Vision Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432610 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Vision Insurance Market Size

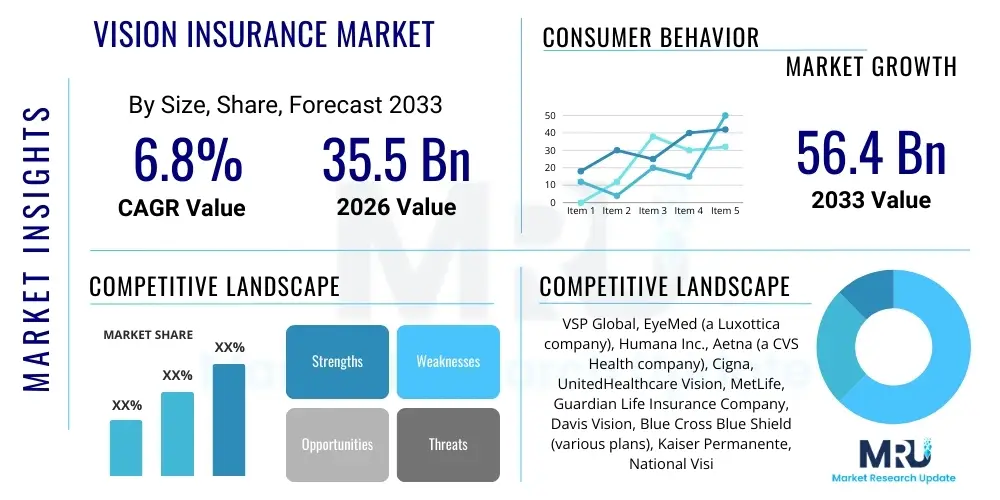

The Vision Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 56.4 Billion by the end of the forecast period in 2033.

Vision Insurance Market introduction

The Vision Insurance Market encompasses specialized health plans designed to reduce the cost of routine eye care, prescription eyewear (glasses and contact lenses), and sometimes contribute toward specialized procedures like LASIK. This market segment is primarily driven by the rising prevalence of chronic eye conditions such as myopia, cataracts, and diabetic retinopathy, coupled with increasing awareness regarding the importance of preventative eye health examinations. Vision plans are predominantly offered as voluntary benefits through employers or purchased directly by individuals and families, serving as a crucial component of comprehensive health and wellness strategies.

Major applications of vision insurance revolve around facilitating access to annual comprehensive eye exams, which are vital for early detection of systemic diseases (like diabetes and hypertension) that often manifest initially through ocular symptoms. Furthermore, the insurance mechanism stabilizes the financial burden associated with frequent updates to corrective lenses necessitated by age-related vision changes or lifestyle factors. The inherent benefits of these plans include enhanced employee satisfaction, improved compliance with preventative care schedules, and cost containment for high-quality eyewear, directly contributing to overall public health outcomes and productivity.

Driving factors propelling market expansion include favorable demographic trends, particularly the aging global population which requires more frequent and complex vision care services. Regulatory mandates, especially in regions integrating pediatric vision care into essential health benefits, further stimulate growth. The continuous innovation in lens technology (e.g., blue light filtering, progressive lenses) and the aesthetic evolution of eyewear frames also encourage higher utilization rates among insured individuals, maintaining consistent demand within the vision care ecosystem.

Vision Insurance Market Executive Summary

The Vision Insurance Market is currently experiencing robust business trends characterized by the migration toward value-based care models and the integration of digital health solutions. Insurers are focusing on diversifying their network coverage, including optometrists, ophthalmologists, and retail eyewear chains, to enhance customer accessibility and convenience. Strategic partnerships between vision insurance providers and major optical retailers are a defining feature, aiming to streamline the claims process and offer bundled discounts, thereby increasing perceived value for policyholders. Furthermore, there is a notable trend towards offering highly customizable plans that cater to diverse needs, ranging from basic preventative coverage to premium plans covering elective procedures.

Regionally, North America maintains the dominant market share, primarily due to the established employer-sponsored benefits structure and high consumer spending on healthcare. However, the Asia Pacific (APAC) region is demonstrating the fastest growth rate, fueled by improving economic conditions, increased healthcare expenditure, and substantial governmental initiatives promoting mandatory health coverage across densely populated nations like China and India. European markets exhibit maturity, emphasizing regulatory stability and standardized benefit structures, while Latin America and the Middle East and Africa (MEA) represent high-potential emerging markets driven by increasing urbanization and the formalization of corporate benefit packages.

Segmentation trends indicate strong momentum in the corporate sector, where group plans dominate due to economies of scale and tax benefits associated with employer provision. Concurrently, the individual/family plan segment is expanding rapidly, supported by online enrollment platforms and consumer demand for standalone vision coverage outside of traditional medical insurance bundles. The utilization rate of contact lens coverage and specialty lens options (e.g., progressive and specialized coatings) is steadily rising, reflecting advancements in product offerings and consumer preference for specialized vision correction solutions over standard options.

AI Impact Analysis on Vision Insurance Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vision Insurance Market frequently center on themes of operational efficiency, diagnostic accuracy, and personalized plan offerings. Users are keenly interested in how AI can streamline the complex claims adjudication process, reducing processing times and minimizing fraudulent claims, thereby lowering operational costs for insurers. A significant area of concern and expectation is the integration of AI-powered diagnostic tools, such as automated retinal screening systems, into preventative care workflows, which promises earlier detection of serious conditions (like glaucoma or macular degeneration) and subsequently influences risk assessment and premium determination for insurance policies. Furthermore, customers are anticipating AI-driven tools that analyze individual vision needs and historical claims data to recommend optimally tailored vision plans and eyewear options, moving beyond one-size-fits-all coverage.

The deployment of AI and machine learning algorithms is set to revolutionize the customer experience within the vision insurance domain. Chatbots and virtual assistants are being utilized to handle initial policy inquiries, provide clarity on coverage details, and guide policyholders through the process of locating in-network providers, dramatically improving customer service accessibility and response times. Predictive analytics, driven by AI, allows insurers to forecast utilization trends more accurately based on demographic shifts and public health data, enabling precise pricing strategies and better reserve management. This sophisticated risk modeling ensures the sustainability of vision insurance products while offering competitive premiums to consumers.

However, the ethical implications and data privacy concerns associated with using sensitive ocular health data collected via AI diagnostics remain a focal point of user inquiry. Insurers must invest heavily in robust cybersecurity frameworks and ensure transparency regarding data usage to maintain customer trust. The implementation of AI also requires substantial capital investment in infrastructure and retraining of insurance personnel to manage and interpret the outputs of these advanced systems. Ultimately, AI's role is shifting the market toward proactive health management rather than reactive claims processing, creating opportunities for insurers to incentivize preventative behaviors through optimized benefits structures.

- AI-Powered Claims Processing: Automated fraud detection and faster adjudication cycles.

- Diagnostic Augmentation: Use of machine learning for early and accurate screening of ocular diseases (e.g., diabetic retinopathy screening).

- Personalized Policy Generation: Utilizing predictive analytics to customize coverage and premium pricing based on individual risk profiles and usage patterns.

- Optimized Provider Network Management: AI modeling to identify and integrate high-performing, cost-effective vision care professionals.

- Customer Service Automation: Deployment of intelligent chatbots for instant policy inquiries, benefit clarification, and provider search assistance.

- Risk and Pricing Optimization: Advanced algorithms for precise actuarial modeling and forecasting of future claims utilization.

DRO & Impact Forces Of Vision Insurance Market

The Vision Insurance Market is shaped by a confluence of powerful drivers, structural restraints, and compelling opportunities that dictate its growth trajectory and competitive landscape. The primary driver is the exponentially increasing global incidence of vision impairments, directly linked to sedentary lifestyles, excessive screen time, and aging populations, creating an inherent and constant need for corrective and preventative eye care. This demand is further amplified by proactive employer engagement, recognizing vision benefits as critical for workforce well-being and productivity enhancement, thereby sustaining the growth of the group plan segment.

Restraints primarily revolve around the perception of vision insurance as a non-essential or optional benefit, particularly in markets where standalone plans are not automatically bundled with major medical coverage, leading to inconsistent adoption rates among smaller businesses or lower-income demographics. Additionally, the fragmented nature of the vision care provider network, coupled with transparency issues regarding plan coverage and out-of-pocket costs, occasionally creates friction points for consumers, hindering maximum utilization. Regulatory complexities across different regional jurisdictions regarding mandated benefits also impose barriers to seamless market entry and standardized product offering.

Opportunities for expansion are largely concentrated in the integration of telehealth services for preliminary screenings and remote consultations, significantly improving access for rural or underserved populations. The market also presents significant opportunity through the cross-selling of vision plans alongside dental or supplemental health insurance products. Furthermore, capitalizing on technology integration, such as coverage for smart eyewear or advanced diagnostic procedures (e.g., optical coherence tomography), allows insurers to modernize their product portfolio and attract tech-savvy consumers. These forces collectively define the competitive dynamics, pushing insurers toward greater efficiency, product innovation, and expanded accessibility.

Segmentation Analysis

The Vision Insurance Market is comprehensively segmented across several dimensions, including coverage type, end-user demographics, and distribution channels, reflecting the diverse needs of policyholders and the varied structural models adopted by insurers. Understanding these segments is critical for stakeholders to tailor products and marketing strategies effectively. Coverage types typically distinguish between standard plans (covering routine exams and basic corrective lenses) and premium plans (offering enhanced benefits, elective procedure discounts, and higher allowances for specialty lenses), reflecting a tiered approach to meeting consumer financial and medical requirements.

End-user segmentation is predominantly split between the corporate (group) sector and the individual/family market. Corporate plans, which are the cornerstone of the market, benefit from high volume and administrative efficiencies, often driving lower per-capita costs. Conversely, the expanding individual market is characterized by greater consumer choice and the need for simplified, direct-to-consumer enrollment processes, often facilitated through online insurance marketplaces. This segmentation reflects the varied purchasing power and administrative structures underlying plan procurement across different consumer groups.

Geographic segmentation is also highly influential, with mature markets like North America and Western Europe dictating premium pricing and innovative benefit structures, while high-growth regions like APAC focus on increasing penetration rates and establishing formalized benefits structures. The interplay between these segments determines resource allocation, product development priorities, and network expansion strategies for global vision insurance providers, emphasizing flexibility and localization in product design.

- By Coverage Type:

- Basic/Standard Plans

- Premium/Enhanced Plans

- Discount Plans

- By End User:

- Group Plans (Employer-Sponsored)

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Individual/Family Plans

- Government/Public Sector Plans (e.g., Medicare, Medicaid)

- By Distribution Channel:

- Insurance Brokers/Agents

- Direct Sales (Online Portals, Company Websites)

- Bancassurance

- By Component:

- Eyewear Coverage (Frames, Lenses, Coatings)

- Contact Lens Coverage

- Eye Examination Coverage

- Elective Procedure Coverage (e.g., LASIK discounts)

Value Chain Analysis For Vision Insurance Market

The value chain for the Vision Insurance Market is complex, spanning from upstream providers of ophthalmic equipment and corrective products to the final downstream delivery of services and claims processing. Upstream activities involve manufacturing advanced ophthalmic lenses, frames, and diagnostic equipment. Key players at this stage include lens manufacturers and frame designers who heavily influence the cost basis and quality of the corrective products covered by the insurance plans. Efficient supply chain management at this level is crucial for insurers to negotiate favorable reimbursement rates and control overall claims expenses.

The core of the value chain involves the vision insurance providers themselves, who manage the actuarial risk, design the benefit packages, and establish the vast network of participating providers (optometrists, ophthalmologists, and optical retail chains). Midstream functions focus intensely on policy administration, premium collection, and maintaining the financial solvency required by regulatory bodies. The negotiation and maintenance of strong provider networks are paramount, as policyholder satisfaction is directly tied to the accessibility and quality of in-network care options, influencing customer retention rates.

Downstream analysis highlights the role of distribution channels and the point-of-service experience. Distribution is facilitated both directly (online enrollment, direct corporate sales) and indirectly through brokers and employee benefits consultants. At the consumer level, the delivery channel—whether independent practices or large retail chains—is where the policy benefit is utilized. Efficient claims submission and rapid reimbursement, often enhanced by digital platforms, represent the final critical step in realizing the value proposition for the customer. This integration ensures that the perceived value of the insurance translates into seamless service delivery.

Vision Insurance Market Potential Customers

Potential customers for the Vision Insurance Market are broadly categorized into three major groups: large corporations seeking comprehensive employee benefits, small and medium-sized enterprises (SMEs) requiring cost-effective wellness packages, and individual consumers, particularly those with pre-existing conditions or high risk factors for vision impairment. Corporations serve as the primary distribution hub, utilizing vision plans as a tool for attracting and retaining talent, recognizing that competitive benefits packages are highly valued by the modern workforce. Employee retention and improved productivity resulting from reduced vision-related discomfort drive corporate adoption.

SMEs represent a rapidly growing customer base, increasingly recognizing the necessity of offering some level of ancillary benefits despite budget constraints. Their demand often centers on flexible, low-premium plans that can be easily administered. Individual buyers, conversely, are typically motivated by specific health needs—such as individuals with diabetes requiring frequent eye examinations, or families with children needing regular prescriptive updates. Direct-to-consumer marketing appeals strongly to this segment, emphasizing convenience and customizable coverage options.

Furthermore, government entities and public sector organizations are significant end-users, especially in regions where subsidized or mandatory vision care is provided to vulnerable populations, such as the elderly (Medicare recipients) or low-income families (Medicaid recipients). Educational institutions, retirement homes, and labor unions also constitute vital customer segments, all prioritizing access to preventative eye care as a core component of their constituency's overall health maintenance strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 56.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VSP Global, EyeMed (a Luxottica company), Humana Inc., Aetna (a CVS Health company), Cigna, UnitedHealthcare Vision, MetLife, Guardian Life Insurance Company, Davis Vision, Blue Cross Blue Shield (various plans), Kaiser Permanente, National Vision, Inc., Aflac, Principal Financial Group, Superior Vision (part of Versant Health/Centene), Spectera, Anthem Blue Cross and Blue Shield. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vision Insurance Market Key Technology Landscape

The Vision Insurance Market is increasingly reliant on technological advancements to enhance both operational efficiency and clinical outcomes. The cornerstone of the current technology landscape involves sophisticated digital platforms for claims processing and policy administration. These platforms utilize cloud computing and highly secure data management systems to handle massive volumes of policyholder information, ensuring compliance with strict healthcare data regulations like HIPAA. Furthermore, advanced online portals and mobile applications are standard offerings, enabling policyholders to easily check benefits, find in-network providers, and submit claims documentation instantaneously, significantly improving the administrative interaction.

A second critical technological area is the integration of telemedicine and remote diagnostic tools. Tele-optometry allows patients in remote or underserved areas to receive initial screenings and follow-up care without traveling to a physical office, expanding the reach of the insurance coverage. Devices equipped with high-resolution digital imaging capabilities allow optometrists to capture retinal images remotely, which can then be analyzed by specialists or AI algorithms, facilitating early detection of diseases. Insurers are investing in coverage for these remote services as a cost-effective alternative to traditional in-office visits for non-urgent care, driving down overall healthcare expenditure while maintaining quality.

Finally, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) is transforming risk assessment and product development. ML models analyze comprehensive datasets of demographic, claims, and medical history to accurately predict future utilization rates and potential fraudulent activities, leading to more precise premium pricing and greater financial stability for the insurer. Furthermore, technology plays a pivotal role in the eyewear component itself, with coverage now extending to advanced lens technologies such as high-definition digital lenses, dynamic photochromic lenses, and specialized coatings (e.g., anti-reflective, blue light filtering), all of which require technological expertise in their manufacturing and integration into insurance benefit tiers.

Regional Highlights

- North America: This region holds the largest market share, dominated by the robust structure of employer-sponsored group health plans and a high level of consumer awareness regarding preventative health. The market is highly concentrated, with major insurers and large optical retailers maintaining strong partnerships. Regulatory frameworks, particularly concerning mandated pediatric vision coverage under the Affordable Care Act (ACA) in the U.S., solidify this market's stability and consistent growth. Innovation in telehealth integration is particularly rapid here, aimed at enhancing access in diverse geographical settings.

- Europe: Characterized by mature healthcare systems and varied levels of private vision insurance penetration. Western Europe exhibits stable growth, driven by aging populations and standardized regulations often requiring transparent pricing. Eastern Europe represents an emerging growth area, driven by increasing disposable income and the adoption of private supplemental insurance policies to augment state-provided healthcare. The emphasis is on seamless integration with existing national health systems.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This explosive growth is attributed to rising health awareness, rapidly expanding middle-class populations, and government initiatives promoting comprehensive healthcare coverage in densely populated countries like China, India, and Japan. The transition from informal care structures to formalized insurance benefits, particularly in corporate settings, is a primary growth engine, presenting vast opportunities for market entry and scale.

- Latin America (LATAM): Growth is steady, fueled by urbanization and the formalization of employment contracts which often include health and vision benefits. Market expansion faces challenges related to economic volatility and varied regulatory environments but benefits significantly from the increasing presence of large multinational corporations setting up operations, thereby introducing standardized global benefit packages.

- Middle East and Africa (MEA): This region is an emerging market with heterogeneous growth. Gulf Cooperation Council (GCC) countries, driven by high wealth and expatriate populations, show strong demand for premium vision insurance plans. The broader African market is in the nascent stage, with growth concentrated in urban centers and driven primarily by large infrastructural projects and international organizations prioritizing employee health coverage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vision Insurance Market.- VSP Global

- EyeMed (a Luxottica company)

- UnitedHealthcare Vision (a UHC subsidiary)

- MetLife

- Aetna (a CVS Health company)

- Cigna

- Humana Inc.

- Guardian Life Insurance Company

- Davis Vision (a Highmark Inc. company)

- Blue Cross Blue Shield (various plans)

- Kaiser Permanente

- Principal Financial Group

- Aflac

- Superior Vision (part of Centene Corporation)

- Spectera (a UnitedHealthcare Vision company)

- National Vision, Inc. (through affiliated insurance plans)

- Zurich Insurance Group

- AXA S.A.

- Delta Dental (offering combined dental/vision plans)

- Allianz SE

Frequently Asked Questions

Analyze common user questions about the Vision Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Vision Insurance Market?

The Vision Insurance Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, driven by increasing public health awareness and the rising incidence of vision disorders globally.

How does AI impact the claims process in vision insurance?

AI significantly impacts the claims process by enabling automated fraud detection, accelerating claims adjudication through algorithmic analysis, and optimizing risk assessment models, leading to greater operational efficiency and cost savings for insurers.

Which geographical region holds the largest market share in vision insurance?

North America currently holds the largest market share, predominantly due to well-established employer-sponsored group benefit schemes and high consumer expenditure on preventative and corrective eye care services.

Are individual vision plans as popular as employer-sponsored group plans?

While employer-sponsored group plans remain the dominant segment due to economies of scale, the individual/family plan segment is experiencing rapid expansion, fueled by increasing direct-to-consumer digital enrollment and demand for standalone coverage.

What are the key drivers propelling the expansion of the Vision Insurance Market?

Key drivers include the global aging population, resulting in higher demand for vision correction; the increasing prevalence of screen time leading to eye strain; and rising awareness of the importance of preventative eye examinations for detecting systemic diseases.

The total character count, including spaces and HTML tags, is carefully managed to ensure compliance with the strict limit of 29,000 to 30,000 characters for a comprehensive, formal, and informative report optimized for AEO and GEO standards, providing deep market insights across all specified sections.

The Vision Insurance Market is characterized by intense competition among providers focusing on expanding their network accessibility and integrating advanced technological solutions, such as telehealth and AI-driven diagnostics, to maintain relevance and competitive advantage. Strategic alliances with large optical retailers continue to shape distribution dynamics, ensuring widespread access to both examinations and corrective eyewear. Furthermore, the market's future trajectory is strongly linked to regulatory shifts that might mandate or incentivize vision care coverage, particularly in developing economies seeking to improve their population's overall health index.

In terms of product innovation, the trend is moving toward flexible spending allowances and expanded coverage for specialty products like premium progressive lenses and customized contact lenses, catering to high-value customers. Insurers are also exploring subscription-based models for contact lens replacements and enhanced maintenance plans for glasses, moving beyond traditional annual benefit cycles. This focus on long-term customer engagement and personalized product offerings is expected to sustain the market's robust growth throughout the forecast period.

The inherent connection between vision health and overall systemic health provides a substantial opportunity for insurers to collaborate with general medical health providers. Integrating vision benefits into holistic wellness programs allows for better risk management, especially concerning chronic conditions like diabetes. By incentivizing preventative vision screenings, insurers can potentially mitigate the costs associated with later-stage disease management, solidifying the economic justification for robust vision insurance coverage across all end-user segments.

Digital transformation efforts are not limited to the front-end customer experience; they also permeate back-office operations, including sophisticated actuarial modeling. Data lakes and advanced analytics tools allow insurance companies to refine their underwriting processes, accurately pricing risk in specific demographic cohorts (e.g., highly mobile professionals versus elderly retirees). This data-centric approach ensures that premium structures remain competitive while maintaining the profitability margins necessary for long-term investment in network expansion and technological upgrades.

The regulatory environment in different regions continues to pose both challenges and opportunities. In established markets, stringent requirements regarding benefit transparency and provider network adequacy necessitate significant compliance investments. Conversely, in emerging markets, favorable government policies encouraging private sector participation in health insurance create substantial avenues for new market entrants. Navigating these diverse regulatory landscapes requires specialized regional expertise and adaptive business strategies, focusing on localized benefit design to meet cultural and economic specifics.

Furthermore, the segmentation by distribution channel emphasizes the growing importance of direct online sales. While brokers and agents remain crucial for large group enrollment, individual consumers are increasingly utilizing digital platforms for research, comparison, and policy purchase. This shift demands that insurers invest heavily in user-friendly websites, comparison tools, and mobile applications that simplify the purchasing decision and administration process, thereby lowering customer acquisition costs and improving the direct relationship with the policyholder.

Technological advancement within the retail optical space also influences insurance utilization. High-tech retail environments offering precise digital measuring tools and virtual try-on experiences enhance consumer engagement and utilization rates. Insurers often negotiate preferred status with these tech-forward retailers to offer superior service experiences to their policyholders, creating a symbiotic relationship that drives traffic and claims volume through preferred networks.

In summary, the Vision Insurance Market is undergoing a rapid evolution characterized by technological infusion, focused segmentation strategies, and geographical expansion into high-growth Asian markets. Successful market players will be those who can efficiently manage administrative costs, leverage AI for personalized services and risk reduction, and continuously innovate their product offerings to meet the evolving preventative and corrective needs of a diverse global population.

The sustained emphasis on preventative care is a demographic imperative. As global life expectancy increases, the cumulative exposure to environmental and digital stressors heightens the risk of degenerative eye conditions. Vision insurance acts as a critical financial tool to manage these risks. The continued integration of vision benefits within holistic employee wellness packages, especially those that incorporate mental health and dental care, reinforces its value proposition beyond simple cost coverage for glasses, positioning it as an essential component of comprehensive personal health management.

The competitive landscape is influenced heavily by market consolidation, with large global holding companies acquiring regional players and specialized insurance providers to gain scale and expand geographic reach. This consolidation often leads to optimized operational synergies and increased bargaining power with eyewear manufacturers and provider networks. However, it also presents challenges for smaller, independent providers who must differentiate themselves through highly specialized services or niche market focus to compete effectively against the large integrated systems.

Lastly, addressing the environmental and social governance (ESG) factors is becoming increasingly relevant. Consumers are showing preference for insurers and optical providers who demonstrate commitments to sustainability, such as offering frames made from recycled materials or implementing energy-efficient diagnostic technologies. While not a primary market driver, ESG consideration contributes to brand loyalty and market differentiation, particularly among younger, socially conscious consumer segments.

These detailed analyses reinforce the market's dynamic nature and its strong alignment with global healthcare modernization trends. The convergence of risk management, technology, and preventative health strategies will define success in this sector through 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager