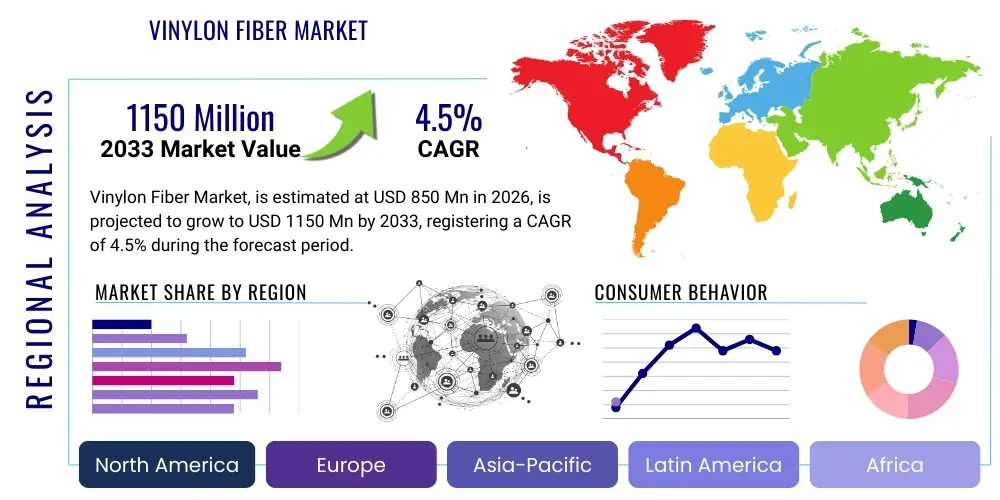

Vinylon Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435291 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Vinylon Fiber Market Size

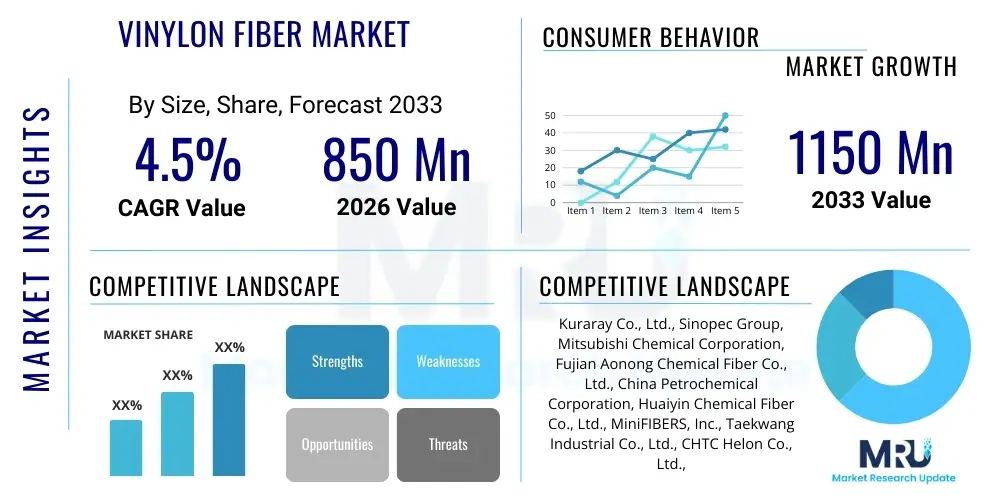

The Vinylon Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1150 Million by the end of the forecast period in 2033.

Vinylon Fiber Market introduction

Vinylon fiber, chemically known as poly(vinyl alcohol) fiber (PVA fiber), is a high-performance synthetic fiber renowned for its exceptional tensile strength, chemical stability, and excellent compatibility with cementitious materials. Developed primarily in East Asia, particularly China and Japan, Vinylon has established itself as a critical material in infrastructure and specialized textile applications. Its physical and chemical properties, such as high resistance to alkali and acid environments, moisture absorption capabilities, and favorable thermal stability, allow it to outperform traditional synthetic fibers in certain demanding environments. The fiber's unique structure, achieved through wet spinning followed by heat treatment and formalization, ensures durability and longevity, making it highly valued in applications requiring permanent structural integrity.

The major applications of Vinylon fiber span several key industries, most prominently in the construction sector where it serves as a non-asbestos reinforcement material in cement products like roofing sheets, pipes, and wall panels. This application is a primary market driver, fueled by global regulatory mandates phasing out carcinogenic asbestos. Beyond construction, Vinylon is extensively utilized in specialty textiles, including industrial filter fabrics, fishing nets, ropes, and high-performance clothing due to its high tenacity and soft feel when blended. Furthermore, the agricultural sector employs water-soluble Vinylon fibers for seed tapes and temporary bundling materials, highlighting the material's versatility across varied end-uses. The transition towards sustainable and safer construction materials continuously bolsters Vinylon demand globally.

Key driving factors propelling the market expansion include massive global investments in infrastructure development, especially across emerging economies in the Asia Pacific region, necessitating durable and reliable construction components. The increasing regulatory pressure against hazardous materials like asbestos provides a substantial opportunity for Vinylon to capture market share in reinforcement applications. Moreover, ongoing technological advancements focused on improving Vinylon's mechanical properties, such as achieving higher modulus and better dispersion in matrices, are broadening its adoption in advanced composite materials. However, the market faces constraints related to the volatility of raw material prices, primarily vinyl acetate monomer (VAM), and intense competition from other high-performance synthetic fibers like polypropylene and aramid fibers, necessitating continuous innovation in cost-effective production techniques.

Vinylon Fiber Market Executive Summary

The Vinylon Fiber Market is characterized by robust growth anchored in infrastructure spending and environmental regulatory shifts. The global business trend shows a strong concentration of production capacity and consumption within the Asia Pacific (APAC), which acts as the dominant manufacturing and demand hub, led by China. This regional dominance is driven by low-cost manufacturing capabilities and extensive use in major public works projects. Globally, manufacturers are focusing intensely on developing specialty grades, such as high-modulus and high-shrinkage fibers, to diversify applications beyond traditional cement reinforcement and mitigate risks associated with raw material price fluctuations. Strategic acquisitions and vertical integration, particularly involving PVA polymerization processes, are common strategies employed by major players to secure supply chain stability and achieve cost efficiencies in an increasingly competitive environment.

From a regional perspective, APAC dictates market dynamics, accounting for the largest share due to high demand in construction and textile industries, coupled with supportive governmental policies for large-scale infrastructure projects. While North America and Europe currently hold smaller shares, these regions exhibit higher growth rates in specialty and technical textile applications, driven by stringent quality standards and a strong focus on sustainable and recycled materials. European growth is particularly tied to innovation in non-metallic substitutes for steel and asbestos in high-end construction and automotive composites. Latin America and the Middle East & Africa (MEA) represent emerging markets where demand is accelerating, primarily driven by nascent construction booms and the adoption of modern, durable building techniques necessary for climate resilience.

Segmentation trends indicate that the application segment dominated by the construction industry, particularly non-asbestos cement products and concrete reinforcement, maintains the largest market share. This dominance is expected to persist throughout the forecast period due to the fiber's superior alkaline resistance compared to natural cellulose or glass fibers. However, the industrial textile and specialized filtration segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). By product type, High Tenacity Vinylon Fiber, utilized in demanding applications requiring maximum load-bearing capacity, holds a substantial share. Simultaneously, Water Soluble Vinylon Fiber is gaining traction in niche markets like temporary textile support and medical applications, propelled by its environmental benefits and specific functional properties, thereby encouraging R&D efforts towards functionalized Vinylon variants.

AI Impact Analysis on Vinylon Fiber Market

Analysis of common user questions regarding AI's impact on the Vinylon Fiber market reveals key themes centered around operational efficiency, material science innovation, and supply chain resilience. Users are primarily concerned with how AI can optimize the complex wet-spinning and formalization processes to reduce energy consumption and waste, thereby addressing the high operational costs associated with Vinylon production. Furthermore, there is significant interest in utilizing machine learning algorithms to predict material performance based on varying polymerization inputs and to accelerate the discovery of new, advanced PVA fiber formulations with improved properties (e.g., higher heat resistance or bio-degradability). The expectation is that AI tools will move beyond simple data logging to become integrated decision-support systems, enhancing quality control and minimizing downtime across the manufacturing lifecycle.

The integration of Artificial Intelligence and advanced analytics is set to revolutionize Vinylon fiber manufacturing by offering unprecedented levels of process control and predictive modeling. AI-powered systems can analyze vast datasets concerning temperature, flow rates, polymer concentration, and tension during the spinning and post-treatment stages, ensuring consistent fiber quality and reducing the rejection rate of substandard batches. This enhanced precision directly addresses major operational challenges, optimizing resource allocation and significantly lowering manufacturing overheads. In the R&D domain, generative AI models are being used to simulate molecular structures of new Vinylon derivatives, drastically cutting down the time and cost associated with laboratory trials and paving the way for commercially viable bio-based or functionalized Vinylon fibers demanded by niche, high-value markets.

- Optimization of Polymerization: AI models predict optimal reaction parameters (temperature, catalyst concentration) for Vinyl Acetate Monomer (VAM) conversion to Polyvinyl Alcohol (PVA).

- Predictive Maintenance: Machine learning algorithms analyze sensor data from spinning machines to foresee equipment failure, minimizing unplanned downtime and maximizing throughput.

- Quality Control Automation: Computer vision and AI analytics assess fiber uniformity, diameter, and defect density in real-time, ensuring stringent quality standards for high-tenacity grades.

- Supply Chain Forecasting: AI improves the accuracy of demand forecasting and raw material (VAM) price predictions, enabling more strategic procurement and inventory management.

- Accelerated Material R&D: Generative AI assists in simulating new Vinylon chemistries and compound compositions for specialized applications (e.g., bio-absorbable medical fibers).

DRO & Impact Forces Of Vinylon Fiber Market

The Vinylon Fiber Market's trajectory is determined by a balance of significant drivers, persistent restraints, and compelling opportunities, all contributing to the overall impact forces shaping its competitive landscape. The primary driver is the mandated global substitution of asbestos in construction, particularly in developing economies, which rely heavily on cement products for infrastructure development. Vinylon fiber offers a safe, highly effective, and cost-competitive alternative, propelling its adoption globally. Simultaneously, the growing demand for durable, lightweight, and chemically resistant industrial materials in automotive, marine, and filtration industries further expands the market base. However, this growth is moderated by the restraint of raw material price volatility, as VAM pricing is closely linked to crude oil derivatives, introducing significant cost uncertainty for manufacturers and downstream consumers.

Impact forces are predominantly driven by technological shifts and regulatory environments. The strong regulatory push in Europe and North America towards sustainable construction practices amplifies the opportunity for Vinylon, especially as manufacturers explore bio-based PVA synthesis routes to enhance the fiber's environmental profile. Opportunities also lie in penetrating high-value markets such as friction materials, specialized protective apparel, and high-performance concrete (HPC), where Vinylon's unique properties are highly desirable. Conversely, one major restraint is the intense rivalry from established synthetic fibers like polypropylene (PP) and polyester, which often offer lower production costs or specialized performance characteristics in specific applications, requiring Vinylon producers to continuously justify their product's premium based on superior alkali resistance and tensile properties.

The strategic dynamics suggest that market players must focus on optimizing production processes to mitigate raw material risks while aggressively pursuing product differentiation through high-modulus and specialty grades. The high capital expenditure required for establishing efficient Vinylon production facilities acts as a barrier to entry for new competitors, consolidating power among existing major manufacturers, predominantly based in Asia. Furthermore, the necessity for robust technical support and collaborative development with major construction material companies (the potential customers) serves as a critical impact force, ensuring the fibers are properly integrated into complex matrix systems, thus dictating long-term adoption rates and market loyalty.

Segmentation Analysis

The Vinylon Fiber Market is comprehensively segmented based on product type, application, and geographic region, allowing for targeted analysis of market opportunities and competitive dynamics. Segmentation by product type primarily categorizes Vinylon into High Tenacity Fiber, Medium Tenacity Fiber, and Water Soluble Fiber. High Tenacity Vinylon fibers, which possess superior tensile strength and modulus, dominate the market share due to their extensive use as structural reinforcement in demanding construction materials and industrial products where durability and load-bearing capacity are paramount. Water Soluble Vinylon fibers, while a smaller segment, are exhibiting rapid growth owing to their unique utility in temporary fabric support, medical textiles, and specialized textile manufacturing processes requiring a temporary binder.

Segmentation by application reveals the profound influence of the global construction industry on market demand. The construction segment, encompassing fiber cement products, concrete reinforcement, and mortars, represents the largest revenue generator for Vinylon fiber globally, driven by infrastructure upgrades and the asbestos ban. The second major application is the textile industry, which utilizes Vinylon for specialized industrial fabrics, fishing gear, and certain blends for apparel, valuing its high strength and chemical resistance. Other significant applications include automotive friction materials, nonwoven fabrics (filtration and wipes), and agricultural products (seed tapes). Analyzing these application segments provides critical insights into end-user requirements and regional consumption patterns, influencing the strategic focus of market leaders toward specific functional attributes and required fiber formats (staple fiber or filament yarn).

- Product Type:

- High Tenacity Fiber

- Medium Tenacity Fiber

- Water Soluble Fiber

- Other Types (e.g., modified/functionalized fibers)

- Application:

- Construction (Fiber Cement Products, Concrete Reinforcement, Mortars)

- Industrial Textiles (Ropes, Nets, Filtration)

- Apparel and Household Textiles

- Automotive (Friction Materials, Composites)

- Nonwoven Fabrics

- Agricultural Applications

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Vinylon Fiber Market

The Vinylon Fiber value chain is complex, starting with petrochemical feedstock and extending through highly specialized chemical processing to downstream consumption in infrastructure and technical product manufacturing. The upstream segment is fundamentally dependent on the supply and pricing of raw materials, primarily Vinyl Acetate Monomer (VAM), which is then polymerized to Polyvinyl Acetate (PVAc) and subsequently hydrolyzed into Polyvinyl Alcohol (PVA). Fluctuations in the global oil and natural gas markets directly impact VAM costs, positioning chemical suppliers and integrated petrochemical companies as critical upstream influencers. Efficiency in the polymerization and subsequent wet-spinning processes is crucial here, as these steps dictate the final fiber characteristics, such as tenacity and modulus, and significantly determine manufacturing cost competitiveness.

The midstream involves the core Vinylon fiber manufacturers who transform PVA into usable staple fibers or filament yarns through advanced spinning and post-treatment techniques (formalization, heat setting). These manufacturers operate on a global scale, with a heavy concentration of capacity in East Asia, necessitating sophisticated logistics for global distribution. The distribution channel is multifaceted: large-volume High Tenacity Vinylon intended for major infrastructure projects (cement reinforcement) often utilizes direct sales models or specialized material distributors who maintain close technical relationships with construction firms. Conversely, Vinylon aimed at the textile or consumer product markets employs indirect channels, relying on global textile distributors, agents, and converters who process the raw fiber into finished products (e.g., fishing nets, nonwoven wipes). This complex interplay of direct technical sales for construction and indirect commodity sales for textiles defines the strategic distribution requirements across different end-use markets.

Vinylon Fiber Market Potential Customers

The primary consumers of Vinylon fiber are large-scale industrial entities and specialized manufacturers whose operational success relies on the fiber's unique reinforcement, thermal, and chemical resistance properties. Foremost among these are manufacturers of fiber-cement building materials, who utilize Vinylon as a direct, safe replacement for asbestos in roofing, siding, and pressure pipes, driven by the need to comply with international health and safety regulations while maintaining high product durability. These customers require bulk quantities of high-tenacity staple fiber that disperses uniformly within the cement matrix, demanding robust quality assurance from suppliers to ensure structural integrity and long-term performance in construction applications subject to weathering and mechanical stress.

Another significant segment of potential customers includes specialized technical textile producers and industrial nonwoven manufacturers. These buyers leverage Vinylon's strength, high modulus, and favorable chemical profile for applications such as high-strength ropes, industrial belts, specialized filtration media for chemical processing, and protective clothing components. For these applications, fiber format (filament vs. staple, linear density) and specific functional finishes are critical buying criteria. Additionally, the automotive industry represents a growing customer base, utilizing Vinylon in brake pads (friction materials) and specific interior or exterior composites where its thermal stability and noise dampening characteristics are valued, often purchasing through highly regulated supply chains that prioritize material consistency and certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1150 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray Co., Ltd., Sinopec Group, Mitsubishi Chemical Corporation, Fujian Aonong Chemical Fiber Co., Ltd., China Petrochemical Corporation, Huaiyin Chemical Fiber Co., Ltd., MiniFIBERS, Inc., Taekwang Industrial Co., Ltd., CHTC Helon Co., Ltd., Shanghai Chemical Fiber Co., Ltd., Vinylon Fiber (VFC) Co., Ltd., Sichuan Vinylon Works, Toray Industries, Inc., Jiangsu Euro-Asia Chemical Co., Ltd., Shandong Lishida Chemical Co., Ltd., Jilin Chemical Fiber Co., Ltd., Ningxia Dadi Circular Development Co., Ltd., Inner Mongolia Binhai Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vinylon Fiber Market Key Technology Landscape

The technological landscape of the Vinylon Fiber market is defined by advancements in polymerization chemistry, spinning techniques, and post-treatment modification aimed at enhancing the fiber's mechanical properties, chemical resistance, and processability. The core technology remains the wet spinning method, where a high-concentration PVA solution is extruded into a coagulation bath, followed by stretching, heat treatment, and formalization (acetalization) to achieve high degrees of crystallinity and tenacity. Recent innovations focus on developing high-speed spinning processes that can reduce manufacturing costs while maintaining superior quality, particularly for the high-modulus grades required in advanced concrete applications. Manufacturers are investing heavily in advanced process control systems, often integrated with AI, to tightly manage parameters like drawing ratio, temperature gradients during heat treatment, and the degree of formalization, ensuring homogeneity and maximizing performance attributes crucial for market differentiation.

A significant area of technological focus is the development of functionalized and environmentally friendly Vinylon variants. Research is ongoing into synthesizing PVA from renewable resources, such as bio-ethanol derived from biomass, moving towards a truly bio-based Vinylon fiber that meets sustainability demands, especially in European and North American markets. Furthermore, surface modification technologies, including plasma treatment or specialized coatings, are being employed to enhance the fiber's adhesion properties when embedded in polymer or cement matrices, thereby improving the performance of composite materials. Specialized low-temperature dissolution Vinylon is also a growing technology, addressing niche demands in temporary support textiles and nonwoven carriers, requiring precise control over the fiber’s solubility characteristics without compromising necessary handling strength during the manufacturing stage. These technological developments are vital for maintaining Vinylon’s competitive edge against cheaper synthetic alternatives.

Regional Highlights

- Highlight key countries or regions and their market relevance

The Asia Pacific (APAC) region stands as the undisputed powerhouse in the global Vinylon Fiber Market, dominating both production capacity and consumption volume. This leadership position is primarily driven by massive, ongoing infrastructure expansion projects across China, India, and Southeast Asia, which create huge demand for durable, non-asbestos cement products and concrete reinforcement fibers. China, in particular, is the world's largest consumer and producer, benefiting from integrated supply chains and low manufacturing costs, making it a critical hub for both domestic use and global export. Furthermore, the region's large and rapidly expanding textile and industrial application sectors, including fishing nets and filtration media, contribute substantially to the high consumption rates. The stringent governmental focus on public works and housing development ensures that demand for high-tenacity Vinylon fibers remains robust throughout the forecast period, positioning APAC as the primary market growth engine.

Europe represents a mature yet high-value market, characterized by stringent environmental regulations and a strong inclination toward innovative construction materials. Although the overall volume is lower than in APAC, European demand focuses predominantly on specialty and high-modulus Vinylon used in advanced composite structures, geotechnical applications, and high-performance concrete where material safety and long-term reliability are paramount. The phase-out of traditional hazardous materials and the push towards sustainable building solutions create significant opportunities for premium Vinylon grades. Key consuming countries, such as Germany, France, and the UK, drive regional growth through advanced research and adoption of technical textiles in industrial filtration and automotive applications, requiring manufacturers to adhere to high technical specifications and prioritize material sustainability credentials.

North America is steadily increasing its Vinylon adoption, especially as awareness of its superior alkaline resistance compared to alternative fibers grows within the construction and infrastructure rehabilitation sectors. The market here is highly segmented, with demand driven primarily by niche, high-performance applications, including friction materials for brake pads, specialized nonwoven reinforcement for roofing, and advanced civil engineering projects. The market is highly price-sensitive and quality-focused, requiring suppliers to demonstrate proven long-term performance and certifications. Meanwhile, emerging regions like Latin America (LATAM) and the Middle East & Africa (MEA) are witnessing accelerating demand, fueled by rapid urbanization, energy infrastructure development, and growing adoption of modern building codes. In MEA, specifically, Vinylon is gaining traction as a reliable and cost-effective reinforcement solution for cement and mortar in harsh desert environments, where chemical resistance is essential for material longevity, presenting untapped growth potential for major global players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vinylon Fiber Market.- Kuraray Co., Ltd.

- Sinopec Group (China Petrochemical Corporation)

- Mitsubishi Chemical Corporation

- Fujian Aonong Chemical Fiber Co., Ltd.

- Huaiyin Chemical Fiber Co., Ltd.

- MiniFIBERS, Inc.

- Taekwang Industrial Co., Ltd.

- CHTC Helon Co., Ltd.

- Shanghai Chemical Fiber Co., Ltd.

- Vinylon Fiber (VFC) Co., Ltd.

- Sichuan Vinylon Works

- Toray Industries, Inc.

- Jiangsu Euro-Asia Chemical Co., Ltd.

- Shandong Lishida Chemical Co., Ltd.

- Jilin Chemical Fiber Co., Ltd.

- Ningxia Dadi Circular Development Co., Ltd.

- Inner Mongolia Binhai Chemical Co., Ltd.

- Japan VAM & Poval Co., Ltd.

- Jiangsu High-Polymer Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Vinylon Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Vinylon Fiber Market?

The primary growth driver is the construction sector, particularly the global demand for Vinylon fiber as a safe and superior substitute for asbestos in fiber cement products (such as pipes and roofing sheets) and as reinforcement in concrete and mortars. Secondary drivers include demand from industrial textiles, fishing nets, and automotive friction materials, valued for the fiber's high tenacity and excellent alkali resistance, ensuring long-term material durability in harsh environments.

How does Vinylon fiber compare to other synthetic reinforcement fibers like Polypropylene (PP) and Polyester?

Vinylon fiber (PVA) offers superior resistance to strong alkaline environments, making it ideal for use in highly alkaline cement and concrete matrices where traditional fibers like Polyester and sometimes PP may degrade over time. While PP often offers a cost advantage, Vinylon excels in tensile strength, thermal stability, and adhesion to cement, justifying its higher cost in critical structural and high-performance applications requiring permanent, reliable reinforcement integrity.

What is the current impact of raw material volatility on the Vinylon Fiber industry?

Raw material volatility, specifically the price fluctuations of Vinyl Acetate Monomer (VAM) which is derived from petrochemicals, poses a significant restraint on market profitability and stability. VAM costs directly influence the production expenses of Polyvinyl Alcohol (PVA), the precursor to Vinylon fiber. Manufacturers mitigate this risk through strategic long-term procurement contracts, vertical integration into VAM/PVA production, and optimizing operational efficiencies to absorb fluctuating input costs.

Which geographic region holds the largest market share and why is it dominant?

The Asia Pacific (APAC) region currently holds the largest market share due to its status as the global manufacturing hub for Vinylon fiber and its massive consumption base. This dominance is driven by high levels of government investment in major infrastructure projects, sustained rapid urbanization, and readily available, cost-effective manufacturing capabilities, particularly in China, which fuels both domestic use in construction and global fiber export.

What are the future opportunities regarding sustainable Vinylon fiber production?

Future opportunities are concentrated in the development of sustainable, bio-based Vinylon fiber derived from renewable sources, such as bio-ethanol. This innovation addresses increasing consumer and regulatory pressure for eco-friendly materials, particularly in European and North American markets. Advancements in recycling technologies for PVA-based products and the development of functionalized Vinylon fibers for niche high-value medical or composite applications also represent significant long-term growth avenues.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager