meal grinding solutions. The APAC region is also characterized by intense price competition and a focus on mills offering the lowest capital cost relative to capacity.

Europe and North America represent mature markets, where growth is primarily driven by replacement demand, modernization, and regulatory compliance. European demand is intensely focused on achieving the highest levels of energy efficiency (low specific energy consumption) and environmental performance. Producers in this region frequently replace older ball mills with new VRMs to meet strict EU emission mandates and reduce operational energy costs. North America follows a similar trend, with steady demand stemming from the requirement for robust, highly automated grinding solutions for coal pulverization in aging power plants and for specialized mineral processing applications. Automation integration, predictive maintenance features, and long-term service contracts are critical competitive factors in these established markets.

The Middle East and Africa (MEA), along with Latin America (LATAM), represent high-potential emerging markets. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is undergoing massive construction booms fueled by diversification away from oil economies, leading to substantial demand for new cement and mineral processing facilities. African nations are seeing increased investment in cement production capacity to reduce import dependency, driving new project initiation. LATAM's growth is more localized, centered around countries like Brazil and Mexico, where robust mining and commodity processing industries necessitate heavy-duty grinding equipment. In these emerging regions, local assembly capabilities, financing options, and the ability of OEMs to provide robust after-sales support significantly influence purchasing decisions, highlighting potential risks related to political and economic instability alongside substantial growth opportunities.

- Asia Pacific (APAC): Dominates the market size due to unparalleled infrastructure development, high rates of cement production, and major greenfield investments in high-capacity mills.

- Europe: Growth driven by regulatory mandates focusing on decarbonization, efficiency upgrades, and the replacement of outdated grinding technology (brownfield investments).

- North America: Stable demand centered on technological adoption (automation and AI integration) and modernization projects in power generation and specialized industrial mineral sectors.

- Middle East & Africa (MEA): High growth potential fueled by large-scale infrastructure projects (NEOM, new city developments) and the expansion of local cement manufacturing capacity across Africa.

- Latin America (LATAM): Market activity tied heavily to the mining and metallurgy sectors, requiring durable and reliable VRMs for processing dense and abrasive materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vertical Roller Mill Market.- FLSmidth

- Loesche GmbH

- Gebr. Pfeiffer SE

- KHD Humboldt Wedag International AG

- Thyssenkrupp Industrial Solutions AG

- Metso Outotec Corporation

- Kawasaki Heavy Industries, Ltd.

- CITIC Heavy Industries Co., Ltd. (CITIC HIC)

- Pengfei Group Co., Ltd.

- Shanghai Zenith Mineral Co., Ltd.

- Williams Patent Crusher & Pulverizer Co., Inc.

- Nanjing Kisen International Engineering Co., Ltd.

- Shenyang Liming Heavy Industry Machinery Co., Ltd.

- Estanda Foundry (Specializing in wear parts/components)

- Christian Pfeiffer Maschinenfabrik GmbH

- Hengda Heavy Industry Machinery Manufacturing Co., Ltd.

- Polysius SAS (a segment of Thyssenkrupp)

- Claudius Peters Projects GmbH

- Dalian Heavy Industry Co., Ltd.

- Fives Group

Frequently Asked Questions

Analyze common user questions about the Vertical Roller Mill market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key advantages of Vertical Roller Mills (VRMs) over traditional grinding technologies?

VRMs offer significant operational benefits, primarily achieving a 30% to 50% reduction in specific energy consumption compared to ball mills. They also allow for simultaneous grinding, drying, and classification in a single unit, minimizing system complexity, and can efficiently handle raw materials with high moisture content. Furthermore, maintenance is often simpler due to better accessibility to the grinding elements.

Which industry segment accounts for the largest demand for Vertical Roller Mills?

The Cement Industry segment is the largest consumer of VRMs, utilizing them extensively for grinding raw meal (limestone, clay), cement clinker, and supplementary cementitious materials such as ground granulated blast furnace slag (GGBS). The ongoing demand for high-capacity, energy-efficient solutions in cement production sustains this market dominance.

How does AI technology specifically improve the performance and reliability of VRMs?

AI improves VRM performance through predictive maintenance (PdM), using sensor data to anticipate equipment failures weeks in advance, thus eliminating unplanned downtime. AI also optimizes grinding parameters (roller pressure, classifier speed) in real-time, leading to lower specific energy consumption and highly consistent product fineness, maximizing throughput and operational efficiency.

What is the forecast growth outlook for the VRM market in the Asia Pacific region?

The Asia Pacific region is expected to exhibit the highest growth rate during the forecast period (2026-2033). This robust growth is driven by substantial governmental spending on infrastructure projects, high urbanization rates, and the continuous need for expansion and modernization of cement and power generation capacity in major economies like India and China.

What are the primary restraints affecting the mass adoption of Vertical Roller Mills?

The primary restraint is the significantly high initial capital expenditure (CapEx) required for the purchase, installation, and commissioning of large-scale VRM systems. This high barrier to entry, coupled with the reliance on proprietary, specialized components for maintenance, often extends the payback period and limits rapid adoption among smaller or financially constrained producers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager