Vibration test equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433657 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Vibration test equipment Market Size

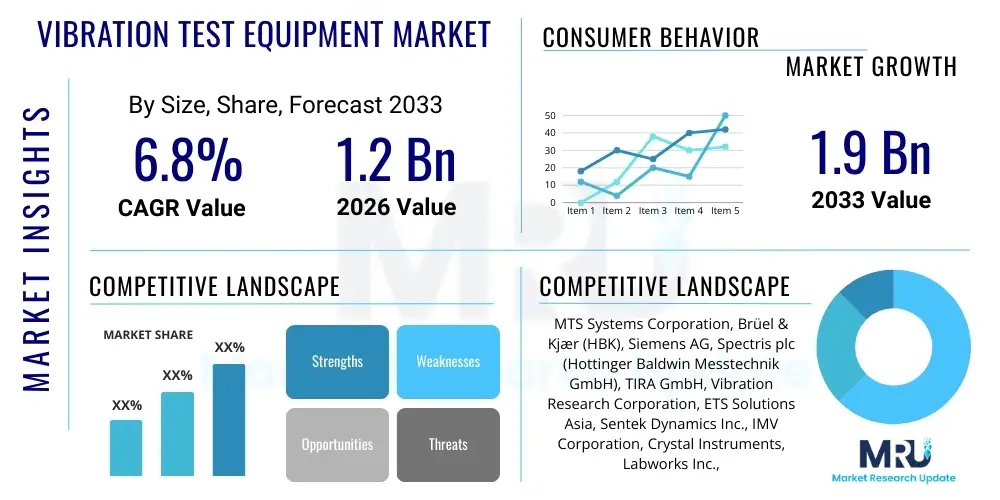

The Vibration test equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Vibration test equipment Market introduction

The Vibration test equipment market encompasses specialized devices designed to simulate real-world vibration and shock environments to assess the durability, reliability, and structural integrity of products and components, crucial for quality assurance across high-reliability industries. These sophisticated systems include shakers (electrodynamic, servo-hydraulic), controllers, sensors, and supporting software, which collectively ensure that critical products, ranging from automotive parts and avionics to consumer electronics, can withstand operational stresses and transportation challenges without failure. The primary applications span rigorous testing phases in research and development laboratories, manufacturing quality control checkpoints, and certification agencies where adherence to strict international standards (such as ISO, MIL-STD, and IEC) is mandatory. The tangible benefits derived from utilizing these systems include reduced product recall rates, accelerated time-to-market due to optimized design cycles, and enhanced overall operational safety and lifetime performance of engineered systems. Key driving factors fueling market expansion are the escalating complexity of modern electronic and mechanical systems, stringent regulatory requirements mandating failure analysis, and the rapid proliferation of electric vehicles and satellite technologies which necessitate highly reliable components under extreme operational conditions.

Vibration test equipment Market Executive Summary

The global Vibration test equipment Market is defined by intense technological competition, driven primarily by the need for higher frequency response ranges, increased payload capacity, and tighter integration with digital modeling environments. Business trends indicate a strong pivot towards combined testing solutions that integrate thermal, vacuum, and vibration testing capabilities, catering to the burgeoning aerospace and defense sectors where space simulation is paramount. Additionally, the shift towards predictive maintenance methodologies is accelerating the demand for portable and continuously operational vibration monitoring equipment within the industrial sector. Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by massive investments in automotive manufacturing, particularly electric vehicle production in China and India, and expanding electronics production bases requiring strict quality control protocols. North America and Europe maintain dominance in terms of technology adoption and high-end testing services, driven by military standards compliance and advanced research activities. Segment trends reveal that the Electrodynamic Shaker segment continues to lead due to its versatility and precision in general testing applications, while the software and services segment is experiencing the highest growth trajectory, spurred by the integration of advanced data analysis, cloud connectivity, and diagnostic capabilities, transforming raw data into actionable engineering insights.

AI Impact Analysis on Vibration test equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vibration test equipment Market predominantly revolve around automation potential, enhanced data processing capabilities, and the integration of predictive intelligence into testing protocols. Key concerns frequently raised include how AI can optimize test profiles to reduce testing time without compromising rigor, the accuracy of AI algorithms in detecting subtle failure patterns that human analysts might miss, and the necessary infrastructure investment required to deploy complex machine learning models within existing testing laboratories. There is a high expectation that AI will standardize and automate the generation of test reports, making compliance easier and less prone to human error, thereby accelerating the certification process for highly regulated components. Furthermore, users are keenly interested in leveraging AI and machine learning (ML) to correlate field data with laboratory simulation results, leading to the creation of more realistic and representative test standards and reducing the gap between simulation and operational reality.

The application of AI in this domain fundamentally shifts vibration testing from a reactive quality check to a proactive predictive tool. AI algorithms can analyze vast datasets generated during vibration tests—including sensor readings, frequency response graphs, and temporal data—to rapidly identify anomalies and predict potential failure points long before catastrophic events occur. This capability drastically improves the efficiency of Design of Experiments (DoE) by suggesting optimal test parameters and sequence adjustments in real-time. Moreover, integrating AI allows for adaptive testing, where the severity or duration of a test is modified dynamically based on the observed structural response, ensuring resources are concentrated on stress points rather than being uniformly applied across the entire test specimen.

This integration also fosters the development of sophisticated Digital Twins. AI models, trained on simulation data and validated with real-world testing, can create high-fidelity virtual replicas of components. These twins allow engineers to simulate millions of lifecycle stress scenarios virtually, minimizing the need for physical prototypes and maximizing material efficiency. The convergence of high-speed data acquisition systems, cloud computing, and advanced AI frameworks positions vibration testing equipment not just as measurement tools, but as critical components in intelligent, closed-loop product development ecosystems, leading to substantial cost savings and profound improvements in product robustness.

- AI-driven optimization of test cycles, reducing total testing duration by suggesting minimal necessary stress application while maintaining high reliability standards.

- Enhanced failure prediction through Machine Learning models identifying subtle non-linear degradation patterns in vibration signatures.

- Automation of test data analysis and report generation, minimizing manual intervention and accelerating compliance certification.

- Development of adaptive testing protocols that dynamically adjust test parameters based on real-time feedback from the specimen's structural response.

- Facilitation of Digital Twin technology by correlating physical test results with simulation models, enhancing the accuracy of virtual life cycle prediction.

- Improved correlation between laboratory tests and actual operational environments using AI to synthesize real-world sensor data into test profiles (Load Synthesis).

- Reduced maintenance downtime for the test equipment itself through AI-powered anomaly detection and predictive servicing schedules for shakers and amplifiers.

DRO & Impact Forces Of Vibration test equipment Market

The market trajectory is significantly influenced by a confluence of driving factors, strict restraining forces, and compelling opportunities that shape investment and innovation within the vibration testing ecosystem. The primary drivers stem from global trends demanding higher product quality, mandatory regulatory adherence in safety-critical sectors, and the technological evolution necessitating robust components for extreme environments such as space exploration and high-speed rail. Restraints primarily revolve around the initial high capital expenditure required for purchasing and installing complex electrodynamic or hydraulic systems, coupled with the need for highly specialized technical expertise to operate and maintain these precision instruments, which limits adoption among smaller enterprises. However, substantial opportunities arise from the ongoing miniaturization of electronics, requiring micro-vibration testing capabilities, and the explosive growth in hybrid and electric vehicle (EV) manufacturing, where battery vibration testing under thermal stress is critical for safety and longevity. These market dynamics are further amplified by several impact forces including the pervasive trend of Industry 4.0 integration, demanding connectivity and remote diagnostics for all testing assets.

Key drivers include the automotive industry's rigorous push for zero-defect production, especially concerning ADAS (Advanced Driver-Assistance Systems) components and EV battery packs which are subject to stringent durability tests against road shock and continuous vibration. In the aerospace and defense sector, the increasing frequency of complex satellite launches and drone deployment mandates comprehensive simulation of launch loads and in-flight environmental stress, requiring advanced multi-axis vibration tables. Furthermore, global safety standards bodies are continually updating regulations, forcing manufacturers across all industries to upgrade or replace legacy testing systems with modern, compliant equipment capable of generating comprehensive, verifiable data logs, thereby ensuring market stability and driving continuous equipment replacement cycles.

Conversely, the high proprietary nature of vibration control software and hardware can lead to vendor lock-in, acting as a restraint. Moreover, the inherent complexity in accurately replicating highly non-linear, multi-directional field vibrations in a controlled laboratory setting remains a technical challenge, requiring expensive, sophisticated controllers and actuation systems. The greatest opportunities lie in the expansion of affordable, portable, and cloud-connected vibration analysis tools targeted at predictive maintenance applications in heavy machinery and infrastructure monitoring. This shift broadens the market scope beyond traditional R&D laboratories into operational field environments, offering high-margin service contracts and software subscriptions related to data analytics and remote diagnostics, thus facilitating market diversification and addressing cost barriers for end-users focused on condition monitoring.

- Drivers (D)

- Escalating safety standards and regulatory compliance requirements across automotive, aerospace, and medical device manufacturing.

- Increasing complexity and component density in modern electronic devices and mechanical systems, demanding rigorous stress testing.

- Rapid growth in Electric Vehicle (EV) production, necessitating specialized battery pack and powertrain vibration endurance testing.

- Expansion of the aerospace and defense sectors, particularly in satellite technology and advanced avionics requiring multi-axis simulation.

- Restraints (R)

- High initial capital investment and operational costs associated with advanced electrodynamic and servo-hydraulic shaker systems.

- Requirement for highly specialized technical expertise for sophisticated test setup, execution, and data interpretation.

- Challenges associated with accurately simulating complex, non-linear, real-world operational vibrations in a controlled lab environment.

- Opportunities (O)

- Integration of IoT and cloud connectivity for real-time monitoring, remote diagnostics, and data logging, enhancing efficiency.

- Development of compact, modular, and portable vibration analysis tools for industrial predictive maintenance applications.

- Focus on combined environmental testing (vibration, thermal, vacuum) to cater to space and defense industry demands.

- Emergence of advanced software solutions featuring AI/ML integration for predictive failure analysis and automated test optimization.

- Impact Forces

- Technological advancements in sensor precision and data acquisition speed, enabling higher frequency testing.

- Global economic cycles influencing capital expenditure budgets for research and quality control equipment.

- Standardization efforts (e.g., ISO 16750 for road vehicles) driving mandatory equipment upgrades.

Segmentation Analysis

The Vibration test equipment Market is extensively segmented based on the type of technology employed, the application sector utilizing the equipment, and the end-user profile requiring the testing services. Analysis of these segments is critical for manufacturers to tailor product development and market penetration strategies effectively. Segmentation by Type primarily differentiates between the driving mechanism—electrodynamic shakers, which dominate due to their frequency range and control precision, and servo-hydraulic systems, which are essential for high-force, low-frequency testing typically required in civil engineering or large component testing. The market is increasingly adopting newer technologies such as servo-electric systems for energy efficiency and specialized pneumatic systems for unique shock applications, though their market share remains relatively niche compared to electrodynamic technology.

The segmentation by Application illustrates the diverse industrial necessity for vibration testing. The Automotive sector commands the largest share, driven by mandatory component reliability checks for powertrain elements, chassis systems, and the increasingly crucial electronic control units (ECUs). The Aerospace & Defense segment, though smaller in volume, accounts for a higher average selling price due to the stringent specifications and high forces required to test rocket components, aircraft structures, and sensitive avionics. Meanwhile, the Electronics sector, specifically consumer electronics and semiconductor manufacturing, is driving demand for micro-vibration testing and highly sensitive measurement systems to ensure device integrity during handling and operational use. The diversity of testing requirements across these industries necessitates manufacturers to offer modular and highly adaptable solutions that can switch easily between different test standards and profiles.

The segmentation by End-User further defines the market landscape, distinguishing between Original Equipment Manufacturers (OEMs), who incorporate testing directly into their product development lifecycle; Third-Party Testing and Certification Agencies, which provide outsourced compliance and validation services; and Research & Development (R&D) Institutions, including universities and government labs, focused on material science and structural dynamics. The services segment, encompassing calibration, maintenance, and software support, is demonstrating accelerated growth as complexity rises, shifting the value proposition from solely hardware provision to comprehensive, recurring service agreements. This focus on service quality and responsiveness becomes a key differentiator among major market competitors.

- By Type

- Electrodynamic Shakers (Dominant segment due to precision and frequency range)

- Servo-Hydraulic Shakers (Preferred for high-force, low-frequency applications)

- Servo-Electric Shakers (Emerging segment focused on energy efficiency and mobility)

- Mechanical Shakers (Used for simple fatigue and screening tests)

- By Application

- Automotive (Powertrain, ADAS, Battery Testing)

- Aerospace & Defense (Avionics, Structural Components, Launch Simulation)

- Electronics & Semiconductors (Consumer devices, component stress screening)

- Civil Engineering (Bridge and structure analysis, seismic simulation)

- Industrial Machinery (Condition monitoring and reliability testing of heavy equipment)

- Others (Medical devices, rail transport)

- By End-User

- Original Equipment Manufacturers (OEMs)

- Research & Development (R&D) Laboratories

- Third-Party Testing and Certification Agencies

- Academic and Government Institutions

- By Component/Product

- Vibration Shakers/Exciters

- Vibration Controllers

- Vibration Sensors and Accelerometers

- Amplifiers and Data Acquisition Systems

- Software and Services

Value Chain Analysis For Vibration test equipment Market

The value chain for the Vibration test equipment Market begins with the upstream suppliers responsible for providing highly specialized raw materials and critical electronic components. This includes manufacturers of high-performance magnets (essential for electrodynamic shakers), precision mechanical components, specialized power electronics for amplifiers, and advanced sensor technologies such as piezoelectric and capacitive accelerometers. The performance and reliability of the final testing system are intrinsically linked to the quality and specification of these fundamental inputs, making strong supplier relationships crucial for managing costs and ensuring component stability. The integration and assembly stage, dominated by key market players, involves complex system integration, proprietary software development, and stringent internal calibration procedures to guarantee the accuracy and compliance of the final test setup. This phase adds the most significant value through intellectual property, software algorithms, and system engineering expertise.

Distribution channels for vibration test equipment are predominantly direct, particularly for large, highly customized systems such as multi-axis hydraulic shakers destined for aerospace or large-scale automotive testing labs. Direct sales allow manufacturers to offer comprehensive pre-sales consultation, installation services, and tailored calibration based on client specifications. For standard shakers, sensors, and controllers, an indirect channel involving specialized industrial distributors and technical representatives is often utilized, especially in geographically dispersed markets like Asia Pacific, providing local support and quicker delivery times. Post-sale activities, encompassing calibration services, annual maintenance contracts (AMCs), and software updates, form a critical part of the downstream value chain, often providing stable, high-margin revenue streams and reinforcing client loyalty. This downstream segment is increasingly prioritized due to the long operational life of the equipment.

The complexity of the equipment mandates that both direct and indirect channels must employ highly trained personnel capable of providing technical training and ongoing application support. The shift towards IoT and connected testing labs is intensifying the downstream focus on software-as-a-service (SaaS) models for data analytics and predictive maintenance of the testing assets themselves. End-users place high value on system reliability and compliance verification, making certification and traceable calibration services provided within the value chain non-negotiable requirements. Therefore, strategic investment in robust service networks and accredited calibration facilities is essential for maintaining a competitive edge and maximizing the lifetime value extracted from the customer base.

Vibration test equipment Market Potential Customers

The primary cohort of potential customers for Vibration test equipment spans several high-value, quality-critical industries where component failure poses significant safety or financial risks. Original Equipment Manufacturers (OEMs) within the automotive sector constitute the largest and most consistent buying group, requiring equipment for routine qualification testing of everything from infotainment systems to structural fatigue analysis of chassis components. In the burgeoning Electric Vehicle (EV) industry, OEMs are heavily investing in specialized thermal and vibration testing chambers to simulate battery pack conditions under extreme stress, positioning them as high-priority clients for next-generation, high-capacity shakers.

Another crucial customer segment involves the aerospace and defense contractors, along with space agencies globally. These entities demand the highest precision and largest, most powerful testing systems to simulate launch vehicle dynamics, satellite deployment stresses, and extreme temperature cycling combined with vibration. Their purchase decisions are driven by military specifications (MIL-STD) and rigorous governmental certification requirements, often resulting in long-term, high-value contracts. Furthermore, independent commercial testing houses and standardization bodies (e.g., TÜV, SGS) form a vital customer base, as they require versatile, multi-standard compliant equipment to service multiple industries, making them targets for mid-range, highly adaptable electrodynamic systems and comprehensive software suites.

Finally, academic and industrial research laboratories, particularly those focusing on material science, structural dynamics, and seismic studies, represent a consistent customer stream, typically seeking specialized, often custom-built equipment for fundamental research purposes. The future growth potential lies significantly with industrial operators requiring proactive condition monitoring. Companies managing large fleets of rotating machinery (power generation, oil & gas, mining) are increasingly moving from traditional manual monitoring to continuous, IoT-integrated vibration monitoring and analysis software, representing a growing market for specialized sensors, data loggers, and analytical service subscriptions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MTS Systems Corporation, Brüel & Kjær (HBK), Siemens AG, Spectris plc (Hottinger Baldwin Messtechnik GmbH), TIRA GmbH, Vibration Research Corporation, ETS Solutions Asia, Sentek Dynamics Inc., IMV Corporation, Crystal Instruments, Labworks Inc., NVT Group, Data Physics Corporation, The Modal Shop, PCL Construction, Star Testing Systems, Wuxi South Star Electro-Mechanical Co., Ltd., Lansmont Corporation, Qualmark Corporation, Thermotron Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vibration test equipment Market Key Technology Landscape

The technological landscape of the Vibration test equipment Market is rapidly evolving, driven by the demand for higher fidelity, increased efficiency, and seamless integration into digital enterprise systems. Modern systems are characterized by sophisticated digital signal processing (DSP) based controllers that offer exceptional loop control, faster sampling rates, and superior resolution for complex random and transient shock testing profiles. Electrodynamic shakers are continually improving in areas such as stiffness and moving mass reduction, allowing for higher frequency testing (up to 50 kHz) while maintaining large payload capacity, essential for testing compact but heavy electronic modules and satellite components. A major technological focus is the development of multi-axis testing systems (e.g., three or six degrees of freedom tables) capable of simultaneously replicating real-world translational and rotational movements, providing a more accurate simulation than traditional single-axis testing.

The sensor and data acquisition technology segment is seeing significant advancements, particularly with the transition from analog to highly reliable digital accelerometers featuring embedded calibration and smart TEDS (Transducer Electronic Data Sheet) functionality. This improves setup time and reduces the margin for error. Furthermore, manufacturers are heavily investing in proprietary software platforms that integrate real-time monitoring, advanced analytical tools (such as fatigue life prediction models and modal analysis), and robust data archival capabilities compliant with stringent industry standards. The ability of the equipment to integrate seamlessly with other testing environments, such as thermal chambers and vacuum systems, through standardized communication protocols (like EtherCAT or proprietary APIs), is now a fundamental requirement for comprehensive environmental stress screening.

Crucially, the market is undergoing digitalization, driven by Industry 4.0 paradigms. This involves implementing IoT connectivity for remote diagnostics, predictive maintenance of the testing equipment itself, and cloud-based data storage and processing. This connectivity facilitates global collaboration and allows engineers to access test data and control parameters from any location. The future technological direction is focused heavily on integrating virtual reality (VR) and augmented reality (AR) for advanced test visualization and setup calibration, alongside further leveraging AI to automate test profile generation based on learned failure characteristics, fundamentally transforming how products are qualified for reliability.

Regional Highlights

The global Vibration test equipment Market exhibits distinct regional dynamics, with high-growth rates projected for emerging economies and technological leadership maintained by established industrial regions. The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily attributable to the substantial government support and private investment poured into advanced manufacturing sectors, particularly in China, South Korea, and Japan. The burgeoning EV manufacturing ecosystem in China and India requires thousands of new testing facilities for battery safety and vehicle durability. Furthermore, the expansion of local aerospace programs and the mass production of consumer electronics drive immense demand for both high-end electrodynamic shakers and affordable, standard testing equipment for quality control on production lines. Regulatory harmonization within key APAC countries is also contributing to the standardization of testing needs, boosting equipment procurement.

North America maintains its position as a dominant market in terms of technological sophistication and high-value contracts, driven heavily by the Aerospace & Defense industry. The U.S. remains the global leader in defense spending and space technology (NASA, SpaceX), necessitating continuous upgrades in multi-axis shakers, high-frequency controllers, and comprehensive environmental testing chambers to meet stringent military standards (MIL-STD-810G). Furthermore, the robust automotive R&D sector, focusing on autonomous driving systems and advanced material science, ensures consistent demand for the latest vibration analysis tools. The strong presence of key technology providers and R&D institutions facilitates early adoption of cutting-edge solutions, including AI-integrated control software and advanced sensors.

Europe represents a mature yet stable market, characterized by stringent European Union (EU) regulations concerning product safety and environmental resilience. Germany, France, and the UK are key markets, propelled by highly advanced automotive manufacturing (driven by internal combustion engine reduction and EV adoption), and significant investments in rail infrastructure and civil engineering research. European companies are leading the charge in developing energy-efficient servo-electric shakers and advanced modal analysis tools. The emphasis in Europe is often on precision, long-term durability testing, and adherence to international quality management systems (ISO standards), ensuring steady replacement and upgrade cycles for existing equipment fleets. The Middle East and Africa (MEA) and Latin America currently hold smaller market shares but offer emerging opportunities in the oil & gas and infrastructure development sectors, requiring heavy-duty vibration monitoring and condition-based maintenance equipment.

- Asia Pacific (APAC): Characterized by the fastest growth, driven by massive domestic automotive (especially EV) and electronics manufacturing expansions. Key markets include China, Japan, South Korea, and India. Investment in local R&D and standardization of quality control protocols are primary growth accelerators.

- North America: Dominates in high-value, high-precision systems due to intense spending in Aerospace, Defense, and advanced R&D related to autonomous vehicles. Emphasis on compliance with MIL-STD and integration of complex digital simulation tools.

- Europe: A mature market focused on regulatory compliance, precision engineering, and sustainable testing solutions. Strong demand from the automotive, heavy machinery, and civil engineering sectors. High adoption rate of advanced analytical software and services.

- Latin America (LATAM): Emerging market driven by infrastructure projects, mining, and regional automotive assembly plants. Demand is focused on robust, reliable, mid-range equipment and condition monitoring solutions.

- Middle East & Africa (MEA): Growth concentrated in the Gulf Cooperation Council (GCC) countries due to massive infrastructure development projects, oil and gas sector maintenance, and diversification into defense industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vibration test equipment Market.- MTS Systems Corporation

- Brüel & Kjær (HBK – Hottinger Brüel & Kjær)

- IMV Corporation

- TIRA GmbH

- Data Physics Corporation

- Spectris plc (including specialized subsidiaries)

- Vibration Research Corporation

- ETS Solutions Asia

- Sentek Dynamics Inc.

- Crystal Instruments

- Labworks Inc.

- The Modal Shop (a unit of PCB Piezotronics)

- Lansmont Corporation

- Thermotron Industries

- Qualmark Corporation

- Vibration Test Systems (VTS)

- Unholtz-Dickie Corporation (A unit of Data Physics)

- Wuxi South Star Electro-Mechanical Co., Ltd.

- PCL Construction (Through specialized testing services)

- Dongling Technologies

Frequently Asked Questions

Analyze common user questions about the Vibration test equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for electrodynamic shakers over hydraulic systems?

Electrodynamic shakers are primarily preferred due to their superior performance in high-frequency testing and their ability to provide highly precise, repeatable control necessary for simulating random vibration profiles, which is crucial for electronics and small component reliability testing.

How is the Electric Vehicle (EV) industry impacting the vibration test equipment market?

The EV industry is profoundly impacting the market by demanding specialized, large-capacity vibration testing systems integrated with thermal chambers. These systems are essential for validating the safety, structural integrity, and longevity of heavy battery packs under combined mechanical stress and extreme temperature cycling, driving growth in the high-force segment.

What role does Industry 4.0 play in the future development of vibration testing controllers?

Industry 4.0 integration mandates that modern controllers must feature high-speed data connectivity (IoT), cloud compatibility, and open APIs for seamless integration with enterprise systems (MES/ERP). This allows for remote control, predictive maintenance of the testing asset, and advanced data analytics using AI/ML algorithms.

Which regional market shows the greatest growth potential for vibration testing equipment?

The Asia Pacific (APAC) region, specifically China and India, exhibits the greatest growth potential due to massive investments in automotive manufacturing (especially EV components), robust consumer electronics production, and increasing adherence to global quality standards, fueling demand for new testing infrastructure.

What are the typical applications of multi-axis vibration testing systems?

Multi-axis systems, offering simultaneous simulation across three or six degrees of freedom, are critical for highly complex applications in the aerospace and defense sectors, used to replicate real-world dynamic forces experienced by satellites during launch and severe in-flight conditions, providing significantly higher test fidelity than single-axis systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager