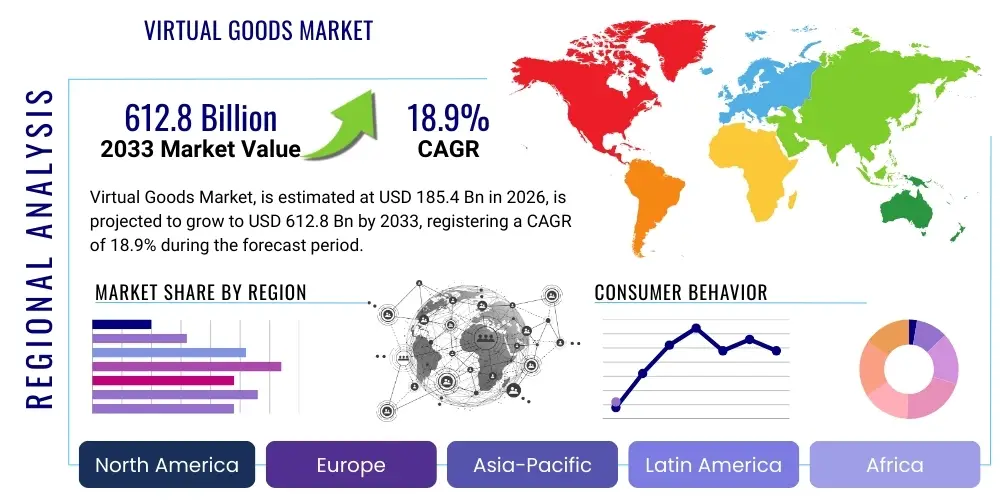

Virtual Goods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436917 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Virtual Goods Market Size

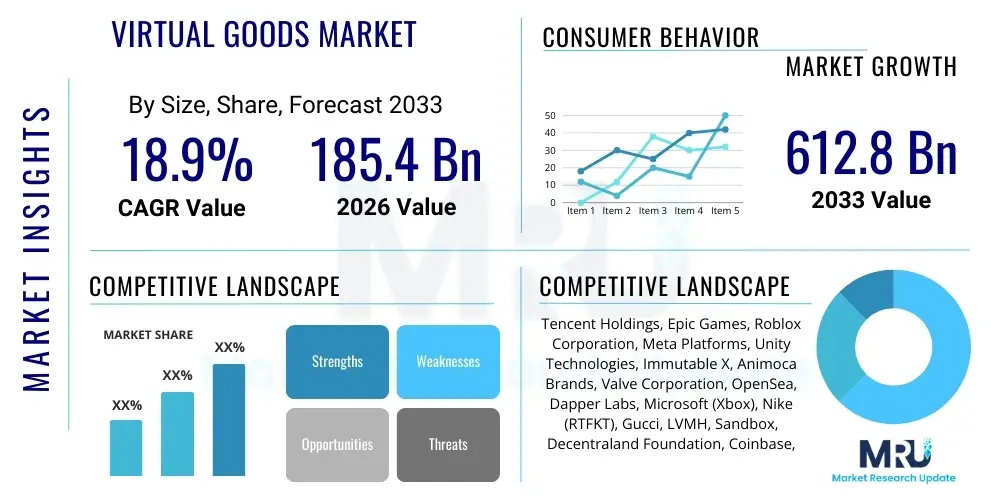

The Virtual Goods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.9% between 2026 and 2033. The market is estimated at USD 185.4 Billion in 2026 and is projected to reach USD 612.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated integration of metaverse platforms across various industries, coupled with the increasing consumer willingness, particularly among younger demographics, to invest in digital identity and status symbols. The shift towards persistent, interoperable digital environments validates the long-term intrinsic value of virtual assets, moving them beyond ephemeral in-game purchases to essential components of online social and economic participation. Furthermore, the robust growth in blockchain technology, facilitating verifiable ownership and secondary market liquidity through Non-Fungible Tokens (NFTs), is transforming the economic infrastructure of virtual goods, offering new monetization streams for creators and platforms.

The market valuation reflects the convergence of several high-growth sectors, including interactive entertainment (gaming), social media, and digital commerce. As major technology companies continue to invest heavily in building out expansive digital worlds, the demand for accompanying virtual apparel, accessories, land, and functional items escalates. This forecast considers the mitigating effects of potential regulatory headwinds related to digital currencies and assets, balancing them against the transformative opportunity presented by augmented reality (AR) and virtual reality (VR) hardware adoption, which significantly enhances the utility and perceived value of these non-physical products. The primary contributors to this growth trajectory are regions with high penetration of mobile gaming and sophisticated digital payment infrastructure, notably the Asia-Pacific (APAC) market, alongside innovative decentralized finance (DeFi) experiments in North America and Europe.

Virtual Goods Market introduction

The Virtual Goods Market encompasses the creation, exchange, and consumption of non-physical, intangible assets primarily utilized within digital environments, including video games, social networking platforms, and emerging metaverse applications. These goods range from cosmetic enhancements like character skins and digital apparel to functional assets such as virtual land, power-ups, and in-game currency. The product description centers on their digital scarcity and utility, whether providing aesthetic value (status, identity) or functional benefits (performance enhancement, access rights). Major applications span interactive entertainment, where monetization is heavily reliant on virtual goods, extending into digital fashion, art, and decentralized finance ecosystems where NFTs represent underlying assets. The inherent benefits include enabling digital self-expression, fostering strong community engagement, and providing platform developers with sustainable, high-margin revenue streams that bypass traditional physical inventory costs.

The market is predominantly driven by the fundamental shift in consumer behavior, recognizing digital ownership as equivalent to, or sometimes surpassing, physical ownership in terms of social validation and utility. Key driving factors include the massive global expansion of the gaming industry, the proliferation of high-speed internet and sophisticated mobile devices, and the increasing cultural significance of online identity, particularly among Gen Z and Millennials. Furthermore, technological innovations, particularly the maturation of blockchain and smart contracts, have provided the necessary infrastructure to authenticate digital ownership, thereby enhancing the asset value and facilitating secure secondary market transactions. This infrastructure has unlocked new economic models, such as play-to-earn (P2E) gaming, which directly links the value of virtual assets to real-world economic incentives, further catalyzing market growth and investor interest.

Virtual Goods Market Executive Summary

The Virtual Goods Market is experiencing a pivotal structural transformation, moving rapidly from proprietary, centralized in-game economies toward decentralized, interoperable metaverse ecosystems underpinned by blockchain technology. Current business trends indicate a strong focus on intellectual property (IP) leverage, with major brands across luxury, sports, and entertainment sectors collaborating with digital platforms to launch exclusive virtual collections, driving mainstream adoption. Regionally, Asia Pacific maintains dominance, fueled by robust mobile gaming engagement and high spending on customization items, while North America and Europe are leading innovation in high-value, collectible virtual real estate and digital fashion, prioritizing cross-platform utility. Segment trends show significant acceleration in the avatar and identity customization segment, as users seek unique, portable digital personas, alongside sustained growth in virtual currency and high-tier collectible assets, highlighting a market maturation towards scarcity-based economic models.

The executive outlook suggests that market expansion will be highly dependent on solving current interoperability challenges and establishing clear regulatory frameworks, particularly concerning KYC (Know Your Customer) and anti-money laundering (AML) compliance for NFT transactions. Strategic investment is concentrated in infrastructure platforms that facilitate asset creation, secure marketplace operations, and enhance user experience across multiple digital worlds. Key competitive dynamics involve traditional gaming giants adapting their walled-garden models to integrate decentralized elements, while pure-play Web3 companies focus on establishing early dominance in niche metaverse environments. Success in this evolving landscape is tied to fostering creator economies, offering robust governance mechanisms, and consistently delivering digital assets that resonate strongly with the aspirational and functional needs of an increasingly digitally-native consumer base.

AI Impact Analysis on Virtual Goods Market

User queries regarding AI's impact on the Virtual Goods Market primarily center on three themes: the efficiency of generative AI in asset creation, the personalization capabilities offered by AI algorithms, and the role of AI in detecting fraud or ensuring scarcity/authenticity. Users frequently ask if AI will saturate the market with low-effort goods, devaluing existing assets, or conversely, if AI tools will democratize high-quality asset creation, empowering independent artists. A significant concern is whether AI-generated virtual goods can truly possess the uniqueness and perceived value associated with human creativity. Based on this analysis, the key themes summarize an expectation of radical efficiency gains in content pipelines—reducing the time and cost to produce complex virtual items—but also underline concerns about maintaining aesthetic quality and preventing market dilution. Expectations also highlight the use of AI for dynamic pricing models, ensuring assets are appropriately valued in volatile digital economies, and improving user retention through highly personalized in-game recommendations and custom avatar generation, thereby accelerating the market's overall scale and sophistication.

- AI-driven Generative Design: Mass production of unique textures, skins, and 3D models, significantly lowering the barrier to entry for content creators and enabling rapid asset pipeline scaling for major platforms.

- Personalized Asset Recommendation: Using machine learning to analyze user behavior, spending patterns, and social trends to recommend or dynamically generate virtual goods highly tailored to individual digital identities, maximizing conversion rates.

- Dynamic Pricing and Market Balancing: Employment of AI algorithms to adjust the scarcity and real-time market value of virtual goods based on supply, demand, and player engagement metrics, stabilizing decentralized economies.

- Fraud Detection and Authenticity Verification: Utilizing AI to monitor blockchain transactions and platform activity, detecting illicit duplication, scam attempts, and intellectual property infringement related to high-value virtual assets and NFTs.

- AI-Enhanced Interoperability: Developing machine learning models that automatically adapt virtual goods (e.g., clothing, accessories) to fit different avatar specifications and digital platform standards, improving cross-metaverse portability.

DRO & Impact Forces Of Virtual Goods Market

The dynamics of the Virtual Goods Market are shaped by a potent combination of enabling drivers, structural restraints, and transformative opportunities that collectively dictate the trajectory and pace of expansion. The primary drivers include the exponential adoption of metaverse platforms, the proven efficiency of blockchain technology in establishing verifiable digital ownership, and the massive cultural shift toward digital identity expression among Gen Z consumers who view virtual assets as essential social capital. However, the market faces significant restraints, notably the regulatory ambiguity surrounding decentralized finance (DeFi) and NFTs across major jurisdictions, the ongoing technical challenges related to achieving true cross-platform interoperability without compromising asset integrity, and the pervasive intellectual property (IP) disputes that arise from unauthorized replication and use of digital designs. These forces create a volatile yet highly lucrative environment.

Opportunities for growth are concentrated in the commercialization of high-fidelity virtual fashion and apparel, driven by major luxury brands entering the space, and the development of sophisticated decentralized autonomous organizations (DAOs) for the governance of virtual land and community-owned assets. Furthermore, the convergence of virtual goods with physical counterparts through phygital strategies offers innovative revenue streams. The impact forces indicate that technological advancement (specifically improved rendering and AR/VR integration) will be the most immediate catalyst for market expansion, pushing virtual goods into everyday consumer use cases beyond traditional gaming. Simultaneously, efforts to standardize technical protocols (e.g., ERC standards) and achieve regulatory clarity will be crucial determinants of long-term stability and institutional investment attraction, profoundly impacting asset liquidity and consumer trust over the forecast period.

Segmentation Analysis

The Virtual Goods Market is comprehensively segmented based on Type, Platform, and End-User, reflecting the diverse applications and monetization strategies employed across the digital economy. The segmentation by Type allows for a clear distinction between fungible assets (like virtual currencies used for internal platform transactions) and non-fungible, unique assets (NFTs, skins, virtual land). Platform segmentation highlights the differential growth rates and asset complexity between highly controlled Gaming environments (PC/Console) versus more decentralized Metaverse and Social Media ecosystems. Analyzing the End-User segmentation provides crucial insights into purchasing behavior, differentiating between high-spending Enthusiasts who invest in scarcity and identity, and broader Casual Users focused primarily on cosmetic upgrades and basic utility. This detailed breakdown is essential for stakeholders to target specific consumer segments and allocate development resources effectively across high-growth product categories, ensuring market strategies are aligned with evolving digital consumption habits.

- By Type:

- Virtual Currency (In-Game Coins, Platform Tokens)

- Collectible Assets (NFTs, Digital Art)

- Functional Assets (Power-ups, Virtual Land, Access Keys)

- Cosmetic Items (Skins, Avatars, Accessories, Digital Fashion)

- By Platform:

- Gaming Platforms (PC, Console, Mobile)

- Metaverse Environments (Decentralized Worlds, Proprietary Metaverses)

- Social Media Platforms (Stickers, Gifting, Avatars)

- eCommerce Platforms (Specialized NFT Marketplaces)

- By End-User:

- Gamers and Enthusiasts

- Social Media Users and Creators

- Digital Collectors and Investors

- Corporate and Institutional Buyers (Virtual Land)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Virtual Goods Market

The Value Chain for the Virtual Goods Market begins with the Upstream Analysis, which focuses on the creative and technological foundational elements. This stage involves concept design, 3D modeling, coding smart contracts (for blockchain-based goods), and utilizing advanced software development kits (SDKs) and rendering engines (like Unity or Unreal Engine). The primary actors here are independent digital artists, design studios, game developers, and blockchain architects, whose quality of output directly dictates the intrinsic desirability and technical utility of the virtual asset. The cost structure at this stage is heavily influenced by human capital and specialized software licensing, and technological proficiency in creating optimized, low-latency digital assets suitable for diverse platforms is paramount for success.

Moving through the chain, the core activities transition to Platform Integration and Distribution. Platforms (e.g., Roblox, Epic Games, Decentraland) act as central hosting environments, validating the assets, managing the digital economy, and providing user interfaces for interaction. The distribution channel is bifurcated into Direct and Indirect sales. Direct distribution involves platforms selling their internally generated goods directly to users (e.g., battle passes, in-game stores). Indirect distribution relies heavily on secondary marketplaces (both centralized like OpenSea or proprietary exchanges) where users trade assets peer-to-peer. This stage requires robust security protocols, efficient transaction processing, and community trust to ensure liquidity and protect intellectual property rights, driving the platform’s revenue through transaction fees.

The Downstream Analysis culminates in the consumer interaction and asset utilization stage. Consumers acquire the virtual goods to enhance their digital experience—either for status, utility, or speculative investment. Key downstream activities include consumption, trading, and asset portability across different digital environments, which requires seamless integration of wallets and identity systems. The success of the virtual good is measured by its adoption rate, secondary market activity, and its ability to maintain perceived value over time. Effective monetization depends on balancing scarcity and accessibility, ensuring the economic model encourages both initial purchases and sustainable secondary trading, thereby completing the value cycle and informing future upstream content creation based on performance data.

Virtual Goods Market Potential Customers

The primary end-users and buyers of virtual goods exhibit a diverse profile, extending far beyond the traditional gaming demographics into sophisticated collectors, corporate entities, and mainstream social media users. The most prolific consumers are generally categorized as Digital Natives, specifically Gen Z and younger Millennials (aged 16-35), who prioritize digital self-expression and social standing within their online communities. These users are heavy investors in cosmetic items, unique avatar components, and social gifting mechanisms, viewing virtual expenditure as a natural extension of discretionary income. This cohort often leads early adoption of decentralized platforms and novel asset classes, driving demand for high-scarcity NFTs and virtual identity portability solutions across the metaverse.

A second crucial customer segment is the Digital Collector and Investor base, characterized by higher disposable income and a focus on long-term asset appreciation. These buyers target high-value virtual land, limited-edition digital art, and utility NFTs offering exclusive access or voting rights within decentralized autonomous organizations (DAOs). For this group, the authenticity and verified scarcity afforded by blockchain technology are critical purchasing determinants. Lastly, corporate entities—including fashion houses, media companies, and educational institutions—represent a rapidly emerging segment, purchasing virtual real estate for branding, hosting virtual events, and establishing persistent digital headquarters within established metaverses, indicating a maturation of the market into B2B applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.4 Billion |

| Market Forecast in 2033 | USD 612.8 Billion |

| Growth Rate | 18.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tencent Holdings, Epic Games, Roblox Corporation, Meta Platforms, Unity Technologies, Immutable X, Animoca Brands, Valve Corporation, OpenSea, Dapper Labs, Microsoft (Xbox), Nike (RTFKT), Gucci, LVMH, Sandbox, Decentraland Foundation, Coinbase, NetEase, Sea Ltd. (Garena), Zynga. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Virtual Goods Market Key Technology Landscape

The Virtual Goods Market is fundamentally enabled by a confluence of cutting-edge technologies that facilitate creation, secure ownership, and enhance user experience. At the core is Blockchain Technology, which, through Non-Fungible Tokens (NFTs) and smart contracts, provides the necessary infrastructure for proving unique digital ownership, tracking asset provenance, and facilitating secure secondary markets without reliance on centralized intermediaries. This technological shift is pivotal, moving virtual goods from simple platform licenses to verifiable, tradable assets with real economic value, addressing long-standing issues of scarcity and authenticity in the digital realm. Specific blockchain implementations, such as Ethereum, Solana, and dedicated Layer 2 solutions like Immutable X, are crucial for managing high transaction volumes and minimizing gas fees associated with virtual goods trading.

In addition to foundational infrastructure, advanced rendering and interaction technologies drive the perceived value and usability of virtual goods. High-fidelity 3D Rendering Engines, notably Unity and Unreal Engine, are indispensable for creating the visually compelling, highly detailed virtual environments and assets demanded by modern consumers, ensuring cross-platform compatibility and graphical immersion. These engines are continuously updated to support advanced features like ray tracing and photorealism, making virtual apparel and architecture indistinguishable from their physical counterparts. Furthermore, Augmented Reality (AR) and Virtual Reality (VR) technologies are crucial for broadening the application of virtual goods, allowing assets purchased in the metaverse to be viewed or utilized in the real world via AR filters (digital try-ons) or fully immersive VR environments, thereby increasing their utility and investment appeal.

Finally, data analytics and Artificial Intelligence (AI) complete the technology landscape by optimizing market function and personalization. AI algorithms are increasingly deployed for generating unique virtual assets efficiently (Generative AI), personalizing content recommendations to boost conversion rates, and establishing dynamic pricing mechanisms that respond instantly to market demand fluctuations. Concurrently, sophisticated data analytics tools track user engagement, asset liquidity, and economic stability within platform ecosystems, allowing developers to manage the delicate balance between scarcity and revenue maximization. The synergy between secure ledger technology, immersive visualization capabilities, and intelligent market optimization tools is what defines the competitive edge in the modern virtual goods production and distribution landscape.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum: APAC stands as the undisputed leader in the Virtual Goods Market, primarily due to its massive population of mobile gamers and the deeply ingrained culture of microtransactions across countries like China, South Korea, and Japan. The region’s early adoption of free-to-play (F2P) monetization models, heavily reliant on selling cosmetic items and functional virtual currency, established a high-spending consumer base. Future growth is fueled by the rapid expansion of domestic technology giants (Tencent, NetEase) aggressively pushing into Web3 and metaverse initiatives, alongside government support for digital economy infrastructure.

- North America (NA) Innovation and Investment Leadership: North America is a critical hub for innovation, particularly in the high-value NFT, virtual real estate, and digital fashion segments. The region possesses the highest concentration of venture capital funding dedicated to blockchain infrastructure and metaverse startups, driving sophisticated technical advancements in interoperability and decentralized governance (DAOs). Consumer spending is generally focused on unique, status-driven assets and early access to nascent platforms, demonstrating a willingness to pay premium prices for scarcity and investment potential, cementing its role as the trendsetter for high-end virtual assets.

- Europe's Focus on Regulatory Frameworks and Premium Brands: Europe shows steady growth, characterized by strong participation from luxury and high-street fashion brands integrating virtual goods as a marketing and revenue channel, often through high-profile collaborations with metaverse platforms. A key differentiator in Europe is the proactive development of regulatory frameworks (e.g., MiCA) concerning digital assets and virtual currencies. This pursuit of legal clarity, while sometimes perceived as a temporary constraint, is expected to provide long-term stability and attract institutional investment into the virtual goods ecosystem, fostering consumer trust.

- Latin America (LATAM) Adoption of Play-to-Earn (P2E) Models: The LATAM region, particularly countries like Brazil and Mexico, exhibits strong adoption rates for Virtual Goods linked to Play-to-Earn gaming models. High inflation and economic volatility in certain areas have made P2E games, where earned virtual assets can be exchanged for real currency, an attractive economic opportunity for many users. This utility-driven consumption contrasts slightly with the cosmetic-focused spending in other regions, positioning LATAM as a critical market for virtual goods that bridge digital interaction with tangible financial benefits.

- Middle East and Africa (MEA) Emerging Digital Hubs: Growth in MEA is accelerating, particularly driven by rapid digitization efforts and significant sovereign wealth fund investment in technology infrastructure, notably in the UAE and Saudi Arabia. These emerging digital hubs are actively promoting the establishment of dedicated metaverse and gaming zones, aiming to capture global talent and investment. Virtual goods adoption is centered around high-end lifestyle assets, exclusive experiences, and the early establishment of proprietary digital platforms tailored to regional consumer preferences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Virtual Goods Market.- Tencent Holdings Ltd.

- Epic Games, Inc.

- Roblox Corporation

- Meta Platforms, Inc. (formerly Facebook)

- Unity Technologies Inc.

- Microsoft Corporation (Xbox)

- Valve Corporation (Steam)

- Animoca Brands Corporation Ltd.

- Dapper Labs, Inc.

- OpenSea (Ozone Networks, Inc.)

- Immutable X

- The Sandbox

- Decentraland Foundation

- NetEase, Inc.

- Sea Ltd. (Garena)

- Coinbase Global, Inc.

- Nike Inc. (RTFKT acquisition)

- Gucci (Kering Group)

- Take-Two Interactive Software, Inc.

- Zynga Inc. (a subsidiary of Take-Two)

Frequently Asked Questions

Analyze common user questions about the Virtual Goods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers propelling the growth of the Virtual Goods Market?

The market is primarily driven by the mass adoption of metaverse platforms, the proven efficiency of blockchain technology in securing asset ownership (NFTs), the rise of the digital creator economy, and shifting consumer demographics, particularly Gen Z, prioritizing online identity and digital assets as status symbols.

How does blockchain technology impact the perceived value and trading of virtual goods?

Blockchain technology, utilizing NFTs, provides verifiable digital scarcity and proof of ownership, transforming virtual goods from simple platform licenses into high-value, tradable assets. This enhances secondary market liquidity, increases asset provenance, and builds consumer trust necessary for investment.

What is the most significant restraint currently affecting the Virtual Goods Market expansion?

The most significant restraint is regulatory uncertainty and the lack of standardized international frameworks governing decentralized finance, NFT taxation, and consumer protection laws across major economic jurisdictions. This ambiguity complicates institutional investment and platform operational compliance.

Which geographical region holds the largest market share for virtual goods and why?

The Asia Pacific (APAC) region holds the largest market share, predominantly driven by high penetration of mobile gaming, robust microtransaction culture, and the large, established consumer base in countries like China and South Korea, where spending on cosmetic and functional in-game items is deeply embedded.

How is Artificial Intelligence (AI) changing the creation and distribution of digital assets?

AI is transforming the market by enabling generative design, which drastically reduces the time and cost required to create unique virtual assets (skins, environments). It also powers dynamic pricing models and enhances personalization, ensuring that distributed goods are highly relevant to specific user tastes and engagement patterns.

This concludes the Virtual Goods Market analysis report, adhering to the requested format and content specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager