Viewfinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431980 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Viewfinder Market Size

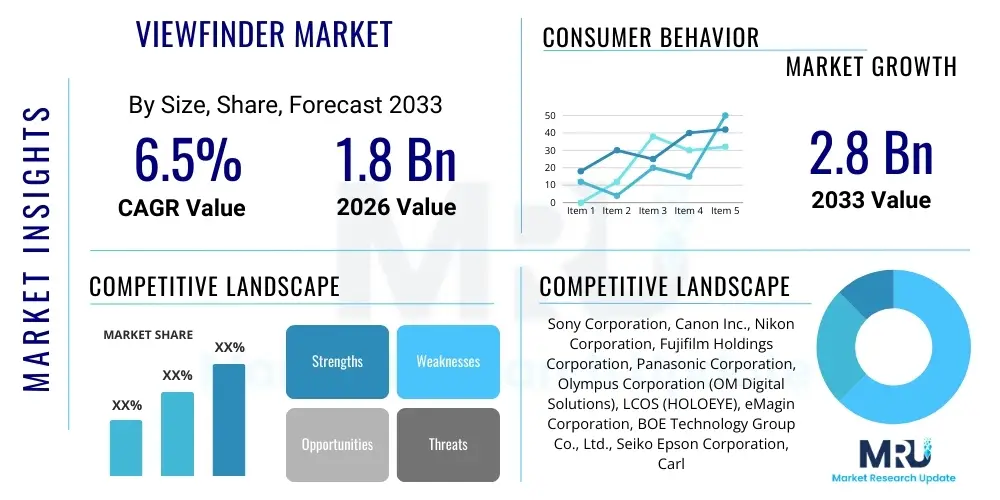

The Viewfinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by the ongoing transition from traditional optical systems to advanced electronic viewfinders (EVFs) within the digital imaging sector, particularly in the professional and high-end consumer mirrorless camera segments.

The valuation reflects robust investment across the imaging ecosystem, including substantial research and development expenditures focused on enhancing resolution, refresh rates, and color fidelity of micro-displays utilized in EVFs. While the consumer DSLR segment is experiencing contraction, the premiumization trend in mirrorless cameras, which heavily rely on cutting-edge EVF technology for a superior shooting experience, compensates for this decline, ensuring steady market progression throughout the projection timeline.

Viewfinder Market introduction

The Viewfinder Market encompasses the technologies and components used to provide a visual interface for users to frame, compose, and focus images through a camera or optical instrument. Products within this market range from traditional Optical Viewfinders (OVFs), predominantly used in older DSLR and rangefinder cameras, to sophisticated Electronic Viewfinders (EVFs) that employ high-resolution micro-displays (such as OLED or LCD) and miniature lenses. The electronic variety provides substantial advantages, including immediate preview of exposure, white balance, and computational photography effects, making them essential components in modern mirrorless and cinema cameras.

Major applications of viewfinder technology are centralized in the photographic equipment industry, spanning high-end professional digital single-lens reflex (DSLR) cameras, mirrorless interchangeable lens cameras (MILCs), cinema cameras, and specialized imaging equipment used in defense and medical visualization. Key benefits driving the market include improved framing accuracy, enhanced ability to shoot in low-light conditions when coupled with modern sensors, and the indispensable feature of "what you see is what you get" (WYSIWYG) exposure monitoring offered by EVFs. Furthermore, the integration of advanced features like focus peaking, histogram displays, and real-time stabilization feedback directly within the viewfinder significantly elevates the user experience and professional workflow efficiency.

Driving factors for sustained market growth include the rapid global adoption of mirrorless camera systems, which inherently require high-quality EVFs; continuous technological miniaturization leading to smaller, lighter, and higher-resolution display modules; and the increasing demand from professional cinematographers for viewfinders that can handle high dynamic range (HDR) footage and complex video assist functionalities. The push towards 8K and higher resolution video capture also necessitates viewfinders capable of displaying extremely fine detail accurately, stimulating innovation across the display component supply chain.

Viewfinder Market Executive Summary

The Viewfinder Market is fundamentally characterized by a paradigm shift from conventional OVF dominance to near-universal EVF adoption, particularly among industry leaders focusing on professional and enthusiast segments. Business trends indicate aggressive investment in Micro-OLED technology to achieve lower latency, higher contrast ratios, and improved color rendition, directly addressing past criticisms regarding EVF performance. Consolidation is observable in the supply chain, where specialized micro-display manufacturers are partnering closely with major camera Original Equipment Manufacturers (OEMs) to ensure proprietary integration and performance optimization. The market also sees rising demand for modular and detachable viewfinders, catering specifically to the needs of professional cinema production and specialized industrial inspection applications, creating profitable niche opportunities outside mainstream consumer electronics.

Regionally, Asia Pacific (APAC), led by manufacturing hubs in Japan, South Korea, and China, maintains its dominant position, both as a production center for camera systems and a rapidly expanding consumer base for advanced imaging equipment. North America and Europe remain crucial markets, characterized by high Average Selling Prices (ASPs) due to the strong presence of professional photographers, filmmakers, and high-spending enthusiasts who demand state-of-the-art viewfinder specifications. The proliferation of digital content creation across emerging economies further supports growth, particularly for mid-range mirrorless systems equipped with competent, although perhaps less premium, electronic viewfinders.

Segment trends confirm the ascendance of the Electronic Viewfinder segment over the Optical Viewfinder segment. Within EVFs, the OLED display segment is exhibiting the highest growth rate, surpassing traditional LCD technology due to its superior pixel density and black level performance, crucial for accurate visual confirmation in varying light conditions. Furthermore, segmentation by application highlights professional photography and cinema as the segments commanding the highest specifications and driving the demand for custom, high-durability, and highly integrated viewfinder solutions, thus influencing overall market profitability and technological direction.

AI Impact Analysis on Viewfinder Market

The integration of Artificial Intelligence (AI) and machine learning (ML) algorithms is rapidly transforming the functionality and perceived value of modern viewfinders, shifting them from mere viewing ports to intelligent visualization tools. Common user questions often revolve around how AI can enhance real-time viewing experience, particularly concerning predictive focusing, enhanced low-light visibility, and the seamless overlay of augmented reality (AR) data within the optical path. Users are keen to understand if AI processing, such as advanced subject recognition (e.g., distinguishing between human eyes, animals, or vehicles), can operate fast enough to be displayed instantaneously within the viewfinder, thereby eliminating perceived lag and improving shot accuracy. Concerns also focus on the potential computational overhead and battery drain associated with continuous AI processing necessary for these advanced features, balancing performance improvements against practical use metrics like device longevity.

AI's primary influence is enabling computational visualization, where the image displayed in the EVF is not just a raw sensor output but an enhanced, predictive, and stabilized rendition. Algorithms are utilized for complex tasks like instantaneous depth mapping for hyper-accurate focus peaking, predictive tracking acceleration for high-speed subjects, and real-time noise reduction, all processed before the final image is captured. This allows photographers to see a representation much closer to the final output (HDR, specific color grading profile, etc.) directly in the viewfinder, mitigating the need for post-capture review and significantly speeding up the professional workflow. The enhanced viewing experience facilitated by AI processing justifies the adoption of more advanced and higher-priced EVF components.

Furthermore, AI facilitates advanced overlay features crucial for specialized tasks. For instance, in cinema applications, ML models can predict camera movement or track complex subject trajectories, projecting stabilization vectors or required focus adjustments directly onto the viewfinder display. In defense or surveillance sectors, AI-powered viewfinders are used for automated target recognition and classification, highlighting potential threats or points of interest in real-time. This sophisticated integration elevates the viewfinder from a passive component to an active, cognitive instrument critical for capturing complex and demanding imagery, driving demand for faster processors and higher data throughput capabilities within the device architecture.

- AI-enhanced Predictive Autofocus: Utilizes ML to anticipate subject movement and display the predicted focus plane in the EVF, minimizing focus lag.

- Real-time Computational Preview: Applies chosen processing parameters (HDR blending, noise reduction, specialized color profiles) to the EVF feed instantaneously.

- Subject Recognition and Tracking Overlay: AI identifies and highlights specific subjects (e.g., eyes, birds, vehicles) directly within the viewfinder frame for improved compositional accuracy.

- Augmented Reality (AR) Data Display: Overlays critical contextual information, such as geographical data, exposure warnings, or motion guides, optimized by AI assessment of the scene.

- Optimized Power Management: AI algorithms dynamically adjust the EVF's refresh rate and display brightness based on scene complexity and user interaction patterns to conserve battery life.

DRO & Impact Forces Of Viewfinder Market

The Viewfinder Market is primarily driven by the relentless pursuit of imaging excellence and technological convergence, leading to superior user interaction (Drivers). Key drivers include the overwhelming success and continuous innovation within the mirrorless camera segment, which mandates the use of high-performance Electronic Viewfinders (EVFs), and the consumer demand for features like high-speed shooting and low-light performance requiring precise real-time feedback. Opportunities in this market are predominantly centered on the development of ultra-miniaturized, high-pixel-density Micro-OLED displays and their integration into advanced AR/VR devices, diversifying the application beyond traditional photography. However, the market faces significant Restraints, notably the high manufacturing cost associated with premium micro-displays and the ongoing challenge of latency reduction in EVF systems, which can still deter some traditional photographers accustomed to zero-lag optical systems.

Impact forces significantly shape the competitive landscape. Technological change represents a strong impact force, as rapid cycles of innovation necessitate constant updating of hardware and software, creating barriers to entry for new players and favoring established camera OEMs with deep R&D budgets. The bargaining power of buyers, particularly large OEMs like Sony, Canon, and Nikon, is substantial, as they dictate component specifications and pricing volumes to micro-display suppliers, influencing market profitability across the value chain. Furthermore, the threat of substitution, while moderated by the fundamental need for framing and composition, slightly looms from the increasing use of large, high-resolution rear LCD screens for primary composition, although viewfinders remain indispensable for shooting in bright sunlight and for professional stabilization techniques.

Market sustainability and growth are intricately linked to addressing key technical challenges. While EVF resolution has dramatically improved, the industry continually strives for 100% color gamut accuracy and truly instantaneous refresh rates to fully replicate the experience of an OVF. Overcoming these technical restraints, coupled with leveraging the opportunity presented by integrating computational photography results directly into the viewfinder, will define competitive success. The necessity for high-performance, weather-sealed, and durable viewfinders in professional and industrial applications further drives specialized market segments, ensuring that high-quality viewing solutions remain a high-value component within sophisticated imaging systems.

Segmentation Analysis

The Viewfinder Market is broadly segmented based on technology type, display material, application, and end-user demography, providing a clear map of market dynamics and adoption trends. The technological segmentation is crucial, distinguishing between Optical Viewfinders (OVF), which rely on mirrors or prisms, and Electronic Viewfinders (EVF), which utilize micro-displays. The shift towards EVFs dictates most current investment strategies, favoring segments capable of delivering superior digital features and real-time previews. Within the EVF segment, further differentiation occurs based on the display medium, specifically between OLED (Organic Light Emitting Diode) and LCD (Liquid Crystal Display) technologies, with OLED commanding a premium price point due to its superior contrast and black levels.

Segmentation by application highlights distinct performance requirements. Professional Photography and Cinema applications demand the highest specifications, including ruggedized construction, high resolution (4K and above), and minimal latency, often dictating custom-designed components. Conversely, the Consumer Electronics segment, encompassing standard MILCs and advanced compact cameras, focuses more on cost-efficiency and power consumption, driving demand for standardized components. End-user segmentation mirrors the application split, focusing on professional imaging specialists versus advanced amateur photographers and casual users.

Geographic segmentation remains essential, reflecting varying adoption rates and manufacturing centers. APAC leads in both production volume and early adoption of cutting-edge mirrorless technology, making it the fastest-growing region. The stringent quality demands from professional users in North America and Europe, however, maintain these regions as primary revenue generators for high-end, premium viewfinder units. Understanding these segments is paramount for manufacturers to tailor their supply chain strategies, focusing either on high-volume, cost-effective solutions for the mainstream consumer base or specialized, low-volume, high-margin components for professional cinema equipment.

- By Technology Type:

- Electronic Viewfinder (EVF)

- Optical Viewfinder (OVF)

- By Display Material (within EVF):

- OLED (Organic Light Emitting Diode)

- LCD (Liquid Crystal Display)

- Micro-LED (Emerging Technology)

- By Application:

- Professional Photography

- Professional Cinema and Broadcast

- Consumer Imaging (Mirrorless/Compact)

- Surveillance and Defense

- Industrial and Medical Imaging

- By Resolution:

- Up to 2.5 Million Dots

- 2.5 Million Dots to 5.0 Million Dots

- Above 5.0 Million Dots (High-Resolution)

Value Chain Analysis For Viewfinder Market

The Viewfinder Market value chain is complex and highly specialized, beginning with the upstream supply of core materials and components. This upstream analysis focuses primarily on the sourcing of micro-display panels (OLED/LCD), which are the most critical and highest-cost component of an EVF. Key suppliers include specialized display manufacturers like Sony Semiconductor, eMagin, and various Asian OLED producers. The supply of micro-optics, focusing lenses, and associated integrated circuits (ICs) for processing high-speed video feeds also forms a significant part of the upstream segment. Price fluctuations and technological breakthroughs in micro-display manufacturing directly impact the profitability and pricing structure of the final product, underscoring the strong bargaining power of these specialized component suppliers.

The midstream involves the design, assembly, and integration of the viewfinder module. Camera OEMs (Original Equipment Manufacturers) often engage in proprietary design, integrating the sourced micro-display and optics into a complete viewfinder unit, which is then integrated into the camera body. This integration phase is highly technical, involving meticulous calibration to ensure optical clarity, minimal distortion, and low latency. Quality control at this stage is crucial, particularly concerning dust ingress and pixel uniformity. The downstream segment encompasses the distribution channel, moving the final camera product from manufacturers to end-users.

Distribution channels are categorized into direct and indirect methods. Direct distribution involves sales through proprietary brand stores or official e-commerce platforms, offering manufacturers maximum control over pricing and customer experience. Indirect distribution, which accounts for the majority of sales volume, relies on specialized photographic equipment retailers, consumer electronics chains, and large e-commerce aggregators. Professional and cinema viewfinders often utilize highly specialized direct sales channels or value-added resellers (VARs) who can provide technical support and integration services. The effectiveness of the distribution network, particularly the reach of large indirect retailers, is vital for mass-market penetration, while direct channels support high-margin, professional-grade equipment sales.

Viewfinder Market Potential Customers

Potential customers for the Viewfinder Market are broadly categorized based on their technical requirements, usage frequency, and budget allocation, primarily revolving around professional imaging and specialized technical fields. The core customer base comprises Professional Photographers, including photojournalists, portrait specialists, and commercial studio photographers, who demand high-resolution, high-durability, and low-latency EVFs that perform flawlessly under extreme conditions. For these users, the viewfinder is a mission-critical component directly influencing their ability to capture time-sensitive and commercially valuable content, driving demand for premium specifications and integrated features like focus aids and exposure monitoring systems.

Another significant segment is Cinematographers and Video Production Houses. These end-users typically require viewfinders that can handle extremely high frame rates, support specific log curves for color grading, and often necessitate external, dedicated electronic viewfinders (known as EVF attachments or monitors) rather than integrated solutions. Requirements here focus on robust external interfaces (like SDI or HDMI), precise color calibration, and advanced monitoring tools critical for high-end broadcast and film production. The migration toward large sensor, high-resolution cinema cameras continually pushes the demand for commensurate viewfinder performance.

The third major group includes Advanced Hobbyists and Enthusiast Photographers transitioning from older DSLR systems to contemporary mirrorless platforms. While more budget-conscious than professionals, this segment still prioritizes high-quality EVFs over basic LCDs, seeking features like quick refresh rates and comfortable eye-point distances to enhance their personal creative output. Finally, institutional buyers, such as Defense/Surveillance OEMs, medical imaging manufacturers, and industrial inspection firms, represent a niche but highly profitable segment, requiring viewfinders integrated into specialized optical devices like thermal scopes or specialized diagnostic equipment, where performance under non-standard conditions (e.g., night vision) is paramount. These institutional users often drive specifications for ruggedness and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Canon Inc., Nikon Corporation, Fujifilm Holdings Corporation, Panasonic Corporation, Olympus Corporation (OM Digital Solutions), LCOS (HOLOEYE), eMagin Corporation, BOE Technology Group Co., Ltd., Seiko Epson Corporation, Carl Zeiss AG, Red Digital Cinema, ARRI AG, Blackmagic Design Pty Ltd., Viewfinder Systems Inc., Kopin Corporation, Samsung Display, Microvision Inc., JVCKENWOOD Corporation, Grass Valley. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Viewfinder Market Key Technology Landscape

The Viewfinder Market is experiencing a rapid technological evolution, primarily driven by the maturation of Electronic Viewfinder (EVF) components, pushing the limits of visual fidelity and responsiveness. The current key technology landscape is dominated by Micro-OLED displays, which provide significantly higher contrast ratios, true blacks, and superior color uniformity compared to traditional LCDs, all while maintaining a highly compact form factor suitable for integration into camera bodies. Innovations are focused on increasing pixel density to achieve resolutions exceeding 5 million dots and pushing refresh rates well above 120Hz to eliminate motion blur and latency, which are critical factors for tracking fast-moving subjects. Furthermore, sophisticated proprietary optical designs, including multi-element lens structures, are being developed to maximize the eye-point distance and minimize geometric distortion, ensuring comfort and viewing accuracy across various ambient light conditions.

A crucial technological advancement involves the integration of high-speed image processors dedicated solely to the viewfinder feed. These processors are essential for managing the high data throughput required by modern image sensors and applying complex computational algorithms in real-time. Technologies like advanced dedicated ASICs (Application-Specific Integrated Circuits) are now common, focusing on minimizing the lag between the sensor reading and the image display in the EVF (known as black-out time or display latency). This processing power enables features like advanced electronic stabilization, real-time exposure simulation, and the instantaneous overlay of sophisticated graphical user interfaces (GUIs) without compromising the smoothness of the live view feed, a vital differentiator for professional equipment.

Looking forward, the market is poised to be further influenced by emerging technologies such as Micro-LED and computational photography integration. Micro-LED technology promises even higher brightness and greater energy efficiency than OLED, offering potential benefits for prolonged use in sunny outdoor environments, although manufacturing challenges remain significant. Computational imaging, powered by AI, is transforming the viewfinder into an AR overlay tool, projecting focus information, depth maps, and object tracking vectors directly onto the scene, demanding closer collaboration between sensor technology providers, display manufacturers, and software developers to achieve seamless real-time integration. These technological pressures necessitate substantial investment in R&D and specialized component sourcing.

Regional Highlights

- Asia Pacific (APAC): APAC maintains its role as the global powerhouse for the Viewfinder Market, driven by its dual status as the primary manufacturing base for nearly all major camera OEMs (Japan, South Korea) and the fastest-growing consumer market, particularly in China and Southeast Asia. The concentration of leading technology producers fosters innovation and rapid adoption cycles for new viewfinder technologies, especially Micro-OLED integration. High disposable income growth and the burgeoning content creation economy are fueling mass adoption of mirrorless systems, ensuring high-volume sales. The region is characterized by competitive pricing strategies for mid-range products and intense technological leadership battles among key Japanese and South Korean conglomerates.

- North America: North America represents a crucial high-value market segment, characterized by high adoption rates of premium, professional-grade imaging equipment. Demand here is dominated by professional cinematographers, high-end commercial photographers, and the defense sector, all of whom prioritize extreme performance specifications (low latency, high durability). This region is less sensitive to component cost and more focused on integration quality and aftermarket support. The market growth is stable, driven primarily by replacement cycles and upgrades to new camera platforms offering superior EVF integration, positioning it as the key region for revenue generation from specialized and customized viewfinder solutions.

- Europe: The European market exhibits mature characteristics, similar to North America, with strong demand originating from the established arts, media, and broadcast industries. Western European countries, notably Germany, the UK, and France, showcase strong purchasing power for premium camera brands. Regulatory standards concerning display safety and environmental sustainability also influence product development within this region. While manufacturing presence is less dominant than in APAC, Europe is a major center for product design and customization, especially in professional cinema equipment (e.g., German camera companies), ensuring continued demand for specialized, robust, high-quality electronic viewfinders and associated peripheral viewing systems.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging opportunities for market expansion. While penetration levels and average spending on professional camera gear are generally lower than in developed economies, rapid infrastructural improvements and the increasing decentralization of digital media production are stimulating growth. The demand is often focused on entry-level and mid-range mirrorless systems, requiring cost-effective EVF solutions. The MEA region, particularly the Gulf nations, shows elevated demand for high-end surveillance and defense imaging systems, driving a niche segment for ruggedized, specialized viewfinders suitable for extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Viewfinder Market.- Sony Corporation

- Canon Inc.

- Nikon Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- Olympus Corporation (OM Digital Solutions)

- eMagin Corporation

- Kopin Corporation

- BOE Technology Group Co., Ltd.

- Seiko Epson Corporation

- Carl Zeiss AG

- Red Digital Cinema

- ARRI AG

- Blackmagic Design Pty Ltd.

- JVCKENWOOD Corporation

- Grass Valley

- Viewfinder Systems Inc.

- Microvision Inc.

- Samsung Display

- HOLOEYE Photonics AG

Frequently Asked Questions

Analyze common user questions about the Viewfinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Electronic Viewfinder (EVF) segment?

The primary driver is the widespread transition to mirrorless camera systems, which inherently rely on EVFs for real-time exposure simulation, advanced focusing aids, and seamless integration with computational photography features, offering a significant functional advantage over traditional optical systems.

How does Micro-OLED technology impact the Viewfinder Market performance?

Micro-OLED technology significantly improves EVF performance by providing superior image quality, specifically offering near-perfect black levels, ultra-high contrast ratios, and higher pixel densities in a compact form factor, essential for professional-grade viewing comfort and accuracy.

What is the biggest technical challenge currently faced by EVF manufacturers?

The foremost technical challenge is minimizing display latency and 'black-out' time (the brief delay when capturing a photo), aiming to achieve a viewing experience that closely mimics the instantaneous, lag-free feedback provided by a traditional Optical Viewfinder (OVF) under high-speed shooting conditions.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region, specifically countries like Japan and China, holds the largest market share. This dominance is due to the concentration of major camera OEM manufacturing bases and rapid consumer adoption of new mirrorless technology platforms throughout the region.

How is Artificial Intelligence (AI) being utilized within modern viewfinders?

AI is utilized for critical tasks such as predictive autofocus tracking, real-time subject recognition (e.g., eye detection), and advanced computational imaging previews, allowing the viewfinder to display an optimized, intelligent, and enhanced visualization of the final captured image.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager