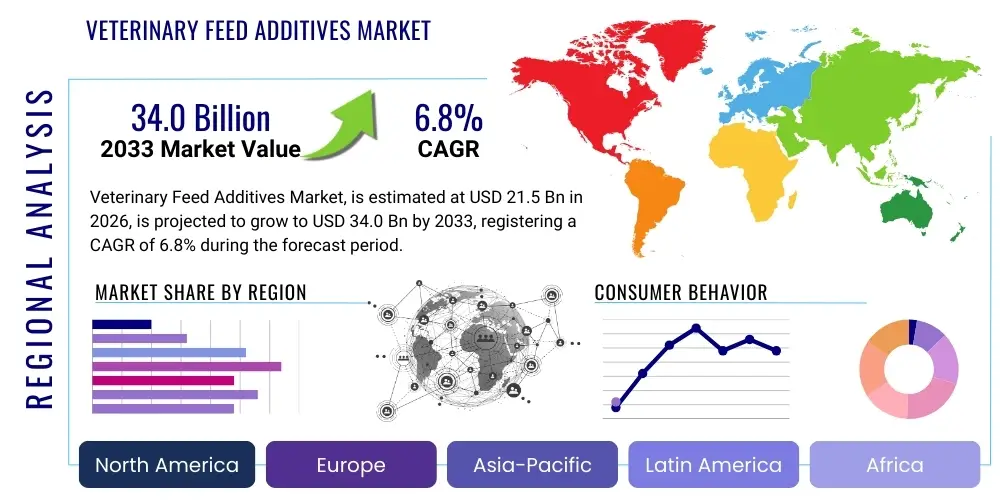

Veterinary Feed Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435866 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Veterinary Feed Additives Market Size

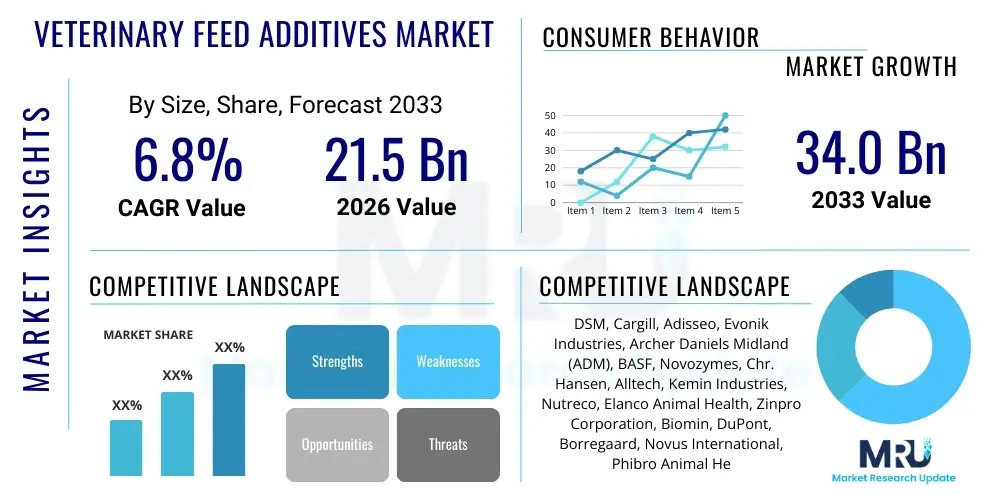

The Veterinary Feed Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 21.5 billion in 2026 and is projected to reach USD 34.0 billion by the end of the forecast period in 2033.

This robust growth trajectory is underpinned by several macro-environmental factors, notably the surging global demand for animal protein, increasing awareness regarding animal gut health, and stringent regulatory pressures mandating the reduction of prophylactic antibiotics in livestock farming. Consumers globally are demanding safer, sustainably produced meat and dairy products, forcing producers to invest heavily in alternative performance enhancers such as prebiotics, probiotics, and phytogenics. These functional ingredients serve not only to improve feed conversion ratios but also to enhance the overall immune status and welfare of production animals, directly supporting higher quality outputs and meeting complex export standards.

Furthermore, the intensification of livestock production systems across developing economies, particularly in Asia Pacific and Latin America, necessitates the use of high-quality feed additives to mitigate the health risks associated with dense confinement and environmental stress. Technological advancements in microencapsulation and targeted delivery systems are enhancing the stability and efficacy of sensitive additives like enzymes and vitamins, thereby maximizing their bioavailability within the animal digestive tract. This continuous innovation cycle, combined with the industry's shift towards precision nutrition, establishes a strong foundation for sustained market expansion throughout the forecast period, emphasizing functional benefits over simple caloric intake.

Veterinary Feed Additives Market introduction

The Veterinary Feed Additives Market encompasses specialty ingredients incorporated into animal feed formulations to improve animal health, enhance growth performance, optimize feed utilization, and prevent diseases in livestock, including poultry, swine, ruminants, and aquaculture species. These products range from nutritional supplements such such as amino acids, vitamins, and minerals, to performance enhancers like enzymes, prebiotics, probiotics, and acidifiers, and increasingly sophisticated medicinal additives designed to manage gut microbiota balance. The primary application of these additives is to support intensive animal farming operations globally, ensuring efficient and sustainable production of high-quality animal protein in response to escalating population growth and changing dietary patterns. Key benefits include improved feed conversion efficiency, reduced environmental impact through optimized nutrient excretion, enhanced animal welfare, and significant reductions in dependence on conventional antibiotic growth promoters, aligning the industry with global public health directives.

The transition away from routine subtherapeutic antibiotic usage, driven by regulatory bodies like the European Union and the US FDA, serves as a primary catalyst for market growth. This regulatory shift has created a massive demand gap for innovative, non-antibiotic alternatives that can maintain high productivity standards while safeguarding animal health. Driving factors include the rapidly growing middle class in emerging markets, leading to increased meat consumption, coupled with continuous scientific breakthroughs in animal nutrition and microbiology that validate the efficacy of novel functional ingredients. Moreover, the prevalence of zoonotic diseases and the need for robust biosecurity measures further incentivize the use of immunomodulatory feed additives, positioning them as essential components of modern animal husbandry practices focused on preventative health strategies.

Veterinary Feed Additives Market Executive Summary

The Veterinary Feed Additives Market is characterized by vigorous expansion, driven fundamentally by the global imperative to produce sustainable and safe animal protein amidst regulatory constraints on antibiotic usage. Business trends indicate a consolidation among large industry players, coupled with significant venture capital investment in biotechnology firms specializing in gut health solutions, such as novel enzyme cocktails and next-generation probiotics tailored for specific animal species. Strategic partnerships between feed manufacturers and pharmaceutical companies are intensifying the development of synergistic additive blends that offer multifunctional benefits, optimizing both nutritional uptake and disease resilience. Furthermore, digitalization and the use of data analytics are increasingly impacting the market, allowing farmers to adopt precision feeding techniques that maximize the return on investment from high-value feed additives. The emphasis on phytogenics and essential oils as natural alternatives represents a major product innovation trend currently reshaping competitive landscapes.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, fueled by the rapid modernization and industrialization of livestock farming, particularly in China, India, and Southeast Asia, aimed at meeting massive domestic demand. North America and Europe, while mature markets, continue to lead in the adoption of premium, science-backed functional ingredients, driven by stringent consumer preferences for welfare-certified and antibiotic-free products. Segment trends highlight Probiotics and Prebiotics as the most dynamic categories, experiencing exponential demand growth due to their role as primary antibiotic replacements in poultry and swine diets. Amino acids also maintain a strong market share, crucial for balancing nutrient profiles in feed, especially in monogastric animals, ensuring optimal growth and minimizing nitrogen excretion, thereby supporting environmental sustainability goals across all geographies.

AI Impact Analysis on Veterinary Feed Additives Market

User inquiries regarding Artificial Intelligence (AI) in the Veterinary Feed Additives Market predominantly focus on how AI can optimize formulation precision, predict animal health outcomes, and enhance supply chain efficiency. Key themes center around the potential for AI algorithms to process massive datasets derived from animal biometric sensors, feed conversion monitoring, and environmental data to recommend real-time adjustments in additive dosage and type, thus maximizing efficacy and reducing input costs. Concerns often revolve around data privacy, the complexity of integrating diverse data sources (e.g., farm management software, lab results, and genomic data), and the initial investment required for sophisticated AI-driven precision feeding systems. Expectations are high regarding AI's capability to fast-track the discovery and validation of novel feed ingredients, particularly in complex areas like microbiome modulation, shifting the industry from reactive supplementation to proactive nutritional management.

- Precision Formulation: AI algorithms optimize feed recipes based on specific animal genetics, environment, and real-time performance data, ensuring exact dosage of additives.

- Predictive Health Modeling: AI analyzes patterns in behavioral data, consumption rates, and clinical markers to predict disease onset or nutritional deficiencies, allowing timely intervention with specific additives.

- Supply Chain Optimization: Machine learning improves forecasting of raw material prices and demand for specific additives, streamlining logistics and reducing waste.

- Novel Ingredient Discovery: AI speeds up the screening and identification of effective new probiotics, enzymes, or phytogenic compounds by analyzing large biological datasets and predicting efficacy.

- Personalized Nutrition: AI enables the creation of highly customized feeding strategies for individual groups or flocks, maximizing the return on investment from high-value additives.

- Risk Management: Algorithms monitor compliance with regulatory standards (e.g., maximum residue limits), minimizing the risk associated with additive usage.

DRO & Impact Forces Of Veterinary Feed Additives Market

The Veterinary Feed Additives Market is significantly influenced by a confluence of accelerating drivers, persistent restraints, and transformative opportunities that shape its growth trajectory and impact forces. The dominant driver is the escalating consumer demand for antibiotic-free animal products globally, compelling the livestock industry to seek functional alternatives like probiotics and acidifiers to maintain production efficiency and animal welfare standards. This shift is reinforced by stricter governmental regulations concerning antimicrobial resistance (AMR), which globally restrict the therapeutic use of antibiotics in feed. However, market expansion faces notable restraints, including the high cost associated with manufacturing, research, and regulatory approval of novel, high-tech additives, which often deters small-scale producers. Furthermore, the variability in efficacy across different farm environments, management practices, and animal genetics presents a technical challenge to consistent product adoption. Opportunities are abundant in the areas of synthetic biology for creating next-generation functional proteins and peptides, developing targeted delivery systems (e.g., encapsulation), and expanding market reach in rapidly industrializing economies.

The impact forces within the market are predominantly driven by technological shifts and regulatory mandates. The high impact force exerted by public health concerns surrounding AMR continually pushes the industry towards cleaner label products and functional ingredients. Simultaneously, the force of innovation in biotechnology allows companies to overcome previous formulation limitations, offering more stable and effective alternatives. Economic pressures, particularly volatile feed ingredient prices, also act as a significant force, driving producers towards high-efficiency additives (like enzymes) that demonstrably improve feed conversion ratios, justifying the increased investment. The combined effect of these forces results in a market characterized by rapid product cycles, stringent quality control requirements, and a constant search for proven, sustainable solutions that address both animal health and global public health priorities, making compliance and documented efficacy paramount for market access and sustained growth.

Segmentation Analysis

The Veterinary Feed Additives Market is extensively segmented based on the type of additive, the target livestock species, the primary function they serve, and the physical form in which they are supplied. This detailed segmentation reflects the complex needs of modern animal husbandry, where feed formulations must be highly specific to optimize health and performance under diverse operational conditions. The segmentation by Type is critical as it delineates traditional nutritional products (like vitamins and minerals) from high-growth functional ingredients (like prebiotics and enzymes). Segmentation by Livestock dictates product formulation, given the distinct digestive physiologies of monogastric animals (poultry, swine) versus ruminants. The functional segmentation further specifies the application focus, separating products primarily aimed at growth enhancement from those designed for disease mitigation or nutrient utilization improvement. Understanding these segments provides key insights into investment areas and technological focus for market participants.

The segmentation structure is crucial for market participants to tailor their research and marketing efforts. For instance, the high-demand poultry and swine segments drive innovation in performance enhancers and gut health modulators, as these intensive production systems benefit significantly from minor efficiency gains. Conversely, the ruminant segment (cattle) requires additives focused on maximizing fiber digestion and mitigating metabolic disorders like acidosis, leading to specialized enzyme and buffer development. The increasing popularity of liquid feed systems in certain farming environments also drives the development of stable Liquid form additives. Given the diverse regulatory landscapes and nutritional requirements across different species and regions, segment-specific innovation remains a core strategy for achieving competitive advantage and maximizing market penetration across varied animal production systems globally, especially those focused on sustainable sourcing and waste reduction.

- By Type:

- Antibiotics (Therapeutic Use Only)

- Vitamins

- Amino Acids

- Enzymes

- Antioxidants

- Prebiotics

- Probiotics

- Acidifiers

- Phytogenics/Essential Oils

- Others (Minerals, Immunomodulators)

- By Livestock:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Pigs)

- Ruminants (Cattle, Sheep, Goats)

- Aquaculture (Fish, Shrimp)

- Others (Pets, Equine)

- By Function:

- Nutritional Supplements

- Performance Enhancers (Growth Promoters)

- Disease Prevention/Gut Health Modulators

- Feed Efficiency Optimization

- By Form:

- Dry (Powders, Granules, Pellets)

- Liquid

Value Chain Analysis For Veterinary Feed Additives Market

The value chain for the Veterinary Feed Additives Market is complex, stretching from the sourcing of biological and chemical raw materials to the final integration into animal feed and consumption by livestock. The upstream segment involves the production of base materials, which include the fermentation of microorganisms (for probiotics and enzymes), chemical synthesis (for amino acids and vitamins), and the extraction of natural compounds (for phytogenics). This stage is characterized by high capital investment in biotechnology and chemical manufacturing plants, and reliance on specialized suppliers like large chemical and life science companies. Quality control and purity are paramount at this stage, as even minor contaminants can significantly impact final feed quality and animal health outcomes. The reliance on bio-based raw materials, particularly for fermentation processes, makes the upstream segment susceptible to commodity price volatility and supply chain disruptions.

The midstream phase involves specialized feed additive manufacturers, who formulate, blend, and process these raw ingredients into marketable products, often utilizing sophisticated technologies like microencapsulation to ensure product stability, shelf life, and targeted release within the animal's digestive system. Distribution channels are highly specialized, relying on direct sales teams for large integrated farming operations and a network of technical distributors or wholesalers who provide value-added services such as nutritional consulting and technical support to smaller farmers and regional feed mills. Direct distribution ensures better control over product handling and technical training, while indirect channels provide wider geographical reach. Transparency and traceability throughout this segment are increasingly demanded by regulators and end-users to ensure compliance with quality and safety standards, particularly concerning the absence of banned substances.

Downstream analysis focuses on the end-users: commercial feed mills, integrated livestock producers, and independent farmers. Large integrated operations often purchase additives in bulk directly from manufacturers and formulate the feed internally, demanding highly technical specifications and price competitiveness. Smaller producers rely heavily on local feed mills that incorporate proprietary additive blends into finished feed products. The consumption phase is highly influenced by technical advisors, veterinarians, and nutritionists who determine the optimal inclusion rates and combination of additives based on animal species, age, environment, and production goals. The ultimate success of the additive is measured by quantifiable improvements in animal health metrics and feed conversion ratios, directly linking product performance to the financial viability of the farm operation. The shift towards non-antibiotic solutions necessitates greater collaboration and data sharing between additive producers and end-users to validate efficacy under real-world conditions.

Veterinary Feed Additives Market Potential Customers

Potential customers for Veterinary Feed Additives are diverse yet primarily concentrated within the commercial animal production sector globally. The largest volume buyers are integrated livestock producers, which include vertically integrated poultry and swine operations that manage breeding, feeding, processing, and distribution. These large corporations require high volumes of standardized, functional additives, such as amino acids, enzymes, and large-scale probiotic formulations, to maintain consistent, high-efficiency production across their facilities. Their buying decisions are driven by proven efficacy, cost-per-performance metrics, reliable supply chains, and regulatory compliance assurances, making them highly strategic customers who often engage in long-term procurement contracts and seek custom formulation partnerships with additive suppliers.

Commercial feed mills represent the second major customer segment, serving as the critical link between additive manufacturers and independent farmers. These mills purchase base additives and incorporate them into thousands of tons of finished feed annually. They prioritize ease of handling, stability, and broad-spectrum applicability of additives, as they serve a wide range of farmer needs and livestock types. Their influence is significant because they often dictate the default additive package provided to non-integrated producers. Additionally, independent large-scale dairy, beef, and aquaculture farms, particularly those focused on high-value or specialty products (e.g., organic, non-GMO, certified welfare), constitute a growing niche customer base, demanding specialized, natural, or certified ingredients like phytogenics and specific mineral complexes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 21.5 billion |

| Market Forecast in 2033 | USD 34.0 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM, Cargill, Adisseo, Evonik Industries, Archer Daniels Midland (ADM), BASF, Novozymes, Chr. Hansen, Alltech, Kemin Industries, Nutreco, Elanco Animal Health, Zinpro Corporation, Biomin, DuPont, Borregaard, Novus International, Phibro Animal Health, Lallemand Animal Nutrition, Impextraco |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Feed Additives Market Key Technology Landscape

The technology landscape within the Veterinary Feed Additives Market is undergoing rapid transformation, moving beyond basic supplementation toward highly engineered and biologically sophisticated solutions. A foundational technological advancement is the development of microencapsulation and targeted delivery systems. These technologies protect sensitive ingredients, such as enzymes, probiotics, and certain vitamins, from degradation during feed processing (pelleting temperatures) and gastric passage in the animal. This protection ensures the active compounds are released precisely in the gut segments where they are most effective, drastically increasing their bioavailability and reducing necessary inclusion rates, thereby improving cost-effectiveness and performance consistency across various farming conditions. Continuous innovation in encapsulation materials, including lipids and polymers, is essential for maintaining product stability and expanding the shelf life of highly volatile compounds like essential oils.

Another crucial technological area is advanced microbial genetics and fermentation science, particularly vital for the production of next-generation probiotics and specialized enzymes. Companies are leveraging synthetic biology and genomic sequencing to identify and culture novel microbial strains with enhanced functions, such as greater acid tolerance, superior competitive exclusion capabilities against pathogens, or high efficiency in producing short-chain fatty acids (SCFAs) in the animal gut. Furthermore, enzyme technology is evolving through directed evolution and protein engineering to create tailored cocktails capable of degrading complex anti-nutritional factors (ANFs) in commonly used feed raw materials, such as non-starch polysaccharides (NSPs), thereby maximizing nutrient accessibility and reducing feed costs. This focus on bio-efficiency is a cornerstone of sustainable animal production, minimizing waste and maximizing resource utilization.

In addition to formulation technology, diagnostic and data integration technologies are significantly influencing additive utilization. Non-invasive monitoring systems and advanced analytical tools are providing real-time data on animal health, feed intake, and gut microbiota composition. This data, often processed through AI platforms, allows for the precise application of functional feed additives. The ability to quickly and accurately analyze the animal's internal environment and external stressors enables nutritionists to select the most appropriate additive (e.g., a specific immunomodulator during a stress period) proactively rather than reactively. This shift towards precision health management, supported by rapid diagnostics and tailored nutritional interventions, represents the technological frontier, linking the biological efficacy of the additive directly to quantifiable, verifiable farm outputs, ensuring robust performance validation for high-value products in the marketplace.

Regional Highlights

The global Veterinary Feed Additives Market exhibits distinct regional dynamics driven by varying regulatory environments, livestock production scales, and consumer preferences. Asia Pacific (APAC) stands out as the highest-growth region, primarily fueled by the rapid expansion and modernization of its poultry and swine sectors, particularly in populous nations like China, India, and Vietnam. The region is actively transitioning from traditional small-scale farming to industrialized operations, necessitating large volumes of performance enhancers (amino acids, enzymes) and health-focused additives (probiotics) to manage intensive production risks and meet rising domestic protein demand. Regulatory convergence toward global standards regarding antibiotic use is accelerating the adoption of alternative growth promoters across APAC markets, positioning the region as a hotbed for technological application and investment, despite challenges related to diverse local regulations and supply chain infrastructure complexities.

North America and Europe represent mature markets characterized by stringent regulatory oversight and high consumer demand for sustainable, welfare-certified, and antibiotic-free products. Europe, specifically, remains the global benchmark for restrictive antibiotic policies, creating robust demand for functional ingredients like acidifiers, prebiotics, and phytogenics that support natural immunity and gut integrity. The European market focuses heavily on scientifically validated, non-GMO, and traceable additives, driving innovation in areas like feed efficiency and emissions reduction (e.g., methane inhibitors in ruminants). North America, while having a slightly varied regulatory approach, also shows strong growth in premium, specialized additives, particularly in the dairy and aquaculture sectors, driven by advanced nutritional research and consumer willingness to pay a premium for enhanced product quality and animal welfare assurances.

Latin America and the Middle East & Africa (MEA) offer significant potential, characterized by increasing industrialization of livestock and aquaculture. Latin America, especially Brazil and Argentina, is a global powerhouse in beef and poultry production, driving demand for high-performance amino acids and specialized mineral supplements essential for optimizing large-scale exports. MEA, while currently smaller, is investing heavily in modernizing its feed industry to enhance food security. Growth in these regions is often linked to infrastructure development and technology transfer, focusing on products that offer resilience against endemic diseases and improve production stability under challenging climatic conditions. The demand here centers on foundational additives and efficient disease-preventive solutions, although sophisticated biological additives are gaining traction as producers look to compete on the international stage with high-quality protein exports.

- Asia Pacific (APAC): Highest growth region driven by massive urbanization, rising protein consumption, and rapid industrialization of poultry and swine farming. Focus on cost-effective performance enhancers and antibiotic replacement strategies.

- North America: Mature market characterized by high consumption of specialized, premium additives (enzymes, specific amino acids) in dairy, beef, and precision poultry systems. Strong emphasis on sustainable production and data-driven formulation.

- Europe: Leading regulatory environment necessitating functional, non-antibiotic alternatives (probiotics, phytogenics). High demand for additives supporting animal welfare, low emissions, and full product traceability.

- Latin America: Major exporter of meat, driving high demand for efficiency additives, particularly essential amino acids and minerals, to optimize large-scale beef and poultry production for the global market.

- Middle East & Africa (MEA): Emerging market focused on enhancing food security. Growth driven by investment in aquaculture and modernizing intensive farming techniques, increasing the need for foundational vitamins and disease prevention additives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Feed Additives Market.- DSM

- Cargill

- Adisseo

- Evonik Industries

- Archer Daniels Midland (ADM)

- BASF

- Novozymes

- Chr. Hansen

- Alltech

- Kemin Industries

- Nutreco

- Elanco Animal Health

- Zinpro Corporation

- Biomin

- DuPont

- Borregaard

- Novus International

- Phibro Animal Health

- Lallemand Animal Nutrition

- Impextraco

Frequently Asked Questions

Analyze common user questions about the Veterinary Feed Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift away from traditional antibiotic growth promoters in animal feed?

The primary driver is the global public health concern over Antimicrobial Resistance (AMR). Regulatory bodies worldwide are implementing stricter limits or outright bans on the non-therapeutic use of antibiotics in livestock, compelling the industry to adopt safe and effective alternatives like probiotics, enzymes, and phytogenics to maintain animal health and production efficiency while safeguarding human health.

Which segment of the Veterinary Feed Additives Market is experiencing the fastest growth?

The Probiotics and Prebiotics segment is witnessing the fastest growth due to their recognized role as highly effective antibiotic alternatives. These biological additives modulate gut microbiota, enhance nutrient absorption, and improve immune function, making them essential for high-intensity poultry and swine production systems focused on antibiotic-free claims.

How do feed additives contribute to environmental sustainability in livestock farming?

Feed additives significantly enhance sustainability by improving Feed Conversion Ratio (FCR) through nutrient optimization, particularly via enzymes that break down complex carbohydrates. This efficiency reduces the total amount of feed required. Additionally, additives like specific minerals or nitrogen-efficient amino acids reduce nutrient excretion (nitrogen and phosphorus) into the environment, minimizing water and soil pollution from farming operations.

What role does technology play in the efficacy of modern feed additives?

Technology, specifically microencapsulation and targeted delivery systems, ensures the stability and precise release of sensitive additives (like enzymes and probiotics) within the animal's digestive tract. Furthermore, AI and precision feeding technologies analyze animal performance data to optimize additive inclusion rates in real time, guaranteeing maximum biological and economic return on investment.

Which geographical region holds the largest market share for Veterinary Feed Additives?

North America and Europe traditionally held the largest value share due to early adoption and high regulatory standards. However, the Asia Pacific region is rapidly expanding and is projected to drive the majority of volume growth, leveraging its massive livestock populations and ongoing industrialization efforts to meet surging domestic demand for animal protein.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager