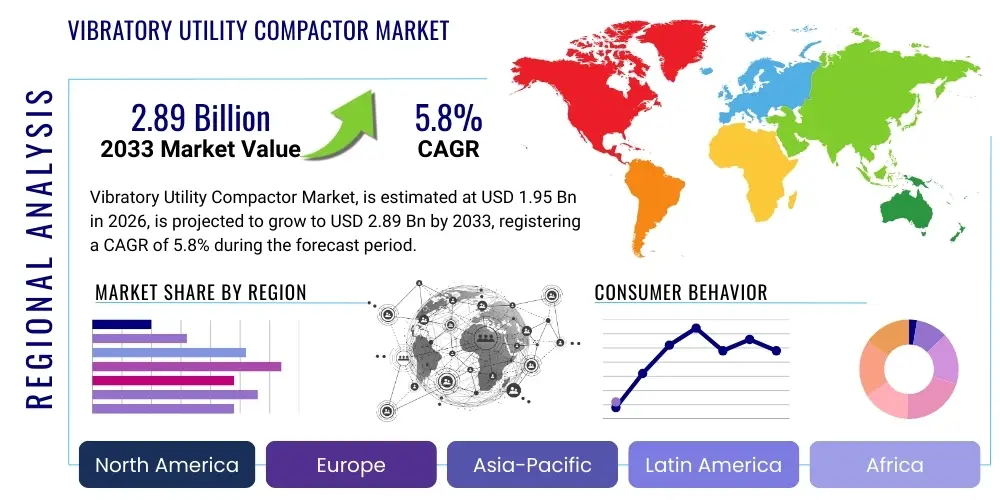

Vibratory Utility Compactor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436629 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Vibratory Utility Compactor Market Size

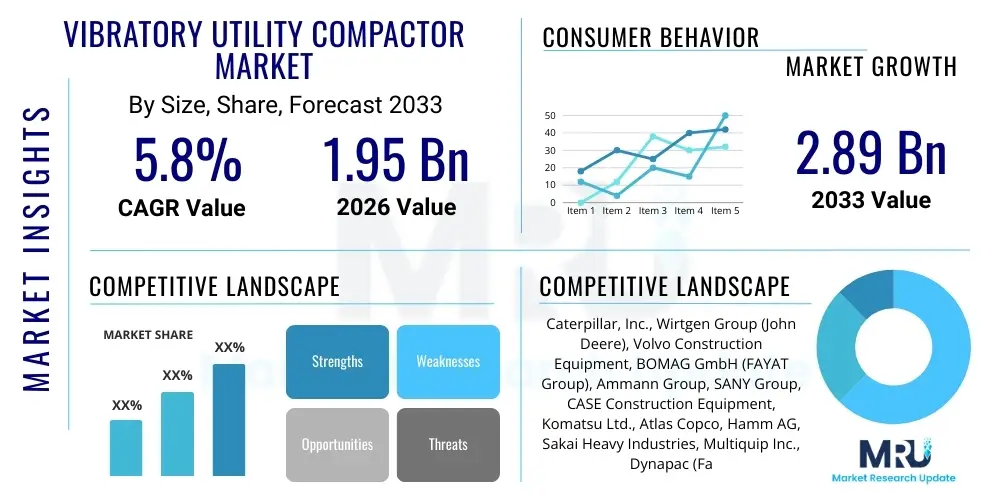

The Vibratory Utility Compactor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.89 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by robust global infrastructure spending, particularly in developing economies where rapid urbanization necessitates expansive road networks, municipal utility installations, and site preparation activities. The demand for reliable, efficient, and versatile compaction equipment that can operate effectively in confined spaces or utility trenches is the core propeller of this market expansion.

The calculation of market size reflects the increasing adoption of technologically advanced compactors featuring telematics, enhanced operator comfort, and superior compaction monitoring systems. While traditional compactors maintain a significant share, the transition towards more environmentally compliant, fuel-efficient models contributes significantly to value appreciation. Furthermore, the cyclic nature of the construction industry, coupled with stringent government regulations concerning pavement quality and subgrade preparation, ensures sustained investment in high-quality vibratory utility compactors by both rental fleets and direct construction contractors.

Vibratory Utility Compactor Market introduction

The Vibratory Utility Compactor Market encompasses equipment designed specifically for efficient soil, asphalt, and aggregate compaction in small-to-medium scale construction projects, particularly focusing on utility trenching, municipal pathways, site preparation for housing developments, and minor road repair. These machines, which often include walk-behind rollers, trench compactors, and small tandem rollers, utilize dynamic forces (vibration) combined with static weight to achieve high density and stability in compacted materials, which is crucial for preventing settling and ensuring long-term structural integrity of infrastructure. The product class is defined by versatility, maneuverability, and optimized performance in confined operational envelopes where larger machinery cannot effectively function.

Major applications of these compactors are concentrated within critical infrastructure sectors, including water and sewage line installation, telecom cable laying, pipeline maintenance, and general landscaping. The primary benefit derived from utilizing vibratory utility compactors is superior material density achieved faster and more uniformly than static compaction methods, leading to reduced rework, lower operational costs, and compliance with stringent engineering specifications. Moreover, modern utility compactors are engineered for enhanced operator safety and reduced noise pollution, making them highly suitable for urban operational environments. The equipment's suitability for trench work, minimizing wall collapse and ensuring proper backfilling, makes it indispensable for utility providers and specialized contractors.

Driving factors for sustained market demand include the exponential rise in global smart city initiatives, which require continuous upgrades and expansions of underground utility networks. Additionally, government stimuli aimed at revitalizing aging infrastructure, particularly in mature economies of North America and Europe, mandate efficient and rapid compaction solutions for repair work. The inherent need for foundation stability in all construction—from residential paving to commercial site development—underpins the necessity of these compactors, positioning them as essential tools in the construction value chain. Furthermore, the replacement cycle driven by technological obsolescence, favoring advanced compaction metrics and autonomous features, consistently fuels new sales.

Vibratory Utility Compactor Market Executive Summary

The Vibratory Utility Compactor Market is undergoing a significant transformation driven by technological integration and shifting infrastructure priorities globally. Current business trends indicate a strong move towards equipment rental models, providing contractors flexibility and minimizing capital expenditure, thereby broadening access to the latest machinery. Manufacturers are focusing intensely on developing compactors featuring real-time compaction measurement (CCV technology), enhanced engine efficiency compliant with Tier 4 Final/Stage V emission standards, and telematics integration for predictive maintenance and utilization tracking. Geographically, Asia Pacific remains the central growth engine, fueled by rapid urbanization and massive public investment in transportation and utility corridors, while North America and Europe emphasize replacement demand focused on safety and environmental compliance.

Regional trends reveal a dichotomy: mature markets prioritize specialized, highly maneuverable, and low-emission equipment for dense urban areas and sensitive utility corridors, whereas emerging markets prioritize affordability and robustness for extensive rural infrastructure build-out. The demand in the Middle East and Africa is tied to large-scale oil and gas pipeline projects and new city development, requiring durable equipment capable of operating in harsh climatic conditions. Segmentation trends highlight the increasing preference for remote-controlled and articulated tandem vibratory rollers due to their versatility and ability to handle various material types, including asphalt and granular soils. Trench compactors, especially those with articulated steering and hydraulic features, are seeing renewed demand as utility trench depths increase and safety standards become stricter, favoring remote operation over manual interaction in hazardous zones.

AI Impact Analysis on Vibratory Utility Compactor Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vibratory Utility Compactor Market predominantly center on automated operation, predictive maintenance capabilities, and optimization of compaction processes. Users are keenly interested in whether AI can interpret continuous compaction values (CCV) data to autonomously adjust vibration frequencies and amplitude for achieving optimal density with minimum passes, thereby reducing fuel consumption and operational time. Concerns often revolve around the initial investment cost for AI-enabled machines and the requirement for highly skilled technicians to manage and calibrate sophisticated sensor systems. Expectations are high regarding AI's ability to minimize human error, automate hazard avoidance (especially in trenching), and generate precise, auditable reports confirming construction quality compliance.

The primary influence of AI lies in transforming the operational efficiency and quality control aspects of compaction. By leveraging machine learning algorithms to analyze sensor data from the drum—such as accelerometer readings, temperature, and GPS coordinates—AI can provide instantaneous feedback and control mechanisms that far surpass the capabilities of traditional operator input. This integration facilitates truly optimized compaction, ensuring uniform density across the surface area regardless of changing soil conditions or material consistency. This technological leap moves the process from being reliant on operator experience to being data-driven and automated, dramatically enhancing project predictability and lowering long-term maintenance costs for the infrastructure built.

Furthermore, AI significantly enhances the maintenance lifecycle of these utility assets. Predictive maintenance protocols, utilizing machine learning to analyze telematics data (engine parameters, hydraulic pressures, vibration history), can accurately forecast component failure before it occurs. This transition from reactive or scheduled maintenance to predictive intervention maximizes machine uptime, reduces unexpected breakdowns on critical job sites, and optimizes inventory management for spare parts. The long-term adoption of AI in compactors will therefore shift procurement decisions toward models offering robust data analytics and integrated smart features, ensuring longevity and lower total cost of ownership for construction firms and rental agencies.

- AI-driven Compaction Optimization: Automated adjustment of frequency and amplitude based on real-time soil response data, ensuring minimum passes for maximum density.

- Predictive Maintenance Systems: Machine learning analysis of operational telemetry data to anticipate mechanical failures, minimizing downtime and extending asset life.

- Autonomous Operation and Guidance: Implementation of sophisticated algorithms for self-driving trench compactors and path planning, enhancing safety in confined or hazardous environments.

- Quality Assurance Reporting: Generation of verifiable, geo-referenced compaction maps and density reports, ensuring regulatory compliance and reducing disputes.

- Enhanced Operator Safety: Utilization of object recognition and proximity sensors guided by AI to prevent collisions and ensure safe operation zones.

DRO & Impact Forces Of Vibratory Utility Compactor Market

The Vibratory Utility Compactor Market dynamics are shaped by a complex interplay of robust demand drivers related to infrastructure development and urbanization, balanced against significant constraints, primarily high capital expenditure and specialized maintenance requirements. The principal driver remains the exponential growth in global population and concurrent migration to urban centers, mandating continuous investment in foundational infrastructure such as roads, utilities, and communication networks, all of which require meticulous compaction. Opportunities arise predominantly from the advancement in automation technology and the integration of sustainable, electric-powered models, appealing to environmentally conscious municipal projects. Restraints, including cyclical economic downturns affecting construction budgets and intense regulatory requirements related to emissions and noise, temper the overall market growth pace, forcing manufacturers to innovate constantly to maintain competitive advantages and market relevance.

Impact forces within the market are predominantly technological and regulatory. Technological impact forces, particularly the rapid integration of telematics and smart compaction technology, are redefining performance expectations and creating a strong divide between legacy equipment and new models. This technological shift creates a powerful replacement cycle driver. Regulatory impact forces, driven by tightening global environmental standards (e.g., EU Stage V, US Tier 4 Final), compel manufacturers to invest heavily in engine technology and alternative power sources, affecting production costs and end-user pricing. Furthermore, the competitive intensity among key manufacturers, who frequently leverage rental partners for market penetration, acts as a significant force shaping pricing strategies and geographical expansion.

The long-term outlook for the market is highly positive, provided economic conditions remain stable, due to the non-negotiable nature of compaction in civil engineering. The resilience of the market is tested by material costs and supply chain volatility, yet the essential nature of utility compactors in facilitating essential services (water, power, communication) ensures continuous, albeit potentially moderated, investment. Key market participants must therefore strategically manage pricing, technology adoption, and distribution networks to effectively capitalize on global infrastructure mandates, especially in the booming markets of Southeast Asia and emerging economies in Africa, where infrastructure deficits are most pronounced.

Segmentation Analysis

The Vibratory Utility Compactor Market is comprehensively segmented based on product type, operational mechanism, application, and geography, allowing stakeholders to precisely target specific construction needs and procurement strategies. Product segmentation differentiates the market based on machine size and configuration, ranging from small walk-behind vibratory plates and tandem rollers to specialized articulated trench compactors. Operational segmentation is critical, distinguishing between mechanical and hydraulic drive systems, and increasingly, between traditional diesel compactors and battery-electric variants. Application segmentation provides insights into end-user focus, splitting demand across road construction and paving, utility trenching, residential landscaping, and maintenance operations. Understanding these granular segments is vital for manufacturers optimizing product portfolios and for suppliers gauging demand fluctuations across the construction cycle.

- Product Type:

- Single Drum Vibratory Rollers (Small/Utility Grade)

- Tandem Vibratory Rollers (Utility Grade, typically up to 3 tons)

- Trench Compactors (Remote-controlled/Articulated)

- Vibratory Plate Compactors (Heavy Duty)

- Operational Mechanism:

- Hydraulic Drive Systems

- Hydrostatic Drive Systems

- Mechanical Drive Systems

- Power Source:

- Diesel-Powered

- Gasoline-Powered

- Electric/Battery-Powered

- Application:

- Road & Highway Maintenance (Patching, Shoulder Work)

- Utility Trenching (Water, Sewage, Gas, Telecom)

- Residential and Commercial Site Preparation

- Municipal Paving and Pathway Construction

Value Chain Analysis For Vibratory Utility Compactor Market

The value chain for the Vibratory Utility Compactor Market begins upstream with raw material suppliers providing specialized steel, hydraulic components, advanced sensors, and engine systems (Tier 4 Final/Stage V compliant). The manufacturing stage involves complex assembly, quality control checks, and integration of sophisticated telematics and compaction monitoring technologies. Efficiency in this stage is heavily reliant on lean manufacturing principles and global sourcing strategies to mitigate commodity price volatility. Downstream analysis focuses on the robust distribution channels, which are predominantly structured around authorized dealer networks, strategic rental partnerships, and, to a lesser extent, direct sales to large municipal or national infrastructure entities. The final stage involves post-sales support, maintenance contracts, and the provision of genuine spare parts, which represents a significant recurring revenue stream for OEMs.

The distribution channel structure is a critical differentiator in this market. Indirect distribution through expansive dealer networks, particularly those offering financial services and local maintenance support, dominates sales volumes globally. Dealers play a crucial role in providing localized technical training and rapid parts delivery, vital for minimizing equipment downtime in the construction sector. Direct distribution, although less common, is utilized for very large governmental tenders or sales to major international construction conglomerates that require specialized fleet management solutions. The proliferation of third-party equipment rental companies has significantly altered the market landscape, providing a crucial avenue for manufacturers to reach small and medium-sized contractors without requiring massive upfront investment from the end-user.

Upstream risks include reliance on specific suppliers for high-performance components like specialized engines and hydraulic pumps, requiring stringent supplier management and inventory optimization. Downstream market power rests increasingly with large rental organizations that dictate fleet specifications and purchasing volume. Therefore, optimizing the flow of information and physical goods—from raw material sourcing to delivery and after-market support—is essential for maximizing profit margins and ensuring long-term customer satisfaction and brand loyalty. Investment in digital platforms connecting manufacturers, dealers, and end-users for maintenance tracking and utilization analytics is becoming standard practice to enhance value chain efficiency.

Vibratory Utility Compactor Market Potential Customers

Potential customers for vibratory utility compactors span a diverse range of sectors within the global construction and infrastructure maintenance ecosystem. The largest segment of end-users comprises general civil engineering contractors and specialized subcontractors focusing on utility installation, road patching, and excavation work. These entities are characterized by high volume usage and a need for reliable, robust equipment capable of meeting tight project deadlines and strict quality specifications. Procurement decisions for this group are typically driven by machine durability, fuel efficiency, and the availability of immediate service support from local dealerships or rental partners.

Another major customer segment includes equipment rental companies. These organizations purchase large fleets of compactors to lease to smaller contractors and project managers, focusing on standardized models that offer high utilization rates, ease of maintenance, and broad applicability across various job sites. Rental companies prioritize machines that integrate telematics for tracking asset location, monitoring operational hours, and facilitating proactive maintenance scheduling, thereby maximizing their return on investment (ROI) over the asset lifecycle. The rental model provides the critical flexibility required by the cyclical nature of the construction industry, particularly for utility-grade equipment.

Furthermore, governmental agencies at the municipal, state, and national levels constitute significant buyers. Public works departments frequently purchase utility compactors for in-house maintenance of municipal roads, parks, sidewalks, and utility infrastructure. Their buying decisions are often influenced by procurement rules prioritizing environmental compliance, local content requirements, and favorable long-term service contracts. Lastly, private developers involved in large-scale residential housing projects and commercial developments represent consistent customers, requiring specialized utility compactors for grading, soil stabilization, and preparatory work before vertical construction commences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.89 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar, Inc., Wirtgen Group (John Deere), Volvo Construction Equipment, BOMAG GmbH (FAYAT Group), Ammann Group, SANY Group, CASE Construction Equipment, Komatsu Ltd., Atlas Copco, Hamm AG, Sakai Heavy Industries, Multiquip Inc., Dynapac (Fayat Group), XCMG, Terex Corporation, Lonking Holdings Limited, Doosan Infracore, JCB, LiuGong Machinery, and Zoomlion Heavy Industry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vibratory Utility Compactor Market Key Technology Landscape

The technological evolution within the Vibratory Utility Compactor Market is focused on three major pillars: precision, connectivity, and sustainability. Precision compaction is achieved through Continuous Compaction Control (CCC) systems, which use accelerometers and GPS to monitor soil stiffness and generate real-time data on compaction metrics, ensuring uniformity and compliance with engineering standards. This technology minimizes over-compaction, thereby saving fuel and wear, and reduces the need for subsequent, costly destructive testing. Connectivity, primarily through advanced telematics systems, allows fleet managers to monitor machine location, performance, fuel consumption, and diagnostic trouble codes remotely. This level of connectivity facilitates predictive maintenance scheduling and optimal fleet deployment, drastically improving overall operational efficiency and providing verifiable data required for modern construction auditing processes.

Sustainability is driving innovation through the development and adoption of electric and hybrid vibratory compactors. Battery-electric models, particularly prominent in the utility and trench compactor segments, offer zero exhaust emissions at the point of use and significantly reduced noise levels, making them ideal for sensitive urban, residential, and indoor construction environments. While currently representing a smaller market share, the demand for battery-powered compaction equipment is rapidly accelerating due to increasingly stringent municipal noise and emission regulations across North America and Europe. Manufacturers are tackling the challenge of battery life and charging infrastructure to ensure electric models can match the operational uptime of their diesel counterparts.

Furthermore, technology is enhancing safety and reducing operator fatigue. Remote-control systems, especially for trench compactors, allow operators to stand clear of hazardous excavation zones, mitigating risks associated with trench collapse and dust exposure. Vibration isolation systems and ergonomic cab designs (for small tandem rollers) improve operator comfort and productivity over long shifts. The integration of sensors for obstacle detection and automatic shutdown mechanisms further contributes to a safer working environment. These technological advancements are moving the utility compactor from a basic mechanical tool to a sophisticated, data-generating asset critical for quality infrastructure delivery.

Regional Highlights

The Vibratory Utility Compactor Market exhibits diverse growth characteristics across key geographical regions, dictated by regional infrastructure funding models, regulatory environments, and the pace of urbanization. Asia Pacific (APAC) currently dominates the market, driven by substantial national investment in mega-infrastructure projects, including high-speed rail, extensive highway development, and the expansion of utility networks across rapidly developing countries such as China, India, and Indonesia. The sheer volume of new construction necessitates a massive inventory of compaction equipment, favoring high volume sales of utility-grade compactors, often prioritizing robust construction over advanced technological features, though smart compaction is rapidly gaining ground in urban centers.

North America (NA) and Europe represent mature markets characterized by steady replacement demand and a strong emphasis on technological sophistication, emission control, and worker safety. In these regions, sales are often driven by regulatory cycles; for instance, the adoption of electric compactors is highest here due to municipal low-emission zone policies. The robust rental market in NA and EU is a key distribution channel, allowing contractors access to the latest models featuring telematics and GPS guidance. Infrastructure spending is often focused on maintenance, rehabilitation, and utility upgrades (e.g., replacement of lead pipes, fiber optic deployment), requiring specialized, high-precision utility compactors capable of navigating densely packed urban environments efficiently.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging high-growth markets where demand is highly volatile but presents significant long-term potential. In MEA, demand is tied to large-scale, planned city projects (like NEOM in Saudi Arabia) and energy sector infrastructure (pipelines and related facilities), requiring durable, high-capacity utility equipment capable of handling high temperatures and desert conditions. LATAM growth is patchy but solidifying, particularly in Brazil and Mexico, driven by renewed public and private investments in urban development and resource extraction infrastructure. Across both regions, the establishment of efficient dealership networks and local service capabilities is critical for sustained market penetration.

- Asia Pacific (APAC): Highest volume growth driven by rapid urbanization, extensive government infrastructure spending (roads, utility trenches, ports), and development of new urban corridors; strong focus on utility and small tandem rollers.

- North America (NA): Stable market characterized by high technology adoption (telematics, smart compaction), strong rental sector dominance, and demand for low-emission equipment for urban renewal and maintenance projects.

- Europe: Focus on regulatory compliance (Stage V emissions), adoption of electric compactors for quiet operation, and demand for highly maneuverable equipment suitable for compact European urban centers and sensitive historical sites.

- Middle East & Africa (MEA): Growth tied to mega-project development, oil & gas pipeline construction, and civil infrastructure build-out; prioritization of durability and climate resilience.

- Latin America (LATAM): Moderate, recovering growth driven by governmental investment in resource infrastructure and urban expansion projects in major economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vibratory Utility Compactor Market.- Caterpillar, Inc.

- Wirtgen Group (John Deere)

- Volvo Construction Equipment

- BOMAG GmbH (FAYAT Group)

- Ammann Group

- SANY Group

- CASE Construction Equipment

- Komatsu Ltd.

- Atlas Copco

- Hamm AG

- Sakai Heavy Industries

- Multiquip Inc.

- Dynapac (Fayat Group)

- XCMG

- Terex Corporation

- Lonking Holdings Limited

- Doosan Infracore

- JCB

- LiuGong Machinery

- Zoomlion Heavy Industry

Frequently Asked Questions

Analyze common user questions about the Vibratory Utility Compactor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Vibratory Utility Compactor Market?

The Vibratory Utility Compactor Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by global investment in utility infrastructure and road maintenance projects.

How is AI impacting the performance and maintenance of utility compactors?

AI is fundamentally enhancing compaction quality through automated optimization (real-time adjustment of vibration based on soil feedback) and is crucial for implementing predictive maintenance systems that maximize machine uptime and reduce operational costs.

Which geographical region represents the largest market share for these compactors?

The Asia Pacific (APAC) region currently holds the largest market share and is projected to exhibit the highest growth rate, fueled by extensive government-backed infrastructure development and rapid urbanization across major economies like China and India.

What key technological trends are reshaping the design of utility compactors?

Key trends include the integration of advanced telematics for fleet management, the adoption of Continuous Compaction Control (CCC) systems for precision, and the increasing market introduction of electric and hybrid compactors to meet stringent urban emission and noise regulations.

What are the primary applications of vibratory utility compactors?

The primary applications include utility trenching (for water, gas, telecom lines), municipal road patching and sidewalk construction, residential and commercial site preparation, and foundation work where confined space maneuverability is critical.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager