Video Door Entry Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434416 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Video Door Entry Systems Market Size

The Video Door Entry Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Video Door Entry Systems Market introduction

The Video Door Entry Systems Market encompasses a range of integrated electronic devices designed to enhance security and communication at building access points, primarily utilized in residential complexes, commercial facilities, and institutional settings. These systems traditionally feature an outdoor station with a camera, microphone, and call button, connected to an indoor unit equipped with a display and intercom functionality. Modern systems increasingly leverage Internet Protocol (IP) technology, enabling remote access, cloud storage, and integration with broader smart home ecosystems, moving beyond basic access control to sophisticated security management platforms. The evolution of these systems is driven by rising security concerns globally and the growing consumer demand for seamless, integrated smart living solutions. The core product offering includes components like monitors, cameras (HD/Fisheye), intercom stations, and networking hardware, catering to diverse security needs from single-family homes to large multi-tenant buildings, emphasizing features such as facial recognition, high-definition video streaming, and multi-platform accessibility.

Major applications of Video Door Entry Systems span residential segments, including apartments and villas, where they provide enhanced convenience and theft deterrence, and the commercial sector, encompassing office buildings, hospitals, and educational institutions, where they streamline visitor management and audit entry logs. The primary benefits derived from these installations include heightened property security through visual verification of visitors, improved convenience via remote monitoring and access granting, and the documentation of entry events, significantly mitigating risks associated with unauthorized access. The increasing urbanization rate, coupled with the necessity for robust security infrastructure in dense metropolitan areas, serves as a fundamental driving factor for market expansion, particularly in developing economies where infrastructure modernization is accelerating rapidly. Furthermore, stringent regulatory mandates concerning building safety and compliance are compelling developers and property owners to integrate advanced video entry solutions, fueling sustained market growth across key geographical areas.

Technological advancements, particularly the widespread adoption of wireless communication standards like Wi-Fi and the incorporation of artificial intelligence for enhanced video analytics, are fundamentally reshaping the competitive landscape. These innovations facilitate easier installation, greater scalability, and superior operational performance, making high-end systems accessible to a broader consumer base. The integration capabilities with other security peripherals, such as smart locks and intrusion alarms, transform video entry systems into central hubs for property security management. The market is also heavily influenced by continuous product innovation focused on miniaturization, enhanced durability, and aesthetic design, meeting the sophisticated demands of modern architecture and interior design preferences. These factors collectively underscore the market's trajectory toward integrated, intelligent, and highly customizable security communication platforms globally.

Video Door Entry Systems Market Executive Summary

The Video Door Entry Systems market is experiencing robust growth characterized by a significant shift from analog and two-wire systems toward advanced IP-based and wireless solutions, driven primarily by the global proliferation of smart homes and increasing integration requirements within the IoT ecosystem. Business trends indicate strong capital expenditure in research and development aimed at AI integration for enhanced facial recognition, automated threat detection, and seamless user authentication, positioning convenience and superior security as key competitive differentiators. Strategic mergers and acquisitions among established security firms and nascent technology providers are consolidating the market, leading to comprehensive security offerings that package door entry systems with cloud services and subscription-based monitoring. Furthermore, sustainability in manufacturing and energy efficiency are emerging requirements, influencing procurement decisions in mature European and North American markets where environmental, social, and governance (ESG) factors are increasingly weighted in purchasing processes.

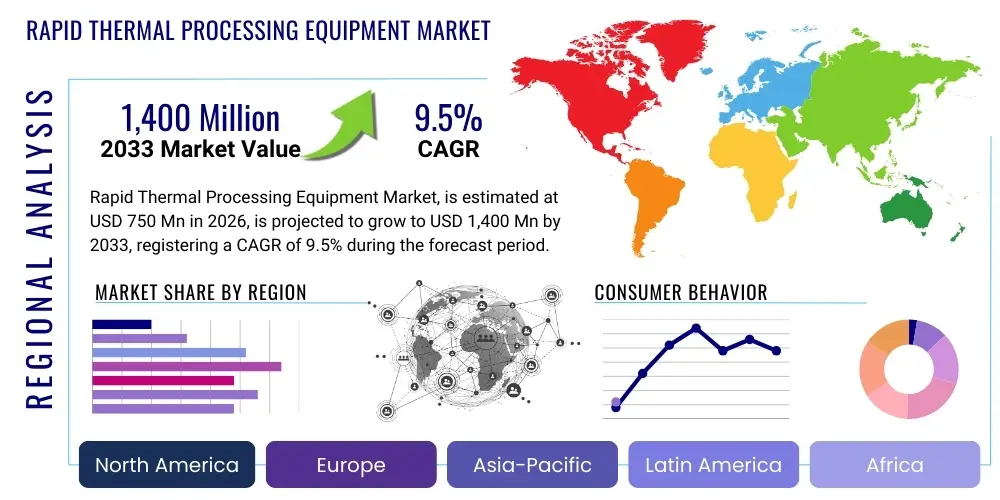

Regional trends reveal that Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by massive infrastructure development, rapid urbanization, and a surge in the construction of smart city projects across countries like China, India, and Southeast Asian nations. North America and Europe maintain substantial market share, acting as early adopters of sophisticated IP and wireless technologies, focusing heavily on integration with established home automation platforms and cybersecurity features essential for protecting sensitive user data. Conversely, regions such as Latin America and the Middle East and Africa (MEA) are seeing accelerated adoption, particularly in high-end residential and secure government facilities, largely driven by escalating regional security concerns, though adoption often concentrates around major urban centers due to infrastructure limitations outside these hubs.

Segment trends demonstrate that the IP-based segment holds significant dominance due to its superior scalability, enhanced video quality, and capacity for deep integration with various third-party applications and cloud services, vastly outperforming traditional analog segments. Within the end-user vertical, the residential segment continues to be the largest consumer base, propelled by DIY-friendly wireless systems and the overall expansion of the smart home movement. However, the commercial and institutional segment, particularly within large multi-dwelling units (MDUs) and offices, is demonstrating rapid revenue acceleration, primarily due to the complex requirements for visitor management, audit trails, and centralized security control that sophisticated video entry systems provide. The shift toward subscription models for cloud storage and remote maintenance services is also transforming revenue streams, ensuring steady recurring income for service providers and adding value beyond initial hardware sales, reinforcing market stability.

AI Impact Analysis on Video Door Entry Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on Video Door Entry Systems predominantly focus on how AI enhances practical security functions, addresses privacy concerns related to biometric data, and improves user convenience. Common questions revolve around the accuracy and reliability of AI-driven facial recognition in diverse conditions (e.g., low light, masks), the integration of sophisticated anomaly detection capabilities to flag suspicious loitering or package theft, and the long-term cost implications of requiring advanced processing power or cloud infrastructure for AI algorithms. Users are keenly interested in understanding the balance between enhanced personalization, such as tailored visitor greetings or specific access permissions, and the regulatory challenges associated with storing and processing sensitive personal identifiable information (PII) captured by AI systems. This underscores a central theme: the market is moving toward proactive, intelligent security verification, but consumer trust hinges on transparency regarding data governance and demonstrable improvements in security efficacy over traditional systems.

- AI facilitates highly accurate facial and voice recognition for seamless, keyless entry, improving speed and convenience.

- Advanced video analytics, powered by AI, enable precise detection of unusual activities, loitering, and package delivery/theft events, transforming systems from reactive to proactive security tools.

- Machine learning algorithms optimize bandwidth usage and video compression, ensuring high-quality streaming even in constrained network environments.

- AI enhances cybersecurity by continuously monitoring system integrity and identifying potential vulnerabilities or unauthorized access attempts in real-time.

- Integration of natural language processing (NLP) allows for intelligent voice interaction and guided instructions for visitors or delivery personnel, improving operational efficiency.

- AI-driven personalization permits custom access rules, temporary visitor codes, and context-aware notifications, enhancing overall user experience.

- Predictive maintenance features utilize AI to analyze system performance data, alerting administrators to potential hardware failures before they occur, minimizing downtime.

DRO & Impact Forces Of Video Door Entry Systems Market

The Video Door Entry Systems Market is significantly influenced by a confluence of accelerating drivers, structural restraints, and considerable opportunities, all subjected to dynamic external impact forces. Primary drivers include the global expansion of the smart home ecosystem, which inherently requires integrated security access solutions, alongside dramatically increasing public safety and security concerns globally, compelling both residential and commercial sectors to upgrade their perimeter security. Technological advancements, particularly in IP connectivity, AI-driven analytics, and wireless installation ease, further accelerate adoption. However, market growth faces restraints such as high initial investment costs for sophisticated IP and PoE (Power over Ethernet) systems, significant data privacy concerns related to biometric collection and cloud storage, and interoperability challenges arising from fragmented standards across various smart home device manufacturers. Opportunities reside in developing highly secure, affordable, and easy-to-install wireless systems tailored for the vast retrofit market, expanding cloud-based subscription services for monitoring and data retention, and targeting emerging markets in APAC and MEA undergoing rapid digitalization and infrastructure modernization. These forces, when combined, create a complex market landscape where innovation in data security and seamless integration will determine competitive success.

Segmentation Analysis

The Video Door Entry Systems Market is comprehensively segmented based on technology, product type, end-user application, and geographical region, offering a granular view of market dynamics and adoption patterns. The technological segmentation is pivotal, showcasing the rapid migration from legacy analog and two-wire systems, which are cost-effective but limited in features, toward advanced IP-based systems that offer superior connectivity, scalability, and integration capabilities, representing the primary growth vector. Product type differentiation separates video door phones (for single entrances), integrated video intercom systems (for multi-apartment units or complex commercial structures), and specialized components like software and monitoring stations, each catering to specific scale and complexity requirements. End-user classification highlights the varying demands of the large residential segment versus the higher security and regulatory needs of the commercial, institutional, and government sectors, revealing distinct purchasing behaviors and feature preferences, with the residential sector focusing on ease of use and affordability, while commercial applications prioritize robustness and advanced access control features such as auditing and centralized management.

- By Technology:

- Analog

- IP-based (Internet Protocol)

- 2-Wire/Bus Systems

- Wireless Systems

- By Product Type:

- Video Door Phones

- Video Intercom Systems (MDUs)

- Software and Services

- By End-User:

- Residential (Single Family Homes, Apartments/Villas)

- Commercial (Office Buildings, Retail)

- Institutional (Hospitals, Schools, Government Buildings)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Video Door Entry Systems Market

The value chain for the Video Door Entry Systems Market begins with upstream activities centered on the procurement and manufacturing of critical electronic components, including high-resolution camera sensors, specialized microprocessors (often leveraging high-performance CPUs/GPUs for AI processing), networking modules, and display panels. Key suppliers are typically concentrated in Asian economies, which provide essential components at competitive scales, necessitating robust quality control and intellectual property protection throughout the sourcing phase. Research and Development (R&D) activities constitute a core value-added step, focusing on developing proprietary algorithms for video compression, biometric recognition, and secure communication protocols (e.g., end-to-end encryption) to maintain a competitive technological edge. Component standardization and supply chain resilience, especially in the wake of global semiconductor shortages, are crucial factors impacting manufacturing timelines and final product costs, emphasizing the strategic importance of long-term supplier relationships.

The downstream segment encompasses the distribution, installation, and post-sales support of the finished systems, interacting directly with end-users and large institutional buyers. Distribution channels are bifurcated into direct and indirect routes. Direct sales often cater to large institutional projects, such as smart city developments or major residential builders, allowing manufacturers to maintain tight control over pricing and customized installation requirements. The indirect channel relies heavily on specialized security integrators, certified installers, and wholesale distributors who provide crucial localized technical expertise and facilitate penetration into the broad residential retrofit and SME (Small and Medium Enterprise) markets. The quality of installation and subsequent maintenance services, including software updates and cloud service uptime, are critical determinants of customer satisfaction and long-term brand loyalty, necessitating substantial investment in certified partner training programs.

The distribution ecosystem is further stratified by the type of product being marketed. Traditional analog systems are often sold through conventional electrical wholesalers and hardware stores due to their simplicity, while advanced IP-based systems require specialized security system integrators capable of managing complex network infrastructures and integrating the door entry unit with broader building management systems (BMS). E-commerce platforms are increasingly vital for the direct-to-consumer (D2C) sales of wireless and DIY-friendly video door entry systems, offering convenience and rapid market reach. Post-sales support, increasingly bundled as part of a recurring revenue stream (SaaS model for cloud storage and monitoring), adds significant value and stabilizes the manufacturer’s income base, transforming the product from a one-time hardware purchase into a long-term service relationship. Effective management of this multi-faceted distribution channel is crucial for maximizing market coverage and ensuring product performance consistency.

Video Door Entry Systems Market Potential Customers

Potential customers for Video Door Entry Systems span a broad spectrum of property ownership and management entities, categorized primarily by their scale and complexity of security requirements. The largest volume segment consists of homeowners and individual apartment residents who seek systems that offer basic visual verification, remote access control, and seamless integration with existing smart home platforms like Amazon Alexa or Google Home. These buyers prioritize ease of installation (often wireless solutions), affordability, and a strong user experience via mobile applications. The rapidly expanding Multi-Dwelling Unit (MDU) sector, including apartment complexes, condominiums, and housing associations, represents a high-value customer base requiring scalable, networked intercom solutions capable of managing hundreds of independent units from a centralized administrative point, emphasizing features like integrated package delivery management and visitor logging.

The commercial sector forms another critical customer group, encompassing corporate offices, retail establishments, banks, and data centers. These end-users demand robust, high-security systems integrated with comprehensive access control (e.g., integration with employee ID badge systems) and video surveillance networks, often prioritizing Power over Ethernet (PoE) infrastructure for reliability and centralized power management. For commercial clients, features such as tamper resistance, encrypted communication, and the ability to maintain detailed, compliant audit trails of all access events are paramount considerations. System procurement in this segment is typically managed by facilities managers or Chief Security Officers, focusing on total cost of ownership (TCO) and compliance with industry-specific security standards, necessitating strong service level agreements (SLAs) from vendors.

Lastly, the institutional and governmental segments, including hospitals, universities, military bases, and critical infrastructure facilities, represent the highest-tier customer segment requiring the most advanced, highly customized video entry solutions. These customers prioritize military-grade encryption, redundancy, extreme durability, and seamless integration with existing campus-wide or facility-wide security management platforms. Procurement decisions are heavily influenced by stringent government regulations, security certifications, and the vendor’s capacity to provide long-term maintenance and scalable solutions suitable for future expansion. The increasing focus on smart city initiatives worldwide further elevates governments as strategic customers, requiring large-scale, interconnected video entry solutions across public housing and municipal buildings to enhance urban security management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aiphone Corporation, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Honeywell International Inc., Legrand SA, Comelit Group SpA, Akuvox, Ring (Amazon), DoorBird (Bird Home Automation GmbH), Fermax, Panasonic Corporation, Siedle & Söhne GmbH & Co. KG, Bticino (Legrand Group), ZKTeco Co., Ltd., Kocom Co., Ltd., 2N Telekomunikace (Axis Communications), TMEzon, Videotronic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Video Door Entry Systems Market Key Technology Landscape

The technological landscape of the Video Door Entry Systems market is defined by rapid convergence with general Internet of Things (IoT) protocols and significant advancements in digital imaging and biometric authentication methods. IP-based infrastructure (utilizing TCP/IP protocols) stands as the foundational technology, enabling high-definition video transmission, integrated cloud services, and scalability across large networks, replacing outdated analog and 2-wire systems which lacked the necessary bandwidth and integration capacity. Power over Ethernet (PoE) technology is crucial within this landscape, simplifying installation and reducing wiring complexity by delivering both data and electrical power over a single standard Ethernet cable, making it the preferred method for commercial and high-end residential installations due to its reliability and cost efficiency in large-scale deployments. The widespread adoption of Wi-Fi and specialized low-power wide-area networks (LPWAN) protocols further supports the growth of wireless, battery-operated door entry devices, catering directly to the rapidly expanding DIY and retrofit market segments, emphasizing modularity and simplified consumer setup.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly integrated at both the edge (within the door station hardware) and in the cloud processing layer. These advanced technologies power sophisticated features such as highly secure facial recognition for hands-free access, differentiating between authorized individuals, visitors, and unknown persons with high accuracy. AI also fuels advanced video analytics, enabling the system to detect behavioral anomalies, identify package drop-offs, and filter out false alarms triggered by environmental factors like rain or moving shadows, thereby dramatically improving the system's practical utility as a security tool. Furthermore, advancements in camera technology, including Wide Dynamic Range (WDR) and thermal imaging capabilities, ensure clear visual identification regardless of challenging lighting conditions, such as intense backlighting or complete darkness, which is essential for consistent security performance.

The integration focus is heavily skewed towards interoperability standards, ensuring that Video Door Entry Systems function seamlessly within a broader smart home or building management ecosystem. Open protocols like ONVIF (Open Network Video Interface Forum) and standardized APIs (Application Programming Interfaces) facilitate easy connectivity with smart locks, intruder alarms, central security panels, and virtual assistants. Cloud technology is vital, enabling remote monitoring, encrypted data storage for video footage, over-the-air firmware updates, and subscription-based remote diagnostics and maintenance services, shifting the market toward a service-oriented model. The persistent challenge remains balancing these cutting-edge features with robust cybersecurity measures, ensuring data privacy compliant with regulations like GDPR and CCPA, as these highly connected devices present potential vulnerability points if not securely designed and managed throughout their operational lifecycle.

Regional Highlights

- North America: This region is characterized by high consumer spending power, leading to early and aggressive adoption of advanced, IP-based, and smart-integrated video entry systems. The market is dominated by wireless and DIY solutions (e.g., Ring, DoorBird), driven by the robust smart home penetration and a strong preference for cloud-based monitoring and subscription services. Regulatory frameworks concerning data security and the high concentration of large commercial infrastructure projects mandate the use of highly encrypted and reliable systems, positioning North America as a key market for innovation in biometric and AI-driven access control solutions, particularly in the multi-dwelling unit (MDU) sector.

- Europe: Europe represents a mature market with stringent regulations (notably GDPR) heavily influencing system design, necessitating strong data encryption and privacy-by-design principles. Western Europe (Germany, UK, France) leads in the adoption of sophisticated 2-wire bus systems for retrofit projects and high-end IP systems for new construction, prioritizing energy efficiency and aesthetic integration. The trend here is moving toward comprehensive building automation integration, where the door entry system is a vital component of the overall security and climate control network, reflecting a strong demand for high-quality, reliable, and standardized products.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, massive government investment in smart city infrastructure, and explosive growth in the residential construction sector across China, India, and Southeast Asia. The market is highly price-sensitive but increasingly feature-conscious, resulting in a dual demand for both highly affordable, basic systems and cutting-edge biometric solutions used in high-density urban developments and centralized residential towers. Local manufacturing giants dominate the supply chain, focusing on scalable, high-volume production, with significant opportunities for integrated solutions in commercial complexes and high-rise residential towers demanding complex visitor management.

- Latin America (LATAM): Market growth in LATAM is substantially driven by heightened security concerns regarding property crime and unauthorized access, compelling accelerated adoption in high-security residential communities (condominiums) and commercial facilities. While the market initially relied on traditional analog systems, there is a rapid shift toward IP technology, primarily concentrated in metropolitan areas such as São Paulo, Mexico City, and Santiago. Key drivers include the need for dependable remote monitoring capabilities and the integration of advanced anti-theft and video verification features to compensate for regional security risks.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale, high-profile construction projects, particularly in the UAE, Saudi Arabia, and Qatar, focusing on smart city developments and luxury residential estates. This region demands premium, customized security solutions, often integrating high-end video entry systems with extensive command and control infrastructure. Growth is focused on advanced technologies like facial recognition and networked IP systems, driven by high government expenditure on security and the prestige associated with deploying the latest technology in new urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Video Door Entry Systems Market.- Aiphone Corporation

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Honeywell International Inc.

- Legrand SA

- Comelit Group SpA

- Akuvox

- Ring (Amazon)

- DoorBird (Bird Home Automation GmbH)

- Fermax

- Panasonic Corporation

- Siedle & Söhne GmbH & Co. KG

- Bticino (Legrand Group)

- ZKTeco Co., Ltd.

- Kocom Co., Ltd.

- 2N Telekomunikace (Axis Communications)

- TMEzon

- Videotronic

- Lattice Semiconductor Corporation

- ASSA ABLOY AB

Frequently Asked Questions

Analyze common user questions about the Video Door Entry Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Video Door Entry Systems Market?

The primary factor driving market growth is the widespread adoption of smart home technology, coupled with rising global security concerns. This combination increases demand for integrated, remote-accessible, and visually verifiable perimeter security solutions, especially IP-based and wireless systems.

What are the key differences between IP-based and Analog Video Door Entry Systems?

IP-based systems use standard network infrastructure (Ethernet/Wi-Fi), offering superior high-definition video quality, advanced integration capabilities with third-party IoT devices, and scalability for large installations. Analog systems are generally simpler, lower cost, but limited in feature set and remote connectivity.

How does AI technology enhance the security features of modern door entry systems?

AI enhances security through accurate facial recognition for hands-free entry, advanced video analytics to detect suspicious behavior (e.g., loitering or package theft), and real-time noise cancellation and optimized compression, making systems proactive and more reliable under various conditions.

Which end-user segment contributes the largest share to the Video Door Entry Systems Market?

The residential end-user segment currently holds the largest market share, driven by increasing consumer desire for convenience and property security. However, the commercial and institutional sectors are exhibiting the fastest growth due to high demand for centralized access control and visitor management solutions in MDUs and corporate facilities.

What is the biggest restraint affecting market adoption in developed economies?

The primary restraint in developed economies like Europe is the increasing complexity of data privacy regulations (such as GDPR) concerning the collection, storage, and processing of sensitive biometric data captured by AI-enabled video entry systems, which necessitates expensive compliance mechanisms.

This report provides a granular analysis of the Video Door Entry Systems Market, highlighting the technological paradigm shift toward IP and AI integration, coupled with the critical influence of global security demands and smart home ecosystems on consumer and commercial procurement decisions. The market trajectory is firmly focused on providing scalable, secure, and highly connected access solutions. The competitive landscape demands continuous innovation, particularly in securing sensitive data and ensuring system interoperability across diverse proprietary platforms. Future expansion will heavily rely on penetrating high-growth emerging markets in APAC and addressing the retrofitting needs of established infrastructure in North America and Europe with seamless wireless and 2-wire bus technology upgrades.

The transition from hardware-centric sales to a service-based revenue model, emphasizing cloud monitoring and subscription services for features like video archiving and predictive maintenance, represents a fundamental restructuring of market profitability. Manufacturers must prioritize sustainable component sourcing and secure software development lifecycles to meet evolving ESG criteria and maintain consumer trust in this highly sensitive security domain. Strategic investments in localized distribution networks and certified installer training programs are imperative for converting market opportunities into sustained revenue growth, particularly as regional differences in infrastructure and regulatory adherence continue to shape demand characteristics. The long-term market viability rests on delivering solutions that perfectly balance state-of-the-art security performance with robust data governance and user-friendly interface design.

Market stakeholders must closely monitor legislative changes regarding facial recognition and data retention policies, as non-compliance poses substantial financial and reputational risks. Furthermore, standardization efforts across the IoT ecosystem will be crucial for reducing installation complexity and lowering the total cost of ownership for end-users, thereby accelerating mass market adoption across all segments, from single-family homes to sprawling governmental campuses. The convergence with smart lock technologies and unified security management platforms means that video door entry systems are increasingly viewed not as standalone products, but as integral nodes within a broader, interconnected security infrastructure, necessitating a holistic approach to product development and market positioning. This integrated approach ensures the market remains highly dynamic and strategically vital within the global security industry.

The expansion into commercial and institutional segments necessitates specialized certification processes and adherence to rigorous quality standards, differentiating successful vendors from those focused solely on the consumer space. The demand for customized solutions, particularly in hospitals and educational facilities requiring specific lockdown protocols or emergency communication integration, provides premium margin opportunities for vendors capable of delivering tailored software and hardware configurations. Cybersecurity resilience remains a top-tier differentiator; as these devices operate at the property perimeter and manage sensitive access permissions, their resistance to network penetration and unauthorized data extraction is non-negotiable for high-security clients. Thus, continued investment in advanced encryption, network segmentation, and secure boot technologies is essential for maintaining market relevance in the commercial and government sectors.

Finally, the competitive strategy for leading players involves not only technological superiority but also deep ecosystem integration. Forming strategic partnerships with major property developers, telecommunication providers, and smart home platform manufacturers (e.g., Apple HomeKit, Google Home) is vital for ensuring seamless user experiences and capitalizing on large-scale infrastructure projects. These collaborations ensure that the video door entry system is viewed as a necessary utility rather than an optional security add-on, firmly embedding the technology within the next generation of connected buildings. The future of the market is smart, integrated, secure, and increasingly subscription-driven.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager