Viscoelastic Surfactant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437311 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Viscoelastic Surfactant Market Size

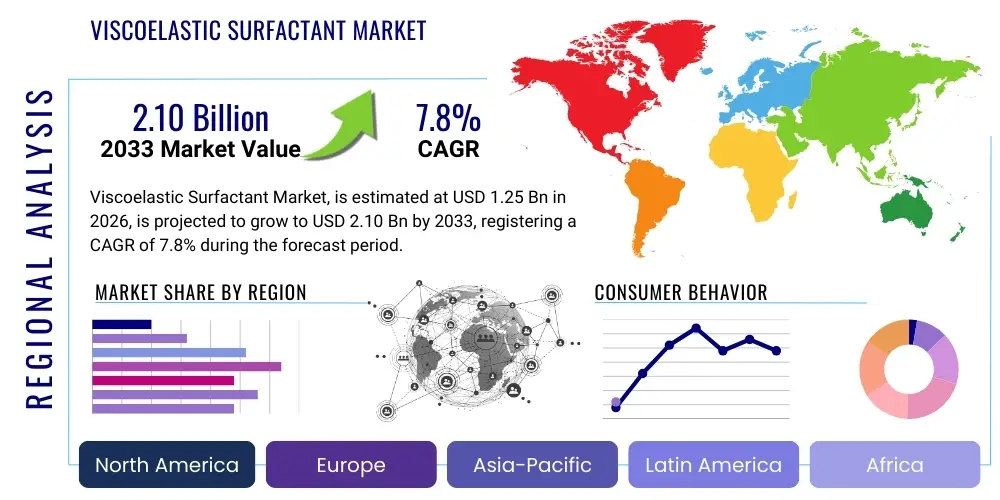

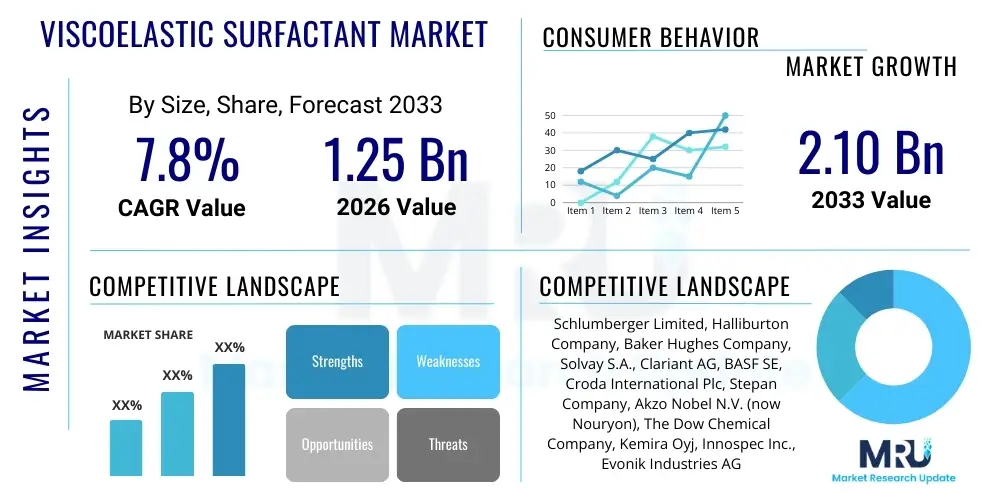

The Viscoelastic Surfactant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.10 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for energy resources, necessitating advanced fluid technologies for efficient extraction from challenging unconventional reserves. The inherent operational advantages of Viscoelastic Surfactants (VES) over traditional polymer-based fracturing fluids, particularly concerning residue management and formation damage minimization, solidify their critical role in optimizing hydrocarbon recovery operations worldwide. Furthermore, the stabilization of crude oil prices during the forecast period is anticipated to encourage renewed capital investment in exploration and production (E&P) activities, thereby directly boosting the consumption of specialized chemical additives like VES in oilfield services.

Market valuation growth is closely tied to the technological advancements in VES formulation that allow for deployment in increasingly extreme environments, characterized by high temperatures, high pressures (HTHP), and varying salinity levels. These new generation surfactants offer superior thermal stability and shear-thinning behavior, which are crucial for deep-well drilling and horizontal completion activities prevalent in shale gas and tight oil plays. The geographical focus of this growth remains centered on regions with extensive unconventional resource bases, notably North America and increasingly, areas within the Middle East and Latin America that are beginning to exploit similar complex geological formations. The shift towards non-damaging reservoir stimulation techniques further reinforces the economic viability of VES, positioning it as a preferred chemical component in advanced well intervention programs aimed at maximizing ultimate recovery rates without compromising reservoir permeability.

While the oil and gas sector remains the primary revenue contributor, ancillary growth is observed in industrial applications, particularly in sophisticated industrial cleaning and personal care products where superior rheological control and mildness are desired attributes. However, the oilfield application, encompassing hydraulic fracturing, well cementing, and enhanced oil recovery (EOR), dictates the overall market trajectory. Regulatory pressures aimed at minimizing environmental impact are also subtly influencing market dynamics, favoring the adoption of greener, bio-based or readily degradable VES formulations. This dual pressure of maximizing efficiency while adhering to environmental stewardship creates a premium market segment for advanced, sustainable VES products, ensuring sustained high-value growth throughout the projection period.

Viscoelastic Surfactant Market introduction

Viscoelastic Surfactants (VES) constitute a specialized class of chemical additives characterized by their unique ability to form intricate, reversible supramolecular structures, typically wormlike micelles, when dispersed in an aqueous solution under specific conditions of concentration, salinity, and temperature. This microstructural organization imbues the fluid with pronounced non-Newtonian, viscoelastic properties, enabling high-viscosity performance analogous to that achieved by conventional polymers, but without the detrimental residue associated with polymer use. The fundamental product description involves long-chain surfactants, often derived from amine oxides or specialized quaternary ammonium salts, which self-assemble above the critical micelle concentration (CMC). This inherent characteristic makes VES fluids highly desirable in technical applications requiring temporary, shear-recoverable viscosity generation, particularly in demanding industrial environments.

The primary application domain for VES technology is undeniably the oil and gas industry, specifically in hydraulic fracturing operations, where the fluids serve as effective fracturing fluid thickeners and diverting agents. In this context, VES fluids transport proppant effectively into hydraulic fractures while minimizing permeability damage to the reservoir face upon flowback, as the micelles readily break down upon contact with hydrocarbons or simple chemical breakers. Other critical oilfield applications include drilling fluid rheology modification, gravel packing operations, and cementing processes, where their thermal stability and low friction pressure are invaluable operational benefits. Beyond the energy sector, VES finds minor but growing utilization in industrial cleaners, specialized coatings, and personal care products (such as high-performance shampoos and body washes) where the viscoelastic nature contributes to texture, stability, and controlled delivery of active ingredients, highlighting the versatility and broad technological applicability of these compounds.

Key driving factors propelling the VES market include the relentless global pursuit of unconventional oil and gas resources, such as shale gas and tight oil, which are highly reliant on complex fracturing processes requiring non-damaging fluid systems. The benefits derived from VES, particularly the reduction in associated costs due to simpler fluid preparation and cleanup compared to guar or synthetic polymers, significantly enhance operational efficiency. Furthermore, increasing environmental regulations necessitate the deployment of fracturing fluids that leave minimal formation damage and offer higher biodegradability profiles, an attribute where advanced VES formulations often demonstrate superior performance compared to traditional chemistries, thus aligning market growth with sustainable technological trends. The ability of VES systems to tolerate high levels of salinity and temperature also makes them indispensable for deep-sea and deep-well exploration activities, where conditions often exceed the operational limits of many alternative viscosifiers.

Viscoelastic Surfactant Market Executive Summary

The Viscoelastic Surfactant market is experiencing robust growth driven predominantly by intensified global exploration and production activities within the unconventional hydrocarbon sector. Key business trends indicate a concentrated effort by major chemical suppliers to innovate novel VES chemistries that offer enhanced thermal tolerance and compatibility with various formation waters, directly addressing the technical limitations encountered in high-pressure, high-temperature (HPHT) deep well environments. There is a perceptible business shift toward 'green' VES formulations, often derived from bio-based feedstocks or designed for rapid environmental degradation, responding proactively to stringent regulatory landscapes, especially across North America and Europe. Strategic mergers and acquisitions among specialty chemical providers and oilfield service companies are shaping the competitive landscape, aiming for vertical integration to secure supply chains and optimize service delivery costs, ultimately influencing pricing power and market penetration strategies across major oilfield basins.

Regionally, North America maintains its position as the dominant market, primarily due to the maturity and sheer scale of hydraulic fracturing operations in the Permian Basin, Bakken, and Marcellus shale plays. The United States and Canada continue to lead in VES consumption, serving as the crucible for technological testing and rapid commercial deployment of new VES chemistries. The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by expanding energy demands, particularly in China and India, alongside nascent investments in offshore and unconventional resource exploration. Concurrently, the Middle East and Africa (MEA) region shows significant potential, characterized by major state-owned oil companies investing heavily in complex EOR projects and offshore developments that necessitate high-performance, salt-tolerant VES systems to ensure operational success and maximized recovery factors from aging fields. Regulatory clarity and government policies favoring indigenous energy independence are critical accelerators in these emerging markets, dictating the pace of regional VES adoption.

In terms of segmentation, the Amine Oxide segment commands a substantial market share, owing to its cost-effectiveness, established performance profile, and versatility across a range of operational temperatures and fluid compositions. However, the Quaternary Ammonium Salt segment is projected to grow rapidly, driven by the need for formulations exhibiting superior thermal stability and higher salt tolerance essential for deep, hypersaline wells. Application-wise, hydraulic fracturing remains the cornerstone of market demand, absorbing the vast majority of VES production volumes. Segment trends also highlight the increasing customization of VES blends tailored for specific geological formations or operational requirements, moving away from standardized, off-the-shelf products. This trend underscores the increasing sophistication in reservoir engineering and the reliance on specialized chemical solutions to address unique downhole challenges, thereby commanding premium pricing and higher market value realization across all major application sub-segments within the oil and gas vertical.

AI Impact Analysis on Viscoelastic Surfactant Market

Common user questions regarding AI's influence on the Viscoelastic Surfactant Market frequently revolve around optimizing complex fluid formulation, predicting real-time rheological performance under downhole conditions, and streamlining the supply chain for specialized chemical delivery. Users are keenly interested in whether AI can accelerate the discovery and testing of new, more environmentally friendly VES molecules, reducing the reliance on traditional, lengthy laboratory experimentation cycles. Key themes emerging from these inquiries include the potential for AI-driven predictive modeling to minimize costly trial-and-error in selecting the optimal VES concentration and type for a specific reservoir, and the application of machine learning algorithms to analyze vast datasets related to well performance and fluid compatibility. The general expectation is that AI integration will lead to higher operational efficiency, reduced chemical waste, and significant improvements in the precision of fracture geometry creation, ultimately transforming VES from a static chemical product into a dynamically managed fluid system tailored instantaneously to changing well conditions.

- AI algorithms enable the rapid screening and simulation of thousands of VES formulations, accelerating the discovery of high-performance, thermally stable chemistries.

- Predictive maintenance analytics, powered by machine learning, forecast fluid degradation or stability issues in real-time, allowing for proactive chemical adjustments downhole.

- Optimization of VES inventory and logistics through AI-driven demand forecasting reduces storage costs and ensures timely delivery of specialized chemicals to remote drilling sites.

- Machine learning models analyze historical fracturing data to recommend precise VES concentration and breaker schedules, maximizing conductivity and minimizing formation damage.

- AI-guided smart fluid systems dynamically adjust VES injection rates based on real-time sensor feedback regarding pressure, temperature, and shear, ensuring optimal fluid rheology throughout the operation.

DRO & Impact Forces Of Viscoelastic Surfactant Market

The Viscoelastic Surfactant market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influenced by external Impact Forces. The primary driver is the pervasive and sustained global demand for unconventional oil and gas, particularly shale resources, which necessitate the use of advanced, non-damaging fracturing fluids to maintain reservoir permeability and maximize ultimate recovery. Restraints largely center on the inherent volatility of global crude oil and natural gas prices, which directly impacts E&P capital expenditure, causing market contraction during price downturns. Furthermore, the increasing stringency of environmental regulations regarding the toxicity and disposal of chemical additives pressures manufacturers toward expensive R&D for bio-based or biodegradable alternatives. Opportunities are abundant in the expansion of Enhanced Oil Recovery (EOR) techniques, where VES systems demonstrate significant promise, and the burgeoning need for specialized fluids capable of operating reliably in extreme high-temperature, high-pressure (HTHP) deep-water and ultra-deep wells, offering high-margin growth avenues for technological leaders. These internal factors are constantly modulated by powerful external impact forces originating from technology shifts, regulatory changes, and economic cycles.

The impact forces exerted on the market structure are best understood through the lens of competitive intensity, supplier power, buyer power, threat of substitution, and threat of new entry. Supplier power remains moderate, as the raw materials for key VES types (e.g., specific fatty acids, specialized amines) are sourced from a concentrated chemical industry base, allowing suppliers to exert some influence over input costs. However, the competitive rivalry among established VES manufacturers is high, driving constant price competition and innovation pressure, especially in commodity-grade products. Buyer power is substantial, dominated by large, integrated oilfield service companies (OFS providers) who purchase vast volumes and possess significant negotiation leverage, demanding specific performance specifications and cost efficiencies. The threat of substitution, predominantly from traditional polymer-based fluids (guar derivatives, polyacrylamides) and new proprietary fluid systems, remains a constant challenge, though VES's low-damage profile provides a competitive moat in high-value applications.

Technological change acts as a continuous, powerful impact force, favoring companies that invest heavily in creating next-generation VES systems that are robust, environmentally benign, and cost-effective under diverse conditions. Regulatory scrutiny, particularly concerning water usage and chemical disclosure in hydraulic fracturing, acts as a pivotal force, potentially restraining market growth where environmental compliance costs become prohibitive, or conversely, driving market share towards manufacturers offering certified "green" solutions. Economic impact forces, tied directly to global macroeconomic stability and long-term energy policies, dictate investment cycles. When oil prices stabilize above critical thresholds, market growth accelerates substantially due as operators increase completion intensity and footage drilled. Conversely, sustained low prices compel operators to optimize chemical usage, favoring VES fluids for their efficiency benefits, yet potentially lowering overall volume consumption. The synergistic effects of these DRO factors and impact forces define the complex landscape within which VES manufacturers must strategically operate to maximize their competitive advantage and sustained profitability over the forecast period.

Segmentation Analysis

The Viscoelastic Surfactant market is comprehensively segmented based on Type, predominantly distinguishing between the chemical structures employed, and Application, focusing on the end-use industry and specific operational requirement. Segmentation by Type is crucial as it directly relates to the performance characteristics, such as thermal stability, shear recovery, and salt tolerance, which dictate suitability for specific downhole environments. The market includes segments such as Amine Oxides, Quaternary Ammonium Salts, and Zwitterionic Surfactants (Betaines), each offering distinct advantages in terms of cost profile and operational window. The Amine Oxide category generally represents a balanced choice, providing reliable viscosity generation and easy breaking, making it a foundation in many standard fracturing fluid formulations. Conversely, the Quaternary Ammonium Salt segment is frequently utilized in more demanding, high-salinity or high-temperature applications where robust micellar stability is paramount for operational integrity and proppant suspension capability.

Segmentation by Application reveals the overwhelming dominance of the Oil & Gas sector, which is further refined into critical sub-applications: Hydraulic Fracturing, Drilling Fluids, Cementing, and Enhanced Oil Recovery (EOR). Hydraulic fracturing is the most significant consumer, leveraging VES for proppant transport due to its residue-free flowback characteristics, which prevent irreversible reservoir damage that polymer residues often cause. The use of VES in drilling fluids aids in rheology control and hole cleaning, particularly in highly directional and horizontal drilling operations where friction reduction is also a significant benefit. Though smaller in volume, the Personal Care segment, which includes high-end shampoos and body washes, and the Industrial Cleaners sector represent niche markets where the thickening and stabilizing properties of VES are leveraged to achieve superior product aesthetics and performance, providing diversification opportunities away from the cyclical nature of the energy sector.

The structure of the market segmentation allows manufacturers and strategists to tailor product development and marketing efforts towards specific needs, recognizing that a "one-size-fits-all" approach is ineffective given the diversity of reservoir conditions globally. The fastest-growing sub-segment is expected to be EOR applications, as mature fields increasingly require advanced chemical flooding techniques to maximize recovery, often involving specialized VES formulations that can efficiently mobilize residual oil without compromising the rock structure. Furthermore, the segmentation helps in understanding the competitive dynamics, as different chemical types may be dominated by specialized manufacturers possessing unique synthesis capabilities and intellectual property related to micellar stabilization and breaking technologies, ensuring differentiation and intellectual dominance within targeted market sub-segments.

- By Type: Amine Oxide, Quaternary Ammonium Salt, Zwitterionic Surfactants (Betaines), Others (e.g., Specialized non-ionic systems)

- By Application: Oil & Gas (Hydraulic Fracturing, Drilling Fluids, Cementing, Enhanced Oil Recovery), Personal Care (Shampoos, Body Wash, Liquid Soaps), Industrial Cleaners (Heavy-duty Degreasers, Specialized Cleaning Solutions), Others (e.g., Adhesives, Paints and Coatings)

- By Chemistry: Cationic, Anionic, Non-ionic, Amphoteric

- By Functionality: Viscosifier, Friction Reducer, Gelling Agent, Stabilizer

- By Geography: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)

Value Chain Analysis For Viscoelastic Surfactant Market

The Value Chain for the Viscoelastic Surfactant market initiates with the Upstream stage, which involves the sourcing and processing of essential raw materials. These materials primarily include specialized amines, fatty acids (often derived from natural oils or petrochemical sources), and various counter-ions and solvents required for synthesis. The reliance on petrochemical intermediaries links the upstream costs directly to the fluctuating prices of crude oil and natural gas derivatives, introducing inherent supply chain volatility. Suppliers in this stage are typically large commodity chemical producers. The quality and purity of these inputs are paramount, as they directly influence the final VES performance, particularly thermal stability and micellar structure formation. Effective management of this upstream segment requires robust supplier relationships and strategic hedging against raw material price fluctuations to ensure consistent production economics and product quality control throughout the subsequent stages of the value chain, focusing heavily on specialized chemical intermediate manufacturing.

The core segment of the value chain is the Manufacturing and Synthesis stage, where specialty chemical companies execute complex reaction sequences to produce the specific VES molecules. This stage is characterized by high capital investment in reaction vessels, stringent quality assurance protocols, and proprietary intellectual property related to molecular design and purification processes. Efficiency in synthesis and yield optimization are critical drivers of profitability. Following production, the VES products enter the Distribution Channel. Due to the highly specialized nature and required handling expertise, the distribution is primarily direct, involving the VES manufacturer selling directly to major Oilfield Service (OFS) providers (e.g., Schlumberger, Halliburton) or large independent E&P operators. Indirect distribution occurs mainly through specialized regional chemical distributors, particularly in smaller or geographically remote markets where local logistical support is essential. The distribution network must be capable of handling bulk liquid chemical shipments, often requiring specialized storage and transportation logistics to ensure product integrity before it reaches the wellsite.

The Downstream segment involves the application and service delivery. OFS companies integrate the VES into comprehensive fluid systems, often alongside breakers, crosslinkers, and other additives, constituting the final specialized fluid blend utilized in fracturing or drilling operations. This integration step adds significant value through engineering expertise and real-time fluid management services. Potential customers, the end-users (E&P companies), purchase the complete service package rather than just the chemical itself. Therefore, the long-term success of VES manufacturers is tied not only to product performance but also to the strength of their strategic partnerships with major service companies, who act as the immediate commercial interface to the end-consumer. Feedback from the downstream application—concerning performance under specific geological conditions—is critical for guiding future R&D efforts, completing the continuous improvement loop within the value chain and ensuring products remain optimally matched to demanding industry requirements.

Viscoelastic Surfactant Market Potential Customers

The primary and largest demographic of potential customers for the Viscoelastic Surfactant Market resides within the global energy sector, specifically comprising Exploration and Production (E&P) companies, major Integrated Oil Companies (IOCs), and National Oil Companies (NOCs). These entities are the ultimate buyers who authorize and finance the utilization of VES in their upstream operations, ranging from routine maintenance to complex well completions. Their demand is fundamentally driven by the need to maximize hydrocarbon recovery from both conventional and unconventional reservoirs while mitigating the risk of formation damage. E&P operators require VES systems that can deliver high viscosity for proppant transport in hydraulic fracturing, possess excellent thermal stability for deep or hot wells, and ensure rapid, clean breakability upon completion to achieve maximum well conductivity. The purchasing decision for these customers is heavily weighted on demonstrated field performance, technical support from suppliers, and adherence to increasingly strict environmental, social, and governance (ESG) criteria related to chemical usage.

A secondary, yet crucial, category of potential customers are the major Oilfield Service (OFS) companies. Although they act as intermediaries, integrating VES products into their proprietary fluid systems and providing the final service package to E&P operators, they are the immediate, high-volume buyers from VES manufacturers. Companies such as Halliburton, Schlumberger, Baker Hughes, and Weatherford procure vast quantities of VES as a critical component of their fracturing, cementing, and drilling fluid portfolios. Their purchasing power is immense, and they often require customized formulations or large-scale supply agreements. For VES manufacturers, securing long-term contracts with these OFS giants is essential for achieving economies of scale and establishing market legitimacy. The technical specifications and performance guarantees demanded by OFS providers are typically the most stringent in the industry, reflecting the competitive nature of their service offerings and the high stakes involved in multi-million dollar completion projects.

Beyond the energy sector, potential customers exist within the specialty chemicals and consumer goods industries. Manufacturers of high-end Personal Care products, including premium shampoos, conditioners, and specialized body washes, leverage the shear-thinning and mild thickening properties of specific VES types (often zwitterionic or non-ionic) to improve product aesthetics, feel, and stability. Similarly, industrial manufacturers specializing in high-performance cleaning solutions, such as heavy-duty degreasers for transportation or machinery maintenance, rely on VES for their superior emulsification and surface-active properties. While these segments represent a smaller volume share, they offer important market diversification and stability, often demanding highly purified and regulatory-compliant grades of VES. Focusing on these non-O&G applications requires specific sales strategies centered on product development for consumer safety and formulation expertise rather than just downhole performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.10 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Solvay S.A., Clariant AG, BASF SE, Croda International Plc, Stepan Company, Akzo Nobel N.V. (now Nouryon), The Dow Chemical Company, Kemira Oyj, Innospec Inc., Evonik Industries AG, Lubrizol Corporation (A Berkshire Hathaway Company), Ashland Global Holdings Inc., Huntsman Corporation, SUEZ, China National Petroleum Corporation (CNPC), Chevron Phillips Chemical Company, Nalco Champion (Ecolab). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Viscoelastic Surfactant Market Key Technology Landscape

The Viscoelastic Surfactant market is characterized by continuous technological evolution aimed at enhancing fluid performance reliability across increasingly diverse and challenging downhole environments. A primary area of focus involves the development of high-performance VES systems capable of operating efficiently under extreme conditions, specifically high temperature (up to 400°F) and high pressure, often coupled with hypersaline formation waters. Traditional VES formulations often lose viscosity or break prematurely under these stresses. Current R&D efforts leverage sophisticated molecular engineering to design surfactants with modified head groups and longer, more robust hydrophobic tails, resulting in micelles that maintain their wormlike structure and, consequently, the desired viscoelastic properties, under severe thermal and chemical attack. This pursuit of ultra-stable VES is crucial for exploiting deep-water reserves and ultra-deep continental wells, where conventional fluid limitations previously hindered economic extraction, thereby expanding the potential application envelope significantly.

Another pivotal technological trend involves the transition toward "green chemistry" and the adoption of self-healing fluid systems. With heightened environmental scrutiny, manufacturers are investing heavily in synthesizing VES from bio-based, readily biodegradable feedstocks, such as specific derivatives of natural oils or sugars, aiming to minimize the ecological footprint associated with fracturing fluid discharge and flowback. These next-generation, bio-derived VES must maintain performance parity with traditional petrochemical derivatives, presenting a complex challenge in balancing environmental efficacy with functional requirements. Furthermore, self-healing VES fluids represent a cutting-edge advancement, where the surfactant system possesses the intrinsic ability to repair minor damage to the micellar structure caused by transient shear forces encountered during high-rate pumping. This self-repair capability ensures consistent viscosity maintenance and efficient proppant transport throughout the entire pumping schedule, minimizing operational risks associated with temporary viscosity loss and sedimentation.

The integration of advanced rheology modifiers and specialized salt-tolerant additives also defines the contemporary technology landscape. VES formulations are increasingly being optimized with specific counter-ions (e.g., potassium chloride, specialized inorganic salts) or co-surfactants designed to promote micellar growth and stability in the presence of high concentrations of calcium, magnesium, and total dissolved solids (TDS) found in produced water or brackish source water used for fracturing. This optimization reduces the need for extensive water treatment prior to use, significantly lowering overall operational costs and environmental burden associated with sourcing fresh water. Sophisticated laboratory testing methods, including Cryo-Transmission Electron Microscopy (Cryo-TEM) and advanced rheometry, are foundational tools supporting this R&D, allowing scientists to visualize micellar structures and precisely quantify the viscoelastic response under simulated downhole conditions, ensuring that the final commercial product meets exact performance specifications before large-scale deployment.

Regional Highlights

- North America (United States and Canada): North America dominates the global VES market in terms of volume consumption and technological maturity, primarily driven by the massive scale of hydraulic fracturing in shale plays like the Permian Basin, Marcellus, and Eagle Ford. The region’s focus on maximizing efficiency and minimizing environmental impact has fostered rapid adoption of high-performance, residue-free VES fluids. The US serves as the epicenter for new product testing and deployment, characterized by stringent competition among service providers and chemical suppliers. Technological adoption is high, specifically for VES systems engineered for reduced friction pressure and high-temperature performance necessary for deeper, longer horizontal well sections common across these prolific shale regions. Regulatory clarity, particularly regarding chemical disclosure, is accelerating the transition toward greener, standardized VES formulations, maintaining North America's status as the definitive market leader.

- Asia Pacific (APAC) (China, India, Australia): The APAC region is poised for the fastest growth due to rapidly increasing energy demand and governmental pushes for energy independence, stimulating investment in indigenous oil and gas resources, including nascent unconventional plays and significant offshore activity. While China leads in domestic shale gas exploration, India and Australia are investing heavily in offshore deep-water projects requiring advanced, thermally stable drilling and completion fluids. The market growth here is driven by the need for EOR projects in aging conventional fields and the initial phase of unconventional resource development. Local manufacturing capacity is expanding, but there is significant reliance on specialized VES imports from North American and European chemical majors due to proprietary technology barriers.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, Nigeria): MEA represents a high-value, high-potential market segment. While historically focused on conventional production, the region is increasingly investing in complex, large-scale Enhanced Oil Recovery (EOR) projects, deep offshore drilling, and exploration in high-salinity environments, all requiring robust VES technology. National Oil Companies (NOCs) are major end-users, demanding ultra-reliable, salt-tolerant VES solutions for maximizing recovery from critical reservoirs. The market is characterized by long-term contracts and high specification requirements due to the extreme operating conditions (high temperature and high salinity), which limits the entry of low-cost, low-performance VES alternatives, favoring established global suppliers with proven HTHP capabilities.

- Europe (Norway, UK, Russia): The European market for VES is concentrated in offshore exploration and production activities, particularly in the North Sea (Norway and UK sectors), and the vast onshore conventional and unconventional fields in Russia. While strict environmental regulations severely restrict onshore hydraulic fracturing in many EU countries, the demand remains robust for high-specification VES in deep-water drilling, subsea well intervention, and mature field abandonment activities where zero-residue fluids are highly valued. Russia's massive conventional and potential unconventional reserves ensure a steady, high-volume market for VES, often requiring customized solutions adapted to extremely cold operating climates and specific geological profiles, though logistical complexity remains a key factor.

- Latin America (Brazil, Argentina, Mexico): Latin America offers substantial growth opportunities, anchored by deep-water pre-salt exploration in Brazil and the rapidly expanding Vaca Muerta shale play in Argentina. These operations demand specialized VES for deep-water cementing and high-volume fracturing, respectively. Mexico's energy reforms are also opening up opportunities for international E&P investment. The region’s challenges include political instability and significant logistical hurdles, yet the sheer volume of recoverable resources ensures sustained, long-term demand for technologically advanced VES systems capable of handling the region's diverse and often complex geological requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Viscoelastic Surfactant Market.- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Solvay S.A.

- Clariant AG

- BASF SE

- Croda International Plc

- Stepan Company

- Nouryon (formerly Akzo Nobel N.V.)

- The Dow Chemical Company

- Kemira Oyj

- Innospec Inc.

- Evonik Industries AG

- Lubrizol Corporation (A Berkshire Hathaway Company)

- Ashland Global Holdings Inc.

- Huntsman Corporation

- SUEZ

- China National Petroleum Corporation (CNPC)

- Chevron Phillips Chemical Company

- Nalco Champion (Ecolab)

Frequently Asked Questions

Analyze common user questions about the Viscoelastic Surfactant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Viscoelastic Surfactants (VES) over traditional polymer fracturing fluids?

VES fluids are preferred in hydraulic fracturing because they are residue-free, breaking cleanly to a low-viscosity state upon contact with hydrocarbons or simple chemical breakers. This minimizes formation damage, unlike polymers which can leave behind damaging residues, thereby ensuring superior long-term well conductivity and enhanced ultimate recovery rates. Furthermore, VES systems generally exhibit lower friction pressure during pumping.

How is the Viscoelastic Surfactant market influenced by fluctuating oil prices?

The VES market is highly sensitive to crude oil price volatility. Low oil prices often trigger reduced capital expenditure (CapEx) in exploration and production (E&P), leading to decreased drilling and completion activity, thereby restraining VES demand. Conversely, stabilized or rising oil prices incentivize operators to invest in maximizing recovery, boosting demand for advanced fluids like VES for efficient well stimulation.

Which VES Type holds the largest market share and why?

The Amine Oxide segment typically holds the largest market share. This is due to their favorable cost profile, established performance history, and versatility in forming stable wormlike micelles across a wide range of common fracturing conditions. Amine oxides offer a balanced solution for viscosity generation and residue-free breaking, making them suitable for standard unconventional reservoir operations.

What role does sustainability play in the future development of VES technology?

Sustainability is becoming a crucial driver, pushing manufacturers towards developing "green chemistry" VES formulations. Future technology focuses on utilizing bio-based feedstocks and designing molecules for rapid biodegradability to meet increasingly stringent environmental regulations, particularly regarding fluid disposal and minimizing the ecological footprint of oilfield operations.

In which regional market is the highest growth rate expected for Viscoelastic Surfactants?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) for the VES market during the forecast period. This growth is fueled by intensified efforts in China and India to develop indigenous unconventional resources and increased regional investment in complex Enhanced Oil Recovery (EOR) projects in aging conventional fields.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager