Videoscopes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435596 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Videoscopes Market Size

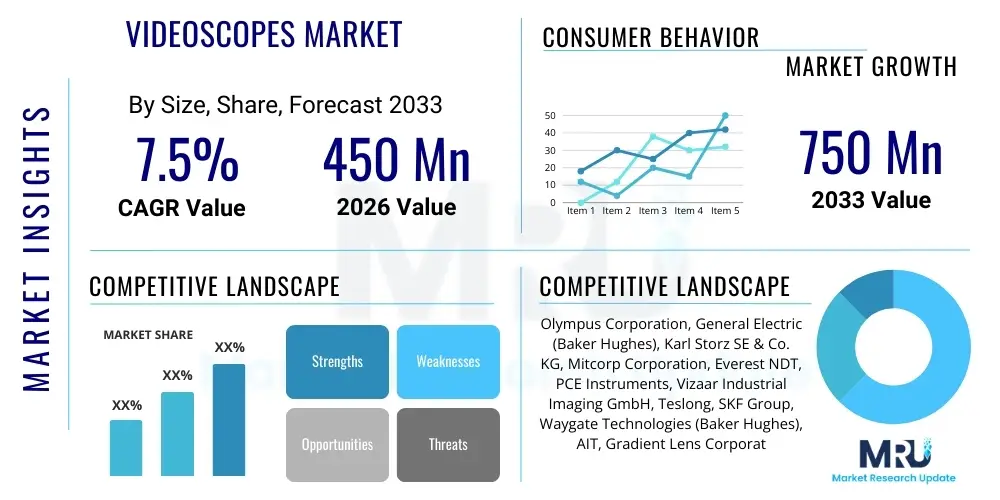

The Videoscopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Videoscopes Market introduction

Videoscopes, a crucial component of Remote Visual Inspection (RVI), are advanced non-destructive testing (NDT) instruments used across various industrial sectors to inspect inaccessible areas. These devices utilize flexible or rigid insertion tubes equipped with high-resolution cameras, lighting, and sophisticated articulation mechanisms to capture detailed visual data of internal structures, machinery, and components without requiring disassembly. The primary function of videoscopes is condition monitoring and quality assurance, particularly in complex or safety-critical environments such as aerospace engines, power generation turbines, and industrial piping.

The core product description encompasses features like high-definition (HD) imaging, 3D measurement capabilities, durable insertion probes often made of tungsten braiding, and ergonomic control systems. Major applications span Maintenance, Repair, and Overhaul (MRO) operations, manufacturing quality control, forensic engineering, and infrastructure inspection. Key benefits derived from the adoption of videoscopes include reduced downtime, early detection of faults leading to improved safety and operational efficiency, and compliance with stringent industry regulatory standards, especially in sectors governed by strict quality mandates like aviation (FAA/EASA) and petrochemicals.

Market growth is predominantly driven by the increasing global emphasis on predictive maintenance (PdM) strategies over traditional reactive maintenance, coupled with the rising complexity of modern industrial equipment which necessitates highly specialized inspection tools. Furthermore, technological advancements, including improved image resolution, enhanced portability, and the integration of advanced software for automated defect recognition, are expanding the functional scope and accessibility of videoscopes, thereby accelerating their adoption across emerging industrial economies seeking to modernize their quality management protocols.

Videoscopes Market Executive Summary

The Videoscopes Market is poised for significant expansion, driven by accelerating demands from the aerospace and defense sectors for rigorous component integrity checks and the oil and gas industry’s need for pipeline integrity monitoring in challenging environments. Current business trends indicate a strong shift towards highly portable, ruggedized systems offering advanced metrology capabilities, moving beyond simple visual assessment to precise dimensional fault analysis. Manufacturers are increasingly focusing on incorporating modular designs that allow users to interchange probe diameters and lengths, providing enhanced versatility and maximizing the return on investment for industrial clients maintaining diverse equipment portfolios. Competition is intense, characterized by continuous innovation in sensor technology (CMOS/CCD) and software integration, leading to a landscape where sophisticated user interfaces and integrated data management systems are becoming competitive necessities rather than mere differentiators.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the fastest growth, fueled by massive investments in infrastructure development, rapid industrialization, and the establishment of new manufacturing hubs, particularly in China and India. North America and Europe maintain leading market shares primarily due to established high-value industries like aerospace, automotive manufacturing, and nuclear power generation, coupled with strict regulatory environments mandating routine non-destructive examination. Segment trends highlight the increasing prominence of smaller diameter (under 6mm) videoscopes due to the miniaturization of components in aviation and electronics, alongside a robust demand for high-end systems featuring 3D Phase Measurement capabilities, which deliver critical geometric analysis essential for precision engineering maintenance tasks.

Overall market dynamics reflect a maturing technology sector that is rapidly integrating digital transformation principles. The proliferation of Industrial Internet of Things (IIoT) frameworks is enabling seamless data transfer from the videoscope directly into enterprise asset management (EAM) systems, fundamentally transforming how inspection data informs maintenance decisions. Key risks include the high initial capital expenditure associated with purchasing advanced systems and the perennial requirement for highly skilled technicians to operate and accurately interpret the complex data generated by these specialized instruments, which serves as a marginal restraint on broader, lower-end market adoption.

AI Impact Analysis on Videoscopes Market

Common user questions regarding AI’s impact on the Videoscopes Market often revolve around automated decision-making, reduction in inspection time, and the reliability of AI-driven defect recognition. Users frequently inquire whether AI can fully replace human inspectors, or if it merely acts as an assistive technology to minimize human error and accelerate the process. Concerns are also raised about the standardization and validation processes required for AI algorithms to be trusted in critical, safety-sensitive applications like aerospace engine inspection. The key expectation is that AI will drastically enhance the efficiency and objectivity of RVI, moving the process from subjective visual assessment to quantitative, automated data interpretation and reporting.

The implementation of Artificial Intelligence and Machine Learning (AI/ML) algorithms represents a paradigm shift in videoscope functionality, transforming them from passive data capture devices into intelligent inspection systems. AI primarily addresses the challenges associated with the subjective nature and labor intensity of manual defect detection. ML models trained on vast datasets of known defects (e.g., corrosion, cracks, pitting, wear) can automatically identify, classify, and measure anomalies captured by the videoscope camera, drastically accelerating the inspection cycle and improving the consistency of results across multiple operators and sites. This integration is crucial for industries facing technician shortages or high volumes of inspection points, enabling scalability and reducing the overall operational costs associated with non-productive maintenance downtime.

Furthermore, AI facilitates predictive reporting and advanced integration with IIoT platforms. By correlating real-time videoscope inspection data with historical maintenance records and operational sensor data, AI can predict future component failures with higher accuracy than traditional scheduling methods. This ability to generate instant, validated reports detailing fault severity and recommended maintenance actions shifts the focus of the technician from data acquisition and basic interpretation to complex problem-solving and strategic planning, thereby maximizing the value proposition of the videoscope technology within modern asset management ecosystems. This shift reinforces the role of AI as an invaluable assistant, augmenting human expertise rather than replacing it entirely, particularly where complex contextual analysis is still required.

- AI enables automated defect recognition (ADR) and classification, significantly reducing inspection time.

- Machine learning algorithms enhance the accuracy and repeatability of fault identification, minimizing human subjective error.

- Integration with asset management software allows AI to correlate visual inspection data with historical operational parameters for improved predictive maintenance forecasting.

- AI assists in 3D metrology data interpretation, automating the measurement and severity analysis of identified defects.

- Generative AI tools are used for automated report generation, summarizing inspection findings and recommended remedial actions.

DRO & Impact Forces Of Videoscopes Market

The market is predominantly driven by stringent regulatory frameworks across industries like aerospace, nuclear energy, and oil and gas, which mandate regular non-destructive inspection to ensure operational integrity and public safety. The accelerating adoption of predictive maintenance (PdM) strategies globally further fuels demand, as videoscopes are integral to proactive condition monitoring programs designed to minimize unplanned equipment downtime. However, key restraints include the substantial initial investment cost associated with high-resolution, articulated, and metrology-enabled videoscope systems, which can be prohibitive for small and medium-sized enterprises (SMEs). Additionally, the necessity for highly trained personnel to operate, interpret, and accurately document complex inspection results presents an ongoing challenge for market expansion.

Opportunities for market growth lie primarily in technological advancements such as miniaturization, allowing for inspection in increasingly small and convoluted spaces, and the development of truly wireless (cable-free) systems for enhanced portability and safety in hazardous environments. The integration of advanced computational photography, such as real-time image stitching and fusion, promises clearer and more comprehensive views of large inspection areas. Analyzing the impact forces reveals that the bargaining power of buyers is moderate to high, particularly large industrial conglomerates who purchase in bulk and demand customization, placing continuous pressure on manufacturers to innovate pricing models and technology roadmaps.

The threat of substitutes remains relatively low for core applications where RVI is uniquely suited, although complementary NDT methods like ultrasound or eddy current testing occasionally overlap in scope. However, for specialized inspections, videoscopes remain the primary choice for visual confirmation and geometric analysis. The competitive rivalry among existing players is high, characterized by continuous product refinement and aggressive patent strategies focused on optical clarity, articulation precision, and software functionality. New market entrants face high barriers related to required technical expertise, capital investment in R&D, and the necessity for extensive certification and reputation building, particularly in critical end-use sectors.

Segmentation Analysis

The Videoscopes Market segmentation provides a granular view of demand dynamics, reflecting the diverse industrial requirements governing inspection tasks. Segmentation is primarily conducted based on probe diameter, which dictates accessibility (e.g., sub-4mm for small bores versus 8mm+ for general industrial use); working length, which determines the depth of inspection; and articulation type, differentiating between manual, semi-automated, and fully motorized tip control. The technology segment is crucial, distinguishing between basic visual inspection systems and advanced 3D measurement systems (stereo and phase measurement), which command a significant price premium due to their enhanced analytical capabilities.

Application-based segmentation is critical, highlighting the dominance of the aerospace and power generation sectors where safety and failure avoidance justify high capital expenditure on premium equipment. The service component, including calibration, repair, and training, is also a significant market segment, offering recurring revenue streams for key manufacturers. Analyzing these segments reveals a growing trend toward high-resolution, articulated probes ranging from 4mm to 6mm, representing the sweet spot for versatility across major automotive and general manufacturing inspection requirements, balancing maneuverability with optical performance.

Furthermore, portability remains a differentiating segment, dividing the market between highly ruggedized, heavy-duty systems designed for extreme environments (e.g., offshore oil and gas) and lightweight, handheld units optimized for rapid, frequent inspections in maintenance environments. Understanding these segmentation nuances allows stakeholders to target specific niche requirements, such as long-reach (>10 meters) inspection systems required for large boiler tubes or specialized systems designed to operate in high-temperature or radiation environments, showcasing the market’s technological diversity in meeting highly customized industrial challenges.

- By Diameter: Less than 6 mm, 6 mm to 10 mm, Greater than 10 mm

- By Working Length: Up to 3 Meters, 3 Meters to 8 Meters, Greater than 8 Meters

- By Articulation Type: Manual, Motorized (4-way, 2-way, Multi-way)

- By Technology: Visual Inspection Systems, 3D Measurement Systems (Stereo Measurement, Phase Measurement)

- By Application: Aerospace & Defense, Automotive, Oil & Gas, Power Generation (Nuclear, Thermal), Manufacturing & General Industry, Infrastructure

- By Portability: Handheld/Portable Systems, Benchtop/Fixed Systems

Value Chain Analysis For Videoscopes Market

The value chain for the Videoscopes Market is complex, beginning with highly specialized upstream suppliers focusing on critical components such as high-resolution CMOS/CCD imaging sensors, micro-LED lighting assemblies, precision optics (lenses and relay systems), and durable, flexible probe materials (e.g., advanced metallic or polymeric braiding). These upstream activities are characterized by high R&D intensity and stringent quality control, as component performance directly dictates the final product's image quality and durability. Key manufacturers often rely on specialized third-party providers for custom articulation motors and sophisticated image processing chipsets, forming a concentrated supply base for specialized hardware components.

The core manufacturing and assembly phase involves integrating these complex components, including the challenging process of assembling the slender insertion probe, calibrating the optical path, and developing the proprietary software interface and metrology algorithms. This midstream process requires significant expertise in micro-assembly and precision engineering. Distribution channels are varied: direct sales are common for high-end, customized systems sold to large aerospace or power utility customers, allowing manufacturers to maintain tight control over service and pricing. Indirect distribution, leveraging specialized NDT equipment distributors and MRO service providers, is frequently utilized for standard products targeting general manufacturing and smaller enterprises, ensuring wider market reach and localized technical support.

Downstream activities center on end-user utilization, training, maintenance, and service. High-margin services, including periodic calibration, necessary repairs of damaged probes, and specialized application training (crucial for accurate 3D measurement usage), constitute a significant portion of the total value delivery. The efficient flow of information—from end-user feedback regarding product durability and usability back to R&D—is essential for continuous product iteration and maintaining competitive advantage. The entire chain is heavily regulated, requiring adherence to ISO standards and industry-specific compliance certifications, reinforcing the critical link between high quality in upstream components and trustworthy results downstream.

Videoscopes Market Potential Customers

Potential customers for videoscopes are primarily concentrated within industries where component failure poses significant risks to safety, financial viability, or environmental compliance. The largest and most demanding segment is the Aerospace and Defense industry, where customers require videoscopes for detailed foreign object debris (FOD) searches, combustion chamber inspection, and turbine blade integrity checks during engine MRO cycles. These buyers demand the highest levels of image quality, precision 3D measurement capabilities, and probes capable of enduring the harsh, complex geometry of jet engines.

Another major end-user group is the Power Generation sector, specifically nuclear, thermal, and hydro plants. These customers utilize videoscopes for inspecting boiler tubes, reactor components, heat exchangers, and turbine internals to detect corrosion, scaling, and stress cracking, crucial for regulatory compliance and preventing catastrophic outages. Similarly, the Oil & Gas industry relies heavily on videoscopes for pipeline integrity assessments, vessel inspection, and monitoring intricate subsea equipment, especially where non-intrusive inspection methods are paramount for safety and efficiency in difficult-to-access locations.

Finally, the Automotive and General Manufacturing sectors represent a broad customer base, focusing heavily on quality control and production line inspection. Automotive manufacturers use these tools for inspecting engine blocks, casting voids, and finished component integrity. General manufacturing clients, including pharmaceutical and food processing companies, use specialized, sometimes sterile, videoscopes for equipment validation and hygiene checks in processing lines. These customers typically prioritize speed, portability, and ease of use, often opting for more mid-range, versatile models that can be rapidly deployed across various production assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, General Electric (Baker Hughes), Karl Storz SE & Co. KG, Mitcorp Corporation, Everest NDT, PCE Instruments, Vizaar Industrial Imaging GmbH, Teslong, SKF Group, Waygate Technologies (Baker Hughes), AIT, Gradient Lens Corporation (Hawkeye), Extech Instruments, JME Technologies, VIK-ING GmbH, Fiberoptic Systems Inc., Lenox Instrument Company, R.STAHL AG, QSA Global, Inc., Optim LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Videoscopes Market Key Technology Landscape

The technological evolution of the Videoscopes Market is centered on enhancing image fidelity, improving measurement accuracy, and maximizing operational flexibility. A foundational technological shift involves the transition from traditional fiber optic illumination to advanced LED or laser diode light sources, coupled with high-resolution CMOS (Complementary Metal-Oxide-Semiconductor) or CCD (Charge-Coupled Device) sensors positioned at the probe tip. This distal tip imaging eliminates image degradation common with fiber bundle scopes, delivering crisp, bright, and high-contrast images, often supporting 1080p HD resolution or higher, which is crucial for identifying minute surface anomalies like micro-cracks or pitting.

A second major technological differentiator is the advent of 3D Measurement capabilities, notably Phase Measurement and Stereo Measurement. Phase measurement, utilizing structured light projection (often in the form of a grid or pattern), allows the system to calculate the precise distance and depth of defects by analyzing the distortion of the projected light pattern. Stereo measurement employs two separate optical paths at the tip to create a depth perception, offering accurate dimensioning of defects such as corrosion loss or pit size, thereby transforming the videoscope from a qualitative tool into a quantitative measurement instrument essential for engineering assessment and compliance reporting.

Furthermore, connectivity and articulation technologies are undergoing significant refinement. Motorized, multi-way articulation systems provide precise control over the probe tip, enabling comprehensive inspection of complex geometries, often incorporating haptic feedback or joystick control for intuitive navigation. The adoption of wireless technologies (Wi-Fi, low-latency transmission protocols) facilitates data streaming and remote collaboration, while ruggedized, durable insertion tubes utilizing advanced materials like tungsten braiding ensure longevity and reliability in harsh industrial settings. Software integration, particularly features like automated image scaling, image comparison tools, and seamless data transfer to cloud-based or local maintenance software, completes the modern technological profile of high-end videoscope systems, ensuring data integrity and streamlined workflow.

Regional Highlights

- North America (U.S. and Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (APAC) (China, Japan, India, South Korea)

- Latin America (LATAM)

- Middle East and Africa (MEA)

North America holds a substantial share of the Videoscopes Market, driven primarily by the colossal aerospace and defense industry in the United States, which requires best-in-class NDT equipment for maintaining highly regulated assets like aircraft engines and strategic defense systems. The region benefits from early and rapid adoption of advanced technologies, including AI-integrated and 3D measurement videoscopes, fueled by significant R&D investments and a strong regulatory environment (e.g., FAA regulations mandating rigorous inspections). The mature oil and gas sector, particularly for monitoring aging infrastructure and ensuring compliance in challenging environments, further solidifies the market position. The demanding nature of these industries ensures sustained demand for premium, ruggedized, and technologically sophisticated inspection solutions, maintaining high average selling prices for equipment within this region.

The European market is characterized by robust demand from the automotive manufacturing sector, especially in Germany, where videoscopes are essential for quality control in advanced engine production and casting inspection. Furthermore, the region’s strong focus on renewable and nuclear power generation necessitates extensive use of videoscopes for turbine and reactor maintenance, adhering to strict EU safety directives. European manufacturers are often at the forefront of developing ergonomic design and sophisticated optical systems, catering to a user base that prioritizes high precision and reliability. The market dynamic here is moderately competitive, with established local players maintaining strong relationships with legacy industrial clients and focusing heavily on comprehensive service and calibration packages to ensure long-term customer loyalty.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is attributed to large-scale infrastructure projects, rapid industrialization, and massive government investment in power generation and transportation networks across countries like China and India. The burgeoning manufacturing base, transitioning from low-cost production to high-quality output (particularly in electronics and automotive components), drives significant demand for affordable yet reliable videoscopes for quality control. While price sensitivity remains a factor, the escalating regulatory emphasis on safety and quality standards, mirroring those in the West, increasingly pushes adoption toward higher-end, feature-rich systems. Japan and South Korea, with their advanced technology sectors, remain key markets for specialized, high-resolution videoscopes utilized in precision engineering and high-tech manufacturing.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging but promising markets. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees demand primarily stemming from the large-scale investment and continuous operational requirements of the upstream and downstream oil and gas industry. Videoscopes are essential for asset integrity management of refineries, storage tanks, and pipelines. Demand in LATAM is more dispersed, centered on mining, localized manufacturing, and infrastructure projects. Growth in these regions is often influenced by global commodity prices, but the necessity for modernizing existing industrial assets and adopting international safety standards ensures a steady, albeit slower, expansion path, with particular interest in portable and cost-effective solutions suitable for remote or austere operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Videoscopes Market.- Olympus Corporation

- General Electric (Baker Hughes/Waygate Technologies)

- Karl Storz SE & Co. KG

- Mitcorp Corporation

- Vizaar Industrial Imaging GmbH

- PCE Instruments

- Teslong

- Gradient Lens Corporation (Hawkeye)

- SKF Group

- Extech Instruments

- AIT (Advanced Inspection Technologies)

- JME Technologies

- VIK-ING GmbH

- Fiberoptic Systems Inc.

- Lenox Instrument Company

- R.STAHL AG

- QSA Global, Inc.

- Optim LLC

- Ametek Inc. (Solartron Metrology)

- Wohler USA Inc.

Frequently Asked Questions

Analyze common user questions about the Videoscopes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-end 3D measurement videoscopes?

The primary driver is the stringent demand from safety-critical industries, such as aerospace and power generation, to shift from subjective visual inspection to quantitative Non-Destructive Testing (NDT). 3D measurement capabilities (like Phase Measurement) allow operators to accurately quantify the size, depth, and area of defects (e.g., pitting or corrosion) to determine the component's remaining service life, which is essential for compliance and predictive maintenance planning.

How is Artificial Intelligence (AI) fundamentally changing the videoscope inspection process?

AI is transforming the process by enabling Automated Defect Recognition (ADR). Instead of relying solely on human interpretation, AI algorithms instantly analyze video feed, automatically identifying and classifying common defects like cracks and corrosion. This significantly accelerates inspection time, enhances consistency across various operators, and reduces the subjective error inherent in manual visual assessments, directly improving efficiency in MRO operations.

Which videoscope probe features are most critical for aerospace engine maintenance?

For aerospace applications, critical features include small diameters (typically under 6mm) for accessing intricate engine parts, high-articulation precision (motorized 4-way control) for navigating complex turbine pathways, and exceptional image clarity (HD resolution) combined with advanced 3D measurement systems. Additionally, probes must possess extreme durability, often utilizing tungsten braiding, to withstand the mechanical and thermal stresses encountered during turbine and combustion chamber inspections.

What are the key restraints impacting market growth despite technological advancements?

The main restraints include the high initial capital investment required for purchasing advanced, metrology-enabled videoscope systems, limiting adoption by smaller industrial players. Furthermore, the mandatory requirement for highly skilled and certified technicians to accurately operate the complex equipment and correctly interpret the resulting inspection and 3D measurement data presents an ongoing labor challenge for global market expansion and utilization.

What role does digitalization play in the future development of the videoscopes market?

Digitalization, fueled by IIoT (Industrial Internet of Things), is crucial. Future development focuses on seamless data integration, allowing videoscope findings to be automatically logged into cloud-based Enterprise Asset Management (EAM) systems. This integration supports real-time remote collaboration, centralized data storage for compliance auditing, and sophisticated predictive analytics, ensuring that inspection data immediately informs maintenance scheduling and strategic operational decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager