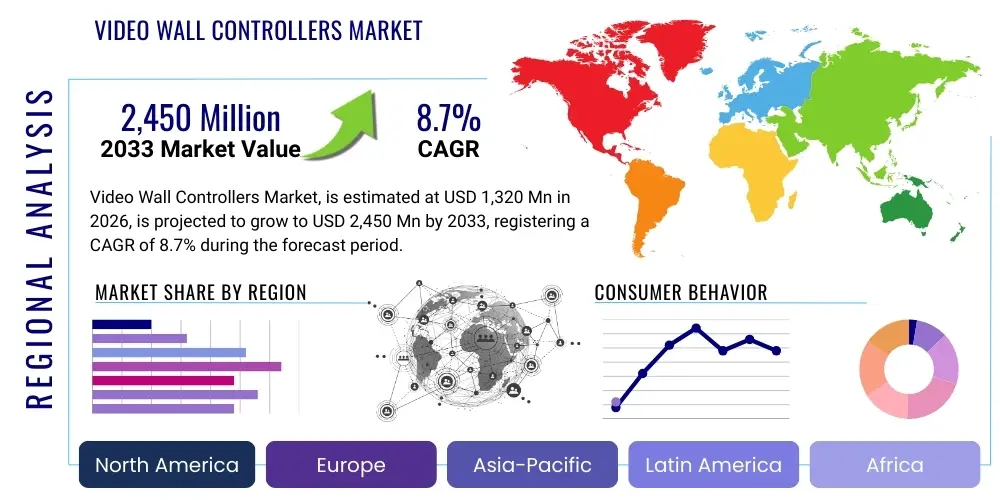

Video Wall Controllers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435368 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Video Wall Controllers Market Size

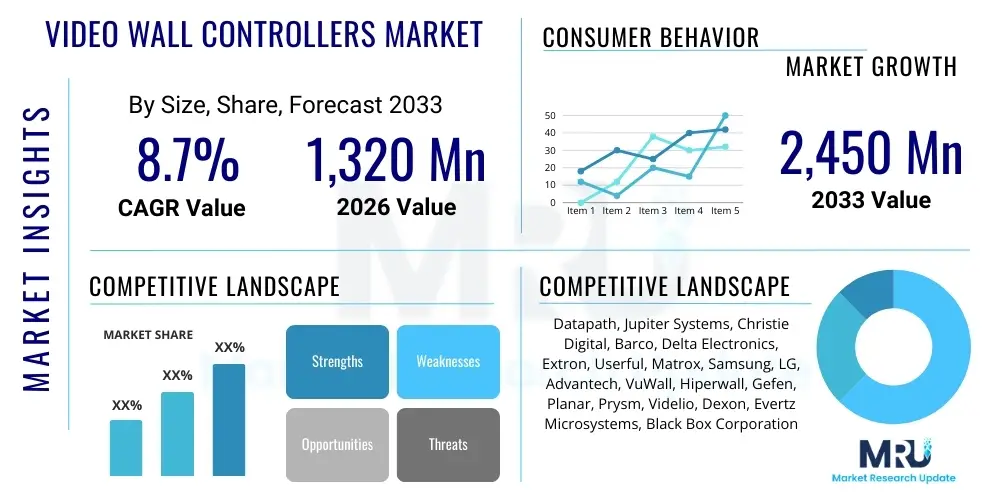

The Video Wall Controllers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at $1,320 Million in 2026 and is projected to reach $2,450 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating demand for high-resolution visualization systems across critical applications such as centralized control rooms, transportation hubs, and large-scale digital out-of-home (DOOH) advertising infrastructure. The continuous evolution of display technologies, particularly fine-pitch LED and advanced LCD panels, necessitates more robust and flexible controller solutions capable of handling diverse input sources and complex output configurations, thereby driving market expansion globally.

Video Wall Controllers Market introduction

The Video Wall Controllers Market encompasses specialized hardware and software solutions designed to manage, process, and distribute video signals across multiple display screens configured as a single, large visual canvas. These controllers serve as the central processing unit for video walls, allowing operators to seamlessly display data, video streams, and graphic content from numerous sources onto the collective display surface. Key functionalities include source switching, layout management, resolution scaling, windowing, and edge blending, ensuring a cohesive and high-fidelity visual experience essential for real-time monitoring and decision-making environments. The robust capabilities of modern video wall controllers enable complex operational setups required in demanding sectors.

Major applications for video wall controllers span mission-critical environments such as surveillance centers, utility command centers, traffic management hubs, and network operations centers (NOCs), where continuous real-time data visualization is paramount. Beyond these critical infrastructure applications, video walls are increasingly adopted in corporate lobbies, educational institutions, retail environments for immersive branding, and large public venues for informational and entertainment purposes. The versatility of these systems, capable of handling inputs ranging from traditional video feeds and IP streams to specialized graphic workstation outputs, positions them as essential tools for centralized visualization across diverse commercial and governmental sectors.

The market growth is primarily driven by the increasing deployment of ultra-high-definition (UHD) and 4K displays, the proliferation of Internet of Things (IoT) devices generating vast amounts of visual data requiring centralized display, and the growing complexity of data sources (including multiple remote desktop feeds and simultaneous video streams). Furthermore, the transition toward IP-based controllers and matrix switching solutions offers improved flexibility, scalability, and remote management capabilities, appealing to organizations seeking future-proof visualization infrastructure. The demand for seamless integration with existing AV-over-IP networks is a significant accelerant.

Video Wall Controllers Market Executive Summary

The Video Wall Controllers Market exhibits strong growth, underpinned by fundamental business trends focusing on modularity, software-defined control, and enhanced cybersecurity features tailored for mission-critical installations. Technology advancement is shifting investment towards hybrid controllers that effectively manage both legacy analog/digital sources and modern IP/networked video feeds, offering enterprises maximum interoperability and scalable deployment paths. Market consolidation is observable, with key players emphasizing integration capabilities with control room management systems (CRMS) and specialized command and control software suites to offer end-to-end solutions. The overall business strategy is moving from pure hardware sales to bundled solutions incorporating perpetual or subscription-based software licenses for advanced management features, thereby creating stable recurring revenue streams.

Regionally, North America and Europe currently dominate the market share, driven by high capital expenditure in military and defense control systems, mature infrastructure for public safety, and early adoption of 4K and 8K display technologies in corporate environments. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by massive infrastructural developments in smart cities, rapid urbanization necessitating new transportation and utility control centers, and significant government investment in surveillance and public security projects, particularly in countries like China, India, and South Korea. Latin America and MEA are nascent but promising markets, largely focusing on resource management control rooms and foundational digital signage deployments.

Segmentation trends highlight the increasing importance of Software-defined Video Wall Controllers (SVWC) over dedicated hardware boxes, offering greater operational flexibility, reduced physical footprint, and simplified maintenance. Within application segments, the Control Rooms segment remains the primary revenue generator due to stringent reliability requirements and high-value system installations. However, the Digital Signage segment is rapidly expanding, driven by the retail and advertising sectors seeking dynamic, large-format visual communication tools. The demand for controllers capable of handling massive input resolution aggregation (such as 10G or 40G network streams) is growing, indicating a continuous push toward higher data throughput and processing power across all end-user sectors.

AI Impact Analysis on Video Wall Controllers Market

User queries regarding AI's impact on video wall controllers primarily revolve around three core themes: the integration of AI-powered video analytics for source optimization and intelligent display, the use of machine learning algorithms to automate content scheduling and dynamic layout adjustments (AEO focus on "smart video wall management"), and the potential for AI to enhance operator efficiency by prioritizing and filtering critical alarms displayed on the wall (GEO focus on "intelligent control room visualization"). Concerns center on the computational demands AI processing places on the controller hardware and the requirement for seamless integration between third-party AI analytics platforms and the controller management software. Users expect AI to transform passive display systems into proactive decision-support tools. Consequently, the key themes summarize the shift from simple video display to intelligent, context-aware visualization systems where AI algorithms dictate which critical information should be highlighted, how it should be scaled, and where it should be positioned on the wall based on real-time operational context.

- AI-Powered Content Prioritization: Utilizing machine learning to filter non-critical data and automatically elevate high-priority alerts or data streams, optimizing operator focus and response times.

- Intelligent Layout Management: AI algorithms dynamically adjusting video wall layouts based on shifting operational demands, incident severity, or pre-defined situational contexts.

- Predictive Maintenance and Diagnostics: Implementing AI within the controller software to monitor hardware performance, predict potential failures, and ensure high system uptime, crucial for 24/7 operations.

- Enhanced Video Analytics Integration: Seamlessly handling metadata and object detection results generated by external AI cameras and servers, allowing the controller to display real-time graphical overlays or highlight specific areas on the video feeds.

- Optimization of Resource Allocation: AI determining the optimal resolution, encoding, and decoding resources needed for diverse input signals, ensuring efficient processing power utilization and minimizing latency.

- Gesture and Voice Control Interface: Integrating AI for natural language processing (NLP) and computer vision to enable advanced, hands-free interaction with the video wall interface, particularly useful in sterile or high-stress environments.

- Automated Bandwidth Management: Utilizing AI to manage network traffic and prioritize critical video streams when operating in congested IP environments, ensuring stability and low latency for essential feeds.

DRO & Impact Forces Of Video Wall Controllers Market

The market dynamics are defined by several intertwined forces: Drivers predominantly include the proliferation of high-resolution displays (4K/8K) requiring powerful processing engines and the increasing need for centralized visualization in smart city infrastructure and corporate environments. Restraints often center around the high initial capital investment required for comprehensive video wall setups, complexity in integrating heterogeneous sources (varying inputs, resolutions, and protocols), and the rapid pace of technological obsolescence, pressuring companies to frequently upgrade systems. Opportunities lie significantly in the growing adoption of software-based controllers and AV-over-IP architectures, which offer enhanced flexibility and lower total cost of ownership over time, appealing to a wider range of mid-market enterprises previously deterred by cost barriers. Furthermore, specialized niches like augmented reality visualization within industrial control environments represent substantial future growth avenues.

The primary impact forces shaping the competitive landscape are technological standardization and the demand for interoperability. The shift towards IP-centric control systems, driven by standards like SMPTE 2110 and HDBaseT-IP, exerts massive pressure on vendors to transition away from proprietary hardware interfaces toward open, network-based solutions. This transition democratizes system design but intensifies competition among hardware manufacturers and pure-play software vendors. Economic volatility also acts as an impact force, particularly concerning large public sector projects, where budgetary constraints can delay massive infrastructural deployments requiring high-end video wall systems. However, the critical nature of control room applications generally shelters this sector from drastic spending cuts, ensuring a baseline demand.

The market must balance the requirement for extreme reliability in control rooms with the flexibility demanded by commercial digital signage applications. This dichotomy drives product innovation, leading to the development of highly specialized controllers for mission-critical uses (emphasizing redundancy and robust processing) and more standardized, scalable software platforms for commercial deployment. Success hinges on a vendor's ability to offer modular, scalable solutions that meet both sets of requirements while providing robust security features, essential as controllers increasingly sit on enterprise networks and handle sensitive operational data. The continued miniaturization of processing technology also acts as an underlying driver, enabling more powerful yet compact controller units.

Segmentation Analysis

The Video Wall Controllers Market is meticulously segmented based on components, technology, application, and end-user vertical, reflecting the highly diverse operational needs of different sectors. Component segmentation differentiates between the physical processing units (hardware), the management software platforms, and the integrated solutions (hybrid). Technology classification separates traditional analog/digital controllers from modern IP-based networked controllers, which are seeing accelerating uptake due to their scalability and reduced cabling requirements. Analyzing these segments provides critical insights into purchasing trends, showing a clear preference for software-defined control that maximizes flexibility and reduces reliance on proprietary hardware interfaces, crucial for future scalability initiatives across various geographical regions.

- Component:

- Hardware Controllers (Dedicated Chassis, Modular Cards)

- Software Controllers (Virtual Machines, PC-based)

- Hybrid Solutions

- Technology:

- Analog/Digital Controllers

- IP-based Network Controllers (AV-over-IP)

- Display Type:

- LCD Video Walls

- LED Video Walls (Fine-pitch)

- DLP Rear Projection Cubes

- Application:

- Control Rooms and Command Centers (NOCs, SOCs)

- Digital Signage and Advertising

- Transportation and Public Venues (Airports, Rail)

- Corporate and Education Facilities

- Security and Surveillance

- Broadcast and Entertainment

- End-User Vertical:

- Government and Defense

- Utilities and Energy

- Transportation

- Retail and Hospitality

- Healthcare

- IT and Telecom

Value Chain Analysis For Video Wall Controllers Market

The value chain for video wall controllers begins with upstream activities involving component suppliers, primarily manufacturers of specialized processors (GPUs, FPGAs, CPUs), high-speed memory modules, and proprietary capture/output cards. These suppliers provide the foundational technology that determines the controller's performance, capacity, and reliability. Key challenges at this stage include managing the supply chain volatility of high-end microelectronics and ensuring specialized chipsets meet the stringent low-latency requirements of real-time video processing. Successful vendors maintain strong, proprietary relationships with chip developers to secure allocation and ensure technology differentiation, which is crucial in a highly competitive hardware environment focused on minimizing latency and maximizing resolution throughput.

Midstream activities involve the design, assembly, and integration of the controller unit, including the development of proprietary management software and APIs. Market participants add value by providing robust, redundant hardware architectures (especially for control room applications) and highly intuitive, feature-rich control software that simplifies complex multi-source routing and layout configuration. Distribution channels play a vital role in reaching end-users; the model often relies on indirect channels such as specialized Audio Visual (AV) integrators, System Integrators (SIs), and value-added resellers (VARs) who possess the necessary expertise to design, install, and commission complex video wall systems tailored to specific client needs. Direct sales channels are typically reserved for large governmental or defense contracts where bespoke solutions and direct technical support are required, bypassing standard distribution margins but demanding higher internal resource allocation.

Downstream activities center on installation, post-sales support, and system maintenance. The ultimate value delivery is determined by the system integrator’s ability to flawlessly execute the installation and provide long-term maintenance contracts, ensuring maximum uptime, especially in mission-critical environments. The market is increasingly adopting remote monitoring and diagnostic tools embedded within the controller software, allowing vendors or integrators to proactively address issues, thereby enhancing customer satisfaction and securing ongoing service revenue. The successful management of the downstream lifecycle, including timely software updates for security and feature enhancements, is pivotal for maintaining customer loyalty and extending the operational lifespan of the installed controller base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,320 Million |

| Market Forecast in 2033 | $2,450 Million |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Datapath, Jupiter Systems, Christie Digital, Barco, Delta Electronics, Extron, Userful, Matrox, Samsung, LG, Advantech, VuWall, Hiperwall, Gefen, Planar, Prysm, Videlio, Dexon, Evertz Microsystems, Black Box Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Video Wall Controllers Market Key Technology Landscape

The technology landscape for video wall controllers is currently dominated by two major architectural approaches: traditional hardware-based modular matrices and cutting-edge software-defined IP controllers (AV-over-IP). Hardware controllers, which use dedicated chassis and specialized input/output cards (often leveraging high-performance FPGAs or specialized GPUs), continue to be preferred in mission-critical control rooms where zero latency, high redundancy, and maximum security are non-negotiable requirements. These systems excel at handling a high density of physical video inputs and outputs, providing guaranteed bandwidth and deterministic performance regardless of network conditions. Innovations in this segment focus on increasing slot density, integrating KVM-over-IP functionality, and enhancing hot-swappable redundancy features to maximize operational uptime in critical 24/7 environments. The continuous evolution of capture card technology to support native 4K/8K resolutions across multiple inputs simultaneously is a key development.

Conversely, the Software-defined Video Wall Controller (SVWC) architecture, utilizing standard COTS (Commercial Off-the-Shelf) server hardware and leveraging powerful software platforms, is rapidly gaining traction, particularly in commercial, corporate, and digital signage applications. This approach offers unparalleled flexibility, scalability, and simplified deployment, relying on the established enterprise IP network for signal distribution. The shift towards SVWC is highly influential as it drastically reduces the physical footprint and complexity associated with traditional matrix switching. Key technological advances here include highly optimized software encoding/decoding techniques (like H.264/H.265, JPEG2000, and proprietary low-latency codecs) and advanced virtualization capabilities that allow video wall control to run efficiently within virtualized environments or public cloud infrastructure, offering significant management advantages.

A crucial technological convergence point is the rise of hybrid controllers, which merge the best features of both architectures—retaining dedicated physical inputs for critical legacy sources while fully embracing networked IP inputs and outputs for scale and flexibility. Furthermore, technology development is heavily focused on user experience (UX) and management simplicity. Advanced graphical user interfaces (GUIs), drag-and-drop layout editors, and integration with third-party automation systems (like BMS or SCADA) through robust APIs are standard expectations. The future landscape will likely be dominated by secure, fully IP-native solutions capable of AI integration, standardized on Ethernet networks, with performance measured not just by resolution capacity, but by network resilience, low overall system latency, and software sophistication in dynamic content management.

Regional Highlights

The global Video Wall Controllers Market demonstrates distinct regional characteristics driven by variances in infrastructure investment, regulatory environments, and technological maturity across key geographic areas. Each region presents unique opportunities and challenges for market participants, necessitating tailored strategies regarding product features and distribution models.

- North America: This region holds the largest market share, characterized by high adoption rates in advanced military and defense command centers, extensive utility control systems (oil, gas, and power grid management), and robust corporate campus visualization needs. Demand is strong for high-redundancy, high-security hardware controllers and advanced KVM integration solutions. The early and fast adoption of 4K and 8K displays drives continuous controller upgrade cycles.

- Europe: Europe is a mature market focusing heavily on sophisticated public safety control rooms, air traffic management (ATM) systems, and stringent regulatory environments that favor secure, long-lifecycle installations. The push towards smart city integration, particularly in Western European nations, drives demand for IP-based and decentralized visualization systems. Countries such as Germany and the UK lead in advanced industrial automation requiring integrated video wall monitoring.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC’s expansion is fueled by massive urbanization, new large-scale infrastructural projects (e.g., high-speed rail networks, new airport construction), and significant investment in governmental surveillance and smart policing initiatives. China, India, and Southeast Asian nations represent vast, growing markets for scalable, cost-effective controllers, emphasizing digital signage and public sector control rooms.

- Latin America (LATAM): The LATAM market is emerging, with primary demand originating from resource-rich countries focused on mining, oil and gas, and foundational governmental surveillance projects. Price sensitivity is higher, often favoring scalable, entry-level software or hybrid solutions. Growth is tied to national security modernization efforts and development of modern infrastructure.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in large capital projects, particularly in the UAE and Saudi Arabia, driven by smart city initiatives (like NEOM), extensive energy sector control rooms, and massive exhibition/event venues. Demand focuses on high-impact, large-format LED video walls, necessitating controllers capable of managing extremely large pixel canvases and providing exceptional redundancy and support services tailored to extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Video Wall Controllers Market.- Datapath

- Jupiter Systems

- Christie Digital

- Barco

- Delta Electronics

- Extron

- Userful

- Matrox

- Samsung

- LG

- Advantech

- VuWall

- Hiperwall

- Gefen

- Planar

- Prysm

- Videlio

- Dexon

- Evertz Microsystems

- Black Box Corporation

Frequently Asked Questions

Analyze common user questions about the Video Wall Controllers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between hardware and software video wall controllers?

Hardware controllers utilize dedicated, purpose-built chassis with specialized I/O cards, ensuring maximum performance, minimal latency, and high redundancy, ideal for 24/7 mission-critical applications like control rooms. Software controllers leverage COTS server hardware and run virtualization software or specialized operating systems, offering greater scalability, flexibility, and easier integration with standard enterprise networks (AV-over-IP), often preferred for commercial digital signage and corporate environments.

How does AV-over-IP technology impact video wall controller selection?

AV-over-IP technology revolutionizes controller selection by replacing proprietary, fixed-port hardware switching with network-based distribution. This allows organizations to use standard Ethernet infrastructure for video transport, leading to immense scalability, simplified cabling, and reduced costs. Controllers must now possess robust networking capabilities and advanced codecs to handle low-latency IP streams efficiently, moving the focus from physical ports to network bandwidth and processing capacity.

What are the primary considerations for choosing a controller for a control room environment?

For control rooms, the primary considerations are reliability, redundancy (hot-swappable components and failover capabilities), ultra-low latency signal processing for real-time monitoring, high input density to manage numerous sources, and robust integration with existing KVM and operational management software (SCADA, DCS). Cybersecurity features and long-term product lifecycle support are also essential criteria for these mission-critical deployments.

Is the Video Wall Controllers Market transitioning towards cloud-based solutions?

Yes, the market is showing a measured transition towards cloud-enabled management and specific cloud-based input sources, particularly for digital signage networks and non-mission-critical applications. While the core processing of video streams for display still often requires on-premise hardware for latency reasons, cloud solutions are increasingly used for remote content scheduling, centralized management of distributed video walls, and data aggregation before local display processing.

Which regions are driving the highest growth rate for video wall controllers?

The Asia Pacific (APAC) region, specifically driven by countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by massive infrastructure investments in smart cities, rapid deployment of public safety and surveillance systems, and high demand from new commercial and retail developments requiring large-format digital visualization tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager