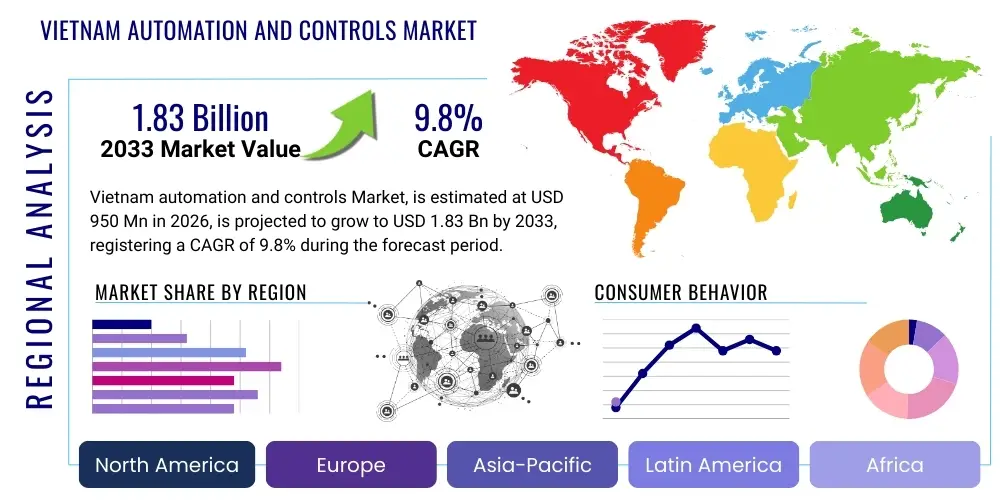

Vietnam automation and controls Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437809 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Vietnam automation and controls Market Size

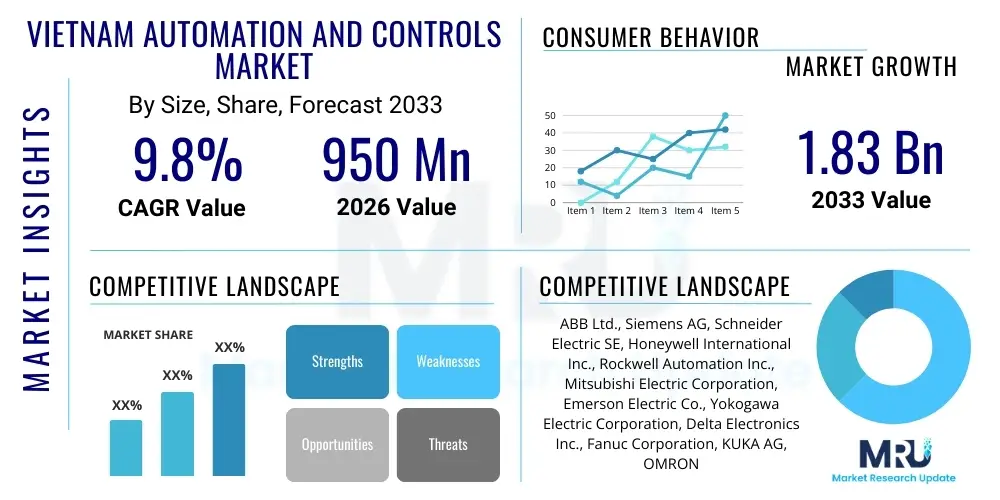

The Vietnam automation and controls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1.83 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the Vietnamese government's strategic focus on industrial modernization, encapsulated by the Industry 4.0 national strategy, which necessitates high-precision control systems across emerging and established manufacturing sectors.

Vietnam automation and controls Market introduction

The Vietnam automation and controls market encompasses a wide array of technological solutions designed to monitor, regulate, and execute operations within industrial settings with minimal human intervention. Key products include Distributed Control Systems (DCS), Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA) systems, Human-Machine Interfaces (HMI), and various sensors and actuators. Major applications span critical sectors such as automotive manufacturing, electronics and semiconductor production, food and beverage processing, pharmaceuticals, and power generation. The primary benefits realized by adopting these technologies are enhanced operational efficiency, reduced production costs, improved product quality consistency, and adherence to stringent international safety standards. The market's robust growth is primarily driven by significant Foreign Direct Investment (FDI) inflows into the manufacturing sector, particularly from East Asian economies seeking diversified production bases, coupled with governmental incentives promoting smart factory implementation.

Vietnam automation and controls Market Executive Summary

The Vietnam automation market is characterized by dynamic business trends centered on rapid digital transformation and the adoption of integrated solutions linking enterprise resource planning (ERP) with shop floor operations. Business models are shifting towards service-oriented architectures, including subscription-based access to automation software and predictive maintenance services, moving away from purely capital expenditure purchases. Regionally, growth is highly concentrated in key industrial hubs surrounding Ho Chi Minh City (HCMC), Hanoi, and the provinces of Binh Duong and Dong Nai, which attract the bulk of high-tech manufacturing investments and require advanced process control systems. Segmentation trends show robust growth in the Discrete Automation segment, fueled by the booming electronics and automotive assembly industries, while the Process Automation segment sees steady demand from the petrochemical and water treatment sectors. Furthermore, there is a distinct vertical trend towards adopting modular and scalable automation components that can be quickly integrated and redeployed to meet changing global supply chain requirements and flexibility demands.

AI Impact Analysis on Vietnam automation and controls Market

Common user questions regarding AI's impact on the Vietnam automation and controls Market primarily revolve around operational efficiency gains, the feasibility of implementing advanced predictive maintenance in legacy systems, and the necessary cybersecurity measures required for increasingly interconnected smart factories. Users frequently inquire about the return on investment (ROI) for AI-driven optimization tools versus traditional control loop tuning, and the specific skill sets Vietnamese engineers will need to manage these intelligent systems. Furthermore, there is concern regarding data privacy and the integration complexity of AI algorithms within existing Operational Technology (OT) networks. These inquiries underscore a high expectation for AI to solve persistent manufacturing challenges, such as unexpected downtime and waste reduction, while highlighting critical concerns related to data governance and the required technical infrastructure overhaul.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the landscape of industrial automation in Vietnam by enabling truly intelligent control systems that move beyond mere prescriptive logic. AI algorithms are increasingly being deployed for real-time fault detection, optimization of complex production schedules, and highly nuanced quality control inspections, especially in high-volume, high-precision sectors like semiconductor packaging and automotive component manufacturing. This shift allows Vietnamese manufacturers to significantly reduce variability, maximize throughput, and achieve higher yields than previously possible with conventional automation technologies. The adoption of AI is critical for maintaining competitiveness against regional rivals, positioning Vietnam as a high-value manufacturing destination, rather than just a low-cost assembly hub. However, the success of this integration hinges upon the availability of clean, reliable operational data and substantial investment in local data science capabilities tailored for industrial applications.

Furthermore, AI is instrumental in extending the operational lifespan of expensive machinery through advanced predictive maintenance. By analyzing sensor data streams in real-time—including vibration, temperature, and current consumption—AI models can predict component failure with high accuracy, allowing maintenance to be scheduled precisely when needed, minimizing catastrophic breakdowns and associated lost production time. This capability is particularly valuable in Vietnam’s rapidly expanding heavy industry and infrastructure projects, where downtime costs are prohibitive. As the domestic industrial Internet of Things (IIoT) infrastructure matures, AI's role in optimizing energy consumption and managing decentralized supply chains is also expanding, providing manufacturers with critical tools for sustainability reporting and enhanced resource management, thereby future-proofing their operational investments against rising energy costs and stricter environmental regulations.

- AI enhances predictive maintenance, reducing unplanned downtime by analyzing real-time sensor data.

- Optimizes control loop tuning and process parameters for improved energy efficiency and yield.

- Enables sophisticated quality inspection through machine vision systems and deep learning algorithms.

- Facilitates human-robot collaboration (HRC) by improving robot path planning and safety protocols.

- Requires significant investment in robust OT cybersecurity infrastructure to protect intelligent networks.

- Drives the demand for specialized data engineers and AI/ML experts within industrial enterprises.

- Supports supply chain resilience by providing advanced demand forecasting and operational insights.

DRO & Impact Forces Of Vietnam automation and controls Market

The market is predominantly influenced by robust Drivers, tempered by significant Restraints, and buoyed by emerging Opportunities, all shaped by internal and external Impact Forces. Key drivers include aggressive government initiatives like the National Digital Transformation Program, consistent growth in Foreign Direct Investment targeting high-tech manufacturing, and the urgent need for local companies to improve efficiency to compete globally, especially as labor costs continue to rise. Restraints largely center on the high initial capital expenditure required for advanced automation systems, a critical shortage of skilled technical personnel capable of deploying and maintaining complex control architectures, and the inherent complexity of integrating disparate legacy systems common in older Vietnamese factories. Opportunities are prevalent in integrating automation with renewable energy grids, developing smart city infrastructure, and providing highly specialized solutions for niche sectors such as pharmaceutical manufacturing, demanding stringent regulatory compliance and precision control. These forces collectively dictate the pace and direction of technological adoption across Vietnam's industrial landscape.

A major driving force is the regional geopolitical shift, making Vietnam a preferred manufacturing hub (the "China+1" strategy), which significantly increases the volume and sophistication of factory construction requiring state-of-the-art automation systems. This influx of large international manufacturers sets higher benchmarks for quality, reliability, and production speed, compelling domestic suppliers and smaller manufacturers to modernize rapidly or risk being sidelined. Government policies offering tax incentives and land subsidies for high-tech investments further accelerate this driver, creating a concentrated demand zone for industrial control hardware and software. Furthermore, the imperative to comply with international standards, particularly in export-oriented industries like textiles and seafood processing, necessitates automated quality assurance and traceability systems, cementing automation as a prerequisite for global market access.

Conversely, the primary restraint involving the skills gap is multifaceted; it extends beyond merely operating the equipment to encompassing system design, programming, maintenance diagnostics, and cybersecurity management in converged IT/OT environments. While universities are beginning to address this, the current supply of qualified engineers cannot keep pace with the demand generated by the market's explosive growth. Furthermore, SMEs, which constitute a large portion of Vietnam's industrial base, often face financing challenges and perceive the ROI period for highly integrated automation solutions as too long, preferring incremental upgrades over transformative system replacements. These constraints often slow the diffusion of the most advanced automation technologies, limiting the market primarily to large multinational corporations (MNCs) that possess the necessary capital and technical expertise. Successfully mitigating these restraints requires collaborative efforts between private automation providers, educational institutions, and government training programs.

- Drivers: High FDI inflows into electronics and automotive sectors; Government emphasis on Industry 4.0; Rising domestic labor costs and demand for quality consistency; Expansion of sophisticated infrastructure projects (water, power).

- Restraints: Significant capital expenditure and long ROI cycles for SMEs; Shortage of highly skilled local engineers (OT/IT convergence); Complexity and cost of integrating legacy systems (brownfield sites); Vulnerability to sophisticated cyber threats.

- Opportunities: Development of smart cities and renewable energy integration requiring smart grid control systems; Growth of specialized manufacturing (pharmaceuticals, high-precision components); Leveraging 5G for distributed control and remote asset monitoring; Adoption of cloud-based industrial software and services.

- Impact Forces: Geopolitical trade diversification favoring Vietnam; Technological advancement in edge computing and industrial IoT; Fluctuations in global semiconductor supply chains affecting component availability; Domestic macroeconomic stability supporting long-term industrial investment.

Segmentation Analysis

The Vietnam automation and controls market is segmented based on component type, system type, and end-user industry, reflecting the diverse applications across the nation's rapidly industrializing economy. Component segmentation reveals high demand for sensors and actuators, crucial for data acquisition in smart factory environments, alongside robust growth in control valves and industrial robots. System-wise, the market is broadly divided between Process Automation, dominating sectors like oil and gas, chemicals, and cement, and Discrete Automation, which is heavily leveraged by the thriving electronics, textiles, and automotive assembly industries. Analyzing these segments provides a clear picture of investment priorities, showing a pronounced shift towards modular and integrated automation platforms that facilitate flexible manufacturing operations, a necessity for meeting dynamic global market demands.

The segmentation structure is dynamic, influenced heavily by government policies and foreign investment patterns. For example, recent large-scale investments in semiconductor manufacturing have dramatically boosted the demand for ultra-precise motion control systems and sophisticated Distributed Control Systems (DCS), which are vital for maintaining extremely tight tolerances and managing complex recipe handling. Similarly, the growing domestic pharmaceutical and food & beverage processing sectors are driving demand for automation solutions that comply with global safety standards (e.g., FDA and HACCP), thus prioritizing validated software and stainless-steel components suitable for cleanroom environments. This granular demand dictates technology adoption, favoring suppliers who can provide highly specialized, compliant, and scalable solutions tailored to specific industry regulatory burdens.

- By Component:

- Sensors & Transmitters (Pressure, Temperature, Flow, Level)

- Control Valves & Actuators

- Controllers & Relays (PLCs, PACs)

- Industrial Robotics (Articulated, SCARA, Delta, Cartesian)

- Drives & Motors

- Human-Machine Interface (HMI)

- By System Type:

- Process Automation Systems (DCS, Safety Instrumented Systems)

- Discrete Automation Systems (Factory Automation, CNC)

- Field Devices (Smart Transmitters, Control Valves)

- By End-User Industry:

- Automotive & Transportation

- Electronics & Semiconductor Manufacturing

- Food & Beverage Processing

- Pharmaceuticals & Life Sciences

- Oil & Gas / Chemical

- Power Generation & Utilities (including Renewables)

- Metal & Mining

- Textile & Garment

Value Chain Analysis For Vietnam automation and controls Market

The value chain for the Vietnam automation and controls market starts with upstream activities involving component and software development, primarily dominated by large international technology providers in North America, Europe, and Japan. These core component manufacturers (e.g., specialized ASIC producers, sensor fabrication plants) set the technological standards and innovation pace. The midstream involves system integrators and distributors—both international firms with local offices and domestic Vietnamese companies—who are responsible for customizing, assembling, programming, and deploying the automation architecture according to specific industrial site requirements. This integration phase is critical in Vietnam, as it often involves retrofitting advanced controls onto existing brownfield infrastructure, requiring specialized local expertise in bridging old and new technologies.

The downstream segment focuses on the operational end-users—the manufacturing facilities, power plants, and utility providers—who consume these solutions. Post-installation activities include crucial services such as ongoing maintenance, software updates, operational training, and cybersecurity monitoring, often provided through long-term service contracts. Distribution channels are typically a mix of direct sales for large-scale, complex projects (like major DCS installations in a refinery) where manufacturers engage directly with the client, and indirect channels, utilizing authorized distributors and value-added resellers (VARs) to handle standardized components, spares, and localized technical support for smaller projects and SMEs across the decentralized industrial zones. The effectiveness of the indirect channel is a key determinant of market penetration into Vietnam's vast base of small and medium-sized enterprises.

Success within the Vietnamese value chain is increasingly reliant on establishing robust local service networks. Foreign providers must invest in training local partners to ensure rapid response times and culturally fluent technical support, which are highly valued by Vietnamese operators. The trend towards industrial IoT (IIoT) shifts value creation further downstream towards data analytics and cloud services, necessitating strong collaboration between traditional hardware manufacturers and software platform providers. Furthermore, intellectual property protection and combating grey market components remain persistent challenges that suppliers must navigate, often requiring strategic selection of reliable, certified local partners who adhere strictly to quality and ethical standards.

Vietnam automation and controls Market Potential Customers

Potential customers (End-Users/Buyers) for automation and controls solutions in Vietnam are predominantly large multinational corporations (MNCs) that anchor the high-tech manufacturing base, followed by large state-owned enterprises (SOEs) undergoing mandated modernization, and a growing segment of sophisticated domestic private enterprises. MNCs in the electronics and automotive sectors (e.g., those assembling consumer electronics or manufacturing auto parts) require the highest level of precision, speed, and traceability, making them prime buyers of integrated robotics, high-end PLCs, and sophisticated SCADA systems. SOEs in the power generation, cement, and water treatment sectors are consistent buyers of robust Process Automation systems (DCS and safety systems) aimed at improving long-term asset reliability and compliance with environmental regulations.

A rapidly expanding customer segment includes domestic food and beverage manufacturers and pharmaceutical companies. As Vietnam's middle class expands, demand for quality and safety-assured domestic products grows, requiring these producers to adopt automated quality control, batch processing, and packaging lines. These customers look for flexible, hygienic, and scalable solutions that meet international certification standards (e.g., ISO 22000, GMP), focusing heavily on validated software and components suitable for washdown or cleanroom environments. Suppliers targeting this segment often need to offer tailored financial solutions and extensive local support to overcome the high initial investment barrier perceived by medium-sized domestic players.

Beyond traditional manufacturing, the emerging sectors of smart infrastructure and renewable energy present significant new customer bases. Grid operators and smart city project developers are seeking advanced control systems for optimizing energy distribution, managing microgrids, and automating urban services like traffic control and smart waste management. These buyers prioritize interoperability, network security, and real-time data processing capabilities, often requiring complex integration with existing municipal IT infrastructure. The convergence of OT and IT in these environments necessitates suppliers with expertise in both industrial controls and enterprise-level cybersecurity solutions, signaling a shift in the skills required to successfully serve these high-growth customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1.83 billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Honeywell International Inc., Rockwell Automation Inc., Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Delta Electronics Inc., Fanuc Corporation, KUKA AG, OMRON Corporation, Yaskawa Electric Corporation, Fuji Electric Co. Ltd., Advantech Co. Ltd., Bosch Rexroth AG, Keyence Corporation, Endress+Hauser Group, Eaton Corporation, WAGO Kontakttechnik GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vietnam automation and controls Market Key Technology Landscape

The technological landscape of the Vietnam automation market is rapidly converging around the Industrial Internet of Things (IIoT) and advanced connectivity solutions, primarily driven by the need for real-time data visibility and decentralized control. Implementation of Edge Computing is becoming critical, allowing data processing and localized decision-making to occur closer to the source (i.e., on the factory floor) rather than relying solely on cloud infrastructure. This minimizes latency, which is essential for high-speed manufacturing processes like robotics control and automated inspection systems. Furthermore, the deployment of 5G networks in industrial parks is beginning to unlock the potential for large-scale, wireless sensor networks and highly reliable mobile robotics, drastically simplifying factory layouts and enabling flexible production line changes without the constraint of fixed wiring. Manufacturers are actively seeking solutions that integrate these technologies seamlessly into existing PLC and SCADA architectures.

Another transformative technology is the pervasive focus on industrial cybersecurity, moving from a peripheral concern to a mandatory foundational requirement, especially as Vietnamese factories connect their operational technology (OT) systems to corporate IT networks. Given the high reliance on imported components and software, securing the entire automation stack against sophisticated external threats is paramount. Solutions now integrate deep packet inspection, anomaly detection, and unified security management platforms designed specifically for OT environments, recognizing that traditional IT security measures are often incompatible with real-time industrial protocols. The adoption of robust security measures is driven not only by the fear of operational disruption but also by the requirements imposed by international partners and clients who demand certified compliance throughout their supply chain.

Finally, the growing sophistication of collaborative robotics (Cobots) represents a significant technological shift. Unlike traditional, caged industrial robots, Cobots are designed to work safely alongside human operators, offering flexibility and agility in tasks like assembly, packaging, and material handling. This technology is highly relevant in Vietnam, where labor remains a critical resource but tasks require higher precision and speed. The ease of programming and deployment of modern Cobots reduces the technical entry barrier for SMEs, enabling them to introduce automation without needing extensive specialized robotic engineering teams. This human-centric approach to automation is vital for maximizing productivity while managing the transition of the workforce into higher-value oversight and maintenance roles, aligning with Vietnam's long-term workforce development goals.

Regional Highlights

The market growth in Vietnam is spatially heterogeneous, heavily influenced by the concentration of industrial parks and supporting logistics infrastructure. Three core economic regions serve as the primary demand centers for automation and control technologies.

- Southern Economic Region (HCMC, Binh Duong, Dong Nai, Ba Ria-Vung Tau): This region is the undisputed industrial powerhouse, dominating high-tech manufacturing, specifically electronics assembly (smartphones, components), automotive parts production, and petrochemical processing. Binh Duong and Dong Nai provinces, due to their proximity to major ports and established industrial zones, are focal points for large-scale FDI projects requiring advanced discrete automation (robotics, CNC) and complex process control (DCS in chemical facilities).

- Northern Key Economic Region (Hanoi, Hai Phong, Bac Ninh, Vinh Phuc): Characterized by major foreign investments in automotive manufacturing, high-tech R&D centers, and electronics component fabrication, particularly in provinces like Bac Ninh, which hosts major global electronics firms. Demand here is high for cleanroom automation, precision motion control, and integrated logistics automation solutions crucial for the supply chain efficiency tied to the Hai Phong port.

- Central Coastal Region (Da Nang, Quang Nam): While smaller, this region is emerging as a secondary hub for specialized manufacturing, including textiles and some higher-value assembly operations. Automation adoption here often focuses on optimizing logistics, material handling, and quality inspection to maintain competitiveness against the larger established northern and southern hubs. Infrastructure investment in Da Nang's port and high-tech parks is expected to accelerate automation demand post-2025.

- Mekong River Delta Region (Can Tho, Long An): Primarily focused on agriculture, aquaculture, and food processing. The automation demand is highly specialized, centered on food safety compliance, automated sorting, cold chain management, and water management controls, offering significant potential for modular and purpose-built automation solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vietnam automation and controls Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Delta Electronics Inc.

- Fanuc Corporation

- KUKA AG

- OMRON Corporation

- Yaskawa Electric Corporation

- Fuji Electric Co. Ltd.

- Advantech Co. Ltd.

- Bosch Rexroth AG

- Keyence Corporation

- Endress+Hauser Group

- Eaton Corporation

- WAGO Kontakttechnik GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Vietnam automation and controls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for automation adoption in Vietnam's manufacturing sector?

The primary driver is the rapid influx of Foreign Direct Investment (FDI) into high-tech manufacturing, particularly electronics and automotive, coupled with rising domestic labor costs and the governmental mandate to implement Industry 4.0 technologies to enhance global competitiveness and production quality.

Which industrial segment demonstrates the fastest growth rate for automation solutions in Vietnam?

The Discrete Automation segment, driven by the booming electronics assembly and semiconductor industries, currently exhibits the fastest growth due to the high demand for robotics, precision motion control systems, and automated testing equipment required for high-volume, high-tolerance production.

What are the main challenges faced by Small and Medium-sized Enterprises (SMEs) in adopting automation?

SMEs primarily struggle with high initial capital expenditure requirements, the difficulty in justifying the long-term Return on Investment (ROI), and a significant shortage of locally skilled engineers capable of operating and maintaining advanced, integrated automation systems effectively.

How is Artificial Intelligence (AI) impacting industrial control systems in Vietnam?

AI is mainly impacting industrial control systems by enabling advanced predictive maintenance, optimizing complex process controls in real-time for efficiency and yield improvement, and enhancing quality inspection through sophisticated machine vision and deep learning applications, facilitating a move toward intelligent manufacturing.

Where are the key geographical hubs for automation demand within Vietnam?

The key geographical hubs are the Southern Economic Region (HCMC, Binh Duong) and the Northern Key Economic Region (Hanoi, Bac Ninh, Hai Phong), as these areas host the largest concentrations of industrial parks, advanced manufacturing facilities, and critical infrastructure projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager