Video Extensometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431554 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Video Extensometers Market Size

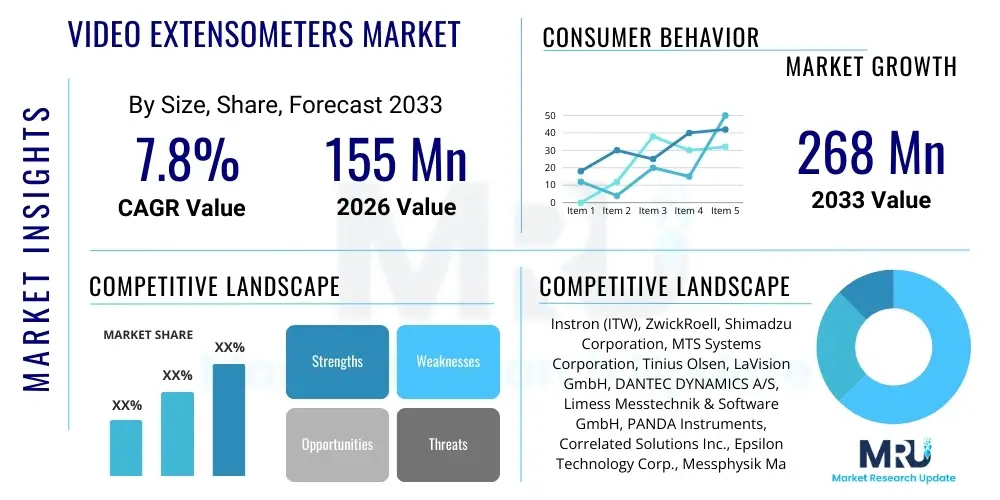

The Video Extensometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 155 Million in 2026 and is projected to reach USD 268 Million by the end of the forecast period in 2033.

Video Extensometers Market introduction

The Video Extensometers Market encompasses advanced non-contact measuring systems utilized primarily in materials testing to accurately determine strain, displacement, and elongation of test specimens. These systems employ high-resolution cameras and sophisticated image processing software to track markers or natural patterns on the material's surface, offering superior precision and flexibility compared to traditional contact extensometers. They are essential tools in quality control and research and development across various high-stakes industries where precise deformation measurement under mechanical stress is critical. Key advantages include the elimination of mechanical influence on the test sample, suitability for testing fragile or small specimens, and the capacity to operate across a wide range of temperatures and harsh environmental conditions, making them indispensable in modern testing laboratories.

Product descriptions typically emphasize the system’s ability to perform both axial and transverse strain measurements simultaneously, facilitating the calculation of complex material properties like Poisson’s ratio. Major applications span structural mechanics, aerospace engineering, automotive component testing, and biomedical research, where materials ranging from composites and metals to plastics and textiles are subjected to tensile, compression, fatigue, and fracture tests. The core technology relies on real-time digital image correlation (DIC) or specific marker tracking algorithms, ensuring high temporal and spatial resolution for dynamic testing scenarios. The versatility of these devices allows for testing specimens under extreme conditions, such as high temperatures in furnaces or cryogenic environments, which would compromise traditional contact sensors.

The primary driving factors fueling market expansion include the increasing demand for high-performance materials requiring stringent quality assurance, the global surge in R&D investment in advanced composites (especially in aerospace and electric vehicle manufacturing), and the inherent benefits of non-contact testing, which improves measurement accuracy and repeatability. Furthermore, regulatory requirements mandating precise material characterization in safety-critical applications are pushing industries toward adopting validated, non-contact measurement solutions like video extensometers. The continuous evolution of camera technology, coupled with enhanced processing power, is making these systems more accessible, faster, and more robust for routine laboratory use, further accelerating market penetration.

Video Extensometers Market Executive Summary

The Video Extensometers Market is experiencing robust growth driven by accelerating demand for advanced materials testing capabilities across critical industrial sectors. Current business trends indicate a strong shift towards integrated testing solutions that combine video extensometry with advanced simulation software and AI-driven data analysis tools, enhancing the efficiency and predictive capability of materials research. Manufacturers are focusing on developing high-speed, high-resolution systems capable of capturing ultra-fast deformation events, particularly relevant for dynamic testing such as impact and fatigue analysis. Investment in digital image correlation (DIC) technology remains the cornerstone of product innovation, aiming for increased measurement field size and reduced calibration time, thereby streamlining laboratory workflows and boosting operational efficiency for end-users worldwide.

Regional trends highlight North America and Europe as established markets characterized by stringent quality standards and high R&D expenditure in aerospace and defense, leading to early adoption of premium video extensometer systems. However, the Asia Pacific (APAC) region is projected to register the fastest growth, primarily due to the rapid industrialization, massive infrastructure development, and expanding manufacturing base in countries like China, India, and South Korea, which are increasingly prioritizing material quality and standardized testing procedures. Latin America and MEA are nascent markets but show steady potential driven by investments in the oil and gas sector, construction, and localized manufacturing expansion. The regional dynamics underscore the necessity for vendors to establish strong local distribution and technical support networks to capitalize on emerging opportunities in high-growth economies.

Segmentation trends reveal that systems based on Digital Image Correlation (DIC) dominate the market due to their unparalleled versatility and ability to measure full-field strain maps, moving beyond simple gauge length measurements. By application, the fracture and fatigue testing segment holds a substantial market share, reflecting the critical need to understand material behavior under cyclic loading for component longevity prediction. Furthermore, the segmentation by end-user shows the Materials Research Laboratories and Academic Institutions segment as a consistent consumer base, while the Automotive and Aerospace sectors are the primary drivers of commercial high-volume equipment procurement. The market is consolidating around established brands known for measurement traceability and robust software integration, favoring solutions that offer compliance with ISO and ASTM standards.

AI Impact Analysis on Video Extensometers Market

Common user questions regarding AI's impact on video extensometers often center on how machine learning can automate the testing process, improve data interpretation accuracy, and predict material failures more effectively. Users frequently inquire about the reliability of automated image processing, the feasibility of using AI for real-time anomaly detection during high-speed tests, and how AI integration affects system calibration and standardization. Concerns also revolve around the need for vast, high-quality datasets to train AI models specific to various material types and testing geometries. Based on these themes, the key expectation is that AI will transform video extensometry from a high-precision measurement tool into an intelligent diagnostic system, reducing human error, accelerating testing cycles, and unlocking deeper material insights far beyond conventional strain calculations, fundamentally altering the competitive landscape.

AI’s influence is primarily manifested through enhanced image analysis algorithms, which can automatically identify and track speckle patterns or markers, even under challenging conditions such as poor lighting or extreme temperature gradients, significantly improving the robustness and repeatability of measurements. Machine learning models are increasingly being trained to filter out noise, compensate for external vibrations, and automate quality checks on the acquired video data, ensuring that only reliable measurements are processed. This automation minimizes the manual intervention typically required for setup and post-processing, thereby lowering the total operational cost and increasing the throughput of testing facilities, which is crucial for high-volume manufacturing quality control.

Furthermore, AI-driven predictive analytics is emerging as a critical differentiator. By analyzing vast amounts of historical test data, including images, strain fields, and corresponding load curves, machine learning algorithms can detect subtle patterns indicative of impending material failure or unexpected behavior earlier than human operators. This capability is highly valuable in research settings for material model validation and in industrial applications for optimizing production processes and ensuring component reliability. The integration of AI also facilitates seamless system integration with Laboratory Information Management Systems (LIMS), providing smarter data organization and making testing results more searchable and interoperable within digital engineering environments.

- AI-enhanced Digital Image Correlation (DIC) for pattern recognition accuracy.

- Automated defect and anomaly detection in real-time during testing.

- Predictive failure analysis based on historical strain data modeling.

- Optimization of testing parameters and adaptive control based on material response.

- Streamlined data processing and automated report generation via machine learning interfaces.

- Improved calibration robustness and self-correction mechanisms in dynamic environments.

DRO & Impact Forces Of Video Extensometers Market

The Video Extensometers Market growth is powerfully driven by the increasing need for non-contact measurement in sensitive and high-temperature testing environments where traditional contact gauges are unsuitable, particularly in the aerospace and advanced materials sectors. The continuous miniaturization of components and the introduction of complex composite materials necessitate the high spatial resolution and non-invasive nature offered by video systems. Furthermore, global regulatory pressures requiring verifiable and traceable material properties, coupled with the inherent capability of video extensometers to provide full-field strain mapping, act as significant accelerators. These drivers underscore the technological leap video extensometers offer over older measurement technologies, ensuring their continued adoption across various high-value engineering disciplines.

However, market growth faces notable restraints, primarily the high initial capital investment required for high-resolution cameras, specialized lighting, and powerful proprietary software, which can be prohibitive for smaller laboratories or academic institutions with limited budgets. Additionally, the operational complexity associated with setting up and calibrating Digital Image Correlation (DIC) systems, including ensuring perfect speckle pattern application and maintaining optimal lighting conditions, necessitates highly skilled technicians. This steep learning curve and reliance on specialized expertise pose a barrier to wider, more generalized market adoption. Competition from mature, lower-cost contact extensometry solutions also continues to restrict rapid market penetration in price-sensitive segments, despite the technological superiority of the video counterparts.

Significant opportunities lie in the expansion of the electric vehicle (EV) market, which requires extensive testing of battery components, lightweight structural materials, and novel composites under cyclic loading and temperature extremes. Developing standardized, user-friendly, and cost-effective entry-level video extensometers specifically tailored for high-volume manufacturing quality control presents a vast untapped opportunity, lowering the barrier to entry. Furthermore, the integration of 3D video extensometry systems that can measure out-of-plane deformation, coupled with AI-driven software, presents a compelling opportunity for comprehensive, high-fidelity material characterization, aligning with the industry's move toward digital twin creation and advanced simulation model validation. The impact forces are characterized by moderate supplier power due to high specialization, moderate buyer power constrained by the necessity of high precision, and strong threat of substitution only from high-end laser-based solutions rather than contact sensors.

Segmentation Analysis

The Video Extensometers Market is segmented based on critical technical and application parameters, providing a detailed view of market demand and product specialization. Key segmentation includes Type (2D Video Extensometers and 3D Video Extensometers), Technology (Digital Image Correlation (DIC) and Marker Tracking), Application (Tensile/Compression Testing, Fatigue and Fracture Testing, High-Temperature Testing, and Others), and End-User (Aerospace & Defense, Automotive, Materials Research Laboratories & Academic Institutions, Biomedical, and Others). The structure of the segmentation reflects the varying levels of measurement complexity required across different industry verticals, where 3D DIC systems cater to advanced research and complex loading scenarios, while 2D marker tracking systems are often used for straightforward axial strain measurements in industrial QC.

Analysis of these segments indicates that the 3D Video Extensometers segment is poised for faster growth, driven by the increasing complexity of materials requiring simultaneous measurement of all three axes of strain for accurate material modeling, particularly in composite and anisotropic materials testing. The Digital Image Correlation (DIC) technology segment holds the dominant share, owing to its ability to provide comprehensive, non-contact full-field strain mapping over the entire sample surface, offering unparalleled diagnostic information compared to point-based measurements. This dominance is further cemented by ongoing software improvements that make DIC more robust and easier to implement in various testing environments, moving it from a specialized research tool to a standard industrial requirement.

From an application standpoint, Fatigue and Fracture Testing represents a high-value segment, as understanding the durability and life cycle of safety-critical components (e.g., in aviation turbine blades or automotive structural parts) is non-negotiable and requires highly precise, non-invasive measurement throughout extended test durations. Geographically, the market segmentation highlights strong demand concentration in technologically advanced regions, but with significant emerging demand in APAC's burgeoning manufacturing and infrastructure sectors. Understanding these segments is vital for vendors to strategically allocate resources, focus product development efforts on high-growth areas like 3D DIC, and tailor marketing strategies to specific end-user needs, such as the stringent traceability demands of the Aerospace sector.

- Type:

- 2D Video Extensometers

- 3D Video Extensometers (Stereo Vision)

- Technology:

- Digital Image Correlation (DIC)

- Marker Tracking (Gauge Length Measurement)

- Application:

- Tensile and Compression Testing

- Fatigue and Fracture Testing

- High-Temperature Testing (Furnace Applications)

- Bending and Torsion Testing

- End-User:

- Aerospace and Defense

- Automotive and Transportation

- Materials Research Laboratories and Academic Institutions

- Biomedical and Medical Devices

- Construction and Infrastructure

Value Chain Analysis For Video Extensometers Market

The value chain for the Video Extensometers Market begins with the upstream suppliers of core technology components, including specialized high-resolution industrial cameras, advanced optics (lenses), high-speed data acquisition hardware, and sophisticated lighting systems (e.g., LED panels or structured light projectors). These foundational components are sourced globally, often requiring specialized integration to meet the precise demands of metrology applications, differentiating this market from general industrial vision systems. Key upstream factors include the availability of high-speed sensors and powerful GPUs for real-time processing, which significantly impact the final system performance and cost. Maintaining strong relationships with high-tech component manufacturers is crucial for vendors to ensure consistent quality and leverage the latest advancements in imaging technology.

The manufacturing and integration stage involves the assembly of hardware components, meticulous calibration of the optical setup (especially for stereo 3D systems), and, most critically, the development and refinement of proprietary software algorithms for image correlation and data analysis. This middle stage represents the highest value addition, as the software dictates the system's ease of use, measurement accuracy, compliance with standards (ASTM E83, ISO 9513), and integration capabilities with universal testing machines (UTMs). Major manufacturers invest heavily in R&D to enhance software robustness, improve automated reporting features, and reduce the complexity of the speckle application and calibration procedures, differentiating their offerings primarily on software sophistication and measurement traceability.

The downstream segment involves distribution, installation, training, and extensive after-sales support. Distribution channels are typically a mix of direct sales teams targeting large corporate R&D centers and specialized third-party distributors or integrators who handle localized sales and technical support, especially in geographically dispersed markets like APAC. Direct channels are preferred for highly customized, high-end systems, ensuring specialized application engineering support. Indirect channels, through regional partners, are essential for penetrating smaller laboratories and academic sectors, where localized service and training are paramount. End-users, including aerospace material scientists and automotive quality managers, prioritize the quality of post-installation calibration services and software maintenance contracts, recognizing that long-term system reliability depends heavily on continuous technical engagement from the supplier.

Video Extensometers Market Potential Customers

The primary potential customers and end-users of video extensometers span highly technical and regulatory-intensive industries where material failure is catastrophic or costly. The most significant segment comprises Materials Research Laboratories and Academic Institutions globally, which utilize these instruments for fundamental research, developing new material models, and teaching advanced mechanics. These users demand high flexibility, extreme precision, and the capability to perform non-standardized testing procedures on novel or experimental materials, often requiring advanced features like custom scripting and compatibility with specialized environmental chambers, forming a consistent base demand for premium, feature-rich systems.

The Automotive and Transportation sector represents a major industrial consumer, driven by the need to test lightweight alloys, polymers, and composites used in chassis, safety structures, and electric vehicle battery enclosures under simulated operational loads, fatigue cycles, and crash scenarios. Automotive buyers prioritize speed, reliability, and ease of integration with existing testing frameworks (e.g., compatibility with high-speed data acquisition systems). Similarly, the Aerospace and Defense industry is a critical customer segment, demanding the highest level of accuracy and compliance for testing mission-critical components such as engine parts, structural composites, and landing gear materials, often under extreme thermal and mechanical loads, making 3D DIC systems a requirement rather than a choice.

Emerging segments include the Biomedical and Medical Devices sector, where video extensometers are essential for characterizing the mechanical properties of biomaterials, surgical threads, implants, and soft tissues, often requiring measurements on very small or fragile samples without imparting contact force. Additionally, quality control departments within high-volume manufacturing (e.g., plastics, textiles, and metals production) are increasingly adopting simplified 2D marker tracking systems for inline or near-line testing to ensure batch consistency and compliance with specification tolerances. These industrial users seek robust, factory-floor suitable systems that offer fast measurement cycles and minimal maintenance requirements, demonstrating the market's broadening appeal beyond pure research into routine industrial quality assurance protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155 Million |

| Market Forecast in 2033 | USD 268 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instron (ITW), ZwickRoell, Shimadzu Corporation, MTS Systems Corporation, Tinius Olsen, LaVision GmbH, DANTEC DYNAMICS A/S, Limess Messtechnik & Software GmbH, PANDA Instruments, Correlated Solutions Inc., Epsilon Technology Corp., Messphysik Material Testing, Applied Test Systems (ATS), TestResources Inc., Micro-Epsilon, WDW Testing Machine Co., GOM Metrology (Zeiss Group), CellScale Biomaterials Testing, HBM (Hottinger Baldwin Messtechnik GmbH), Shanghai Hualong Test Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Video Extensometers Market Key Technology Landscape

The technological core of the Video Extensometers Market is bifurcated primarily into Digital Image Correlation (DIC) and traditional marker-based tracking systems, with DIC representing the leading edge of innovation and complexity. DIC technology relies on stereoscopic cameras (for 3D systems) capturing high-speed, high-resolution images of a specimen surface treated with a random, high-contrast speckle pattern. Proprietary software then tracks the movement and deformation of these unique surface subsets in real-time. This methodology allows for the calculation of full-field strain maps, providing significantly more data points than traditional contact gauges or single-point marker systems. Recent technological advancements in DIC focus on higher frame rates (for dynamic testing), improved algorithms for sub-pixel accuracy, and enhanced robustness in challenging environments such as high vacuum or extreme temperatures, pushing the boundaries of material characterization capabilities for advanced manufacturing processes.

The Marker Tracking technology, while simpler, remains vital for standardized testing applications requiring only precise measurement of the axial elongation or displacement between two defined points (gauge length). These systems typically use one or two cameras to track physical markers adhered to the specimen. Technological improvements in this sector focus on developing non-intrusive, lightweight markers suitable for fragile materials and enhancing automated recognition algorithms to quickly and accurately lock onto the markers, even if they move out of the initial focal plane or distort slightly. Although limited to measuring relative displacement, their simplicity, speed, and lower computational requirements make them highly effective and cost-efficient for routine Quality Control (QC) tasks in industrial environments where the full-field strain analysis capabilities of DIC are overkill.

A crucial technological trend across both DIC and marker-based systems is the convergence with integrated testing environments. This involves developing sophisticated Application Programming Interfaces (APIs) and software protocols to ensure seamless data exchange and control synchronization between the video extensometer, the Universal Testing Machine (UTM), and external data acquisition systems (DAQ). Furthermore, the push towards 3D systems (stereo vision) using two or more synchronized cameras is becoming standard for advanced research, as it eliminates errors associated with out-of-plane movement and allows for accurate measurement of Poisson's ratio and shear strains. The shift toward higher megapixel cameras and dedicated graphical processing units (GPUs) embedded in the system architecture is essential to handle the massive data processing required for real-time 3D DIC measurements, ensuring speed does not compromise accuracy.

Regional Highlights

- North America: North America holds a substantial market share, driven primarily by high investments in aerospace and defense R&D, stringent quality standards, and the presence of numerous leading research institutions and material testing laboratories. The region, particularly the United States, is a key adopter of premium 3D Digital Image Correlation (DIC) systems for complex testing of composite materials used in aircraft and rockets. Furthermore, the strong push toward electric vehicle manufacturing and localized material testing for compliance is fueling consistent demand. The market here is mature, characterized by high automation levels and a focus on software integration and measurement traceability, leading to high adoption rates of advanced, integrated testing solutions. The regulatory environment strongly favors highly reliable measurement techniques, solidifying the market position of video extensometers over less precise alternatives.

- Europe: Europe is a highly competitive market, characterized by significant automotive manufacturing bases in Germany and France, and specialized aerospace manufacturing across the continent. European quality control demands, particularly those related to the longevity and safety of structural components, ensure steady procurement of high-specification video extensometers. The market is also heavily influenced by public and private research funding into novel material science, particularly within the EU’s Horizon programs, stimulating demand from academic and industrial consortia. Countries like Germany and the UK lead in technological adoption, focusing on advanced fatigue and fracture testing methodologies using high-speed video systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market due to rapid industrial expansion, massive infrastructure projects, and the accelerating growth of domestic automotive and electronics manufacturing in countries like China, India, and South Korea. This region is witnessing a rapid transition from basic contact testing methods to non-contact video extensometry as manufacturers seek to enhance product quality and align with international testing standards. While initial adoption may favor cost-effective 2D marker tracking systems for routine QC, increasing R&D activities and government initiatives promoting technological modernization are driving strong growth in the sophisticated 3D DIC segment, particularly in advanced materials development.

- Latin America (LATAM): The LATAM market is currently characterized by moderate growth, primarily driven by investments in the construction, mining, and oil and gas sectors, which necessitate reliable testing of large structures and materials. Brazil and Mexico are the primary markets, showcasing demand for robust testing equipment suitable for industrial environments. Adoption tends to be concentrated among large multinational companies or specialized government testing facilities, with slower uptake in the general industrial sector due to budget constraints, though the focus on infrastructure improvement provides a foundational demand.

- Middle East and Africa (MEA): The MEA region represents an emerging market, with demand concentrated in energy infrastructure projects (oil and gas, renewables) and large-scale construction in the GCC countries. The adoption of video extensometers is often tied to foreign investment and technology transfer in specialized testing labs. Growth is steady but dependent on stabilization of commodity prices and continued infrastructure spending, particularly in Saudi Arabia and the UAE, where high-specification materials are required for critical national projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Video Extensometers Market.- Instron (ITW)

- ZwickRoell

- Shimadzu Corporation

- MTS Systems Corporation

- Tinius Olsen

- LaVision GmbH

- DANTEC DYNAMICS A/S

- Limess Messtechnik & Software GmbH

- PANDA Instruments

- Correlated Solutions Inc.

- Epsilon Technology Corp.

- Messphysik Material Testing

- Applied Test Systems (ATS)

- TestResources Inc.

- Micro-Epsilon

- WDW Testing Machine Co.

- GOM Metrology (Zeiss Group)

- CellScale Biomaterials Testing

- HBM (Hottinger Baldwin Messtechnik GmbH)

- Shanghai Hualong Test Instruments

Frequently Asked Questions

Analyze common user questions about the Video Extensometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Video Extensometer and how does it measure strain?

A Video Extensometer is a non-contact optical measurement system that uses high-resolution cameras and image processing software, often based on Digital Image Correlation (DIC) or marker tracking, to precisely determine the deformation, strain, or displacement of a material specimen under mechanical load without physically touching it, offering higher accuracy than contact methods.

What are the primary advantages of 3D Digital Image Correlation (DIC) over 2D systems?

3D DIC systems, utilizing stereoscopic cameras, allow for the simultaneous measurement of strain in all three axes (x, y, and z), accurately accounting for out-of-plane movement. This capability is essential for testing composite materials, bending tests, and complex loading scenarios, providing full-field strain maps and eliminating errors caused by specimen rotation or warping.

Which industries are the major end-users driving the demand for advanced Video Extensometers?

The primary high-growth end-users include the Aerospace and Defense sector (due to stringent material safety standards), the Automotive industry (especially for electric vehicle component testing), and specialized Materials Research Laboratories, all requiring highly accurate, non-invasive measurements for fatigue and fracture analysis.

Is the high cost of Video Extensometers justified for general industrial quality control?

While the initial cost is high, the investment is justified for quality control applications requiring high repeatability, high-temperature testing capability, or testing of fragile materials where contact methods fail. Simplified 2D marker tracking systems offer a more cost-effective entry point for general industrial QC tasks compared to complex 3D DIC research systems, balancing accuracy and budget.

How is Artificial Intelligence (AI) influencing the future development of these systems?

AI is transforming video extensometry by enabling automated, high-speed image processing, enhancing the accuracy of speckle pattern recognition under challenging conditions, and providing advanced predictive analytics for material failure detection. This integration streamlines workflows and elevates the system's role from a measurement tool to an intelligent diagnostic platform.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Non-Contacting Video Extensometers Market Statistics 2025 Analysis By Application (Plastic Measurement, Metal Measurement, Fiber Measurement, Others), By Type (Digital Type, Analog Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Video Extensometers Market Statistics 2025 Analysis By Application (Plastic Measurement, Metal Measurement, Fiber Measurement, Others), By Type (Materials Testing Lenses, General Purpose Lenses), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager