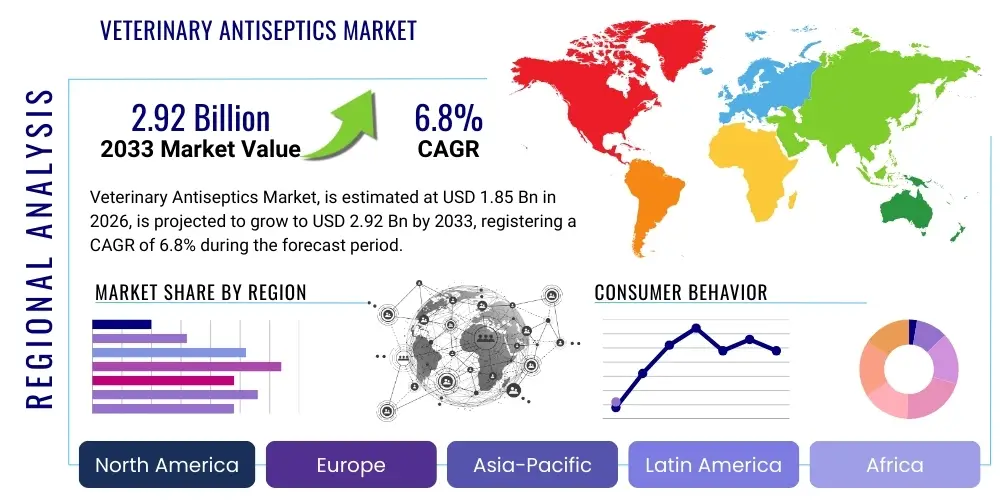

Veterinary Antiseptics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436538 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Veterinary Antiseptics Market Size

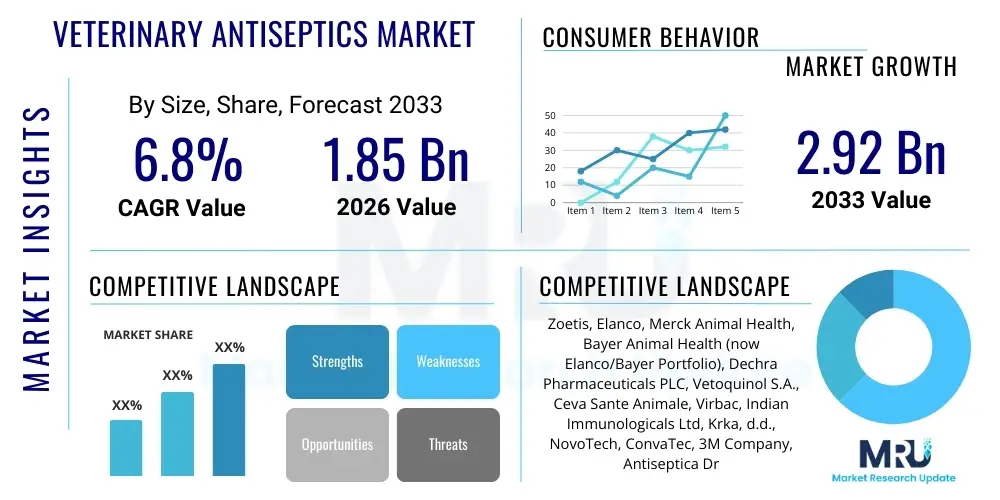

The Veterinary Antiseptics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.92 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing global focus on animal health, stringent regulations concerning hygiene in veterinary practices, and the rising prevalence of zoonotic and livestock diseases which necessitates effective infection control protocols across various animal care settings, including companion animal clinics, livestock farms, and specialized veterinary hospitals.

Veterinary Antiseptics Market introduction

The Veterinary Antiseptics Market encompasses a range of chemical agents applied to living tissues—such as skin or mucous membranes—to reduce the possibility of infection, sepsis, or putrefaction. These essential products are distinct from disinfectants, which are used on inanimate surfaces. Key product categories include Iodine-based solutions, Chlorhexidine formulations, alcohol-based solutions, and quaternary ammonium compounds, each tailored for specific veterinary applications ranging from surgical site preparation and wound management to mucosal cleaning and routine hygiene maintenance in animal handling facilities. The primary objective is preventing microbial contamination and ensuring the rapid healing and well-being of companion animals and livestock alike.

Major applications of veterinary antiseptics span surgical procedures, post-operative care, dermal infections treatment, and maintaining biosecurity in high-density animal environments such as poultry farms and dairy operations. The crucial role these antiseptics play in minimizing hospital-acquired infections (HAIs) within veterinary clinics and controlling widespread disease outbreaks in livestock contributes significantly to market demand. Benefits include reduced infection rates, faster recovery times for animals, lower healthcare costs associated with treating severe infections, and enhanced productivity in the agriculture sector by preventing production losses due to animal illness.

Driving factors propelling market expansion include the increasing humanization of pets, leading to higher spending on veterinary care and advanced medical procedures, and the global mandate for food safety, which emphasizes rigorous hygiene standards in livestock farming. Furthermore, governmental initiatives promoting animal welfare and controlling zoonotic diseases necessitate the mandatory use of high-quality antiseptic solutions. The continuous development of specialized, low-toxicity, and broad-spectrum antiseptic formulations further supports sustained market growth by addressing concerns related to antimicrobial resistance and animal tolerance.

Veterinary Antiseptics Market Executive Summary

The global Veterinary Antiseptics Market exhibits robust growth driven by escalating demand for sophisticated animal healthcare services and the imperative to manage infectious diseases effectively across both companion and production animals. Business trends highlight a pronounced shift towards ready-to-use, single-application antiseptic products, particularly in the professional veterinary setting, alongside an increased investment in research and development aimed at overcoming microbial resistance to traditional compounds. Strategic collaborations between pharmaceutical companies and veterinary distributors are optimizing supply chain efficiencies and enhancing product accessibility, particularly in emerging economies where livestock populations are rapidly expanding. Innovation in delivery systems, such as antiseptic wipes and sprays, is also simplifying application procedures and improving compliance among pet owners and farm managers.

Regional trends indicate North America and Europe retaining dominant market shares due to high pet adoption rates, advanced veterinary infrastructure, and substantial spending on animal wellness and disease prevention. However, the Asia Pacific (APAC) region is projected to register the fastest growth, primarily fueled by the rapid expansion of the livestock industry, increasing awareness regarding animal hygiene, and governmental investments in improving farm biosecurity standards in countries like China and India. The mature markets are focused on premium, specialized products for surgical applications, while emerging markets prioritize cost-effective, bulk solutions essential for large-scale farm disinfection and preventive care against high-incidence livestock diseases.

Segment trends reveal that the Chlorhexidine segment continues to lead the market by product type due to its persistent antimicrobial activity and safety profile for diverse applications. Application-wise, the surgical segment demands the highest quality and concentration of antiseptics, while the wound care segment is experiencing rapid innovation through hydrogel and advanced film-forming antiseptic dressings. End-user segmentation shows that Veterinary Hospitals and Clinics are the primary revenue generators, driven by complex surgical procedures and high patient turnover, while Livestock Farms constitute a high-volume demand sector crucial for disease control and maintaining optimal food production quality.

AI Impact Analysis on Veterinary Antiseptics Market

Common user questions regarding AI's impact on the Veterinary Antiseptics Market often center on how automation and predictive analytics can improve infection control, optimize supply chain management for consumables, and assist in identifying emerging antimicrobial resistance patterns. Users inquire about AI's role in diagnostics, specifically if AI-powered image analysis or clinical data integration can pinpoint infection sources more quickly, thereby ensuring the correct and timely application of specific antiseptic agents. Concerns also revolve around AI’s capacity to monitor adherence to hygiene protocols in large veterinary hospitals or massive livestock farms, and whether predictive modeling can forecast disease outbreaks that necessitate preemptive antiseptic deployment. These themes highlight user expectations that AI will enhance precision, efficiency, and preventative strategies in veterinary hygiene management, moving beyond manual application and into data-driven decision making.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to significantly impact the demand, usage patterns, and supply chain of veterinary antiseptics. While AI does not directly manufacture the chemical products, its influence is profound in optimizing the environment where these products are used. AI-driven systems can analyze vast datasets from electronic health records (EHRs), environmental sensors, and diagnostic labs to identify high-risk areas for infection within a clinical setting or farm. This capability allows veterinary practices to implement targeted cleaning and antiseptic application protocols, reducing wasteful usage and ensuring resources are focused on critical zones, thereby optimizing operational efficiency and minimizing the risk of healthcare-associated infections (HAIs).

Furthermore, AI algorithms can process epidemiological data on a regional scale to predict the probability and trajectory of infectious disease outbreaks, particularly zoonotic diseases affecting livestock. Such predictive capabilities enable proactive stockpiling and distribution of necessary antiseptic supplies, ensuring market readiness and preventing shortages during peak demand periods. In research and development, AI assists in screening new chemical compounds for enhanced antiseptic efficacy and reduced toxicity, accelerating the development cycle for next-generation formulations that can combat increasingly resistant microbial strains, thereby providing manufacturers with a competitive advantage based on highly effective and specialized product lines derived through smart drug discovery platforms.

- AI-driven real-time monitoring of hygiene compliance in veterinary hospitals, ensuring appropriate antiseptic use.

- Predictive analytics for infectious disease modeling, optimizing the supply chain and regional distribution of antiseptics.

- Automated image analysis (e.g., wound imaging) to assess infection severity and determine the most effective antiseptic regimen.

- Optimization of inventory management and expiration tracking for high-volume antiseptic consumables using ML algorithms.

- Accelerated discovery of novel broad-spectrum antiseptic agents resistant to emerging microbial strains.

DRO & Impact Forces Of Veterinary Antiseptics Market

The market dynamics of veterinary antiseptics are shaped by a confluence of accelerating drivers (D), significant restraints (R), and compelling opportunities (O), creating a complex set of impact forces that dictate growth and evolution. Key drivers include the exponential increase in global pet ownership and the accompanying elevation in veterinary medical standards, demanding sterile environments for complex procedures. Simultaneously, the global focus on food security and the need for rigorous biosecurity measures in large-scale livestock operations—particularly concerning highly contagious diseases like African Swine Fever or Avian Influenza—mandates high-volume antiseptic usage for environmental hygiene and animal treatment. These drivers collectively push market expansion by increasing the absolute demand for infection control products across all animal sectors.

Restraints primarily revolve around the challenges posed by antimicrobial resistance (AMR), where the overuse or misuse of antiseptics can contribute to the development of resistant microbial strains, potentially mirroring the issues seen with antibiotics. Regulatory scrutiny regarding the toxicity and environmental impact of certain chemical compounds, such as persistent organic pollutants or quaternary ammonium compounds, also limits the adoption of some older, more aggressive formulations. Furthermore, the market faces pricing pressures, especially in the livestock segment where producers prioritize cost-effectiveness for bulk purchases, potentially favoring lower-cost, less specialized options over advanced, high-efficacy products, thereby affecting profit margins for innovative manufacturers.

Opportunities for market growth lie in the development and commercialization of advanced, non-toxic, and eco-friendly antiseptic formulations, such as those based on stabilized hypochlorous acid or advanced silver nanoparticle technology, which offer high efficacy without contributing to traditional AMR pathways. The expansion of professional services, including mobile veterinary clinics and specialized wound care centers for animals, creates new distribution channels and application points for premium antiseptic products. Moreover, penetration into untapped markets in developing nations, coupled with increasing governmental mandates for animal disease surveillance and vaccination programs, promises substantial future market growth, particularly for prophylactic antiseptic applications in agriculture and public health initiatives focused on zoonoses control.

The resulting impact forces indicate a strong positive momentum (High Impact, High Probability) driven by regulatory support for animal welfare and growing consumer expenditure on pet health. However, manufacturers must navigate the critical challenges posed by resistance development and environmental regulations (Medium Impact, Medium Probability). The overall market trajectory is highly favorable, contingent upon sustained innovation that addresses the balance between antimicrobial effectiveness, safety, and environmental stewardship, ensuring long-term product viability and acceptability in professional veterinary settings.

Segmentation Analysis

The Veterinary Antiseptics Market is systematically segmented based on Product Type, Application, Animal Type, and End-User, providing granular insights into demand patterns and competitive landscapes across various veterinary settings. Product type segmentation distinguishes between chemical classes like Iodine, Chlorhexidine, and Alcohol, which possess distinct mechanisms of action and spectrums of activity, catering to specific requirements such as rapid pre-operative sterilization versus prolonged post-operative microbial suppression. Application segments delineate usage areas, with surgical applications demanding sterile and highly concentrated formulations, while wound care applications prioritize gentle, non-irritating agents that promote tissue healing and manage chronic infections.

Animal type segmentation differentiates between companion animals (pets) and production animals (livestock), reflecting significant variances in product volume, required formulation sizes, and regulatory oversight. Companion animal care drives demand for premium, specialized products often sold in smaller, consumer-friendly packaging, while production animals necessitate bulk packaging and cost-effective solutions for widespread environmental and topical applications critical for biosecurity management and maintaining herd health metrics. End-user categories, including Veterinary Hospitals, Clinics, and Farms, highlight the primary points of consumption, with hospitals exhibiting higher demand for advanced surgical grade antiseptics and farms consuming large quantities of environmental and skin preparation products.

- Product Type:

- Iodine Antiseptics (Povidone-Iodine, Iodophor)

- Chlorhexidine Antiseptics (CHG Solution, Scrub)

- Alcohol Antiseptics (Ethanol, Isopropyl Alcohol)

- Quaternary Ammonium Compounds (QACs)

- Other Antiseptics (Hydrogen Peroxide, Hypochlorous Acid)

- Application:

- Surgical Site Preparation

- Wound Care and Management

- Pre-operative and Post-operative Skin Disinfection

- Mucosal Cleaning and Irrigation

- Hand Hygiene (Veterinary Professionals)

- Animal Type:

- Companion Animals (Dogs, Cats, Horses, Others)

- Production Animals (Cattle, Poultry, Swine, Aquaculture)

- End-User:

- Veterinary Hospitals and Clinics

- Livestock Farms and Production Facilities

- Animal Shelters and Breeding Centers

- Home Care/Retail Channel

Value Chain Analysis For Veterinary Antiseptics Market

The value chain for veterinary antiseptics commences with the upstream analysis involving the sourcing and refinement of basic chemical raw materials (e.g., alcohols, iodine compounds, chlorhexidine base, surfactants). Key chemical manufacturers supply these ingredients to formulators. Pricing and quality consistency at this stage significantly influence the final cost structure and stability of the supply chain. Manufacturers then engage in the formulation, blending, and packaging of the final antiseptic products, adhering strictly to veterinary pharmaceutical and regulatory standards (e.g., FDA/EMA approval for veterinary use). Manufacturing processes focus on maintaining sterility, ensuring efficacy (broad spectrum microbial kill), and optimizing shelf stability for the diverse product portfolio.

The downstream analysis focuses on the distribution channels, which are crucial for timely market penetration and product availability. Direct distribution involves large manufacturers supplying bulk products directly to major end-users like large integrated livestock corporations or centralized veterinary hospital groups under procurement contracts. This channel is cost-effective for high-volume sales. Indirect distribution relies heavily on specialized veterinary distributors, wholesalers, and retail pharmacies (for over-the-counter products intended for pet owners or small clinics). These intermediaries provide logistical support, localized inventory, and crucial technical support to a fragmented customer base, ensuring timely access to specialized surgical and therapeutic antiseptics, particularly for independent veterinary practices.

The distribution network is segmented by product type; for instance, surgical-grade antiseptics are typically routed through specialized veterinary pharmaceutical channels, whereas general wound cleaning solutions are often available through broader agricultural supply outlets and pet stores. The efficiency of the distribution channel is increasingly critical due to the perishable nature of some chemical components and the need for rapid response during disease outbreaks. Maintaining a cold chain or temperature-controlled storage, while not universally required, is sometimes necessary for specialized biological or sensitive formulations, adding complexity and cost to the final delivery to the end-user, emphasizing the importance of robust logistics partners.

Veterinary Antiseptics Market Potential Customers

The primary end-users and buyers of veterinary antiseptics span the entire spectrum of animal care and production, from sophisticated surgical centers to large agricultural enterprises. Veterinary Hospitals and Clinics represent the most crucial segment for high-margin, specialized antiseptic products, as they require stringent infection control measures for surgical operations, diagnostic procedures, and general patient care. These professional settings prioritize product efficacy, rapid action, and documented safety profiles for use on various animal species, often demanding premium brands recognized for quality assurance and compliance with established surgical protocols. Purchasing decisions here are heavily influenced by veterinarians and surgical technicians who mandate products that minimize complication rates and improve patient outcomes.

Livestock Farms and Production Facilities, particularly those involved in swine, poultry, and dairy production, constitute a massive volume customer base. Their demand is driven by prophylactic hygiene requirements, biosecurity mandates, and the need to manage environmental contamination that can lead to large-scale herd or flock illness. These customers typically purchase antiseptics in bulk quantities for environmental sanitation, routine dipping (e.g., teat dips), and general animal hygiene. Cost-effectiveness is a major purchasing determinant in this segment, though regulatory compliance regarding zoonotic disease control increasingly mandates the use of specified, effective chemical compounds to ensure food safety standards are met throughout the production cycle.

Other significant end-users include Animal Shelters, municipal Animal Control Services, and specialized Breeding Centers. These organizations face continuous challenges related to controlling infectious diseases within high-density animal populations and rely on effective antiseptic solutions for daily sanitation, cage cleaning, and managing minor injuries or skin infections upon intake. Furthermore, the retail channel caters to individual pet owners who purchase non-prescription antiseptic sprays, wipes, and solutions for minor wound care and routine hygiene maintenance at home, representing a growing segment focused on user-friendly formulations and convenient application methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.92 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis, Elanco, Merck Animal Health, Bayer Animal Health (now Elanco/Bayer Portfolio), Dechra Pharmaceuticals PLC, Vetoquinol S.A., Ceva Sante Animale, Virbac, Indian Immunologicals Ltd, Krka, d.d., NovoTech, ConvaTec, 3M Company, Antiseptica Dr. Hans-Joachim Moller GmbH, Ecolab Inc., Medline Industries, Medtronic plc, B. Braun Melsungen AG, Advanced Medical Solutions Group plc, STERIS Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Antiseptics Market Key Technology Landscape

The technology landscape within the veterinary antiseptics market is continuously evolving, driven by the dual need for enhanced antimicrobial efficacy and improved safety profiles for both animals and handlers. A significant technological shift involves the development of stabilized, sustained-release antiseptic delivery systems. Traditional liquid solutions offer immediate microbial kill but require frequent reapplication. Modern technologies, however, incorporate antiseptic agents into advanced matrices such as hydrogels, film-forming sprays, and specialized dressings. These systems allow the antiseptic compound, such as Chlorhexidine or Povidone-Iodine, to be released slowly over an extended period (up to 72 hours), maintaining a consistently effective concentration at the application site, which is crucial for complex surgical wounds or chronic skin infections in animals, minimizing the risk of secondary contamination.

Another critical area of innovation focuses on developing novel chemical formulations to circumvent the challenge of antimicrobial resistance (AMR), which is rapidly becoming a major threat in veterinary medicine. Technologies utilizing non-traditional microbicides, such as stabilized hypochlorous acid (HOCl) solutions or formulations incorporating metal nanoparticles (e.g., silver or copper), are gaining traction. HOCl offers potent, broad-spectrum antimicrobial activity but breaks down safely into saline solution, posing minimal environmental risk and reducing concerns related to resistance development. Nanoparticle technology, particularly silver nanoparticles, leverages physical mechanisms of microbial destruction, making it difficult for pathogens to evolve resistance, and is increasingly integrated into advanced wound dressings specifically designed for veterinary use.

Furthermore, technology is improving the application and compliance aspects of antiseptic use. This includes the implementation of advanced packaging technologies, such as unit-dose sterile swabs and pre-saturated applicators, which guarantee precise dosing and minimize the risk of contamination associated with bulk containers in clinical settings. The development of color-indicating antiseptics, which visually confirm adequate coverage of the surgical site before incision, has significantly improved adherence to pre-operative sterilization protocols. These technological advancements collectively enhance the reliability, safety, and effectiveness of veterinary antiseptic practices, ensuring better outcomes and aligning the veterinary industry with the highest standards of human medical infection control.

Regional Highlights

- North America (U.S. and Canada): Dominates the market due to the high density of companion animals, substantial consumer willingness to spend on advanced pet healthcare, and the presence of sophisticated veterinary hospitals. The region is a leader in adopting specialized surgical antiseptics and is characterized by rigorous regulatory standards that drive the demand for high-quality, approved formulations.

- Europe (Germany, UK, France, etc.): Holds a significant market share, supported by robust animal welfare regulations, high standards of biosecurity in livestock production, and strong emphasis on preventative veterinary medicine. The market is mature, focusing on innovation in anti-resistance formulations and environmentally sustainable products.

- Asia Pacific (APAC) (China, India, Japan): Expected to exhibit the highest CAGR during the forecast period. This growth is primarily fueled by the rapid expansion and modernization of livestock farming to meet growing domestic and export meat demand, coupled with increasing awareness of zoonotic diseases. Government initiatives to control animal epidemics are driving massive bulk purchasing of antiseptics for farm biosecurity.

- Latin America (Brazil, Mexico): Driven by large-scale agricultural economies, particularly cattle and poultry production. The demand centers around cost-effective bulk antiseptics for maintaining herd health and managing high-volume farm environments, although the companion animal sector is growing steadily.

- Middle East and Africa (MEA): Represents an emerging market with potential driven by modernization efforts in veterinary services and growing concerns over food security. Market growth is constrained by infrastructure development but sees high demand in niche areas like equine care and specific livestock sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Antiseptics Market.- Zoetis

- Elanco

- Merck Animal Health

- Bayer Animal Health (now Elanco/Bayer Portfolio)

- Dechra Pharmaceuticals PLC

- Vetoquinol S.A.

- Ceva Sante Animale

- Virbac

- Indian Immunologicals Ltd

- Krka, d.d.

- NovoTech

- ConvaTec

- 3M Company

- Antiseptica Dr. Hans-Joachim Moller GmbH

- Ecolab Inc.

- Medline Industries

- Medtronic plc

- B. Braun Melsungen AG

- Advanced Medical Solutions Group plc

- STERIS Corporation

Frequently Asked Questions

Analyze common user questions about the Veterinary Antiseptics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Veterinary Antiseptics Market?

The primary factor driving market growth is the significant increase in global pet ownership coupled with heightened consumer spending on pet health and sophisticated veterinary procedures, which mandates stringent infection control protocols.

How do Chlorhexidine and Iodine-based antiseptics differ in veterinary use?

Chlorhexidine (CHG) offers prolonged residual activity on the skin, making it ideal for pre-surgical scrubs and long-term wound management, whereas Iodine (Povidone-Iodine) provides rapid microbial kill but has a shorter residual effect, commonly used for quick surface disinfection.

What are the main restraints impacting the Veterinary Antiseptics Market?

The main restraints include the emerging global challenge of antimicrobial resistance (AMR) linked to misuse, alongside strict regulatory requirements concerning the environmental safety and potential toxicity of chemical antiseptic compounds.

Which geographical region exhibits the fastest growth potential for veterinary antiseptics?

The Asia Pacific (APAC) region is projected to show the fastest growth potential, driven by the modernization of large-scale livestock operations and increasing governmental focus on regional animal disease prevention and biosecurity measures.

How is technology addressing the challenge of microbial resistance in antiseptics?

Technology is addressing resistance by developing advanced non-traditional microbicides, such as stabilized hypochlorous acid and metal nanoparticle formulations, which utilize mechanisms of action less prone to bacterial resistance evolution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager