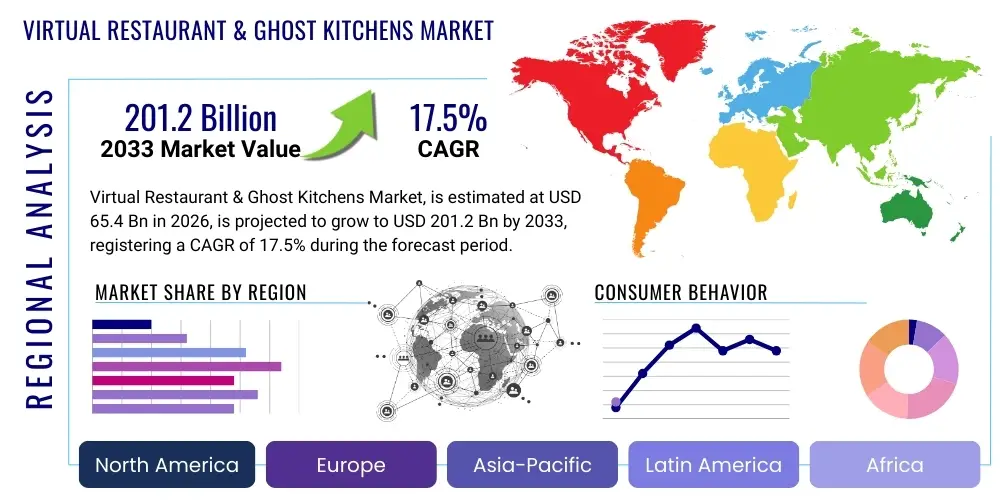

Virtual Restaurant & Ghost Kitchens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435232 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Virtual Restaurant & Ghost Kitchens Market Size

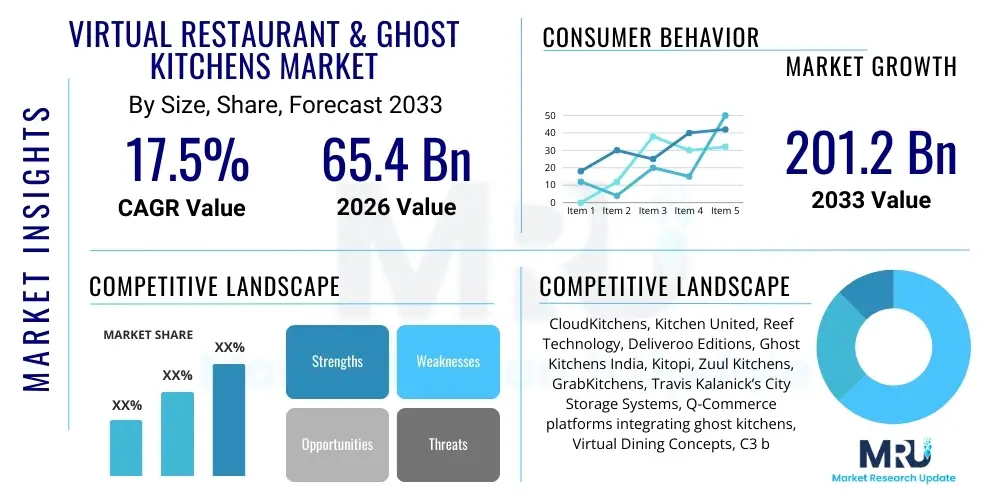

The Virtual Restaurant & Ghost Kitchens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 201.2 Billion by the end of the forecast period in 2033.

Virtual Restaurant & Ghost Kitchens Market introduction

The Virtual Restaurant and Ghost Kitchens Market encompasses a revolutionary business model in the food service industry, characterized by delivery-only operations lacking a traditional physical storefront or dine-in capacity. These operations leverage existing or dedicated commissary kitchen spaces (ghost kitchens) to prepare meals for various digitally branded concepts (virtual restaurants). This model significantly reduces capital expenditure related to front-of-house operations, staffing, and prime real estate, allowing operators to focus entirely on food production efficiency, menu optimization, and leveraging third-party logistics platforms for last-mile delivery.

Major applications of this market structure include providing scalable expansion for established restaurant chains seeking geographic penetration without high upfront costs, enabling independent chefs to launch multiple niche brands simultaneously, and optimizing food preparation for high-demand delivery zones. Key products within this ecosystem are the physical ghost kitchen infrastructure (ranging from single kitchen pods to large, shared commissary spaces) and the technological stack that integrates order management systems, inventory tracking, and consumer-facing delivery applications. The primary benefit is improved profitability through operational efficiency and enhanced market reach, catering directly to the global shift towards convenience and mobile ordering.

Driving factors for sustained market expansion include the increasing penetration of food delivery aggregators (Uber Eats, DoorDash, etc.), urbanization leading to higher disposable incomes and less time for cooking, and crucial technological advancements in kitchen automation and predictive analytics. Furthermore, the necessity for lower operating costs, particularly in high-rent urban areas, makes the ghost kitchen model highly attractive to both startups and established food service corporations seeking operational resilience and flexibility in response to market demand fluctuations. The seamless digital interface between customer, virtual brand, and delivery agent forms the backbone of this rapidly evolving industry.

Virtual Restaurant & Ghost Kitchens Market Executive Summary

The Virtual Restaurant and Ghost Kitchens market is experiencing unprecedented growth, driven primarily by technological integration and changing consumer behavior favoring delivery convenience. Key business trends indicate a strong move toward "kitchen-as-a-service" models, where technology platforms provide not only the physical infrastructure but also integrated software solutions covering POS, inventory, and marketing analytics. Investment is heavily concentrated on optimizing kitchen workflow and automating prep stations to maximize throughput during peak hours. The landscape is witnessing intense competition among dedicated ghost kitchen operators (like CloudKitchens) and traditional real estate firms adapting their properties, leading to strategic partnerships between tech providers and foodservice operators globally, aiming for rapid market capture through hyperlocal fulfillment centers.

Regional trends highlight Asia Pacific (APAC) as the largest and fastest-growing market, largely due to high population density, existing robust delivery ecosystems (e.g., in China and Southeast Asia), and consumer familiarity with mobile ordering. North America and Europe demonstrate mature market adoption, driven by labor cost optimization and the strong presence of major delivery aggregators. While North America focuses on high-tech automation and multi-brand consolidation, European markets are navigating diverse regulatory landscapes concerning food preparation standards and urban planning restrictions. Emerging markets in Latin America and MEA are beginning to adopt the model, showing potential for accelerated growth as digital infrastructure improves and urbanization increases delivery demand.

Segment trends underscore the dominance of the shared kitchen model, offering lower entry barriers and flexible lease terms compared to fully dedicated facilities. Furthermore, the operational complexity segment is being addressed by sophisticated software platforms that manage multiple virtual brands from a single kitchen seamlessly. In terms of end-users, Quick Service Restaurants (QSRs) are leveraging ghost kitchens to optimize delivery radius and reduce in-store congestion, while the emerging segment of professional chefs and culinary startups utilizes this structure to test new concepts with minimal financial risk. The consistent demand for diverse and accessible food delivery continues to propel expansion across all segments, ensuring sustained investment in specialized equipment and digital infrastructure.

AI Impact Analysis on Virtual Restaurant & Ghost Kitchens Market

User inquiries regarding AI's influence in the Virtual Restaurant and Ghost Kitchens Market predominantly focus on optimizing efficiency, managing complex logistics, and personalizing consumer experiences. Common questions revolve around how AI can predict demand fluctuations to minimize food waste, how automation platforms leverage machine learning for real-time menu pricing and labor scheduling, and the role of natural language processing (NLP) in handling customer interactions and feedback. Users are keenly interested in predictive kitchen management systems that utilize historical order data, weather patterns, and local events to preemptively stock ingredients and staff kitchens appropriately, addressing the core ghost kitchen challenge of maximizing production without overspending on inventory or labor. The consensus expectation is that AI will transform ghost kitchens from operational centers into highly intelligent, data-driven fulfillment hubs, significantly enhancing profitability and consumer satisfaction through precision.

The implementation of Artificial Intelligence is fundamentally restructuring the operational spine of virtual restaurants. AI algorithms are crucial for demand forecasting, allowing kitchens to transition from static menus and fixed inventory models to dynamic, responsive systems. This predictive capability minimizes food spoilage—a major cost factor in traditional foodservice—by optimizing procurement cycles and calculating precise production quotas throughout the day. Furthermore, AI-powered routing and dispatch systems enhance the efficiency of third-party delivery services, predicting optimal preparation times to align food readiness exactly with driver arrival, thereby reducing waiting times and ensuring food quality upon delivery, which is vital for maintaining brand reputation in a virtual setting.

Beyond logistics, AI is deeply integrated into customer engagement and menu engineering. Machine learning models analyze vast amounts of customer ordering data, location demographics, and preference patterns to recommend personalized menu items and promotions, effectively replacing the traditional role of front-of-house staff in upselling and providing tailored service. For operators, AI tools provide instantaneous feedback loops on menu performance, suggesting optimal dish ingredients, price points, and even necessary substitutions based on ingredient availability and competitor pricing. This level of automated, data-driven decision-making provides a significant competitive edge, allowing virtual brands to iterate rapidly and maintain market relevance.

- AI-driven demand forecasting optimizes inventory levels and labor scheduling, reducing operational waste.

- Machine learning algorithms enable dynamic pricing strategies, adjusting menu costs in real-time based on demand, competition, and time of day.

- AI powers optimized kitchen layout and workflow planning for maximum efficiency in small ghost kitchen spaces.

- Natural Language Processing (NLP) is used for automated customer service, feedback analysis, and sentiment monitoring across multiple platforms.

- Predictive maintenance schedules for kitchen equipment are generated by AI, minimizing unexpected downtime.

- Advanced routing systems integrate AI to minimize delivery latency and improve last-mile logistics performance.

DRO & Impact Forces Of Virtual Restaurant & Ghost Kitchens Market

The growth trajectory of the Virtual Restaurant and Ghost Kitchens market is shaped by a confluence of powerful drivers, structural restraints, and significant opportunities, which collectively constitute the critical impact forces defining the industry's evolution. Primary drivers include the sustained consumer demand for high-quality, convenient food delivery, coupled with the inherent cost-efficiency of the ghost kitchen model, which significantly lowers overheads compared to traditional brick-and-mortar establishments. These drivers push market adoption by both established chains seeking to optimize delivery channels and new entrants aiming to capitalize on digital-first strategies. The exponential growth of third-party delivery platforms also acts as a powerful catalyst, providing necessary infrastructure and customer access, fundamentally changing how food service brands connect with consumers.

However, the market faces notable restraints. High dependency on third-party delivery aggregators leads to commission pressures and reduced control over the customer experience, potentially eroding profit margins for virtual brands. Secondly, the intense market saturation and low barriers to entry mean that maintaining brand differentiation and securing customer loyalty in a purely digital environment is exceptionally challenging. Furthermore, regulatory hurdles, particularly concerning zoning laws for commercial kitchens in residential or mixed-use areas, pose operational complexities, while the need for skilled kitchen staff adapted to high-volume, rapid-prep environments remains a persistent labor restraint.

Opportunities within this ecosystem are vast, particularly through vertical integration and technological specialization. The potential for ghost kitchen operators to launch their own in-house delivery networks or develop proprietary ordering apps presents a pathway to mitigate aggregator dependency. Additionally, the increasing sophistication of kitchen automation, robotics, and cloud-based operating systems offers opportunities for substantial efficiency gains and scalability. The ability to launch highly focused, niche culinary concepts rapidly in response to micro-trends represents a significant market opportunity, allowing for unprecedented agility and responsiveness to consumer data insights. These impact forces—efficiency gains, technological dependency mitigation, and rapid concept iteration—determine competitive advantage in this dynamic sector.

Segmentation Analysis

The Virtual Restaurant and Ghost Kitchens market is strategically segmented based on kitchen type, end-user application, and operational model, reflecting the diverse approaches employed by businesses seeking to capitalize on delivery-centric foodservice. Analyzing these segments is crucial for understanding market dynamics, investment priorities, and target audience needs. Segmentation by kitchen type typically delineates between shared kitchen spaces, dedicated facilities, and modular kitchen pods, each offering different levels of scalability, operational control, and upfront investment requirements. The shared kitchen model, often favored by startups and smaller brands, provides flexible lease terms and common infrastructure access, driving high market utilization in densely populated urban centers worldwide.

Further analysis focuses on the end-user application, differentiating between traditional Quick Service Restaurants (QSRs) leveraging ghost kitchens for delivery expansion, Full-Service Restaurants (FSRs) using them to manage overflow and cater to delivery demand separate from their dining room operations, and independent Virtual Brands (pure-play digital concepts). Virtual brands represent a rapidly expanding category, utilizing the inherent flexibility of the model to launch multiple, distinct culinary concepts from a single location. This segment relies heavily on robust digital marketing and data analytics to substitute for physical brand visibility, leading to high investment in SEO and targeted digital advertising strategies.

Finally, the operational model segmentation examines how technology and services are deployed, often distinguishing between fully managed services (where the kitchen provider handles maintenance, technology, and compliance) and unmanaged spaces (where the brand takes full responsibility for operations). This detailed segmentation allows stakeholders—from investors to operators—to precisely target infrastructure and service investments that align with their specific business goals, whether focused on maximizing throughput volume (QSRs) or rapid concept testing (Virtual Brands).

-

By Kitchen Type:

- Shared Kitchen/Commissary

- Dedicated Kitchen

- Kitchen Pods/Containers

-

By End-User:

- Quick Service Restaurants (QSR)

- Full-Service Restaurants (FSR)

- Independent Virtual Brands

- Catering and Institutional Food Service

-

By Operating Model:

- Platform/Aggregator Owned

- Restaurant/Brand Owned

- Third-Party Managed Services (Kitchen-as-a-Service)

-

By Cuisine Type (Operational Focus):

- International Cuisine

- Local/Regional Specialties

- Fast Food and Comfort Food

- Healthy and Specialty Diets (Vegan, Keto, Gluten-Free)

Value Chain Analysis For Virtual Restaurant & Ghost Kitchens Market

The value chain of the Virtual Restaurant and Ghost Kitchens market is fundamentally streamlined compared to traditional foodservice, heavily emphasizing efficiency and digital integration from sourcing to consumer delivery. The upstream analysis focuses intensely on supply chain optimization, including ingredient procurement and logistics. Virtual restaurants require robust, data-driven relationships with suppliers to ensure high-volume, reliable ingredient delivery directly to the ghost kitchen hubs. Upstream technological providers include providers of smart inventory management systems (which often use AI to predict usage) and automated procurement platforms that facilitate bulk ordering across multiple virtual brands operating within a single facility, maximizing purchasing power and minimizing spoilage risk.

Downstream analysis centers on the critical stages of order fulfillment, last-mile logistics, and customer relationship management. The downstream success is entirely reliant on the seamless integration between the virtual brand's POS system, the ghost kitchen's preparation workflow, and the delivery aggregator’s dispatching system. Direct distribution channels are typically limited to proprietary ordering apps developed by large ghost kitchen operators or multi-brand restaurant groups. However, the indirect distribution channel, dominated by major third-party delivery platforms (Uber Eats, DoorDash, Deliveroo), constitutes the overwhelming majority of transactions. The efficiency and cost of this indirect channel are key determinants of overall profitability, driving brands to constantly evaluate commission structures and optimize packaging for delivery.

The entire value chain is linked by advanced cloud technology and middleware that ensures order accuracy and speed. Key interactions include the flow of goods from automated storage to preparation stations, the handover process to the courier, and the subsequent digital tracking and customer feedback loop. Technology solutions that offer consolidated dashboards for managing multiple virtual brands simultaneously—including menu updates, inventory tracking, and sales analytics—are critical components, enabling operators to maintain high operational standards across diverse offerings without increasing managerial complexity. This hyper-efficient, tech-driven structure differentiates the ghost kitchen value chain from its traditional counterparts.

Virtual Restaurant & Ghost Kitchens Market Potential Customers

The primary potential customers and end-users of the Virtual Restaurant and Ghost Kitchens model are highly diverse, spanning both established enterprises seeking expansion and entrepreneurial culinary ventures aiming for low-risk market entry. Large, international Quick Service Restaurant (QSR) chains constitute a major customer segment; they leverage ghost kitchens to penetrate new urban areas rapidly, increase their delivery radius without investing in costly retail locations, and alleviate delivery pressure on existing dine-in stores. For these established entities, the value proposition lies in optimizing capital allocation, redirecting investment from prime real estate to kitchen efficiency and technology.

Another crucial customer segment is the independent restaurant operator or aspiring professional chef. For them, ghost kitchens offer an unparalleled opportunity to launch and test culinary concepts with minimal overhead. These entrepreneurs bypass the massive initial investment in dining room build-out, permits, and furnishings, focusing resources solely on product development and digital marketing. They utilize the flexibility of short-term leases and shared equipment available in commissary kitchens to experiment with multiple virtual brands simultaneously, providing immediate access to a broad digital customer base via aggregator platforms.

Furthermore, specialty food service providers, including high-end catering companies, meal kit preparation services, and institutional food suppliers (e.g., those serving schools or hospitals), are increasingly adopting the ghost kitchen model. This adoption is driven by the need for centralized, high-volume production facilities dedicated exclusively to off-premise consumption. By focusing on production logistics rather than customer-facing aesthetics, these businesses can achieve superior scale and efficiency, meeting the growing demands for specialized, mass-produced dietary items delivered reliably and quickly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 201.2 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CloudKitchens, Kitchen United, Reef Technology, Deliveroo Editions, Ghost Kitchens India, Kitopi, Zuul Kitchens, GrabKitchens, Travis Kalanick’s City Storage Systems, Q-Commerce platforms integrating ghost kitchens, Virtual Dining Concepts, C3 by SBE, Lunchbox Technologies, Flipdish, Chowly, Ordermark, Inspire Brands (via delivery optimization), DoorDash (Drive services), Keatz. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Virtual Restaurant & Ghost Kitchens Market Key Technology Landscape

The technological backbone of the Virtual Restaurant and Ghost Kitchens market is sophisticated and multifaceted, designed to maximize efficiency in production, logistics, and digital interaction. Central to this landscape is the seamless integration of Point of Sale (POS) and Order Management Systems (OMS). Modern OMS platforms are engineered to consolidate orders from multiple sources—including various third-party aggregators and proprietary websites—into a single, unified workflow visible across the kitchen operation. This consolidation prevents manual input errors, reduces order processing time, and ensures that staff can manage several virtual brands concurrently without confusion. Essential technological differentiators include real-time inventory synchronization and automated ticket printing categorized by the specific brand and prep station.

Beyond order processing, advanced Kitchen Display Systems (KDS) and workflow optimization software are crucial. KDS platforms visually manage the production pipeline, timing each step from prep to plating to ensure that meals are ready precisely when the delivery driver arrives, thereby maintaining food quality and temperature. Many high-performing ghost kitchens utilize machine learning algorithms integrated within the KDS to prioritize orders dynamically, shifting labor allocation in real-time based on fluctuating demand and predicted driver wait times. This data-driven approach to production scheduling is a key competitive technology, enabling significantly higher throughput during peak delivery windows compared to traditional restaurant models.

Finally, the success of a virtual restaurant hinges on its digital storefront and customer data analytics capabilities. Technology providers offer specialized tools for menu engineering, A/B testing of virtual brand concepts, and targeted digital marketing strategies that substitute for physical visibility. Cloud-based analytics platforms ingest sales data, customer reviews, and operational metrics to provide operators with granular insights into profitability per dish, brand performance across different delivery zones, and customer retention rates. Essential technologies also encompass robust cybersecurity measures to protect sensitive customer data and reliable cloud infrastructure to ensure continuous uptime for ordering portals.

Regional Highlights

The global Virtual Restaurant and Ghost Kitchens Market exhibits distinct characteristics and maturity levels across key geographical regions, driven by localized consumer habits, regulatory environments, and digital infrastructure readiness. Understanding these regional dynamics is crucial for companies planning global expansion or focused market penetration strategies.

- North America: Characterized by high technological adoption and significant investment from major ghost kitchen infrastructure providers (e.g., CloudKitchens, Kitchen United). The market is mature, driven by a highly fragmented restaurant sector seeking efficient scaling and optimizing labor costs. Key relevance lies in the integration of automation (robotics for food prep) and the strong presence of dominant delivery aggregators.

- Asia Pacific (APAC): Currently the largest market globally, propelled by densely populated urban areas, highly established delivery culture, and cost-effective labor. Countries like China, India, and Southeast Asian nations show exponential growth. The APAC market is relevant for its focus on shared kitchen models and the rapid launch of multiple hyper-localized virtual brands catering to diverse tastes.

- Europe: Growth is steady but often tempered by stringent labor laws and diverse urban planning regulations regarding commercial kitchen operations. The market is primarily driven by QSR chains optimizing delivery in capital cities (London, Paris, Berlin). Key relevance includes a strong emphasis on sustainability in packaging and a growing push towards proprietary delivery networks to manage costs associated with third-party aggregators.

- Latin America (LATAM): An emerging market demonstrating high potential, spurred by rapidly increasing smartphone penetration and urbanization. Countries like Brazil and Mexico are seeing substantial investment in localized ghost kitchen facilities. The region's relevance lies in providing accessible food delivery options to a growing middle class and leveraging digital platforms for entrepreneurship.

- Middle East and Africa (MEA): This region, particularly the GCC countries, is seeing accelerated development due to high disposable incomes, significant expatriate populations, and robust logistics infrastructure (especially in Dubai and Riyadh). The market is relevant for its focus on premium, managed ghost kitchen services (like Kitopi) and rapid scaling of international food concepts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Virtual Restaurant & Ghost Kitchens Market.- CloudKitchens

- Kitchen United

- Reef Technology

- Deliveroo Editions

- Kitopi

- Travis Kalanick’s City Storage Systems

- Ghost Kitchens India

- Zuul Kitchens

- GrabKitchens

- Virtual Dining Concepts (VDC)

- C3 by SBE (Creating Culinary Communities)

- Keatz

- DoorDash (via specialized kitchen services)

- Uber Eats (via kitchen partnerships)

- Chowly

- Ordermark

- Lunchbox Technologies

- Flipdish

- Inspire Brands

- Olo

Frequently Asked Questions

Analyze common user questions about the Virtual Restaurant & Ghost Kitchens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a virtual restaurant and a ghost kitchen?

A ghost kitchen (or cloud kitchen) is the physical infrastructure—the professional kitchen space used solely for preparing delivery-only food. A virtual restaurant is the digital brand or culinary concept that operates out of the ghost kitchen. A single ghost kitchen facility can house multiple distinct virtual restaurant brands simultaneously, maximizing asset utilization and minimizing branding overlap.

How do ghost kitchens achieve lower operational costs compared to traditional restaurants?

Ghost kitchens significantly reduce costs by eliminating high-rent, prime retail locations, and front-of-house expenses (servers, host staff, dining room décor). They operate exclusively in commercial zones focused on production efficiency, leading to substantial savings in labor, utilities, real estate acquisition, and ongoing maintenance.

What are the primary challenges associated with operating a virtual restaurant brand?

Key challenges include maintaining consistent food quality during transit (last-mile delivery complexity), achieving effective brand visibility and customer loyalty in a purely digital environment, managing high commission fees charged by third-party delivery aggregators, and navigating operational dependence on external logistics partners.

How does technological integration drive profitability in the ghost kitchen market?

Technology drives profitability through dynamic demand forecasting (reducing food waste and optimizing inventory), real-time menu pricing adjustments, and workflow automation (enhancing speed and volume). Integrated Order Management Systems consolidate sales channels, providing precise data that enables rapid concept iteration and localized marketing optimization.

Which regions are leading the innovation and growth in the Virtual Restaurant Market?

Asia Pacific (APAC), particularly Southeast Asia and China, leads in sheer volume and rapid adoption due to dense urban populations and established delivery infrastructures. North America and parts of Europe lead in technological innovation, focusing on integrating AI, robotics, and advanced kitchen display systems for maximum operational throughput and labor efficiency.

In summary, the transition towards delivery-centric models, powered by technological infrastructure, ensures that the Virtual Restaurant and Ghost Kitchens Market will continue to be one of the most transformative sectors within the global foodservice industry throughout the forecast period. The market success is increasingly dependent on strategic data utilization, logistical precision, and the ability to maintain strong digital branding in the absence of a physical presence.

The detailed analysis confirms that future growth will be dominated by providers offering comprehensive, integrated solutions, bridging the gap between kitchen operations and consumer interaction platforms. This ecosystem requires continuous adaptation to evolving consumer expectations regarding speed, convenience, and food traceability, solidifying the market’s position as a permanent fixture in modern commerce.

Further analysis of emerging trends suggests a consolidation phase where major delivery aggregators and infrastructure providers seek deeper integration, potentially leading to more favorable commission structures or the rise of hybrid models that combine limited retail presence with extensive ghost kitchen networks to serve different customer needs effectively. This structural evolution emphasizes resilience and operational flexibility as primary competitive differentiators.

The market also faces an impending environmental assessment concerning the sustainability of delivery logistics and packaging materials. Companies that successfully implement eco-friendly operational practices and leverage automation to minimize waste will gain significant competitive advantages, appealing to the environmentally conscious modern consumer. This focus on sustainability represents a crucial, non-financial metric for future valuation in the sector.

Investment patterns are shifting towards specialized kitchen equipment designed for high-throughput delivery menus, moving away from generalized cooking apparatus. This includes investments in rapid-heating ovens, optimized packaging systems, and robotic arms for repetitive tasks, signaling a deeper commitment to industrializing food production while maintaining culinary quality. Stakeholders must prioritize capital expenditure in these specialized areas to stay ahead in the efficiency race.

The regulatory environment, particularly in urban centers, remains a variable factor. Successful market penetration relies on proactive engagement with local governments regarding zoning, food safety regulations, and labor standards applicable to this distinct operational model. Companies demonstrating a commitment to transparency and compliance in their decentralized operations will be better positioned for sustained, unobstructed growth across multiple jurisdictions.

The emergence of proprietary software solutions that bypass traditional third-party aggregators is a significant opportunity. These direct-to-consumer platforms not only reduce commission costs but also provide virtual brands with invaluable first-party customer data, enabling highly personalized marketing campaigns and improving customer lifetime value—a critical element for building sustainable digital brands.

Labor management within ghost kitchens is evolving rapidly, moving towards skillsets focused on technology management, complex logistics coordination, and standardized execution of recipes at scale, rather than traditional customer service roles. This transition necessitates retraining and specialized recruitment efforts to ensure the operational efficiency promised by the ghost kitchen model is realized.

Geographically, while APAC and North America dominate, the incremental growth observed in LATAM and MEA signals that the ghost kitchen model is globally applicable, provided that reliable internet access and a functioning logistics network are in place. These emerging regions offer greenfield opportunities for infrastructure development and market capture with potentially fewer incumbent competitors.

Finally, the evolution of consumer behavior, accelerated by recent global events, has cemented delivery as a necessity rather than a luxury. This fundamental shift guarantees a continuous demand floor for the Virtual Restaurant market, encouraging ongoing innovation in both kitchen technology and digital consumer engagement strategies.

The future landscape suggests that successful virtual brands will operate not just as food preparers, but as sophisticated tech-logistics entities, utilizing data to inform every aspect of their supply chain, production flow, and digital marketing outreach, fundamentally redefining the economics of the restaurant industry.

The high initial capital requirement for building out high-tech commissary kitchens serves as a slight barrier to entry for smaller infrastructure providers, concentrating the market power among well-funded global players. However, this investment intensity ensures high-quality, standardized facilities, which ultimately benefits the virtual restaurant operators relying on this infrastructure for dependable output.

The market is seeing an increased trend in "host kitchen" models, where existing traditional restaurants dedicate a portion of their kitchen time and space to fulfilling orders for virtual brands during off-peak hours, maximizing asset utilization. This hybrid approach offers flexibility and lower risk for established players dipping into the virtual concept space without requiring entirely new infrastructure.

Detailed performance metrics, such as preparation time per order, driver handover efficiency, and ingredient cost per item, are tracked with extreme precision in advanced ghost kitchen setups. This reliance on granular data allows for immediate operational adjustments and competitive benchmarking that is often unavailable in traditional foodservice environments.

Security and compliance, especially concerning food safety in high-volume, potentially multi-brand environments, are paramount. Technology solutions are critical for maintaining audit trails, tracking batch provenance, and ensuring adherence to diverse international food handling standards, mitigating the high public relations risk associated with food safety incidents in a delivery-only model.

The competition among ghost kitchen facility providers often centers on offering integrated software packages and ancillary services (e.g., marketing support, procurement assistance) alongside the physical space. This "kitchen-as-a-service" approach simplifies the launch process for virtual brands, further lowering the effective barrier to market entry.

The long-term viability of the virtual restaurant model depends on its ability to foster genuine customer loyalty without the benefit of physical ambiance or face-to-face interaction. Investment in specialized customer relationship management (CRM) tools tailored for delivery-only interactions, focusing on personalized digital communication and loyalty programs, is becoming increasingly essential.

As the market matures, standardization of kitchen design and operational protocols across different geographic locations will become a key driver for international scalability. Companies that can reliably replicate their high-efficiency kitchen model globally will gain a significant competitive edge in attracting large, multi-national QSR clients.

Financial valuation models for virtual restaurant companies are increasingly focusing on the efficiency of their delivery radius utilization and their success in minimizing the "dead time" between order placement and driver pickup. These technical performance indicators replace traditional metrics like revenue per square foot of dining space.

The integration of voice AI and chatbot technologies for order placement and customer query handling is minimizing the need for manual customer service, further streamlining operations and reducing labor costs associated with managing high volumes of digital interactions across various platforms.

Overall, the market is characterized by rapid, disruptive innovation that shifts value from real estate assets to intellectual property, technological integration, and mastery of complex logistics chains, fundamentally reshaping the competitive dynamics of the food industry.

The projected CAGR of 17.5% underscores the robust confidence in the scalability and profitability of the ghost kitchen concept, indicating continued strong investment and M&A activities throughout the forecast period of 2026 to 2033, particularly targeting technology enablers and scalable infrastructure platforms.

This expansion is not homogenous; it favors highly specialized cuisine types that travel well and satisfy specific digital demographics (e.g., specialized bowls, artisan pizzas, customized salads), highlighting the importance of data-driven menu optimization based on hyperlocal delivery radius performance.

The reliance on cloud computing infrastructure for managing distributed operations across potentially hundreds of ghost kitchen sites simultaneously is non-negotiable. Robust, low-latency cloud solutions are critical for ensuring real-time data flow between the POS, KDS, and delivery logistics systems, maintaining operational coherence across the network.

Finally, continuous technological disruption, including advancements in drone and robotic last-mile delivery systems, promises further future reduction in logistic costs, potentially increasing the market size projection beyond current estimates if mass adoption of these automated delivery methods becomes economically viable within the forecast timeframe.

The investment thesis in this sector has shifted from simply acquiring physical real estate to investing in the technological platform that manages the distributed kitchen network. Companies that excel in software development and data science are proving to be the most valuable assets in this ecosystem.

Environmental concerns are driving demand for advanced packaging technologies that maintain food integrity and temperature during delivery while utilizing biodegradable or recyclable materials. This focus on sustainable logistics is a growing differentiator for virtual brands seeking ethical consumer appeal.

The competitive landscape includes non-traditional rivals, such as automated food vending concepts and large-scale centralized meal preparation factories, which are also vying for the delivery market share by leveraging similar technological efficiencies and high automation levels.

The market also presents opportunities for equipment manufacturers to specialize their product lines, designing smaller, highly efficient appliances tailored specifically for the constrained footprint and high-throughput requirements of ghost kitchen pods, creating a new niche manufacturing sector.

Regulatory adaptation lags behind market innovation, creating uncertainty regarding long-term operating licenses in certain dense urban areas. Proactive industry collaboration with regulatory bodies is essential to establish clear, sustainable operational guidelines for these facilities.

Consumer interaction is evolving, with virtual restaurants utilizing sophisticated marketing techniques, including influencer collaborations and geo-fenced promotions, to build brand affinity digitally—strategies that are highly data-intensive and require deep analytical capabilities.

The global reach of delivery aggregation platforms is facilitating the rapid internationalization of virtual restaurant concepts, allowing successful brands to test new markets overseas with relatively minimal infrastructural investment compared to traditional franchising models.

Ultimately, the long-term success of the Virtual Restaurant and Ghost Kitchens Market hinges on maximizing the efficiency derived from technology while effectively managing the complex interplay between numerous digital platforms, physical logistics, and ever-changing consumer tastes.

The analysis of competitive maneuvers indicates that vertically integrated models—where the infrastructure provider, technology platform, and sometimes even the virtual brand ownership are centralized—are gaining traction, offering superior control over the entire consumer experience and cost structure.

The market is witnessing a professionalization of the operational side, moving away from purely experimental startups towards disciplined, standardized execution driven by Six Sigma methodologies applied to food production and delivery logistics, emphasizing repeatable quality and speed.

This structural change implies a significant shift in required workforce skills, necessitating continuous training programs focused on high-tech kitchen equipment operation, data interpretation, and fast-paced, high-volume order fulfillment under intense time constraints.

The ability to harness consumer feedback data in real-time to immediately adjust recipes, packaging, and marketing spend is a defining feature of market leaders, creating an iterative cycle of improvement that drastically surpasses the feedback cycles of traditional restaurants.

As density increases, location intelligence—optimizing the placement of ghost kitchens to cover demographic sweet spots while minimizing delivery distances—becomes a critical, proprietary technology advantage for infrastructure giants in the market.

Investment into sustainable and energy-efficient kitchen design is increasing, reflecting both regulatory pressure and corporate responsibility goals, positioning the market favorably for long-term operational cost reduction and enhanced public perception.

The report underscores that the Virtual Restaurant and Ghost Kitchens Market is not merely a transient trend but a foundational restructuring of the global food service industry, built upon digital connectivity, logistics efficiency, and asset optimization.

Technological advancement in ingredient preparation automation, such as robotic fryers and automated assembly lines, is poised to address labor scarcity challenges and ensure consistent product quality across distributed virtual kitchens.

The competitive moat for companies in this space is built less on food uniqueness and more on superior logistical and technological execution—the seamless ability to deliver a consistent, high-quality meal faster and cheaper than rivals.

Market segmentation based on the required level of automation (low, medium, or high automation kitchens) provides a clearer picture for capital expenditure planning, aligning technology spend with projected volume and labor cost saving targets.

Finally, the proliferation of specialized software middleware designed to facilitate communication between disparate delivery, POS, and inventory systems is simplifying the operational complexity inherent in managing multiple virtual brands from a single kitchen hub.

The robustness of the market’s projected growth rate demonstrates its resilience and adaptability, confirming its central role in future urban food supply chains globally.

This detailed market insight provides a strategic roadmap for businesses seeking to enter, expand, or invest in the dynamic and technologically driven Virtual Restaurant and Ghost Kitchens sector.

The imperative for continuous optimization across the digital and physical realms defines success in this intensely competitive environment.

Further research indicates that smaller, specialized virtual brands are increasingly bundling their offerings into curated subscription box models, leveraging the ghost kitchen infrastructure for mass production and distribution flexibility.

The strategic deployment of multi-layered security protocols, encompassing both digital transaction security and physical kitchen access control, is paramount to protect sensitive business data and maintain operational integrity across geographically dispersed sites.

The shift towards renewable energy sources for powering ghost kitchen facilities in developed markets signals a growing commitment to ESG (Environmental, Social, and Governance) factors, appealing to institutional investors and environmentally conscious consumers alike.

The market trajectory confirms that delivery is fundamentally decoupled from the dine-in experience, requiring specialized skills and infrastructure optimized solely for high-speed, high-volume production, cementing the necessity of the ghost kitchen model.

Analysis shows that brand proliferation often necessitates sophisticated trademark and intellectual property management to prevent dilution and maintain distinctiveness across the rapidly expanding network of virtual concepts.

Ultimately, the ghost kitchen model is transforming real estate usage in urban food service, turning previously undesirable industrial spaces into profitable, high-tech logistical hubs, driving broader economic and spatial changes in metropolitan areas.

The market's sustained growth validates the model's economic resilience, offering a necessary operational alternative to the capital-intensive and less flexible traditional restaurant structure.

This evolution necessitates that regulatory frameworks adapt quickly to accommodate shared commercial kitchen operations, establishing clear guidelines for cross-brand hygiene management and licensing.

The future of the sector lies in its ability to combine industrial-scale efficiency with personalized, data-driven consumer experiences, ensuring that the convenience of delivery does not compromise food quality or brand identity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager