Vinylidene Chloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438225 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Vinylidene Chloride Market Size

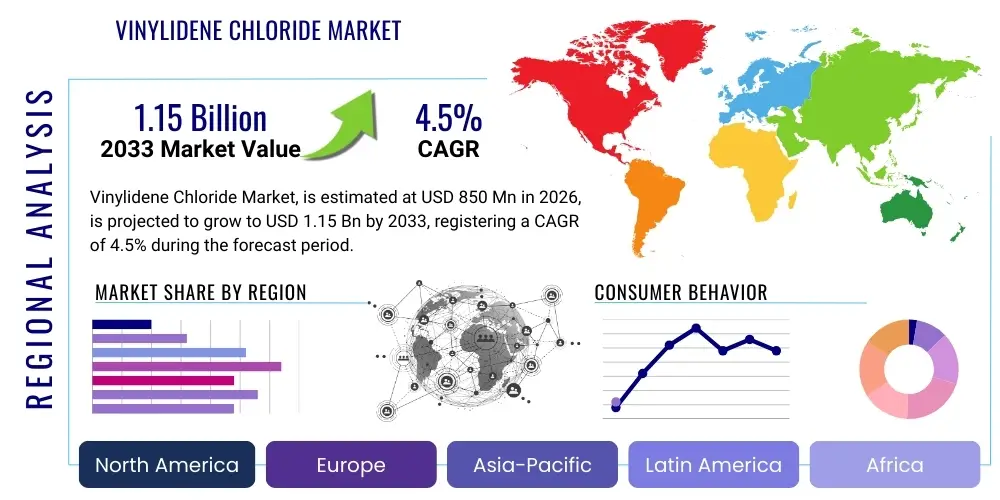

The Vinylidene Chloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1.15 Billion by the end of the forecast period in 2033.

Vinylidene Chloride Market introduction

Vinylidene Chloride (VDC), chemically known as 1,1-dichloroethene, is a colorless, highly volatile liquid primarily utilized as a critical intermediate in the production of polymers, most notably Polyvinylidene Chloride (PVDC). VDC is synthesized industrially via the dehydrochlorination of 1,1,2-trichloroethane. The resulting PVDC is highly valued across various industries due to its exceptional barrier properties against gases, moisture, and odors, making it indispensable in high-performance applications where product longevity and freshness are paramount. Its unique chemical structure provides superior resistance to organic solvents and chemicals compared to many other commonly used polymers, solidifying its niche in protective coatings and specialized film production.

The major applications of VDC derivatives revolve around the packaging sector, particularly in food and pharmaceutical packaging, where its superior barrier capabilities significantly extend shelf life. PVDC is frequently co-extruded or coated onto other flexible substrates like polyethylene (PE) or polypropylene (PP) to enhance their performance characteristics without compromising flexibility. Beyond packaging, VDC derivatives find extensive use in the construction industry for pipe liners and specialized films, in the automotive sector for protective coatings, and in textile fibers for specific flame-retardant and high-durability applications. The versatility and robustness of the resultant polymers drive sustained demand across economically vital sectors globally.

Driving factors for the Vinylidene Chloride market include the relentless expansion of the global packaged food industry, especially in emerging economies, coupled with stringent quality requirements for pharmaceutical blister packaging that necessitates high-barrier materials. Furthermore, the increasing consumer preference for extended shelf life and reduced food waste reinforces the reliance on materials like PVDC. While regulatory scrutiny regarding chlorination products exists, continuous innovation in co-polymer formulations, aimed at improving processability and addressing environmental concerns, ensures VDC remains a strategically vital chemical commodity despite substitution pressures from alternative high-barrier polymers like EVOH or specialized PET grades.

Vinylidene Chloride Market Executive Summary

The Vinylidene Chloride market exhibits strong resilience driven primarily by robust demand from the advanced packaging industry, particularly within the food and healthcare sectors where its unparalleled barrier properties are essential for product integrity and safety. Current business trends indicate a concentrated effort by key manufacturers to optimize production processes to meet increasingly stringent environmental regulations concerning precursor handling and waste minimization. Strategic investment is heavily skewed towards Asia Pacific, which serves both as the largest manufacturing hub and the region with the fastest growth in end-user consumption, particularly driven by urbanization and rising disposable incomes leading to greater reliance on packaged goods. European and North American markets, while mature, focus intensely on performance enhancements and closed-loop recycling solutions for PVDC-containing composites.

Regional trends highlight a significant divergence in growth trajectory and regulatory environment. Asia Pacific, led by China and India, dominates both consumption and capacity expansion due to lower operational costs and surging domestic demand for packaged foods and consumer durables. Conversely, regulatory frameworks in Europe and North America are prompting material innovation, focusing on the development of VDC co-polymers that are easier to separate or depolymerize at the end of their lifecycle, mitigating the long-term environmental accumulation issues associated with heavily chlorinated polymers. The Middle East and Africa represent nascent markets showing moderate growth, particularly in construction and industrial coating applications stimulated by large-scale infrastructure projects.

Segmentation trends reveal that the application segment related to films and sheets, specifically barrier films for food wrap and industrial linings, remains the largest revenue contributor due to the sheer volume used in flexible packaging. Furthermore, specialized applications such as saran fibers and lacquer coatings, though smaller in volume, command higher price points due to their unique properties, including flame resistance and chemical inertness. The market also sees growth in the segment dedicated to pipe lining and construction materials, where the chemical resistance of VDC polymers is leveraged to protect infrastructure assets from corrosion and aggressive environments. Sustained investment in research and development is focused on improving thermal stability and reducing the volatile organic compound (VOC) emissions associated with VDC processing.

AI Impact Analysis on Vinylidene Chloride Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vinylidene Chloride market commonly revolve around enhancing operational safety, optimizing complex chemical synthesis processes, and predicting fluctuations in volatile feedstock pricing. Key themes emerging from these questions center on how AI can stabilize the supply chain for VDC and its precursors (ethylene and chlorine), improve energy efficiency during the highly intensive chlorination and dehydrochlorination steps, and accelerate the discovery of novel, potentially less hazardous catalyst systems. Users also express interest in AI’s role in simulating the environmental fate and performance characteristics of new PVDC copolymer formulations, aiming to meet sustainability goals faster than traditional trial-and-error methods. The core expectation is that AI will move VDC production toward a safer, more efficient, and ultimately more sustainable industrial pathway, mitigating risks associated with handling and processing a hazardous intermediate.

AI’s initial implementation is heavily focused on the manufacturing phase, specifically through predictive maintenance systems and advanced process control. By analyzing real-time sensor data—including temperature, pressure, flow rates, and spectral analysis—AI algorithms can detect minute deviations that precede equipment failure or safety incidents, enabling proactive intervention. This capability is critical in VDC production, where high pressures and corrosive intermediates demand rigorous safety protocols. Furthermore, machine learning models are being deployed to fine-tune reaction kinetics, maximizing VDC yield while minimizing energy consumption and byproduct formation, leading to significant cost savings and reduced environmental footprint per unit produced.

On the strategic and commercial fronts, AI models are providing more accurate forecasts for VDC demand across diverse end-use sectors, helping manufacturers adjust production schedules to minimize inventory costs and avoid supply bottlenecks. Moreover, AI aids in environmental compliance by analyzing complex regulatory data and predicting the performance of VDC derivatives under various recycling and disposal scenarios. This predictive capability is vital for companies navigating the shifting landscape of plastics legislation, particularly concerning food contact materials. AI applications thus extend beyond the factory floor, becoming integral tools for strategic risk assessment and sustainable product development within the VDC value chain.

- Enhanced predictive maintenance and safety protocol optimization in VDC synthesis plants.

- Machine learning algorithms optimizing reaction conditions to maximize yield and reduce energy consumption.

- AI-driven supply chain forecasting improving inventory management of VDC precursors (ethylene and chlorine).

- Accelerated R&D through computational chemistry and simulation for sustainable PVDC co-polymer development.

- Automated analysis of regulatory compliance data, assisting manufacturers in navigating complex global plastics standards.

- Real-time process monitoring utilizing multivariate data analysis for quality control and operational stability.

DRO & Impact Forces Of Vinylidene Chloride Market

The Vinylidene Chloride market is characterized by a unique set of interconnected forces where the material's superior functional benefits clash with growing environmental scrutiny. Key drivers include the ever-increasing global demand for flexible, high-barrier packaging materials, especially for perishable goods and pharmaceuticals, leveraging VDC’s unparalleled protection against oxygen and water vapor transfer. However, strong restraints exist due to the regulatory challenges associated with VDC handling, its status as a chlorinated hydrocarbon, and the difficulty of recycling multi-layer packaging containing PVDC, leading to significant pressure for material substitution. Opportunities are concentrated in developing specialized, high-value applications, such as chemical-resistant coatings and advanced filtration membranes, and in technological advancements aimed at creating bio-based or more easily separable VDC co-polymers, striving for a more circular economy model. These dynamics create powerful impact forces, compelling manufacturers to balance high-performance product delivery with strict adherence to environmental responsibility and evolving consumer preferences for sustainable packaging solutions.

Drivers primarily originate from global demographic and lifestyle shifts. The urbanization of large populations in Asia, coupled with the expansion of organized retail and cold chains, necessitates packaging that can withstand prolonged transit and storage while maintaining food safety. The pharmaceutical industry's strict requirements for blister packs and sterile medical devices provide a non-negotiable application area where PVDC’s barrier properties are often the benchmark standard. Furthermore, the expansion of modern industrial infrastructure and construction projects globally drives demand for VDC-based protective coatings and liners that offer exceptional corrosion resistance and longevity in harsh chemical environments, ensuring market stability even amidst packaging sector volatility.

Restraints are dominated by environmental and regulatory concerns. Vinylidene Chloride is classified as a hazardous substance, requiring specialized handling and storage, which significantly increases operational costs and complexity. More critically, the increasing legislative push towards banning or taxing non-recyclable plastics places immense pressure on PVDC usage in single-use packaging, particularly in developed regions like the European Union. While PVDC itself is technically recyclable, its integration into multi-layer films makes separation economically and technically challenging with current mechanical recycling infrastructures, leading to a perception that PVDC contributes heavily to landfill waste. This perception fuels the search for viable, non-chlorinated alternatives, presenting a substantial long-term challenge to market growth.

Segmentation Analysis

The Vinylidene Chloride market is primarily segmented based on its resulting polymer type, the diverse range of applications, and the major end-user industries utilizing the derivatives. The most critical segmentation is by application, which delineates the market into barrier films, coating resins, fibers, and specialty applications. Barrier films dominate, encompassing flexible packaging used extensively for food, medical, and consumer products due to the material's superior gas and moisture impermeability. Coating resins form the second largest segment, crucial for protecting metals and surfaces in construction and industrial settings. Analyzing these segments provides strategic insights into where market value is concentrated and where innovation, particularly regarding sustainability, is most urgently required.

Further granularity in segmentation involves end-use industries, including food and beverages, pharmaceuticals, construction, textiles, and chemicals. The food and beverage sector remains the primary engine of demand, relying on VDC co-polymers to extend the freshness and safety of highly sensitive items. The pharmaceutical sector, driven by stringent regulatory requirements for drug stability, represents a high-value, albeit smaller, segment. Geographical segmentation is also vital, showing high growth potential in Asia Pacific where packaging demand is accelerating rapidly, contrasted with mature, substitution-sensitive markets in Western Europe and North America.

- By Polymer Type:

- Polyvinylidene Chloride (PVDC) Homopolymers

- Vinylidene Chloride Copolymers (e.g., VDC/Vinyl Chloride, VDC/Acrylate)

- By Application:

- Barrier Films and Sheets (Food Packaging, Blister Packs, Shrink Films)

- Coating Resins and Lacquers (Protective Coatings, Industrial Coatings)

- Fibers (Saran Fibers, Synthetic Textiles)

- Piping and Tubing (Chemical Transfer, Construction)

- By End-User Industry:

- Food & Beverage

- Pharmaceutical & Medical Devices

- Construction

- Chemical & Automotive

- Textiles

Value Chain Analysis For Vinylidene Chloride Market

The Vinylidene Chloride value chain is complex, starting with the procurement of critical commodity feedstocks and extending through sophisticated chemical synthesis, polymerization, conversion, and final distribution to specialized end-user markets. The upstream segment is heavily reliant on the petrochemical industry for ethylene and the chlor-alkali industry for chlorine. These raw materials are converted into 1,1,2-trichloroethane, the primary precursor. Efficiency and cost stability in this initial phase are highly dependent on global energy prices and the geopolitical stability of crude oil and natural gas supplies, making upstream volatility a significant risk factor for VDC manufacturers. Key players often integrate backward to secure feedstock supplies and manage costs, ensuring operational stability in a highly competitive chemical intermediate market.

The core manufacturing stage involves the capital-intensive and chemically sensitive process of dehydrochlorination of 1,1,2-trichloroethane to produce VDC monomer. This process requires specialized equipment and stringent safety measures due to the hazardous nature of VDC. Subsequently, the VDC monomer undergoes polymerization, often copolymerization with other monomers like vinyl chloride or acrylates, to tailor the resulting PVDC polymer for specific performance criteria (e.g., heat sealability, flexibility). This manufacturing step adds significant value through proprietary catalytic processes and process technology, differentiating manufacturers based on the purity and quality of their final polymer resins.

Downstream activities involve the conversion of VDC polymers into final products, primarily high-barrier films, sheets, or coatings, often through co-extrusion or lamination processes performed by specialized converters. Distribution channels are typically specialized, utilizing both direct sales models for large industrial customers (e.g., pharmaceutical packaging manufacturers, construction firms) and indirect channels through global chemical distributors for smaller processors and regional end-users. The indirect channels facilitate localized inventory management and technical support, critical for complex application integration. The market sees strong competition between integrated chemical giants who manage the entire chain and specialized converters who focus solely on high-margin film production and customization.

Vinylidene Chloride Market Potential Customers

Potential customers for Vinylidene Chloride derivatives are primarily found in sectors that require exceptional material performance regarding barrier properties, chemical resistance, and longevity. The largest contingent of buyers resides within the flexible packaging and converting industry, particularly those serving the food processing sector, including meat packers, dairy producers, and manufacturers of snack foods and ready-to-eat meals. These customers purchase PVDC resins and pre-made barrier films to protect products from oxygen ingress, preventing spoilage and flavor degradation. Their purchasing decisions are heavily influenced by regulatory compliance (FDA/EFSA standards) and the efficiency of the material in preserving sensitive components like flavors or antioxidants over extended periods, making PVDC an essential component for high-quality, long-shelf-life products.

A second crucial group of potential customers is the pharmaceutical and medical device manufacturing sector. These buyers require materials for blister packaging, medical pouches, and sterile instrument wrapping where moisture barrier properties are non-negotiable for drug stability and efficacy. PVDC is often specified in drug master files due to its proven performance in protecting highly hygroscopic (moisture-sensitive) drugs. The purchasing cycle in this segment is characterized by rigorous qualification processes, long-term supply agreements, and strict adherence to good manufacturing practices (GMP), demanding consistent quality and supply chain reliability from VDC manufacturers. These customers prioritize performance and regulatory adherence far above minor cost differentials.

Finally, industrial and construction enterprises represent substantial, albeit often volume-intensive, customers. These include manufacturers of specialized industrial pipes, chemical storage tank liners, and protective coatings used in infrastructure projects, chemical processing facilities, and automotive manufacturing. Customers in the construction segment value the chemical inertness and corrosion resistance offered by PVDC polymers, seeking solutions that minimize maintenance costs and extend the lifespan of critical assets operating in aggressive chemical environments. These buyers typically engage directly with VDC polymer producers or large coating formulators, seeking high-volume material supplies tailored to extreme operational conditions and specific environmental resistance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.15 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Kureha Corporation, SK Saran, Solvay S.A., Dow Chemical Company, Asahi Kasei Corporation, Zhejiang Juhua Co., Ltd., Kaneka Corporation, Jiangsu Tianke Environmental Protection Materials Co., Ltd., Shandong Huaxing Chemical Industry Co., Ltd., Changzhou Tronly New Electronic Materials Co., Ltd., Ineos Group Holdings S.A., Westlake Chemical Corporation, PPG Industries, Inc., Akzo Nobel N.V., Wanhua Chemical Group Co., Ltd., BASF SE, Kuraray Co., Ltd., Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vinylidene Chloride Market Key Technology Landscape

The technological landscape for the Vinylidene Chloride market is defined by efforts to improve production efficiency, enhance safety, and, most critically, address the recyclability challenges associated with PVDC. A key area of innovation focuses on catalysis for VDC synthesis. Traditional methods rely on older, sometimes less efficient catalyst systems; however, modern R&D emphasizes developing highly selective, heterogeneous catalysts that operate at milder conditions. This aims to increase VDC yield, reduce energy requirements, and minimize the formation of hazardous byproducts, thus improving the overall environmental profile of the monomer production process. Furthermore, process control technologies, often leveraging digital twin models and advanced sensors, are becoming standard to ensure optimal operating parameters and immediate detection of process deviations, crucial for safety and quality consistency.

Another major technological thrust is centered on polymerization science, particularly concerning VDC co-polymers. While PVDC homopolymers offer the ultimate barrier, they can be rigid and difficult to process; therefore, advancements are focused on creating novel co-polymer compositions that balance excellent barrier properties with improved flexibility, heat-seal strength, and processability on standard packaging lines. Crucially, research is heavily invested in designing "recycling-ready" multi-layer structures. This involves developing tie-layers or compatibilizers that allow for the easier separation of the PVDC layer from bulk polymers (like PE or PP) during mechanical recycling, or developing PVDC co-polymers that can be efficiently chemically depolymerized back into monomer components, though the latter remains a long-term research goal.

In the end-use application domain, technology is advancing through sophisticated thin-film coating and extrusion techniques. Manufacturers are striving to achieve maximum barrier performance using minimal material volume. Ultra-thin PVDC coatings applied via solvent-free or high-solids dispersion technologies are gaining traction, reducing solvent use and minimizing the overall mass of chlorinated polymer used in packaging while still maintaining high-performance standards. These technological shifts are not only driven by cost reduction but are fundamentally necessary to ensure VDC derivatives remain competitive against non-chlorinated alternatives in an increasingly sustainability-focused global marketplace, ensuring the material’s future viability in high-performance applications.

Regional Highlights

- North America (USA, Canada, Mexico): North America represents a mature, high-value market characterized by stringent food and pharmaceutical safety regulations. Demand for VDC derivatives is stable, driven by specialized applications in high-barrier pharmaceutical blister packaging and industrial coatings for corrosion control. While production capacity is significant, growth rates are moderate compared to Asia. The focus in this region is less on volume expansion and more on premium, specialized products and ensuring the adoption of best practices regarding lifecycle management and chemical safety. Regulatory pressure, particularly regarding plastic waste, incentivizes innovation towards multi-layer films optimized for separation or replacement by alternative high-barrier technologies.

- Europe (Germany, UK, France, Italy, Spain): The European market is highly sensitized to environmental concerns and restrictive plastics legislation, which acts as a restraint on bulk PVDC usage in common consumer packaging. However, the region maintains robust demand in critical, non-negotiable applications such as specialized chemical protective equipment, high-performance lacquers, and specific food preservation packaging where no functional alternative suffices. European companies are leading the charge in developing solvent-free VDC dispersion coatings and focusing intensely on end-of-life solutions, including advanced recycling research for PVDC-containing materials, ensuring compliance with circular economy directives.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the fastest-growing and largest regional market, driven by rapid industrialization, massive expansion of the middle class, and the consequential surge in demand for packaged food and pharmaceuticals. China and India are focal points for both consumption growth and manufacturing capacity expansion due to favorable feedstock availability and lower operational costs. While environmental regulations are tightening, the sheer scale of demand, coupled with increasing quality standards for product preservation, ensures that VDC and its polymers remain essential. The region acts as the primary global hub for both VDC monomer synthesis and PVDC conversion into films and fibers.

- Latin America (Brazil, Argentina): The Latin American market exhibits moderate, steady growth, primarily influenced by the expanding consumer base and the need for improved cold chain infrastructure. Demand is concentrated in imported or locally manufactured flexible packaging materials and specific applications in the construction sector. Market development is often sensitive to economic volatility, but the long-term trend remains positive due to increasing investment in local manufacturing and processing capabilities, requiring stable, high-performance packaging solutions for internal consumption and export.

- Middle East and Africa (MEA): This region is characterized by substantial growth in construction and infrastructure projects, driving demand for VDC-based coatings and piping liners that resist high temperatures and corrosive chemicals common in the oil and gas sector. The demand for advanced food packaging is also rising, supported by high import reliance and developing domestic food processing capabilities. While smaller in scale, the MEA market represents significant future potential, particularly in industrial and specialized applications requiring the chemical robustness of PVDC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vinylidene Chloride Market.- Shin-Etsu Chemical Co., Ltd.

- Kureha Corporation

- SK Saran

- Solvay S.A.

- Dow Chemical Company

- Asahi Kasei Corporation

- Zhejiang Juhua Co., Ltd.

- Kaneka Corporation

- Jiangsu Tianke Environmental Protection Materials Co., Ltd.

- Shandong Huaxing Chemical Industry Co., Ltd.

- Changzhou Tronly New Electronic Materials Co., Ltd.

- Ineos Group Holdings S.A.

- Westlake Chemical Corporation

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Wanhua Chemical Group Co., Ltd.

- BASF SE

- Kuraray Co., Ltd.

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Vinylidene Chloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for Vinylidene Chloride in the packaging sector?

The primary driver is the need for superior barrier properties against oxygen, moisture, and odors, which PVDC provides exceptionally well. This extends the shelf life of perishable food and ensures the stability and efficacy of sensitive pharmaceuticals, catering directly to global demand for food safety and waste reduction.

Is Polyvinylidene Chloride (PVDC) considered environmentally sustainable or recyclable?

While PVDC itself is a technically recyclable polymer, its common use in complex multi-layer packaging structures (co-extruded films) makes separation and economic recycling extremely challenging with current standard mechanical recycling infrastructure. This difficulty is the main source of current environmental scrutiny and drives research into advanced separation or chemical recycling technologies.

How do regulatory changes, particularly in Europe, affect the Vinylidene Chloride market?

European regulations (e.g., REACH, directives on single-use plastics) impose significant constraints on chlorinated polymers like VDC derivatives. These regulations increase operational costs, necessitate stringent risk management, and stimulate intense R&D investment into substitution or the development of easily separable/sustainable VDC co-polymer alternatives to maintain market access.

Which geographical region exhibits the highest growth rate for Vinylidene Chloride consumption?

The Asia Pacific (APAC) region, led by China and India, demonstrates the highest growth rate. This is fueled by rapid urbanization, expanding organized retail, rising disposable incomes, and increasing domestic manufacturing capacity for both VDC monomer and subsequent barrier film production to meet surging local demand.

Beyond packaging, what are the most critical specialized applications for VDC derivatives?

Critical specialized applications include high-performance, chemical-resistant industrial coatings and lacquers used to protect infrastructure (pipes, tanks) in harsh chemical processing environments, specialized synthetic fibers (Saran fibers) used in textiles for flame resistance, and sophisticated membrane components for specialized filtration processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Polyvinylidene Chloride Coated Film Market Statistics 2025 Analysis By Application (Food, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Others), By Type (Coated PVDC One Side, Coated PVDC Two Side), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Vinylidene Chloride Market Statistics 2025 Analysis By Application (Polyvinylidene Chloride(PVDC) Industry, Organic Synthesis Intermediates), By Type (Vinyl Chloride-Chlorine Process, Vinyl Chloride-Chlorine Hydride Process, 1,2-Dichloroethane-Chlorine Process), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Polyvinylidene Chloride (Pvdc) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (PVDC resin, PVDC latex), By Application (Medical Packaging, Pharmaceutical Packaging, Food Packaging, Military Packaging, Barrier Film Packaging, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Polyvinylidene Chloride Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Aqueous Dispersion, Extrudable Powder, Soluble Powder), By Application (Construction, Consumer, Packaging, Electronics, Transportation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager