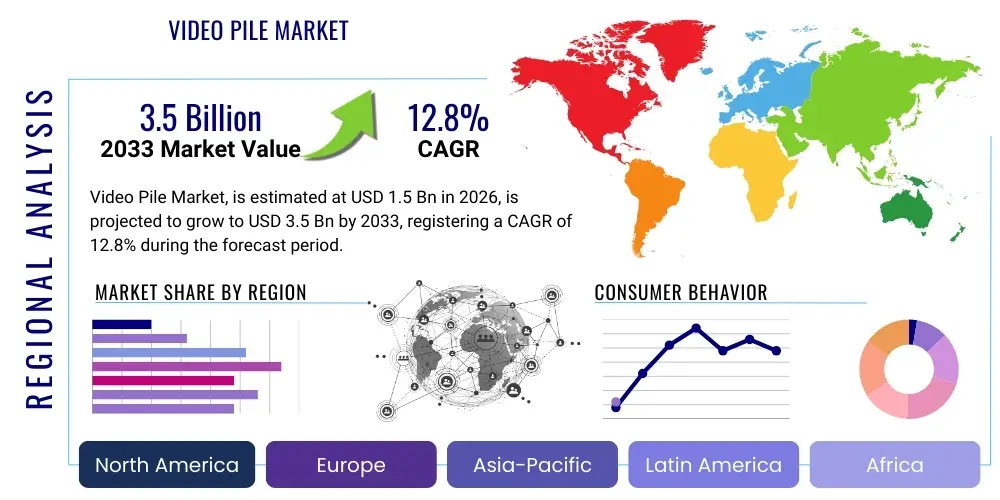

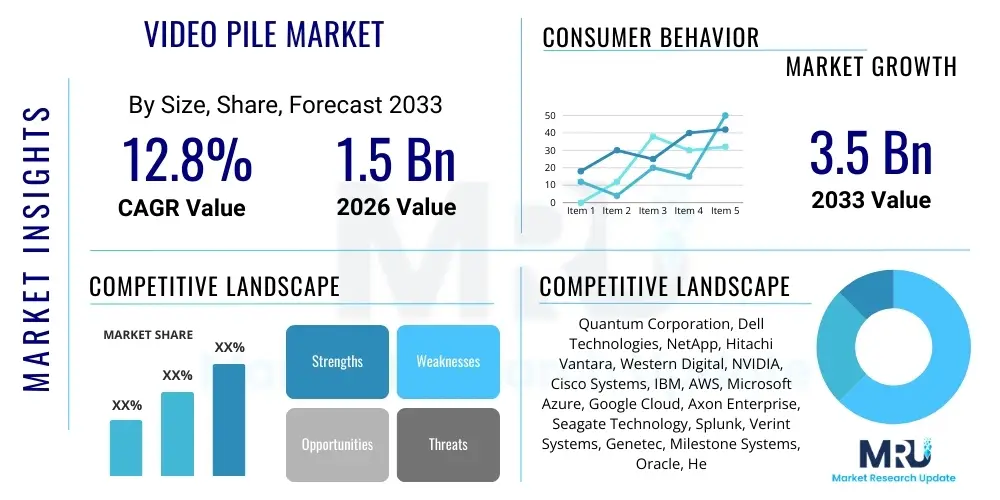

Video Pile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436282 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Video Pile Market Size

The Video Pile Market, defined by the extensive infrastructure and sophisticated software required to manage, store, and extract insights from colossal, rapidly accumulating volumes of unstructured video data, is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. This growth trajectory reflects the ubiquitous deployment of video capture devices across consumer, enterprise, and governmental sectors, driving demand for scalable storage and advanced analytical tools capable of processing petabytes of information efficiently.

The market is estimated at USD 1.5 Billion in 2026, encompassing revenues derived from specialized storage hardware, video management platforms, AI-driven indexing solutions, and related integration services. The escalating need for actionable intelligence from surveillance footage, user-generated content, medical imaging videos, and autonomous vehicle recordings serves as a primary economic accelerator, mandating continuous investment in capacity and retrieval optimization technologies.

The Video Pile Market is projected to reach USD 3.5 Billion by the end of the forecast period in 2033. This substantial expansion will be largely propelled by the maturation of edge computing capabilities, allowing initial processing and metadata generation closer to the source, thus mitigating networking burdens and improving real-time analysis feasibility. Furthermore, stricter regulatory requirements in sectors like finance and healthcare necessitate long-term, verifiable archival of video communications and recordings, creating sustained revenue streams for compliance-focused video management vendors.

Video Pile Market introduction

The Video Pile Market centers around the technological ecosystem dedicated to tackling the "video deluge"—the exponentially increasing accumulation of raw, often untagged, video data generated globally every second. This market provides comprehensive solutions ranging from ultra-dense storage infrastructure and robust networking protocols to sophisticated software layers specializing in automated categorization, indexing, and retrieval of specific video segments within massive archives. Products within this domain include advanced Video Content Analytics (VCA) platforms, tiered storage systems (combining flash, HDD, and tape for cost optimization), and specialized transcoding engines designed to harmonize disparate video formats for efficient processing and long-term archival integrity.

Major applications of Video Pile technologies span high-stakes sectors, prominently including public safety and surveillance (for forensic analysis and real-time threat detection), Media and Entertainment (for content libraries, asset management, and rapid monetization), and Autonomous Systems (training data sets for machine learning models and operational logging). The core benefit offered by these solutions is the transformation of inert, overwhelming data volumes into accessible, searchable, and valuable business assets. By enabling quick search capabilities based on context, objects, events, or faces, organizations can drastically reduce operational costs associated with manual data review, accelerate regulatory compliance efforts, and unlock new avenues for data monetization through precise metadata tagging.

Driving factors for sustained market growth include the continuous drop in camera sensor costs coupled with widespread 5G deployment, leading to higher resolution and volume of captured video. The demand for advanced video quality in sectors like remote surgery (telemedicine) and high-definition aerial mapping also boosts market expansion. Furthermore, the imperative for governmental bodies and large corporations to maintain comprehensive, searchable records for legal discovery and security audits ensures stable demand, cementing the market’s reliance on data fidelity, security, and ultra-high availability characteristics.

Video Pile Market Executive Summary

Global business trends in the Video Pile Market are heavily oriented toward integrating Generative AI for synthetic data generation and employing hyper-efficient compression techniques to manage storage costs. Enterprises are moving away from monolithic, proprietary systems towards modular, cloud-native architectures that facilitate seamless scaling and cross-platform interoperability, particularly favoring hybrid cloud deployments that balance control and elasticity. Key shifts include the focus on automated data lifecycle management—moving rarely accessed video from expensive, high-speed storage to cold archival tiers—and the growing adoption of decentralized storage models, which promise enhanced resilience and reduced vendor lock-in risk for petabyte-scale repositories.

Regional trends indicate North America maintaining leadership in terms of technological adoption and software expenditure, driven by significant investments in defense, autonomous vehicle development, and sophisticated media production infrastructure. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive government investments in smart city initiatives, large-scale public surveillance projects in countries like China and India, and a rapid surge in consumer-generated video content across emerging digital platforms. Europe, while a mature market, exhibits unique dynamics driven by stringent data privacy regulations like GDPR, compelling vendors to offer specialized anonymization and localized data processing features, prioritizing compliance and ethical AI usage in video analytics.

Segment trends highlight the dominance of Content Management Systems (CMS) and Video Analytics software within the overall revenue pie, reflecting the market’s shift from mere storage provision to value extraction. The surveillance sector continues to be a foundational segment, demanding advanced deep learning models for anomaly detection and predictive behavioral analysis. Moreover, the segmentation based on deployment type shows a clear long-term migration towards cloud and hybrid models, driven by the operational expenditure (OpEx) advantage and the instant scalability required to handle unpredictable video data ingestion spikes, contrasting with the high upfront capital expenditure (CapEx) associated with traditional on-premise Video Pile infrastructure.

AI Impact Analysis on Video Pile Market

Common user questions regarding AI's impact on the Video Pile Market frequently revolve around efficiency, security, and cost-effectiveness: "How can AI efficiently process and index petabytes of historical video data without prohibitive cost?", "What security risks does automated facial recognition introduce, and how can they be mitigated?", and "Can AI systems automatically synthesize training data to reduce reliance on expensive, manually tagged real-world footage?". Users are primarily concerned with the feasibility of applying sophisticated deep learning models to archives of unprecedented scale, expecting AI to deliver faster, more accurate retrieval while simultaneously optimizing storage utilization through intelligent prioritization and dynamic compression.

The integration of Artificial Intelligence is fundamentally reshaping the Video Pile Market, transitioning it from a purely archival function to a dynamic, insight-generating ecosystem. AI algorithms, particularly Convolutional Neural Networks (CNNs) and transformer models, are crucial for automated indexing, metadata generation, and object recognition, tasks that were historically manual and resource-intensive. This automation dramatically reduces the 'dark data' phenomenon, making stored video instantly searchable based on semantic content rather than just time stamps or file names. Furthermore, AI contributes significantly to predictive maintenance and anomaly detection within physical security systems, moving surveillance from reactive investigation to proactive threat identification.

In terms of optimization, AI analyzes access patterns and data importance, enabling intelligent storage tiering—ensuring frequently accessed, high-value data resides on fast SSDs, while cold data is relegated to cheaper, high-latency storage (like LTO tape or archive cloud tiers). This intelligent allocation directly impacts the total cost of ownership (TCO) for organizations managing massive Video Piles. Additionally, the development of specialized AI models for video compression (AI codecs) is emerging, promising to achieve quality retention at significantly lower bitrates than traditional compression standards, thus alleviating bandwidth pressure and lowering long-term infrastructure investment requirements.

- AI enables rapid, automated indexing and semantic search within massive video archives, shifting value creation from storage to analysis.

- Predictive AI algorithms are utilized for real-time anomaly detection in surveillance and security applications, enhancing proactive response capabilities.

- Machine Learning models drive intelligent storage tiering, optimizing TCO by dynamically migrating data based on access frequency and organizational value.

- Generative AI facilitates the creation of synthetic video data, accelerating the training and validation of computer vision models without relying solely on sensitive real-world footage.

- AI-powered video summarization and transcription tools drastically reduce the time needed for human review and forensic investigation processes.

DRO & Impact Forces Of Video Pile Market

The dynamics of the Video Pile Market are governed by powerful opposing and complementary forces. The primary drivers include the relentless global proliferation of high-definition capture devices and the foundational need across industries (from healthcare to finance) for comprehensive, verifiable video records. This necessity is counterbalanced by significant restraints, primarily the exponential growth in storage expenditure, the high computational requirements for real-time analysis, and the intrinsic complexity of managing interoperability across diverse vendor hardware and legacy systems. Opportunities are centered around technological advances like Edge Computing, which decentralizes processing power, and the development of specialized hardware accelerators (like GPUs and TPUs) that make massive video analysis economically viable. These factors, alongside regulatory mandates for data retention and privacy, exert considerable impact on strategic investment decisions and market segmentation.

Drivers are inherently linked to digital transformation initiatives across governmental and commercial sectors. The sheer volume of data necessitates immediate, scalable solutions. For instance, the autonomous vehicle sector alone generates terabytes of video data per hour per vehicle, demanding robust Video Pile infrastructure for model training and incident logging. Conversely, the greatest restraint remains the technological overhead associated with retrieval latency—even if data is stored cheaply, the time required to retrieve specific frames from petabytes of archived video can render the data useless for timely applications. Furthermore, the specialized skill set required to deploy and maintain complex AI-integrated Video Pile solutions poses a workforce challenge for many organizations, acting as a secondary restraint on broader adoption.

Key opportunities involve leveraging open-source frameworks for video management and analysis, fostering greater ecosystem integration and reducing proprietary lock-in. The push toward secure, decentralized, and anonymized video data handling also presents a major avenue for growth, particularly in compliance-sensitive regions. The impact forces acting upon this market are technological (rapid obsolescence of compression standards and storage media), economic (global semiconductor shortages affecting hardware pricing), and regulatory (evolving international data governance and privacy laws dictating where and how video data can be stored and analyzed). The convergence of these forces accelerates innovation in efficiency and security features, positioning vendors who offer modular, future-proof solutions for long-term market dominance.

Segmentation Analysis

The Video Pile Market is comprehensively segmented based on technology, deployment model, application vertical, and geographic region, reflecting the diverse needs of end-users managing massive video repositories. Segmentation by component reveals distinct market contributions from hardware (storage arrays, servers, networking), software (VMS, analytics, indexing tools), and services (integration, consultation, managed services). This granularity allows vendors to tailor their offerings, ranging from providing petabyte-scale on-premise arrays for high-security environments to offering flexible Software-as-a-Service (SaaS) video analytics platforms hosted on hyper-scale public clouds for decentralized content creators.

Segmentation based on application vertical highlights where the highest value extraction occurs. While the Security and Surveillance sector remains the largest consumer due to critical operational needs, the Media and Entertainment segment is rapidly increasing its market share, driven by the monetization potential of deep, historical content libraries requiring constant indexing and retrieval. Furthermore, emerging verticals such as Smart Retail and Healthcare are increasingly investing in Video Pile solutions to manage in-store behavior analysis and complex diagnostic video recordings, respectively, demonstrating a trend of diversification beyond traditional security applications.

- By Component:

- Hardware (Storage Arrays, Servers, Networking Equipment)

- Software (Video Management Systems (VMS), Video Content Analytics (VCA), Indexing and Retrieval Tools)

- Services (Professional Services, Managed Services, Integration Services)

- By Deployment Mode:

- On-Premise

- Cloud (Public, Private, Hybrid)

- By Storage Tier:

- Hot Storage (High-Speed Access, SSD/Flash)

- Cold Storage (Archival, LTO Tape, Deep Cloud Archive)

- By Application Vertical:

- Security and Surveillance

- Media and Entertainment (M&E)

- Autonomous Vehicles & Transportation

- Healthcare and Life Sciences

- Government and Defense

- Education (E-Learning Archives)

Value Chain Analysis For Video Pile Market

The value chain for the Video Pile Market initiates with the Upstream segment, dominated by foundational hardware manufacturing and core IP development. This includes semiconductor producers responsible for high-density memory and processing units (CPUs/GPUs), storage array developers, and specialized networking hardware providers (e.g., high-speed fiber optics). These components form the base infrastructure necessary for handling the massive input/output (I/O) demands of continuous video ingestion. Software developers and algorithm providers (often specializing in computer vision and proprietary compression codecs like H.266/VVC) then integrate their solutions onto this hardware foundation, adding intelligence and management capability to the raw storage capacity. Efficiency and performance metrics are largely dictated at this upstream level.

Moving mid-stream, the value shifts to system integrators and Original Equipment Manufacturers (OEMs) who assemble, configure, and optimize these components into coherent, scalable Video Pile solutions tailored for specific industrial needs, such as a petabyte-scale data lake for a national surveillance network or a low-latency archive for a major film studio. Distribution channels play a critical role here, utilizing a mix of Direct Sales (for high-value governmental or hyperscale cloud contracts) and Indirect Channels, which include Value-Added Resellers (VARs) and Managed Service Providers (MSPs). VARs provide localized expertise in deployment, compliance, and ongoing maintenance, especially crucial for small to mid-sized enterprises (SMEs) lacking internal IT capacity for complex video infrastructure management.

The Downstream segment involves the end-users and the service layer. End-users derive value through the application of the technology—extracting actionable insights, ensuring regulatory compliance, or monetizing archived content. The indirect influence of professional service providers, including cloud consultancies and data scientists, is profound, as they specialize in optimizing the integration of Video Pile data with broader organizational analytics frameworks. This final stage is where true value realization occurs, determined by the system’s reliability, search speed, and the accuracy of the embedded AI analytics, completing the cycle from raw component production to advanced data utilization.

Video Pile Market Potential Customers

The primary target customers for Video Pile solutions are organizations characterized by massive, continuous data ingestion needs and a requirement for long-term, searchable archival. Media and Entertainment companies, including global streaming services, production houses, and historical archives, are key buyers, needing robust systems to manage terabytes of raw footage, maintain metadata integrity, and facilitate rapid content retrieval for repurposing and monetization across global platforms. Their purchasing decisions are driven by scalability, interoperability with existing editing workflows, and ultra-high bandwidth requirements.

Government agencies and defense organizations represent another foundational customer base, utilizing Video Pile infrastructure for national security, public surveillance initiatives, forensic evidence archiving, and intelligence gathering. For these entities, the critical factors are data sovereignty, robust encryption, high physical and digital security protocols, and compliance with stringent public records laws, often necessitating deployment in secure, on-premise environments or sovereign cloud regions. The ability to integrate advanced facial recognition and behavioral analysis software seamlessly is a major purchasing determinant.

Furthermore, emerging high-growth potential customers include operators of large fleets of autonomous vehicles (AVs), which require Video Piles to store critical operational data for liability assessment and continuous machine learning model retraining. Healthcare providers, particularly research hospitals and telemedicine platforms, also represent a significant opportunity, driven by the need to securely archive high-resolution medical imaging (e.g., endoscopic video, surgical footage) in compliance with privacy regulations like HIPAA, where reliable archival and fast retrieval are essential for clinical and research purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Quantum Corporation, Dell Technologies, NetApp, Hitachi Vantara, Western Digital, NVIDIA, Cisco Systems, IBM, AWS, Microsoft Azure, Google Cloud, Axon Enterprise, Seagate Technology, Splunk, Verint Systems, Genetec, Milestone Systems, Oracle, Hewlett Packard Enterprise (HPE), Pure Storage |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Video Pile Market Key Technology Landscape

The technological landscape of the Video Pile Market is defined by innovations aimed at improving storage density, enhancing data access speed, and automating analytical processes. Central to storage efficiency is the adoption of advanced video compression standards, particularly H.265 (HEVC) and the emerging Versatile Video Coding (VVC/H.266), which drastically reduce file sizes without significant quality loss, mitigating the physical storage crisis. Furthermore, the reliance on high-density storage media, including Shingled Magnetic Recording (SMR) hard drives for archive tiers and large-capacity Linear Tape-Open (LTO) systems, is crucial for achieving cost-effective, long-term data preservation for petabyte-scale Video Piles.

In terms of processing and analysis, the market is heavily invested in specialized hardware acceleration. Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs), often packaged as dedicated AI accelerators (like TPUs), are essential for running computationally intensive computer vision algorithms (e.g., object detection, facial recognition) directly on the ingested video streams. This parallel processing capability is non-negotiable for real-time applications and for rapidly indexing massive historical archives. The architecture supporting these components is evolving toward distributed, hyper-converged systems that integrate storage, compute, and networking into a single, scalable fabric, enhancing management simplicity and reducing latency.

Furthermore, cloud technologies and modern networking protocols are foundational. Software-Defined Storage (SDS) allows for flexible management of multi-vendor hardware, while advanced object storage protocols (like S3) facilitate scalability and integration with cloud services. The push towards 5G and fiber optics enables high-speed data ingestion from distributed sources (e.g., smart city cameras, drone footage). Security technologies, including blockchain for tamper-proof video logging and sophisticated encryption methods, are also crucial components ensuring data integrity and regulatory compliance throughout the video data lifecycle, from capture to deep archive.

Regional Highlights

The market dynamics of Video Pile solutions vary significantly across major global regions, reflecting differences in infrastructure maturity, regulatory environments, and dominant application verticals. North America, particularly the United States, commands the largest market share primarily due to early and aggressive adoption of cloud infrastructure, substantial investment in proprietary AI video analytics for defense and tech sectors, and a mature Media and Entertainment industry constantly demanding cutting-edge content management systems. The region benefits from a high concentration of market leaders and technology innovators driving research and development in decentralized video processing.

Asia Pacific (APAC) represents the fastest-growing region, characterized by extensive government spending on public safety and surveillance infrastructure, particularly in rapidly urbanizing economies like China, India, and Southeast Asia. The sheer volume of video data generated by massive populations and smart city projects mandates the rapid deployment of scalable, high-capacity Video Pile solutions. However, this growth is often driven by volume rather than high-margin software sales, favoring vendors who can offer competitive, high-density hardware and fundamental video management systems suitable for large-scale, decentralized monitoring.

Europe holds a substantial, mature market share, with growth primarily influenced by the strict requirements imposed by the General Data Protection Regulation (GDPR). This regulatory environment necessitates highly sophisticated data anonymization, selective retention, and secure localized storage capabilities. European adoption is strong in corporate archival, healthcare, and high-tech manufacturing, where video monitoring is deployed for process optimization. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, showing high localized growth spurred by investments in smart oil fields, secure city initiatives (MEA), and expanding telecommunications infrastructure (LATAM), though these regions often rely heavily on imported solutions and service contracts.

- North America: Market leader; driven by advanced AI integration, cloud adoption, defense contracts, and the large M&E sector. Focus on high-value, sophisticated analytical platforms.

- Asia Pacific (APAC): Highest growth rate; dominated by smart city initiatives, large-scale public surveillance, and high data volume generation in China and India.

- Europe: Mature market; constrained and shaped by stringent data privacy regulations (GDPR), favoring solutions with robust anonymization and secure, local hosting capabilities.

- Latin America (LATAM): Emerging market; growth fueled by expanding telecommunications infrastructure and increasing investments in corporate security and mining operations.

- Middle East & Africa (MEA): High potential; strategic investments in smart nation projects, particularly in the Gulf Cooperation Council (GCC) countries, focusing on security and critical infrastructure monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Video Pile Market.- Quantum Corporation

- Dell Technologies

- NetApp

- Hitachi Vantara

- Western Digital

- NVIDIA

- Cisco Systems

- IBM

- AWS

- Microsoft Azure

- Google Cloud

- Axon Enterprise

- Seagate Technology

- Splunk

- Verint Systems

- Genetec

- Milestone Systems

- Oracle

- Hewlett Packard Enterprise (HPE)

- Pure Storage

Frequently Asked Questions

Analyze common user questions about the Video Pile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary challenge in managing a Video Pile?

The foremost challenge is the balance between storage cost and retrieval speed. Exponential data growth necessitates cheap storage (cold archives), but users require instant access for analytical tasks, leading to complex storage tiering and high latency management overheads.

How does AI reduce the total cost of ownership (TCO) for Video Piles?

AI reduces TCO by automating indexing and metadata generation, drastically cutting down on manual review labor. It also enables intelligent storage tiering, ensuring expensive, fast storage is reserved only for high-priority data, optimizing infrastructure expenditure.

Is cloud storage suitable for petabyte-scale Video Pile solutions?

Yes, cloud storage is highly suitable, particularly hybrid and public cloud archival tiers, due to unmatched scalability and operational flexibility (OpEx model). However, organizations must carefully manage egress fees and ensure sufficient network bandwidth for large-scale data ingestion and retrieval.

What role does compression technology play in the Video Pile Market?

Compression technologies like H.265 and VVC are critical for market viability. They reduce the physical footprint of video data, alleviating strain on storage infrastructure, decreasing networking bandwidth demands, and ultimately lowering the overall capital expenditure required for long-term archiving.

Which industry vertical is currently the largest consumer of Video Pile technology?

The Security and Surveillance industry remains the largest consumer, driven by continuous monitoring requirements in public safety, government, and corporate sectors that demand high-capacity, legally compliant, and searchable historical video data retention systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager