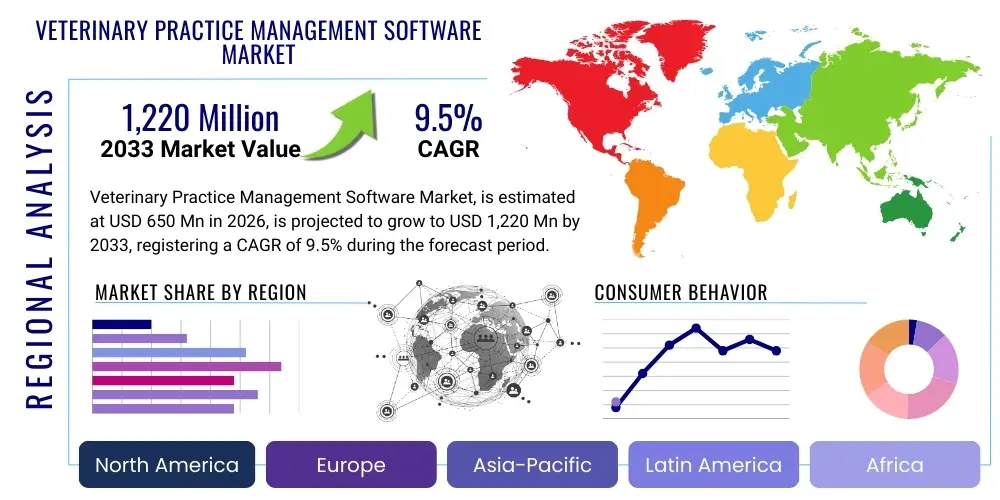

Veterinary Practice Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436110 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Veterinary Practice Management Software Market Size

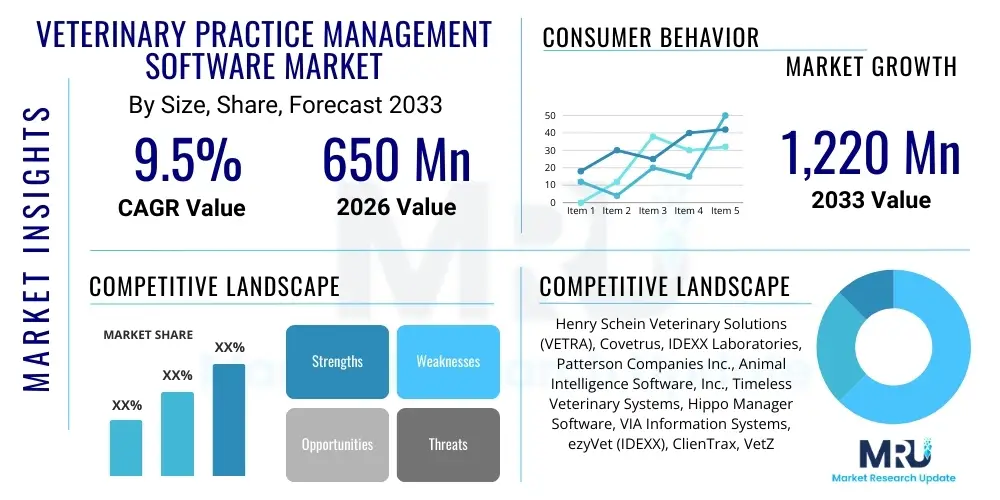

The Veterinary Practice Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650 million in 2026 and is projected to reach USD 1,220 million by the end of the forecast period in 2033.

Veterinary Practice Management Software Market introduction

The Veterinary Practice Management Software (VPMS) market encompasses specialized digital solutions designed to streamline and automate the daily operations of veterinary clinics, hospitals, and specialized animal care facilities. These systems integrate essential functions such as electronic health records (EHRs), appointment scheduling, inventory management, billing, client communication, and laboratory integration into a unified platform. VPMS is critical for enhancing operational efficiency, reducing administrative burden, ensuring accurate record-keeping, and ultimately improving the quality of patient care delivered to animals. The product description highlights its role as the central nervous system for modern veterinary practices, moving away from fragmented, paper-based processes toward seamless digital workflows.

Major applications of VPMS span across general veterinary medicine, specialty veterinary services (e.g., cardiology, oncology), emergency veterinary hospitals, and large animal practices. The primary benefits driving adoption include optimized workflow management, improved financial performance through accurate billing and claims processing, enhanced client engagement via automated reminders and portals, and compliance with increasingly complex regulatory requirements regarding medical record documentation. These systems are foundational for practices seeking scalability and modernization in response to growing pet ownership rates and the increasing complexity of veterinary medical procedures. The integration capabilities with external devices, such as diagnostic equipment and payment processors, further solidifies the essential role of VPMS in contemporary animal healthcare.

The key factors driving the market include the rising global companion animal population, increased expenditure on pet healthcare, and the accelerating trend of digitalization within the healthcare sector overall. Furthermore, the necessity for efficient inventory control, especially for pharmaceuticals and specialized medical supplies, and the demand for robust data security and accessibility for remote patient monitoring are significantly influencing market growth. The shift towards cloud-based solutions, offering greater flexibility and lower upfront capital expenditure compared to traditional on-premise systems, is also a major catalyst, particularly appealing to small and mid-sized veterinary clinics looking for cost-effective modernization strategies.

Veterinary Practice Management Software Market Executive Summary

The Veterinary Practice Management Software market exhibits robust growth driven by favorable business trends, primarily stemming from increased consolidation among veterinary practices and the subsequent demand for standardized, scalable enterprise solutions. Large corporate veterinary groups are increasingly investing in sophisticated VPMS platforms that allow for centralized data management, cross-clinic reporting, and streamlined operational oversight across multiple locations. Furthermore, the shift from localized software licensing to subscription-based Software-as-a-Service (SaaS) models is lowering the barrier to entry for smaller practices while ensuring vendors a predictable recurring revenue stream. Technological innovation focusing on user experience, mobile compatibility, and automated features, such as AI-driven appointment reminders and automated billing audits, defines the prevailing competitive landscape.

Regionally, North America maintains market dominance due to high pet insurance penetration, advanced veterinary healthcare infrastructure, and a substantial concentration of veterinary professionals utilizing sophisticated technology. However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapidly increasing discretionary spending on pets in countries like China and India, coupled with government initiatives promoting animal health and modernization of clinical infrastructure. European markets show stable growth, heavily influenced by stringent data privacy regulations (like GDPR), necessitating VPMS solutions that offer robust compliance features and secure client data management. Latent demand in Latin America and MEA is centered around basic operational needs, transitioning from manual processes to fundamental digital scheduling and patient charting systems, signaling future expansion opportunities for tailored, cost-effective solutions.

In terms of segment trends, the Cloud-based deployment segment is projected to significantly outpace the On-premise segment due to its inherent advantages in accessibility, lower maintenance costs, and ease of updates, aligning with the operational flexibility required by modern veterinary professionals. Within the End-User segment, Veterinary Hospitals and Referral Centers constitute the largest revenue share, demanding complex features such as integrated imaging and specialized module support. The software components segment is witnessing heavy investment in Electronic Health Records (EHRs) and client engagement portals, reflecting the industry's focus on enhancing documentation accuracy and strengthening the relationship between clinics and pet owners. This strategic emphasis on client retention and operational optimization confirms the market's trajectory towards integrated, user-centric platforms.

AI Impact Analysis on Veterinary Practice Management Software Market

User inquiries concerning AI's integration into Veterinary Practice Management Software frequently center on how these technologies can transition VPMS from purely administrative tools to true clinical decision-support systems. Common questions revolve around the effectiveness of AI in automating diagnosis triage, predicting patient adherence to treatment plans, and streamlining complex administrative tasks like coding and compliance checks. Users are particularly interested in the feasibility of leveraging machine learning for predictive inventory management, anticipating seasonal supply needs, and optimizing scheduling based on historical patient flow data. Key concerns often address data privacy, the potential for algorithmic bias in patient management, and the need for seamless integration that does not disrupt existing clinical workflows. Furthermore, there is a strong expectation that AI will enhance client communication capabilities, offering personalized outreach and automated responses to routine inquiries, thereby freeing up veterinary staff for direct patient care.

The analysis confirms that the primary theme driving user interest is operational efficiency coupled with augmented clinical capabilities. Users expect AI tools to drastically reduce the time spent on administrative overhead—a significant burden on veterinary professionals—by automating tasks such as transcription of notes, generating preliminary billing estimates, and monitoring insurance claim statuses. In the clinical domain, AI integration is anticipated to analyze EHR data to flag potential disease risks, recommend diagnostic pathways based on symptoms input, and assist in monitoring treatment efficacy post-procedure. This shift represents a transformation of VPMS from static record-keepers into dynamic intelligence hubs, ensuring better resource allocation, enhanced diagnostic accuracy, and ultimately, superior patient outcomes across the board. The market is thus pivoting towards intelligent VPMS solutions that embed machine learning capabilities directly into the core management functions.

- AI-driven automation of medical note transcription and entry into Electronic Health Records (EHRs).

- Predictive inventory management algorithms to optimize stock levels and minimize waste of pharmaceuticals and supplies.

- Enhanced decision support tools utilizing machine learning for preliminary diagnosis assistance and treatment protocol suggestions.

- Automated appointment scheduling optimization based on patient history, staff availability, and urgency scoring.

- Advanced data analytics for identifying operational bottlenecks and generating actionable insights for practice profitability.

- AI-powered client communication features, including chatbots for routine inquiries and personalized treatment compliance reminders.

- Automated coding and billing assurance to minimize errors and improve revenue cycle management compliance.

DRO & Impact Forces Of Veterinary Practice Management Software Market

The Veterinary Practice Management Software market is propelled by significant Drivers (D) such as the increasing adoption of cloud computing, the growing complexity of medical documentation requiring robust EHR systems, and the imperative for veterinary practices to enhance operational efficiency to manage rising patient volumes. Restraints (R) include high initial setup costs for sophisticated enterprise solutions, reluctance among some smaller or traditional clinics to transition from legacy systems, and ongoing concerns regarding data security and regulatory compliance, particularly concerning the handling of sensitive client and patient information. Opportunities (O) are substantial, centered on the expansion into emerging APAC markets, the development of specialized modules for niche veterinary fields (e.g., equine or exotic animal medicine), and the integration of telehealth and remote monitoring capabilities directly into VPMS platforms. These forces collectively shape the market's trajectory, mandating continuous innovation in security features and workflow optimization to sustain high growth.

The impact forces influencing the market demonstrate a strong positive correlation with technological advancements and evolving consumer behavior in pet care. The increase in pet humanization across North America and Europe translates into higher demand for specialized and technologically advanced veterinary services, requiring sophisticated software to manage complex diagnostic and treatment schedules. Furthermore, the regulatory landscape is tightening globally, especially concerning prescription drug tracking and medical record accuracy, making reliable VPMS essential for mitigating legal and financial risks. Conversely, the restraint posed by the need for technical training and continuous staff education to fully utilize advanced software features acts as a temporary dampener, pushing vendors to develop more intuitive and user-friendly interfaces to facilitate quicker adoption and reduce implementation friction. The overall net effect of these forces is driving the market towards integrated, secure, and user-centric solutions.

Segmentation Analysis

The Veterinary Practice Management Software market is meticulously segmented based on components, deployment types, practice sizes, and end-users, reflecting the diverse needs across the veterinary landscape. Component segmentation allows for the analysis of core software modules versus accompanying services, highlighting where modernization investment is being concentrated, particularly within EHRs and imaging modules. Deployment type segmentation, differentiating between cloud and on-premise solutions, reveals the rapid acceleration towards cloud adoption due to scalability and access benefits. Furthermore, segmenting by practice size is critical, as the feature requirements of a large multi-specialty hospital vastly differ from those of a small, single-doctor clinic, influencing pricing models and feature sets offered by vendors.

This granular segmentation is vital for accurate market forecasting and strategic planning. The end-user analysis provides insight into which operational environments—be it specialty hospitals, research institutes, or mobile clinics—are driving the highest demand for specific features like integration with laboratory systems or mobility solutions. Understanding the interplay between these segments enables market players to tailor their product development strategies and marketing efforts effectively. For instance, focusing on mid-sized practices often requires offering a balance of advanced features and affordability, while targeting enterprise veterinary groups necessitates robust multi-site management and centralized reporting functionalities. The comprehensive segmentation ensures that the diverse demands of the global veterinary health sector are captured and addressed.

- Component

- Software (EHR/EMR, Scheduling, Billing, Inventory, Client Management)

- Services (Implementation, Support, Training)

- Deployment Type

- On-premise

- Cloud-based

- Practice Size

- Small Practices (1-2 Veterinarians)

- Mid-sized Practices (3-10 Veterinarians)

- Large Practices/Hospitals (10+ Veterinarians and Specialty Centers)

- End User

- Veterinary Hospitals and Referral Centers

- Veterinary Clinics

- Research Institutions

- Mobile Veterinary Practices

- Application

- Diagnostic Imaging Management

- Prescription Management

- Client Communication

- Financial Management and Accounting

Value Chain Analysis For Veterinary Practice Management Software Market

The value chain for Veterinary Practice Management Software begins with upstream analysis, focusing on core technology providers, including database management systems developers, cloud infrastructure providers (such as AWS and Azure), and specialized module developers for features like payment processing and diagnostic imaging integration (PACS). These upstream activities are crucial as they define the foundational capabilities, security protocols, and performance metrics of the final VPMS product. Strategic relationships with reliable infrastructure providers and specialized medical technology developers are essential for vendors to ensure scalability, interoperability, and high uptime for their software solutions. This stage requires significant intellectual capital and R&D investment to maintain technological parity and address evolving cybersecurity threats and data management standards.

Midstream activities involve the core VPMS development, customization, and deployment processes carried out by the market vendors. This stage includes software architecture design, user interface development, testing, and continuous updating based on user feedback and regulatory changes. Distribution channels are bifurcated into direct sales models, where large enterprise vendors engage directly with major veterinary hospital chains and corporate groups, and indirect models, often involving channel partners, value-added resellers (VARs), and regional distributors who target small and mid-sized clinics. The indirect channel is crucial for penetration into fragmented regional markets, providing localized support and integration services. Downstream analysis centers on the veterinary end-users—clinics, hospitals, and specialized centers—where the software is implemented and utilized for daily operations, driving the realization of value through improved efficiency and patient care.

The effectiveness of the value chain is highly dependent on robust customer support and training services, categorized under the services component. Direct distribution ensures greater control over the implementation process and customer experience for large-scale deployments, facilitating immediate feedback loops for product refinement. Indirect distribution leverages local expertise for onboarding smaller practices, often bundling the software with hardware or IT services. A well-optimized value chain minimizes latency in updates, maximizes software uptime, and provides continuous educational resources, which are key determinants of customer satisfaction and long-term retention within the competitive VPMS market.

Veterinary Practice Management Software Market Potential Customers

The primary customer base for Veterinary Practice Management Software comprises any entity involved in providing professional animal healthcare services, ranging from small, independent veterinary practitioners to massive, multi-location animal hospital networks. End-users require systems that can handle appointment booking, client communication, and basic patient charting efficiently. Specifically, general veterinary clinics represent the broadest demographic of potential customers, seeking VPMS solutions that are affordable, easy to implement, and robust enough to manage the complexities associated with high-volume routine care, including vaccinations, wellness checks, and minor procedures. Their buying decision is often centered on minimizing administrative costs while improving client retention rates through features like automated reminders and online portals.

A second crucial segment of potential customers includes large veterinary hospitals, specialized referral centers, and university veterinary teaching hospitals. These institutions require highly sophisticated, modular, and customizable VPMS platforms capable of integrating complex functions such as advanced diagnostic imaging (MRI, CT scans), specialized procedure scheduling, laboratory result interfacing, and detailed financial reporting across multiple departments and profit centers. These larger entities often prioritize enterprise-level security, robust data migration services, and the ability to interface seamlessly with complex third-party medical equipment. Additionally, specialty practices focusing on areas like orthopedic surgery, oncology, or exotic animal medicine represent a niche but high-value customer group seeking software with specific customizable templates and detailed patient monitoring features tailored to their complex medical protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 million |

| Market Forecast in 2033 | USD 1,220 million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henry Schein Veterinary Solutions (VETRA), Covetrus, IDEXX Laboratories, Patterson Companies Inc., Animal Intelligence Software, Inc., Timeless Veterinary Systems, Hippo Manager Software, VIA Information Systems, ezyVet (IDEXX), ClienTrax, VetZ GmbH, Medgen, Onward Vet, PIMS (Practice Information Management System), DaySmart Vet, Vetter Software, VetRadar, Provet, RoboVet, VetBLUE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Practice Management Software Market Key Technology Landscape

The technological landscape of the Veterinary Practice Management Software market is rapidly evolving, driven primarily by the shift towards cloud computing architecture and the imperative for seamless system interoperability. Cloud-native VPMS solutions leveraging scalable public or private cloud infrastructure are becoming the industry standard, offering benefits such as remote accessibility, automatic updates, and enhanced data backup capabilities, which are crucial for maintaining business continuity in veterinary operations. Furthermore, the incorporation of advanced cybersecurity protocols, including multi-factor authentication, end-to-end encryption, and HIPAA-compliant (or equivalent regional standard) data storage, is foundational, ensuring the integrity and confidentiality of sensitive patient health information and client data within the digital ecosystem.

A central technological focus is the integration of standardized application programming interfaces (APIs) to allow VPMS platforms to communicate effectively with a wide array of specialized veterinary technology. This includes interfaces for digital radiography (DR/CR) and ultrasound equipment (PACS integration), laboratory information systems (LIS) for automated result importation, and specialized pharmacy management systems for compliance tracking. Mobile technology also plays a significant role, with vendors developing dedicated mobile applications for veterinarians (for rounding and remote patient monitoring) and client portals (for scheduling, telemedicine consultations, and accessing medical records). The current trajectory leans heavily toward integrating AI and machine learning engines for predictive scheduling, clinical decision support, and robotic process automation (RPA) for redundant administrative tasks, defining the future generation of VPMS as intelligent, rather than merely functional, systems.

Regional Highlights

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM) and Middle East & Africa (MEA)

North America currently holds the largest share of the Veterinary Practice Management Software market, largely attributable to the high levels of disposable income spent on pet healthcare and the presence of advanced, highly consolidated veterinary healthcare infrastructure. The United States and Canada are frontrunners in technology adoption, driven by large corporate veterinary groups (VCA, Banfield Pet Hospital) that demand sophisticated, multi-site enterprise resource planning (ERP) solutions integrated with VPMS. The stringent regulatory environment concerning veterinary prescriptions and medical record-keeping necessitates robust digital documentation, fueling continuous investment in compliant VPMS platforms. Furthermore, the region has a high penetration rate of pet insurance, requiring VPMS solutions with efficient automated claims processing and billing functionalities. The competitive environment is mature, favoring vendors who offer advanced features like telemedicine integration and comprehensive data analytics dashboards. Innovation is focused on enhancing client engagement through sophisticated mobile applications and personalized communication tools, ensuring high customer lifetime value.

The U.S. market specifically is characterized by a strong move towards cloud-based SaaS models, offering practices flexibility and reduced IT management burden. Consolidation efforts continue to drive demand for integrated solutions that can standardize workflows across numerous newly acquired clinics, making scalability a non-negotiable feature for VPMS providers targeting this region. Educational resources for training staff on new software implementations are also critical success factors, ensuring rapid and effective system adoption. The sheer volume of veterinary practices, from specialized referral centers to small town clinics, necessitates a diverse portfolio of software solutions, ranging from basic scheduling tools to full-fledged enterprise clinical and financial management systems, all contributing significantly to regional market valuation.

Europe represents a stable and high-growth market, distinguished by significant variations in regulatory requirements and healthcare structures across countries like the UK, Germany, France, and Scandinavia. The adoption rate of VPMS is high, particularly in Western Europe, where the emphasis on animal welfare standards is strong and digitalization efforts are supported by government initiatives aimed at modernizing healthcare, including veterinary services. GDPR compliance is a major driver, compelling practices to use VPMS solutions that prioritize strict data security and privacy management for client information, influencing purchasing decisions significantly. The market is moderately fragmented, with local vendors often dominating specific national markets due to language support and localized regulatory expertise, though larger global players are actively consolidating their presence.

The UK market shows a particular affinity for integrated solutions that link VPMS directly with national veterinary databases and e-prescription services. Germany, known for its rigorous standards, emphasizes systems offering deep integration with specialized diagnostic equipment. A rising trend across Europe is the demand for integrated financial modules that handle complex VAT and local taxation rules seamlessly, alongside features supporting high-quality client communication in multiple languages. Northern European countries lead in the adoption of advanced clinical features, whereas Southern and Eastern European markets are primarily focusing on transitioning from manual records to fundamental digital scheduling and basic EHR functionality, offering substantial future growth opportunities as disposable incomes rise and pet healthcare becomes more advanced.

The APAC region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by explosive growth in the companion animal population, particularly in urban centers of China, Japan, and Australia. Rising middle-class disposable income is directly translating into increased expenditure on sophisticated pet healthcare services, which necessitates digital infrastructure capable of managing higher patient loads and complex procedures. While Australia and New Zealand represent mature VPMS markets with high technology penetration rates, mirroring Western standards, the emerging economies of India and Southeast Asia are the primary growth engines, albeit starting from a lower base.

The challenge in APAC often revolves around addressing the fragmented nature of the market, where a mix of technologically advanced, corporately owned hospitals coexists with numerous small, independent local clinics. This dictates demand for flexible, scalable, and affordable cloud-based VPMS solutions that can be implemented rapidly with minimal upfront infrastructure investment. Language localization and support for varying local regulatory frameworks concerning veterinary practice licenses and drug dispensing are critical requirements for success in markets like Japan and South Korea. Furthermore, the rapid growth of veterinary franchising and corporate chains in China is fostering significant demand for centralized VPMS platforms that enable multi-site management, standardized clinical protocols, and remote performance monitoring across vast geographical distances, underpinning the region's dynamic market expansion.

LATAM and MEA currently represent nascent but rapidly expanding markets for VPMS, characterized by a lower overall technology adoption rate compared to North America and Europe. In LATAM, countries like Brazil and Mexico are leading the charge, fueled by significant urbanization and the subsequent rise in companion animal ownership. The primary market driver here is the shift away from paper-based records to achieve basic operational efficiencies, such as streamlined appointment booking and basic financial tracking. Price sensitivity remains high, favoring vendors who can offer entry-level, cost-effective, cloud-based solutions that require minimal local IT infrastructure support. The market is slowly maturing, with larger veterinary hospital groups beginning to invest in more comprehensive, integrated systems to compete with international standards.

In the MEA region, the growth is concentrated in affluent urban centers within the UAE, Saudi Arabia, and South Africa, where high-end veterinary hospitals cater to an expatriate and wealthy local clientele demanding premium care and modern management tools. The demand is often specific, focusing on modules for exotic animal medicine and advanced diagnostics. Infrastructure challenges, including intermittent internet connectivity and reliance on localized IT support, sometimes restrain the adoption of purely cloud-based models in rural areas, maintaining a small but persistent demand for robust on-premise solutions. Overall, both LATAM and MEA offer substantial greenfield opportunities for vendors capable of providing culturally adapted, flexible, and scalable VPMS solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Practice Management Software Market.- Henry Schein Veterinary Solutions (VETRA)

- Covetrus

- IDEXX Laboratories

- Patterson Companies Inc.

- Animal Intelligence Software, Inc.

- Timeless Veterinary Systems

- Hippo Manager Software

- VIA Information Systems

- ezyVet (IDEXX)

- ClienTrax

- VetZ GmbH

- Medgen

- Onward Vet

- eVetPractice (Covetrus)

- Vetter Software

- DaySmart Vet

- Provet

- RoboVet

- VetBlue

- Animana (IDEXX)

Frequently Asked Questions

Analyze common user questions about the Veterinary Practice Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Veterinary Practice Management Software market?

The Veterinary Practice Management Software market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 9.5% during the forecast period of 2026 to 2033. This growth is primarily fueled by the increasing digitalization of veterinary practices and rising expenditure on pet health services globally.

What are the primary differences between cloud-based and on-premise VPMS deployment models?

Cloud-based VPMS offers flexibility, lower initial capital expenditure, automatic updates, and remote access, ideal for mobile or multi-site practices. On-premise solutions provide greater control over data security and customization but require significant internal IT infrastructure and maintenance, often favored by large university hospitals with strict data governance policies.

How is Artificial Intelligence (AI) influencing the future of Veterinary Practice Management Software?

AI is transforming VPMS by shifting its role from administrative record-keeping to proactive intelligence. Key AI applications include predictive scheduling optimization, automated clinical note generation and transcription, advanced inventory forecasting, and enhanced clinical decision support for veterinarians, leading to significant operational efficiency gains.

Which geographical region dominates the global VPMS market and why?

North America currently holds the largest market share in VPMS due to its mature veterinary healthcare infrastructure, high consumer spending on advanced pet care, significant market consolidation among major veterinary hospital chains, and early adoption of sophisticated, integrated enterprise software solutions.

What are the most crucial functionalities potential customers look for in a modern VPMS system?

Potential customers highly prioritize integrated Electronic Health Records (EHR) for accurate documentation, efficient appointment scheduling systems, robust client communication tools (including portals and automated reminders), reliable inventory management modules to prevent losses, and seamless integration capabilities with diagnostic imaging equipment (PACS) and external laboratories.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager