Vinyl Acetate Homopolymer Emulsion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433496 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Vinyl Acetate Homopolymer Emulsion Market Size

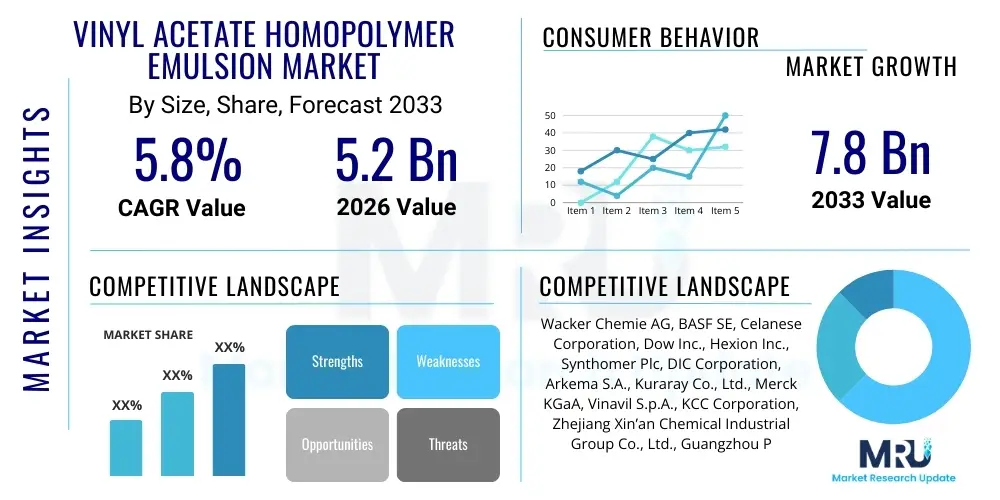

The Vinyl Acetate Homopolymer Emulsion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033.

Vinyl Acetate Homopolymer Emulsion Market introduction

Vinyl Acetate Homopolymer (VAP) emulsions, often referred to as PVAc emulsions, constitute a significant segment of the specialty chemicals market, characterized by their thermoplastic nature, excellent adhesive properties, and cost-effectiveness. These emulsions are synthesized through the polymerization of vinyl acetate monomer and are typically utilized as water-based binders, offering superior film formation and rapid drying times. Their inherent characteristics, such as good tensile strength, flexibility, and compatibility with various substrates like wood, paper, and textiles, position them as foundational materials in multiple industrial applications.

The primary applications driving the demand for VAP emulsions include the manufacturing of architectural coatings (paints), adhesives for woodworking and packaging, binders for non-woven fabrics, and specialized cement modification agents in construction. Their low toxicity and ease of handling compared to solvent-based alternatives make them highly desirable, aligning with global regulatory trends promoting environmental safety and sustainability. The shift towards waterborne formulations across the construction and automotive sectors is a fundamental driver supporting continuous market penetration of VAP emulsions.

Key benefits associated with the adoption of VAP emulsions include enhanced durability, moisture resistance, and improved overall performance characteristics of the final product, particularly in coating and adhesive applications where strong bonding is paramount. Furthermore, the versatility in formulation, allowing for adjustments in viscosity and solids content, enables manufacturers to tailor products for specific performance requirements. Driving factors include rapid infrastructural development in emerging economies, increasing consumer demand for DIY home improvement products, and continuous innovation aimed at producing VAP emulsions with zero or ultra-low volatile organic compound (VOC) content.

Vinyl Acetate Homopolymer Emulsion Market Executive Summary

The global Vinyl Acetate Homopolymer Emulsion market demonstrates robust expansion, primarily fueled by significant growth in the Asia Pacific construction sector and the worldwide mandate for sustainable, water-based chemical alternatives. Current business trends indicate a strong focus on capacity expansion among leading multinational chemical manufacturers to capitalize on the soaring demand from the paints and coatings industry, particularly for interior architectural coatings where VAP emulsions excel in cost-performance balance. Furthermore, technological advancements are concentrated on developing specialized VAP formulations offering superior freeze-thaw stability and improved wet adhesion characteristics, addressing performance gaps in specific climatic regions and specialized industrial requirements.

Regional trends highlight the dominance of the Asia Pacific (APAC) market, driven by massive investments in residential, commercial, and industrial infrastructure, particularly in China and India. North America and Europe, while mature, exhibit growth centered around high-performance, regulatory-compliant, low-VOC products, pushing innovation in the specialty adhesive and textile sectors. Latin America and the Middle East & Africa (MEA) are emerging as high-potential regions, leveraging increased industrialization and local manufacturing capabilities, making them attractive destinations for new production facilities and strategic market entry.

Segmentation trends reveal that the end-use segment is significantly dominated by paints and coatings, although the adhesives segment is projected to exhibit the fastest growth owing to expanding packaging and woodworking industries globally. From a capacity standpoint, bulk quantity shipments remain the standard, but the demand for customized, pre-mixed formulations for small-to-medium enterprises (SMEs) is gradually increasing. The overall market trajectory suggests sustained consolidation, with major players acquiring smaller, regional specialists to enhance their technological portfolios and expand geographic reach, thereby tightening the competitive landscape.

AI Impact Analysis on Vinyl Acetate Homopolymer Emulsion Market

User queries regarding the impact of AI on the Vinyl Acetate Homopolymer Emulsion market frequently revolve around how artificial intelligence and machine learning (ML) can optimize synthesis processes, improve product consistency, and enhance supply chain resilience against raw material volatility. Key themes identified include the integration of predictive maintenance in polymerization reactors, AI-driven quality control for emulsion stability, and the use of ML algorithms for optimizing complex formulation parameters to meet precise customer performance specifications (e.g., specific viscosity, particle size distribution, and minimum film-forming temperature). There is also significant user interest in utilizing AI for demand forecasting, particularly concerning the highly cyclical nature of the construction sector, ensuring efficient inventory management and minimizing waste in production. While AI does not directly replace the chemical product itself, it serves as a critical tool for operational efficiency and rapid innovation cycles, particularly in reducing the time required for new product development and scaling up successful formulations.

- AI-enhanced Quality Control: Machine learning models analyze real-time reactor data (temperature, pressure, monomer feed rates) to predict and mitigate deviations in particle size and stability, ensuring batch consistency.

- Predictive Maintenance: AI algorithms forecast equipment failures in polymerization units, reducing unscheduled downtime and improving overall manufacturing throughput.

- Formulation Optimization: ML is used to quickly iterate through thousands of potential additive combinations to achieve desired physical properties (e.g., shear stability, scrub resistance) for new emulsion grades.

- Supply Chain Optimization: AI analyzes global logistics, raw material pricing (Vinyl Acetate Monomer), and geopolitical risks to recommend optimal procurement and distribution strategies, hedging against volatility.

- Accelerated R&D: Deep learning helps simulate and predict the performance of novel VAP copolymers or modified VAP structures before costly laboratory synthesis, shortening the innovation cycle.

DRO & Impact Forces Of Vinyl Acetate Homopolymer Emulsion Market

The Vinyl Acetate Homopolymer Emulsion market is governed by a dynamic interplay of propelling forces and significant constraints, shaped largely by macroeconomic trends and stringent environmental regulations. The primary driver is the accelerating pace of global urbanization, particularly in Asia, which necessitates high volumes of cost-effective, durable coatings and adhesives for new construction projects. Concurrently, the increasing regulatory pressure in developed markets, mandating the reduction of VOCs and hazardous air pollutants (HAPs), strongly favors water-based solutions like VAP emulsions over traditional solvent-based systems, ensuring sustained demand growth across key end-use sectors like architectural paints and specialized industrial coatings.

However, the market faces inherent challenges, most notably the high volatility and interdependence of raw material prices, particularly for vinyl acetate monomer (VAM), which is derived from petrochemical feedstocks and subject to fluctuations in crude oil markets and complex supply chain logistics. Furthermore, VAP emulsions often struggle with limitations in achieving very high-performance characteristics required for exterior or demanding industrial applications, where competitive polymers (like VAE or acrylics) offer superior water resistance or UV stability, thereby restraining VAP adoption in high-end segments. Regulatory hurdles, especially concerning the disposal of spent process water and potential microplastic concerns related to polymer binders, also pose ongoing operational and investment restraints for manufacturers.

Opportunities for market expansion are substantial, primarily focused on developing specialized, modified VAP emulsions tailored for niche applications, such as high-solids content for faster processing in packaging adhesives or formulations offering enhanced fire retardancy for specific building materials. Moreover, the robust expansion of the non-woven textiles and paper processing industries, requiring effective binders and strengthening agents, provides fertile ground for new applications. Impact forces, therefore, lean positively toward drivers rooted in infrastructure development and regulatory mandates, while the volatility of input costs remains a persistent negative influence requiring robust risk management strategies by market participants.

- Drivers

- Surging demand from the global construction and building materials sector, especially in APAC.

- Favorable regulatory landscape promoting low-VOC and water-based formulations.

- Cost-effectiveness and versatile applications in paints, adhesives, and textiles.

- Restraints

- High volatility in the price and supply of Vinyl Acetate Monomer (VAM).

- Performance limitations in extreme exterior environments compared to high-end acrylics.

- Strict environmental regulations impacting waste disposal and chemical handling.

- Opportunities

- Development of high-solids, specialty modified VAP formulations for industrial applications.

- Untapped potential in emerging economies with rapid industrialization and urbanization.

- Increasing adoption in sophisticated applications like cement modification and dry-mix mortars.

- Impact Forces

- Economic Impact: Directly correlated with GDP growth and housing starts worldwide.

- Technological Impact: Continuous incremental innovation in emulsion stability and particle size.

- Regulatory Impact: Favoring environmental compliance, accelerating the shift to waterborne systems.

Segmentation Analysis

The Vinyl Acetate Homopolymer Emulsion market is comprehensively segmented based on end-use application, which provides the clearest view of demand patterns and strategic market foci. The dominance of the paints and coatings segment is undisputed, driven by its necessity in architectural and decorative applications, where VAP provides an ideal balance of performance, cost, and ease of application. However, the market is also segmented by product type (standard homopolymers vs. modified homopolymers) and by physical properties (particle size, viscosity, and minimum film-forming temperature), allowing manufacturers to address highly specific industrial requirements efficiently.

Geographic segmentation remains crucial, distinguishing between high-volume manufacturing hubs (primarily Asia) and high-value, regulation-driven markets (Europe and North America). Within the end-use applications, the market differentiates between high-volume, low-margin segments (like standard woodworking adhesives) and lower-volume, higher-margin specialty applications (like specialty paper coating binders or advanced textile finishes). This structure enables key players to optimize their product portfolios, focusing either on maximizing throughput in commodity grades or investing heavily in R&D for proprietary, high-performance formulations that command premium pricing.

Further analysis of segmentation emphasizes the material properties required by various buyers; for instance, the packaging industry requires VAP emulsions with superior wet tack and quick-setting times, whereas the construction industry needs excellent water resistance and adhesion to inorganic substrates like concrete and plaster. This necessitates diverse product offerings, from standard VAP (often used in interior paints) to plasticizer-modified VAP versions offering greater flexibility and robustness. The growth trajectory for modified homopolymers is projected to surpass that of standard grades due to increasing performance demands across all major end-use sectors, requiring specialized chemical modification to overcome inherent property limitations of pure homopolymers.

- By Application

- Paints and Coatings (Architectural, Industrial)

- Adhesives (Woodworking, Packaging, Paper & Board)

- Textiles and Non-Wovens

- Paper and Pulp

- Construction (Cement Modification, Dry-Mix Mortars, Sealants)

- Other Industrial Uses

- By Grade/Type

- Standard VAP Homopolymers

- Specialty Modified VAP (e.g., Plasticizer-modified, High-Solids)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Vinyl Acetate Homopolymer Emulsion Market

The value chain for Vinyl Acetate Homopolymer Emulsion is highly structured, beginning with upstream raw material procurement, dominated by petrochemical producers supplying Vinyl Acetate Monomer (VAM). VAM accounts for the largest share of production cost and is synthesized from ethylene or methanol. Other critical upstream inputs include initiators, stabilizers, and protective colloids, often sourced from specialized chemical companies. The performance and consistency of the VAP emulsion are heavily dependent on the quality and stable supply of these upstream components; therefore, large emulsion manufacturers often engage in long-term contracts or backward integration to secure VAM supply and mitigate price volatility, forming a robust link in the chemical supply chain.

The midstream phase involves the polymerization process, where chemical manufacturers convert VAM into aqueous VAP emulsions using sophisticated reactor technology. This phase is capital-intensive and requires high levels of process control to manage particle size distribution and stability. Distribution channels are varied: Direct sales and technical support are crucial for large industrial buyers (e.g., major paint manufacturers), ensuring specifications are met precisely. Indirect channels involve distributors and regional agents, which are essential for reaching SMEs, small construction firms, and smaller regional adhesive producers, providing local stock and faster delivery times across diverse geographic markets, optimizing localized supply logistics.

Downstream analysis focuses on the end-use sectors. The final VAP emulsion product is integrated into various applications, such as being formulated into house paint, compounded into wood glue, or incorporated into cement additives. The demand is driven purely by consumer and industrial activity in construction, packaging, and textiles. Performance requirements are stringent; downstream players require just-in-time delivery and reliable quality. The final products, such as interior wall paints or packaging adhesives, are then sold through retail, wholesale, or large-scale industrial procurement. The direct connection between VAP quality and the final product performance (e.g., scrub resistance of paint, bond strength of glue) emphasizes the necessity of strong technical partnerships across the entire value chain.

Vinyl Acetate Homopolymer Emulsion Market Potential Customers

The primary customers for Vinyl Acetate Homopolymer Emulsions are large industrial manufacturers across sectors requiring effective, water-based binders and adhesives. Foremost among these are architectural and industrial paint manufacturers, who utilize VAP emulsions as the key binder component to achieve desirable film-forming properties, opacity, and washability in interior coatings. Secondly, the packaging and woodworking industries represent massive consumers, utilizing VAP emulsions for laminating, case and carton sealing, and general assembly adhesives where high tack and rapid setting are required, making VAP a staple product in these fast-paced manufacturing environments.

Another significant customer segment includes the construction and building materials industry, where VAP is incorporated into dry-mix mortars, tile adhesives, and cementitious coatings to improve flexibility, water retention, and adhesion strength to various substrates. Furthermore, the textile industry and specialized paper manufacturers rely on VAP emulsions as sizing agents, non-woven fabric binders, and paper coatings to enhance printability, strength, and finish. These customers prioritize high-volume supply, technical assistance, and certification compliance (e.g., FDA approval for food packaging adhesives or specific EU regulations for coatings materials) when selecting their suppliers.

In essence, the end-user base is highly diversified but consistently requires a binder that offers low cost, good mechanical properties, and environmental compliance. Potential buyers range from global chemical conglomerates operating massive paint manufacturing facilities to small, regional producers specializing in customized wood furniture or high-end artisanal paper products. The attractiveness of VAP emulsions lies in their balanced performance profile, making them a foundational ingredient for any buyer seeking a reliable, aqueous polymer system for binding or coating applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, BASF SE, Celanese Corporation, Dow Inc., Hexion Inc., Synthomer Plc, DIC Corporation, Arkema S.A., Kuraray Co., Ltd., Merck KGaA, Vinavil S.p.A., KCC Corporation, Zhejiang Xin’an Chemical Industrial Group Co., Ltd., Guangzhou Pearl River Chemical Group Co., Ltd., Forbest Trading, Shanxi Sanwei Group Co., Ltd., CCP Composites, Organik Kimya, Resinex, Showa Denko K.K. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vinyl Acetate Homopolymer Emulsion Market Key Technology Landscape

The technological landscape of the Vinyl Acetate Homopolymer Emulsion market is primarily focused on refining polymerization techniques to achieve superior colloidal stability, precise particle size control, and enhanced environmental profiles. The bulk of commercial production utilizes emulsion polymerization, which is continuously being optimized through advanced reactor design (e.g., semi-batch processes) to ensure tight control over the reaction kinetics and heat management. Recent technological advancements emphasize developing VAP emulsions with extremely small particle sizes, which are crucial for enhancing the opacity, binding efficiency, and sheen of architectural coatings, while simultaneously improving the mechanical stability of the emulsion under high shear conditions during application or mixing.

A critical area of innovation involves the development of specialized protective colloid systems and surfactant packages. Traditional VAP formulations often rely on polyvinyl alcohol (PVA) as a primary protective colloid. Modern research is exploring alternative stabilizing systems that enhance water resistance and freeze-thaw stability without negatively impacting adhesion or cost. This includes the use of tailor-made non-ionic and ionic surfactants, and proprietary polymeric stabilizers designed to minimize residual monomer content, directly addressing regulatory concerns and enhancing product safety. Furthermore, research into advanced post-polymerization treatments focuses on reducing trace amounts of VOCs, moving towards near-zero VOC compliant products necessary for premium green building certifications.

Beyond polymerization chemistry, significant technological effort is directed towards developing modified VAP products that incorporate features traditionally associated with more expensive polymers. This includes internally plasticized VAP emulsions (often involving the co-polymerization with monomers like ethylene, though strictly speaking, VAE is a different category, pure VAP modifications are achieved through specialized additives or external plasticizers) and the integration of functional groups to provide properties like temporary tack, hydrophobic characteristics, or improved scrub resistance. The integration of advanced computational fluid dynamics (CFD) and process analytical technology (PAT) is becoming common in modern plants, enabling real-time monitoring and automated adjustment of production parameters, leading to highly consistent, quality-assured VAP emulsions optimized for high-speed, large-scale industrial applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily due to unprecedented rates of urbanization, massive government investment in infrastructure (residential and commercial), and the rapid expansion of manufacturing sectors in countries like China, India, and Southeast Asian nations. The region acts as a major production hub, leveraging lower operational costs and proximity to massive downstream consumer markets in paints, adhesives, and textiles. The demand here is driven by cost-effectiveness and high-volume consumption.

- North America: This region is characterized by high performance expectations and stringent environmental regulations. Market growth is stable, focusing predominantly on specialty, high-value applications, such as premium-grade adhesives for complex packaging and low-VOC interior architectural coatings. Technological compliance and sustainability certifications are key competitive factors in the U.S. and Canadian markets, driving demand for innovative, ultra-low formaldehyde VAP grades.

- Europe: Europe maintains a mature but sophisticated market. Growth is heavily influenced by the REACH regulatory framework and the push towards circular economy principles. The market emphasizes sustainable sourcing and the development of bio-based or partially bio-derived vinyl acetate systems. Key demand areas include the construction retrofit sector, dry-mix mortar applications, and advanced textile binders, demanding high standards of durability and environmental safety.

- Latin America (LATAM): LATAM is an emerging market experiencing significant infrastructural development, particularly in Brazil and Mexico. The market is highly price-sensitive but shows strong potential in the paints and coatings segment driven by expanding middle-class consumer spending on housing improvements. Supply chain logistics and localized production capacity are crucial for penetrating this fragmented regional market effectively.

- Middle East & Africa (MEA): Growth in MEA is highly variable but generally positive, propelled by large-scale mega-construction projects in the Gulf Cooperation Council (GCC) countries and increasing industrialization in parts of Africa. Demand is concentrated in specialized coatings that offer excellent heat and water resistance, necessary for the extreme regional climate, although standard VAP products are commonly used in general construction adhesives and interior finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vinyl Acetate Homopolymer Emulsion Market.- Wacker Chemie AG

- BASF SE

- Celanese Corporation

- Dow Inc.

- Hexion Inc.

- Synthomer Plc

- DIC Corporation

- Arkema S.A.

- Kuraray Co., Ltd.

- Merck KGaA

- Vinavil S.p.A.

- KCC Corporation

- Zhejiang Xin’an Chemical Industrial Group Co., Ltd.

- Guangzhou Pearl River Chemical Group Co., Ltd.

- Forbest Trading

- Shanxi Sanwei Group Co., Ltd.

- CCP Composites

- Organik Kimya

- Resinex

- Showa Denko K.K.

- PT Lautan Luas Tbk

- Reichhold LLC

- Jubail Chemical Industries Company (JANA)

- Scott Bader Company Ltd.

- Ashland Global Holdings Inc.

- Nippon Gohsei

- Dairen Chemical Corporation

- Mitsubishi Chemical Corporation

- Kaneka Corporation

- Apcotex Industries Limited

Frequently Asked Questions

Analyze common user questions about the Vinyl Acetate Homopolymer Emulsion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Vinyl Acetate Homopolymer Emulsion market?

The market growth is primarily driven by accelerating global infrastructure development, particularly in the Asia Pacific region, and the increasing worldwide regulatory mandate favoring the adoption of low-VOC, water-based chemical systems over traditional solvent-based alternatives across paints, coatings, and adhesives sectors. The cost-effectiveness of VAP compared to acrylics in standard applications also sustains high demand.

How do fluctuations in Vinyl Acetate Monomer (VAM) prices impact the VAP Emulsion market?

Since VAM is the main raw material derived from petrochemicals, its price volatility directly impacts the production costs and overall profitability margins for VAP emulsion manufacturers. Manufacturers often mitigate this risk through hedging strategies, long-term procurement contracts, or by passing increased costs downstream to end-users, affecting the final price of products like architectural paint and wood glue.

What are the key differences in VAP consumption between mature markets (Europe/North America) and emerging markets (APAC)?

Mature markets focus on high-performance, specialized, ultra-low-VOC grades and sustainable sourcing due to strict environmental regulations, emphasizing quality over volume. Emerging markets, conversely, are volume-driven, primarily consuming standard VAP homopolymers for general construction and high-throughput industrial applications, prioritizing cost-effectiveness and availability for rapid urbanization projects.

In which end-use application is Vinyl Acetate Homopolymer Emulsion most widely utilized?

Vinyl Acetate Homopolymer Emulsion is most widely utilized in the Paints and Coatings sector, specifically in architectural interior paints. VAP serves as a critical binder, offering excellent film formation, cost efficiency, good adhesion, and scrub resistance, making it an ideal foundational polymer for large-volume decorative coating formulations worldwide.

What technological advancements are shaping the future of VAP emulsion formulations?

Future VAP formulations are being shaped by advancements in developing ultra-low VOC systems, optimizing particle size distribution for improved coating opacity and performance, and integrating specialized stabilizers and polymeric additives to enhance freeze-thaw stability and overall water resistance, thereby expanding VAP's use into moderately demanding environments where it previously faced performance limitations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager