Virtual Data Room Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433035 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Virtual Data Room Service Market Size

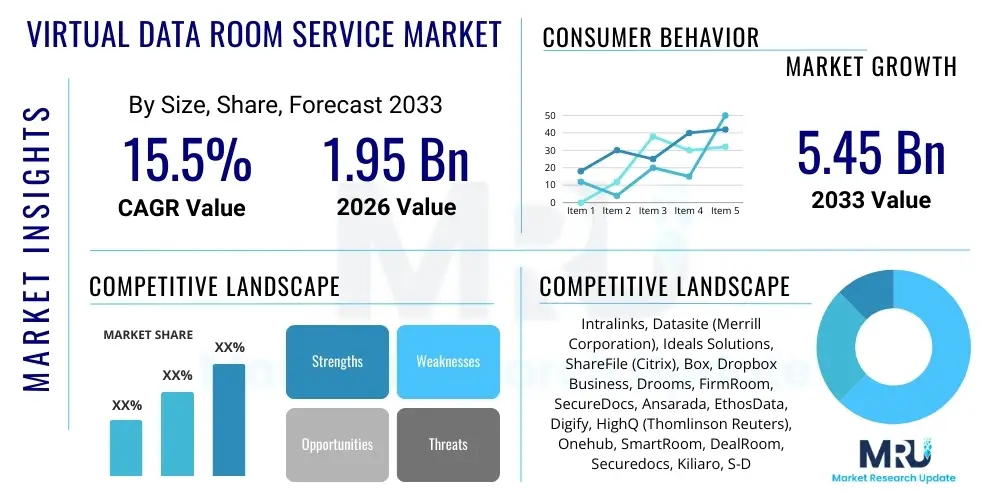

The Virtual Data Room Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $5.45 Billion by the end of the forecast period in 2033.

Virtual Data Room Service Market introduction

The Virtual Data Room (VDR) Service Market encompasses secure online repositories designed for the storage, exchange, and management of confidential documents during financial transactions, regulatory compliance audits, and complex legal processes. A VDR acts as a critical hub for due diligence, predominantly serving mergers and acquisitions (M&A), initial public offerings (IPOs), fundraising, and asset sales. These platforms offer advanced security features, including granular access control, 256-bit encryption, dynamic watermarking, and comprehensive audit trails, ensuring data integrity and confidentiality throughout high-stakes projects. The core product is the provision of secure, high-availability cloud-based environments tailored to streamline complex, multi-party data sharing workflows, moving beyond rudimentary file sharing solutions.

Major applications for VDR services span across various highly regulated industries, including banking, financial services, and insurance (BFSI), legal firms, healthcare, and life sciences, where the secure handling of intellectual property, patient data, and sensitive financial records is paramount. Key benefits derived from utilizing VDR services include significant reductions in transaction time and costs associated with physical document management, enhanced transparency through detailed reporting on document access, and superior compliance adherence, especially concerning global data protection regulations such as GDPR and CCPA. The inherent capability of VDRs to handle large volumes of documents simultaneously, while maintaining stringent security protocols, positions them as indispensable tools in the modern corporate landscape characterized by rapid globalization and increasing regulatory scrutiny.

Driving factors propelling the market expansion include the sustained global rise in M&A activity, particularly cross-border deals requiring standardized and secure document exchange across jurisdictions. Furthermore, the increasing complexity of regulatory environments necessitates robust audit trails and detailed reporting capabilities, which VDRs inherently provide. The growing prevalence of remote work models, exacerbated by global events, has further accelerated the adoption of secure, cloud-native collaboration tools like VDRs. Companies are increasingly seeking solutions that not only manage data but also offer integrated analytical capabilities to speed up the due diligence process, thereby enhancing decision-making efficiency during critical transactions.

Virtual Data Room Service Market Executive Summary

The Virtual Data Room Service Market is experiencing robust growth fueled by strategic business trends, including the digital transformation of corporate legal and financial operations and a sustained appetite for strategic M&A across industrialized economies. Providers are shifting their focus from simple document storage to offering sophisticated platforms integrated with artificial intelligence (AI) and machine learning (ML) capabilities for automated document organization, risk flagging, and sentiment analysis, thereby reducing the manual burden of due diligence. Cloud deployment remains the dominant business model, favored for its scalability and accessibility, although highly sensitive sectors still utilize hybrid or private cloud options. Competitive dynamics are intensifying, with vendors competing on security certifications, ease of use (UX/UI), and regional compliance expertise, prompting frequent feature upgrades and strategic partnerships to capture specialized vertical markets.

Regional trends indicate North America currently holds the largest market share, driven by a high volume of complex M&A transactions, a mature technological infrastructure, and stringent regulatory compliance requirements (e.g., SOX, HIPAA). However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, primarily due to expanding private equity activity, burgeoning startup ecosystems, and increasing awareness regarding data security standards in fast-growing economies like China, India, and Southeast Asia. Europe maintains a strong presence, underpinned by strict data localization rules (GDPR) which mandate VDR solutions capable of ensuring data sovereignty, driving demand for localized, compliant service offerings tailored to diverse European legal frameworks.

Segment trends reveal that the BFSI sector remains the primary end-user, capitalizing on VDRs for M&A, loan syndication, and regulatory audits. The Legal sector is rapidly increasing adoption for litigation support and intellectual property management. Based on deployment, the cloud segment dominates due to its cost-efficiency and rapid deployment characteristics, yet the emphasis on enterprise-grade security features is leading to greater adoption of highly secure private and dedicated VDR environments. Small and Medium-sized Enterprises (SMEs) represent a crucial emerging segment, driven by the availability of tiered, cost-effective VDR solutions, enabling them to professionalize their fundraising and contractual processes previously limited to large corporations.

AI Impact Analysis on Virtual Data Room Service Market

Common user questions regarding AI's impact on the VDR market center on themes of efficiency gains, accuracy improvements in document review, and enhanced security capabilities. Users frequently ask: "How much faster can AI make the due diligence process?" and "Can AI accurately identify risks or anomalies in contracts?" and "Will AI integration compromise data privacy?" The core user expectation is that AI and ML will transform VDRs from static storage solutions into intelligent transaction management platforms capable of handling massive datasets with unprecedented speed and precision. Key concerns revolve around the trustworthiness of AI-generated insights, ensuring ethical use, and guaranteeing that AI models trained on sensitive data adhere to stringent confidentiality and compliance standards, particularly regarding cross-border data transfer regulations.

AI's integration fundamentally changes the value proposition of VDRs by moving beyond simple indexing and search. AI-powered capabilities, such as automated document categorization, predictive analytics for identifying relevant documents, and natural language processing (NLP) for extracting key clauses and entities, drastically reduce the time needed for legal and financial review. This transformation is critical in high-pressure M&A scenarios where speed is paramount. Moreover, AI algorithms are instrumental in security enhancements, offering real-time threat detection and anomaly flagging in user behavior, thereby proactively mitigating risks associated with insider threats or unauthorized data access attempts, cementing VDRs as highly intelligent repositories.

The deployment of AI also necessitates higher levels of transparency regarding the processing of confidential information. VDR providers must invest heavily in explainable AI (XAI) features to allow users to understand how certain conclusions or risk flags were generated, fostering trust in the automated review process. Furthermore, the adoption of AI drives the competitive need for VDR providers to specialize their models for specific industry jargon—for instance, customizing models to recognize nuanced terminology in pharmaceutical licensing agreements versus energy asset sales contracts—thereby tailoring the analytical depth and relevance for diverse vertical markets. This continuous refinement and specialization of AI tools is essential for maintaining competitive advantage.

- AI-driven automated document classification and tagging (NLP).

- Accelerated due diligence timelines via intelligent search and key clause extraction.

- Risk and anomaly detection in user behavior and document content (security enhancement).

- Sentiment analysis on stakeholder communications within the platform.

- Predictive analytics for estimating transaction closure likelihood based on document review progress.

- Enhanced regulatory compliance checks through automated content scrutiny against predefined standards.

- Streamlined Q&A processes by automatically routing and suggesting answers based on reviewed documents.

DRO & Impact Forces Of Virtual Data Room Service Market

The Virtual Data Room Service market is dynamically shaped by powerful drivers and significant restraints, offering considerable opportunities for strategic growth, all interacting under various impact forces. The primary driver is the accelerating pace and complexity of global mergers and acquisitions, coupled with a fundamental, organization-wide mandate for digital transformation and secure cloud migration. However, this growth is tempered by critical restraints, chiefly the consistently high implementation and subscription costs associated with premium VDR platforms, which can deter Small and Medium-sized Enterprises (SMEs), alongside persistent user concerns regarding data privacy and the potential for vendor lock-in, which necessitate strict contractual and technical assurances. The market presents immense opportunities through geographical expansion into emerging economies and the specialization of platforms to serve niche sectors like complex infrastructure projects or biotechnology R&A data management, demanding highly customized security and organizational features. These elements operate under impact forces dominated by regulatory evolution, continuous technological advancement (especially in cryptography and AI), and the ever-present threat landscape necessitating proactive security measures.

Key drivers include the imperative for regulatory compliance, particularly in sectors dealing with sensitive information (e.g., healthcare, finance), where VDRs provide non-repudiable audit trails necessary for fulfilling governmental mandates (e.g., GDPR, CCPA, HIPAA, Basel III). The increasing volume and sensitivity of corporate data shared during transactions mandate highly specialized security infrastructure that standard file-sharing services cannot provide, pushing enterprises toward dedicated VDR solutions. Furthermore, the widespread shift towards remote and hybrid working models accelerates the demand for centralized, secure, and accessible cloud-based collaboration environments, enabling geographically dispersed teams to conduct high-stakes due diligence efficiently and securely, irrespective of physical location or time zones, thereby streamlining global operations.

Restraints primarily revolve around cybersecurity perceptions and budgetary constraints. Despite advanced security features, potential users remain wary of entrusting highly confidential information to third-party cloud solutions, demanding rigorous penetration testing and frequent third-party security certifications. The lack of standardized pricing models across the industry creates complexity, often making premium VDR services prohibitively expensive for smaller firms or non-transactional use cases, pushing some toward less secure, consumer-grade alternatives. Overcoming these restraints requires vendors to emphasize transparent pricing structures, provide robust educational content on security protocols, and offer tiered solutions tailored to varying organizational sizes and project complexities, thereby democratizing access to secure data management tools.

Opportunities are substantial in leveraging AI and ML to enhance the speed and quality of data review, effectively reducing the overall cost and duration of complex transactions, creating a compelling return on investment for users. Furthermore, developing robust, compliant, regional VDR solutions that strictly adhere to local data sovereignty laws provides a significant competitive edge, especially in fragmented regulatory regions like the EU and APAC. The expansion of VDR utility beyond traditional M&A—into areas such as regulatory reporting, board communication, bankruptcy restructuring, and complex intellectual property licensing—opens up new, consistent revenue streams, transforming the VDR from a transactional tool into a continuous enterprise content management solution.

Segmentation Analysis

The Virtual Data Room Service Market is comprehensively segmented based on component (Solution and Services), deployment model (Cloud and On-Premise), organization size (SMEs and Large Enterprises), and application (M&A and Strategic Initiatives, Fundraising/IPO, Regulatory Compliance, and Others), and end-user vertical (BFSI, Legal, Healthcare & Life Sciences, Real Estate, Energy & Utilities, and Others). This multi-dimensional segmentation allows for granular analysis of demand patterns, highlighting which specific features and service levels are driving adoption across different operational and industry contexts. The segmentation underscores the market's maturity, reflecting a shift towards specialized solutions that address unique industry-specific workflows and regulatory needs, moving away from generic document repositories to highly tailored, secure transaction platforms. For instance, the needs of a BFSI institution conducting loan syndication differ significantly from those of a pharmaceutical company managing sensitive clinical trial data, necessitating distinct feature sets regarding data governance and audit trails.

Analyzing the segmentation by component, the Solution segment, which includes the core software platform and its integrated features (AI, analytics, reporting), holds the larger revenue share, driven by continuous investment in feature innovation like advanced document encryption and granular permissions settings. However, the Services segment—encompassing implementation, technical support, training, and managed services—is growing rapidly, reflecting the increasing need for professional assistance in migrating large datasets and ensuring optimal configuration for complex, multi-jurisdictional transactions. By deployment, the cloud model is the clear leader due to scalability and cost advantages, particularly among SMEs, while large enterprises in highly regulated environments still show strong preference for hybrid or private cloud options to maintain strict control over data residency and infrastructure security.

The end-user segmentation confirms the criticality of VDRs within the BFSI and Legal sectors, which are continually involved in high volumes of sensitive transactions requiring absolute security. However, sectors such as Healthcare and Life Sciences are exhibiting explosive growth, driven by collaborative research efforts, stringent patient data privacy laws (HIPAA), and the necessity to securely share intellectual property during drug development and licensing. The M&A and Strategic Initiatives application segment remains the largest revenue generator, directly correlating VDR usage with the economic cycle of corporate restructuring. Vendors are increasingly tailoring their offerings to fit the specific compliance and data handling requirements of each major vertical, using segmentation analysis to guide product development and targeted marketing strategies, ensuring their platforms meet specialized operational needs.

- Component:

- Solution (Software Platform)

- Services (Professional Services, Managed Services, Support)

- Deployment Model:

- Cloud (Public, Private, Hybrid)

- On-Premise

- Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Application:

- Mergers and Acquisitions (M&A) and Strategic Initiatives

- Fundraising and Initial Public Offerings (IPOs)

- Regulatory Compliance and Audits

- Litigation Support and Intellectual Property Management

- Board Communications and Corporate Repository

- End-User Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Legal

- Healthcare and Life Sciences

- Real Estate and Construction

- Energy and Utilities

- Government and Public Sector

- Technology, Media, and Telecommunications (TMT)

Value Chain Analysis For Virtual Data Room Service Market

The value chain for the Virtual Data Room Service Market begins with upstream activities focused on foundational technology development and data infrastructure management, followed by core service provision, and culminating in downstream distribution and end-user engagement. Upstream analysis involves the development and licensing of secure core technologies, including cryptographic protocols (like AES-256), sophisticated access management systems (Zero Trust principles), and integrated AI/ML engines for data processing. This stage is dominated by specialized software developers, security firms, and cloud infrastructure providers (like AWS, Azure, Google Cloud) which offer the underlying scalable and highly redundant infrastructure necessary to host VDR environments. The quality of upstream components, particularly regarding compliance with international security standards (ISO 27001, SOC 2 Type II), directly impacts the platform's reliability and credibility in the highly sensitive corporate transaction market.

The midstream focuses on the core VDR service providers who integrate these upstream technologies to create the final secure platform solution. This involves critical activities such as platform customization, development of proprietary features (e.g., dynamic watermarking, detailed audit logging), user interface design optimization for efficiency, and obtaining crucial third-party security certifications. Pricing models, service level agreements (SLAs), and global deployment capabilities are refined at this stage. Effective midstream management is crucial for differentiating offerings, as providers compete intensely on user experience (UX), security robustness, and the depth of their industry-specific functionalities, tailoring the platform to meet the exacting needs of legal, finance, and pharmaceutical professionals.

Downstream analysis covers the distribution channels and direct engagement with end-users. Distribution is primarily direct, with VDR providers maintaining internal sales teams and account management specialists to handle complex enterprise contracts and negotiations, particularly with large financial institutions and global law firms. However, indirect channels, involving partnerships with investment banks, consulting firms (for advisory services integrated with VDR usage), and specialized legal technology resellers, are becoming increasingly important for penetrating new geographic or industry segments. The efficiency of customer support, training, and rapid deployment capabilities are paramount in the downstream segment, as time sensitivity in M&A deals dictates that implementation and issue resolution must be instantaneous and highly professional. Successful downstream execution ensures high customer retention and strong referral networks, which are vital in this reputation-driven industry.

Virtual Data Room Service Market Potential Customers

Potential customers for Virtual Data Room Services are entities that regularly engage in high-stakes financial transactions, sensitive intellectual property sharing, or require rigorous, auditable compliance mechanisms for confidential data exchange. The primary end-users are large enterprises and financial institutions involved in Mergers and Acquisitions (M&A), including corporate development teams, investment banks, private equity firms, and venture capital companies utilizing VDRs for due diligence, asset valuation, and investor relations. Beyond transactional finance, the legal sector forms a massive customer base, employing VDRs for complex litigation support, managing e-discovery processes, and safeguarding large volumes of privileged client information during case preparation and settlement negotiations, seeking systems that provide superior chain-of-custody documentation.

Another significant segment comprises highly regulated industries such as Healthcare, Pharmaceuticals, and Life Sciences, which require VDRs to manage clinical trial data sharing, secure licensing agreements, and maintain compliance with patient privacy regulations (e.g., HIPAA in the US and GDPR in Europe). Real Estate developers and construction firms utilize VDRs for managing complex project documentation, land acquisition due diligence, and secure exchanges of engineering blueprints and financial models with consortium partners and regulatory bodies. Increasingly, government agencies and public sector entities are adopting VDRs for secure tendering processes, confidential procurement, and inter-departmental collaboration requiring auditability and absolute data integrity, often opting for private cloud or on-premise VDR deployments to satisfy strict data sovereignty requirements, thereby expanding the customer horizon beyond purely commercial enterprises.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $5.45 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intralinks, Datasite (Merrill Corporation), Ideals Solutions, ShareFile (Citrix), Box, Dropbox Business, Drooms, FirmRoom, SecureDocs, Ansarada, EthosData, Digify, HighQ (Thomlinson Reuters), Onehub, SmartRoom, DealRoom, Securedocs, Kiliaro, S-Docs, VDR Pro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Virtual Data Room Service Market Key Technology Landscape

The technology landscape of the Virtual Data Room Service market is centered on providing uncompromising security, high availability, and intelligence to streamline complex transaction workflows. Core technology revolves around advanced cryptography, specifically 256-bit AES encryption for data at rest and in transit, combined with sophisticated key management systems that ensure only authorized parties can access highly sensitive documents. Beyond foundational encryption, the utilization of multi-factor authentication (MFA), role-based access controls (RBAC), and digital rights management (DRM) features are standard, allowing administrators to control exactly who can view, print, download, or forward specific documents, even after they have been downloaded from the VDR platform. This granular control over data access and distribution forms the technological backbone supporting the security guarantees offered by VDR providers, distinguishing them sharply from consumer-grade file storage solutions.

The market is rapidly being redefined by the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities, which represent the most significant technological evolution in recent years. These technologies are utilized primarily for enhancing efficiency and data governance. AI-powered tools include Natural Language Processing (NLP) for automated indexing, semantic search capabilities that move beyond keyword matching, and automatic categorization of unstructured data. ML algorithms are deployed for predictive analytics, risk scoring of documents based on legal terms, and anomaly detection to flag suspicious user activities or potential data leaks in real time. This integration transforms the VDR from a passive repository into an active, intelligent assistant that dramatically accelerates the due diligence lifecycle, providing competitive differentiation among vendors.

Furthermore, cloud architecture and infrastructure remain a critical technological determinant. Modern VDR solutions rely on globally distributed, highly secure cloud environments, often leveraging specialized cloud services designed for high compliance needs (e.g., FedRAMP, regional specific certifications). The focus is on providing robust disaster recovery mechanisms, ensuring 99.99% uptime, and facilitating compliance with increasingly strict data sovereignty and localization laws, requiring providers to maintain data centers across key geographical regions. Technologies facilitating seamless integration via APIs with existing enterprise resource planning (ERP), customer relationship management (CRM), and legal management systems are also vital, enabling VDRs to function as integrated components within the broader corporate technology ecosystem rather than isolated transaction tools, thereby maximizing user adoption and data workflow efficiency.

Regional Highlights

- North America: North America currently holds the dominant market share, primarily driven by the United States, which is the epicenter of global M&A activity, private equity investment, and technological innovation. The region benefits from a mature technological infrastructure, a high concentration of sophisticated financial institutions, and stringent corporate governance and compliance mandates (e.g., Sarbanes-Oxley, HIPAA). Demand is characterized by a high willingness to adopt advanced features such as AI-powered due diligence tools and complex integrations. The competitive environment is fierce, with established global players headquartered here.

- Europe: Europe represents a highly regulated and high-growth market, heavily influenced by the General Data Protection Regulation (GDPR). GDPR mandates strict data residency and sovereignty requirements, pushing European VDR users towards solutions offering localized hosting and certified compliance. While growth drivers are strong—including robust intra-European M&A and mandatory regulatory audits—the market is fragmented by diverse language requirements and varying legal systems, necessitating VDR providers to offer highly customizable, multi-lingual, and jurisdiction-aware platforms, particularly in the UK, Germany, and France.

- Asia Pacific (APAC): The APAC region is anticipated to be the fastest-growing market globally. This exponential growth is fueled by rapidly increasing foreign direct investment (FDI), expanding cross-border transactions, and the proliferation of tech startups and IPOs across economies like China, India, Japan, and Southeast Asia. Although the market is less mature in terms of VDR adoption compared to the West, increasing awareness of data security risks and the professionalization of business processes are accelerating uptake, especially among BFSI and TMT sectors, driving demand for scalable, localized cloud VDR solutions.

- Latin America (LATAM): The LATAM VDR market is emerging, driven primarily by infrastructure projects, resource sector deals, and expanding regional trade. Challenges include varying levels of digital maturity and economic volatility; however, the ongoing digital transformation within major economies like Brazil and Mexico is creating consistent opportunities for VDR adoption, focusing mainly on regulatory compliance and centralized project management for large-scale operations.

- Middle East and Africa (MEA): The MEA region shows significant potential, propelled by large-scale sovereign wealth fund investments, ambitious national diversification strategies, and rapidly expanding financial hubs (e.g., Dubai, Riyadh). Demand is concentrated in highly regulated financial services, energy, and government sectors, where ensuring absolute data integrity and complying with specific local security requirements, often favoring private or government-certified cloud infrastructure, is critical for market entry and growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Virtual Data Room Service Market.- Intralinks

- Datasite (Merrill Corporation)

- Ideals Solutions

- ShareFile (Citrix)

- Box

- Dropbox Business

- Drooms

- FirmRoom

- SecureDocs

- Ansarada

- EthosData

- Digify

- HighQ (Thomlinson Reuters)

- Onehub

- SmartRoom

- DealRoom

- Securedocs

- Kiliaro

- S-Docs

- VDR Pro

Frequently Asked Questions

Analyze common user questions about the Virtual Data Room Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Virtual Data Room (VDR) and how does it differ from standard cloud storage?

A Virtual Data Room is a secure online repository specifically designed for managing and sharing highly confidential documents during high-stakes corporate transactions like M&A due diligence or IPOs. Unlike standard cloud storage (e.g., Dropbox or Google Drive), VDRs offer advanced security features such as granular access permissions, dynamic watermarking, detailed audit logging, and digital rights management (DRM), ensuring superior control and compliance required for legal and financial processes.

Which industry vertical is the largest user of Virtual Data Room services?

The Banking, Financial Services, and Insurance (BFSI) sector is historically the largest end-user of Virtual Data Room services. This dominance is driven by the sector's continuous involvement in M&A activities, loan syndication, fundraising, and mandatory regulatory audits, all of which require the secure and auditable exchange of sensitive financial data and confidential documentation.

How is Artificial Intelligence (AI) influencing the functionality of VDR platforms?

AI significantly enhances VDR functionality by introducing intelligent automation. AI and Machine Learning (ML) are used for automated document categorization, rapid key clause extraction (NLP), and sophisticated risk detection, drastically speeding up the due diligence process and reducing manual review hours. AI transforms VDRs into analytical tools rather than mere storage facilities.

What are the primary factors driving the growth of the Virtual Data Room market?

The primary growth factors are the continuous increase in global M&A transaction volume, the global shift towards digital transformation necessitating secure cloud-based collaboration, and the escalating complexity and stringency of international regulatory compliance and data protection laws (e.g., GDPR, CCPA) requiring robust audit trails.

Is the Cloud deployment model secure for sensitive VDR data?

Yes, the Cloud deployment model, particularly Private and Hybrid cloud VDR solutions, is highly secure, often exceeding on-premise security. Leading VDR providers implement advanced protocols, including 256-bit encryption, multi-factor authentication, ISO 27001 certification, and frequent security audits to ensure data integrity and compliance with international standards, making it the preferred method for most large enterprises and SMEs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager