Virtual Family Office Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434631 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Virtual Family Office Market Size

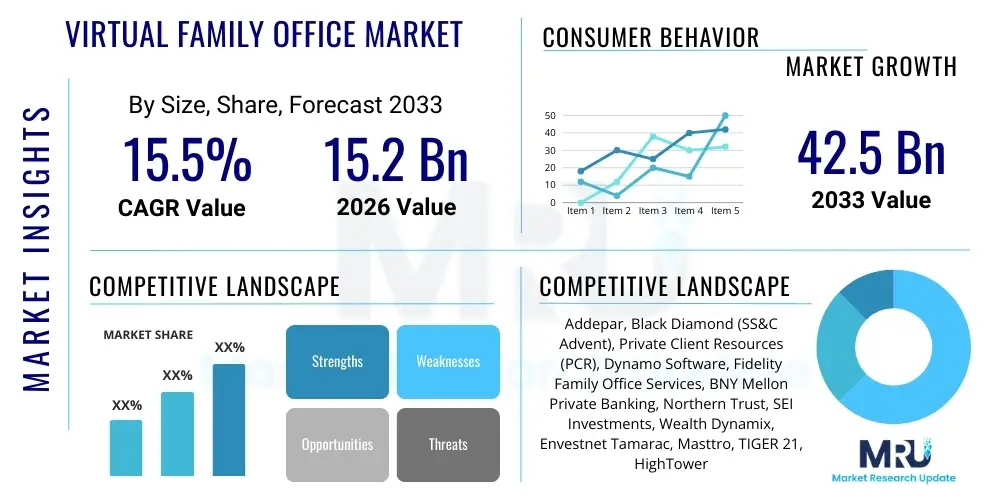

The Virtual Family Office Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 42.5 Billion by the end of the forecast period in 2033.

Virtual Family Office Market introduction

The Virtual Family Office (VFO) Market encompasses technology-enabled platforms and service models designed to provide comprehensive wealth management, financial planning, succession planning, and administrative services to high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), replacing or complementing traditional single or multi-family office structures. Unlike physical family offices which require significant fixed overheads, VFOs leverage advanced digital tools, cloud infrastructure, cybersecurity protocols, and specialized professional networks to deliver highly personalized and scalable services remotely. This model significantly democratizes access to institutional-grade wealth management expertise, making sophisticated financial structures accessible to a broader cohort of affluent families who prioritize flexibility, global reach, and cost-efficiency. The core product offering is the integration of disparate advisory functions—legal, tax, investment, philanthropy—into a seamless digital experience.

Major applications of VFO services span complex asset consolidation, real-time performance reporting across diversified portfolios (including traditional, alternative, and illiquid assets), cross-border tax optimization, and intricate estate planning. Furthermore, VFOs are increasingly utilized for governance and communication structures within generational wealth transfers, offering specialized platforms for educating next-generation beneficiaries on fiduciary responsibilities and investment strategies. The primary benefit derived by clients is the ability to maintain centralized control and oversight of their wealth ecosystem through a single digital interface, coupled with access to a decentralized network of best-in-class specialists without the logistical burdens and high cost structure associated with building and maintaining a proprietary physical office. This hybrid service model, combining human expertise with algorithmic efficiency, defines the modern VFO paradigm and appeals strongly to globally mobile and technologically savvy client segments.

Key driving factors accelerating the market’s expansion include the escalating demand for transparency and real-time reporting catalyzed by digital transformation across financial services, the global rise of newly affluent individuals from the technology and startup sectors who intrinsically prefer digital interaction, and critical cost pressures faced by traditional family offices seeking operational efficiencies. Additionally, the complex regulatory environment and the increasing globalization of wealth necessitate sophisticated cross-jurisdictional advisory capabilities, which VFO platforms are structurally better equipped to handle than localized, traditional counterparts. The shift in client preference towards subscription-based, modular service offerings further reinforces the market momentum, positioning VFOs as the agile solution for complex global wealth management challenges.

Virtual Family Office Market Executive Summary

The Virtual Family Office Market is poised for substantial growth driven by convergent macroeconomic trends and technological maturation. Business trends indicate a significant consolidation of advisory technologies, with VFO providers focusing heavily on integrating specialized solutions for illiquid asset management, complex tax structures, and philanthropic advising onto centralized platforms. This move toward ecosystem integration allows providers to offer superior customization and scalability, shifting the competitive landscape from transactional service delivery to holistic, relationship-based digital enablement. Operational efficiency derived from automation—particularly in compliance, reporting, and middle-office functions—is emerging as a critical differentiator, enabling VFOs to lower their service thresholds and expand their total addressable market beyond the ultra-high-net-worth segment into the affluent market seeking multi-disciplinary advice.

Regionally, North America maintains market dominance due to early adoption of financial technology, a highly sophisticated HNWI population, and the presence of leading technological solution providers. However, the Asia Pacific region (APAC) is projected to exhibit the highest growth trajectory, fueled by rapid wealth creation in economies such as China and India, coupled with increasing demand for robust generational transition planning and cross-border investment management. European adoption is steady, centered around regulatory harmonization efforts (e.g., GDPR, MiFID II) that necessitate advanced digital compliance frameworks, making the VFO model an attractive mechanism for streamlined cross-jurisdictional service provision. Emerging markets in Latin America and MEA are seeing initial traction, primarily focused on capital protection, repatriation services, and accessing global investment opportunities efficiently through digital channels.

Segment trends reveal critical shifts, particularly within service model categories, where the outsourced model (utilizing third-party technology providers) is gaining rapid traction over proprietary technology builds, favoring speed-to-market and lower initial capital outlay. Furthermore, there is a pronounced growth in demand for highly specialized VFO services focused specifically on complex asset classes, notably digital assets and private equity participation management, reflecting the evolving composition of modern family wealth. Technology segmentation highlights the increasing dominance of cloud-based Software-as-a-Service (SaaS) platforms, which offer inherent flexibility and rapid feature updates, critical for keeping pace with dynamic regulatory and market conditions. This holistic digital transformation underscores the VFO market's resilience and adaptability in serving complex global client needs.

AI Impact Analysis on Virtual Family Office Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Virtual Family Office market primarily revolve around three core themes: the extent of displacement of human advisors, the capability of AI in handling complex, bespoke financial scenarios, and the implications for data security and personalization. Users frequently inquire about AI's role in portfolio construction, specifically whether AI can genuinely capture complex family biases and risk tolerances beyond simple quantitative metrics. There is high interest in how AI tools, such as Large Language Models (LLMs) and predictive analytics, are being deployed for regulatory compliance checks, tax optimization across multiple jurisdictions, and sophisticated risk modeling that goes beyond traditional Monte Carlo simulations. Concerns center on ethical AI use, data privacy when integrating diverse family financial data streams, and the governance frameworks necessary to ensure algorithmic accountability and transparency, particularly in sensitive succession and philanthropic planning activities.

The consensus emerging from market analysis suggests that AI will not replace the lead relationship manager but will profoundly enhance their capabilities, transforming VFOs into highly augmented advisory ecosystems. AI is rapidly taking over repetitive, data-intensive back-office tasks, freeing up human advisors to focus on high-touch client relationships, complex negotiation, and nuanced psychological advice inherent in multigenerational wealth planning. AI-driven predictive analytics are revolutionizing cash flow forecasting and liquidity management by identifying future financial stressors or opportunities with high accuracy. Furthermore, natural language processing (NLP) is dramatically improving document management, allowing VFO platforms to quickly synthesize complex legal documents, investment mandates, and regulatory updates, drastically reducing the time spent on due diligence and compliance reporting.

Ultimately, the impact of AI is measured by its contribution to Hyper-Personalization and Operational Resilience. By analyzing behavioral economics data and investment preferences across family cohorts, AI can tailor communication strategies and investment product offerings with unprecedented precision. This capability directly enhances client satisfaction and retention. Operationally, machine learning models continuously monitor transactional data for anomalies, significantly bolstering fraud detection and ensuring adherence to increasingly stringent global Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, thereby establishing a new standard for compliance efficiency and risk mitigation within the VFO domain.

- Automated compliance monitoring and regulatory reporting drastically reduce manual errors and overhead.

- AI-driven predictive analytics enhance portfolio stress- testing and customized risk modeling based on familial behavioral data.

- Machine learning algorithms optimize resource allocation and vendor management within the VFO network.

- Natural Language Processing (NLP) accelerates synthesis of complex legal and trust documentation for faster advisory insights.

- Chatbots and conversational AI improve client engagement for routine inquiries and access to standardized reports.

- Enhanced cybersecurity features leveraging AI detect and neutralize sophisticated financial cyber threats in real time.

- Hyper-personalization engines tailor investment advice and philanthropic strategies based on generational preferences and values.

DRO & Impact Forces Of Virtual Family Office Market

The Virtual Family Office Market is influenced by a dynamic interplay of propelling drivers, systemic restraints, and lucrative opportunities, collectively shaping the market's impact forces. The primary drivers include the inherent cost-efficiency and operational scalability offered by the virtual model compared to traditional structures, a critical factor for global wealth management firms aiming to optimize their expense ratios. Technological acceleration, particularly the maturation of cloud computing and secure data aggregation technologies, provides the necessary infrastructure for VFO platforms to function reliably across borders. Restraints primarily involve persistent client resistance rooted in security concerns regarding sensitive financial data stored in the cloud and the historical preference among older HNWI demographics for face-to-face, high-touch advisory relationships. Overcoming these trust barriers through demonstrably robust cybersecurity protocols and hybrid service models remains essential for widespread adoption.

Opportunities are largely centered on expanding service modularity and targeting underserved segments. The growing cohort of newly wealthy entrepreneurs and technology founders, who are digitally native and possess complex, often illiquid wealth structures, represents a prime demographic seeking the flexibility of VFO services. Furthermore, integrating specialized decentralized finance (DeFi) and digital asset advisory services into the VFO framework offers a significant competitive advantage in capturing forward-looking capital. The impact forces are thus dominated by the pressure for innovation: providers must continuously upgrade their technology stacks to maintain a competitive edge, focusing on user experience, comprehensive data visualization, and seamless integration with disparate financial systems globally. The capability to seamlessly integrate tax, legal, and investment platforms without data fragmentation is a non-negotiable requirement defining market success.

The accelerating complexity of global tax laws, driven by international initiatives such as the Common Reporting Standard (CRS) and FATCA, serves as both a driver and an opportunity. While compliance complexity is a restraint for small players, it drives HNWIs toward VFO platforms equipped with automated, jurisdiction-aware compliance tools, transforming regulatory burdens into a service differentiator. The overarching impact force is the necessity of demonstrated security and regulatory rigor; market participants who can establish an unimpeachable record of data governance and security will capture market share rapidly, ensuring that technology implementation is inextricably linked to fiduciary responsibility. This convergence of efficiency, complexity management, and security defines the current competitive dynamics.

Segmentation Analysis

The Virtual Family Office market segmentation provides a comprehensive view of the market structure, categorizing services based on organizational model, service type, and asset complexity. This granularity allows providers to tailor their offerings to specific client profiles and operational needs. Segmentation by organizational model—Outsourced, Hybrid, and Proprietary—reflects the differing levels of technology investment and control desired by firms. Service type segmentation highlights the specialized functions sought by HNWIs, encompassing everything from basic wealth administration to highly complex, integrated advisory services combining legal, tax, and fiduciary planning. Crucially, the segmentation by technology component (software versus platform) helps differentiate providers focusing solely on back-end automation from those offering end-to-end client engagement portals. Understanding these segments is vital for strategic product development and targeted market penetration.

Growth trends show the highest momentum in the Hybrid and Outsourced models, as firms seek to rapidly leverage existing, proven technologies rather than incurring the expense and risk of developing proprietary solutions. Within service types, Integrated Advisory Services dominate due to the demand for a single point of contact for multifaceted wealth issues. The categorization also reflects client wealth tiers, with UHNWIs often requiring bespoke, proprietary VFO structures, whereas emerging HNWIs are more likely to utilize modular, standardized outsourced platforms. This detailed segmentation aids in optimizing resource allocation and identifying high-growth niches, particularly those associated with digital asset management and personalized philanthropy structures, which require unique technological support distinct from traditional asset management services.

- By Organizational Model:

- Outsourced VFO Model

- Hybrid VFO Model

- Proprietary/Internal VFO Model

- By Service Type:

- Wealth Administration and Reporting

- Integrated Advisory Services (Tax, Legal, Investment)

- Estate Planning and Succession Services

- Fiduciary and Trustee Services

- Philanthropy Management

- Lifestyle and Concierge Services (integrated digitally)

- By Asset Class Focus:

- Traditional Assets (Equities, Fixed Income, Real Estate)

- Alternative Assets (Hedge Funds, Private Equity, Venture Capital)

- Digital Assets and Cryptocurrencies

- By Technology Component:

- Software (Back-end CRM, Portfolio Management Systems)

- Client Engagement Platforms (Front-end Portals)

Value Chain Analysis For Virtual Family Office Market

The Value Chain of the Virtual Family Office market begins with the Upstream analysis, primarily centered on technology providers and specialized data aggregators. This initial stage involves the development and maintenance of core VFO software platforms, secure cloud hosting infrastructure (SaaS/PaaS providers), sophisticated cybersecurity tools, and the data feeds necessary for real-time portfolio valuation and market intelligence. Key upstream activities include software development life cycle management, rigorous testing for regulatory compliance compatibility (e.g., AML/KYC modules), and securing strategic partnerships with proprietary data vendors. The quality and security of these upstream technology inputs directly determine the service capabilities and operational resilience of the downstream VFO operators. Innovation in this segment focuses heavily on AI integration for automation and predictive analysis, making the technology vendors crucial enablers of market growth.

The midstream and downstream segments involve the deployment, integration, and delivery of VFO services to the end-client. The core VFO provider acts as the integrator, taking the upstream technology and customizing it to meet the complex needs of specific wealthy families. Downstream activities involve high-touch advisory services—delivered virtually—covering investment policy, cross-border tax strategy, and generational wealth transfer. Distribution channels are predominantly direct, involving bespoke client onboarding processes managed by dedicated Relationship Managers who utilize the VFO platform as their primary tool. However, indirect channels are emerging through strategic partnerships with independent financial advisors (IFAs) and smaller wealth management firms who utilize outsourced VFO platforms under a white-label arrangement, expanding market reach significantly without requiring the end-client to build their own digital infrastructure.

The efficiency of the value chain is highly dependent on seamless data flow and integration between various professional service nodes (external lawyers, tax specialists, investment banks) and the central VFO platform. Direct distribution allows for maximum control over the client experience and data security, which is paramount in this sector. Indirect distribution, while broadening the client base, requires robust API integration capabilities to ensure data integrity and compliance across third-party networks. Optimization efforts throughout the chain focus on eliminating data silos, ensuring regulatory consistency across different jurisdictions, and leveraging cloud scalability to manage the large data volumes associated with multi-asset, multi-jurisdictional wealth structures, guaranteeing that the delivery of complex advisory services remains highly efficient and technologically advanced.

Virtual Family Office Market Potential Customers

The primary potential customers and end-users of the Virtual Family Office market are High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) who require sophisticated, integrated wealth management services but seek a flexible, cost-effective, and geographically decentralized delivery model. This demographic includes globally mobile entrepreneurs, technology executives with complex compensation structures (e.g., restricted stock units and private equity stakes), and inheritors of significant wealth navigating multi-jurisdictional tax and trust landscapes. These clients are generally technologically proficient, prioritize real-time data access and transparency, and are accustomed to utilizing digital platforms for managing their personal and business affairs, making the VFO model an ideal fit for their operational philosophy.

A rapidly expanding segment of potential customers includes wealthy families transitioning wealth to the second and third generations (NextGen clients). These younger inheritors often seek greater involvement in investment decisions, demand social impact investing (ESG) capabilities, and expect highly customized, digitally interactive platforms that align with their value systems. For these families, the VFO serves as a central hub for financial education, fostering communication, and ensuring family governance protocols are transparently applied across all assets. Additionally, multi-family offices (MFOs) seeking to enhance their operational efficiency and service offerings constitute a crucial B2B customer segment, adopting VFO platforms as proprietary technology to serve their existing client base more effectively and scalably, thus optimizing their internal cost structure and increasing their competitive differentiation.

Furthermore, newly affluent clients, particularly those residing in emerging markets experiencing rapid wealth creation, represent a significant untapped customer base. These individuals often lack access to comprehensive local professional infrastructure but require international advisory standards for global diversification and capital protection. The Virtual Family Office model bypasses geographic constraints, offering institutional-grade services remotely, thereby addressing the needs of clients in regions where traditional family office infrastructure is nascent or prohibitively expensive. This global reach and modular service structure attract institutional buyers such as trust companies and specialized asset managers looking to offer expanded, digitally integrated services to their existing client portfolios without undertaking massive internal infrastructure investments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 42.5 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Addepar, Black Diamond (SS&C Advent), Private Client Resources (PCR), Dynamo Software, Fidelity Family Office Services, BNY Mellon Private Banking, Northern Trust, SEI Investments, Wealth Dynamix, Envestnet Tamarac, Masttro, TIGER 21, HighTower Advisors, Mercer Advisors, Ascent Private Capital Management, Wealth Manager Platform (WMP), Trust & Will, InvestCloud, Canopy, and Mirador. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Virtual Family Office Market Key Technology Landscape

The technology landscape underpinning the Virtual Family Office market is highly dependent on scalable, secure, and interoperable software solutions. Central to this ecosystem are robust Portfolio Management Systems (PMS) and Client Relationship Management (CRM) tools, which form the backbone for data aggregation, reporting, and client communication. Modern VFOs heavily rely on cloud-based Software-as-a-Service (SaaS) architecture, which facilitates rapid deployment, minimizes latency, ensures high availability, and allows for seamless third-party API integration. Crucially, sophisticated data aggregation engines are necessary to pull financial data from disparate sources—custodians, banks, private equity registers, and alternative asset ledgers—into a single, unified view for comprehensive wealth reporting. This aggregation capability, coupled with real-time data cleansing and reconciliation, dictates the accuracy and utility of the VFO platform.

Beyond core administrative tools, the competitive edge in the VFO technology space is increasingly defined by advanced analytical capabilities and secure communication layers. This includes the utilization of Artificial Intelligence (AI) and Machine Learning (ML) for scenario planning, personalized investment advice, and predictive risk modeling. Furthermore, enterprise-grade cybersecurity measures, encompassing multi-factor authentication, biometric verification, and advanced encryption protocols (both in transit and at rest), are non-negotiable standards due to the sensitive nature of HNW financial data. Secure client portals, often incorporating sophisticated data visualization dashboards, are essential for maintaining engagement and providing clients with intuitive access to complex financial metrics and governance documents.

Emerging technologies like Distributed Ledger Technology (DLT) or blockchain are gaining relevance, particularly in the management of digital assets and enhancing the transparency and immutability of legal and trust documentation for succession planning. Compliance technology (RegTech) is also critical, leveraging automation to monitor regulatory changes globally and automatically adapt reporting frameworks to maintain adherence to jurisdictional requirements, significantly reducing the operational burden on advisors. The integration of these modular yet interconnected technologies—from cloud infrastructure to AI-driven insights—is essential for VFO platforms to deliver the personalized, scalable, and secure service experience demanded by the modern global wealth market.

Regional Highlights

- North America (United States and Canada): North America remains the most mature and dominant market for VFO services, primarily driven by a highly concentrated HNWI population, a deeply ingrained culture of technological innovation in financial services, and high levels of institutional sophistication. The US market, in particular, benefits from robust venture capital funding fueling FinTech solutions specifically tailored for wealth aggregation and complex tax management. Adoption rates are high among technology-driven UHNWIs and multi-family offices looking to optimize operational expenditure. The region leads in the deployment of AI for wealth planning and advanced cybersecurity solutions. Regulatory stability, although complex, provides a solid foundation for VFO scalability, focusing heavily on compliance with SEC and IRS reporting standards.

- Europe (UK, Germany, Switzerland, Luxembourg): The European VFO market is characterized by strong underlying demand for cross-border tax planning and jurisdictional diversification due to the complex regulatory tapestry of the EU and associated financial hubs like Switzerland. Countries like the UK and Switzerland serve as key innovation centers, focusing on wealth structuring and private banking digital solutions. Growth is propelled by regulatory harmonization efforts (MiFID II, GDPR) which necessitate standardized, digital data management platforms. The market favors hybrid VFO models that combine established trust advisory relationships with highly secure, geographically agnostic digital portals. Emphasis is placed on data sovereignty and stringent compliance with EU privacy laws, driving investment in proprietary data hosting solutions.

- Asia Pacific (APAC) (China, Japan, India, Singapore): APAC is anticipated to be the fastest-growing region, fueled by rapid wealth creation, especially among first-generation entrepreneurs in China and India. The demand is strong for generational wealth transfer solutions and access to global investment opportunities, which VFOs facilitate efficiently. Singapore and Hong Kong act as crucial financial gateways, driving VFO adoption due to their sophisticated legal frameworks and international connectivity. The challenges in this region include diverse regulatory landscapes and varying technological infrastructure maturity; however, the digitally native behavior of the NextGen wealth holders ensures sustained high growth. VFOs here prioritize multilingual support and integration with local digital payment ecosystems.

- Latin America (LATAM) (Brazil, Mexico): The LATAM market is growing steadily, primarily driven by the need for capital preservation, regulatory compliance management, and efficient access to offshore investment vehicles (US and European markets). Clients often prioritize security and stability, making robust VFO platforms attractive mechanisms for structuring assets internationally and managing currency risks. The key growth driver is the professionalization of wealth management services, moving away from fragmented advisory models towards integrated, digital solutions. However, market penetration is often hindered by economic volatility and slower technological adoption rates outside major financial centers, necessitating localized service models.

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa): The MEA market for VFOs is concentrated around key financial hubs like Dubai and Riyadh, focusing on cross-border wealth structuring, succession planning compliant with local laws (including Sharia principles), and investment diversification away from regional economic dependencies. The high percentage of UHNW families in the Gulf Cooperation Council (GCC) countries provides a strong base for sophisticated VFO services. Digital adoption is accelerating, championed by government visions for smart economies. The primary focus is on secure, private digital communication channels and platforms capable of managing complex, often illiquid, regional investments alongside global portfolios.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Virtual Family Office Market.- Addepar

- Black Diamond (SS&C Advent)

- Private Client Resources (PCR)

- Dynamo Software

- Fidelity Family Office Services

- BNY Mellon Private Banking

- Northern Trust

- SEI Investments

- Wealth Dynamix

- Envestnet Tamarac

- Masttro

- TIGER 21

- HighTower Advisors

- Mercer Advisors

- Ascent Private Capital Management

- Wealth Manager Platform (WMP)

- Trust & Will

- InvestCloud

- Canopy

- Mirador

Frequently Asked Questions

Analyze common user questions about the Virtual Family Office market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a Virtual Family Office (VFO) and a traditional Family Office?

The core difference lies in the operating model and infrastructure cost. A traditional family office requires dedicated physical staff and proprietary infrastructure, incurring high fixed costs. A VFO leverages cloud technology and outsourced professional networks to deliver services remotely, resulting in lower operational overhead, greater scalability, and seamless global service delivery, making high-level advice accessible to a wider HNWI segment.

How do Virtual Family Offices ensure the security and privacy of sensitive financial data?

VFOs prioritize enterprise-grade cybersecurity measures, utilizing end-to-end encryption, multi-factor authentication, and secure, often private, cloud hosting environments compliant with international standards like GDPR and SOC 2. Data aggregation platforms are typically non-custodial, meaning they read data but do not hold assets, minimizing direct risk exposure while employing continuous AI monitoring for real-time threat detection.

Is the Virtual Family Office model suitable for managing complex, illiquid alternative assets?

Yes, VFOs are increasingly specializing in managing complex and illiquid alternative assets such as private equity, venture capital, and real estate. Modern VFO platforms integrate specialized software that can aggregate and track these non-traditional assets, providing detailed valuation methodologies and comprehensive reporting, thereby solving a major pain point often neglected by standard wealth management platforms.

What role does Artificial Intelligence play in enhancing the services provided by a VFO?

AI significantly enhances VFO services by automating tedious tasks such as regulatory compliance checks and data reconciliation, improving operational efficiency. It is also used for advanced predictive analytics, allowing advisors to perform sophisticated stress-testing on portfolios, personalize investment recommendations based on behavioral patterns, and optimize tax strategies across multiple jurisdictions rapidly.

Which geographical region is expected to demonstrate the highest growth in VFO adoption by 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in VFO adoption through 2033. This growth is primarily driven by rapid wealth accumulation among new entrepreneurs, increasing demand for robust generational succession planning, and the need for efficient, digitally-enabled access to international investment opportunities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager