Veterinary Centrifuges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434816 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Veterinary Centrifuges Market Size

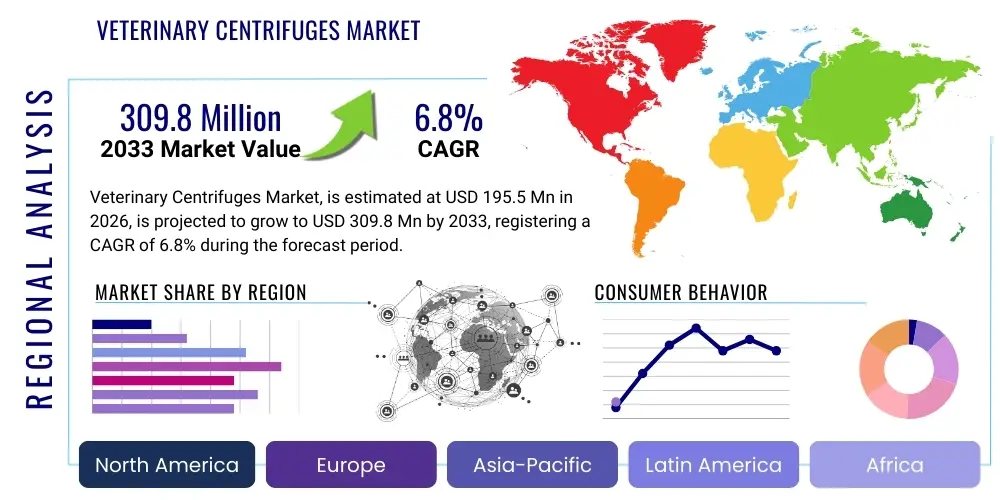

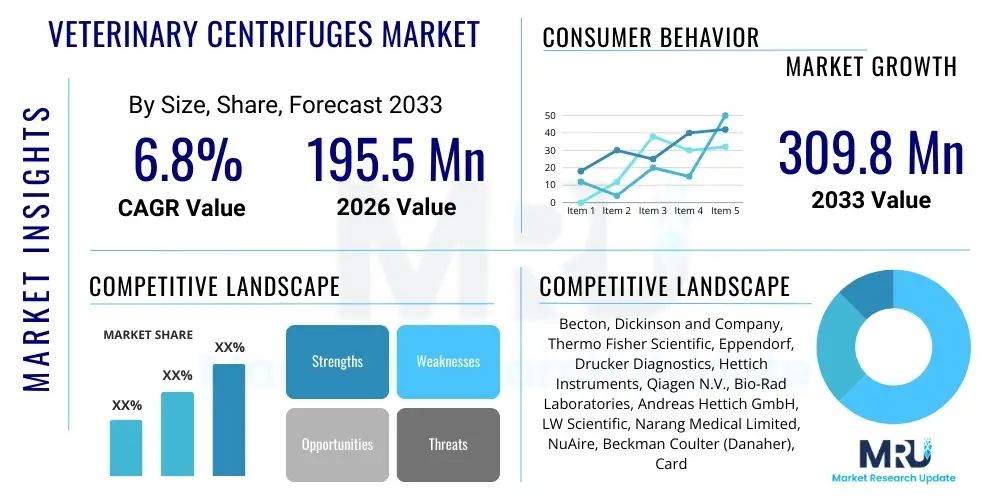

The Veterinary Centrifuges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 195.5 Million in 2026 and is projected to reach USD 309.8 Million by the end of the forecast period in 2033. This growth trajectory underscores the continuous investment in advanced diagnostic infrastructure across the global animal healthcare sector, reflecting an accelerating trend of adopting sophisticated laboratory practices previously confined to human medicine. The valuation reflects the combined revenue generated from sales of various centrifuge types, including microcentrifuges, high-speed refrigerated models, and specialized cytocentrifuges, alongside associated accessories such as specialized rotors and essential maintenance contracts. Market size calculation incorporates both new equipment sales and the sustained revenue stream derived from the replacement and upgrade cycles necessitated by technological obsolescence and increased throughput demands in high-volume veterinary reference laboratories globally.

Veterinary Centrifuges Market introduction

The Veterinary Centrifuges Market is fundamentally defined by the segment of laboratory equipment critical for the pre-analytical phase of veterinary diagnostic testing. These instruments employ centrifugal force to rapidly separate components of heterogeneous samples based on differing densities, a process pivotal for isolating serum, plasma, blood cell components, parasites, and particulate matter from complex biological matrices like whole blood, urine, feces, and cerebrospinal fluid. The essential product description spans a spectrum from highly compact, battery-operated Point-of-Care (POC) models designed for mobile veterinarians to large, sophisticated floor-standing refrigerated centrifuges capable of processing dozens of samples simultaneously in institutional settings. The precision and reliability of these instruments are non-negotiable, as inconsistencies in sample preparation directly compromise the accuracy and integrity of downstream analyses, including clinical chemistry profiles, hematological counts, and molecular diagnostics, impacting clinical decision-making across all animal species.

Major applications for veterinary centrifuges permeate routine clinical diagnostics, specialized pathology, and cutting-edge research. In clinical settings, they are indispensable for determining Packed Cell Volume (PCV), preparing samples for electrolyte analysis, and separating cellular components for microscopic evaluation. Beyond routine applications, the emergence of advanced veterinary therapies, notably in orthopedics and internal medicine, has positioned centrifuges as central tools for preparing biological products such as Platelet-Rich Plasma (PRP) and isolating mononuclear cells for regenerative therapies. The inherent benefits derived from utilizing high-quality centrifugation equipment include drastically improved sample integrity, standardized protocol execution leading to highly reproducible results, and significantly reduced manual processing time, allowing veterinary technicians and laboratory staff to focus on critical analysis rather than tedious sample preparation steps, thereby enhancing overall laboratory efficiency and reducing the turnaround time for critical patient results.

The market expansion is robustly driven by several macro-level and industry-specific factors. The escalating worldwide population of companion animals, coupled with the "human-animal bond" phenomenon leading to increased willingness to pay for premium veterinary services, sustains high demand for advanced diagnostic testing. Concurrently, public health concerns related to zoonotic diseases necessitate continuous, high-volume testing, particularly in the livestock and exotic animal sectors, bolstering the need for reliable laboratory tools. Furthermore, continuous product refinement by manufacturers, focusing on enhanced safety features (e.g., aerosol containment), greater energy efficiency, and intuitive digital interfaces that integrate seamlessly with laboratory informatics systems, accelerates the replacement cycle for older, less efficient units. These technological and socio-economic drivers collectively underscore the vital, non-discretionary role centrifuges play in ensuring the quality and efficiency of global veterinary healthcare provision, making them essential capital equipment across all levels of practice.

Veterinary Centrifuges Market Executive Summary

The Veterinary Centrifuges Market is characterized by robust business trends emphasizing automation, portability, and integration with broader laboratory information systems (LIS) to minimize manual handling errors and maximize diagnostic efficiency. Key stakeholders, including major diagnostic equipment manufacturers and specialized laboratory instrument providers, are focusing strategic investments on developing high-throughput refrigerated centrifuges to handle increasing sample volumes derived from large reference laboratories, and compact, battery-operated centrifuges tailored for field diagnostics and mobile veterinary services. Competitive dynamics are increasingly driven by offering comprehensive service contracts, calibration adherence, and validation documentation necessary for regulatory compliance and quality assurance in veterinary diagnostics, moving the market focus from mere product sales to holistic, integrated laboratory solutions.

Regionally, North America and Europe maintain dominance due to high levels of expenditure on pet healthcare, advanced veterinary infrastructure, and stringent regulatory environments promoting quality diagnostic testing. These regions show sustained demand for high-precision, technologically advanced models essential for specialized veterinary medicine (e.g., oncology and complex surgical procedures). However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly expanding livestock farming sectors, rising disposable incomes leading to increased companion animal ownership, and governmental initiatives focusing on zoonotic disease surveillance. Emerging markets in Latin America and MEA are gradually increasing adoption, primarily driven by international aid programs and modernization efforts in public and private veterinary clinics, focusing initially on standard, durable benchtop models to meet essential diagnostic needs.

Segment trends reveal that the clinical diagnostics application segment accounts for the largest market share, directly correlated with the high volume of routine blood work and sample testing performed daily across all veterinary settings. Within product types, high-speed tabletop centrifuges are witnessing strong demand due to their versatility and suitability for smaller to medium-sized veterinary clinics, offering a superior balance between throughput capacity and laboratory footprint. The specialized segment focusing on applications like Platelet-Rich Plasma (PRP) preparation for regenerative medicine in equine and companion animals is experiencing above-average growth, reflecting the expanding scope of veterinary medical treatments and the adoption of advanced therapeutic modalities that require precise, repeatable centrifugation protocols, thereby pulling the industry towards greater instrument sophistication and specialization.

AI Impact Analysis on Veterinary Centrifuges Market

User queries regarding the impact of Artificial Intelligence (AI) on the Veterinary Centrifuges Market often center on whether AI can optimize centrifugation protocols, predict equipment failure, and integrate sample preparation data seamlessly into electronic health records (EHRs). Common concerns relate to the immediate utility of AI, as the core function of centrifugation (physical separation) is mechanically driven. However, high-level analysis confirms that AI's influence is significant, primarily through adjacent process optimization. AI is leveraged to create smarter laboratory workflows, where algorithms optimize rotor speed, duration, and temperature based on sample type and volume, minimizing human error and standardizing preparation quality. Furthermore, predictive maintenance models utilizing machine learning monitor operational parameters (vibration, heat profiles) to preemptively identify potential component failures, thereby maximizing instrument uptime in high-volume veterinary laboratories, fundamentally enhancing the efficiency and reliability of the pre-analytical phase, which is crucial for overall diagnostic accuracy.

Specifically, AI algorithms are being integrated into the operational firmware of high-end veterinary centrifuges to achieve unparalleled protocol standardization. This involves systems that use computer vision or advanced sensor arrays to assess sample homogeneity post-processing, flagging imperfect separations or potential issues like micro-clotting, which traditionally require manual verification. Moreover, the integration of AI-driven diagnostics helps in monitoring the mechanical health of the unit. By analyzing patterns in motor torque, vibration frequencies, and bearing temperature drift over time, machine learning models can accurately predict the remaining useful life (RUL) of critical components, alerting laboratory managers to schedule maintenance precisely when needed, rather than relying on time-based schedules. This crucial shift from reactive or calendar-based maintenance to predictive maintenance significantly cuts operational costs and guarantees crucial equipment uptime, especially important for high-volume 24/7 veterinary reference labs where delays are unacceptable.

The long-term influence of AI extends to the integration layer, facilitating true laboratory automation. AI tools manage the data flow from the centrifugation phase—recording precise run parameters, rotor ID, and sample specific metadata—directly into the LIS or LIMS, eliminating manual transcription errors and establishing a complete, traceable audit trail for every sample. This automated data integrity is becoming essential for laboratories seeking accreditation under bodies like ISO or specific veterinary quality assurance programs. Ultimately, AI transforms the centrifuge from a standalone mechanical separator into a smart, networked, and self-diagnosing pre-analytical workstation, significantly enhancing the overall quality and reliability of veterinary diagnostic output, addressing the growing expectation for human-grade diagnostic accuracy in animal health across all segments of the veterinary market.

- AI-driven protocol optimization: Automated adjustment of centrifugation parameters (RPM, time) based on real-time sample characteristics, tube density, and target separation purity requirements, achieving greater consistency and reproducible results.

- Predictive Maintenance (PdM): Machine learning algorithms analyze operational data (vibration, motor load, temperature profiles) to forecast imminent mechanical component failure, thus minimizing unexpected instrument downtime and optimizing maintenance scheduling to reduce overall operational costs.

- Quality Control (QC) automation: AI algorithms monitor and verify successful sample separation post-centrifugation using integrated optical sensors, flagging improper layering or hemolysis to ensure sample quality before subsequent analytical testing begins.

- Workflow integration: Seamless and error-free data transfer of comprehensive centrifuge run parameters (speed, time, cooling status, rotor details) directly to Laboratory Information Systems (LIS) and Electronic Health Records (EHRs), enhancing regulatory traceability and providing a robust audit trail.

- Enhanced safety features: AI integration aids in immediate and highly precise rotor imbalance detection, moving beyond simple weight sensors to nuanced vibrational analysis for instantaneous automated shutdown procedures, surpassing traditional safety mechanisms and protecting expensive rotors and samples.

- Remote Diagnostics and Support: AI facilitates remote troubleshooting and performance tuning by analyzing real-time sensor data transmitted over network connections, allowing manufacturers to rapidly diagnose and resolve issues without requiring an immediate physical service visit, improving service efficiency.

- Energy Optimization: Smart algorithms adjust power consumption based on workload and ambient conditions, ensuring efficient operation, particularly for large, refrigerated floor models running continuously in high-demand environments, contributing to laboratory sustainability goals.

DRO & Impact Forces Of Veterinary Centrifuges Market

The market is experiencing considerable impetus from robust Drivers, offset by specific Restraints, yet presenting significant Opportunities that define its long-term viability. Core Drivers include the accelerating adoption of sophisticated diagnostic panels in routine animal healthcare, necessitating precise sample preparation; the burgeoning field of veterinary specialist care (oncology, neurology) which demands higher precision centrifugation for specialized tests; and the fundamental expansion of global pet ownership leading to an inherent increase in the total volume of samples processed daily. Furthermore, the regulatory environment in many developed countries is gradually moving toward stricter standards for veterinary laboratory quality, compelling clinics to upgrade outdated, non-calibrated centrifugation equipment with modern, validated instruments capable of providing audit trails and consistent performance, reinforcing market sales and driving technological adoption.

Despite these favorable conditions, significant Restraints pose challenges, primarily centered on economic barriers and operational complexities. The high initial capital outlay for specialized, high-capacity, refrigerated floor-standing centrifuges, often costing tens of thousands of USD, presents a substantial procurement hurdle, particularly for small independent veterinary clinics and emerging market institutions operating under budget constraints. Compounding this is the ongoing cost of specialized maintenance, calibration, and validation required to meet high-level quality assurance standards, which significantly adds to the total cost of ownership (TCO). A further restraint is the scarcity of highly trained laboratory personnel in many developing regions capable of optimally operating and troubleshooting advanced centrifugation technology, sometimes leading to underutilization or misuse of complex instruments, hindering full market potential realization and stressing the need for more user-friendly designs.

Opportunities for market expansion are concentrated in technological niches and geographic white spaces. The high-growth segment of veterinary regenerative medicine, which relies on proprietary centrifugation protocols for autologous cell preparation, presents a lucrative pathway for specialized instrument development and associated consumable sales (e.g., custom PRP tubes). Geographically, the massive, underserved markets of the Asia Pacific and parts of Latin America offer substantial potential as veterinary infrastructure investment accelerates, shifting the focus towards developing robust, modular, and affordable product lines tailored for tropical climates and variable power grids. Strategic opportunities also exist in integrating centrifuges into comprehensive, vendor-neutral laboratory automation tracks, positioning the equipment as a seamless component of a fully digitalized diagnostic workflow that minimizes manual intervention and maximizes sample processing integrity from collection to analysis.

The Impact Forces shaping competitive strategy are defined by intense technological rivalry and moderate market fragmentation. Supplier bargaining power is moderately high for proprietary components like ultra-light carbon fiber rotors or specialized high-precision motors, where a few manufacturers hold key intellectual property, but this power is somewhat diluted by the proliferation of viable standard benchtop models. Buyer bargaining power is strongest among large Corporate Veterinary Groups (e.g., VCA, Mars Veterinary Health) and high-volume reference laboratories, who leverage bulk purchasing power to secure advantageous pricing, extensive warranty periods, and tailored maintenance contracts. The threat of new entrants is mitigated by the significant R&D investment required to develop precision, safety-compliant, and validated centrifugation technology, alongside the need for established global distribution and service networks. The threat of substitutes is relatively low, as centrifugation remains the gold standard, non-substitutable technique for precise separation of biological fluids in clinical diagnostics, reinforcing the intrinsic value and foundational role of this equipment in veterinary laboratories and ensuring continued market relevance.

Segmentation Analysis

A detailed segmentation analysis of the Veterinary Centrifuges Market is essential for understanding the highly diversified demands across the animal healthcare ecosystem. The market structure is bifurcated based on several operational and functional criteria, allowing manufacturers to develop targeted product offerings that satisfy the specific needs of distinct end-user environments, from small ambulatory practices to large-scale bio-safety level research facilities. The segmentation by Product Type (Microcentrifuges, Benchtop, Floor-standing) directly correlates with throughput requirements and laboratory space constraints. For instance, microcentrifuges cater to molecular and genomic research requiring very small volumes, while large floor-standing models are necessary for high-volume blood component processing and long-run, temperature-critical separations in central reference labs. The continuous evolution of these segments is driven by the demand for smaller footprints without sacrificing performance, integrating high-RCF capabilities into benchtop formats, and enhancing energy efficiency across all types to meet modern sustainability goals.

The segmentation based on Application provides the clearest indication of revenue allocation and growth hotspots. Clinical Diagnostics accounts for the vast majority of market revenue, continually strengthened by the ubiquity of procedures like Complete Blood Counts (CBCs), serum chemistry analysis, and fecal floatations, all requiring efficient phase separation. However, the fastest growth is observed in specialized applications such as Regenerative Medicine, where demand for precise, repeatable centrifugation protocols for PRP and stem cell isolation fuels the high-margin sale of specialty equipment and proprietary consumables. Furthermore, the segmentation by End-User distinguishes procurement needs; Veterinary Hospitals prioritize versatility, speed, and ease of maintenance, whereas Academic and Research Institutes emphasize precise temperature control, high gravitational forces (RCF), and rigorous data logging capabilities necessary for experimental reproducibility and peer-reviewed publication compliance, often leading to the purchase of the most technologically advanced and expensive units.

Operational criteria further refine the market view, particularly the division between Refrigerated and Non-refrigerated Centrifuges. Refrigeration capability is crucial for processing heat-sensitive biological samples, such as enzymes, proteins, and cellular components required for blood banking and specific molecular assays, ensuring sample viability and integrity during long runs. Conversely, non-refrigerated models suffice for many routine diagnostic tasks where rapid separation occurs at ambient temperature. This detailed segmentation not only guides product development, ensuring alignment with specific functional requirements but also informs market strategy by identifying high-value, underserved niches, such as mobile diagnostics requiring robust, power-efficient, battery-operated centrifuges designed to withstand transportation stress and function reliably outside of controlled laboratory environments, offering unique opportunities for specialized manufacturers.

- By Product Type:

- Microcentrifuges (High-speed, small volume, often used for molecular and PCR prep, handling volumes typically under 2 ml)

- Benchtop Centrifuges (Standard medium-capacity models, often refrigerated, versatile for clinics, common capacity up to 4 x 100 ml)

- Floor-standing Centrifuges (Ultra-high capacity and speed, dedicated for blood banks and reference laboratories, capacity often exceeding 4 liters)

- Specialty Centrifuges (e.g., Cytocentrifuges for slide preparation, Hematocrit Centrifuges for PCV determination, and custom regenerative medicine centrifuges)

- By Application:

- Clinical Diagnostics (Primary revenue segment: Hematology, Biochemistry, Serology, Urinalysis, Parasitology)

- Veterinary Research and Academics (Genomics, Proteomics, Cell Culture, Vaccine and Drug Discovery requiring ultra-precision)

- Veterinary Blood Banking and Transfusion Services (High-capacity fractionation of whole blood components like plasma and platelets)

- Regenerative Medicine (High-precision preparation of Platelet-Rich Plasma (PRP) and Stem Cell Concentrates for therapeutic use)

- Pharmaceutical and Toxicology Testing (Sample preparation for residual analysis and drug metabolism studies in animal models)

- By End-User:

- Veterinary Hospitals and Clinics (Includes specialized referral centers and general practices, the largest user base by volume)

- Veterinary Reference Laboratories (Centralized, high-throughput, outsourced testing facilities with critical uptime requirements)

- Academic and Research Institutes (Universities, government research labs focused on animal health and public safety)

- Biotechnology and Pharmaceutical Companies (R&D focused on animal drugs and biologicals requiring controlled environments)

- Mobile and Field Veterinary Services (Demand for portable and ruggedized, often battery-powered, equipment)

- By Operational Criteria:

- Refrigerated Centrifuges (Essential for preserving temperature-sensitive biological components, maintaining cold chain integrity)

- Non-refrigerated (Ambient) Centrifuges (Sufficient for routine, non-temperature critical separations like fecal analysis)

- High-Speed Centrifuges (RCF greater than 15,000 x g, used for molecular and cellular work)

- Low-Speed Centrifuges (RCF less than 5,000 x g, used primarily for routine blood and urine separation)

Value Chain Analysis For Veterinary Centrifuges Market

The value chain for the Veterinary Centrifuges Market begins with the upstream suppliers providing critical components such as high-performance, maintenance-free brushless induction motors, precise temperature control units, and advanced electronic controls. Key dynamics in the upstream phase involve stringent quality control for motor precision and balance, ensuring longevity and reliability under high RCF (Relative Centrifugal Force) conditions, demanding specialized technical partnerships between component manufacturers and final instrument assemblers. Strategic material sourcing for rotors, increasingly favoring lightweight, durable carbon fiber composites over traditional heavy metals, adds significant value at the component level. Manufacturers then engage in complex assembly, sophisticated dynamic balancing, proprietary software integration for protocol management, and strict quality assurance testing of the final instrument, where specialized technical expertise and adherence to ISO standards are paramount for market entry and competitiveness.

The downstream component involves the distribution and subsequent utilization of the centrifuges. Distribution channels are rigorously managed, bifurcated into direct sales channels, favored by large global players targeting major veterinary hospital groups and institutional buyers for high-value units. Direct sales ensure manufacturers maintain greater control over technical installation, staff training, and margin integrity. Conversely, indirect distribution relies on specialized laboratory equipment distributors and regional resellers, a critical strategy for reaching the vast network of smaller, independent veterinary clinics and mobile units, where localized inventory, rapid delivery, and proximity to technical support are essential factors. Distributors often provide essential value-added services, including installation, staff training tailored to specific veterinary protocols, and routine preventative maintenance, bridging the technical gap between manufacturer complexity and end-user operational needs across diverse geographic locations.

The market is characterized by a high degree of technical involvement at the point of sale and post-sale service. Effective supply chain management is increasingly focused on reducing lead times for customized rotors and ensuring the availability of essential spare parts, minimizing instrument downtime at veterinary reference laboratories where sample processing is time-critical and continuous operation is required. Operational value is continually added through after-sales support, encompassing specialized calibration services required for quality assurance accreditation, and the provision of proprietary or recommended consumables (e.g., specialized tube holders or PRP kits) that ensure optimal instrument performance for specific veterinary applications. Optimization of the entire value chain is increasingly leaning toward digital integration, allowing for remote diagnostics, usage tracking, and automated software updates, transforming the instrument sale into a continuous service relationship and securing predictable, high-margin revenue streams over the long term, cementing customer loyalty through superior support.

Veterinary Centrifuges Market Potential Customers

The primary end-users and buyers of veterinary centrifuges span the entire spectrum of animal healthcare and biological research infrastructure. Veterinary hospitals, particularly large specialty and referral centers, represent major customers due to the high volume of complex diagnostic procedures performed daily, requiring sophisticated, high-capacity refrigerated units for hematology, cytology, and toxicology samples. General practice veterinary clinics constitute the largest numerical cohort of buyers, typically purchasing benchtop models essential for routine in-house blood separation and basic urinalysis, prioritizing instruments based on criteria such as ease of use, small footprint, affordability, and rapid processing times. The growing trend toward decentralized, in-house diagnostics, driven by the desire for rapid results and revenue retention within the practice, ensures continuous procurement from this fundamental market segment.

Beyond clinical practice, veterinary reference laboratories are critical consumers, demanding ultra-high-speed and floor-standing centrifuges capable of 24/7 high-throughput operation. These centralized testing facilities require robust instruments with advanced temperature control, stringent calibration, and seamless integration with laboratory automation systems to handle vast volumes of specialized testing, including infectious disease panels and complex molecular diagnostics. Furthermore, academic and government research institutes form a crucial customer base, purchasing specialized microcentrifuges and high-RCF models for fundamental research in veterinary genomics, pathology, and vaccine development. This segment often demands equipment with highly specific programmable protocols and robust documentation capabilities tailored for rigorous experimental reproducibility and maintaining strict regulatory compliance required for grant reporting and scientific publication.

A rapidly emerging customer segment includes companies specializing in animal biotechnology and regenerative therapies. These entities rely on dedicated centrifugation techniques to isolate and concentrate therapeutic components like mesenchymal stem cells and growth factors for use in orthopedic and soft tissue repair in animals. Procurement decisions in this niche market are heavily influenced by the centrifuge's ability to maintain cell viability and achieve precise separation purity, making specialized rotors and customizable slow-acceleration/deceleration profiles highly desirable features, often leading to the purchase of customized, high-precision equipment. The increasing professionalization and specialization of animal health globally ensures sustained, diversified demand across all these distinct end-user categories, necessitating a broad and technologically sophisticated product offering from market manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Million |

| Market Forecast in 2033 | USD 309.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company, Thermo Fisher Scientific, Eppendorf, Drucker Diagnostics, Hettich Instruments, Qiagen N.V., Bio-Rad Laboratories, Andreas Hettich GmbH, LW Scientific, Narang Medical Limited, NuAire, Beckman Coulter (Danaher), Cardinal Health, Sigma Laborzentrifugen GmbH, Hawksley & Sons Ltd., Scilogex LLC, Vetlab Supplies, Centurion Scientific, DLAB Scientific, Benchmark Scientific. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Centrifuges Market Key Technology Landscape

The contemporary technological landscape of veterinary centrifuges is defined by a convergence of advanced motor engineering, sophisticated electronic control systems, and enhanced material science aimed at maximizing performance, safety, and operational longevity. The universal adoption of powerful, energy-efficient brushless induction motors is a foundational technological shift, providing the requisite smooth, vibration-free operation necessary for achieving high relative centrifugal forces (RCF) required for fine separation processes without overheating or compromising sample integrity. These motors require minimal maintenance, significantly reducing the total cost of ownership over the instrument’s lifespan, a critical factor for budget-conscious veterinary operations. Moreover, modern centrifuges utilize sophisticated PID (Proportional-Integral-Derivative) controllers for highly accurate and stable temperature management, ensuring refrigerated models maintain biological sample viability during prolonged, high-speed runs, which is non-negotiable for critical applications like blood component processing and sensitive cellular research.

Innovation in rotor technology is a key differentiator in the competitive market. The introduction and increasing use of lightweight carbon fiber rotors, replacing traditional heavy aluminum rotors, allows for drastically faster acceleration and braking profiles, thereby increasing laboratory throughput and productivity. Carbon fiber offers superior strength-to-weight ratio and greater resistance to corrosion from common laboratory cleaning agents or accidental spills. This material science advancement is coupled with advanced dynamic balancing systems, often leveraging high-precision piezoelectric sensors, which continuously monitor the rotor’s balance in real-time. This sophisticated monitoring not only prevents costly mechanical damage but also minimizes operational noise and maximizes operator safety by instantaneously shutting down the unit if a critical imbalance threshold is reached, addressing biosafety concerns associated with handling potentially infectious veterinary samples and reducing mechanical stress on the entire instrument.

The shift towards intelligent, connected devices is redefining the market’s technological ceiling. New centrifuges are increasingly equipped with integrated microprocessors capable of storing hundreds of user-defined protocols, specific to different animal species or diagnostic tests (e.g., canine hematocrit vs. feline urine sediment). Furthermore, Wi-Fi or Ethernet connectivity is becoming standard, enabling seamless communication with Laboratory Information Management Systems (LIMS). This connectivity supports critical features such as remote diagnostics by manufacturer service teams, automated software updates, and the digital logging of full run histories (time, speed, temperature, error codes) directly into a central database. This detailed, auditable data trail is indispensable for maintaining quality control documentation, satisfying the increasingly stringent accreditation requirements imposed on high-level veterinary diagnostic services, thereby future-proofing the laboratory infrastructure investment against evolving regulatory pressures and enhancing the overall traceability of diagnostic results.

Regional Highlights

The market performance and technological adoption of veterinary centrifuges vary significantly across global regions, reflecting economic maturity, regulatory environment complexity, and the established standard of veterinary care. Analyzing these regional dynamics provides essential context for market entry strategies and resource allocation decisions for global manufacturers.

- North America: This region consistently leads the global market in terms of value share, primarily due to the highest per capita spending on pet healthcare globally and the pervasive presence of highly sophisticated veterinary reference laboratories (VRLs). The market demands advanced, automated, and specialized instruments, including high-speed refrigerated centrifuges and custom PRP preparation systems. Key drivers here include robust corporate consolidation of veterinary practices and a strong regulatory focus on diagnostic quality assurance, promoting continuous equipment upgrades and replacement cycles essential for maintaining competitive edge.

- Europe: Holding the second-largest market position, Europe exhibits steady, mature growth driven by widespread national healthcare protocols for livestock and high levels of companion animal ownership across Western economies. The focus is balanced between cost-effective, high-reliability benchtop models for general practice and specialized equipment fulfilling EU biosafety regulations for research institutions. Germany, the UK, and France are critical markets demanding precision-engineered instruments with comprehensive traceability features and low energy consumption profiles, reflecting stringent European environmental standards.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC’s expansion is accelerated by the economic growth, leading to increased disposable income allocated to pet ownership in urban centers (e.g., China, South Korea). Simultaneously, the massive scale of the livestock industry, particularly in South Asia and Southeast Asia, drives bulk procurement of robust, medium-capacity centrifuges for disease monitoring and quality control testing. The market is highly price-sensitive but rapidly advancing toward adopting automated, Western-standard laboratory technology due to foreign investment and rising quality expectations.

- Latin America (LATAM): This region offers considerable untapped potential, characterized by growing urbanization and increasing investment in veterinary infrastructure, particularly in high-growth economies like Brazil and Mexico. The market currently favors essential, durable benchtop models, but rising consumer expectation for rapid, localized diagnostics is creating demand for POC-compatible centrifuges and standard refrigerated units, signaling a gradual, yet consistent, modernization trend across clinical practices focused on integrating basic laboratory services.

- Middle East and Africa (MEA): Representing the smallest current market share, MEA growth is highly localized, concentrated primarily in affluent GCC nations (UAE, Saudi Arabia) and specific high-volume research centers focusing on endemic animal diseases. The climate necessitates highly reliable refrigerated units with robust cooling capacity, and procurement often involves large tenders managed by governmental or quasi-governmental agricultural and health agencies, making long-term service capability and warranty guarantees a critical selection factor for major contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Centrifuges Market. These entities compete through technological superiority, global distribution networks, and integrated product portfolios that encompass both instruments and supporting diagnostic consumables.- Thermo Fisher Scientific

- Becton, Dickinson and Company (BD)

- Eppendorf AG

- Drucker Diagnostics

- Hettich Instruments, LP

- Qiagen N.V.

- Bio-Rad Laboratories, Inc.

- Andreas Hettich GmbH & Co. KG

- LW Scientific, Inc.

- Narang Medical Limited

- NuAire, Inc.

- Beckman Coulter (A Danaher Company)

- Cardinal Health, Inc.

- Sigma Laborzentrifugen GmbH

- Hawksley & Sons Ltd.

- Scilogex LLC

- Vetlab Supplies, Inc.

- Centurion Scientific Ltd.

- DLAB Scientific Co., Ltd.

- Benchmark Scientific Inc.

- Labnet International, Inc.

- Heal Force Bio-Meditech Holdings Ltd.

Frequently Asked Questions

Analyze common user questions about the Veterinary Centrifuges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Veterinary Centrifuges Market through 2033?

The Veterinary Centrifuges Market is projected to achieve a robust CAGR of 6.8% between 2026 and 2033, primarily sustained by accelerating rates of companion animal ownership and the increasing clinical demand for reliable, high-quality veterinary diagnostic testing worldwide.

How is regenerative medicine specifically impacting the revenue growth of centrifuge manufacturers?

Regenerative medicine, encompassing Platelet-Rich Plasma (PRP) and stem cell concentration, is driving high-margin revenue through the sale of specialized, programmable centrifuges and associated proprietary kits that guarantee cell viability and purity, catering to orthopedic and sports medicine applications in animals.

Which segment accounts for the highest utilization and market share by application?

The Clinical Diagnostics application segment holds the dominant market share. Centrifugation is a non-negotiable step in preparing samples for routine hematology, clinical chemistry panels, and parasitological examinations, underpinning the vast majority of veterinary lab workflows globally.

What are the primary challenges restraining widespread adoption of advanced veterinary centrifuges?

The main restraints include the significant initial capital investment required for high-capacity, refrigerated units, coupled with the ongoing costs associated with complex calibration, specialized maintenance, and training technical staff to operate and troubleshoot sophisticated instrumentation effectively.

How does the integration of AI contribute to the efficiency of modern veterinary centrifuges?

AI integration improves efficiency by offering predictive maintenance schedules based on real-time operational analysis, optimizing centrifugation protocols dynamically according to sample type, and ensuring seamless, error-free transfer of run data directly into Laboratory Information Management Systems (LIMS).

Why are carbon fiber rotors increasingly preferred over traditional aluminum rotors in new centrifuge models?

Carbon fiber rotors are favored for their superior strength-to-weight ratio, allowing for significantly faster acceleration and deceleration times (improving throughput), enhanced corrosion resistance, and increased safety due to their inherent ability to better contain high-energy mechanical failures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager