Veterinary Healthcare for Companion Animals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436528 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Veterinary Healthcare for Companion Animals Market Size

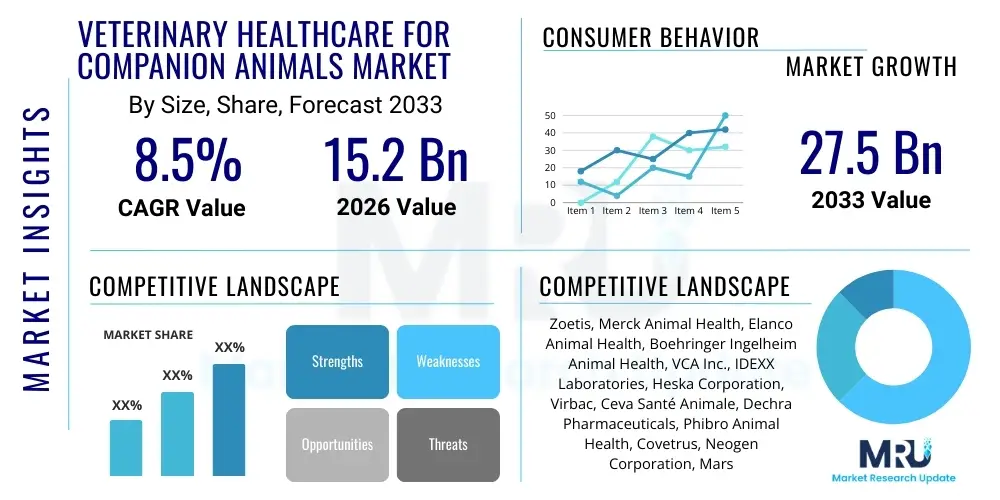

The Veterinary Healthcare for Companion Animals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Veterinary Healthcare for Companion Animals Market introduction

The Veterinary Healthcare for Companion Animals Market encompasses a wide array of products and services designed to maintain and improve the health and well-being of household pets, primarily dogs, cats, horses, and small mammals. This comprehensive ecosystem includes pharmaceuticals (vaccines, antibiotics, parasiticides), diagnostics (imaging, laboratory testing), specialized surgical equipment, and advanced veterinary services provided by clinics and hospitals. The market growth is fundamentally driven by the global phenomenon of pet humanization, where owners treat their animals as integral family members, leading to increased expenditure on premium care, preventive medicine, and sophisticated treatments analogous to human healthcare.

Major applications within this market span preventive care, encompassing regular vaccinations and parasite control; therapeutic care, addressing acute and chronic conditions such as diabetes, arthritis, and cancer; and diagnostic services, which utilize cutting-edge technology for early disease detection. The primary benefits derived from robust veterinary healthcare include extended lifespan, improved quality of life for companion animals, and mitigation of zoonotic disease transmission to human populations. Furthermore, the rising awareness regarding pet nutrition and specialized diets contributes significantly to overall health outcomes, reinforcing the market's trajectory.

Key driving factors accelerating the market include substantial increases in disposable income across developed and emerging economies, a growing global population of companion animals, and the continuous introduction of innovative animal health products. The shift from reactive treatment to proactive, preventive healthcare models, supported by insurance penetration and specialized veterinary practices, provides a stable foundation for sustained market expansion. Technological integration, particularly in diagnostics and telehealth, is transforming service delivery, making high-quality veterinary care more accessible and efficient.

Veterinary Healthcare for Companion Animals Market Executive Summary

The Veterinary Healthcare for Companion Animals Market is characterized by robust business trends centered around consolidation, high investment in research and development (RD), and digitalization of veterinary practices. Major pharmaceutical and diagnostics companies are aggressively acquiring smaller specialized firms to broaden their product portfolios and geographical reach, creating integrated service offerings. Business models are increasingly shifting towards subscription-based wellness plans, ensuring recurrent revenue streams and fostering stronger client relationships. The emphasis on advanced diagnostics, particularly rapid point-of-care testing and sophisticated imaging technologies, is a key market differentiator, enabling quicker and more accurate clinical decision-making across the globe.

Regionally, North America maintains the largest market share, driven by exceptionally high pet ownership rates and superior expenditure per pet, coupled with widespread access to specialized veterinary hospitals. Europe follows, characterized by stringent animal welfare regulations and high adoption rates of pet insurance. The Asia Pacific region is anticipated to demonstrate the fastest growth due to rapid urbanization, increasing middle-class income, and the adoption of Western-style pet ownership trends, particularly in China and India. Regulatory frameworks across all regions are evolving to accommodate novel treatments and digital health solutions, standardizing care protocols.

Segment trends indicate strong growth in the therapeutics segment, particularly for chronic disease management (e.g., oncology and endocrinology), reflecting the aging companion animal population. The biologics segment, including advanced vaccines and monoclonal antibodies, is experiencing rapid commercialization due to their specificity and reduced side effects compared to traditional treatments. Within services, veterinary clinics and hospitals remain the primary delivery channels, though telemedicine and specialized referral centers are gaining prominence. The parasiticide category continues to be a cornerstone of the market, fueled by continuous innovation in dosing forms and broad-spectrum efficacy against prevalent vectors.

AI Impact Analysis on Veterinary Healthcare for Companion Animals Market

Common user questions regarding AI in veterinary healthcare often center on its practical application in daily clinical practice, specifically concerning diagnostic accuracy, workload reduction for veterinarians, and the potential high initial investment costs. Users frequently inquire about AI algorithms used in interpreting medical images (X-rays, CT scans, MRIs) and analyzing pathological samples, seeking evidence of improved diagnostic speed and precision compared to human-only assessment. Furthermore, there is significant interest in how AI can optimize practice management, scheduling, inventory control, and personalize treatment protocols based on vast datasets of patient histories and genetic markers. Concerns often revolve around data privacy, regulatory compliance for AI-driven diagnoses, and the necessity of specialized training for veterinary professionals to effectively utilize these advanced tools.

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the Veterinary Healthcare for Companion Animals Market by enhancing diagnostic capabilities and streamlining operational efficiencies. AI algorithms are proving invaluable in the rapid identification of subtle patterns in medical imaging and laboratory results that might be overlooked by the human eye, leading to earlier disease detection, especially in complex conditions like cancer or cardiac diseases. This technological integration not only increases diagnostic yield but also reduces the time required for diagnosis, significantly improving patient outcomes and owner satisfaction.

Beyond clinical applications, AI is revolutionizing veterinary practice management. Predictive analytics assists clinics in forecasting patient flow, optimizing resource allocation, and managing supply chains effectively, thereby reducing operational overheads. Moreover, in the realm of drug development, AI accelerates the discovery and testing phase for new veterinary pharmaceuticals by modeling drug efficacy and toxicity, paving the way for more targeted and safer medications for pets. This dual impact—clinical accuracy improvement and operational optimization—positions AI as a critical factor in future market dynamics, driving both efficiency and elevated standards of care.

- AI-enhanced diagnostic imaging (radiology and pathology) for rapid, accurate disease detection.

- Predictive modeling for disease outbreak monitoring and preventative health planning in populations.

- Optimization of treatment protocols and personalized medicine based on genetic and historical patient data.

- Automation of administrative tasks, scheduling, and inventory management in veterinary clinics.

- Accelerated drug discovery and development processes for novel veterinary therapeutics and vaccines.

DRO & Impact Forces Of Veterinary Healthcare for Companion Animals Market

The market dynamics are governed by powerful driving forces centered on increasing pet humanization, coupled with substantial restraints related to the affordability and accessibility of advanced care, while compelling opportunities lie in technological integration and expansion into underserved geographies. The primary impact forces include sustained consumer willingness to spend on premium pet products, regulatory pressures concerning animal welfare and pharmaceutical safety, and the continuous pressure from chronic disease prevalence demanding innovative, long-term therapeutic solutions. These forces collectively dictate the investment landscape and strategic decisions of key market participants, driving innovation in areas like non-invasive diagnostic tools and effective pain management therapies.

Key drivers include the rising global rate of pet adoption, particularly among millennials and Generation Z, who exhibit high loyalty and expenditure on their pets' health. The increased availability and adoption of pet insurance schemes globally are mitigating the financial barriers to advanced treatments, encouraging owners to opt for more expensive, specialized procedures. Furthermore, advancements in veterinary medicine, mirroring human healthcare progress—such as sophisticated surgical techniques, chemotherapy, and regenerative medicine—are raising the standard of care and thereby expanding the serviceable market for complex veterinary services.

Conversely, significant restraints hinder growth, notably the high cost associated with advanced diagnostic tools and specialized surgical procedures, making them inaccessible to a large segment of the population, especially in emerging markets. A global shortage of specialized veterinary professionals and veterinary technicians, coupled with high turnover rates in the profession, limits the capacity of clinics to manage the increasing patient load. Opportunities abound in the development of low-cost, high-efficacy drug delivery systems and the aggressive expansion of telehealth services to bridge geographical gaps in care access. The growing focus on nutraceuticals and complementary therapies presents a promising avenue for market diversification and preventative health management.

Segmentation Analysis

The Veterinary Healthcare for Companion Animals Market is meticulously segmented based on product type, animal type, distribution channel, and application, allowing for targeted analysis of market trends and growth pockets. Segmentation by product distinguishes between therapeutics (pharmaceuticals and vaccines), diagnostics (imaging, devices, and consumables), and feed additives, each exhibiting unique growth trajectories influenced by regulatory approvals and technological innovations. Analyzing these segments provides deep insights into where research and development efforts are concentrated and how market players are positioning their portfolio to capture maximum value from the burgeoning companion animal health sector.

Segmentation by animal type is critical, as treatment needs and associated expenditures vary significantly between dogs, cats, and other small companion animals. Dogs generally command the largest share due to their population size and the breadth of specialized services they require, while the cat segment is rapidly catching up, driven by increased recognition of species-specific health requirements and the growth of indoor-only cat populations. Furthermore, understanding the distribution channel segmentation—including veterinary hospitals, pharmacies, and online retail—is essential for optimizing supply chain logistics and ensuring efficient market penetration across diverse geographical areas. This layered segmentation framework offers a granular view of consumer behavior and clinical demand patterns.

- Product Type:

- Pharmaceuticals (Antibiotics, Antiparasitics, Pain Management, Others)

- Vaccines (Core Vaccines, Non-Core Vaccines)

- Medicated Feed Additives

- Diagnostics (Imaging Systems, Consumables, Clinical Chemistry Analyzers)

- Animal Type:

- Dogs

- Cats

- Horses

- Other Companion Animals (Rabbits, Ferrets, Birds)

- Application:

- Preventive Care

- Therapeutic Care

- Diagnostic Services

- Surgical Procedures

- Distribution Channel:

- Veterinary Hospitals and Clinics

- Retail Pharmacies

- Online Pharmacy/E-commerce

- Distributors

Value Chain Analysis For Veterinary Healthcare for Companion Animals Market

The value chain for the Veterinary Healthcare for Companion Animals Market begins with upstream activities involving intensive research and development (RD) by animal health pharmaceutical and biotechnology companies. This stage focuses on the discovery of novel molecules, rigorous clinical trials, and obtaining stringent regulatory approvals from bodies like the FDA Center for Veterinary Medicine (CVM) or the European Medicines Agency (EMA). Key upstream suppliers include manufacturers of active pharmaceutical ingredients (APIs), specialized medical device components, and advanced diagnostic reagents. Efficiency in this stage determines the pipeline robustness and the speed of market entry for innovative products, establishing the foundation of market competitiveness.

Midstream activities primarily encompass manufacturing, formulation, and packaging of final products, ensuring compliance with Good Manufacturing Practices (GMP). Following manufacturing, products move through complex distribution channels. Direct distribution is common for high-value or specialized products sold directly to large veterinary corporate groups or research institutions. Indirect distribution, leveraging major regional and global wholesalers and distributors, ensures widespread availability to thousands of independent veterinary clinics, retail pharmacies, and, increasingly, e-commerce platforms. The choice of channel significantly impacts inventory management, pricing structures, and logistical complexity.

The downstream segment involves the service providers—veterinary hospitals, specialized referral centers, and general practice clinics—who represent the ultimate point of delivery to the end-users (pet owners). These providers use the supplied products and devices to render diagnostic, preventive, and therapeutic services. The success of the downstream stage hinges on the quality of veterinary training, adoption of technology, and effective client communication. The rise of multi-site veterinary corporate groups is consolidating purchasing power in the downstream market, influencing supplier pricing and product negotiation dynamics.

Veterinary Healthcare for Companion Animals Market Potential Customers

The primary end-users and buyers of veterinary healthcare products and services are highly segmented, predominantly consisting of individual companion animal owners who are responsible for the well-being of their pets. This demographic segment can be further categorized based on their willingness to spend and their approach to preventive versus reactive care, often correlating with disposable income and education levels regarding animal health. Owners prioritizing pet humanization are the most valuable customers, consistently investing in premium food, preventative medication, and specialized veterinary procedures, viewing these expenditures as essential quality-of-life investments.

Institutional buyers represent another significant customer segment. This includes professional organizations such as large veterinary corporate groups (e.g., VCA, Banfield, IVC Evidensia), university veterinary teaching hospitals, and government agencies involved in animal welfare and public health. These entities require bulk purchasing of pharmaceuticals, sophisticated diagnostic equipment, and ongoing support services, driven by standardized protocols and centralized procurement strategies. Their purchasing decisions are often based on efficacy, volume discounts, and robust technical support offered by manufacturers and distributors.

Finally, emerging customer segments include pet insurance providers, who act as indirect payers and influencers by defining covered treatments, and pet wellness centers focusing on holistic and non-traditional therapies. The continuous expansion of e-commerce platforms also characterizes a growing customer base that seeks convenience and competitive pricing for routine health products like parasiticides and joint supplements, effectively bypassing traditional clinical distribution channels for certain non-prescription items.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis, Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, VCA Inc., IDEXX Laboratories, Heska Corporation, Virbac, Ceva Santé Animale, Dechra Pharmaceuticals, Phibro Animal Health, Covetrus, Neogen Corporation, Mars Inc. (Veterinary Health Group), Kindred Biosciences, Agrolife, Biogenesis Bago, Parnell Pharmaceuticals, Aratana Therapeutics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Healthcare for Companion Animals Market Key Technology Landscape

The technology landscape within the Veterinary Healthcare for Companion Animals Market is characterized by rapid adoption of tools previously exclusive to human medicine, focusing on enhancing diagnostic speed, therapeutic precision, and practice efficiency. Advanced imaging modalities, including high-resolution digital radiography, computed tomography (CT), and magnetic resonance imaging (MRI), are becoming standard features in specialized veterinary centers, allowing for non-invasive, detailed anatomical analysis crucial for neurology, orthopedics, and oncology. Furthermore, telemedicine platforms and remote monitoring devices, such as wearable sensors tracking vital signs and activity levels, are revolutionizing chronic disease management and post-operative care, enabling veterinarians to maintain continuous contact with patients and intervene proactively.

A major technological driver is the integration of sophisticated in-vitro diagnostics (IVD) systems, particularly point-of-care (POC) testing devices. These compact analyzers provide rapid results for hematology, clinical chemistry, and infectious disease screening directly within the clinic setting, dramatically reducing turnaround times and facilitating immediate treatment initiation. This shift minimizes reliance on external laboratories for routine testing, improving clinical workflow and profitability. Concurrently, molecular diagnostics, including Polymerase Chain Reaction (PCR) and next-generation sequencing (NGS) technologies, are crucial for identifying pathogens, determining antimicrobial resistance profiles, and understanding genetic predispositions to inherited diseases in specific breeds.

The digitalization of practice management through integrated software solutions is equally transformative. These systems manage electronic health records (EHRs), billing, inventory, and client communications, creating seamless data flows that enhance operational productivity and facilitate data-driven decision-making. Moreover, the pharmaceutical sector is leveraging biotechnology for the development of novel biologics, such as therapeutic monoclonal antibodies targeting specific inflammatory or oncological pathways. These targeted therapies represent the cutting edge of veterinary medicine, offering high efficacy with reduced systemic side effects, setting a new benchmark for chronic disease treatment in companion animals.

Regional Highlights

North America: North America, encompassing the United States and Canada, stands as the dominant market for veterinary healthcare for companion animals, primarily due to the deeply entrenched culture of pet humanization and high per-capita spending on pets. The U.S. market, in particular, benefits from a robust pet insurance industry that supports the uptake of expensive, specialized services like advanced oncology and complex orthopedic surgeries. The region has the highest concentration of specialized veterinary referral centers and teaching hospitals, driving the adoption of cutting-edge technologies like regenerative medicine and advanced diagnostic imaging systems. Regulatory frameworks here are mature, fostering innovation while maintaining high standards of drug and vaccine efficacy. The presence of major global animal health company headquarters also fuels continuous RD investment and rapid product commercialization, maintaining North America's leadership position in both revenue generation and technological advancement.

The structure of the veterinary service market in North America is increasingly consolidated, with large corporate groups acquiring independent clinics, leading to standardized protocols and bulk purchasing power. This consolidation impacts pricing and distribution dynamics. Furthermore, the region is witnessing a critical shift towards preventive health strategies, driven by awareness campaigns and subscription-based wellness plans offered by clinics, ensuring regular patient visits and timely vaccinations and parasitic controls. The high incidence of chronic lifestyle diseases in companion animals, mirrored by human trends, ensures sustained demand for long-term therapeutic solutions and specialized nutritional products, solidifying the revenue base for the forecast period.

Europe: Europe represents the second-largest market, characterized by stringent animal welfare regulations, high pet ownership rates, and widespread pet insurance penetration across countries like the UK, Germany, and France. The market is highly mature, focusing intensely on food safety (relevant for production animals, but influencing standards for all veterinary products) and ethical treatment. Key growth drivers include the rapid adoption of digital solutions, such as remote diagnostics and electronic prescription services, particularly in countries with centralized healthcare systems. The aging pet population across Western Europe drives strong demand for geriatric care, pain management products, and therapies for age-related chronic conditions like osteoarthritis and cognitive dysfunction. Investment is significantly directed toward developing safer, more environmentally friendly parasiticides and highly specific vaccines.

However, the European market structure is often fragmented, featuring a mix of highly advanced specialist clinics and small, independent practices, presenting a challenge for homogeneous technology adoption. Economic variances among Central and Eastern European countries compared to Western Europe result in differential spending patterns, though overall market growth remains steady. Regulatory harmonization through the European Medicines Agency (EMA) facilitates market access for new veterinary drugs across member states. The region is a leader in adopting alternative and complementary medicine, including veterinary physiotherapy and nutraceuticals, which contribute significantly to the overall wellness segment of the market.

Asia Pacific (APAC): The APAC region is poised for the fastest Compound Annual Growth Rate (CAGR) due to several socioeconomic factors, including rapid urbanization, substantial growth of the middle-class population, and an escalating trend of pet ownership in metropolitan areas of countries like China, Japan, and South Korea. While the expenditure per pet remains lower than in Western markets, the sheer volume increase in the pet population is the primary growth catalyst. Japan and Australia maintain mature, high-value markets mirroring Western standards, focusing heavily on premium pet food and advanced surgical procedures.

The Chinese and Indian markets are characterized by immense untapped potential. As disposable incomes rise, there is a swift transition from traditional pet care to professional veterinary services. Infrastructure development, including the establishment of modern veterinary clinics and diagnostic laboratories, is crucial for market expansion in these territories. Regulatory landscapes are rapidly evolving; however, challenges remain concerning counterfeit products and fragmented supply chains, necessitating investment in secure distribution infrastructure. The focus in APAC is currently on basic preventive care—vaccinations and parasite control—but sophisticated therapeutics and diagnostics are seeing rapid initial adoption in major urban centers, driven by foreign direct investment and partnerships with global market leaders.

Latin America (LATAM): The LATAM market, led by Brazil and Mexico, exhibits steady growth driven by the increasing awareness of companion animal health and growing disposable incomes. Pet ownership rates are high, but the market is often characterized by a greater concentration on over-the-counter and generic pharmaceuticals due to cost sensitivity. Brazil is a powerhouse in this region, boasting a sophisticated veterinary industry focusing on both companion animals and livestock, enabling shared technological expertise. Economic instability and currency fluctuations occasionally pose a challenge to consistent growth and investment in capital-intensive technologies.

Market expansion hinges on improving access to formal veterinary care in rural and less affluent urban areas. The parasiticides segment is particularly strong due to the high prevalence of vector-borne diseases in tropical and subtropical climates. Opportunities lie in developing locally relevant, cost-effective diagnostic solutions and expanding educational programs for pet owners to emphasize the importance of preventive health measures, driving future growth in higher-value specialty segments.

Middle East and Africa (MEA): The MEA market is highly fragmented and generally underdeveloped compared to global benchmarks, though it presents pockets of high growth in affluent Middle Eastern nations like the UAE and Saudi Arabia. These countries feature high import dependence for specialized veterinary products and services, catering to an expatriate population accustomed to Western standards of pet care. Investment in high-end veterinary hospitals and specialty clinics is noticeable in major cities.

The African continent faces challenges related to infrastructure, limited access to cold chain logistics, and affordability constraints. However, rising awareness and government initiatives to control zoonotic diseases are providing a base for growth in the vaccine and basic pharmaceutical segments. Future growth depends heavily on foreign investment, technology transfer, and localized manufacturing capabilities to overcome logistical and cost barriers in this diverse and complex region.

- North America: Market dominance driven by high pet expenditure, advanced specialization (oncology, orthopedics), and strong pet insurance penetration.

- Europe: Focus on stringent animal welfare regulations, high demand for geriatric care, and rapid adoption of digital veterinary solutions.

- Asia Pacific (APAC): Fastest growing region, fueled by urbanization, rising middle class, and infrastructural development in emerging economies (China, India).

- Latin America (LATAM): Strong growth in Brazil and Mexico, dominated by basic pharmaceuticals and parasiticides due to high prevalence of vector-borne diseases.

- Middle East and Africa (MEA): Emerging market with significant high-end demand in Gulf nations, constrained by infrastructure challenges across Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Healthcare for Companion Animals Market.- Zoetis

- Merck Animal Health

- Elanco Animal Health

- Boehringer Ingelheim Animal Health

- VCA Inc. (Part of Mars Inc.)

- IDEXX Laboratories

- Heska Corporation

- Virbac

- Ceva Santé Animale

- Dechra Pharmaceuticals

- Phibro Animal Health

- Covetrus

- Neogen Corporation

- Kindred Biosciences

- Bayer Animal Health (Acquired by Elanco/Boehringer Ingelheim)

- Aratana Therapeutics (Acquired by Elanco)

- Abaxis (Acquired by Zoetis)

- Parnell Pharmaceuticals

- Biogenesis Bago

- Agrolife

Frequently Asked Questions

Analyze common user questions about the Veterinary Healthcare for Companion Animals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Veterinary Healthcare for Companion Animals Market?

The primary driver is the pervasive trend of pet humanization globally, where companion animals are viewed as family members, leading to increased willingness by owners to invest heavily in advanced preventive care, specialized treatments, and premium nutrition, thereby boosting expenditure per pet.

Which product segment holds the largest share in the veterinary companion animal market?

The pharmaceuticals and therapeutics segment historically holds the largest market share, driven by consistent demand for parasiticides, vaccines, antibiotics, and specialized treatments for chronic conditions such as oncology and pain management in an aging pet population.

How is the rising use of telemedicine impacting veterinary service delivery?

Telemedicine is significantly improving access to care, particularly in remote or underserved areas, by enabling remote consultations, prescription renewals, and continuous patient monitoring. This technology enhances efficiency, reduces non-emergency clinical visits, and supports management of chronic illnesses.

What are the main challenges restraining market growth, despite high demand?

Key challenges include the high cost of advanced veterinary procedures and specialized diagnostic equipment, which can restrict accessibility, coupled with a persistent global shortage of trained and specialized veterinary professionals required to meet the escalating demand for complex care.

Which geographic region is expected to exhibit the highest CAGR during the forecast period?

The Asia Pacific (APAC) region, particularly driven by large economies like China and India, is projected to record the highest CAGR. This growth is fueled by rapid urbanization, rising middle-class income, and the swift adoption of professional veterinary care standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager